Key Insights

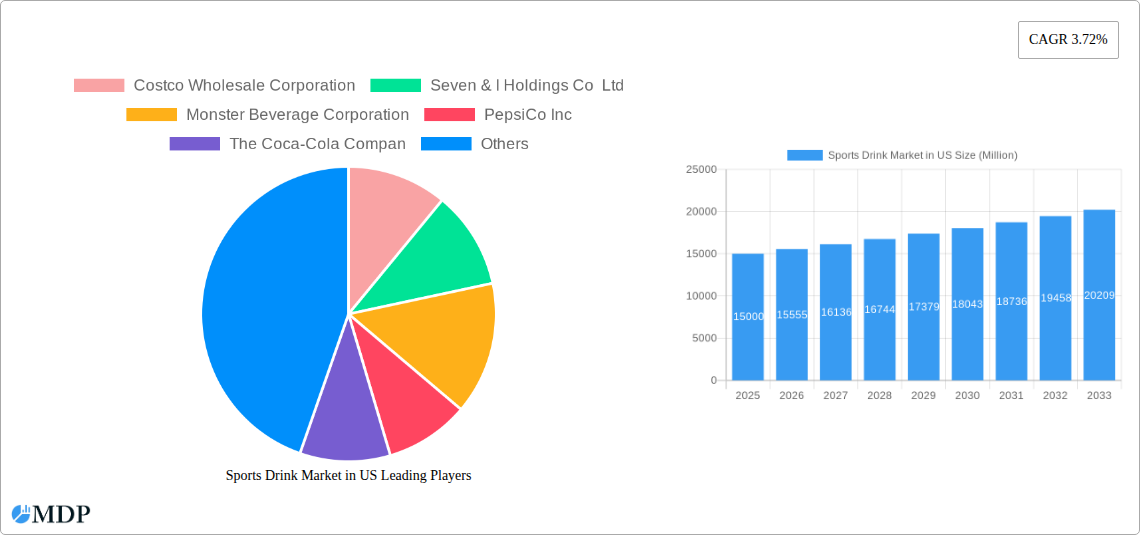

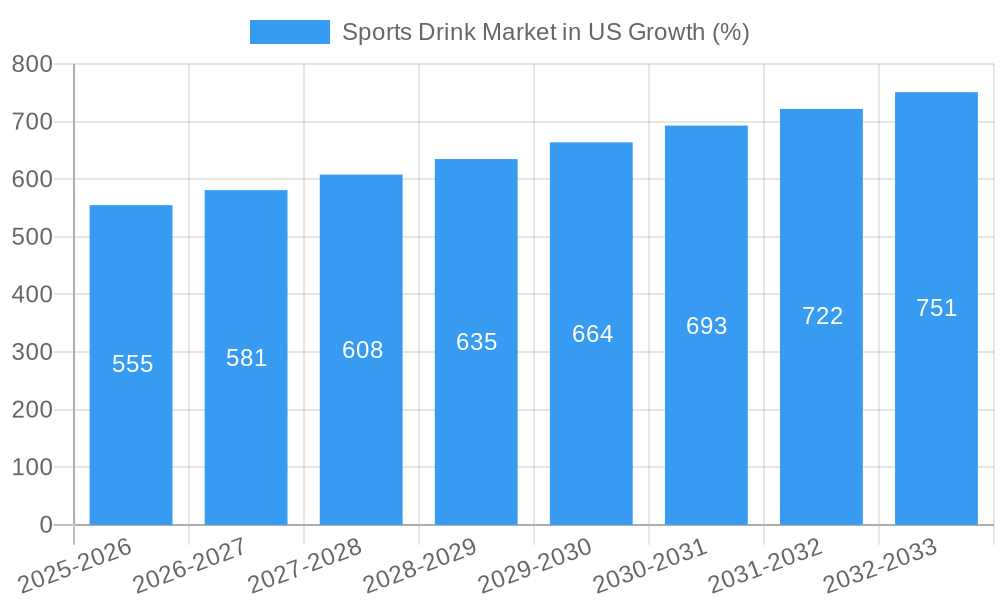

The US sports drink market, valued at approximately $15 billion in 2025, is projected to experience steady growth, driven by increasing health consciousness and participation in athletic activities. The market's Compound Annual Growth Rate (CAGR) of 3.72% from 2019 to 2024 suggests a continued expansion through 2033. Key growth drivers include the rising popularity of functional beverages, a surge in demand for electrolyte-enhanced waters and protein-based sports drinks catering to fitness enthusiasts and athletes. Convenience store distribution channels remain dominant, reflecting the on-the-go nature of consumption. However, the increasing prevalence of online retail presents a significant opportunity for market expansion. The market segmentation reveals a preference for PET bottles as the preferred packaging type, indicating a balance between convenience and cost-effectiveness. Major players like Coca-Cola, PepsiCo, and Monster Beverage Corporation are expected to maintain their market dominance through aggressive marketing strategies and product innovation, while smaller, niche players focusing on specific health benefits or unique flavors may carve out profitable market segments.

The market faces constraints, including increased consumer awareness of added sugars and artificial ingredients in certain sports drinks. This has led to a rise in demand for healthier alternatives, pushing manufacturers to reformulate products and emphasize natural ingredients. Furthermore, competition from other functional beverages, such as energy drinks and enhanced waters, presents a challenge. The market is characterized by a diverse range of product types, including isotonic, hypotonic, and hypertonic drinks, each catering to different consumer needs and athletic intensities. Future growth will likely be fueled by product innovation focusing on natural ingredients, electrolytes, and specialized formulations targeting specific consumer demographics. The continued adoption of healthier lifestyles and increased participation in sports and fitness activities will further propel the growth of the US sports drink market.

US Sports Drink Market Report: A Comprehensive Analysis (2019-2033)

This in-depth report provides a comprehensive analysis of the US sports drink market, encompassing market dynamics, industry trends, leading segments, and key players. With a focus on the period 2019-2033 (base year 2025), this report offers invaluable insights for stakeholders seeking to understand and capitalize on opportunities within this dynamic sector. The report includes detailed forecasts, market sizing (in Millions), and competitive landscape analysis to help you make informed business decisions.

Sports Drink Market in US Market Dynamics & Concentration

The US sports drink market is characterized by a moderately concentrated landscape, with key players like PepsiCo Inc, The Coca-Cola Company, and Monster Beverage Corporation holding significant market share. The market's dynamism is driven by continuous innovation in product formulations (e.g., electrolyte-enhanced waters, protein-based drinks), packaging (PET bottles, aseptic packages), and distribution channels (online retail, convenience stores). Regulatory frameworks concerning sugar content and labeling influence product development and marketing strategies. The market also faces competition from substitutes like enhanced waters and functional beverages. Consumer preferences are increasingly shifting towards healthier options with natural ingredients and lower sugar content. Mergers and acquisitions (M&A) activity remains a key factor in shaping the market landscape, with an estimated xx M&A deals concluded between 2019 and 2024, resulting in a market concentration ratio (CR4) of approximately xx%.

- Market Concentration: Moderately concentrated, with top players holding xx% market share (2024).

- Innovation Drivers: New product formulations, functional ingredients, sustainable packaging.

- Regulatory Frameworks: Sugar content regulations, labeling requirements.

- Product Substitutes: Enhanced waters, functional beverages.

- End-User Trends: Growing demand for healthier, natural, and functional sports drinks.

- M&A Activity: xx M&A deals (2019-2024), leading to increased market consolidation.

Sports Drink Market in US Industry Trends & Analysis

The US sports drink market experienced a CAGR of xx% during the historical period (2019-2024), driven primarily by increasing health consciousness, rising disposable incomes, and growing participation in sports and fitness activities. Technological advancements in production and packaging have enabled the introduction of innovative products catering to specific consumer needs. The market penetration of sports drinks is currently estimated at xx% in the US, with significant potential for future growth. However, challenges such as fluctuating raw material prices and increased competition from substitute products pose ongoing threats. Consumer preferences are also shifting towards low-sugar, natural, and functional variants, requiring companies to adapt their product offerings. The market is witnessing a significant shift towards online retail channels, further influencing distribution strategies. Future growth is anticipated to be fueled by the increasing adoption of functional beverages and the expanding market for health and wellness products.

Leading Markets & Segments in Sports Drink Market in US

The US sports drink market is dominated by the Isotonic segment within the Soft Drink Type category, driven by its widespread appeal and effectiveness for hydration during physical activity. PET Bottles account for the largest share in the Packaging Type segment due to their cost-effectiveness, convenience, and widespread availability. Convenience Stores constitute the leading Sub Distribution Channel, providing convenient access for consumers. The growth of these leading segments is propelled by several key factors:

- Isotonic Drinks: Wide acceptance among athletes and fitness enthusiasts, effective hydration.

- PET Bottles: Cost-effective, convenient, and widely available.

- Convenience Stores: High accessibility, strong impulse buying potential.

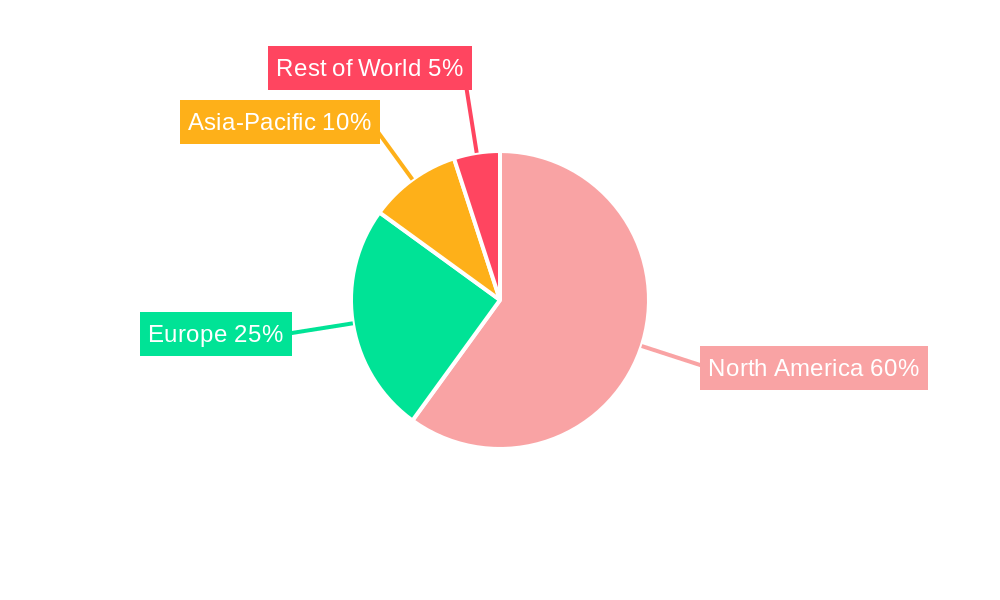

Geographic Dominance: The report's analysis indicates that the South and West regions of the US exhibit higher market growth rates than other areas, fueled by higher participation in outdoor sports and fitness activities. Economic factors, including disposable income and consumer spending habits, are significant drivers in regional market performance. Further influencing the market are the levels of urbanization and presence of sports and wellness infrastructure.

Sports Drink Market in US Product Developments

Recent product innovations focus on enhanced functionality, incorporating ingredients like electrolytes, vitamins, and protein to cater to specific health and fitness needs. This includes a rise in electrolyte-enhanced waters and protein-based sports drinks, offering enhanced hydration and post-workout recovery benefits. Manufacturers are also focusing on sustainable packaging options, such as recycled PET bottles and aseptic packaging, to meet growing environmental concerns. Key competitive advantages stem from innovation in product formulations, unique flavor profiles, branding, and targeted marketing strategies, along with efficient supply chain management.

Key Drivers of Sports Drink Market in US Growth

The US sports drink market’s growth is driven by several key factors:

- Rising Health Consciousness: Increased awareness of hydration's importance in physical activity.

- Growing Fitness Enthusiasm: More individuals participate in sports and fitness activities.

- Technological Advancements: Innovations in product formulations and packaging.

- Favorable Economic Conditions: Rising disposable incomes support increased spending on health and wellness products.

Challenges in the Sports Drink Market in US Market

The market faces challenges such as:

- Intense Competition: Presence of numerous established and emerging brands.

- Fluctuating Raw Material Prices: Impact on production costs and profitability.

- Health Concerns: Consumer concerns over sugar content and artificial ingredients.

- Supply Chain Disruptions: Geopolitical events and logistical challenges impacting availability.

Emerging Opportunities in Sports Drink Market in US

Significant growth opportunities exist in developing innovative products catering to niche consumer segments, such as specialized sports drinks targeting specific athletic disciplines or those focused on particular health needs. Strategic partnerships with fitness centers, gyms, and online platforms can create new avenues for product distribution and brand awareness. Expansion into emerging markets, such as online sales and direct-to-consumer channels, presents significant potential. Furthermore, the increasing trend toward functional and natural ingredients offers scope for the development of premium, high-value products.

Leading Players in the Sports Drink Market in US Sector

- Costco Wholesale Corporation

- Seven & I Holdings Co Ltd

- Monster Beverage Corporation

- PepsiCo Inc

- The Coca-Cola Company

- Abbott Laboratories

- Suntory Holdings Limited

- Keurig Dr Pepper Inc

- Pisa Global S A de C V

- Otsuka Holdings Co Ltd

- Bluetriton Brands Holdings Inc

- Congo Brands

Key Milestones in Sports Drink Market in US Industry

- December 2023: Spar partners with Congo Brands to distribute Prime drinks, marking a significant entry into the convenience store channel.

- April 2023: Congo LLC invests USD 8.25 Million to expand its Louisville headquarters, signaling significant growth and job creation within the industry.

- February 2023: Core Hydration launches Core Hydration+, a line of nutrient-enhanced waters, demonstrating the trend towards functional beverages.

Strategic Outlook for Sports Drink Market in US Market

The US sports drink market shows strong growth potential driven by increasing health awareness, the rising popularity of fitness activities, and ongoing product innovation. Strategic opportunities lie in developing and marketing products with natural ingredients, targeted functionality, and sustainable packaging. Expanding into underserved markets and leveraging digital marketing strategies will be crucial for success. Companies that prioritize product differentiation, brand building, and strong distribution networks are expected to thrive in this competitive landscape.

Sports Drink Market in US Segmentation

-

1. Soft Drink Type

- 1.1. Electrolyte-Enhanced Water

- 1.2. Hypertonic

- 1.3. Hypotonic

- 1.4. Isotonic

- 1.5. Protein-based Sport Drinks

-

2. Packaging Type

- 2.1. Aseptic packages

- 2.2. Metal Can

- 2.3. PET Bottles

-

3. Sub Distribution Channel

- 3.1. Convenience Stores

- 3.2. Online Retail

- 3.3. Specialty Stores

- 3.4. Supermarket/Hypermarket

- 3.5. Others

Sports Drink Market in US Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

Sports Drink Market in US REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 3.72% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Rising Consumer Awareness about Health and Fitness; Increasing the Use of Casein and Caseinate in Food and Beverage Industry

- 3.3. Market Restrains

- 3.3.1. High Competition From Alternative Protein Sources

- 3.4. Market Trends

- 3.4.1. OTHER KEY INDUSTRY TRENDS COVERED IN THE REPORT

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Sports Drink Market in US Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Soft Drink Type

- 5.1.1. Electrolyte-Enhanced Water

- 5.1.2. Hypertonic

- 5.1.3. Hypotonic

- 5.1.4. Isotonic

- 5.1.5. Protein-based Sport Drinks

- 5.2. Market Analysis, Insights and Forecast - by Packaging Type

- 5.2.1. Aseptic packages

- 5.2.2. Metal Can

- 5.2.3. PET Bottles

- 5.3. Market Analysis, Insights and Forecast - by Sub Distribution Channel

- 5.3.1. Convenience Stores

- 5.3.2. Online Retail

- 5.3.3. Specialty Stores

- 5.3.4. Supermarket/Hypermarket

- 5.3.5. Others

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. North America

- 5.4.2. South America

- 5.4.3. Europe

- 5.4.4. Middle East & Africa

- 5.4.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Soft Drink Type

- 6. North America Sports Drink Market in US Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Soft Drink Type

- 6.1.1. Electrolyte-Enhanced Water

- 6.1.2. Hypertonic

- 6.1.3. Hypotonic

- 6.1.4. Isotonic

- 6.1.5. Protein-based Sport Drinks

- 6.2. Market Analysis, Insights and Forecast - by Packaging Type

- 6.2.1. Aseptic packages

- 6.2.2. Metal Can

- 6.2.3. PET Bottles

- 6.3. Market Analysis, Insights and Forecast - by Sub Distribution Channel

- 6.3.1. Convenience Stores

- 6.3.2. Online Retail

- 6.3.3. Specialty Stores

- 6.3.4. Supermarket/Hypermarket

- 6.3.5. Others

- 6.1. Market Analysis, Insights and Forecast - by Soft Drink Type

- 7. South America Sports Drink Market in US Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Soft Drink Type

- 7.1.1. Electrolyte-Enhanced Water

- 7.1.2. Hypertonic

- 7.1.3. Hypotonic

- 7.1.4. Isotonic

- 7.1.5. Protein-based Sport Drinks

- 7.2. Market Analysis, Insights and Forecast - by Packaging Type

- 7.2.1. Aseptic packages

- 7.2.2. Metal Can

- 7.2.3. PET Bottles

- 7.3. Market Analysis, Insights and Forecast - by Sub Distribution Channel

- 7.3.1. Convenience Stores

- 7.3.2. Online Retail

- 7.3.3. Specialty Stores

- 7.3.4. Supermarket/Hypermarket

- 7.3.5. Others

- 7.1. Market Analysis, Insights and Forecast - by Soft Drink Type

- 8. Europe Sports Drink Market in US Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Soft Drink Type

- 8.1.1. Electrolyte-Enhanced Water

- 8.1.2. Hypertonic

- 8.1.3. Hypotonic

- 8.1.4. Isotonic

- 8.1.5. Protein-based Sport Drinks

- 8.2. Market Analysis, Insights and Forecast - by Packaging Type

- 8.2.1. Aseptic packages

- 8.2.2. Metal Can

- 8.2.3. PET Bottles

- 8.3. Market Analysis, Insights and Forecast - by Sub Distribution Channel

- 8.3.1. Convenience Stores

- 8.3.2. Online Retail

- 8.3.3. Specialty Stores

- 8.3.4. Supermarket/Hypermarket

- 8.3.5. Others

- 8.1. Market Analysis, Insights and Forecast - by Soft Drink Type

- 9. Middle East & Africa Sports Drink Market in US Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Soft Drink Type

- 9.1.1. Electrolyte-Enhanced Water

- 9.1.2. Hypertonic

- 9.1.3. Hypotonic

- 9.1.4. Isotonic

- 9.1.5. Protein-based Sport Drinks

- 9.2. Market Analysis, Insights and Forecast - by Packaging Type

- 9.2.1. Aseptic packages

- 9.2.2. Metal Can

- 9.2.3. PET Bottles

- 9.3. Market Analysis, Insights and Forecast - by Sub Distribution Channel

- 9.3.1. Convenience Stores

- 9.3.2. Online Retail

- 9.3.3. Specialty Stores

- 9.3.4. Supermarket/Hypermarket

- 9.3.5. Others

- 9.1. Market Analysis, Insights and Forecast - by Soft Drink Type

- 10. Asia Pacific Sports Drink Market in US Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Soft Drink Type

- 10.1.1. Electrolyte-Enhanced Water

- 10.1.2. Hypertonic

- 10.1.3. Hypotonic

- 10.1.4. Isotonic

- 10.1.5. Protein-based Sport Drinks

- 10.2. Market Analysis, Insights and Forecast - by Packaging Type

- 10.2.1. Aseptic packages

- 10.2.2. Metal Can

- 10.2.3. PET Bottles

- 10.3. Market Analysis, Insights and Forecast - by Sub Distribution Channel

- 10.3.1. Convenience Stores

- 10.3.2. Online Retail

- 10.3.3. Specialty Stores

- 10.3.4. Supermarket/Hypermarket

- 10.3.5. Others

- 10.1. Market Analysis, Insights and Forecast - by Soft Drink Type

- 11. United States Sports Drink Market in US Analysis, Insights and Forecast, 2019-2031

- 12. Canada Sports Drink Market in US Analysis, Insights and Forecast, 2019-2031

- 13. Mexico Sports Drink Market in US Analysis, Insights and Forecast, 2019-2031

- 14. Competitive Analysis

- 14.1. Global Market Share Analysis 2024

- 14.2. Company Profiles

- 14.2.1 Costco Wholesale Corporation

- 14.2.1.1. Overview

- 14.2.1.2. Products

- 14.2.1.3. SWOT Analysis

- 14.2.1.4. Recent Developments

- 14.2.1.5. Financials (Based on Availability)

- 14.2.2 Seven & I Holdings Co Ltd

- 14.2.2.1. Overview

- 14.2.2.2. Products

- 14.2.2.3. SWOT Analysis

- 14.2.2.4. Recent Developments

- 14.2.2.5. Financials (Based on Availability)

- 14.2.3 Monster Beverage Corporation

- 14.2.3.1. Overview

- 14.2.3.2. Products

- 14.2.3.3. SWOT Analysis

- 14.2.3.4. Recent Developments

- 14.2.3.5. Financials (Based on Availability)

- 14.2.4 PepsiCo Inc

- 14.2.4.1. Overview

- 14.2.4.2. Products

- 14.2.4.3. SWOT Analysis

- 14.2.4.4. Recent Developments

- 14.2.4.5. Financials (Based on Availability)

- 14.2.5 The Coca-Cola Compan

- 14.2.5.1. Overview

- 14.2.5.2. Products

- 14.2.5.3. SWOT Analysis

- 14.2.5.4. Recent Developments

- 14.2.5.5. Financials (Based on Availability)

- 14.2.6 Abbott Laboratories

- 14.2.6.1. Overview

- 14.2.6.2. Products

- 14.2.6.3. SWOT Analysis

- 14.2.6.4. Recent Developments

- 14.2.6.5. Financials (Based on Availability)

- 14.2.7 Suntory Holdings Limited

- 14.2.7.1. Overview

- 14.2.7.2. Products

- 14.2.7.3. SWOT Analysis

- 14.2.7.4. Recent Developments

- 14.2.7.5. Financials (Based on Availability)

- 14.2.8 Keurig Dr Pepper Inc

- 14.2.8.1. Overview

- 14.2.8.2. Products

- 14.2.8.3. SWOT Analysis

- 14.2.8.4. Recent Developments

- 14.2.8.5. Financials (Based on Availability)

- 14.2.9 Pisa Global S A de C V

- 14.2.9.1. Overview

- 14.2.9.2. Products

- 14.2.9.3. SWOT Analysis

- 14.2.9.4. Recent Developments

- 14.2.9.5. Financials (Based on Availability)

- 14.2.10 Otsuka Holdings Co Ltd

- 14.2.10.1. Overview

- 14.2.10.2. Products

- 14.2.10.3. SWOT Analysis

- 14.2.10.4. Recent Developments

- 14.2.10.5. Financials (Based on Availability)

- 14.2.11 Bluetriton Brands Holdings Inc

- 14.2.11.1. Overview

- 14.2.11.2. Products

- 14.2.11.3. SWOT Analysis

- 14.2.11.4. Recent Developments

- 14.2.11.5. Financials (Based on Availability)

- 14.2.12 Congo Brands

- 14.2.12.1. Overview

- 14.2.12.2. Products

- 14.2.12.3. SWOT Analysis

- 14.2.12.4. Recent Developments

- 14.2.12.5. Financials (Based on Availability)

- 14.2.1 Costco Wholesale Corporation

List of Figures

- Figure 1: Global Sports Drink Market in US Revenue Breakdown (Million, %) by Region 2024 & 2032

- Figure 2: North America Sports Drink Market in US Revenue (Million), by Country 2024 & 2032

- Figure 3: North America Sports Drink Market in US Revenue Share (%), by Country 2024 & 2032

- Figure 4: North America Sports Drink Market in US Revenue (Million), by Soft Drink Type 2024 & 2032

- Figure 5: North America Sports Drink Market in US Revenue Share (%), by Soft Drink Type 2024 & 2032

- Figure 6: North America Sports Drink Market in US Revenue (Million), by Packaging Type 2024 & 2032

- Figure 7: North America Sports Drink Market in US Revenue Share (%), by Packaging Type 2024 & 2032

- Figure 8: North America Sports Drink Market in US Revenue (Million), by Sub Distribution Channel 2024 & 2032

- Figure 9: North America Sports Drink Market in US Revenue Share (%), by Sub Distribution Channel 2024 & 2032

- Figure 10: North America Sports Drink Market in US Revenue (Million), by Country 2024 & 2032

- Figure 11: North America Sports Drink Market in US Revenue Share (%), by Country 2024 & 2032

- Figure 12: South America Sports Drink Market in US Revenue (Million), by Soft Drink Type 2024 & 2032

- Figure 13: South America Sports Drink Market in US Revenue Share (%), by Soft Drink Type 2024 & 2032

- Figure 14: South America Sports Drink Market in US Revenue (Million), by Packaging Type 2024 & 2032

- Figure 15: South America Sports Drink Market in US Revenue Share (%), by Packaging Type 2024 & 2032

- Figure 16: South America Sports Drink Market in US Revenue (Million), by Sub Distribution Channel 2024 & 2032

- Figure 17: South America Sports Drink Market in US Revenue Share (%), by Sub Distribution Channel 2024 & 2032

- Figure 18: South America Sports Drink Market in US Revenue (Million), by Country 2024 & 2032

- Figure 19: South America Sports Drink Market in US Revenue Share (%), by Country 2024 & 2032

- Figure 20: Europe Sports Drink Market in US Revenue (Million), by Soft Drink Type 2024 & 2032

- Figure 21: Europe Sports Drink Market in US Revenue Share (%), by Soft Drink Type 2024 & 2032

- Figure 22: Europe Sports Drink Market in US Revenue (Million), by Packaging Type 2024 & 2032

- Figure 23: Europe Sports Drink Market in US Revenue Share (%), by Packaging Type 2024 & 2032

- Figure 24: Europe Sports Drink Market in US Revenue (Million), by Sub Distribution Channel 2024 & 2032

- Figure 25: Europe Sports Drink Market in US Revenue Share (%), by Sub Distribution Channel 2024 & 2032

- Figure 26: Europe Sports Drink Market in US Revenue (Million), by Country 2024 & 2032

- Figure 27: Europe Sports Drink Market in US Revenue Share (%), by Country 2024 & 2032

- Figure 28: Middle East & Africa Sports Drink Market in US Revenue (Million), by Soft Drink Type 2024 & 2032

- Figure 29: Middle East & Africa Sports Drink Market in US Revenue Share (%), by Soft Drink Type 2024 & 2032

- Figure 30: Middle East & Africa Sports Drink Market in US Revenue (Million), by Packaging Type 2024 & 2032

- Figure 31: Middle East & Africa Sports Drink Market in US Revenue Share (%), by Packaging Type 2024 & 2032

- Figure 32: Middle East & Africa Sports Drink Market in US Revenue (Million), by Sub Distribution Channel 2024 & 2032

- Figure 33: Middle East & Africa Sports Drink Market in US Revenue Share (%), by Sub Distribution Channel 2024 & 2032

- Figure 34: Middle East & Africa Sports Drink Market in US Revenue (Million), by Country 2024 & 2032

- Figure 35: Middle East & Africa Sports Drink Market in US Revenue Share (%), by Country 2024 & 2032

- Figure 36: Asia Pacific Sports Drink Market in US Revenue (Million), by Soft Drink Type 2024 & 2032

- Figure 37: Asia Pacific Sports Drink Market in US Revenue Share (%), by Soft Drink Type 2024 & 2032

- Figure 38: Asia Pacific Sports Drink Market in US Revenue (Million), by Packaging Type 2024 & 2032

- Figure 39: Asia Pacific Sports Drink Market in US Revenue Share (%), by Packaging Type 2024 & 2032

- Figure 40: Asia Pacific Sports Drink Market in US Revenue (Million), by Sub Distribution Channel 2024 & 2032

- Figure 41: Asia Pacific Sports Drink Market in US Revenue Share (%), by Sub Distribution Channel 2024 & 2032

- Figure 42: Asia Pacific Sports Drink Market in US Revenue (Million), by Country 2024 & 2032

- Figure 43: Asia Pacific Sports Drink Market in US Revenue Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global Sports Drink Market in US Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Global Sports Drink Market in US Revenue Million Forecast, by Soft Drink Type 2019 & 2032

- Table 3: Global Sports Drink Market in US Revenue Million Forecast, by Packaging Type 2019 & 2032

- Table 4: Global Sports Drink Market in US Revenue Million Forecast, by Sub Distribution Channel 2019 & 2032

- Table 5: Global Sports Drink Market in US Revenue Million Forecast, by Region 2019 & 2032

- Table 6: Global Sports Drink Market in US Revenue Million Forecast, by Country 2019 & 2032

- Table 7: United States Sports Drink Market in US Revenue (Million) Forecast, by Application 2019 & 2032

- Table 8: Canada Sports Drink Market in US Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: Mexico Sports Drink Market in US Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: Global Sports Drink Market in US Revenue Million Forecast, by Soft Drink Type 2019 & 2032

- Table 11: Global Sports Drink Market in US Revenue Million Forecast, by Packaging Type 2019 & 2032

- Table 12: Global Sports Drink Market in US Revenue Million Forecast, by Sub Distribution Channel 2019 & 2032

- Table 13: Global Sports Drink Market in US Revenue Million Forecast, by Country 2019 & 2032

- Table 14: United States Sports Drink Market in US Revenue (Million) Forecast, by Application 2019 & 2032

- Table 15: Canada Sports Drink Market in US Revenue (Million) Forecast, by Application 2019 & 2032

- Table 16: Mexico Sports Drink Market in US Revenue (Million) Forecast, by Application 2019 & 2032

- Table 17: Global Sports Drink Market in US Revenue Million Forecast, by Soft Drink Type 2019 & 2032

- Table 18: Global Sports Drink Market in US Revenue Million Forecast, by Packaging Type 2019 & 2032

- Table 19: Global Sports Drink Market in US Revenue Million Forecast, by Sub Distribution Channel 2019 & 2032

- Table 20: Global Sports Drink Market in US Revenue Million Forecast, by Country 2019 & 2032

- Table 21: Brazil Sports Drink Market in US Revenue (Million) Forecast, by Application 2019 & 2032

- Table 22: Argentina Sports Drink Market in US Revenue (Million) Forecast, by Application 2019 & 2032

- Table 23: Rest of South America Sports Drink Market in US Revenue (Million) Forecast, by Application 2019 & 2032

- Table 24: Global Sports Drink Market in US Revenue Million Forecast, by Soft Drink Type 2019 & 2032

- Table 25: Global Sports Drink Market in US Revenue Million Forecast, by Packaging Type 2019 & 2032

- Table 26: Global Sports Drink Market in US Revenue Million Forecast, by Sub Distribution Channel 2019 & 2032

- Table 27: Global Sports Drink Market in US Revenue Million Forecast, by Country 2019 & 2032

- Table 28: United Kingdom Sports Drink Market in US Revenue (Million) Forecast, by Application 2019 & 2032

- Table 29: Germany Sports Drink Market in US Revenue (Million) Forecast, by Application 2019 & 2032

- Table 30: France Sports Drink Market in US Revenue (Million) Forecast, by Application 2019 & 2032

- Table 31: Italy Sports Drink Market in US Revenue (Million) Forecast, by Application 2019 & 2032

- Table 32: Spain Sports Drink Market in US Revenue (Million) Forecast, by Application 2019 & 2032

- Table 33: Russia Sports Drink Market in US Revenue (Million) Forecast, by Application 2019 & 2032

- Table 34: Benelux Sports Drink Market in US Revenue (Million) Forecast, by Application 2019 & 2032

- Table 35: Nordics Sports Drink Market in US Revenue (Million) Forecast, by Application 2019 & 2032

- Table 36: Rest of Europe Sports Drink Market in US Revenue (Million) Forecast, by Application 2019 & 2032

- Table 37: Global Sports Drink Market in US Revenue Million Forecast, by Soft Drink Type 2019 & 2032

- Table 38: Global Sports Drink Market in US Revenue Million Forecast, by Packaging Type 2019 & 2032

- Table 39: Global Sports Drink Market in US Revenue Million Forecast, by Sub Distribution Channel 2019 & 2032

- Table 40: Global Sports Drink Market in US Revenue Million Forecast, by Country 2019 & 2032

- Table 41: Turkey Sports Drink Market in US Revenue (Million) Forecast, by Application 2019 & 2032

- Table 42: Israel Sports Drink Market in US Revenue (Million) Forecast, by Application 2019 & 2032

- Table 43: GCC Sports Drink Market in US Revenue (Million) Forecast, by Application 2019 & 2032

- Table 44: North Africa Sports Drink Market in US Revenue (Million) Forecast, by Application 2019 & 2032

- Table 45: South Africa Sports Drink Market in US Revenue (Million) Forecast, by Application 2019 & 2032

- Table 46: Rest of Middle East & Africa Sports Drink Market in US Revenue (Million) Forecast, by Application 2019 & 2032

- Table 47: Global Sports Drink Market in US Revenue Million Forecast, by Soft Drink Type 2019 & 2032

- Table 48: Global Sports Drink Market in US Revenue Million Forecast, by Packaging Type 2019 & 2032

- Table 49: Global Sports Drink Market in US Revenue Million Forecast, by Sub Distribution Channel 2019 & 2032

- Table 50: Global Sports Drink Market in US Revenue Million Forecast, by Country 2019 & 2032

- Table 51: China Sports Drink Market in US Revenue (Million) Forecast, by Application 2019 & 2032

- Table 52: India Sports Drink Market in US Revenue (Million) Forecast, by Application 2019 & 2032

- Table 53: Japan Sports Drink Market in US Revenue (Million) Forecast, by Application 2019 & 2032

- Table 54: South Korea Sports Drink Market in US Revenue (Million) Forecast, by Application 2019 & 2032

- Table 55: ASEAN Sports Drink Market in US Revenue (Million) Forecast, by Application 2019 & 2032

- Table 56: Oceania Sports Drink Market in US Revenue (Million) Forecast, by Application 2019 & 2032

- Table 57: Rest of Asia Pacific Sports Drink Market in US Revenue (Million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Sports Drink Market in US?

The projected CAGR is approximately 3.72%.

2. Which companies are prominent players in the Sports Drink Market in US?

Key companies in the market include Costco Wholesale Corporation, Seven & I Holdings Co Ltd, Monster Beverage Corporation, PepsiCo Inc, The Coca-Cola Compan, Abbott Laboratories, Suntory Holdings Limited, Keurig Dr Pepper Inc, Pisa Global S A de C V, Otsuka Holdings Co Ltd, Bluetriton Brands Holdings Inc, Congo Brands.

3. What are the main segments of the Sports Drink Market in US?

The market segments include Soft Drink Type, Packaging Type, Sub Distribution Channel.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Rising Consumer Awareness about Health and Fitness; Increasing the Use of Casein and Caseinate in Food and Beverage Industry.

6. What are the notable trends driving market growth?

OTHER KEY INDUSTRY TRENDS COVERED IN THE REPORT.

7. Are there any restraints impacting market growth?

High Competition From Alternative Protein Sources.

8. Can you provide examples of recent developments in the market?

December 2023: Spar works with US distributor Congo Brands to bring Prime drinks to stores. The move makes Spar the first symbol group in the convenience channel to stock PrimeApril 2023: Congo LLC to relocate, expand Louisville headquarters with USD 8.25 million investment, creating 500 high-wage jobs. The company will relocate its Louisville headquarters to an existing 110,000-square-foot location at 13551 Triton Park Blvd., moving from its current 18,000-square-foot facility.February 2023: Premium pH-balanced water brand Core Hydration expanded with Core Hydration+, a series of nutrient-enhanced waters, each formulated to support overall health with functional ingredients. The brand is available in three flavors under the names Core Hydration+Immunity, Core Hydartion+Vibrance, and Core Hydration+ Calm.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Sports Drink Market in US," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Sports Drink Market in US report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Sports Drink Market in US?

To stay informed about further developments, trends, and reports in the Sports Drink Market in US, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence