Key Insights

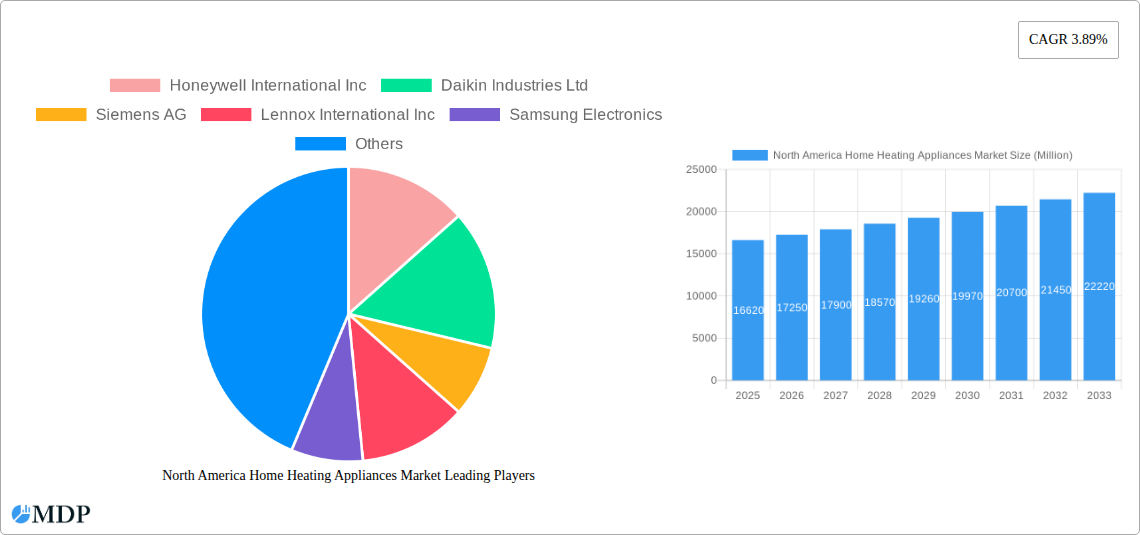

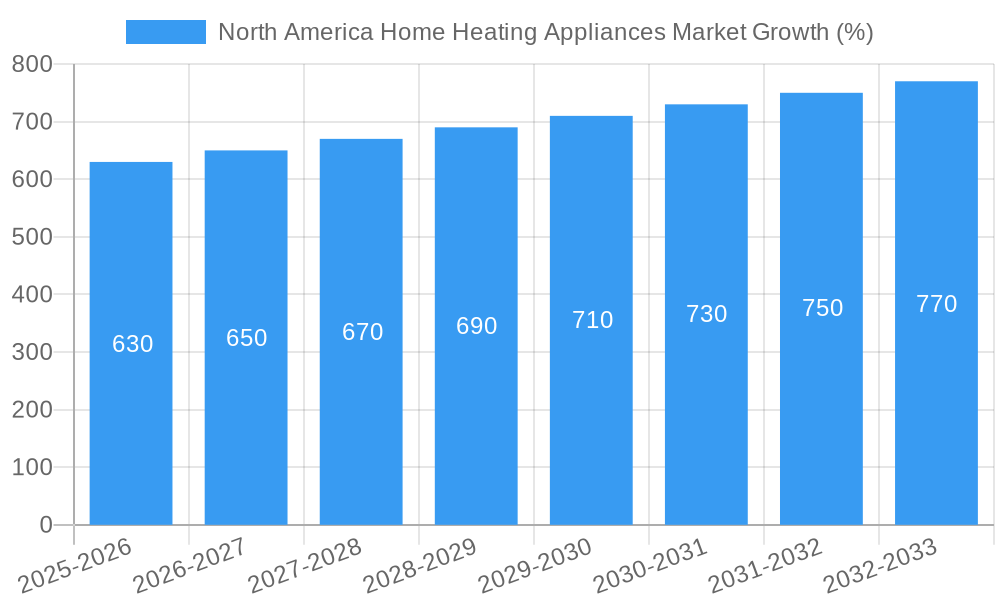

The North America home heating appliances market, valued at $16.62 billion in 2025, is projected to experience steady growth, driven by factors such as increasing energy efficiency standards, rising disposable incomes leading to higher spending on home improvements, and a growing preference for smart home technologies. The market's Compound Annual Growth Rate (CAGR) of 3.89% from 2019 to 2024 suggests a continued expansion through 2033. Key segments within the market include residential applications, which dominate due to the large number of households, and commercial applications, experiencing growth driven by new construction and renovations in the commercial sector. Within distribution channels, online sales are showing significant growth, propelled by the increasing adoption of e-commerce and the convenience it offers to consumers. Supermarkets and hypermarkets remain a significant distribution channel, particularly for readily available and less complex appliances. Leading manufacturers such as Honeywell, Daikin, and Lennox are actively investing in research and development to introduce innovative and energy-efficient products, further driving market growth. However, fluctuating energy prices and potential supply chain disruptions pose challenges to consistent market expansion.

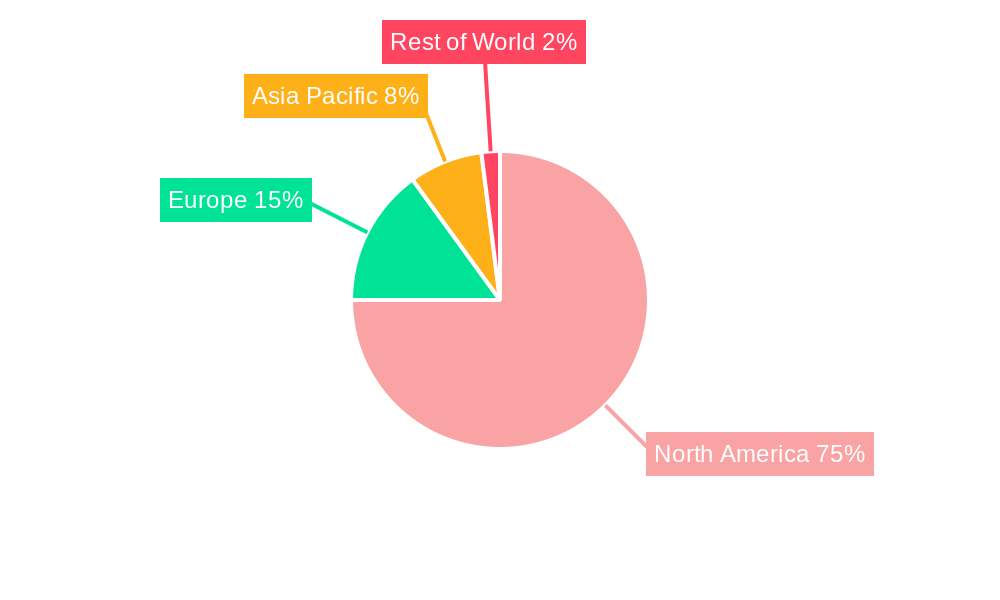

The market segmentation shows a clear dominance of residential applications over commercial ones. Within equipment types, heat pumps are anticipated to witness robust growth due to their energy efficiency and environmental benefits. Boilers and furnaces, however, will maintain a substantial market share due to established consumer preference and existing infrastructure in older buildings. Competition amongst key players is fierce, with companies focusing on technological innovation, brand building, and strategic partnerships to maintain a competitive edge. The North American market, specifically the United States, is the largest contributor to overall revenue, owing to its high population density and developed infrastructure. The forecast period of 2025-2033 anticipates continued growth, influenced by governmental initiatives to promote energy efficiency and technological advancements in the sector. This suggests lucrative opportunities for both established and new market entrants who can cater to the evolving consumer preferences and market needs.

North America Home Heating Appliances Market Report: 2019-2033

This comprehensive report provides an in-depth analysis of the North America home heating appliances market, covering the period 2019-2033. With a focus on key market segments, leading players, and emerging trends, this report is an essential resource for industry stakeholders, investors, and strategic decision-makers. The report leverages extensive market research and data analysis to provide actionable insights and forecasts, enabling informed business strategies. The market size is projected to reach xx Million by 2033, exhibiting a CAGR of xx% during the forecast period (2025-2033).

North America Home Heating Appliances Market Dynamics & Concentration

The North American home heating appliances market is characterized by a moderately concentrated landscape, with key players such as Honeywell International Inc, Daikin Industries Ltd, Siemens AG, Lennox International Inc, and Samsung Electronics holding significant market share. Market concentration is influenced by factors such as brand recognition, technological capabilities, and distribution networks. Innovation plays a crucial role, driven by the increasing demand for energy-efficient and smart home appliances. Stringent environmental regulations and incentives for energy-efficient technologies are further shaping the market dynamics. The rising popularity of heat pumps, driven by their environmental benefits and potential cost savings, is a significant factor disrupting traditional heating systems like furnaces and boilers. Product substitution is also evident with the growing adoption of heat pumps as a viable alternative to traditional systems. Consumer preference for smart, connected appliances and a focus on sustainable solutions is fueling innovation. The number of M&A deals in the sector has averaged xx per year over the past five years, indicating consolidation efforts within the industry.

- Market Share: Top 5 players hold approximately xx% of the market share.

- M&A Activity: Average of xx M&A deals annually (2019-2024).

- Innovation Drivers: Energy efficiency standards, consumer demand for smart appliances, and environmental concerns.

- Regulatory Frameworks: Government incentives for energy-efficient heating solutions, emission reduction policies.

North America Home Heating Appliances Market Industry Trends & Analysis

The North American home heating appliances market is experiencing robust growth, fueled by several key factors. The increasing awareness of energy efficiency and sustainability is driving demand for energy-saving heat pumps and other high-efficiency appliances. Technological advancements, such as the integration of smart home technology and improved energy management systems, are enhancing the functionality and appeal of these products. Consumer preferences are shifting towards smart, energy-efficient solutions that offer convenience and cost savings. The rise of online sales channels is also transforming the distribution landscape, offering consumers greater choice and accessibility. However, competitive pressure remains intense, necessitating continuous innovation and product differentiation to maintain market share. The market is segmented by distribution channels (supermarkets/hypermarkets, specialty stores, online, and others), equipment type (heat pumps, furnaces, boilers, unitary heaters), and application (residential, commercial). The residential segment dominates, accounting for approximately xx% of the total market value.

- CAGR (2019-2024): xx%

- Market Penetration: Heat pumps currently hold approximately xx% of the market. This number is expected to grow in the future.

- Key Growth Drivers: Increasing energy costs, stringent environmental regulations, and consumer preference for smart appliances.

- Technological Disruptions: The introduction of next-generation heat pumps and smart home integration.

Leading Markets & Segments in North America Home Heating Appliances Market

The residential application segment dominates the North American home heating appliances market, driven by the large existing housing stock and ongoing new construction. Within equipment types, heat pumps are experiencing significant growth due to their energy efficiency and environmental benefits. The online distribution channel is exhibiting strong growth, reflecting changing consumer shopping habits and the increasing availability of online retail options. The United States holds the largest share of the market due to its larger population, substantial housing stock, and robust economy.

Dominant Segments:

- Application: Residential (xx Million)

- Equipment: Heat Pumps (xx Million)

- Distribution Channel: Online (xx Million)

Key Drivers:

- Residential: High housing density in key regions, continuous home renovation and construction.

- Heat Pumps: Increased energy efficiency, government incentives for eco-friendly heating solutions.

- Online: Convenience, wider selection, competitive pricing.

North America Home Heating Appliances Market Product Developments

Recent product innovations focus on improving energy efficiency, integrating smart home technology, and enhancing user experience. The launch of next-generation heat pumps, offering superior efficiency and performance, signifies the direction of technological advancement. Manufacturers are increasingly incorporating smart features like remote control, energy monitoring, and voice assistants to create user-friendly and connected appliances. These innovations aim to improve market fit by catering to consumer preferences for advanced technologies and user convenience. The focus on enhanced functionalities and integration with broader smart home ecosystems represents a key competitive advantage.

Key Drivers of North America Home Heating Appliances Market Growth

Several factors contribute to the growth of this market. Technological advancements in heat pump technology offer greater efficiency and reduced environmental impact, attracting environmentally conscious consumers. Government regulations and incentives, such as tax credits for energy-efficient appliances, boost market adoption. The rising cost of traditional heating fuels also drives demand for energy-efficient alternatives. Finally, increasing consumer awareness of sustainability is another significant factor driving market expansion.

Challenges in the North America Home Heating Appliances Market Market

The North America home heating appliances market faces several challenges. Supply chain disruptions resulting from global events can lead to shortages and increased costs. Intense competition among established players and new entrants creates pressure on pricing and profitability. Stringent safety and efficiency regulations require substantial investment in compliance and product development. Lastly, fluctuating energy prices can impact consumer purchasing decisions and overall market demand.

Emerging Opportunities in North America Home Heating Appliances Market

The market offers numerous long-term growth opportunities. Technological breakthroughs, such as advancements in heat pump technology and integration with renewable energy sources, will shape future growth. Strategic partnerships between manufacturers and energy providers can broaden market access and create new business models. Expanding into underserved markets, such as rural areas with limited access to reliable heating solutions, presents significant potential for growth.

Leading Players in the North America Home Heating Appliances Market Sector

- Honeywell International Inc

- Daikin Industries Ltd

- Siemens AG

- Lennox International Inc

- Samsung Electronics

- Emerson Electric Co

- Mitsubishi Electric Corporation

- Johnson Controls

- Robert Bosch GmbH

- Panasonic Corporation

Key Milestones in North America Home Heating Appliances Market Industry

- January 2023: Johnson Controls launched the next-generation YORK YMAE Air-to-Water Inverter Scroll Modular Heat Pump, a high-efficiency air-to-water heat pump for the North American market. This launch strengthened Johnson Controls' position in the heat pump segment.

- September 2023: Octopus Energy launched a revolutionary heating system, including the Cosy 6 heat pump, Cosy Hub home control system, and Cosy Pods room sensors. This integrated approach represents a significant innovation in the market, emphasizing smart home technology integration.

Strategic Outlook for North America Home Heating Appliances Market Market

The North American home heating appliances market is poised for continued growth, driven by technological innovation, increasing energy costs, and stricter environmental regulations. Strategic opportunities exist in developing energy-efficient and smart home-integrated solutions, expanding into new markets, and forging strategic alliances to leverage market access and technological expertise. The focus on sustainability and energy efficiency will continue to shape market dynamics and present lucrative opportunities for innovative players.

North America Home Heating Appliances Market Segmentation

-

1. Equipment

- 1.1. Heat Pumps

- 1.2. Furnaces

- 1.3. Boilers

- 1.4. Unitary Heaters

-

2. Application

- 2.1. Residential

- 2.2. Commercial

-

3. Distribution Channel

- 3.1. Supermarkets/Hypermarkets

- 3.2. Specialty Stores

- 3.3. Online

- 3.4. Other Distribution Channels

-

4. Geography

- 4.1. United States

- 4.2. Canada

- 4.3. Rest of North America

North America Home Heating Appliances Market Segmentation By Geography

- 1. United States

- 2. Canada

- 3. Rest of North America

North America Home Heating Appliances Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 3.89% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Growing Installation of Energy Efficient Heating Systems Drives The Market

- 3.3. Market Restrains

- 3.3.1. Availability of alternatives

- 3.4. Market Trends

- 3.4.1. The Increasing Energy Efficient Heating Appliances Demand Drives the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. North America Home Heating Appliances Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Equipment

- 5.1.1. Heat Pumps

- 5.1.2. Furnaces

- 5.1.3. Boilers

- 5.1.4. Unitary Heaters

- 5.2. Market Analysis, Insights and Forecast - by Application

- 5.2.1. Residential

- 5.2.2. Commercial

- 5.3. Market Analysis, Insights and Forecast - by Distribution Channel

- 5.3.1. Supermarkets/Hypermarkets

- 5.3.2. Specialty Stores

- 5.3.3. Online

- 5.3.4. Other Distribution Channels

- 5.4. Market Analysis, Insights and Forecast - by Geography

- 5.4.1. United States

- 5.4.2. Canada

- 5.4.3. Rest of North America

- 5.5. Market Analysis, Insights and Forecast - by Region

- 5.5.1. United States

- 5.5.2. Canada

- 5.5.3. Rest of North America

- 5.1. Market Analysis, Insights and Forecast - by Equipment

- 6. United States North America Home Heating Appliances Market Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Equipment

- 6.1.1. Heat Pumps

- 6.1.2. Furnaces

- 6.1.3. Boilers

- 6.1.4. Unitary Heaters

- 6.2. Market Analysis, Insights and Forecast - by Application

- 6.2.1. Residential

- 6.2.2. Commercial

- 6.3. Market Analysis, Insights and Forecast - by Distribution Channel

- 6.3.1. Supermarkets/Hypermarkets

- 6.3.2. Specialty Stores

- 6.3.3. Online

- 6.3.4. Other Distribution Channels

- 6.4. Market Analysis, Insights and Forecast - by Geography

- 6.4.1. United States

- 6.4.2. Canada

- 6.4.3. Rest of North America

- 6.1. Market Analysis, Insights and Forecast - by Equipment

- 7. Canada North America Home Heating Appliances Market Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Equipment

- 7.1.1. Heat Pumps

- 7.1.2. Furnaces

- 7.1.3. Boilers

- 7.1.4. Unitary Heaters

- 7.2. Market Analysis, Insights and Forecast - by Application

- 7.2.1. Residential

- 7.2.2. Commercial

- 7.3. Market Analysis, Insights and Forecast - by Distribution Channel

- 7.3.1. Supermarkets/Hypermarkets

- 7.3.2. Specialty Stores

- 7.3.3. Online

- 7.3.4. Other Distribution Channels

- 7.4. Market Analysis, Insights and Forecast - by Geography

- 7.4.1. United States

- 7.4.2. Canada

- 7.4.3. Rest of North America

- 7.1. Market Analysis, Insights and Forecast - by Equipment

- 8. Rest of North America North America Home Heating Appliances Market Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Equipment

- 8.1.1. Heat Pumps

- 8.1.2. Furnaces

- 8.1.3. Boilers

- 8.1.4. Unitary Heaters

- 8.2. Market Analysis, Insights and Forecast - by Application

- 8.2.1. Residential

- 8.2.2. Commercial

- 8.3. Market Analysis, Insights and Forecast - by Distribution Channel

- 8.3.1. Supermarkets/Hypermarkets

- 8.3.2. Specialty Stores

- 8.3.3. Online

- 8.3.4. Other Distribution Channels

- 8.4. Market Analysis, Insights and Forecast - by Geography

- 8.4.1. United States

- 8.4.2. Canada

- 8.4.3. Rest of North America

- 8.1. Market Analysis, Insights and Forecast - by Equipment

- 9. United States North America Home Heating Appliances Market Analysis, Insights and Forecast, 2019-2031

- 10. Canada North America Home Heating Appliances Market Analysis, Insights and Forecast, 2019-2031

- 11. Mexico North America Home Heating Appliances Market Analysis, Insights and Forecast, 2019-2031

- 12. Rest of North America North America Home Heating Appliances Market Analysis, Insights and Forecast, 2019-2031

- 13. Competitive Analysis

- 13.1. Market Share Analysis 2024

- 13.2. Company Profiles

- 13.2.1 Honeywell International Inc

- 13.2.1.1. Overview

- 13.2.1.2. Products

- 13.2.1.3. SWOT Analysis

- 13.2.1.4. Recent Developments

- 13.2.1.5. Financials (Based on Availability)

- 13.2.2 Daikin Industries Ltd

- 13.2.2.1. Overview

- 13.2.2.2. Products

- 13.2.2.3. SWOT Analysis

- 13.2.2.4. Recent Developments

- 13.2.2.5. Financials (Based on Availability)

- 13.2.3 Siemens AG

- 13.2.3.1. Overview

- 13.2.3.2. Products

- 13.2.3.3. SWOT Analysis

- 13.2.3.4. Recent Developments

- 13.2.3.5. Financials (Based on Availability)

- 13.2.4 Lennox International Inc

- 13.2.4.1. Overview

- 13.2.4.2. Products

- 13.2.4.3. SWOT Analysis

- 13.2.4.4. Recent Developments

- 13.2.4.5. Financials (Based on Availability)

- 13.2.5 Samsung Electronics

- 13.2.5.1. Overview

- 13.2.5.2. Products

- 13.2.5.3. SWOT Analysis

- 13.2.5.4. Recent Developments

- 13.2.5.5. Financials (Based on Availability)

- 13.2.6 Emerson Electric Co

- 13.2.6.1. Overview

- 13.2.6.2. Products

- 13.2.6.3. SWOT Analysis

- 13.2.6.4. Recent Developments

- 13.2.6.5. Financials (Based on Availability)

- 13.2.7 Mitsubishi Electric Corporation

- 13.2.7.1. Overview

- 13.2.7.2. Products

- 13.2.7.3. SWOT Analysis

- 13.2.7.4. Recent Developments

- 13.2.7.5. Financials (Based on Availability)

- 13.2.8 Johnson Controls

- 13.2.8.1. Overview

- 13.2.8.2. Products

- 13.2.8.3. SWOT Analysis

- 13.2.8.4. Recent Developments

- 13.2.8.5. Financials (Based on Availability)

- 13.2.9 Robert Bosch GmbH

- 13.2.9.1. Overview

- 13.2.9.2. Products

- 13.2.9.3. SWOT Analysis

- 13.2.9.4. Recent Developments

- 13.2.9.5. Financials (Based on Availability)

- 13.2.10 Panasonic Corporation

- 13.2.10.1. Overview

- 13.2.10.2. Products

- 13.2.10.3. SWOT Analysis

- 13.2.10.4. Recent Developments

- 13.2.10.5. Financials (Based on Availability)

- 13.2.1 Honeywell International Inc

List of Figures

- Figure 1: North America Home Heating Appliances Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: North America Home Heating Appliances Market Share (%) by Company 2024

List of Tables

- Table 1: North America Home Heating Appliances Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: North America Home Heating Appliances Market Volume K Unit Forecast, by Region 2019 & 2032

- Table 3: North America Home Heating Appliances Market Revenue Million Forecast, by Equipment 2019 & 2032

- Table 4: North America Home Heating Appliances Market Volume K Unit Forecast, by Equipment 2019 & 2032

- Table 5: North America Home Heating Appliances Market Revenue Million Forecast, by Application 2019 & 2032

- Table 6: North America Home Heating Appliances Market Volume K Unit Forecast, by Application 2019 & 2032

- Table 7: North America Home Heating Appliances Market Revenue Million Forecast, by Distribution Channel 2019 & 2032

- Table 8: North America Home Heating Appliances Market Volume K Unit Forecast, by Distribution Channel 2019 & 2032

- Table 9: North America Home Heating Appliances Market Revenue Million Forecast, by Geography 2019 & 2032

- Table 10: North America Home Heating Appliances Market Volume K Unit Forecast, by Geography 2019 & 2032

- Table 11: North America Home Heating Appliances Market Revenue Million Forecast, by Region 2019 & 2032

- Table 12: North America Home Heating Appliances Market Volume K Unit Forecast, by Region 2019 & 2032

- Table 13: North America Home Heating Appliances Market Revenue Million Forecast, by Country 2019 & 2032

- Table 14: North America Home Heating Appliances Market Volume K Unit Forecast, by Country 2019 & 2032

- Table 15: United States North America Home Heating Appliances Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 16: United States North America Home Heating Appliances Market Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 17: Canada North America Home Heating Appliances Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 18: Canada North America Home Heating Appliances Market Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 19: Mexico North America Home Heating Appliances Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 20: Mexico North America Home Heating Appliances Market Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 21: Rest of North America North America Home Heating Appliances Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 22: Rest of North America North America Home Heating Appliances Market Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 23: North America Home Heating Appliances Market Revenue Million Forecast, by Equipment 2019 & 2032

- Table 24: North America Home Heating Appliances Market Volume K Unit Forecast, by Equipment 2019 & 2032

- Table 25: North America Home Heating Appliances Market Revenue Million Forecast, by Application 2019 & 2032

- Table 26: North America Home Heating Appliances Market Volume K Unit Forecast, by Application 2019 & 2032

- Table 27: North America Home Heating Appliances Market Revenue Million Forecast, by Distribution Channel 2019 & 2032

- Table 28: North America Home Heating Appliances Market Volume K Unit Forecast, by Distribution Channel 2019 & 2032

- Table 29: North America Home Heating Appliances Market Revenue Million Forecast, by Geography 2019 & 2032

- Table 30: North America Home Heating Appliances Market Volume K Unit Forecast, by Geography 2019 & 2032

- Table 31: North America Home Heating Appliances Market Revenue Million Forecast, by Country 2019 & 2032

- Table 32: North America Home Heating Appliances Market Volume K Unit Forecast, by Country 2019 & 2032

- Table 33: North America Home Heating Appliances Market Revenue Million Forecast, by Equipment 2019 & 2032

- Table 34: North America Home Heating Appliances Market Volume K Unit Forecast, by Equipment 2019 & 2032

- Table 35: North America Home Heating Appliances Market Revenue Million Forecast, by Application 2019 & 2032

- Table 36: North America Home Heating Appliances Market Volume K Unit Forecast, by Application 2019 & 2032

- Table 37: North America Home Heating Appliances Market Revenue Million Forecast, by Distribution Channel 2019 & 2032

- Table 38: North America Home Heating Appliances Market Volume K Unit Forecast, by Distribution Channel 2019 & 2032

- Table 39: North America Home Heating Appliances Market Revenue Million Forecast, by Geography 2019 & 2032

- Table 40: North America Home Heating Appliances Market Volume K Unit Forecast, by Geography 2019 & 2032

- Table 41: North America Home Heating Appliances Market Revenue Million Forecast, by Country 2019 & 2032

- Table 42: North America Home Heating Appliances Market Volume K Unit Forecast, by Country 2019 & 2032

- Table 43: North America Home Heating Appliances Market Revenue Million Forecast, by Equipment 2019 & 2032

- Table 44: North America Home Heating Appliances Market Volume K Unit Forecast, by Equipment 2019 & 2032

- Table 45: North America Home Heating Appliances Market Revenue Million Forecast, by Application 2019 & 2032

- Table 46: North America Home Heating Appliances Market Volume K Unit Forecast, by Application 2019 & 2032

- Table 47: North America Home Heating Appliances Market Revenue Million Forecast, by Distribution Channel 2019 & 2032

- Table 48: North America Home Heating Appliances Market Volume K Unit Forecast, by Distribution Channel 2019 & 2032

- Table 49: North America Home Heating Appliances Market Revenue Million Forecast, by Geography 2019 & 2032

- Table 50: North America Home Heating Appliances Market Volume K Unit Forecast, by Geography 2019 & 2032

- Table 51: North America Home Heating Appliances Market Revenue Million Forecast, by Country 2019 & 2032

- Table 52: North America Home Heating Appliances Market Volume K Unit Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the North America Home Heating Appliances Market?

The projected CAGR is approximately 3.89%.

2. Which companies are prominent players in the North America Home Heating Appliances Market?

Key companies in the market include Honeywell International Inc, Daikin Industries Ltd, Siemens AG, Lennox International Inc, Samsung Electronics, Emerson Electric Co, Mitsubishi Electric Corporation, Johnson Controls, Robert Bosch GmbH, Panasonic Corporation.

3. What are the main segments of the North America Home Heating Appliances Market?

The market segments include Equipment , Application, Distribution Channel, Geography.

4. Can you provide details about the market size?

The market size is estimated to be USD 16.62 Million as of 2022.

5. What are some drivers contributing to market growth?

Growing Installation of Energy Efficient Heating Systems Drives The Market.

6. What are the notable trends driving market growth?

The Increasing Energy Efficient Heating Appliances Demand Drives the Market.

7. Are there any restraints impacting market growth?

Availability of alternatives.

8. Can you provide examples of recent developments in the market?

September 2023: Octopus Energy launched a revolutionary heating system. It includes the Cosy 6, a new heat pump from Octopus, the Cosy Hub, a home control system, the Cosy Pods, room sensors, a customized smart tariff, and the renowned Octopus 5-star service.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in K Unit.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "North America Home Heating Appliances Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the North America Home Heating Appliances Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the North America Home Heating Appliances Market?

To stay informed about further developments, trends, and reports in the North America Home Heating Appliances Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence