Key Insights

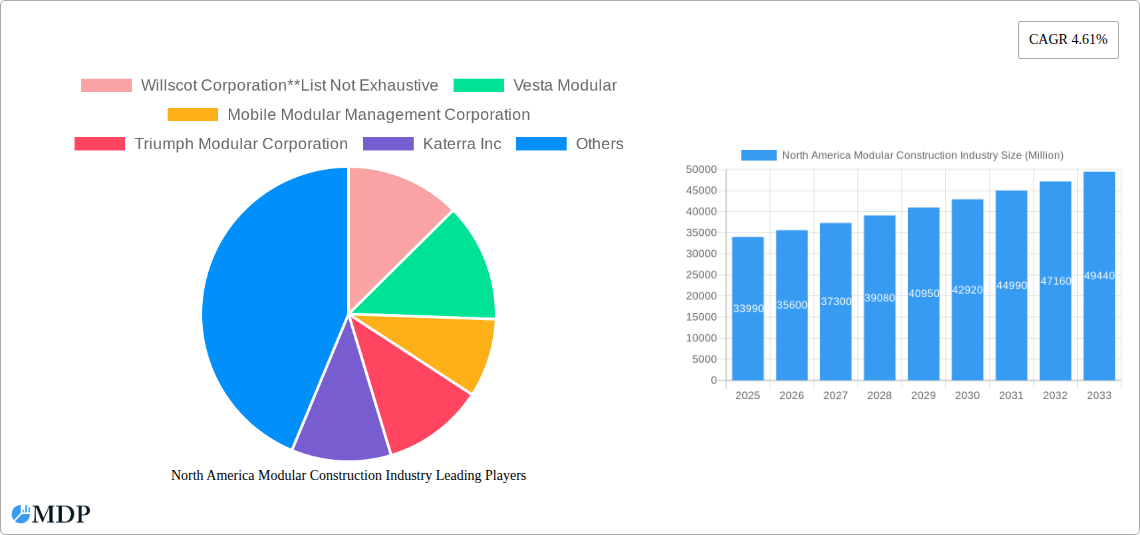

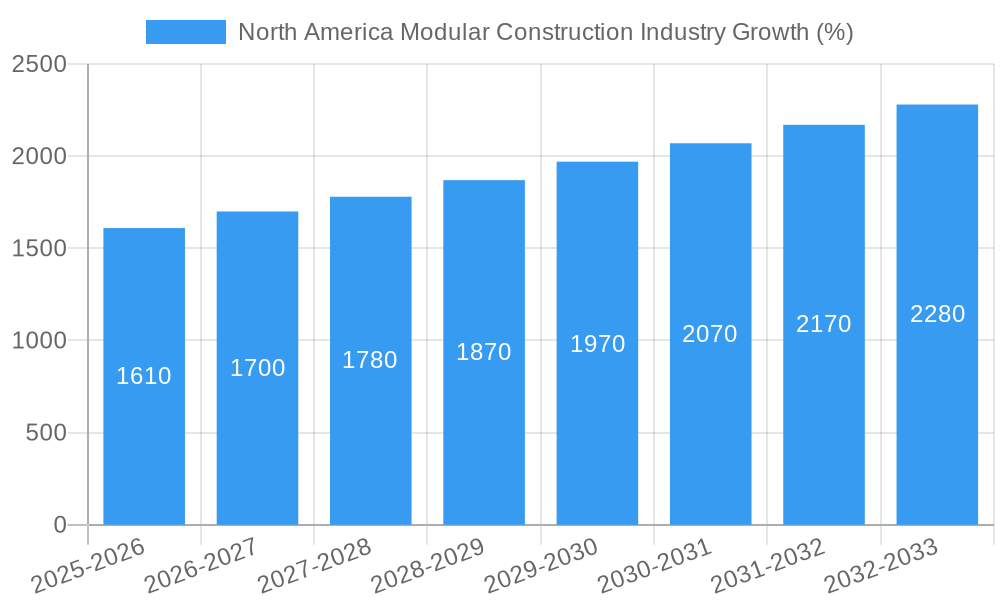

The North American modular construction industry, valued at $33.99 billion in 2025, is poised for significant growth, exhibiting a Compound Annual Growth Rate (CAGR) of 4.61% from 2025 to 2033. This expansion is driven by several key factors. Increasing urbanization and the consequent demand for affordable and rapidly deployable housing are major catalysts. Furthermore, the industry benefits from advancements in modular construction techniques, leading to improved efficiency, reduced construction times, and enhanced building quality. The rising adoption of sustainable building practices and prefabrication further fuels market growth, as modular construction aligns well with environmentally conscious building strategies. The strong performance of the residential sector, coupled with increasing commercial construction activity (driven by factors such as infrastructure development and corporate expansion), significantly contributes to the market's positive outlook. Government initiatives promoting sustainable and efficient construction methods also provide a supportive regulatory environment. While challenges remain, such as overcoming public perception issues and ensuring skilled labor availability, the overall trajectory indicates a robust and expanding market.

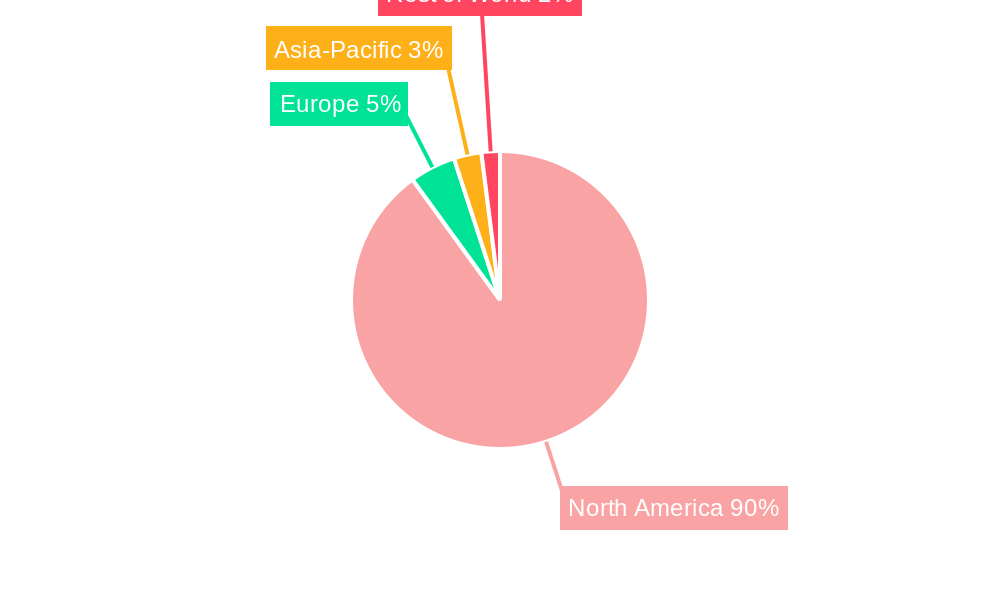

The segmentation within the North American modular construction market reveals distinct opportunities. The permanent modular segment likely holds the largest market share, given its applications in various residential and commercial settings. Relocatable modular construction offers significant potential in temporary housing and disaster relief. Geographically, the United States is expected to dominate the market due to its larger economy and construction activity, followed by Canada and Mexico. Key players like Willscot Corporation, Vesta Modular, and Triumph Modular Corporation are driving innovation and market competition, leading to further market expansion through technological advancements and improved service offerings. The forecast period (2025-2033) promises continued growth, driven by the factors mentioned above, presenting substantial investment and expansion opportunities for existing and new market entrants.

North America Modular Construction Industry Report: 2019-2033

Uncover the booming potential of the North American modular construction market with this comprehensive report, projecting a market value of $XX Million by 2033. This in-depth analysis provides critical insights into market dynamics, leading players, technological advancements, and future growth opportunities, empowering stakeholders to make informed strategic decisions. The report covers the period 2019-2033, with a focus on the base year 2025 and a forecast extending to 2033.

North America Modular Construction Industry Market Dynamics & Concentration

The North American modular construction market, valued at $XX Million in 2025, exhibits a moderately concentrated landscape. Key players like Willscot Corporation, Vesta Modular, Mobile Modular Management Corporation, Triumph Modular Corporation, Katerra Inc, Vanguard Modular Building Systems, Boxx Modular (Black Diamond Group), Satellite Shelters, Modular Genius, ATCO Ltd, and Aries Building Systems hold significant market share, though the exact figures remain proprietary. However, the market is characterized by increasing competition from both established players and emerging entrants, driven by technological innovations and rising demand.

Market Concentration Metrics (2025 Estimates):

- Top 5 players' market share: XX%

- Number of M&A deals (2019-2024): XX

- Average deal size: $XX Million

Innovation Drivers:

- Advancements in modular design and manufacturing technologies

- Sustainable building materials and practices

- Integration of smart building technologies

Regulatory Frameworks:

- Building codes and regulations vary across states/provinces, impacting market penetration.

- Government initiatives promoting sustainable and efficient construction influence adoption.

Product Substitutes:

- Traditional construction methods remain a significant competitor.

- The competitive landscape is influenced by factors like construction costs, project timelines, and material availability.

End-User Trends:

- Growing demand from both residential and commercial sectors

- Increasing preference for faster construction times and cost-effectiveness

North America Modular Construction Industry Industry Trends & Analysis

The North American modular construction market is experiencing robust growth, driven by several key factors. The Compound Annual Growth Rate (CAGR) from 2025 to 2033 is projected to be XX%. This growth is fueled by increasing urbanization, rising demand for affordable housing, and the need for faster construction timelines. Technological advancements, such as Building Information Modeling (BIM) and prefabrication techniques, are significantly improving efficiency and reducing construction time. Furthermore, government initiatives promoting sustainable construction and improved infrastructure are boosting market adoption. Consumer preferences are shifting towards eco-friendly and customizable modular homes and commercial spaces, creating opportunities for market expansion. The competitive landscape is highly dynamic, with ongoing innovation and a push towards value-added services influencing market dynamics. Market penetration of modular construction in the residential sector stands at XX% in 2025, with expectations for considerable growth in the coming years.

Leading Markets & Segments in North America Modular Construction Industry

The United States represents the largest market within North America, followed by Canada and Mexico. Within the segments, the Permanent Modular division holds a larger market share compared to Relocatable Modular, driven by the increasing demand for long-term housing and commercial structures. Similarly, the Commercial sector dominates over the Residential sector due to large-scale project deployments, particularly in sectors like healthcare, education, and hospitality.

Key Drivers:

- United States: Robust construction activity, government support for infrastructure development, and a large pool of potential customers.

- Canada: Government initiatives promoting sustainable building practices and increasing urbanization in major cities.

- Mexico: Growth in tourism and hospitality sectors, driving demand for hotels and resorts constructed via modular methods.

- Permanent Modular: Long-term value proposition, suitability for diverse project types, and ease of customization.

- Commercial Sector: High volume projects, economies of scale, and preference for faster project completion.

North America Modular Construction Industry Product Developments

Recent product innovations focus on improved design flexibility, enhanced energy efficiency, and the integration of smart building technologies. Manufacturers are increasingly utilizing advanced materials and construction techniques to create modular units that are sustainable, durable, and aesthetically appealing. The development of prefabricated modules with integrated plumbing and electrical systems is streamlining the construction process and reducing on-site labor costs, offering a significant competitive advantage.

Key Drivers of North America Modular Construction Industry Growth

Several key factors are driving the growth of the North American modular construction industry. Technological advancements like 3D printing and BIM software are improving design and construction efficiency. Favorable government policies promoting sustainable construction and infrastructure development are also boosting market expansion. Finally, the rising demand for affordable housing and commercial spaces with faster construction times is significantly contributing to the industry's growth.

Challenges in the North America Modular Construction Industry Market

The industry faces challenges such as stringent building codes and regulations that can increase costs and complexity. Supply chain disruptions and fluctuations in material prices can impact project timelines and profitability. Competition from traditional construction methods and other alternative construction technologies also presents a significant challenge, particularly in terms of price sensitivity within certain market segments.

Emerging Opportunities in North America Modular Construction Industry

Emerging opportunities lie in the increasing adoption of sustainable building materials, technological innovations like 3D printing, and growing demand for modular designs in disaster relief and emergency housing. Strategic partnerships between modular construction firms and technology providers could lead to significant improvements in efficiency and product innovation. Expanding into new geographical markets, particularly in regions with limited construction capacity or infrastructure, presents further growth potential.

Leading Players in the North America Modular Construction Industry Sector

- Willscot Corporation

- Vesta Modular

- Mobile Modular Management Corporation

- Triumph Modular Corporation

- Katerra Inc

- Vanguard Modular Building Systems

- Boxx Modular (Black Diamond Group)

- Satellite Shelters

- Modular Genius

- ATCO Ltd

- Aries Building Systems

Key Milestones in North America Modular Construction Industry Industry

- 2020: Increased adoption of BIM software across multiple companies.

- 2021: Launch of several new sustainable modular building systems.

- 2022: Several significant M&A activities consolidate market share.

- 2023: Government initiatives launch support for modular construction in key regions.

- 2024: Significant investment in 3D printing technology for modular construction.

Strategic Outlook for North America Modular Construction Industry Market

The North American modular construction market is poised for significant growth, driven by technological innovation, favorable regulatory environments, and increasing demand for efficient and sustainable construction solutions. Strategic opportunities exist for companies that can leverage these trends through innovation, strategic partnerships, and expansion into new markets. The focus on sustainability, technology integration, and improved design flexibility will be crucial for future success in this dynamic market.

North America Modular Construction Industry Segmentation

-

1. Division

- 1.1. Permanent Modular

- 1.2. Relocatable Modular

-

2. Sector

- 2.1. Residential

- 2.2. Commercial

North America Modular Construction Industry Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

North America Modular Construction Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 4.61% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Surging Application of Blue Hydrogen in Fuel Cell Electric Vehicles; Rising Demand from the Chemical Sector

- 3.3. Market Restrains

- 3.3.1. Loss of Energy During Hydrogen Production; Other Market Restraints

- 3.4. Market Trends

- 3.4.1. Hospitality Industry Driving the Market Growth

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. North America Modular Construction Industry Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Division

- 5.1.1. Permanent Modular

- 5.1.2. Relocatable Modular

- 5.2. Market Analysis, Insights and Forecast - by Sector

- 5.2.1. Residential

- 5.2.2. Commercial

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.1. Market Analysis, Insights and Forecast - by Division

- 6. United States North America Modular Construction Industry Analysis, Insights and Forecast, 2019-2031

- 7. Canada North America Modular Construction Industry Analysis, Insights and Forecast, 2019-2031

- 8. Mexico North America Modular Construction Industry Analysis, Insights and Forecast, 2019-2031

- 9. Rest of North America North America Modular Construction Industry Analysis, Insights and Forecast, 2019-2031

- 10. Competitive Analysis

- 10.1. Market Share Analysis 2024

- 10.2. Company Profiles

- 10.2.1 Willscot Corporation**List Not Exhaustive

- 10.2.1.1. Overview

- 10.2.1.2. Products

- 10.2.1.3. SWOT Analysis

- 10.2.1.4. Recent Developments

- 10.2.1.5. Financials (Based on Availability)

- 10.2.2 Vesta Modular

- 10.2.2.1. Overview

- 10.2.2.2. Products

- 10.2.2.3. SWOT Analysis

- 10.2.2.4. Recent Developments

- 10.2.2.5. Financials (Based on Availability)

- 10.2.3 Mobile Modular Management Corporation

- 10.2.3.1. Overview

- 10.2.3.2. Products

- 10.2.3.3. SWOT Analysis

- 10.2.3.4. Recent Developments

- 10.2.3.5. Financials (Based on Availability)

- 10.2.4 Triumph Modular Corporation

- 10.2.4.1. Overview

- 10.2.4.2. Products

- 10.2.4.3. SWOT Analysis

- 10.2.4.4. Recent Developments

- 10.2.4.5. Financials (Based on Availability)

- 10.2.5 Katerra Inc

- 10.2.5.1. Overview

- 10.2.5.2. Products

- 10.2.5.3. SWOT Analysis

- 10.2.5.4. Recent Developments

- 10.2.5.5. Financials (Based on Availability)

- 10.2.6 Vanguard Modular Building Systems

- 10.2.6.1. Overview

- 10.2.6.2. Products

- 10.2.6.3. SWOT Analysis

- 10.2.6.4. Recent Developments

- 10.2.6.5. Financials (Based on Availability)

- 10.2.7 Boxx Modular (Black Diamond Group)

- 10.2.7.1. Overview

- 10.2.7.2. Products

- 10.2.7.3. SWOT Analysis

- 10.2.7.4. Recent Developments

- 10.2.7.5. Financials (Based on Availability)

- 10.2.8 Satellite Shelters

- 10.2.8.1. Overview

- 10.2.8.2. Products

- 10.2.8.3. SWOT Analysis

- 10.2.8.4. Recent Developments

- 10.2.8.5. Financials (Based on Availability)

- 10.2.9 Modular Genius

- 10.2.9.1. Overview

- 10.2.9.2. Products

- 10.2.9.3. SWOT Analysis

- 10.2.9.4. Recent Developments

- 10.2.9.5. Financials (Based on Availability)

- 10.2.10 ATCO Ltd

- 10.2.10.1. Overview

- 10.2.10.2. Products

- 10.2.10.3. SWOT Analysis

- 10.2.10.4. Recent Developments

- 10.2.10.5. Financials (Based on Availability)

- 10.2.11 Aries Building Systems

- 10.2.11.1. Overview

- 10.2.11.2. Products

- 10.2.11.3. SWOT Analysis

- 10.2.11.4. Recent Developments

- 10.2.11.5. Financials (Based on Availability)

- 10.2.1 Willscot Corporation**List Not Exhaustive

List of Figures

- Figure 1: North America Modular Construction Industry Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: North America Modular Construction Industry Share (%) by Company 2024

List of Tables

- Table 1: North America Modular Construction Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 2: North America Modular Construction Industry Revenue Million Forecast, by Division 2019 & 2032

- Table 3: North America Modular Construction Industry Revenue Million Forecast, by Sector 2019 & 2032

- Table 4: North America Modular Construction Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 5: North America Modular Construction Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 6: United States North America Modular Construction Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 7: Canada North America Modular Construction Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 8: Mexico North America Modular Construction Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: Rest of North America North America Modular Construction Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: North America Modular Construction Industry Revenue Million Forecast, by Division 2019 & 2032

- Table 11: North America Modular Construction Industry Revenue Million Forecast, by Sector 2019 & 2032

- Table 12: North America Modular Construction Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 13: United States North America Modular Construction Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 14: Canada North America Modular Construction Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 15: Mexico North America Modular Construction Industry Revenue (Million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the North America Modular Construction Industry?

The projected CAGR is approximately 4.61%.

2. Which companies are prominent players in the North America Modular Construction Industry?

Key companies in the market include Willscot Corporation**List Not Exhaustive, Vesta Modular, Mobile Modular Management Corporation, Triumph Modular Corporation, Katerra Inc, Vanguard Modular Building Systems, Boxx Modular (Black Diamond Group), Satellite Shelters, Modular Genius, ATCO Ltd, Aries Building Systems.

3. What are the main segments of the North America Modular Construction Industry?

The market segments include Division, Sector.

4. Can you provide details about the market size?

The market size is estimated to be USD 33.99 Million as of 2022.

5. What are some drivers contributing to market growth?

Surging Application of Blue Hydrogen in Fuel Cell Electric Vehicles; Rising Demand from the Chemical Sector.

6. What are the notable trends driving market growth?

Hospitality Industry Driving the Market Growth.

7. Are there any restraints impacting market growth?

Loss of Energy During Hydrogen Production; Other Market Restraints.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 4950, and USD 6800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "North America Modular Construction Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the North America Modular Construction Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the North America Modular Construction Industry?

To stay informed about further developments, trends, and reports in the North America Modular Construction Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence