Key Insights

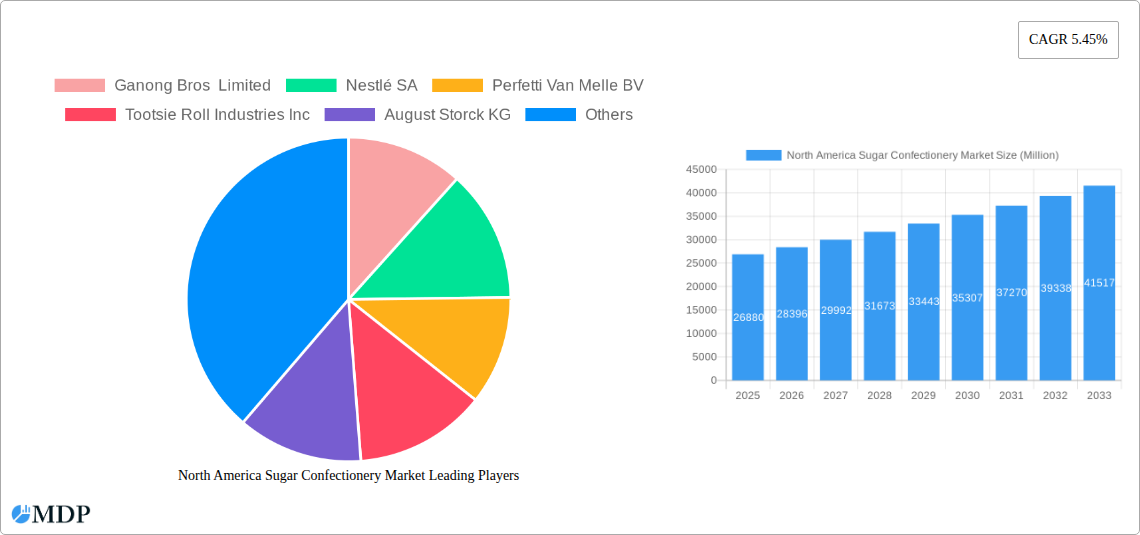

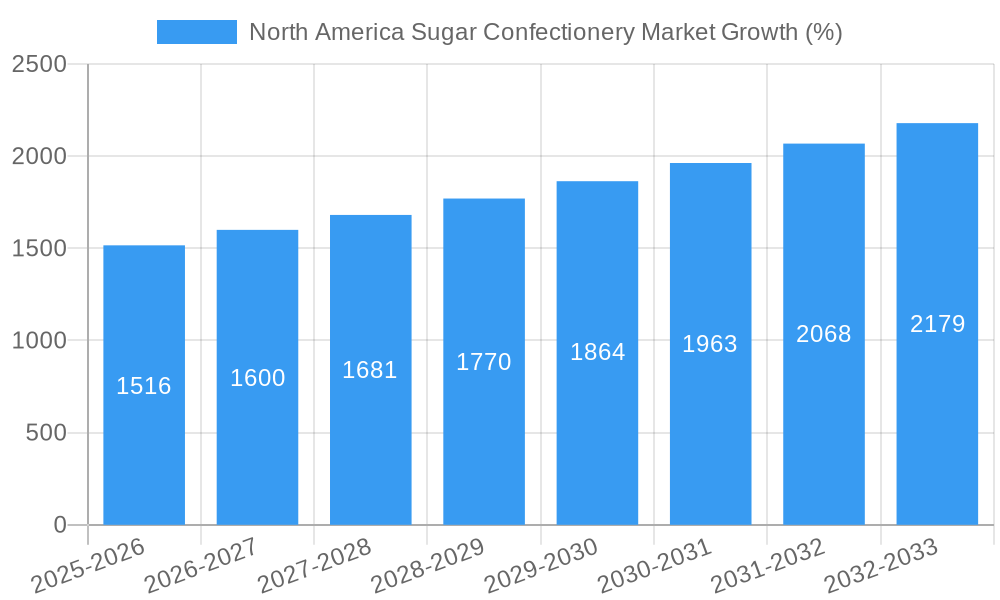

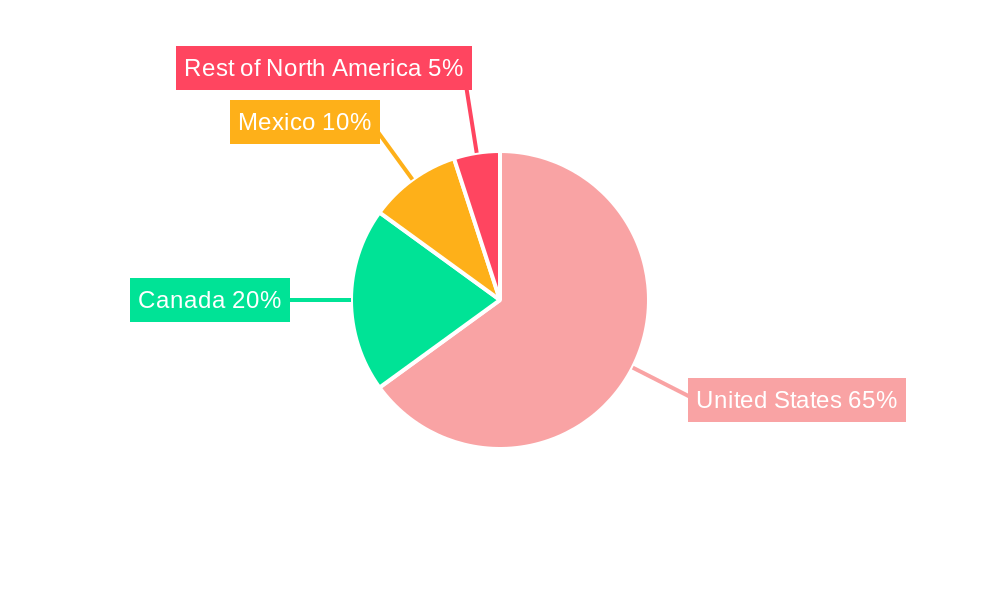

The North American sugar confectionery market, valued at $26.88 billion in 2025, is projected to experience robust growth, driven by a Compound Annual Growth Rate (CAGR) of 5.45% from 2025 to 2033. This growth is fueled by several key factors. Increased disposable incomes, particularly among younger demographics, contribute to higher spending on discretionary items like confectionery. Furthermore, the evolving consumer preferences towards premium and artisanal sugar confectionery products, alongside innovative flavors and product formats, are stimulating market expansion. The strong presence of major confectionery brands in North America, coupled with strategic marketing campaigns targeting specific consumer segments, further drives market expansion. Distribution channels are also diversifying, with online retail stores witnessing significant growth alongside traditional avenues such as supermarkets and convenience stores. However, growing health consciousness and concerns about sugar consumption represent a key restraint, leading manufacturers to innovate with healthier alternatives like sugar-reduced or organic options. The market segmentation reveals a strong preference for gummies and jellies, followed by hard candies and lollipops, indicating significant opportunities for manufacturers focusing on these segments. The United States holds the largest market share within North America, followed by Canada and Mexico.

The regional disparity within the North American market presents both challenges and opportunities. While the United States dominates the market due to its larger population and higher per capita consumption, Canada and Mexico show promising growth potential. Growth strategies focusing on localized flavors and cultural preferences will be crucial for maximizing market penetration in these regions. The competitive landscape is characterized by both multinational giants and regional players. Key players are constantly engaging in product innovation, mergers and acquisitions, and strategic partnerships to maintain their market positions and cater to evolving consumer demands. The forecast period indicates continued market expansion, with growth anticipated to be particularly strong in the online retail segment and in product categories focusing on healthier options and premium experiences. The predicted market value in 2033 will be significantly higher than 2025, reflecting the ongoing market momentum and growth drivers mentioned above.

North America Sugar Confectionery Market Report: 2019-2033

This comprehensive report provides an in-depth analysis of the North America sugar confectionery market, covering the period 2019-2033. With a focus on key market segments, leading players, and emerging trends, this report is an essential resource for industry stakeholders seeking to understand the current landscape and future trajectory of this dynamic market. The report leverages extensive data analysis and expert insights to deliver actionable intelligence, allowing businesses to make informed strategic decisions. Expect detailed analysis of market dynamics, leading companies, growth drivers, and challenges impacting this multi-billion-dollar industry.

North America Sugar Confectionery Market Market Dynamics & Concentration

The North American sugar confectionery market, valued at $XX Million in 2024, is characterized by a moderately concentrated landscape dominated by several multinational corporations. Market share is highly contested, with leading players engaging in fierce competition through innovation, mergers and acquisitions (M&A), and strategic product launches. The market exhibits considerable dynamism, fueled by evolving consumer preferences, technological advancements, and regulatory changes. Innovation, primarily focused on healthier options, novel flavors, and premium product offerings, is a key driver.

- Market Concentration: The top 5 players account for approximately XX% of the market share in 2024.

- Innovation Drivers: Healthier ingredients (e.g., reduced sugar, natural flavors), novel textures, and sustainable packaging are key drivers of innovation.

- Regulatory Frameworks: Regulations related to labeling, sugar content, and food safety significantly influence market dynamics.

- Product Substitutes: The market faces competition from other snack categories, including fruits, nuts, and other confectionery types (e.g., chocolate).

- End-User Trends: Growing demand for premium and artisanal products, personalized experiences, and convenience is driving market growth.

- M&A Activities: The number of M&A deals in the past five years averaged approximately XX per year, reflecting industry consolidation.

North America Sugar Confectionery Market Industry Trends & Analysis

The North American sugar confectionery market is projected to witness a CAGR of XX% during the forecast period (2025-2033), driven by several key factors. Rising disposable incomes, particularly among young adults, fuel demand for indulgent treats. However, growing health consciousness is compelling manufacturers to innovate with healthier alternatives, such as reduced-sugar options and natural ingredients. Technological advancements are facilitating personalized product development and enhanced manufacturing efficiency. Online retail channels are gaining traction, changing the distribution landscape and enhancing consumer access to a broader range of products. Competition is intensifying, with established players investing heavily in research and development to maintain their market share. Market penetration of online confectionery retail is expected to reach XX% by 2033.

Leading Markets & Segments in North America Sugar Confectionery Market

The United States represents the largest market within North America, contributing to approximately XX% of the total market value in 2024. This dominance is driven by a large population base, high consumption levels, and a developed retail infrastructure. Within confectionery variants, Gummies and Jellies, and Hard Candies command significant shares, while Supermarket/Hypermarket remains the dominant distribution channel.

Key Drivers by Country:

- United States: High consumption levels, large and diverse population, robust retail infrastructure, and high disposable income.

- Canada: Growing demand for premium and imported confectionery, strong retail sector.

- Mexico: Increasing urbanization and rising middle class fuelling growth.

- Rest of North America: Small but growing market with unique local preferences.

Dominant Segments:

- Confectionery Variant: Gummies and Jellies exhibit high growth potential due to their versatility and appeal to all age groups.

- Distribution Channel: Supermarket/Hypermarkets dominate due to wide reach, and Online Retail Stores are experiencing rapid growth.

North America Sugar Confectionery Market Product Developments

Recent product innovations have focused on introducing healthier alternatives (e.g., reduced sugar content, natural ingredients), unique flavor combinations, and premium packaging. Companies are leveraging technological advancements to improve product quality, efficiency and introduce personalized experiences. The increasing trend towards convenience and portability is also influencing product development. For example, Hershey's launch of Hershey’s Kisses Milklicious highlights this trend by offering a novel flavor combination in a classic format.

Key Drivers of North America Sugar Confectionery Market Growth

Several factors contribute to the growth of the North American sugar confectionery market. Rising disposable incomes allow consumers to indulge in premium confectionery. Technological advancements lead to improved production efficiency and new product formulations. Favorable regulatory environments in certain segments encourage market expansion.

Challenges in the North America Sugar Confectionery Market Market

The market faces challenges like fluctuating raw material prices, increasing health consciousness leading to decreased consumption of high-sugar products, and intense competition among established players and emerging brands. Stringent regulations regarding labeling and sugar content further increase the complexity of market operations. Supply chain disruptions pose additional challenges for efficient market functioning.

Emerging Opportunities in North America Sugar Confectionery Market

Opportunities exist in developing healthier, functional confectionery products catering to consumer demand for healthier food options. Strategic partnerships and collaborations can help companies achieve economies of scale and expand their reach. Exploring new markets and expanding into emerging geographical areas offer significant growth potential.

Leading Players in the North America Sugar Confectionery Market Sector

- Ganong Bros Limited

- Nestlé SA

- Perfetti Van Melle BV

- Tootsie Roll Industries Inc

- August Storck KG

- Ferrero International SA

- The Bazooka Companies Inc

- Cloetta AB

- Mars Incorporated

- Arcor S A I C

- Frankford Candy LLC

- HARIBO Holding GmbH & Co KG

- Laura Secord SEC

- Mondelēz International Inc

- The Hershey Company

Key Milestones in North America Sugar Confectionery Market Industry

- July 2023: HARIBO® opened its first North American manufacturing facility, significantly increasing gummi candy production capacity in the US market, impacting the gummies and jellies segment.

- May 2023: Mondelēz International Inc. invested nearly USD 50 Million in a new Global R&D Innovation Center, signaling commitment to innovation in cookies, crackers, and candy.

- March 2023: Hershey's launched Hershey's Kisses Milklicious, introducing a new flavor profile to its popular Kisses brand, influencing the hard candy segment.

Strategic Outlook for North America Sugar Confectionery Market Market

The North American sugar confectionery market presents significant opportunities for growth driven by product innovation, expanding online retail channels, and strategic acquisitions. Companies that adapt to changing consumer preferences, embrace sustainable practices, and invest in research and development are poised for success in this dynamic market. Focusing on health-conscious products and leveraging technological advancements will be key strategies for future growth.

North America Sugar Confectionery Market Segmentation

-

1. Confectionery Variant

- 1.1. Hard Candy

- 1.2. Lollipops

- 1.3. Mints

- 1.4. Pastilles, Gummies, and Jellies

- 1.5. Toffees and Nougats

- 1.6. Others

-

2. Distribution Channel

- 2.1. Convenience Store

- 2.2. Online Retail Store

- 2.3. Supermarket/Hypermarket

- 2.4. Others

North America Sugar Confectionery Market Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

North America Sugar Confectionery Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 5.45% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing demand for meat alternatives

- 3.3. Market Restrains

- 3.3.1. Presence of numerous alternatives in the plant proteins

- 3.4. Market Trends

- 3.4.1. OTHER KEY INDUSTRY TRENDS COVERED IN THE REPORT

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. North America Sugar Confectionery Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Confectionery Variant

- 5.1.1. Hard Candy

- 5.1.2. Lollipops

- 5.1.3. Mints

- 5.1.4. Pastilles, Gummies, and Jellies

- 5.1.5. Toffees and Nougats

- 5.1.6. Others

- 5.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 5.2.1. Convenience Store

- 5.2.2. Online Retail Store

- 5.2.3. Supermarket/Hypermarket

- 5.2.4. Others

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.1. Market Analysis, Insights and Forecast - by Confectionery Variant

- 6. United States North America Sugar Confectionery Market Analysis, Insights and Forecast, 2019-2031

- 7. Canada North America Sugar Confectionery Market Analysis, Insights and Forecast, 2019-2031

- 8. Mexico North America Sugar Confectionery Market Analysis, Insights and Forecast, 2019-2031

- 9. Rest of North America North America Sugar Confectionery Market Analysis, Insights and Forecast, 2019-2031

- 10. Competitive Analysis

- 10.1. Market Share Analysis 2024

- 10.2. Company Profiles

- 10.2.1 Ganong Bros Limited

- 10.2.1.1. Overview

- 10.2.1.2. Products

- 10.2.1.3. SWOT Analysis

- 10.2.1.4. Recent Developments

- 10.2.1.5. Financials (Based on Availability)

- 10.2.2 Nestlé SA

- 10.2.2.1. Overview

- 10.2.2.2. Products

- 10.2.2.3. SWOT Analysis

- 10.2.2.4. Recent Developments

- 10.2.2.5. Financials (Based on Availability)

- 10.2.3 Perfetti Van Melle BV

- 10.2.3.1. Overview

- 10.2.3.2. Products

- 10.2.3.3. SWOT Analysis

- 10.2.3.4. Recent Developments

- 10.2.3.5. Financials (Based on Availability)

- 10.2.4 Tootsie Roll Industries Inc

- 10.2.4.1. Overview

- 10.2.4.2. Products

- 10.2.4.3. SWOT Analysis

- 10.2.4.4. Recent Developments

- 10.2.4.5. Financials (Based on Availability)

- 10.2.5 August Storck KG

- 10.2.5.1. Overview

- 10.2.5.2. Products

- 10.2.5.3. SWOT Analysis

- 10.2.5.4. Recent Developments

- 10.2.5.5. Financials (Based on Availability)

- 10.2.6 Ferrero International SA

- 10.2.6.1. Overview

- 10.2.6.2. Products

- 10.2.6.3. SWOT Analysis

- 10.2.6.4. Recent Developments

- 10.2.6.5. Financials (Based on Availability)

- 10.2.7 The Bazooka Companies Inc

- 10.2.7.1. Overview

- 10.2.7.2. Products

- 10.2.7.3. SWOT Analysis

- 10.2.7.4. Recent Developments

- 10.2.7.5. Financials (Based on Availability)

- 10.2.8 Cloetta AB

- 10.2.8.1. Overview

- 10.2.8.2. Products

- 10.2.8.3. SWOT Analysis

- 10.2.8.4. Recent Developments

- 10.2.8.5. Financials (Based on Availability)

- 10.2.9 Mars Incorporated

- 10.2.9.1. Overview

- 10.2.9.2. Products

- 10.2.9.3. SWOT Analysis

- 10.2.9.4. Recent Developments

- 10.2.9.5. Financials (Based on Availability)

- 10.2.10 Arcor S A I C

- 10.2.10.1. Overview

- 10.2.10.2. Products

- 10.2.10.3. SWOT Analysis

- 10.2.10.4. Recent Developments

- 10.2.10.5. Financials (Based on Availability)

- 10.2.11 Frankford Candy LLC

- 10.2.11.1. Overview

- 10.2.11.2. Products

- 10.2.11.3. SWOT Analysis

- 10.2.11.4. Recent Developments

- 10.2.11.5. Financials (Based on Availability)

- 10.2.12 HARIBO Holding GmbH & Co KG

- 10.2.12.1. Overview

- 10.2.12.2. Products

- 10.2.12.3. SWOT Analysis

- 10.2.12.4. Recent Developments

- 10.2.12.5. Financials (Based on Availability)

- 10.2.13 Laura Secord SEC

- 10.2.13.1. Overview

- 10.2.13.2. Products

- 10.2.13.3. SWOT Analysis

- 10.2.13.4. Recent Developments

- 10.2.13.5. Financials (Based on Availability)

- 10.2.14 Mondelēz International Inc

- 10.2.14.1. Overview

- 10.2.14.2. Products

- 10.2.14.3. SWOT Analysis

- 10.2.14.4. Recent Developments

- 10.2.14.5. Financials (Based on Availability)

- 10.2.15 The Hershey Company

- 10.2.15.1. Overview

- 10.2.15.2. Products

- 10.2.15.3. SWOT Analysis

- 10.2.15.4. Recent Developments

- 10.2.15.5. Financials (Based on Availability)

- 10.2.1 Ganong Bros Limited

List of Figures

- Figure 1: North America Sugar Confectionery Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: North America Sugar Confectionery Market Share (%) by Company 2024

List of Tables

- Table 1: North America Sugar Confectionery Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: North America Sugar Confectionery Market Volume K Tons Forecast, by Region 2019 & 2032

- Table 3: North America Sugar Confectionery Market Revenue Million Forecast, by Confectionery Variant 2019 & 2032

- Table 4: North America Sugar Confectionery Market Volume K Tons Forecast, by Confectionery Variant 2019 & 2032

- Table 5: North America Sugar Confectionery Market Revenue Million Forecast, by Distribution Channel 2019 & 2032

- Table 6: North America Sugar Confectionery Market Volume K Tons Forecast, by Distribution Channel 2019 & 2032

- Table 7: North America Sugar Confectionery Market Revenue Million Forecast, by Region 2019 & 2032

- Table 8: North America Sugar Confectionery Market Volume K Tons Forecast, by Region 2019 & 2032

- Table 9: North America Sugar Confectionery Market Revenue Million Forecast, by Country 2019 & 2032

- Table 10: North America Sugar Confectionery Market Volume K Tons Forecast, by Country 2019 & 2032

- Table 11: United States North America Sugar Confectionery Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 12: United States North America Sugar Confectionery Market Volume (K Tons) Forecast, by Application 2019 & 2032

- Table 13: Canada North America Sugar Confectionery Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 14: Canada North America Sugar Confectionery Market Volume (K Tons) Forecast, by Application 2019 & 2032

- Table 15: Mexico North America Sugar Confectionery Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 16: Mexico North America Sugar Confectionery Market Volume (K Tons) Forecast, by Application 2019 & 2032

- Table 17: Rest of North America North America Sugar Confectionery Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 18: Rest of North America North America Sugar Confectionery Market Volume (K Tons) Forecast, by Application 2019 & 2032

- Table 19: North America Sugar Confectionery Market Revenue Million Forecast, by Confectionery Variant 2019 & 2032

- Table 20: North America Sugar Confectionery Market Volume K Tons Forecast, by Confectionery Variant 2019 & 2032

- Table 21: North America Sugar Confectionery Market Revenue Million Forecast, by Distribution Channel 2019 & 2032

- Table 22: North America Sugar Confectionery Market Volume K Tons Forecast, by Distribution Channel 2019 & 2032

- Table 23: North America Sugar Confectionery Market Revenue Million Forecast, by Country 2019 & 2032

- Table 24: North America Sugar Confectionery Market Volume K Tons Forecast, by Country 2019 & 2032

- Table 25: United States North America Sugar Confectionery Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 26: United States North America Sugar Confectionery Market Volume (K Tons) Forecast, by Application 2019 & 2032

- Table 27: Canada North America Sugar Confectionery Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 28: Canada North America Sugar Confectionery Market Volume (K Tons) Forecast, by Application 2019 & 2032

- Table 29: Mexico North America Sugar Confectionery Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 30: Mexico North America Sugar Confectionery Market Volume (K Tons) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the North America Sugar Confectionery Market?

The projected CAGR is approximately 5.45%.

2. Which companies are prominent players in the North America Sugar Confectionery Market?

Key companies in the market include Ganong Bros Limited, Nestlé SA, Perfetti Van Melle BV, Tootsie Roll Industries Inc, August Storck KG, Ferrero International SA, The Bazooka Companies Inc, Cloetta AB, Mars Incorporated, Arcor S A I C, Frankford Candy LLC, HARIBO Holding GmbH & Co KG, Laura Secord SEC, Mondelēz International Inc, The Hershey Company.

3. What are the main segments of the North America Sugar Confectionery Market?

The market segments include Confectionery Variant, Distribution Channel.

4. Can you provide details about the market size?

The market size is estimated to be USD 26880 Million as of 2022.

5. What are some drivers contributing to market growth?

Increasing demand for meat alternatives.

6. What are the notable trends driving market growth?

OTHER KEY INDUSTRY TRENDS COVERED IN THE REPORT.

7. Are there any restraints impacting market growth?

Presence of numerous alternatives in the plant proteins.

8. Can you provide examples of recent developments in the market?

July 2023: HARIBO® officially began gummi production at its first-ever North American manufacturing facility, located in Pleasant Prairie, Wis. The brand-new, state-of-the-art factory was created to meet the growing demand by US consumers of the beloved gummi brand, which produces over 25 varieties of gummi treats in the US and more than 1,200 types globally.May 2023: Mondelēz International Inc. opened its new Global Research & Development (R&D) Innovation Center in Whippany, New Jersey. The state-of-the-art facility, which is supported by an investment of nearly USD 50 million, includes pilot and scale-up capability for cookies, crackers, and candy.March 2023: Hershey's introduced new Hershey's Kisses’ Milklicious candies, featuring a creamy chocolate milk filling packed into the delicious center of a rich, milk chocolate Hershey's Kisses candy.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in K Tons.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "North America Sugar Confectionery Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the North America Sugar Confectionery Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the North America Sugar Confectionery Market?

To stay informed about further developments, trends, and reports in the North America Sugar Confectionery Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence