Key Insights

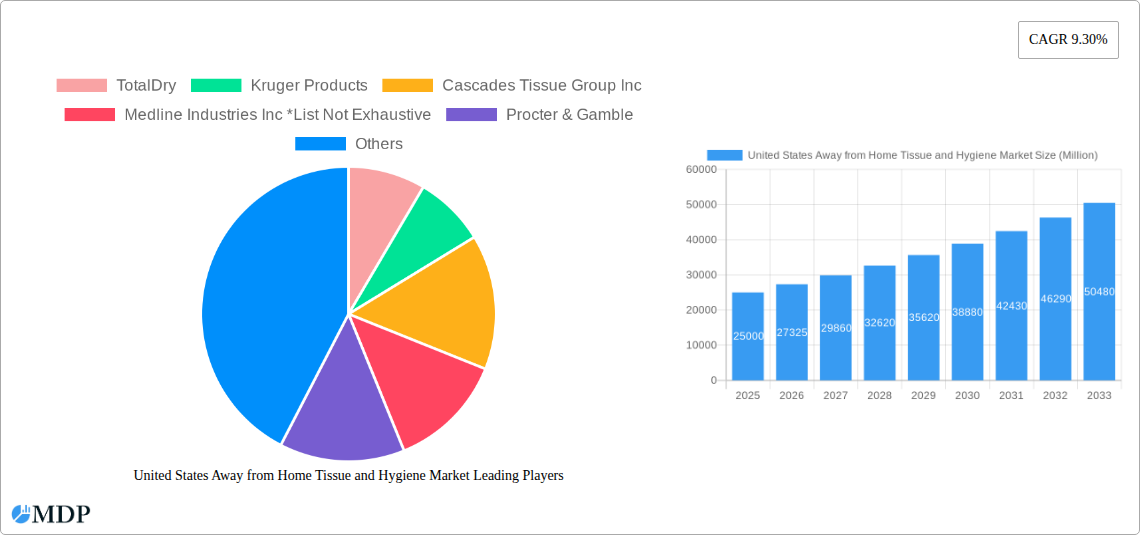

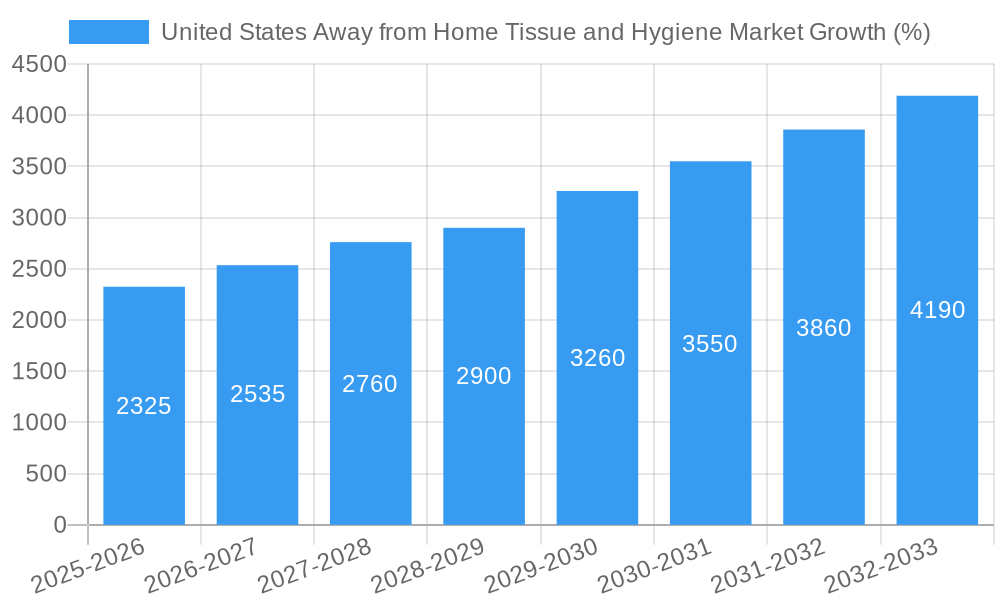

The United States Away From Home Tissue and Hygiene market, currently valued at an estimated $25 billion in 2025, is projected to experience robust growth, driven by several key factors. The rising prevalence of hygiene-conscious practices across commercial settings, food service establishments, and healthcare facilities fuels significant demand for paper napkins, towels, wipes, toilet paper, and incontinence products. Increased consumer awareness of sanitation and infection control, particularly amplified post-pandemic, is further stimulating market expansion. The growing adoption of sustainable and eco-friendly tissue products, such as recycled materials and biodegradable options, presents a significant opportunity for manufacturers. This shift towards sustainability is expected to influence product development and consumer choices throughout the forecast period. While the market faces challenges such as fluctuating raw material prices and supply chain disruptions, the overall positive trajectory suggests continued growth through 2033. Segment-wise, the healthcare sector is anticipated to show considerable growth due to stringent hygiene protocols in hospitals and clinics. The food and beverage industry also contributes significantly, driven by increasing restaurant traffic and the demand for high-quality hygiene products. Key players like Procter & Gamble, Kimberly-Clark, and Essity are expected to maintain their market leadership through strategic product innovation and robust distribution networks, while smaller companies will seek to carve out niches through specialization and sustainable practices.

The anticipated 9.30% CAGR (Compound Annual Growth Rate) suggests a substantial increase in market value by 2033. This projection is based on the sustained demand from key end-user industries, continuous product innovation to cater to evolving consumer needs and preferences, and the expanding adoption of environmentally responsible products. While potential economic downturns could temporarily impact growth, the long-term prospects for the Away From Home Tissue and Hygiene market in the US remain strong. Growth will likely be distributed across segments, with paper towels and toilet paper maintaining strong market shares due to their widespread use, while the incontinence products segment is projected to see above-average growth spurred by an aging population. Geographic distribution will likely reflect existing population density and economic activity patterns, with higher concentration in urban and densely populated areas.

United States Away from Home Tissue and Hygiene Market: A Comprehensive Report (2019-2033)

This comprehensive report provides an in-depth analysis of the United States Away from Home Tissue and Hygiene Market, offering invaluable insights for stakeholders seeking to navigate this dynamic sector. The study covers the period from 2019 to 2033, with a focus on the forecast period from 2025 to 2033, using 2025 as the base year. The report utilizes robust data analysis and expert insights to present a clear picture of market trends, challenges, and opportunities. High-growth segments like wipes and incontinence products are meticulously examined, along with key players such as Procter & Gamble, Kimberly-Clark Corporation, and Essity Hygiene & Health Products.

United States Away from Home Tissue and Hygiene Market Market Dynamics & Concentration

The US Away from Home Tissue and Hygiene Market exhibits a moderately concentrated structure, with several major players holding significant market share. The market is driven by innovation in sustainable materials, product diversification (e.g., antimicrobial wipes), and stringent hygiene regulations across various end-user segments. Regulatory changes, particularly those focusing on environmental sustainability and waste management, significantly influence market dynamics. Product substitution, particularly the rise of biodegradable and eco-friendly alternatives, presents both challenges and opportunities. Mergers and acquisitions (M&A) activity remains moderate, with an estimated xx M&A deals concluded in the past five years, mostly focusing on strategic expansions and portfolio diversification. The top five players collectively hold approximately xx% of the market share in 2025, while smaller players account for the remaining share. Key market dynamics are further elaborated on below:

- Market Concentration: Moderately concentrated, with top five players holding approximately xx% market share (2025).

- Innovation Drivers: Sustainable materials, product diversification (e.g., antimicrobial wipes), improved dispensing systems.

- Regulatory Frameworks: Stringent hygiene standards, environmental regulations driving sustainable product development.

- Product Substitutes: Biodegradable and eco-friendly alternatives posing both challenges and opportunities.

- End-User Trends: Increasing demand for hygiene and sanitation in commercial and healthcare sectors.

- M&A Activities: Moderate activity (xx deals in past five years), focused on expansion and portfolio diversification.

United States Away from Home Tissue and Hygiene Market Industry Trends & Analysis

The US Away from Home Tissue and Hygiene Market is projected to witness a CAGR of xx% during the forecast period (2025-2033). This growth is fueled by several key factors, including rising awareness of hygiene and sanitation, particularly post-pandemic. The increasing prevalence of chronic diseases requiring specialized hygiene products further fuels market growth. Technological advancements in material science and manufacturing processes lead to improved product quality, efficiency, and sustainability. Changing consumer preferences toward eco-friendly and sustainable products are driving manufacturers to adopt sustainable practices, impacting product formulations and packaging. Intense competition among established players leads to continuous innovation and product development to meet evolving customer needs. Market penetration of high-value products such as antimicrobial wipes and specialized incontinence products continues to increase, driving overall market growth. Furthermore, the expansion of the food services sector is contributing significantly to higher demand for paper napkins and towels.

Leading Markets & Segments in United States Away from Home Tissue and Hygiene Market

The Hospitals and Healthcare segment is the leading end-user industry, driven by the stringent hygiene requirements within healthcare facilities. The commercial sector, encompassing offices, restaurants, and other businesses, presents another significant segment. Within product types, paper towels and wipes display the highest demand, followed by toilet paper and incontinence products.

By End-user Industry:

- Hospitals and Healthcare: Highest demand due to stringent hygiene requirements. Growth drivers include rising healthcare expenditure and increasing hospital bed occupancy.

- Commercial: Strong demand driven by the growth of office spaces, restaurants, and other commercial establishments. Growth is tied to economic activity and expansion of the service sector.

- Food and Beverages Industry: Significant demand, particularly for paper napkins and towels. Growth is closely linked to the growth of the food services sector and consumer preference for takeaway meals.

- Other End-user: Includes educational institutions, recreational facilities, etc. Moderate but steady growth projected.

By Product Type:

- Paper Towels: High demand due to widespread use in commercial and healthcare settings.

- Wipes: Rapid growth driven by increasing demand for convenience and specialized applications (e.g., antimicrobial wipes).

- Toilet Papers: Steady demand, driven by population growth and ongoing improvements in product quality.

- Incontinence Products: Growth driven by an aging population and rising prevalence of age-related conditions.

- Paper Napkins: Steady demand, primarily driven by the food services industry.

United States Away from Home Tissue and Hygiene Market Product Developments

Recent product developments focus heavily on sustainability, incorporating recycled and biodegradable materials. Innovative dispensing systems improve hygiene and reduce waste. Antimicrobial and anti-viral properties are being increasingly incorporated into wipes to enhance infection control. These advancements cater to both consumer preferences for eco-friendly options and the growing demand for enhanced hygiene in various settings.

Key Drivers of United States Away from Home Tissue and Hygiene Market Growth

The market's growth is spurred by several factors: increasing awareness of hygiene and sanitation, particularly in the wake of recent health crises; rising healthcare expenditure; technological advancements leading to more sustainable and efficient products; the expansion of the food service industry and the hospitality sector; and favorable government policies supporting hygiene and sanitation initiatives.

Challenges in the United States Away from Home Tissue and Hygiene Market Market

Challenges include fluctuations in raw material prices (e.g., pulp), potential supply chain disruptions, and increasing competition from both domestic and international players. Stringent environmental regulations can increase production costs and necessitate greater investment in sustainable technologies. Meeting ever-increasing hygiene standards while maintaining cost-effectiveness also presents a considerable challenge. The market faces price pressure from competition and increasing consumer expectations for value.

Emerging Opportunities in United States Away from Home Tissue and Hygiene Market

Long-term growth is projected due to technological breakthroughs in sustainable materials, such as bio-based pulp, and strategic partnerships focused on sustainable supply chains. Expansion into niche segments, such as specialized wipes for specific applications (e.g., medical wipes), offer significant opportunities. The market will be driven by growing demand for advanced hygiene solutions and the ongoing focus on sustainability.

Leading Players in the United States Away from Home Tissue and Hygiene Market Sector

- TotalDry

- Kruger Products

- Cascades Tissue Group Inc

- Medline Industries Inc

- Procter & Gamble

- Essity Hygiene & Health Products

- Clearwater Paper Corporation

- Domtar Corporation

- Sofidel Group

- Georgia Pacific LLC

- Kimberly-Clark Corporation

- First Quality Enterprises Inc

Key Milestones in United States Away from Home Tissue and Hygiene Market Industry

- 2020: Increased demand for antimicrobial wipes due to the COVID-19 pandemic.

- 2021: Several major players announced investments in sustainable packaging and manufacturing processes.

- 2022: Introduction of several new product lines emphasizing bio-based and recycled materials.

- 2023: Significant M&A activity involving smaller players being acquired by larger corporations.

- 2024: Several companies launched new product lines focusing on improved dispensing systems to reduce waste.

Strategic Outlook for United States Away from Home Tissue and Hygiene Market Market

The US Away from Home Tissue and Hygiene Market presents substantial growth potential driven by an unwavering focus on hygiene and sustainability. Strategic opportunities include investing in research and development of innovative and eco-friendly products, expanding into high-growth segments like specialized wipes and incontinence products, and forging strategic partnerships to secure sustainable supply chains. Companies that embrace technological advancements and proactively address environmental concerns are positioned for significant success in this evolving market.

United States Away from Home Tissue and Hygiene Market Segmentation

-

1. Produ

- 1.1. Paper Napkins

- 1.2. Paper Towels

- 1.3. Wipes

- 1.4. Toilet Papers

- 1.5. Incontinence Products

- 1.6. Other Product Types

-

2. End-u

- 2.1. Commercial

- 2.2. Food and Beverages Industry

- 2.3. Hospitals and Healthcare

- 2.4. Other End-user

United States Away from Home Tissue and Hygiene Market Segmentation By Geography

- 1. United States

United States Away from Home Tissue and Hygiene Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 9.30% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. ; Growing percentage of aging population and growing number of care homes; Greater emphasis on hygiene in workplaces across the country; Product innovations in the incontinence segment to drive sales

- 3.3. Market Restrains

- 3.3.1. Growing Trend of Electronic Dryers; Slow Growth In the Market

- 3.4. Market Trends

- 3.4.1. Toilet Paper to Account Major Market Demand

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. United States Away from Home Tissue and Hygiene Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Produ

- 5.1.1. Paper Napkins

- 5.1.2. Paper Towels

- 5.1.3. Wipes

- 5.1.4. Toilet Papers

- 5.1.5. Incontinence Products

- 5.1.6. Other Product Types

- 5.2. Market Analysis, Insights and Forecast - by End-u

- 5.2.1. Commercial

- 5.2.2. Food and Beverages Industry

- 5.2.3. Hospitals and Healthcare

- 5.2.4. Other End-user

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. United States

- 5.1. Market Analysis, Insights and Forecast - by Produ

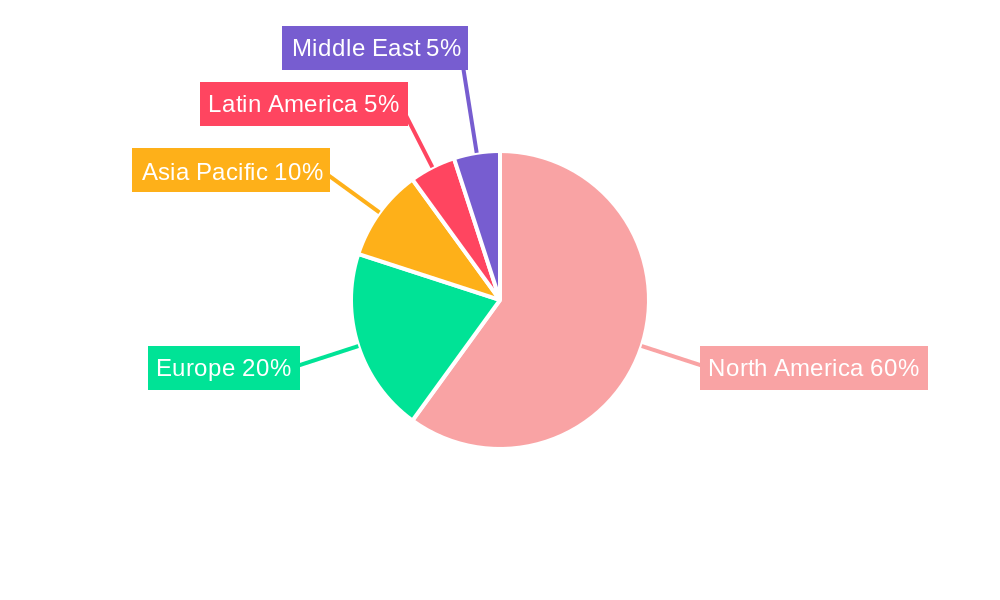

- 6. North America United States Away from Home Tissue and Hygiene Market Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 6.1.1.

- 7. Europe United States Away from Home Tissue and Hygiene Market Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 7.1.1.

- 8. Asia Pacific United States Away from Home Tissue and Hygiene Market Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 8.1.1.

- 9. Latin America United States Away from Home Tissue and Hygiene Market Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 9.1.1.

- 10. Middle East United States Away from Home Tissue and Hygiene Market Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 10.1.1.

- 11. Competitive Analysis

- 11.1. Market Share Analysis 2024

- 11.2. Company Profiles

- 11.2.1 TotalDry

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Kruger Products

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Cascades Tissue Group Inc

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Medline Industries Inc *List Not Exhaustive

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Procter & Gamble

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Essity Hygiene & Health Products

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Clearwater Paper Corporation

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Domtar Corporation

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Sofidel Group

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Georgia Pacific LLC

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 Kimberly-Clark Corporation

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.12 First Quality Enterprises Inc

- 11.2.12.1. Overview

- 11.2.12.2. Products

- 11.2.12.3. SWOT Analysis

- 11.2.12.4. Recent Developments

- 11.2.12.5. Financials (Based on Availability)

- 11.2.1 TotalDry

List of Figures

- Figure 1: United States Away from Home Tissue and Hygiene Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: United States Away from Home Tissue and Hygiene Market Share (%) by Company 2024

List of Tables

- Table 1: United States Away from Home Tissue and Hygiene Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: United States Away from Home Tissue and Hygiene Market Revenue Million Forecast, by Produ 2019 & 2032

- Table 3: United States Away from Home Tissue and Hygiene Market Revenue Million Forecast, by End-u 2019 & 2032

- Table 4: United States Away from Home Tissue and Hygiene Market Revenue Million Forecast, by Region 2019 & 2032

- Table 5: United States Away from Home Tissue and Hygiene Market Revenue Million Forecast, by Country 2019 & 2032

- Table 6: United States Away from Home Tissue and Hygiene Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 7: United States Away from Home Tissue and Hygiene Market Revenue Million Forecast, by Country 2019 & 2032

- Table 8: United States Away from Home Tissue and Hygiene Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: United States Away from Home Tissue and Hygiene Market Revenue Million Forecast, by Country 2019 & 2032

- Table 10: United States Away from Home Tissue and Hygiene Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 11: United States Away from Home Tissue and Hygiene Market Revenue Million Forecast, by Country 2019 & 2032

- Table 12: United States Away from Home Tissue and Hygiene Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 13: United States Away from Home Tissue and Hygiene Market Revenue Million Forecast, by Country 2019 & 2032

- Table 14: United States Away from Home Tissue and Hygiene Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 15: United States Away from Home Tissue and Hygiene Market Revenue Million Forecast, by Produ 2019 & 2032

- Table 16: United States Away from Home Tissue and Hygiene Market Revenue Million Forecast, by End-u 2019 & 2032

- Table 17: United States Away from Home Tissue and Hygiene Market Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the United States Away from Home Tissue and Hygiene Market?

The projected CAGR is approximately 9.30%.

2. Which companies are prominent players in the United States Away from Home Tissue and Hygiene Market?

Key companies in the market include TotalDry, Kruger Products, Cascades Tissue Group Inc, Medline Industries Inc *List Not Exhaustive, Procter & Gamble, Essity Hygiene & Health Products, Clearwater Paper Corporation, Domtar Corporation, Sofidel Group, Georgia Pacific LLC, Kimberly-Clark Corporation, First Quality Enterprises Inc.

3. What are the main segments of the United States Away from Home Tissue and Hygiene Market?

The market segments include Produ, End-u.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

; Growing percentage of aging population and growing number of care homes; Greater emphasis on hygiene in workplaces across the country; Product innovations in the incontinence segment to drive sales.

6. What are the notable trends driving market growth?

Toilet Paper to Account Major Market Demand.

7. Are there any restraints impacting market growth?

Growing Trend of Electronic Dryers; Slow Growth In the Market.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "United States Away from Home Tissue and Hygiene Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the United States Away from Home Tissue and Hygiene Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the United States Away from Home Tissue and Hygiene Market?

To stay informed about further developments, trends, and reports in the United States Away from Home Tissue and Hygiene Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence