Key Insights

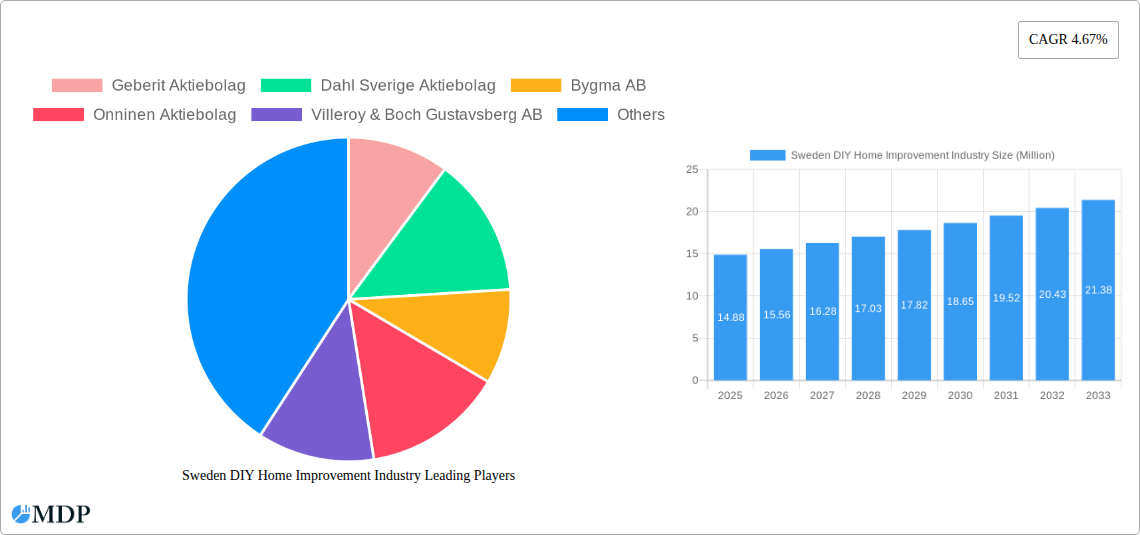

The Swedish DIY home improvement market, valued at €14.88 million in 2025, exhibits robust growth potential, projected to expand at a compound annual growth rate (CAGR) of 4.67% from 2025 to 2033. This growth is fueled by several key factors. Increasing homeownership rates, coupled with a rising disposable income among Swedish households, are driving demand for home renovation and improvement projects. A growing preference for personalized living spaces and a trend towards eco-conscious renovations, focusing on energy efficiency and sustainable materials, further contribute to market expansion. The segment encompassing lumber and landscape management is likely the largest, reflecting the country's significant interest in outdoor spaces and gardening. Meanwhile, the kitchen and bathroom renovation sectors experience consistently strong demand, driven by the desire for modern amenities and increased home value. The rise of online retail channels is transforming the distribution landscape, offering convenience and expanding market access, while established DIY stores maintain a significant share, particularly for larger purchases and expert advice. Competition among key players like Geberit, Dahl, and Bygma remains intense, necessitating strategic differentiation and innovative product offerings.

Sweden DIY Home Improvement Industry Market Size (In Million)

However, the market's growth is not without challenges. Fluctuations in building material costs and supply chain disruptions, influenced by global economic conditions, pose significant restraints. Additionally, increased regulations regarding sustainable building practices and waste management impose higher costs on businesses, potentially impacting profitability. To mitigate these challenges, companies are focusing on developing sustainable product lines, leveraging digital marketing strategies to reach wider audiences, and optimizing their supply chain management to ensure efficient material sourcing and delivery. The Swedish DIY home improvement market is poised for continued expansion, driven by consumer preferences and technological advancements, but must carefully navigate the challenges related to pricing, sustainability and supply chain dynamics.

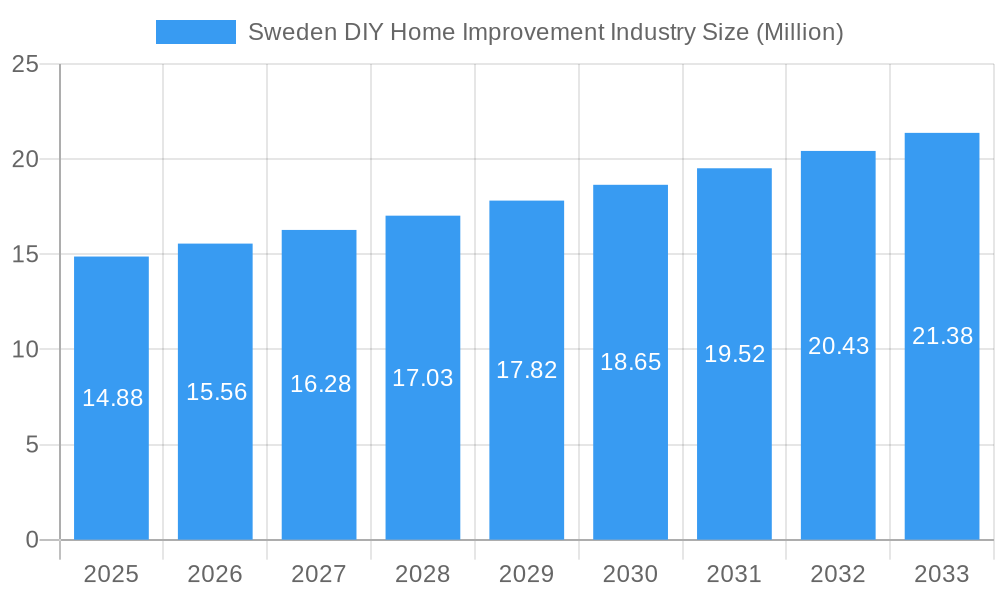

Sweden DIY Home Improvement Industry Company Market Share

Sweden DIY Home Improvement Industry: A Comprehensive Market Report (2019-2033)

This in-depth report provides a comprehensive analysis of the Swedish DIY home improvement industry, covering market dynamics, leading players, emerging trends, and future growth prospects from 2019 to 2033. The report leverages extensive data analysis and industry expertise to deliver actionable insights for stakeholders across the value chain. With a focus on key segments like Lumber & Landscape Management, Kitchen renovations, and Building Materials, this report is an essential resource for businesses seeking to capitalize on the opportunities within this dynamic market. The base year for this report is 2025, with forecasts extending to 2033.

Sweden DIY Home Improvement Industry Market Dynamics & Concentration

The Swedish DIY home improvement market, valued at approximately SEK xx Million in 2024, exhibits a moderately consolidated structure. Market share is distributed among both large multinational players and smaller, specialized businesses. Key drivers of innovation include the increasing adoption of sustainable building materials, smart home technologies, and personalized design solutions. The regulatory landscape, while generally supportive of industry growth, faces ongoing adjustments concerning waste management and environmental regulations. Product substitutes, such as prefabricated components and modular homes, present a moderate competitive pressure. End-user trends show a strong preference for high-quality materials, personalized services, and sustainable options. M&A activity within the sector has been relatively low in recent years, with only approximately xx deals recorded between 2019 and 2024.

- Market Concentration: Moderately consolidated, with a few dominant players and many smaller firms.

- Innovation Drivers: Sustainable materials, smart home tech, personalized design.

- Regulatory Framework: Primarily supportive, but with ongoing adjustments regarding waste and environment.

- Product Substitutes: Prefabricated components, modular homes.

- End-User Trends: Preference for quality, personalization, and sustainability.

- M&A Activity: Approximately xx deals recorded between 2019 and 2024.

Sweden DIY Home Improvement Industry Industry Trends & Analysis

The Swedish DIY home improvement market is projected to experience a Compound Annual Growth Rate (CAGR) of xx% during the forecast period (2025-2033), driven by several key factors. Rising disposable incomes, a growing emphasis on homeownership, and an increasing preference for home renovations are propelling market expansion. Technological disruptions, particularly the adoption of e-commerce platforms and digital design tools, are reshaping consumer behavior and the distribution landscape. Consumer preferences are shifting towards sustainable and eco-friendly products, influencing manufacturers and retailers to adapt their offerings. The competitive dynamics are characterized by both intense rivalry among established players and the emergence of new entrants offering specialized services and innovative products. Market penetration of online sales channels is steadily increasing, reaching an estimated xx% in 2025.

Leading Markets & Segments in Sweden DIY Home Improvement Industry

The DIY home improvement market in Sweden is geographically diversified, with no single region exhibiting absolute dominance. However, urban areas, particularly around Stockholm and Gothenburg, show higher spending patterns due to higher population density and increased disposable incomes.

Dominant Product Types:

- Building Materials: High demand due to construction and renovation projects. Key drivers include ongoing infrastructure development and housing shortages.

- Kitchen Renovations: Strong growth due to the rising desire for modern and functional kitchens.

- Plumbing and Equipment: Steady growth driven by upgrades and replacements in existing housing stock.

Dominant Distribution Channels:

- DIY Home Improvement Stores: These stores maintain a significant market share due to their wide product range and convenient locations.

- Online: Experiencing rapid growth, driven by increased internet penetration and ease of access.

Sweden DIY Home Improvement Industry Product Developments

Recent product innovations focus on sustainable and smart home technologies. Manufacturers are increasingly incorporating recycled materials and energy-efficient solutions into their products. Smart home devices, including automated lighting and temperature control systems, are gaining popularity, offering enhanced convenience and efficiency. These products cater to the growing consumer demand for environmentally friendly and technologically advanced solutions. The emphasis is on seamless integration with other smart devices and easy installation for DIY consumers.

Key Drivers of Sweden DIY Home Improvement Industry Growth

Several factors fuel the growth of the Swedish DIY home improvement industry. Rising disposable incomes empower homeowners to invest in renovations and improvements. Favorable government policies that encourage homeownership and investment in energy-efficient housing also contribute to growth. Technological advancements such as smart home solutions enhance efficiency and consumer experience, driving market expansion. Finally, the growing emphasis on sustainable living further boosts demand for eco-friendly products.

Challenges in the Sweden DIY Home Improvement Industry Market

The industry faces challenges including fluctuations in raw material prices impacting costs and profitability. Supply chain disruptions, particularly those relating to imported building materials, present an ongoing challenge for timely project completion. Stiff competition, with both established and new market entrants, places continuous pressure on pricing and innovation. Furthermore, the need to comply with stringent environmental regulations presents a hurdle for some manufacturers.

Emerging Opportunities in Sweden DIY Home Improvement Industry

The increasing demand for sustainable building materials presents a significant opportunity for businesses to develop and market eco-friendly products. Strategic partnerships between manufacturers, retailers, and technology providers can create integrated solutions for smart home upgrades. Expansion into niche markets, such as specialized home improvement services for elderly populations or energy-efficient retrofitting, offers potential for growth.

Leading Players in the Sweden DIY Home Improvement Industry Sector

- Geberit Aktiebolag

- Dahl Sverige Aktiebolag

- Bygma AB

- Onninen Aktiebolag

- Villeroy & Boch Gustavsberg AB

- Svedbergs i Dalstorp AB

- Eksjohus Aktiebolag

- AB Karl Hedin Bygghandel

- Solar Sverige Aktiebolag

- LK Systems AB

- Optimera Svenska AB

- Lundagrossisten Bo Johansson Aktiebolag

Key Milestones in Sweden DIY Home Improvement Industry Industry

- July 2022: IKEA City opens in Stockholm, increasing accessibility for consumers.

- November 2023: Bauhaus expands to northern and central Sweden, increasing market competition.

Strategic Outlook for Sweden DIY Home Improvement Industry Market

The Swedish DIY home improvement market holds strong potential for continued growth, driven by favorable demographics, increased investment in housing, and technological innovations. Companies should prioritize sustainable practices, embrace digital technologies, and foster strategic partnerships to capitalize on emerging opportunities. A focus on personalized service and customized solutions will be key to differentiate in a competitive market. The forecast indicates strong growth through the end of the study period.

Sweden DIY Home Improvement Industry Segmentation

-

1. Product Type

- 1.1. Lumber and Landscape management

- 1.2. Decor and Indoor Garden

- 1.3. Kitchen

- 1.4. Painting and Wallpaper

- 1.5. Tools and Hardware

- 1.6. Building Materials

- 1.7. Ligthing

- 1.8. Plumbing and Equipment

- 1.9. Flooring, Repair and Replacement

- 1.10. Electric Work

-

2. Distribution Channel

- 2.1. DIY Home Improvement Stores

- 2.2. Speciality Stores

- 2.3. Online

- 2.4. Others

Sweden DIY Home Improvement Industry Segmentation By Geography

- 1. Sweden

Sweden DIY Home Improvement Industry Regional Market Share

Geographic Coverage of Sweden DIY Home Improvement Industry

Sweden DIY Home Improvement Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 4.67% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Interest in Home Renovation and Personalization

- 3.3. Market Restrains

- 3.3.1. Lack of Expertise and Skills

- 3.4. Market Trends

- 3.4.1. Increasing Number of DIY Retail Stores in Sweden

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Sweden DIY Home Improvement Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 5.1.1. Lumber and Landscape management

- 5.1.2. Decor and Indoor Garden

- 5.1.3. Kitchen

- 5.1.4. Painting and Wallpaper

- 5.1.5. Tools and Hardware

- 5.1.6. Building Materials

- 5.1.7. Ligthing

- 5.1.8. Plumbing and Equipment

- 5.1.9. Flooring, Repair and Replacement

- 5.1.10. Electric Work

- 5.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 5.2.1. DIY Home Improvement Stores

- 5.2.2. Speciality Stores

- 5.2.3. Online

- 5.2.4. Others

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Sweden

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Geberit Aktiebolag

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Dahl Sverige Aktiebolag

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Bygma AB

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Onninen Aktiebolag

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Villeroy & Boch Gustavsberg AB

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Svedbergs i Dalstorp AB

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Eksjohus Aktiebolag

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 AB Karl Hedin Bygghandel

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Solar Sverige Aktiebolag

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 LK Systems AB

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 Optimera Svenska AB

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.12 Lundagrossisten Bo Johansson Aktiebolag

- 6.2.12.1. Overview

- 6.2.12.2. Products

- 6.2.12.3. SWOT Analysis

- 6.2.12.4. Recent Developments

- 6.2.12.5. Financials (Based on Availability)

- 6.2.1 Geberit Aktiebolag

List of Figures

- Figure 1: Sweden DIY Home Improvement Industry Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: Sweden DIY Home Improvement Industry Share (%) by Company 2025

List of Tables

- Table 1: Sweden DIY Home Improvement Industry Revenue Million Forecast, by Product Type 2020 & 2033

- Table 2: Sweden DIY Home Improvement Industry Volume K Unit Forecast, by Product Type 2020 & 2033

- Table 3: Sweden DIY Home Improvement Industry Revenue Million Forecast, by Distribution Channel 2020 & 2033

- Table 4: Sweden DIY Home Improvement Industry Volume K Unit Forecast, by Distribution Channel 2020 & 2033

- Table 5: Sweden DIY Home Improvement Industry Revenue Million Forecast, by Region 2020 & 2033

- Table 6: Sweden DIY Home Improvement Industry Volume K Unit Forecast, by Region 2020 & 2033

- Table 7: Sweden DIY Home Improvement Industry Revenue Million Forecast, by Product Type 2020 & 2033

- Table 8: Sweden DIY Home Improvement Industry Volume K Unit Forecast, by Product Type 2020 & 2033

- Table 9: Sweden DIY Home Improvement Industry Revenue Million Forecast, by Distribution Channel 2020 & 2033

- Table 10: Sweden DIY Home Improvement Industry Volume K Unit Forecast, by Distribution Channel 2020 & 2033

- Table 11: Sweden DIY Home Improvement Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 12: Sweden DIY Home Improvement Industry Volume K Unit Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Sweden DIY Home Improvement Industry?

The projected CAGR is approximately 4.67%.

2. Which companies are prominent players in the Sweden DIY Home Improvement Industry?

Key companies in the market include Geberit Aktiebolag, Dahl Sverige Aktiebolag, Bygma AB, Onninen Aktiebolag, Villeroy & Boch Gustavsberg AB, Svedbergs i Dalstorp AB, Eksjohus Aktiebolag, AB Karl Hedin Bygghandel, Solar Sverige Aktiebolag, LK Systems AB, Optimera Svenska AB, Lundagrossisten Bo Johansson Aktiebolag.

3. What are the main segments of the Sweden DIY Home Improvement Industry?

The market segments include Product Type, Distribution Channel.

4. Can you provide details about the market size?

The market size is estimated to be USD 14.88 Million as of 2022.

5. What are some drivers contributing to market growth?

Increasing Interest in Home Renovation and Personalization.

6. What are the notable trends driving market growth?

Increasing Number of DIY Retail Stores in Sweden.

7. Are there any restraints impacting market growth?

Lack of Expertise and Skills.

8. Can you provide examples of recent developments in the market?

November 2023: Bauhaus is expanding to the north of Sweden, by opening new stores in Vaxjo and Umea (2022) and now Karlstad-Valsviken in the center Swedish province of Värmland.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in K Unit.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Sweden DIY Home Improvement Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Sweden DIY Home Improvement Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Sweden DIY Home Improvement Industry?

To stay informed about further developments, trends, and reports in the Sweden DIY Home Improvement Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence