Key Insights

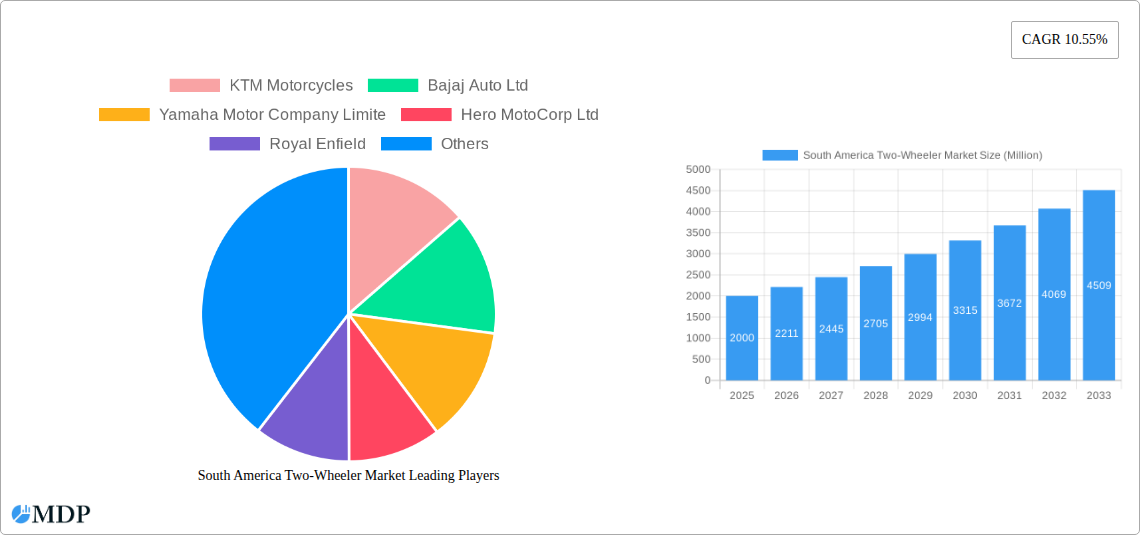

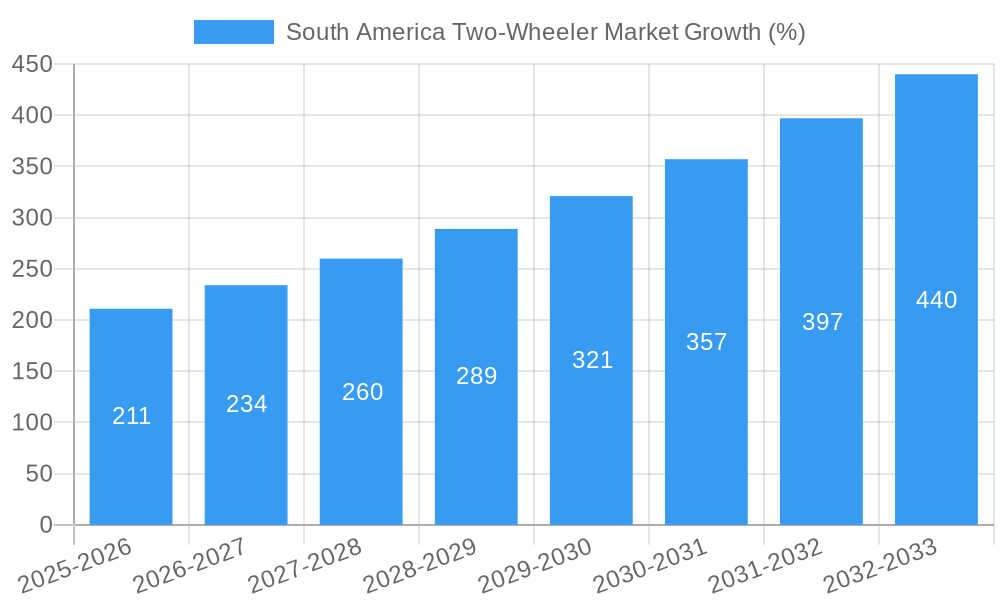

The South American two-wheeler market, valued at approximately $XX million in 2025, is projected to experience robust growth, exhibiting a Compound Annual Growth Rate (CAGR) of 10.55% from 2025 to 2033. This expansion is fueled by several key factors. Rising urbanization across major South American countries like Brazil and Argentina is driving increased demand for personal mobility solutions, with two-wheelers offering an affordable and efficient alternative to four-wheeled vehicles, particularly in congested urban areas. Furthermore, a growing young population and increasing disposable incomes, especially within the burgeoning middle class, are boosting purchasing power and fueling demand for motorcycles and scooters. The increasing popularity of e-commerce and delivery services is also contributing to the market's growth, creating a need for efficient last-mile delivery solutions. Government initiatives promoting sustainable transportation, coupled with the introduction of more affordable electric and hybrid two-wheelers, are further accelerating market expansion.

However, challenges remain. Economic volatility and fluctuations in fuel prices can impact consumer spending and purchasing decisions. The regulatory landscape regarding vehicle emissions and safety standards varies across South American countries, creating complexities for manufacturers navigating the market. Competition among established players like Honda, Yamaha, Bajaj, and Hero, along with emerging local brands, is intense, requiring companies to continuously innovate and offer competitive pricing and features to maintain market share. Despite these restraints, the long-term outlook for the South American two-wheeler market remains positive, driven by the aforementioned factors and the ongoing evolution of consumer preferences towards affordable and convenient transportation solutions. The increasing focus on electric vehicles promises to further reshape this dynamic market in the coming years, attracting investment and driving technological advancements.

South America Two-Wheeler Market: 2019-2033 Forecast & Analysis

This comprehensive report provides an in-depth analysis of the South America two-wheeler market, offering valuable insights for stakeholders across the automotive industry. Covering the period 2019-2033, with a focus on 2025, this report examines market dynamics, leading players, emerging trends, and future growth opportunities. The report leverages extensive market research to provide actionable data and forecasts, supporting informed decision-making. Download now to gain a competitive edge.

South America Two-Wheeler Market Market Dynamics & Concentration

The South American two-wheeler market, valued at xx Million in 2024, exhibits a moderately concentrated landscape. While a few major players dominate, smaller regional manufacturers and importers contribute significantly to the market volume. Market concentration is influenced by factors like brand loyalty, distribution networks, and import tariffs. Innovation, driven by advancements in engine technology (ICE and Hybrid/Electric), safety features, and connected vehicle technologies, is a key driver. Stringent emission regulations in some countries are shaping the market, favoring fuel-efficient and low-emission vehicles. The presence of readily available substitute modes of transport, including public transit in urban areas, presents a challenge. Consumer preferences are shifting towards more fuel-efficient, technologically advanced, and stylish models. M&A activity in the South American two-wheeler market has been relatively modest in recent years, with xx mergers and acquisitions recorded between 2019 and 2024. Market share data reveals that the top five players hold approximately xx% of the market, with KTM Motorcycles, Bajaj Auto Ltd, Yamaha Motor Company Limited, Hero MotoCorp Ltd, and Royal Enfield among the leading brands.

- Market Concentration: Moderately concentrated, top 5 players holding approx. xx% market share.

- Innovation Drivers: Advancements in engine technology, safety features, connected vehicle technologies.

- Regulatory Frameworks: Varying emission standards across countries.

- Product Substitutes: Public transport, particularly in urban areas.

- End-User Trends: Preference for fuel efficiency, technology, and style.

- M&A Activity: xx deals between 2019 and 2024.

South America Two-Wheeler Market Industry Trends & Analysis

The South American two-wheeler market is projected to experience a Compound Annual Growth Rate (CAGR) of xx% during the forecast period (2025-2033). This growth is fueled by several factors. Rising urbanization and increasing disposable incomes are driving demand for personal mobility solutions, particularly in rapidly growing cities. The expanding middle class is a significant contributor to this trend. Government initiatives promoting affordable transportation options and improved road infrastructure in some regions further stimulate market expansion. Technological disruptions, like the increasing adoption of electric and hybrid vehicles, are reshaping the competitive landscape. Consumer preferences are evolving, with a growing demand for technologically advanced features, such as smart connectivity, safety systems, and improved fuel efficiency. Intense competition among established players and the emergence of new entrants are intensifying the market dynamics. Market penetration of electric two-wheelers remains relatively low, estimated at xx% in 2024, but is expected to grow significantly in the coming years due to government incentives and technological advancements.

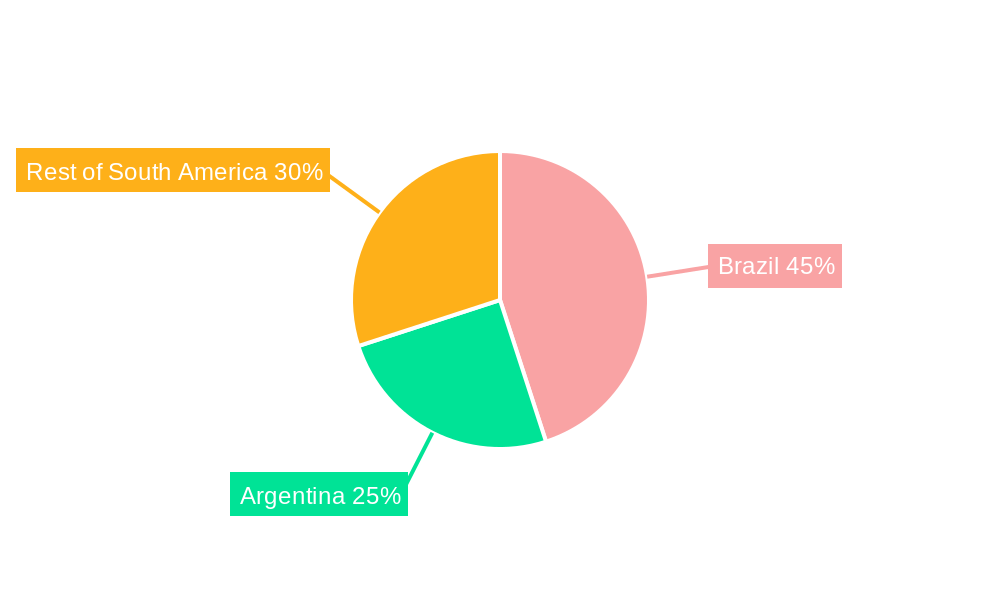

Leading Markets & Segments in South America Two-Wheeler Market

Brazil represents the dominant market within South America for two-wheelers, accounting for approximately xx% of the regional market share in 2024. This dominance stems from several key factors:

- Strong economic base: Brazil's relatively larger economy compared to other South American nations provides a wider consumer base.

- Extensive road network: While uneven in quality, the existing road network supports two-wheeler usage.

- Robust domestic manufacturing: Several major two-wheeler manufacturers have significant presence and production facilities in Brazil.

- Government policies: Government incentives and initiatives at times influence the affordability and accessibility of two-wheelers.

Argentina also holds a significant market share, though smaller than Brazil’s. The Rest-of-South America segment exhibits slower growth compared to Brazil and Argentina, primarily due to lower purchasing power and less developed infrastructure in many areas.

In terms of propulsion type, the Internal Combustion Engine (ICE) segment currently dominates, holding around xx% of the market share. However, the Hybrid and Electric Vehicles (HEV) segment is expected to witness significant growth over the forecast period, driven by government regulations and increasing consumer awareness of environmental concerns.

South America Two-Wheeler Market Product Developments

Recent product developments are characterized by a focus on enhancing fuel efficiency, integrating advanced safety technologies, and incorporating smart connectivity features. Manufacturers are increasingly introducing electric and hybrid models to cater to growing environmental concerns and government regulations. Competitive advantages are achieved through innovative designs, superior performance characteristics, attractive pricing strategies, and comprehensive after-sales services.

Key Drivers of South America Two-Wheeler Market Growth

Several factors contribute to the growth of the South American two-wheeler market. Firstly, rising urbanization and increased disposable incomes are creating a larger consumer base seeking affordable personal transportation. Secondly, technological advancements in engine technology, leading to fuel-efficient and lower-emission models, are driving demand. Thirdly, supportive government policies in some countries through subsidies or tax breaks, aimed at promoting affordable transport solutions, are also playing a significant role.

Challenges in the South America Two-Wheeler Market Market

Several challenges hinder the growth of this market. Fluctuations in currency exchange rates impact the pricing and profitability of imported vehicles. Infrastructure limitations, particularly in certain regions, constrain market expansion. Furthermore, intense competition from established players necessitates continuous product innovation and efficient cost management. Supply chain disruptions due to geopolitical factors also pose a threat.

Emerging Opportunities in South America Two-Wheeler Market

The expansion of the electric and hybrid vehicle segment presents a significant opportunity. Strategic partnerships between established players and new entrants in the electric vehicle technology space can foster market penetration. Government support for infrastructure development could further boost market potential, particularly in underserved areas.

Leading Players in the South America Two-Wheeler Market Sector

- KTM Motorcycles

- Bajaj Auto Ltd

- Yamaha Motor Company Limited

- Hero MotoCorp Ltd

- Royal Enfield

- Harley-Davidson

- Honda Motor Co Ltd

- Kawasaki Heavy Industries Ltd

- TVS Motor Company Limited

- Suzuki Motor Corporation

Key Milestones in South America Two-Wheeler Market Industry

- July 2023: Hero Motocorp and Harley-Davidson launched the Harley-Davidson X440 in India, indicating a potential expansion strategy into the South American market.

- July 2023: Harley-Davidson spinoff LiveWire unveiled its second motorcycle, showcasing advancements in electric motorcycle technology.

- September 2023: KTM India launched the Duke 390 and 250 motorcycles, highlighting ongoing product innovation within the segment.

Strategic Outlook for South America Two-Wheeler Market Market

The South American two-wheeler market holds substantial future potential. The increasing adoption of electric vehicles, coupled with supportive government policies and improving infrastructure in select regions, will drive significant growth. Strategic partnerships and innovative product development will be crucial for manufacturers to capture market share and capitalize on emerging opportunities. Further expansion into less-penetrated segments of the market is a key avenue for future growth.

South America Two-Wheeler Market Segmentation

-

1. Propulsion Type

- 1.1. Hybrid and Electric Vehicles

- 1.2. ICE

South America Two-Wheeler Market Segmentation By Geography

-

1. South America

- 1.1. Brazil

- 1.2. Argentina

- 1.3. Chile

- 1.4. Colombia

- 1.5. Peru

- 1.6. Venezuela

- 1.7. Ecuador

- 1.8. Bolivia

- 1.9. Paraguay

- 1.10. Uruguay

South America Two-Wheeler Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 10.55% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Growing Travel and Tourism Industry is Driving the Car Rental Market

- 3.3. Market Restrains

- 3.3.1. Increasing Popularity of Ride-Sharing Services Pose Challenges for the Conventional Car Rental Market

- 3.4. Market Trends

- 3.4.1. OTHER KEY INDUSTRY TRENDS COVERED IN THE REPORT

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. South America Two-Wheeler Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Propulsion Type

- 5.1.1. Hybrid and Electric Vehicles

- 5.1.2. ICE

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. South America

- 5.1. Market Analysis, Insights and Forecast - by Propulsion Type

- 6. Brazil South America Two-Wheeler Market Analysis, Insights and Forecast, 2019-2031

- 7. Argentina South America Two-Wheeler Market Analysis, Insights and Forecast, 2019-2031

- 8. Rest of South America South America Two-Wheeler Market Analysis, Insights and Forecast, 2019-2031

- 9. Competitive Analysis

- 9.1. Market Share Analysis 2024

- 9.2. Company Profiles

- 9.2.1 KTM Motorcycles

- 9.2.1.1. Overview

- 9.2.1.2. Products

- 9.2.1.3. SWOT Analysis

- 9.2.1.4. Recent Developments

- 9.2.1.5. Financials (Based on Availability)

- 9.2.2 Bajaj Auto Ltd

- 9.2.2.1. Overview

- 9.2.2.2. Products

- 9.2.2.3. SWOT Analysis

- 9.2.2.4. Recent Developments

- 9.2.2.5. Financials (Based on Availability)

- 9.2.3 Yamaha Motor Company Limite

- 9.2.3.1. Overview

- 9.2.3.2. Products

- 9.2.3.3. SWOT Analysis

- 9.2.3.4. Recent Developments

- 9.2.3.5. Financials (Based on Availability)

- 9.2.4 Hero MotoCorp Ltd

- 9.2.4.1. Overview

- 9.2.4.2. Products

- 9.2.4.3. SWOT Analysis

- 9.2.4.4. Recent Developments

- 9.2.4.5. Financials (Based on Availability)

- 9.2.5 Royal Enfield

- 9.2.5.1. Overview

- 9.2.5.2. Products

- 9.2.5.3. SWOT Analysis

- 9.2.5.4. Recent Developments

- 9.2.5.5. Financials (Based on Availability)

- 9.2.6 Harley-Davidson

- 9.2.6.1. Overview

- 9.2.6.2. Products

- 9.2.6.3. SWOT Analysis

- 9.2.6.4. Recent Developments

- 9.2.6.5. Financials (Based on Availability)

- 9.2.7 Honda Motor Co Ltd

- 9.2.7.1. Overview

- 9.2.7.2. Products

- 9.2.7.3. SWOT Analysis

- 9.2.7.4. Recent Developments

- 9.2.7.5. Financials (Based on Availability)

- 9.2.8 Kawasaki Heavy Industries Ltd

- 9.2.8.1. Overview

- 9.2.8.2. Products

- 9.2.8.3. SWOT Analysis

- 9.2.8.4. Recent Developments

- 9.2.8.5. Financials (Based on Availability)

- 9.2.9 TVS Motor Company Limited

- 9.2.9.1. Overview

- 9.2.9.2. Products

- 9.2.9.3. SWOT Analysis

- 9.2.9.4. Recent Developments

- 9.2.9.5. Financials (Based on Availability)

- 9.2.10 Suzuki Motor Corporation

- 9.2.10.1. Overview

- 9.2.10.2. Products

- 9.2.10.3. SWOT Analysis

- 9.2.10.4. Recent Developments

- 9.2.10.5. Financials (Based on Availability)

- 9.2.1 KTM Motorcycles

List of Figures

- Figure 1: South America Two-Wheeler Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: South America Two-Wheeler Market Share (%) by Company 2024

List of Tables

- Table 1: South America Two-Wheeler Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: South America Two-Wheeler Market Revenue Million Forecast, by Propulsion Type 2019 & 2032

- Table 3: South America Two-Wheeler Market Revenue Million Forecast, by Region 2019 & 2032

- Table 4: South America Two-Wheeler Market Revenue Million Forecast, by Country 2019 & 2032

- Table 5: Brazil South America Two-Wheeler Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 6: Argentina South America Two-Wheeler Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 7: Rest of South America South America Two-Wheeler Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 8: South America Two-Wheeler Market Revenue Million Forecast, by Propulsion Type 2019 & 2032

- Table 9: South America Two-Wheeler Market Revenue Million Forecast, by Country 2019 & 2032

- Table 10: Brazil South America Two-Wheeler Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 11: Argentina South America Two-Wheeler Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 12: Chile South America Two-Wheeler Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 13: Colombia South America Two-Wheeler Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 14: Peru South America Two-Wheeler Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 15: Venezuela South America Two-Wheeler Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 16: Ecuador South America Two-Wheeler Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 17: Bolivia South America Two-Wheeler Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 18: Paraguay South America Two-Wheeler Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 19: Uruguay South America Two-Wheeler Market Revenue (Million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the South America Two-Wheeler Market?

The projected CAGR is approximately 10.55%.

2. Which companies are prominent players in the South America Two-Wheeler Market?

Key companies in the market include KTM Motorcycles, Bajaj Auto Ltd, Yamaha Motor Company Limite, Hero MotoCorp Ltd, Royal Enfield, Harley-Davidson, Honda Motor Co Ltd, Kawasaki Heavy Industries Ltd, TVS Motor Company Limited, Suzuki Motor Corporation.

3. What are the main segments of the South America Two-Wheeler Market?

The market segments include Propulsion Type.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Growing Travel and Tourism Industry is Driving the Car Rental Market.

6. What are the notable trends driving market growth?

OTHER KEY INDUSTRY TRENDS COVERED IN THE REPORT.

7. Are there any restraints impacting market growth?

Increasing Popularity of Ride-Sharing Services Pose Challenges for the Conventional Car Rental Market.

8. Can you provide examples of recent developments in the market?

September 2023: KTM India launched the two all-new, single-cylinder Duke 390 and 250 motorcycles priced at INR 310,520 and INR 239,000 respectively.July 2023: Harley-Davidson spinoff LiveWire Unveils Its Second Motorcycle – and It Can Hit 103 MPH.July 2023: Hero Motocorp and Harley-Davidson launched their co-developed premium motorcycle – the Harley-Davidson X440 in India from a starting price of INR 229 thousand and going to INR 269 thousand.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "South America Two-Wheeler Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the South America Two-Wheeler Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the South America Two-Wheeler Market?

To stay informed about further developments, trends, and reports in the South America Two-Wheeler Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence