Key Insights

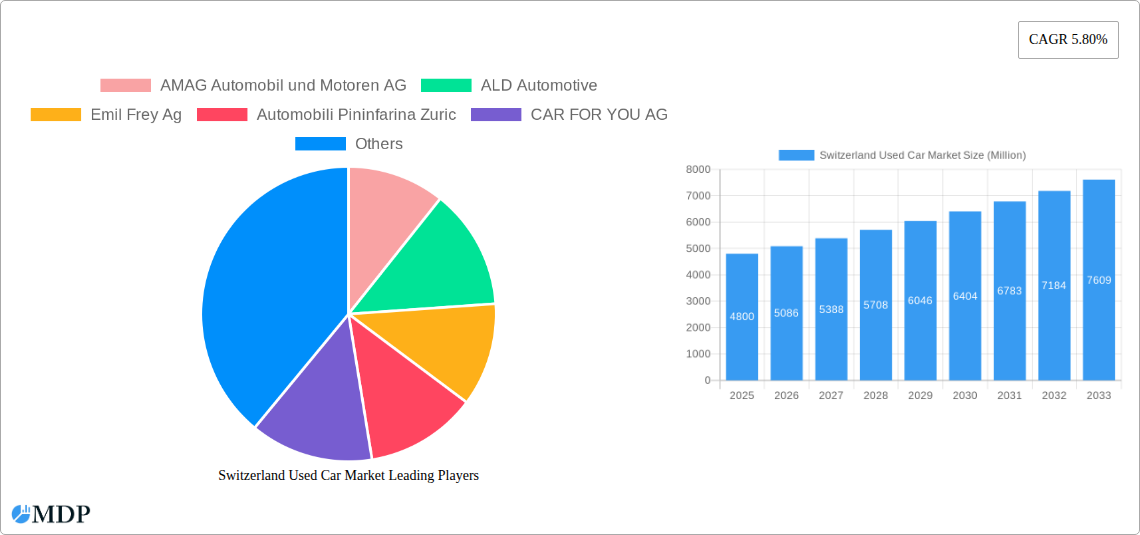

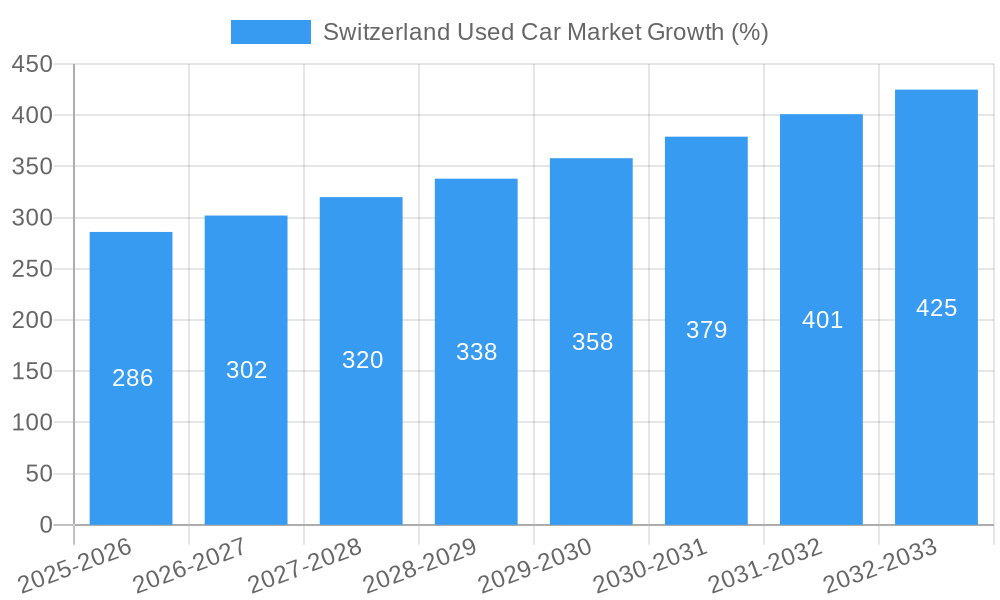

The Switzerland used car market, valued at CHF 4.80 billion in 2025, is projected to experience robust growth, exhibiting a Compound Annual Growth Rate (CAGR) of 5.80% from 2025 to 2033. This expansion is driven by several key factors. Firstly, increasing vehicle ownership among Switzerland's growing population, coupled with a preference for more frequent vehicle changes, fuels demand for used cars. Secondly, the rising cost of new vehicles, particularly amid global economic uncertainties and supply chain disruptions, makes used cars a more financially accessible option for a broader range of consumers. Furthermore, the growing adoption of stringent emission regulations for new cars indirectly boosts the used car market as older, less emission-efficient vehicles are replaced. Finally, the increasing availability of online used car marketplaces and improved vehicle inspection processes enhances transparency and trust in the used car market, fostering growth.

Segmentation analysis reveals a diverse market. SUVs and MUVs are likely to dominate the vehicle type segment, reflecting Switzerland's geographic landscape and family-oriented lifestyles. The organized vendor segment is expected to gain market share, benefiting from their established reputations, financing options, and comprehensive warranty offerings. While gasoline and diesel vehicles currently hold a significant portion of the market, electric vehicles (EVs) are poised for substantial growth as their affordability improves and charging infrastructure expands. The continued expansion of the Swiss economy and consistent consumer confidence will further positively impact market growth, though potential economic downturns or shifts in consumer preference could act as moderating factors. Overall, the outlook for the Swiss used car market remains optimistic, presenting lucrative opportunities for both established players and new entrants.

Switzerland Used Car Market: A Comprehensive Report (2019-2033)

This in-depth report provides a comprehensive analysis of the Switzerland used car market, encompassing market dynamics, industry trends, leading segments, key players, and future outlook. With a study period spanning 2019-2033, a base year of 2025, and a forecast period of 2025-2033, this report offers invaluable insights for industry stakeholders, investors, and businesses operating within this dynamic market. The market is estimated to be valued at xx Million in 2025.

Switzerland Used Car Market Market Dynamics & Concentration

The Swiss used car market exhibits a moderately concentrated landscape, with a few dominant players holding significant market share. The market is influenced by several factors including stringent regulatory frameworks concerning emissions and vehicle safety, technological innovations driving the adoption of electric and hybrid vehicles, and evolving consumer preferences towards specific vehicle types and fuel efficiency. Product substitutes, such as ride-sharing services and public transportation, exert a moderate influence.

Market concentration is further impacted by mergers and acquisitions (M&A) activities. While precise market share figures for individual players are unavailable, AMAG Automobil und Motoren AG, Emil Frey AG, and Auto Kunz AG are likely to hold substantial market share within the organized vendor segment. The number of M&A deals in the sector between 2019 and 2024 is estimated at xx. Innovation drivers include advancements in automotive technology, particularly in electric vehicles and connected car features. End-user trends increasingly favor SUVs and electric vehicles, driven by environmental concerns and technological advancements.

- Key Market Dynamics: Regulatory changes, technological advancements, consumer preferences, M&A activities

- Market Concentration: Moderately concentrated, with key players holding significant, yet undefined, market share.

- Innovation Drivers: Electric vehicle technology, connected car features, enhanced safety systems.

- M&A Activity: xx deals between 2019 and 2024 (estimated).

Switzerland Used Car Market Industry Trends & Analysis

The Switzerland used car market has witnessed consistent growth over the past years, exhibiting a Compound Annual Growth Rate (CAGR) of xx% during the historical period (2019-2024). This growth is driven by several factors, including increasing disposable incomes, a growing preference for used vehicles as a cost-effective alternative to new cars, and the expanding popularity of SUVs and other specific vehicle types. Market penetration of used electric vehicles is also steadily increasing, driven by government incentives and growing environmental awareness.

Technological disruptions, such as the rise of online marketplaces and digital insurance solutions (as evidenced by Emil Frey AG's partnership with iptiQ), are reshaping the market landscape. Competitive dynamics are marked by price competition, brand loyalty, and the ongoing adaptation to the increasing demand for electric and hybrid vehicles. The market is segmented by Vehicle Type (Hatchback, Sedan, SUV, MUV), Vendor Type (Organized, Unorganized), and Fuel Type (Gasoline, Diesel, Electric, Other). The shift towards online platforms has increased competition and improved transparency, thereby benefiting the consumer. The forecast period (2025-2033) anticipates a continued growth trajectory, influenced by these existing trends and the expected influx of pre-owned electric vehicles entering the market.

Leading Markets & Segments in Switzerland Used Car Market

While precise regional data is unavailable, the urban areas of Switzerland likely constitute the dominant market for used cars due to higher population density and greater demand. Within the vehicle type segment, SUVs are expected to hold a significant share, driven by factors such as increasing popularity, perceived versatility, and a preference for larger vehicles. The organized vendor segment dominates the market, attributed to consumer trust and access to better warranties and financing options compared to the unorganized segment. Gasoline remains the dominant fuel type, although the electric vehicle segment is showing notable growth.

- Key Drivers: Urban population concentration, consumer preference for SUVs, organized vendor reliability.

- Dominant Segments: SUVs (Vehicle Type), Organized (Vendor Type), Gasoline (Fuel Type).

- Economic Policies: Government incentives for electric vehicle adoption influence market share dynamics.

- Infrastructure: Well-developed infrastructure supports the used car market's efficient operation.

Switzerland Used Car Market Product Developments

Recent product developments within the Swiss used car market focus on increasing transparency and enhancing the overall customer experience. Online platforms with detailed vehicle history reports and improved search functionalities are gaining traction. Furthermore, technological advancements like telematics and connected car features are influencing the value and appeal of used vehicles. The market is also adapting to the increasing demand for electric and hybrid used cars.

Key Drivers of Switzerland Used Car Market Growth

The growth of the Swiss used car market is propelled by several factors. Firstly, economic conditions, such as fluctuating fuel prices and interest rates, influence consumer demand. Technological advancements, such as improved battery technology for electric vehicles, and the introduction of connected car features, are key growth drivers. Government regulations, including emissions standards and safety regulations, indirectly shape the market by influencing the types of vehicles available.

Challenges in the Switzerland Used Car Market Market

The Swiss used car market faces challenges including fluctuating economic conditions impacting consumer spending, supply chain disruptions affecting vehicle availability, and intense competition from both organized and unorganized vendors. Regulatory changes can also pose challenges in terms of compliance and adaptation. The uncertainty surrounding future regulations concerning emissions further influences market dynamics. The impact of these challenges is reflected in market volatility and potential pricing fluctuations.

Emerging Opportunities in Switzerland Used Car Market

The Swiss used car market presents several emerging opportunities. Technological breakthroughs, particularly in battery technology and autonomous driving, will create new market segments and enhance the appeal of used electric and self-driving vehicles. Strategic partnerships between online marketplaces, insurance providers, and financial institutions create opportunities for enhanced service offerings and improved customer experience. Expansion into niche markets, focusing on specific vehicle types or customer demographics, presents further growth potential.

Leading Players in the Switzerland Used Car Market Sector

- AMAG Automobil und Motoren AG

- ALD Automotive

- Emil Frey Ag

- Automobili Pininfarina Zuric

- CAR FOR YOU AG

- ELSIB AUTOS

- Auto Kunz AG

- CARS FOR ALL

Key Milestones in Switzerland Used Car Market Industry

- July 2023: Noviv Mobility AG partnered with Zurich Insurance Group, offering comprehensive insurance to B2B customers. This enhances the overall used car buying experience for businesses.

- March 2023: Emil Frey AG launched "Emily Frey Protect," a digital insurance solution with iptiQ, improving insurance access for new and used car buyers. This reflects the increasing integration of digital solutions within the used car market.

Strategic Outlook for Switzerland Used Car Market Market

The Switzerland used car market is poised for continued growth driven by evolving consumer preferences, technological advancements, and the increasing prevalence of electric vehicles. Strategic partnerships and investments in technology will be crucial for players to enhance their offerings, improve customer experiences, and maintain a competitive edge. The market's long-term potential hinges on adapting to the changing regulatory landscape and leveraging technological disruptions to create innovative solutions.

Switzerland Used Car Market Segmentation

-

1. Vehicle Type

- 1.1. Hatchback

- 1.2. Sedan

- 1.3. Sport Utility Vehicles (SUVs)

- 1.4. Multi-Purpose Vehicles (MUVs)

-

2. Vendor Type

- 2.1. Organized

- 2.2. Unorganized

-

3. Fuel Type

- 3.1. Gasoline

- 3.2. Diesel

- 3.3. Electric

- 3.4. Other Fuel Types

Switzerland Used Car Market Segmentation By Geography

- 1. Switzerland

Switzerland Used Car Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 5.80% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Decline in New Car Sales

- 3.3. Market Restrains

- 3.3.1. Trust And Transparency In Used Car Remained A Key Challenge For Consumers

- 3.4. Market Trends

- 3.4.1. Rising Trend of Digitalization to Enhance the Growth of Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Switzerland Used Car Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Vehicle Type

- 5.1.1. Hatchback

- 5.1.2. Sedan

- 5.1.3. Sport Utility Vehicles (SUVs)

- 5.1.4. Multi-Purpose Vehicles (MUVs)

- 5.2. Market Analysis, Insights and Forecast - by Vendor Type

- 5.2.1. Organized

- 5.2.2. Unorganized

- 5.3. Market Analysis, Insights and Forecast - by Fuel Type

- 5.3.1. Gasoline

- 5.3.2. Diesel

- 5.3.3. Electric

- 5.3.4. Other Fuel Types

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. Switzerland

- 5.1. Market Analysis, Insights and Forecast - by Vehicle Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2024

- 6.2. Company Profiles

- 6.2.1 AMAG Automobil und Motoren AG

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 ALD Automotive

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Emil Frey Ag

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Automobili Pininfarina Zuric

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 CAR FOR YOU AG

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 ELSIB AUTOS

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Auto Kunz AG

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 CARS FOR ALL

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.1 AMAG Automobil und Motoren AG

List of Figures

- Figure 1: Switzerland Used Car Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Switzerland Used Car Market Share (%) by Company 2024

List of Tables

- Table 1: Switzerland Used Car Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Switzerland Used Car Market Revenue Million Forecast, by Vehicle Type 2019 & 2032

- Table 3: Switzerland Used Car Market Revenue Million Forecast, by Vendor Type 2019 & 2032

- Table 4: Switzerland Used Car Market Revenue Million Forecast, by Fuel Type 2019 & 2032

- Table 5: Switzerland Used Car Market Revenue Million Forecast, by Region 2019 & 2032

- Table 6: Switzerland Used Car Market Revenue Million Forecast, by Country 2019 & 2032

- Table 7: Switzerland Used Car Market Revenue Million Forecast, by Vehicle Type 2019 & 2032

- Table 8: Switzerland Used Car Market Revenue Million Forecast, by Vendor Type 2019 & 2032

- Table 9: Switzerland Used Car Market Revenue Million Forecast, by Fuel Type 2019 & 2032

- Table 10: Switzerland Used Car Market Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Switzerland Used Car Market?

The projected CAGR is approximately 5.80%.

2. Which companies are prominent players in the Switzerland Used Car Market?

Key companies in the market include AMAG Automobil und Motoren AG, ALD Automotive, Emil Frey Ag, Automobili Pininfarina Zuric, CAR FOR YOU AG, ELSIB AUTOS, Auto Kunz AG, CARS FOR ALL.

3. What are the main segments of the Switzerland Used Car Market?

The market segments include Vehicle Type, Vendor Type, Fuel Type.

4. Can you provide details about the market size?

The market size is estimated to be USD 4.80 Million as of 2022.

5. What are some drivers contributing to market growth?

Decline in New Car Sales.

6. What are the notable trends driving market growth?

Rising Trend of Digitalization to Enhance the Growth of Market.

7. Are there any restraints impacting market growth?

Trust And Transparency In Used Car Remained A Key Challenge For Consumers.

8. Can you provide examples of recent developments in the market?

July 2023: Noviv Mobility AG entered into a collaboration with Zurich Insurance Group in Switzerland. This partnership enables the company to provide comprehensive insurance protection to its Business-to-Business (B2B) consumers.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Switzerland Used Car Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Switzerland Used Car Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Switzerland Used Car Market?

To stay informed about further developments, trends, and reports in the Switzerland Used Car Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence