Key Insights

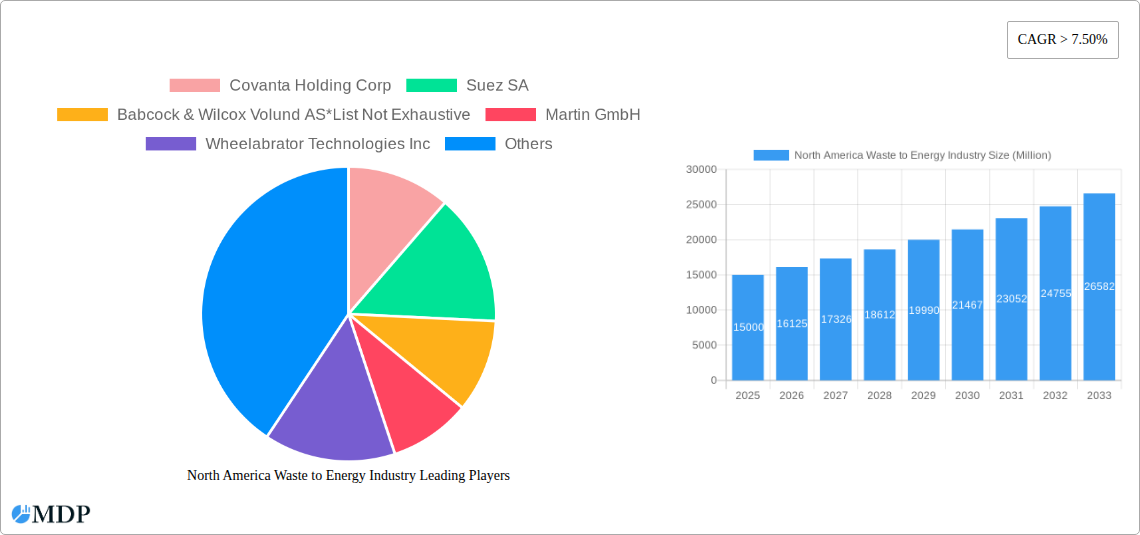

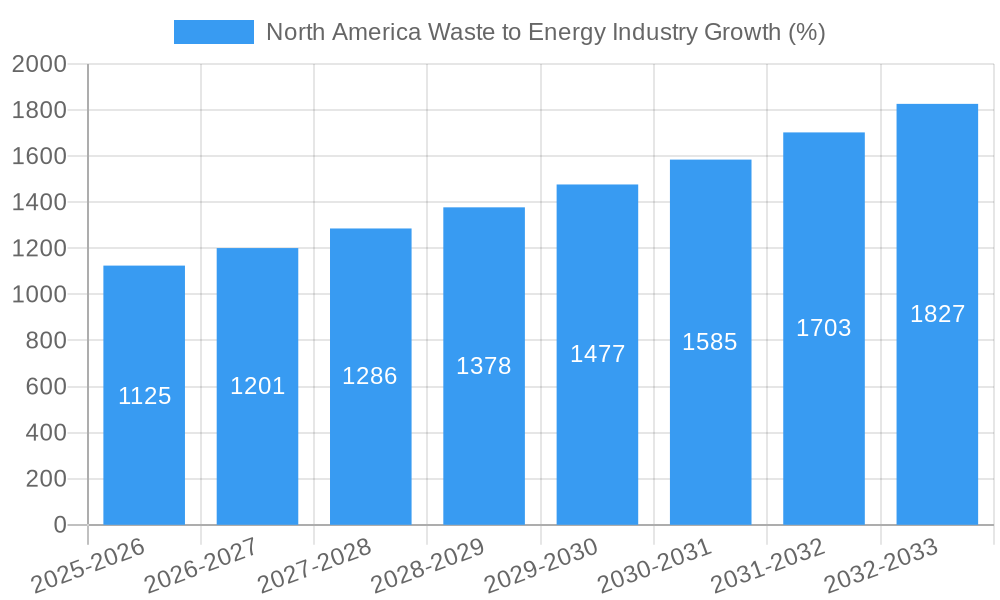

The North American waste-to-energy (WtE) market is experiencing robust growth, driven by stringent environmental regulations aimed at reducing landfill waste and increasing the utilization of renewable energy sources. With a Compound Annual Growth Rate (CAGR) exceeding 7.5% from 2019 to 2024, and a projected continuation of this growth trajectory through 2033, the market presents significant opportunities for investors and industry players. Key technological advancements in physical, thermal, and biological waste processing methods are further fueling this expansion. The increasing adoption of efficient and environmentally friendly technologies, coupled with supportive government policies and incentives, is creating a favorable market environment. Furthermore, rising awareness of sustainable waste management practices among consumers and businesses is also boosting demand for WtE solutions. The market is segmented by technology type, with thermal technologies currently dominating, however, biological technologies are projected to see significant growth due to their ability to produce biofuels and other valuable byproducts. Major players, including Covanta Holding Corp, Suez SA, and Waste Management Inc., are actively investing in expanding their capacities and developing innovative solutions to cater to this growing demand.

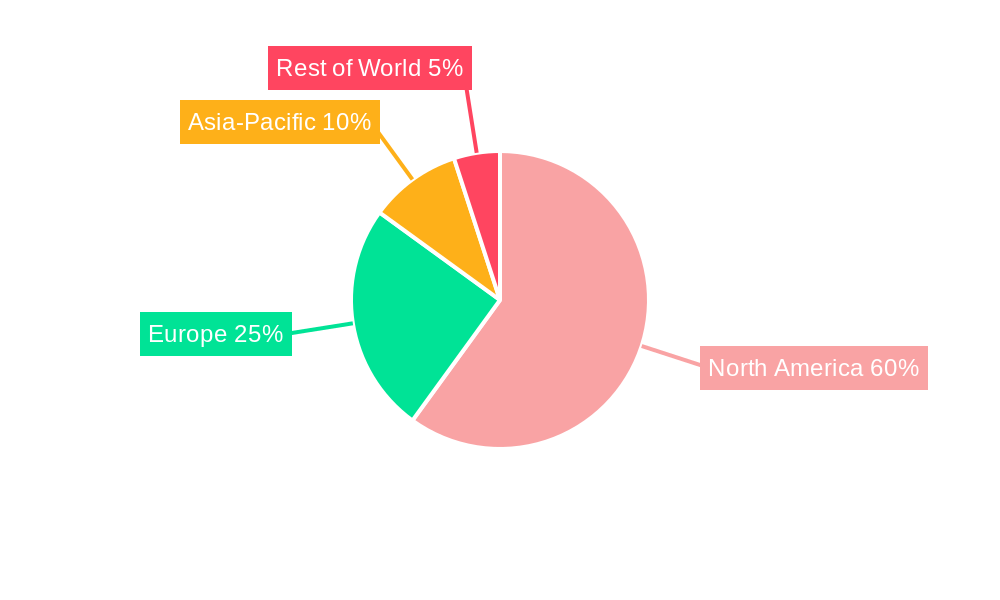

The United States, as the largest market within North America, is expected to continue leading the region's WtE sector, driven by the increasing generation of municipal solid waste and the need for alternative energy solutions. Canada and Mexico also present substantial growth potential, although at a potentially slower pace compared to the US. However, challenges such as high initial capital investment costs associated with WtE plants and the need for effective public awareness campaigns to address potential concerns related to emissions and environmental impact remain hurdles to overcome. Nonetheless, the overall outlook for the North American WtE market is positive, projecting substantial growth and market expansion throughout the forecast period (2025-2033), presenting substantial investment and growth opportunities for businesses engaged in sustainable waste management practices. The market’s sustained expansion hinges on continued technological advancements, supportive regulatory frameworks, and a growing commitment to environmental sustainability.

North America Waste to Energy Industry: A Comprehensive Market Report (2019-2033)

This comprehensive report provides a detailed analysis of the North America Waste-to-Energy industry, offering invaluable insights for stakeholders, investors, and industry professionals. With a study period spanning 2019-2033, a base year of 2025, and a forecast period of 2025-2033, this report leverages historical data (2019-2024) to predict future market trends and opportunities. The report explores market dynamics, leading players, technological advancements, and emerging opportunities within the sector. The total market size in 2025 is estimated at $XX Million, with projections exceeding $XX Million by 2033.

North America Waste to Energy Industry Market Dynamics & Concentration

The North American waste-to-energy market is characterized by a moderately concentrated landscape, with several major players holding significant market share. While precise market share data for each company requires proprietary research, key players like Covanta Holding Corp, Suez SA, and Waste Management Inc., collectively hold a substantial portion. The industry is experiencing increased consolidation through mergers and acquisitions (M&A), as larger companies seek to expand their operational scale and technological capabilities. The number of M&A deals in the period 2019-2024 totalled approximately xx. This consolidation drives innovation and standardization while also creating challenges for smaller entrants.

- Market Concentration: Moderately concentrated, with a few dominant players.

- Innovation Drivers: Stringent environmental regulations, rising landfill costs, and the growing need for renewable energy sources.

- Regulatory Frameworks: Varying regulations across North American states and provinces significantly influence investment decisions and technological adoption.

- Product Substitutes: Landfilling and other waste disposal methods remain substitutes, but their rising costs and environmental concerns are increasing the appeal of waste-to-energy solutions.

- End-User Trends: Growing awareness of sustainability and the circular economy among municipalities and industries is driving demand for waste-to-energy solutions.

- M&A Activities: A significant number of M&A deals point towards industry consolidation and the pursuit of economies of scale.

North America Waste to Energy Industry Trends & Analysis

The North American waste-to-energy market is experiencing robust growth, driven by several factors. Stringent environmental regulations aimed at reducing landfill waste are a primary catalyst. The increasing costs associated with traditional waste disposal methods further incentivize the adoption of waste-to-energy technologies. Furthermore, the global push for renewable energy sources aligns perfectly with the environmental benefits of waste-to-energy solutions. The market's Compound Annual Growth Rate (CAGR) from 2025-2033 is projected to be xx%, indicating substantial market expansion. Market penetration is increasing steadily, particularly in regions with supportive regulatory frameworks and advanced waste management infrastructure. Technological advancements, including the development of more efficient and cost-effective systems, contribute significantly to this growth. Competitive dynamics are shaped by technological innovation, operational efficiency, and the ability to secure favorable contracts with municipalities and industries.

Leading Markets & Segments in North America Waste to Energy Industry

While the entire North American market is expanding, certain regions and technological segments exhibit stronger growth. The northeastern United States and some regions in Canada have established robust waste-to-energy infrastructures and supportive policies, positioning them as leading markets.

- Dominant Technology: Thermal technology currently holds the largest market share due to its established maturity and wider deployment. However, biological technologies are gaining traction due to their potential for carbon-negative outcomes.

- Key Drivers (Northeastern US): Stringent environmental regulations, high landfill costs, and well-established waste management infrastructure contribute to the region's leadership.

- Key Drivers (Specific regions in Canada): Similar to the Northeastern US, strong environmental regulations and the need for diverse energy sources fuel growth.

- Dominance Analysis: The dominance of specific regions is primarily due to early adoption of waste-to-energy technologies and the presence of supportive regulatory environments.

North America Waste to Energy Industry Product Developments

Recent years have witnessed significant product innovations within the waste-to-energy sector. Advancements in thermal technologies, particularly gasification and pyrolysis, are enhancing efficiency and reducing emissions. Biological technologies, such as anaerobic digestion, are gaining prominence for their capacity to generate renewable energy from organic waste and recover valuable by-products. These innovations offer improved environmental performance and economic viability, expanding the market appeal of waste-to-energy solutions.

Key Drivers of North America Waste to Energy Industry Growth

Several key factors are propelling the growth of the North American waste-to-energy industry. Government regulations aimed at reducing landfill reliance and promoting renewable energy are primary drivers. The increasing costs of landfilling and the growing awareness of environmental sustainability further incentivize the adoption of waste-to-energy solutions. Technological advancements are lowering the costs and improving the efficiency of waste-to-energy technologies, making them increasingly attractive to municipalities and industries.

Challenges in the North America Waste to Energy Industry Market

Despite its growth potential, the North American waste-to-energy industry faces several challenges. High capital costs associated with the construction of waste-to-energy facilities can pose significant barriers to entry. Securing long-term contracts with municipalities and industries is critical for financial viability but can be competitive. Furthermore, public perception and concerns regarding potential environmental impacts and emissions require careful management. Regulatory complexities and permitting processes can also delay project implementation. The total estimated impact of these challenges on projected market growth is approximated at xx Million annually.

Emerging Opportunities in North America Waste to Energy Industry

Several emerging opportunities promise significant long-term growth for the North American waste-to-energy industry. Technological advancements, particularly in carbon capture and utilization technologies, are creating opportunities for carbon-negative waste-to-energy solutions. Strategic partnerships between waste management companies, energy producers, and technology developers are fostering innovation and facilitating market expansion. The increasing focus on the circular economy is creating new avenues for recovering valuable materials and energy from waste streams, leading to increased efficiency and economic sustainability.

Leading Players in the North America Waste to Energy Industry Sector

- Covanta Holding Corp

- Suez SA

- Babcock & Wilcox Volund AS

- Martin GmbH

- Wheelabrator Technologies Inc

- Veolia Environnement SA

- Waste Management Inc

- Mitsubishi Heavy Industries Ltd

- Enerkem Inc.

- Green Conversion Systems (GCS)

Key Milestones in North America Waste-to-Energy Industry Industry

- October 2022: Kore Infrastructure successfully demonstrates its modular waste-to-energy system in Los Angeles, showcasing a closed-loop, carbon-negative process capable of producing 100% renewable energy. This milestone highlights technological innovation and market potential.

- October 2022: The Washington State Department of Commerce awards USD 850,000 in grants to support projects exploring beneficial uses for industrial waste. This signifies government support for waste management innovation and resource recovery.

Strategic Outlook for North America Waste-to-Energy Market

The future of the North American waste-to-energy market is exceptionally bright. Continued technological advancements, supportive government policies, and rising environmental concerns will fuel strong growth in the coming years. Strategic partnerships and investments in innovative technologies will be crucial for companies to capitalize on emerging opportunities and maintain a competitive edge. The potential for carbon-negative solutions and the integration of waste-to-energy with broader circular economy initiatives will shape the industry's long-term trajectory.

North America Waste to Energy Industry Segmentation

-

1. Technology

- 1.1. Physical Technology

- 1.2. Thermal Technology

- 1.3. Biological Technology

-

2. Geography

- 2.1. United States

- 2.2. Canada

- 2.3. Rest of North America

North America Waste to Energy Industry Segmentation By Geography

- 1. United States

- 2. Canada

- 3. Rest of North America

North America Waste to Energy Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of > 7.50% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. 4.; Increasing Investments in Wind Power Projects4.; Supportive Government Policies

- 3.3. Market Restrains

- 3.3.1. 4.; Increasing Adoption of Alternate Energy Sources

- 3.4. Market Trends

- 3.4.1. Thermal Based Waste to Energy Conversion to Dominate the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. North America Waste to Energy Industry Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Technology

- 5.1.1. Physical Technology

- 5.1.2. Thermal Technology

- 5.1.3. Biological Technology

- 5.2. Market Analysis, Insights and Forecast - by Geography

- 5.2.1. United States

- 5.2.2. Canada

- 5.2.3. Rest of North America

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. United States

- 5.3.2. Canada

- 5.3.3. Rest of North America

- 5.1. Market Analysis, Insights and Forecast - by Technology

- 6. United States North America Waste to Energy Industry Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Technology

- 6.1.1. Physical Technology

- 6.1.2. Thermal Technology

- 6.1.3. Biological Technology

- 6.2. Market Analysis, Insights and Forecast - by Geography

- 6.2.1. United States

- 6.2.2. Canada

- 6.2.3. Rest of North America

- 6.1. Market Analysis, Insights and Forecast - by Technology

- 7. Canada North America Waste to Energy Industry Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Technology

- 7.1.1. Physical Technology

- 7.1.2. Thermal Technology

- 7.1.3. Biological Technology

- 7.2. Market Analysis, Insights and Forecast - by Geography

- 7.2.1. United States

- 7.2.2. Canada

- 7.2.3. Rest of North America

- 7.1. Market Analysis, Insights and Forecast - by Technology

- 8. Rest of North America North America Waste to Energy Industry Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Technology

- 8.1.1. Physical Technology

- 8.1.2. Thermal Technology

- 8.1.3. Biological Technology

- 8.2. Market Analysis, Insights and Forecast - by Geography

- 8.2.1. United States

- 8.2.2. Canada

- 8.2.3. Rest of North America

- 8.1. Market Analysis, Insights and Forecast - by Technology

- 9. United States North America Waste to Energy Industry Analysis, Insights and Forecast, 2019-2031

- 10. Canada North America Waste to Energy Industry Analysis, Insights and Forecast, 2019-2031

- 11. Mexico North America Waste to Energy Industry Analysis, Insights and Forecast, 2019-2031

- 12. Rest of North America North America Waste to Energy Industry Analysis, Insights and Forecast, 2019-2031

- 13. Competitive Analysis

- 13.1. Market Share Analysis 2024

- 13.2. Company Profiles

- 13.2.1 Covanta Holding Corp

- 13.2.1.1. Overview

- 13.2.1.2. Products

- 13.2.1.3. SWOT Analysis

- 13.2.1.4. Recent Developments

- 13.2.1.5. Financials (Based on Availability)

- 13.2.2 Suez SA

- 13.2.2.1. Overview

- 13.2.2.2. Products

- 13.2.2.3. SWOT Analysis

- 13.2.2.4. Recent Developments

- 13.2.2.5. Financials (Based on Availability)

- 13.2.3 Babcock & Wilcox Volund AS*List Not Exhaustive

- 13.2.3.1. Overview

- 13.2.3.2. Products

- 13.2.3.3. SWOT Analysis

- 13.2.3.4. Recent Developments

- 13.2.3.5. Financials (Based on Availability)

- 13.2.4 Martin GmbH

- 13.2.4.1. Overview

- 13.2.4.2. Products

- 13.2.4.3. SWOT Analysis

- 13.2.4.4. Recent Developments

- 13.2.4.5. Financials (Based on Availability)

- 13.2.5 Wheelabrator Technologies Inc

- 13.2.5.1. Overview

- 13.2.5.2. Products

- 13.2.5.3. SWOT Analysis

- 13.2.5.4. Recent Developments

- 13.2.5.5. Financials (Based on Availability)

- 13.2.6 Veolia Environnement SA

- 13.2.6.1. Overview

- 13.2.6.2. Products

- 13.2.6.3. SWOT Analysis

- 13.2.6.4. Recent Developments

- 13.2.6.5. Financials (Based on Availability)

- 13.2.7 Waste Management Inc

- 13.2.7.1. Overview

- 13.2.7.2. Products

- 13.2.7.3. SWOT Analysis

- 13.2.7.4. Recent Developments

- 13.2.7.5. Financials (Based on Availability)

- 13.2.8 Mitsubishi Heavy Industries Ltd

- 13.2.8.1. Overview

- 13.2.8.2. Products

- 13.2.8.3. SWOT Analysis

- 13.2.8.4. Recent Developments

- 13.2.8.5. Financials (Based on Availability)

- 13.2.9 Enerkem Inc.

- 13.2.9.1. Overview

- 13.2.9.2. Products

- 13.2.9.3. SWOT Analysis

- 13.2.9.4. Recent Developments

- 13.2.9.5. Financials (Based on Availability)

- 13.2.10 Green Conversion Systems (GCS)

- 13.2.10.1. Overview

- 13.2.10.2. Products

- 13.2.10.3. SWOT Analysis

- 13.2.10.4. Recent Developments

- 13.2.10.5. Financials (Based on Availability)

- 13.2.1 Covanta Holding Corp

List of Figures

- Figure 1: North America Waste to Energy Industry Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: North America Waste to Energy Industry Share (%) by Company 2024

List of Tables

- Table 1: North America Waste to Energy Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 2: North America Waste to Energy Industry Volume Gigawatt Forecast, by Region 2019 & 2032

- Table 3: North America Waste to Energy Industry Revenue Million Forecast, by Technology 2019 & 2032

- Table 4: North America Waste to Energy Industry Volume Gigawatt Forecast, by Technology 2019 & 2032

- Table 5: North America Waste to Energy Industry Revenue Million Forecast, by Geography 2019 & 2032

- Table 6: North America Waste to Energy Industry Volume Gigawatt Forecast, by Geography 2019 & 2032

- Table 7: North America Waste to Energy Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 8: North America Waste to Energy Industry Volume Gigawatt Forecast, by Region 2019 & 2032

- Table 9: North America Waste to Energy Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 10: North America Waste to Energy Industry Volume Gigawatt Forecast, by Country 2019 & 2032

- Table 11: United States North America Waste to Energy Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 12: United States North America Waste to Energy Industry Volume (Gigawatt) Forecast, by Application 2019 & 2032

- Table 13: Canada North America Waste to Energy Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 14: Canada North America Waste to Energy Industry Volume (Gigawatt) Forecast, by Application 2019 & 2032

- Table 15: Mexico North America Waste to Energy Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 16: Mexico North America Waste to Energy Industry Volume (Gigawatt) Forecast, by Application 2019 & 2032

- Table 17: Rest of North America North America Waste to Energy Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 18: Rest of North America North America Waste to Energy Industry Volume (Gigawatt) Forecast, by Application 2019 & 2032

- Table 19: North America Waste to Energy Industry Revenue Million Forecast, by Technology 2019 & 2032

- Table 20: North America Waste to Energy Industry Volume Gigawatt Forecast, by Technology 2019 & 2032

- Table 21: North America Waste to Energy Industry Revenue Million Forecast, by Geography 2019 & 2032

- Table 22: North America Waste to Energy Industry Volume Gigawatt Forecast, by Geography 2019 & 2032

- Table 23: North America Waste to Energy Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 24: North America Waste to Energy Industry Volume Gigawatt Forecast, by Country 2019 & 2032

- Table 25: North America Waste to Energy Industry Revenue Million Forecast, by Technology 2019 & 2032

- Table 26: North America Waste to Energy Industry Volume Gigawatt Forecast, by Technology 2019 & 2032

- Table 27: North America Waste to Energy Industry Revenue Million Forecast, by Geography 2019 & 2032

- Table 28: North America Waste to Energy Industry Volume Gigawatt Forecast, by Geography 2019 & 2032

- Table 29: North America Waste to Energy Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 30: North America Waste to Energy Industry Volume Gigawatt Forecast, by Country 2019 & 2032

- Table 31: North America Waste to Energy Industry Revenue Million Forecast, by Technology 2019 & 2032

- Table 32: North America Waste to Energy Industry Volume Gigawatt Forecast, by Technology 2019 & 2032

- Table 33: North America Waste to Energy Industry Revenue Million Forecast, by Geography 2019 & 2032

- Table 34: North America Waste to Energy Industry Volume Gigawatt Forecast, by Geography 2019 & 2032

- Table 35: North America Waste to Energy Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 36: North America Waste to Energy Industry Volume Gigawatt Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the North America Waste to Energy Industry?

The projected CAGR is approximately > 7.50%.

2. Which companies are prominent players in the North America Waste to Energy Industry?

Key companies in the market include Covanta Holding Corp, Suez SA, Babcock & Wilcox Volund AS*List Not Exhaustive, Martin GmbH, Wheelabrator Technologies Inc, Veolia Environnement SA, Waste Management Inc, Mitsubishi Heavy Industries Ltd, Enerkem Inc. , Green Conversion Systems (GCS).

3. What are the main segments of the North America Waste to Energy Industry?

The market segments include Technology, Geography.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

4.; Increasing Investments in Wind Power Projects4.; Supportive Government Policies.

6. What are the notable trends driving market growth?

Thermal Based Waste to Energy Conversion to Dominate the Market.

7. Are there any restraints impacting market growth?

4.; Increasing Adoption of Alternate Energy Sources.

8. Can you provide examples of recent developments in the market?

October 2022: Kore Infrastructure announced the successful one-year demonstration of its waste-to-energy modular system in Los Angeles, California. The company's technology can produce 100% renewable energy from organic waste using a closed-loop, carbon-negative process.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in Gigawatt.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "North America Waste to Energy Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the North America Waste to Energy Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the North America Waste to Energy Industry?

To stay informed about further developments, trends, and reports in the North America Waste to Energy Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence