Key Insights

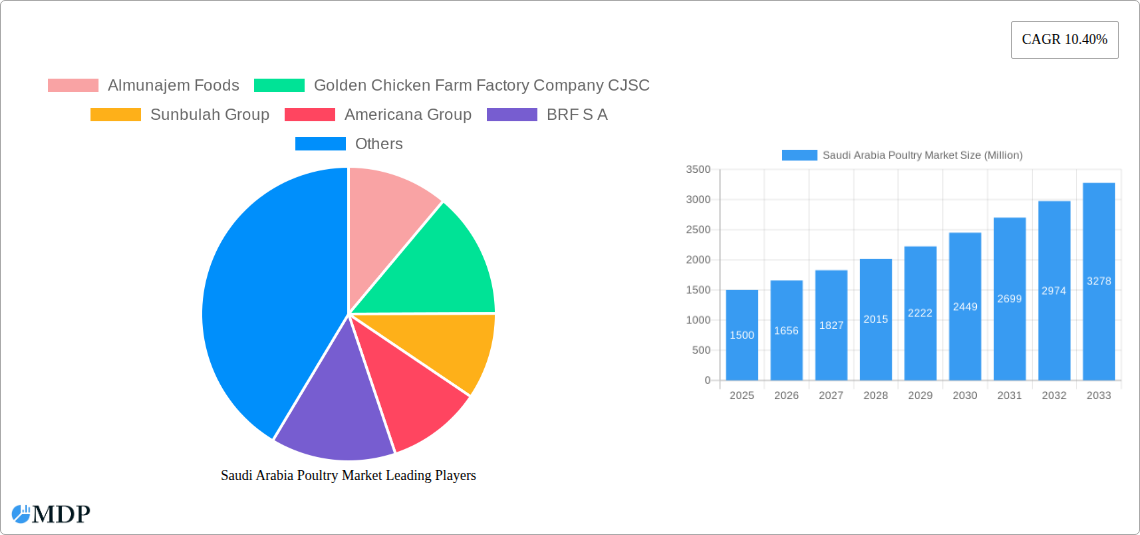

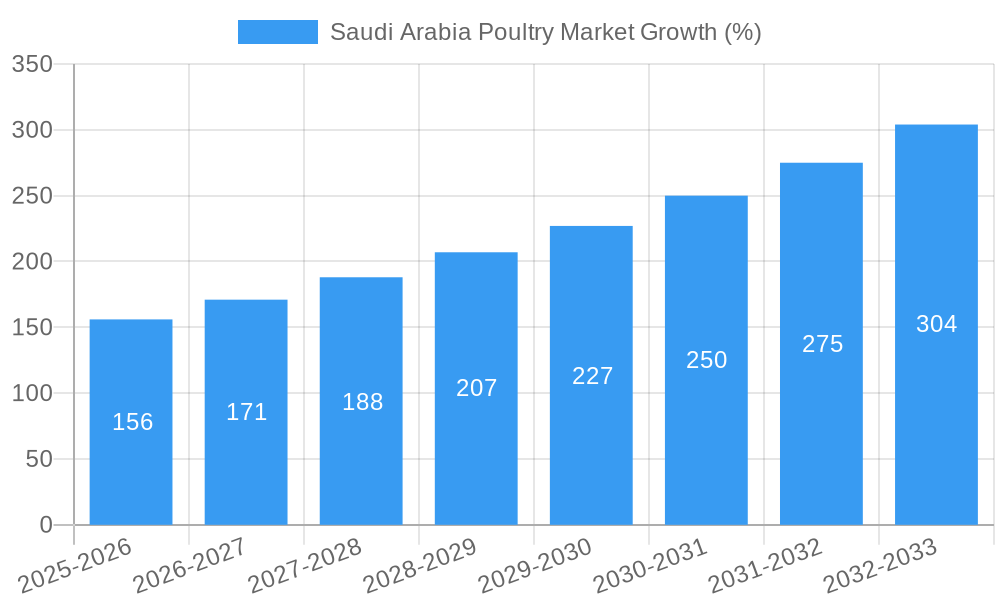

The Saudi Arabian poultry market, valued at approximately $X million in 2025 (assuming a logical estimation based on the provided CAGR of 10.40% and the unspecified market size "XX"), is experiencing robust growth, projected to maintain a compound annual growth rate (CAGR) of 10.40% from 2025 to 2033. This expansion is fueled by several key drivers. A burgeoning population and rising urbanization are increasing demand for affordable protein sources, with poultry consistently ranking as a popular choice. Furthermore, changing consumer lifestyles and preferences toward convenience foods are boosting the popularity of processed poultry products and ready-to-eat meals. The growth is also supported by increasing government initiatives aimed at enhancing food security and supporting domestic agricultural production within the Kingdom. Key players like Almunajem Foods, Americana Group, and Almarai Food Company are capitalizing on this growth, investing in modern production facilities and expanding their product portfolios to meet the diverse needs of consumers. The market is segmented by distribution channel (off-trade dominating), form (canned, fresh/chilled, frozen, and processed, with fresh/chilled likely holding the largest share), and geographic region within Saudi Arabia (with central and eastern regions potentially having higher demand due to population density).

However, the market also faces certain challenges. Fluctuations in feed prices and the overall economic climate can impact profitability. Additionally, increased competition from imported poultry products, regulatory hurdles, and consumer health concerns regarding antibiotic usage in poultry farming could pose potential restraints to growth. To mitigate these challenges, companies are focusing on sustainable practices, improving product quality, and leveraging innovative technologies to increase efficiency and reduce costs. Strategic partnerships, diversification of product offerings, and expanding distribution networks are also crucial for long-term success in this dynamic and competitive market. Further segmentation by product type (whole birds, parts, etc.) would provide a more granular understanding of market trends. A focus on value-added products, such as marinated or seasoned poultry, is likely to be a key strategy for continued market penetration.

Saudi Arabia Poultry Market: A Comprehensive Report (2019-2033)

This in-depth report provides a comprehensive analysis of the Saudi Arabia poultry market, offering invaluable insights for industry stakeholders, investors, and businesses seeking to navigate this dynamic sector. Covering the period from 2019 to 2033, with a focus on 2025, this report delivers actionable intelligence on market dynamics, trends, leading players, and future opportunities. The Saudi Arabia poultry market is projected to reach xx Million by 2033, exhibiting a robust CAGR of xx% during the forecast period (2025-2033).

Saudi Arabia Poultry Market Market Dynamics & Concentration

The Saudi Arabian poultry market is characterized by a moderately concentrated landscape, with key players like Almunajem Foods, Americana Group, and Al-Watania Poultry holding significant market share. Market concentration is further influenced by factors such as stringent regulatory frameworks governing food safety and hygiene, along with ongoing M&A activities aimed at consolidating market dominance. Innovation in breeding techniques, feed formulations, and processing technologies are key drivers, fostering improved efficiency and product quality. The increasing demand for processed poultry products and the rising adoption of modern farming practices are shaping the market. Substitute products, primarily red meat, pose some competitive pressure, yet the affordability and convenience of poultry maintain its leading position. Consumer trends reflect a preference for fresh and chilled poultry, driving growth in this segment. The number of M&A deals in the sector has averaged approximately xx per year during the historical period (2019-2024), indicating a trend of consolidation. This has resulted in a market share distribution approximately as follows (estimated):

- Almunajem Foods: xx%

- Americana Group: xx%

- Al-Watania Poultry: xx%

- Others: xx%

Saudi Arabia Poultry Market Industry Trends & Analysis

The Saudi Arabia poultry market is experiencing significant growth driven by factors such as a rapidly expanding population, increasing disposable incomes, and a shift towards convenient and protein-rich diets. The market is witnessing technological disruptions, particularly in automation and precision farming, boosting efficiency and reducing costs. Consumer preferences lean toward healthier and more sustainably produced poultry, influencing production practices. The competitive landscape is characterized by intense competition, particularly among large players vying for market share. Key trends shaping the market include:

- Rising Demand: A CAGR of xx% is projected for the overall market during 2025-2033, driven by population growth and changing dietary habits.

- Technological Advancements: Automation in hatcheries and processing plants is improving efficiency and product consistency.

- Focus on Food Safety: Stringent regulations are driving investments in biosecurity and quality control measures.

- Growing Preference for Processed Products: Ready-to-cook and ready-to-eat poultry products are gaining popularity.

- Increased Investment: Significant capital investments in poultry farming infrastructure are boosting production capacity.

- Market Penetration: The market penetration of processed poultry products is estimated at xx% in 2025, expected to increase to xx% by 2033.

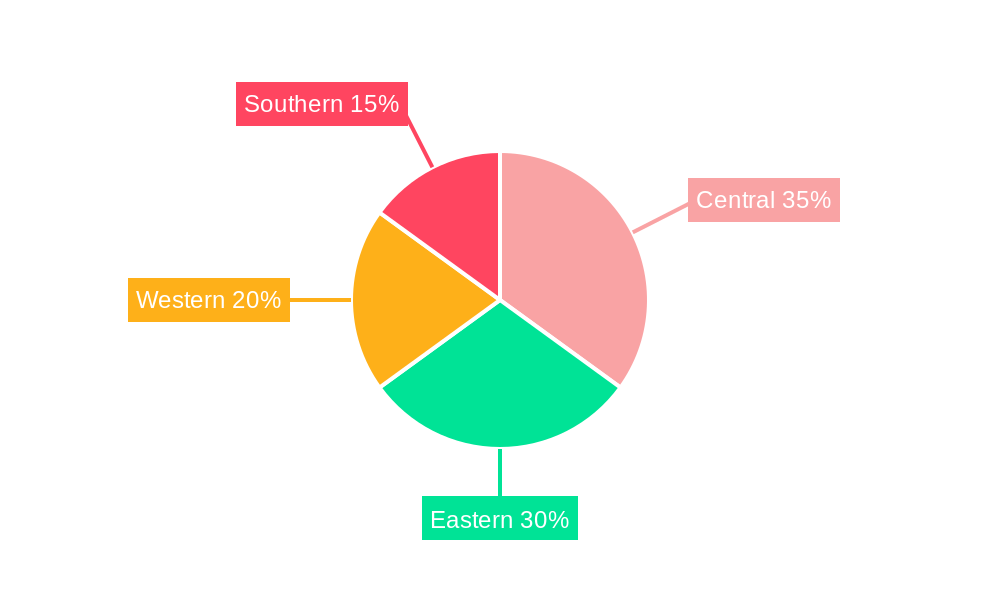

Leading Markets & Segments in Saudi Arabia Poultry Market

The Saudi Arabian poultry market is geographically concentrated, with the majority of production and consumption occurring in major urban centers. The Off-Trade distribution channel dominates, accounting for over xx% of total sales in 2025, driven by widespread availability through supermarkets and hypermarkets. The Fresh/Chilled segment holds the largest market share among various forms, reflecting consumer preference for freshness and quality.

Key Drivers for Off-Trade Dominance:

- Extensive retail infrastructure.

- Well-established supply chains.

- Convenience for consumers.

Key Drivers for Fresh/Chilled Segment Dominance:

- Consumer preference for freshness and quality.

- Shorter shelf life leading to higher frequency of purchase.

- Perception of better taste and nutritional value.

Saudi Arabia Poultry Market Product Developments

Recent product innovations focus on enhancing convenience, improving nutritional value, and catering to evolving consumer preferences. This includes the introduction of value-added products like marinated poultry, ready-to-cook meals, and organic poultry options. Companies are increasingly leveraging technology to improve product quality, traceability, and food safety. The market is seeing a growing trend toward healthier and more sustainable poultry production practices, aligning with increasing consumer awareness of ethical sourcing and environmental impact.

Key Drivers of Saudi Arabia Poultry Market Growth

Several factors fuel the growth of the Saudi Arabia poultry market:

- Government Support: Initiatives promoting food security and local production incentivize investment in the poultry sector.

- Rising Disposable Incomes: Increased purchasing power allows for greater consumption of poultry products.

- Technological advancements: Improved farming practices and processing technologies are increasing efficiency and reducing costs.

Challenges in the Saudi Arabia Poultry Market Market

Challenges facing the market include:

- Feed Costs: Fluctuations in global feed prices impact poultry production costs.

- Disease Outbreaks: Avian influenza outbreaks can disrupt production and supply chains.

- Competition: Intense competition among existing players requires continuous innovation and efficiency improvements. The estimated impact of these factors on overall market growth is around xx% reduction.

Emerging Opportunities in Saudi Arabia Poultry Market

Long-term growth opportunities lie in:

- Value-Added Products: Expanding the range of processed and ready-to-eat poultry products.

- Sustainable Practices: Increasing adoption of eco-friendly and sustainable farming methods.

- Technological Innovation: Exploring further automation and data-driven approaches to improve efficiency and traceability.

Leading Players in the Saudi Arabia Poultry Market Sector

- Almunajem Foods

- Golden Chicken Farm Factory Company CJSC

- Sunbulah Group

- Americana Group

- BRF S.A.

- Al-Watania Poultry

- The Savola Group

- Tanmiah Food Company

- Almarai Food Company

Key Milestones in Saudi Arabia Poultry Market Industry

- April 2021: BRF Global achieved ISO 37001 Anti-bribery Management System certification, enhancing ethical practices within the industry.

- May 2021: Cobb and Al-Watania Poultry announced plans to double production, significantly boosting food security.

- November 2021: Al-Watania Poultry's partnership with Americana Group strengthens local content and enhances food security.

Strategic Outlook for Saudi Arabia Poultry Market Market

The Saudi Arabia poultry market presents significant long-term growth potential, driven by expanding consumption, technological innovation, and government support. Strategic opportunities include focusing on value-added products, expanding into new market segments, and adopting sustainable practices. The market is poised for further consolidation through M&A activities, and companies that prioritize efficiency, innovation, and sustainability are likely to emerge as market leaders.

Saudi Arabia Poultry Market Segmentation

-

1. Form

- 1.1. Canned

- 1.2. Fresh / Chilled

- 1.3. Frozen

-

1.4. Processed

-

1.4.1. By Processed Types

- 1.4.1.1. Deli Meats

- 1.4.1.2. Marinated/ Tenders

- 1.4.1.3. Meatballs

- 1.4.1.4. Nuggets

- 1.4.1.5. Sausages

- 1.4.1.6. Other Processed Poultry

-

1.4.1. By Processed Types

-

2. Distribution Channel

-

2.1. Off-Trade

- 2.1.1. Convenience Stores

- 2.1.2. Online Channel

- 2.1.3. Supermarkets and Hypermarkets

- 2.1.4. Others

- 2.2. On-Trade

-

2.1. Off-Trade

Saudi Arabia Poultry Market Segmentation By Geography

- 1. Saudi Arabia

Saudi Arabia Poultry Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 10.40% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Consumer inclination toward functional food and beverages; Increasing Number of Applications and Growing Industrial Use

- 3.3. Market Restrains

- 3.3.1. Increasing Shift Toward Plant-Based Protein

- 3.4. Market Trends

- 3.4.1. The increasing inflation rates and foodservice consumption are fueling sales

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Saudi Arabia Poultry Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Form

- 5.1.1. Canned

- 5.1.2. Fresh / Chilled

- 5.1.3. Frozen

- 5.1.4. Processed

- 5.1.4.1. By Processed Types

- 5.1.4.1.1. Deli Meats

- 5.1.4.1.2. Marinated/ Tenders

- 5.1.4.1.3. Meatballs

- 5.1.4.1.4. Nuggets

- 5.1.4.1.5. Sausages

- 5.1.4.1.6. Other Processed Poultry

- 5.1.4.1. By Processed Types

- 5.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 5.2.1. Off-Trade

- 5.2.1.1. Convenience Stores

- 5.2.1.2. Online Channel

- 5.2.1.3. Supermarkets and Hypermarkets

- 5.2.1.4. Others

- 5.2.2. On-Trade

- 5.2.1. Off-Trade

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Saudi Arabia

- 5.1. Market Analysis, Insights and Forecast - by Form

- 6. Central Saudi Arabia Poultry Market Analysis, Insights and Forecast, 2019-2031

- 7. Eastern Saudi Arabia Poultry Market Analysis, Insights and Forecast, 2019-2031

- 8. Western Saudi Arabia Poultry Market Analysis, Insights and Forecast, 2019-2031

- 9. Southern Saudi Arabia Poultry Market Analysis, Insights and Forecast, 2019-2031

- 10. Competitive Analysis

- 10.1. Market Share Analysis 2024

- 10.2. Company Profiles

- 10.2.1 Almunajem Foods

- 10.2.1.1. Overview

- 10.2.1.2. Products

- 10.2.1.3. SWOT Analysis

- 10.2.1.4. Recent Developments

- 10.2.1.5. Financials (Based on Availability)

- 10.2.2 Golden Chicken Farm Factory Company CJSC

- 10.2.2.1. Overview

- 10.2.2.2. Products

- 10.2.2.3. SWOT Analysis

- 10.2.2.4. Recent Developments

- 10.2.2.5. Financials (Based on Availability)

- 10.2.3 Sunbulah Group

- 10.2.3.1. Overview

- 10.2.3.2. Products

- 10.2.3.3. SWOT Analysis

- 10.2.3.4. Recent Developments

- 10.2.3.5. Financials (Based on Availability)

- 10.2.4 Americana Group

- 10.2.4.1. Overview

- 10.2.4.2. Products

- 10.2.4.3. SWOT Analysis

- 10.2.4.4. Recent Developments

- 10.2.4.5. Financials (Based on Availability)

- 10.2.5 BRF S A

- 10.2.5.1. Overview

- 10.2.5.2. Products

- 10.2.5.3. SWOT Analysis

- 10.2.5.4. Recent Developments

- 10.2.5.5. Financials (Based on Availability)

- 10.2.6 Al-Watania Poultry

- 10.2.6.1. Overview

- 10.2.6.2. Products

- 10.2.6.3. SWOT Analysis

- 10.2.6.4. Recent Developments

- 10.2.6.5. Financials (Based on Availability)

- 10.2.7 The Savola Grou

- 10.2.7.1. Overview

- 10.2.7.2. Products

- 10.2.7.3. SWOT Analysis

- 10.2.7.4. Recent Developments

- 10.2.7.5. Financials (Based on Availability)

- 10.2.8 Tanmiah Food Company

- 10.2.8.1. Overview

- 10.2.8.2. Products

- 10.2.8.3. SWOT Analysis

- 10.2.8.4. Recent Developments

- 10.2.8.5. Financials (Based on Availability)

- 10.2.9 Almarai Food Company

- 10.2.9.1. Overview

- 10.2.9.2. Products

- 10.2.9.3. SWOT Analysis

- 10.2.9.4. Recent Developments

- 10.2.9.5. Financials (Based on Availability)

- 10.2.1 Almunajem Foods

List of Figures

- Figure 1: Saudi Arabia Poultry Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Saudi Arabia Poultry Market Share (%) by Company 2024

List of Tables

- Table 1: Saudi Arabia Poultry Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Saudi Arabia Poultry Market Revenue Million Forecast, by Form 2019 & 2032

- Table 3: Saudi Arabia Poultry Market Revenue Million Forecast, by Distribution Channel 2019 & 2032

- Table 4: Saudi Arabia Poultry Market Revenue Million Forecast, by Region 2019 & 2032

- Table 5: Saudi Arabia Poultry Market Revenue Million Forecast, by Country 2019 & 2032

- Table 6: Central Saudi Arabia Poultry Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 7: Eastern Saudi Arabia Poultry Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 8: Western Saudi Arabia Poultry Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: Southern Saudi Arabia Poultry Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: Saudi Arabia Poultry Market Revenue Million Forecast, by Form 2019 & 2032

- Table 11: Saudi Arabia Poultry Market Revenue Million Forecast, by Distribution Channel 2019 & 2032

- Table 12: Saudi Arabia Poultry Market Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Saudi Arabia Poultry Market?

The projected CAGR is approximately 10.40%.

2. Which companies are prominent players in the Saudi Arabia Poultry Market?

Key companies in the market include Almunajem Foods, Golden Chicken Farm Factory Company CJSC, Sunbulah Group, Americana Group, BRF S A, Al-Watania Poultry, The Savola Grou, Tanmiah Food Company, Almarai Food Company.

3. What are the main segments of the Saudi Arabia Poultry Market?

The market segments include Form, Distribution Channel.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Consumer inclination toward functional food and beverages; Increasing Number of Applications and Growing Industrial Use.

6. What are the notable trends driving market growth?

The increasing inflation rates and foodservice consumption are fueling sales.

7. Are there any restraints impacting market growth?

Increasing Shift Toward Plant-Based Protein.

8. Can you provide examples of recent developments in the market?

November 2021: Al-Watania Poultry partnered with Americana Group to develop the local content in the poultry sector and provide markets with fresh, high-quality, and reliable products. It helps enhance food security and increase production and other direct and indirect costs that contribute to stability in poultry prices for the final consumer.May 2021: Cobb and Al-Watania Poultry set to double their production following investments in hatcheries and distribution. This move is expected to increase food security in Saudi Arabia and other GCC countries.April 2021: BRF Global achieved the ISO 37001 Anti-bribery Management System certification, issued by an independent and non-governmental entity based in Switzerland. The certification is internationally recognized and emphasizes that the company meets technical requirements and has effect policies, procedures, and controls to prevent and combat bribery, thus promoting an ethical and healthy environment.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Saudi Arabia Poultry Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Saudi Arabia Poultry Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Saudi Arabia Poultry Market?

To stay informed about further developments, trends, and reports in the Saudi Arabia Poultry Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence