Key Insights

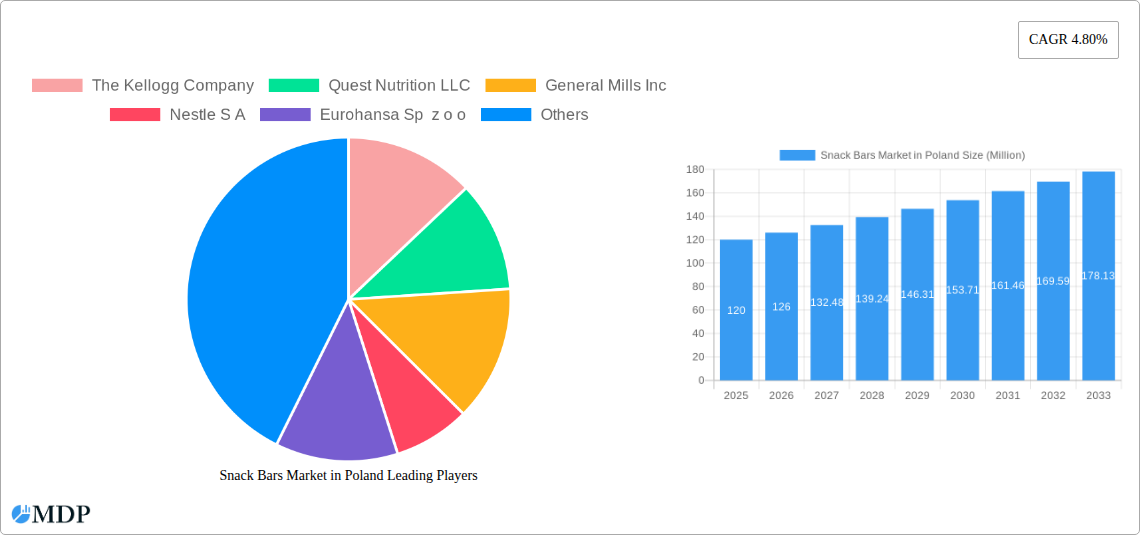

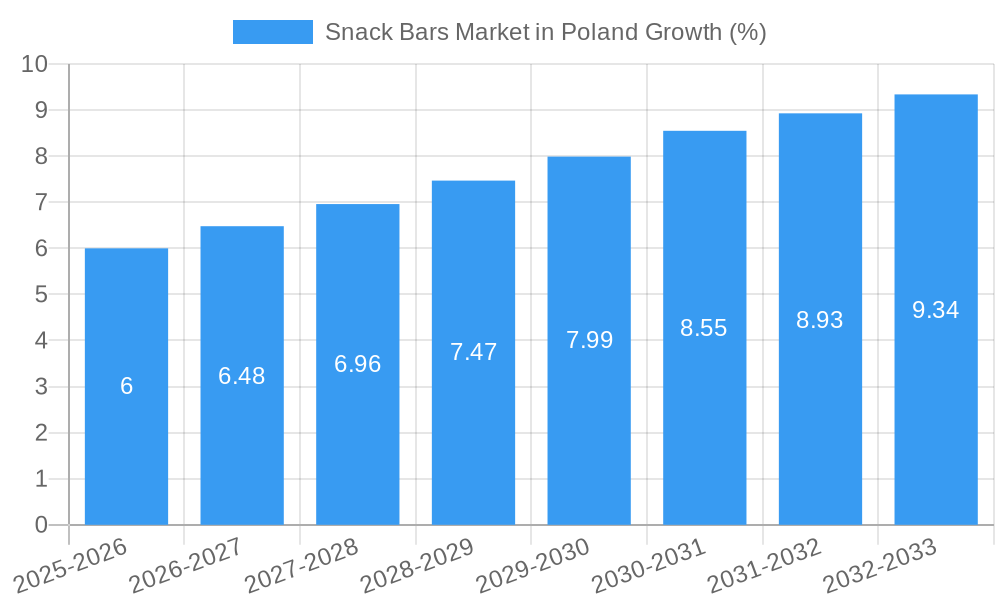

The Polish snack bar market, exhibiting a Compound Annual Growth Rate (CAGR) of 4.80% from 2019 to 2024, is poised for continued expansion. This growth is fueled by several key factors. Increasing health consciousness among Polish consumers is driving demand for protein bars, granola bars, and other nutritious snack options. The busy lifestyles of modern Poles, particularly in urban areas, contribute to the convenience appeal of snack bars as a quick and portable meal replacement or energy boost. Furthermore, the rise of e-commerce and increased availability in supermarkets and convenience stores have broadened market accessibility. Key players like Kellogg's, General Mills, and Nestlé, alongside local brands like Eurohansa and Purella Foods, are actively competing to capture market share, driving innovation in flavors, ingredients, and packaging. The market segmentation likely includes variations based on ingredients (e.g., protein, energy, fruit), dietary needs (e.g., gluten-free, vegan), and price points. While precise market size data for Poland is absent, based on the provided CAGR and considering comparable markets in Western Europe, we can estimate a 2025 market value in the range of €100-€150 million (this is a plausible range, and is not a definitive figure). Future growth will likely be influenced by changing consumer preferences, ingredient costs, and economic conditions within Poland.

The forecast period of 2025-2033 presents significant opportunities for both established and emerging brands. Successful strategies will involve focusing on product diversification, catering to specific dietary preferences (e.g., low-sugar, organic), and effectively leveraging digital marketing channels to reach target consumers. Potential challenges include fluctuating raw material prices and intense competition from both multinational corporations and smaller, specialized snack bar producers. Continuous innovation in product offerings, combined with targeted marketing campaigns highlighting health benefits and convenience, will be crucial for sustained market success in the coming years. Further research into specific consumer preferences and regional variations within Poland is recommended for a more nuanced understanding of the market dynamics.

Snack Bars Market in Poland: A Comprehensive Market Report (2019-2033)

This comprehensive report provides a detailed analysis of the Snack Bars Market in Poland, offering invaluable insights for industry stakeholders, investors, and strategic decision-makers. Covering the period from 2019 to 2033, with a focus on 2025, this report meticulously examines market dynamics, trends, leading players, and future growth opportunities. Maximize your understanding of this dynamic market and gain a competitive edge with this in-depth analysis.

Keywords: Snack Bars Market Poland, Polish Snack Bars Market, Snack Bars Industry Poland, Snack Bar Market Size Poland, Snack Bars Market Growth Poland, Snack Bars Market Trends Poland, Snack Bars Market Analysis Poland, Snack Bars Market Forecast Poland, Snack Bars Market Research Poland, Kellogg's Poland, Nestle Poland, General Mills Poland, Eurohansa Sp z o o, Purella Foods, MAX SPORT s r o

Snack Bars Market in Poland Market Dynamics & Concentration

This section analyzes the competitive landscape of the Polish snack bar market, examining market concentration, innovation drivers, regulatory frameworks, product substitutes, end-user trends, and merger & acquisition (M&A) activities.

The Polish snack bar market exhibits a moderately concentrated structure, with key players such as The Kellogg Company, Nestle S.A., and General Mills Inc. holding significant market share. However, smaller local players like Eurohansa Sp z o o, Purella Foods, and MAX SPORT s r o contribute significantly to the overall market diversity. We estimate the top 5 players hold approximately xx% of the market share in 2025.

- Innovation Drivers: Increased demand for healthier and functional snack bars, fueled by growing health consciousness among Polish consumers, is a major driver. Innovation in ingredients (e.g., plant-based proteins, superfoods) and product formats (e.g., protein bars, energy bars) is key.

- Regulatory Framework: EU regulations concerning food labeling, ingredients, and safety standards significantly impact the market. Compliance is crucial for all market participants.

- Product Substitutes: Other convenient snack options like fruit, yogurt, and energy drinks compete with snack bars.

- End-User Trends: The increasing popularity of on-the-go lifestyles and a growing demand for convenient, nutritious snacks are significant growth drivers.

- M&A Activities: The past five years (2019-2024) witnessed approximately xx M&A deals in the Polish snack bar market, mainly focused on consolidating market share and expanding product portfolios.

Snack Bars Market in Poland Industry Trends & Analysis

This section delves into the detailed analysis of the Polish snack bar market's growth drivers, technological disruptions, consumer preferences, and competitive dynamics.

The Polish snack bar market is experiencing robust growth, with a projected CAGR of xx% during the forecast period (2025-2033). This growth is primarily driven by rising disposable incomes, changing consumer lifestyles, and increasing health awareness. Market penetration of snack bars has increased significantly over the past five years, reaching an estimated xx% in 2025.

Key trends shaping the market include:

- A strong shift towards healthier snack bars with added benefits, such as high protein content, added vitamins, and organic ingredients.

- The rise of e-commerce and online retail channels is expanding market reach and accessibility.

- Increased focus on sustainability and ethical sourcing practices.

- Intense competition is leading to product diversification, innovation, and attractive pricing strategies.

Leading Markets & Segments in Snack Bars Market in Poland

This section identifies the dominant regions, countries, or segments within the Polish snack bar market.

The urban areas of Poland, particularly major cities like Warsaw, Krakow, and Gdansk, show the highest per capita consumption of snack bars. This is attributed to factors such as higher disposable incomes, greater awareness of health and wellness, and increased availability of diverse product offerings.

Key Drivers for Market Dominance:

- High Disposable Incomes: Increased purchasing power in urban areas fuels higher demand for premium snack bar options.

- Retail Infrastructure: The extensive retail network, including supermarkets, convenience stores, and online platforms, ensures broad market access.

- Marketing and Advertising: Targeted marketing campaigns emphasizing convenience, health, and specific benefits drive market demand.

Snack Bars Market in Poland Product Developments

Recent product innovations in the Polish snack bar market focus on healthier formulations and greater functional benefits. Companies are introducing protein-rich bars, gluten-free options, bars with added vitamins and minerals, and organic bars to cater to the growing demand for healthier snacks. These advancements are aimed at expanding market reach and catering to specific consumer needs, thereby enhancing the competitive advantage of leading players.

Key Drivers of Snack Bars Market in Poland Growth

Several factors contribute to the growth of the Polish snack bar market. The rising disposable incomes of consumers are a major factor, allowing increased spending on premium and convenient snack options. Technological advancements in production processes result in more cost-effective options while improvements in ingredients enhance product appeal. Additionally, supportive government regulations and a growing emphasis on health and wellness are significant contributors to overall market growth.

Challenges in the Snack Bars Market in Poland Market

Despite promising growth prospects, the Polish snack bar market faces challenges. Intense competition from both domestic and international brands creates price pressure and necessitates continuous innovation. Fluctuations in the prices of raw materials impact the profitability of snack bar manufacturers. Furthermore, stringent regulatory requirements related to food safety and labeling can increase production costs.

Emerging Opportunities in Snack Bars Market in Poland

The Polish snack bar market presents significant long-term growth opportunities. The increasing demand for functional and healthier snack options creates space for premium products. Expanding into new distribution channels, particularly e-commerce, offers further reach. Collaborations with fitness centers, gyms, and health-focused businesses can strategically position products, driving adoption.

Leading Players in the Snack Bars Market in Poland Sector

- The Kellogg Company

- Quest Nutrition LLC

- General Mills Inc

- Nestle S.A

- Eurohansa Sp z o o

- Purella Foods

- MAX SPORT s r o

Key Milestones in Snack Bars Market in Poland Industry

- 2020: Introduction of several new organic snack bar lines by leading manufacturers.

- 2021: Increased focus on plant-based protein bars.

- 2022: Launch of a major e-commerce initiative by a leading snack bar company.

- 2023: Acquisition of a smaller Polish snack bar manufacturer by a multinational company.

- 2024: Implementation of stricter labeling regulations by the Polish government.

Strategic Outlook for Snack Bars Market in Poland Market

The Polish snack bar market exhibits substantial growth potential driven by rising health consciousness, increased disposable incomes, and the ongoing popularity of convenient snacking. Strategic players should focus on product innovation, particularly within the healthy and functional food segments. Leveraging digital marketing and e-commerce channels is vital, while maintaining a focus on sustainability and ethical sourcing practices will ensure long-term success.

Snack Bars Market in Poland Segmentation

-

1. Type

- 1.1. Cereal Bars

- 1.2. Energy Bars

- 1.3. Other Snack Bars

-

2. Distribution Channel

- 2.1. Supermarkets/Hypermarkets

- 2.2. Convenience Stores

- 2.3. Specialty Stores

- 2.4. Online Stores

- 2.5. Other Distribution Channels

Snack Bars Market in Poland Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

Snack Bars Market in Poland REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 4.80% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 3.4.1. Energy Bars Holds a Significant Share in Poland Snack Bar Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Snack Bars Market in Poland Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Cereal Bars

- 5.1.2. Energy Bars

- 5.1.3. Other Snack Bars

- 5.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 5.2.1. Supermarkets/Hypermarkets

- 5.2.2. Convenience Stores

- 5.2.3. Specialty Stores

- 5.2.4. Online Stores

- 5.2.5. Other Distribution Channels

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. South America

- 5.3.3. Europe

- 5.3.4. Middle East & Africa

- 5.3.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. North America Snack Bars Market in Poland Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Type

- 6.1.1. Cereal Bars

- 6.1.2. Energy Bars

- 6.1.3. Other Snack Bars

- 6.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 6.2.1. Supermarkets/Hypermarkets

- 6.2.2. Convenience Stores

- 6.2.3. Specialty Stores

- 6.2.4. Online Stores

- 6.2.5. Other Distribution Channels

- 6.1. Market Analysis, Insights and Forecast - by Type

- 7. South America Snack Bars Market in Poland Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Type

- 7.1.1. Cereal Bars

- 7.1.2. Energy Bars

- 7.1.3. Other Snack Bars

- 7.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 7.2.1. Supermarkets/Hypermarkets

- 7.2.2. Convenience Stores

- 7.2.3. Specialty Stores

- 7.2.4. Online Stores

- 7.2.5. Other Distribution Channels

- 7.1. Market Analysis, Insights and Forecast - by Type

- 8. Europe Snack Bars Market in Poland Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Type

- 8.1.1. Cereal Bars

- 8.1.2. Energy Bars

- 8.1.3. Other Snack Bars

- 8.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 8.2.1. Supermarkets/Hypermarkets

- 8.2.2. Convenience Stores

- 8.2.3. Specialty Stores

- 8.2.4. Online Stores

- 8.2.5. Other Distribution Channels

- 8.1. Market Analysis, Insights and Forecast - by Type

- 9. Middle East & Africa Snack Bars Market in Poland Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Type

- 9.1.1. Cereal Bars

- 9.1.2. Energy Bars

- 9.1.3. Other Snack Bars

- 9.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 9.2.1. Supermarkets/Hypermarkets

- 9.2.2. Convenience Stores

- 9.2.3. Specialty Stores

- 9.2.4. Online Stores

- 9.2.5. Other Distribution Channels

- 9.1. Market Analysis, Insights and Forecast - by Type

- 10. Asia Pacific Snack Bars Market in Poland Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Type

- 10.1.1. Cereal Bars

- 10.1.2. Energy Bars

- 10.1.3. Other Snack Bars

- 10.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 10.2.1. Supermarkets/Hypermarkets

- 10.2.2. Convenience Stores

- 10.2.3. Specialty Stores

- 10.2.4. Online Stores

- 10.2.5. Other Distribution Channels

- 10.1. Market Analysis, Insights and Forecast - by Type

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2024

- 11.2. Company Profiles

- 11.2.1 The Kellogg Company

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Quest Nutrition LLC

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 General Mills Inc

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Nestle S A

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Eurohansa Sp z o o

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Purella Foods

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 MAX SPORT s r o *List Not Exhaustive

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.1 The Kellogg Company

List of Figures

- Figure 1: Global Snack Bars Market in Poland Revenue Breakdown (Million, %) by Region 2024 & 2032

- Figure 2: North America Snack Bars Market in Poland Revenue (Million), by Type 2024 & 2032

- Figure 3: North America Snack Bars Market in Poland Revenue Share (%), by Type 2024 & 2032

- Figure 4: North America Snack Bars Market in Poland Revenue (Million), by Distribution Channel 2024 & 2032

- Figure 5: North America Snack Bars Market in Poland Revenue Share (%), by Distribution Channel 2024 & 2032

- Figure 6: North America Snack Bars Market in Poland Revenue (Million), by Country 2024 & 2032

- Figure 7: North America Snack Bars Market in Poland Revenue Share (%), by Country 2024 & 2032

- Figure 8: South America Snack Bars Market in Poland Revenue (Million), by Type 2024 & 2032

- Figure 9: South America Snack Bars Market in Poland Revenue Share (%), by Type 2024 & 2032

- Figure 10: South America Snack Bars Market in Poland Revenue (Million), by Distribution Channel 2024 & 2032

- Figure 11: South America Snack Bars Market in Poland Revenue Share (%), by Distribution Channel 2024 & 2032

- Figure 12: South America Snack Bars Market in Poland Revenue (Million), by Country 2024 & 2032

- Figure 13: South America Snack Bars Market in Poland Revenue Share (%), by Country 2024 & 2032

- Figure 14: Europe Snack Bars Market in Poland Revenue (Million), by Type 2024 & 2032

- Figure 15: Europe Snack Bars Market in Poland Revenue Share (%), by Type 2024 & 2032

- Figure 16: Europe Snack Bars Market in Poland Revenue (Million), by Distribution Channel 2024 & 2032

- Figure 17: Europe Snack Bars Market in Poland Revenue Share (%), by Distribution Channel 2024 & 2032

- Figure 18: Europe Snack Bars Market in Poland Revenue (Million), by Country 2024 & 2032

- Figure 19: Europe Snack Bars Market in Poland Revenue Share (%), by Country 2024 & 2032

- Figure 20: Middle East & Africa Snack Bars Market in Poland Revenue (Million), by Type 2024 & 2032

- Figure 21: Middle East & Africa Snack Bars Market in Poland Revenue Share (%), by Type 2024 & 2032

- Figure 22: Middle East & Africa Snack Bars Market in Poland Revenue (Million), by Distribution Channel 2024 & 2032

- Figure 23: Middle East & Africa Snack Bars Market in Poland Revenue Share (%), by Distribution Channel 2024 & 2032

- Figure 24: Middle East & Africa Snack Bars Market in Poland Revenue (Million), by Country 2024 & 2032

- Figure 25: Middle East & Africa Snack Bars Market in Poland Revenue Share (%), by Country 2024 & 2032

- Figure 26: Asia Pacific Snack Bars Market in Poland Revenue (Million), by Type 2024 & 2032

- Figure 27: Asia Pacific Snack Bars Market in Poland Revenue Share (%), by Type 2024 & 2032

- Figure 28: Asia Pacific Snack Bars Market in Poland Revenue (Million), by Distribution Channel 2024 & 2032

- Figure 29: Asia Pacific Snack Bars Market in Poland Revenue Share (%), by Distribution Channel 2024 & 2032

- Figure 30: Asia Pacific Snack Bars Market in Poland Revenue (Million), by Country 2024 & 2032

- Figure 31: Asia Pacific Snack Bars Market in Poland Revenue Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global Snack Bars Market in Poland Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Global Snack Bars Market in Poland Revenue Million Forecast, by Type 2019 & 2032

- Table 3: Global Snack Bars Market in Poland Revenue Million Forecast, by Distribution Channel 2019 & 2032

- Table 4: Global Snack Bars Market in Poland Revenue Million Forecast, by Region 2019 & 2032

- Table 5: Global Snack Bars Market in Poland Revenue Million Forecast, by Type 2019 & 2032

- Table 6: Global Snack Bars Market in Poland Revenue Million Forecast, by Distribution Channel 2019 & 2032

- Table 7: Global Snack Bars Market in Poland Revenue Million Forecast, by Country 2019 & 2032

- Table 8: United States Snack Bars Market in Poland Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: Canada Snack Bars Market in Poland Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: Mexico Snack Bars Market in Poland Revenue (Million) Forecast, by Application 2019 & 2032

- Table 11: Global Snack Bars Market in Poland Revenue Million Forecast, by Type 2019 & 2032

- Table 12: Global Snack Bars Market in Poland Revenue Million Forecast, by Distribution Channel 2019 & 2032

- Table 13: Global Snack Bars Market in Poland Revenue Million Forecast, by Country 2019 & 2032

- Table 14: Brazil Snack Bars Market in Poland Revenue (Million) Forecast, by Application 2019 & 2032

- Table 15: Argentina Snack Bars Market in Poland Revenue (Million) Forecast, by Application 2019 & 2032

- Table 16: Rest of South America Snack Bars Market in Poland Revenue (Million) Forecast, by Application 2019 & 2032

- Table 17: Global Snack Bars Market in Poland Revenue Million Forecast, by Type 2019 & 2032

- Table 18: Global Snack Bars Market in Poland Revenue Million Forecast, by Distribution Channel 2019 & 2032

- Table 19: Global Snack Bars Market in Poland Revenue Million Forecast, by Country 2019 & 2032

- Table 20: United Kingdom Snack Bars Market in Poland Revenue (Million) Forecast, by Application 2019 & 2032

- Table 21: Germany Snack Bars Market in Poland Revenue (Million) Forecast, by Application 2019 & 2032

- Table 22: France Snack Bars Market in Poland Revenue (Million) Forecast, by Application 2019 & 2032

- Table 23: Italy Snack Bars Market in Poland Revenue (Million) Forecast, by Application 2019 & 2032

- Table 24: Spain Snack Bars Market in Poland Revenue (Million) Forecast, by Application 2019 & 2032

- Table 25: Russia Snack Bars Market in Poland Revenue (Million) Forecast, by Application 2019 & 2032

- Table 26: Benelux Snack Bars Market in Poland Revenue (Million) Forecast, by Application 2019 & 2032

- Table 27: Nordics Snack Bars Market in Poland Revenue (Million) Forecast, by Application 2019 & 2032

- Table 28: Rest of Europe Snack Bars Market in Poland Revenue (Million) Forecast, by Application 2019 & 2032

- Table 29: Global Snack Bars Market in Poland Revenue Million Forecast, by Type 2019 & 2032

- Table 30: Global Snack Bars Market in Poland Revenue Million Forecast, by Distribution Channel 2019 & 2032

- Table 31: Global Snack Bars Market in Poland Revenue Million Forecast, by Country 2019 & 2032

- Table 32: Turkey Snack Bars Market in Poland Revenue (Million) Forecast, by Application 2019 & 2032

- Table 33: Israel Snack Bars Market in Poland Revenue (Million) Forecast, by Application 2019 & 2032

- Table 34: GCC Snack Bars Market in Poland Revenue (Million) Forecast, by Application 2019 & 2032

- Table 35: North Africa Snack Bars Market in Poland Revenue (Million) Forecast, by Application 2019 & 2032

- Table 36: South Africa Snack Bars Market in Poland Revenue (Million) Forecast, by Application 2019 & 2032

- Table 37: Rest of Middle East & Africa Snack Bars Market in Poland Revenue (Million) Forecast, by Application 2019 & 2032

- Table 38: Global Snack Bars Market in Poland Revenue Million Forecast, by Type 2019 & 2032

- Table 39: Global Snack Bars Market in Poland Revenue Million Forecast, by Distribution Channel 2019 & 2032

- Table 40: Global Snack Bars Market in Poland Revenue Million Forecast, by Country 2019 & 2032

- Table 41: China Snack Bars Market in Poland Revenue (Million) Forecast, by Application 2019 & 2032

- Table 42: India Snack Bars Market in Poland Revenue (Million) Forecast, by Application 2019 & 2032

- Table 43: Japan Snack Bars Market in Poland Revenue (Million) Forecast, by Application 2019 & 2032

- Table 44: South Korea Snack Bars Market in Poland Revenue (Million) Forecast, by Application 2019 & 2032

- Table 45: ASEAN Snack Bars Market in Poland Revenue (Million) Forecast, by Application 2019 & 2032

- Table 46: Oceania Snack Bars Market in Poland Revenue (Million) Forecast, by Application 2019 & 2032

- Table 47: Rest of Asia Pacific Snack Bars Market in Poland Revenue (Million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Snack Bars Market in Poland?

The projected CAGR is approximately 4.80%.

2. Which companies are prominent players in the Snack Bars Market in Poland?

Key companies in the market include The Kellogg Company, Quest Nutrition LLC, General Mills Inc, Nestle S A, Eurohansa Sp z o o, Purella Foods, MAX SPORT s r o *List Not Exhaustive.

3. What are the main segments of the Snack Bars Market in Poland?

The market segments include Type, Distribution Channel.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

Energy Bars Holds a Significant Share in Poland Snack Bar Market.

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Snack Bars Market in Poland," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Snack Bars Market in Poland report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Snack Bars Market in Poland?

To stay informed about further developments, trends, and reports in the Snack Bars Market in Poland, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence