Key Insights

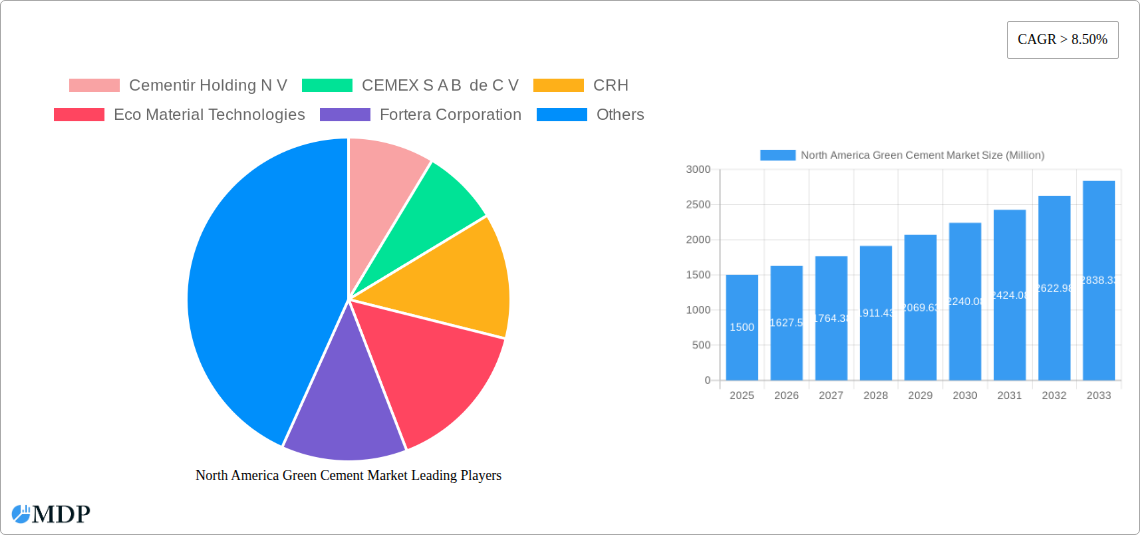

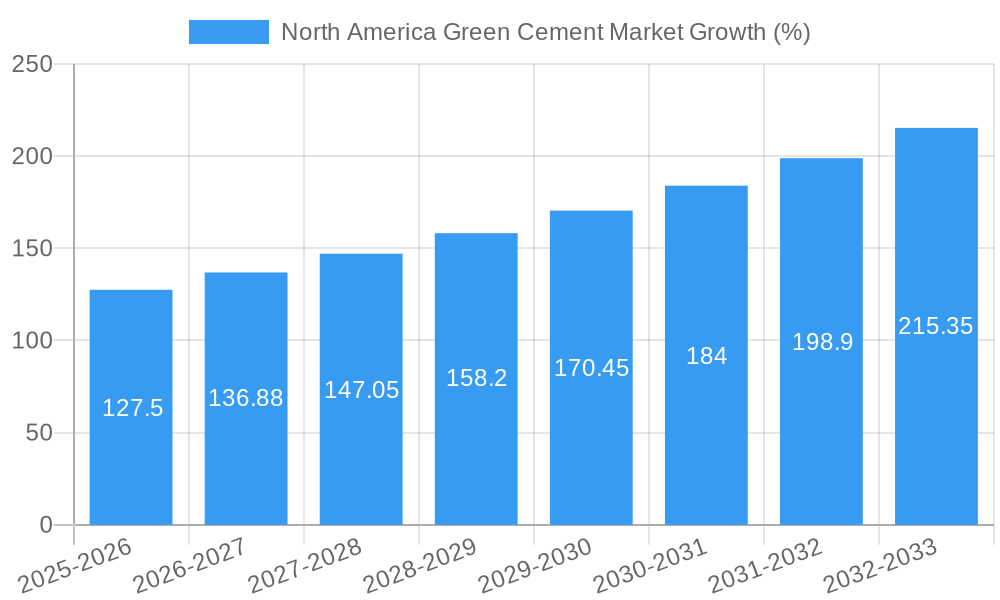

The North America green cement market is experiencing robust growth, driven by stringent environmental regulations aimed at reducing carbon emissions from the construction industry and a rising consumer preference for sustainable building materials. The market's Compound Annual Growth Rate (CAGR) exceeding 8.50% from 2019 to 2024 indicates a significant upward trajectory. This growth is further fueled by increasing awareness of the environmental impact of traditional cement production and the development of innovative, lower-carbon alternatives, such as geopolymer cement and alkali-activated materials. Major players like CEMEX, Heidelberg Materials, and CRH are actively investing in research and development, expanding their green cement production capacity, and strategically acquiring smaller companies specializing in sustainable building solutions. The market segmentation likely includes various types of green cement based on production methods and raw materials, with further differentiation based on application in residential, commercial, and infrastructure projects. Government incentives and subsidies promoting the adoption of eco-friendly construction practices are also contributing to market expansion.

Looking ahead to 2033, the North America green cement market is projected to maintain its strong growth momentum. While challenges remain, such as the higher initial cost of green cement compared to traditional Portland cement and the need for wider infrastructure to support its production and distribution, the long-term outlook remains positive. Continued innovation in green cement technology, coupled with increasing regulatory pressure and escalating consumer demand for sustainable products, will likely drive further market expansion. The market's success will hinge on overcoming the cost barrier through technological advancements and economies of scale, alongside effective communication of the long-term environmental and economic benefits of using green cement. This will ensure its widespread adoption and solidify its position as a key component of sustainable construction practices within North America.

North America Green Cement Market: A Comprehensive Report (2019-2033)

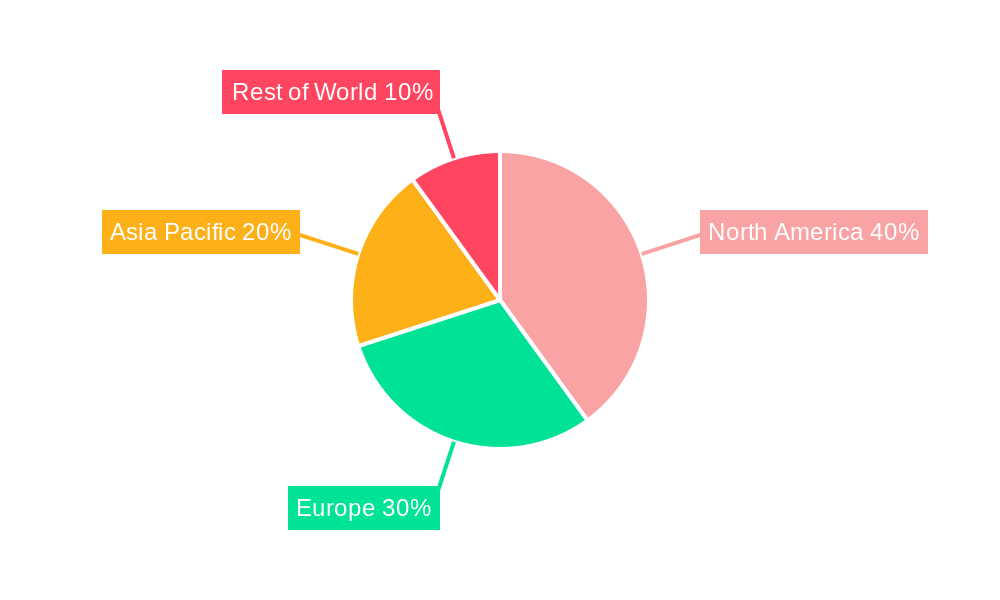

This in-depth report provides a comprehensive analysis of the North America green cement market, offering crucial insights for industry stakeholders, investors, and strategic decision-makers. The report covers market dynamics, industry trends, leading players, and future growth potential, utilizing data from 2019 to 2024 (historical period), with projections extending to 2033 (forecast period), using 2025 as the base and estimated year. The market size is valued in Millions.

North America Green Cement Market Market Dynamics & Concentration

The North America green cement market is experiencing significant growth driven by stringent environmental regulations, increasing demand for sustainable construction materials, and technological advancements in low-carbon cement production. Market concentration is moderate, with several key players holding substantial market share, but also witnessing a rise in smaller, innovative companies.

Market Concentration: The market is characterized by a combination of large multinational corporations and smaller, specialized players. The top five companies (including CEMEX, Holcim, CRH, Heidelberg Materials, and others) likely account for approximately xx% of the market share in 2025. However, the landscape is evolving with increased competition and innovation.

Innovation Drivers: R&D investments are focusing on developing alternative binders, optimizing production processes to reduce carbon emissions, and exploring new applications of green cement, such as 3D printing.

Regulatory Frameworks: Government policies promoting sustainable building practices and carbon emission reduction targets are significant drivers of market growth. Incentives and regulations vary across North American countries.

Product Substitutes: While traditional Portland cement remains dominant, green cement is increasingly competitive. Alternative binders and construction materials are also emerging, although their market penetration remains relatively low in 2025.

End-User Trends: The construction sector is the primary end-user, with growing demand from residential, commercial, and infrastructure projects. Increased awareness of environmental sustainability among consumers and businesses is accelerating the adoption of green cement.

M&A Activities: The market has witnessed several significant mergers and acquisitions (M&As) in recent years, reflecting industry consolidation and strategic expansion. The number of M&A deals in the period 2019-2024 totaled xx, with an average deal value of xx Million. Recent acquisitions like CRH's USD 2.1 Billion acquisition of Martin Marietta assets demonstrate the significant financial investment in market growth.

North America Green Cement Market Industry Trends & Analysis

The North American green cement market is projected to witness robust growth, with a CAGR of xx% during the forecast period (2025-2033). This growth is fueled by various factors. Technological advancements in low-carbon cement production are significantly reducing the carbon footprint of construction materials. Consumer preferences are shifting towards sustainable construction solutions. Furthermore, the increasing adoption of green building certifications and standards is promoting the use of green cement.

The competitive dynamics of the market are intense, with both established players and emerging companies vying for market share. This competition is driving innovation and pushing down prices, making green cement more accessible to a wider range of consumers. Market penetration of green cement is expected to increase from xx% in 2025 to xx% by 2033.

Leading Markets & Segments in North America Green Cement Market

While data specifics require further analysis, California, Texas, and other states with strong environmental regulations and significant construction activity are likely to be leading markets for green cement in North America.

- Key Drivers in Leading Regions:

- Stringent Environmental Regulations: States with ambitious emissions reduction targets are driving demand.

- Robust Construction Activity: High levels of infrastructure development and residential/commercial building fuel demand.

- Government Incentives and Subsidies: Financial support for sustainable construction projects boosts adoption.

- Growing Awareness among Consumers and Businesses: A preference for environmentally responsible building practices is impacting purchasing decisions.

The analysis requires a deeper investigation into the specific segment performances (e.g., by type of cement, application, etc.) Further information is needed to complete this section.

North America Green Cement Market Product Developments

Recent product innovations include the development of low-carbon Portland limestone cement, the utilization of supplementary cementitious materials, and the exploration of alternative binders such as geopolymers. These developments offer significant improvements in terms of reduced CO2 emissions, improved performance, and cost-effectiveness. The market is seeing increasing adoption of these innovative products as they provide a sustainable alternative to traditional Portland cement, aligning well with the growing trend of sustainable construction.

Key Drivers of North America Green Cement Market Growth

Several factors are driving market growth:

- Stringent Environmental Regulations: Governments are implementing stricter regulations to reduce carbon emissions in the construction sector.

- Growing Awareness of Sustainability: Consumers and businesses are increasingly prioritizing environmentally friendly building materials.

- Technological Advancements: Innovations in low-carbon cement production are making green cement more cost-competitive.

- Government Incentives: Many regions offer financial incentives to promote the use of sustainable building materials.

Challenges in the North America Green Cement Market Market

The market faces several challenges:

- Higher Initial Costs: Green cement often has a higher initial cost compared to traditional Portland cement.

- Limited Availability: The supply of green cement may not yet meet the growing demand in all regions.

- Technological Limitations: Some green cement types may have limitations in terms of performance characteristics.

- Supply Chain Issues: Disruptions in the supply chain could hinder market growth.

Emerging Opportunities in North America Green Cement Market

Significant opportunities exist for growth:

- Technological Breakthroughs: Further R&D efforts could lead to even more sustainable and cost-effective green cement options.

- Strategic Partnerships: Collaborations between cement producers and technology companies are accelerating innovation.

- Market Expansion: Demand is increasing in regions with growing construction activity and a greater focus on sustainability.

- Government Support: Continued government support through policy and funding is expected to drive market expansion.

Leading Players in the North America Green Cement Market Sector

- Cementir Holding N V

- CEMEX S A B de C V (CEMEX)

- CRH (CRH)

- Eco Material Technologies

- Fortera Corporation

- HOLCIM (Holcim)

- Hoffmann Green Cement Technologies

- Heidelberg Materials (Heidelberg Materials)

- Titan America LLC

- Votorantim Cimentos *List Not Exhaustive

Key Milestones in North America Green Cement Market Industry

- November 2023: CRH's USD 2.1 Billion acquisition of Martin Marietta assets signals significant investment in the North American market.

- September 2023: Fortera Corporation's aggressive expansion plans with USD 1 Billion in financing highlight strong investor confidence.

- June 2023: Eco Material Technologies' involvement in the first 3D-printed homes using their green cement showcases innovative applications.

- March 2023: Holcim Mexico's launch of Fuerte Más reduced-CO2 cement demonstrates commitment to sustainable production.

- November 2022: Titan America LLC's full conversion to Type IL portland-limestone cement underscores industry-wide adoption of low-carbon materials.

- September 2022: HeidelbergCement's rebranding to Heidelberg Materials reflects strategic focus on sustainable materials.

- February 2022: Holcim and Eni's collaboration on green cement production from captured carbon represents a significant technological advancement.

Strategic Outlook for North America Green Cement Market Market

The North America green cement market is poised for substantial growth. Continued technological innovation, increasing regulatory pressure, and growing consumer demand will drive market expansion. Strategic partnerships and investments in R&D will be crucial for companies to maintain competitiveness. The long-term outlook is positive, with significant opportunities for players who can effectively address the challenges and capitalize on the emerging trends in sustainable construction.

North America Green Cement Market Segmentation

-

1. Product Type

- 1.1. Fly Ash-based

- 1.2. Slag-based

- 1.3. Limestone-based

- 1.4. Silica fume-based

- 1.5. Other Pr

-

2. Construction Sector

- 2.1. Residential

- 2.2. Non-residential

-

3. Geography

- 3.1. United States

- 3.2. Canada

- 3.3. Mexico

North America Green Cement Market Segmentation By Geography

- 1. United States

- 2. Canada

- 3. Mexico

North America Green Cement Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of > 8.50% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Growing Green Construction Activities in North America; Favorable Government Policies for Green Building Construction; Abundance of Availability of Raw Materials

- 3.3. Market Restrains

- 3.3.1. Growing Green Construction Activities in North America; Favorable Government Policies for Green Building Construction; Abundance of Availability of Raw Materials

- 3.4. Market Trends

- 3.4.1. Residential Construction to Dominate the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global North America Green Cement Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 5.1.1. Fly Ash-based

- 5.1.2. Slag-based

- 5.1.3. Limestone-based

- 5.1.4. Silica fume-based

- 5.1.5. Other Pr

- 5.2. Market Analysis, Insights and Forecast - by Construction Sector

- 5.2.1. Residential

- 5.2.2. Non-residential

- 5.3. Market Analysis, Insights and Forecast - by Geography

- 5.3.1. United States

- 5.3.2. Canada

- 5.3.3. Mexico

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. United States

- 5.4.2. Canada

- 5.4.3. Mexico

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 6. United States North America Green Cement Market Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Product Type

- 6.1.1. Fly Ash-based

- 6.1.2. Slag-based

- 6.1.3. Limestone-based

- 6.1.4. Silica fume-based

- 6.1.5. Other Pr

- 6.2. Market Analysis, Insights and Forecast - by Construction Sector

- 6.2.1. Residential

- 6.2.2. Non-residential

- 6.3. Market Analysis, Insights and Forecast - by Geography

- 6.3.1. United States

- 6.3.2. Canada

- 6.3.3. Mexico

- 6.1. Market Analysis, Insights and Forecast - by Product Type

- 7. Canada North America Green Cement Market Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Product Type

- 7.1.1. Fly Ash-based

- 7.1.2. Slag-based

- 7.1.3. Limestone-based

- 7.1.4. Silica fume-based

- 7.1.5. Other Pr

- 7.2. Market Analysis, Insights and Forecast - by Construction Sector

- 7.2.1. Residential

- 7.2.2. Non-residential

- 7.3. Market Analysis, Insights and Forecast - by Geography

- 7.3.1. United States

- 7.3.2. Canada

- 7.3.3. Mexico

- 7.1. Market Analysis, Insights and Forecast - by Product Type

- 8. Mexico North America Green Cement Market Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Product Type

- 8.1.1. Fly Ash-based

- 8.1.2. Slag-based

- 8.1.3. Limestone-based

- 8.1.4. Silica fume-based

- 8.1.5. Other Pr

- 8.2. Market Analysis, Insights and Forecast - by Construction Sector

- 8.2.1. Residential

- 8.2.2. Non-residential

- 8.3. Market Analysis, Insights and Forecast - by Geography

- 8.3.1. United States

- 8.3.2. Canada

- 8.3.3. Mexico

- 8.1. Market Analysis, Insights and Forecast - by Product Type

- 9. Competitive Analysis

- 9.1. Global Market Share Analysis 2024

- 9.2. Company Profiles

- 9.2.1 Cementir Holding N V

- 9.2.1.1. Overview

- 9.2.1.2. Products

- 9.2.1.3. SWOT Analysis

- 9.2.1.4. Recent Developments

- 9.2.1.5. Financials (Based on Availability)

- 9.2.2 CEMEX S A B de C V

- 9.2.2.1. Overview

- 9.2.2.2. Products

- 9.2.2.3. SWOT Analysis

- 9.2.2.4. Recent Developments

- 9.2.2.5. Financials (Based on Availability)

- 9.2.3 CRH

- 9.2.3.1. Overview

- 9.2.3.2. Products

- 9.2.3.3. SWOT Analysis

- 9.2.3.4. Recent Developments

- 9.2.3.5. Financials (Based on Availability)

- 9.2.4 Eco Material Technologies

- 9.2.4.1. Overview

- 9.2.4.2. Products

- 9.2.4.3. SWOT Analysis

- 9.2.4.4. Recent Developments

- 9.2.4.5. Financials (Based on Availability)

- 9.2.5 Fortera Corporation

- 9.2.5.1. Overview

- 9.2.5.2. Products

- 9.2.5.3. SWOT Analysis

- 9.2.5.4. Recent Developments

- 9.2.5.5. Financials (Based on Availability)

- 9.2.6 HOLCIM

- 9.2.6.1. Overview

- 9.2.6.2. Products

- 9.2.6.3. SWOT Analysis

- 9.2.6.4. Recent Developments

- 9.2.6.5. Financials (Based on Availability)

- 9.2.7 Hoffmann Green Cement Technologies

- 9.2.7.1. Overview

- 9.2.7.2. Products

- 9.2.7.3. SWOT Analysis

- 9.2.7.4. Recent Developments

- 9.2.7.5. Financials (Based on Availability)

- 9.2.8 Heidelberg Materials

- 9.2.8.1. Overview

- 9.2.8.2. Products

- 9.2.8.3. SWOT Analysis

- 9.2.8.4. Recent Developments

- 9.2.8.5. Financials (Based on Availability)

- 9.2.9 Titan America LLC

- 9.2.9.1. Overview

- 9.2.9.2. Products

- 9.2.9.3. SWOT Analysis

- 9.2.9.4. Recent Developments

- 9.2.9.5. Financials (Based on Availability)

- 9.2.10 Votorantim Cimentos*List Not Exhaustive

- 9.2.10.1. Overview

- 9.2.10.2. Products

- 9.2.10.3. SWOT Analysis

- 9.2.10.4. Recent Developments

- 9.2.10.5. Financials (Based on Availability)

- 9.2.1 Cementir Holding N V

List of Figures

- Figure 1: Global North America Green Cement Market Revenue Breakdown (Million, %) by Region 2024 & 2032

- Figure 2: United States North America Green Cement Market Revenue (Million), by Product Type 2024 & 2032

- Figure 3: United States North America Green Cement Market Revenue Share (%), by Product Type 2024 & 2032

- Figure 4: United States North America Green Cement Market Revenue (Million), by Construction Sector 2024 & 2032

- Figure 5: United States North America Green Cement Market Revenue Share (%), by Construction Sector 2024 & 2032

- Figure 6: United States North America Green Cement Market Revenue (Million), by Geography 2024 & 2032

- Figure 7: United States North America Green Cement Market Revenue Share (%), by Geography 2024 & 2032

- Figure 8: United States North America Green Cement Market Revenue (Million), by Country 2024 & 2032

- Figure 9: United States North America Green Cement Market Revenue Share (%), by Country 2024 & 2032

- Figure 10: Canada North America Green Cement Market Revenue (Million), by Product Type 2024 & 2032

- Figure 11: Canada North America Green Cement Market Revenue Share (%), by Product Type 2024 & 2032

- Figure 12: Canada North America Green Cement Market Revenue (Million), by Construction Sector 2024 & 2032

- Figure 13: Canada North America Green Cement Market Revenue Share (%), by Construction Sector 2024 & 2032

- Figure 14: Canada North America Green Cement Market Revenue (Million), by Geography 2024 & 2032

- Figure 15: Canada North America Green Cement Market Revenue Share (%), by Geography 2024 & 2032

- Figure 16: Canada North America Green Cement Market Revenue (Million), by Country 2024 & 2032

- Figure 17: Canada North America Green Cement Market Revenue Share (%), by Country 2024 & 2032

- Figure 18: Mexico North America Green Cement Market Revenue (Million), by Product Type 2024 & 2032

- Figure 19: Mexico North America Green Cement Market Revenue Share (%), by Product Type 2024 & 2032

- Figure 20: Mexico North America Green Cement Market Revenue (Million), by Construction Sector 2024 & 2032

- Figure 21: Mexico North America Green Cement Market Revenue Share (%), by Construction Sector 2024 & 2032

- Figure 22: Mexico North America Green Cement Market Revenue (Million), by Geography 2024 & 2032

- Figure 23: Mexico North America Green Cement Market Revenue Share (%), by Geography 2024 & 2032

- Figure 24: Mexico North America Green Cement Market Revenue (Million), by Country 2024 & 2032

- Figure 25: Mexico North America Green Cement Market Revenue Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global North America Green Cement Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Global North America Green Cement Market Revenue Million Forecast, by Product Type 2019 & 2032

- Table 3: Global North America Green Cement Market Revenue Million Forecast, by Construction Sector 2019 & 2032

- Table 4: Global North America Green Cement Market Revenue Million Forecast, by Geography 2019 & 2032

- Table 5: Global North America Green Cement Market Revenue Million Forecast, by Region 2019 & 2032

- Table 6: Global North America Green Cement Market Revenue Million Forecast, by Product Type 2019 & 2032

- Table 7: Global North America Green Cement Market Revenue Million Forecast, by Construction Sector 2019 & 2032

- Table 8: Global North America Green Cement Market Revenue Million Forecast, by Geography 2019 & 2032

- Table 9: Global North America Green Cement Market Revenue Million Forecast, by Country 2019 & 2032

- Table 10: Global North America Green Cement Market Revenue Million Forecast, by Product Type 2019 & 2032

- Table 11: Global North America Green Cement Market Revenue Million Forecast, by Construction Sector 2019 & 2032

- Table 12: Global North America Green Cement Market Revenue Million Forecast, by Geography 2019 & 2032

- Table 13: Global North America Green Cement Market Revenue Million Forecast, by Country 2019 & 2032

- Table 14: Global North America Green Cement Market Revenue Million Forecast, by Product Type 2019 & 2032

- Table 15: Global North America Green Cement Market Revenue Million Forecast, by Construction Sector 2019 & 2032

- Table 16: Global North America Green Cement Market Revenue Million Forecast, by Geography 2019 & 2032

- Table 17: Global North America Green Cement Market Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the North America Green Cement Market?

The projected CAGR is approximately > 8.50%.

2. Which companies are prominent players in the North America Green Cement Market?

Key companies in the market include Cementir Holding N V, CEMEX S A B de C V, CRH, Eco Material Technologies, Fortera Corporation, HOLCIM, Hoffmann Green Cement Technologies, Heidelberg Materials, Titan America LLC, Votorantim Cimentos*List Not Exhaustive.

3. What are the main segments of the North America Green Cement Market?

The market segments include Product Type, Construction Sector, Geography.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Growing Green Construction Activities in North America; Favorable Government Policies for Green Building Construction; Abundance of Availability of Raw Materials.

6. What are the notable trends driving market growth?

Residential Construction to Dominate the Market.

7. Are there any restraints impacting market growth?

Growing Green Construction Activities in North America; Favorable Government Policies for Green Building Construction; Abundance of Availability of Raw Materials.

8. Can you provide examples of recent developments in the market?

November 2023: CRH agreed on a major deal in Texas two months after moving its primary listing from London to New York. It announced that it bought assets from Martin Marietta for USD 2.1 billion.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "North America Green Cement Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the North America Green Cement Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the North America Green Cement Market?

To stay informed about further developments, trends, and reports in the North America Green Cement Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence