Key Insights

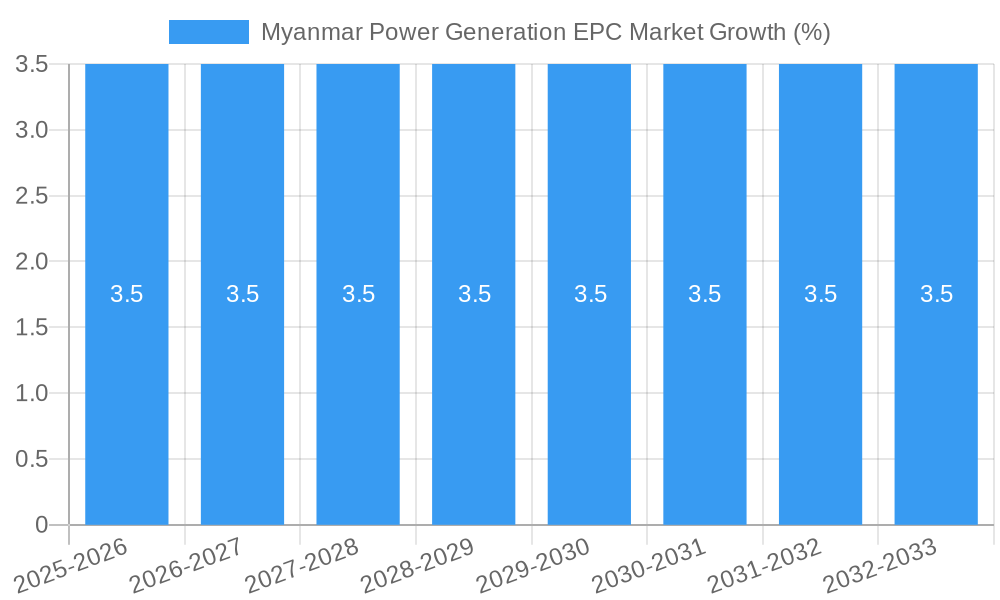

The Myanmar Power Generation Engineering, Procurement, and Construction (EPC) market presents significant growth opportunities, driven by increasing energy demand fueled by a growing population and industrialization. The market, currently estimated at [Estimate based on market size XX and value unit Million. For example, if XX = 100, then the 2025 market size would be 100 million. A logical estimation is needed based on industry knowledge and the provided CAGR.], is projected to expand at a Compound Annual Growth Rate (CAGR) exceeding 3.50% from 2025 to 2033. This growth is primarily fueled by investments in renewable energy sources like solar and wind power, alongside continued reliance on conventional thermal power plants (diesel, gas, and coal) to meet the nation's electricity needs. The government's focus on infrastructure development and efforts to diversify the energy mix are key catalysts. However, challenges remain, including potential political and economic instability, regulatory hurdles, and the need for significant foreign investment to support large-scale projects. Key players like Snowy Mountains Engineering Corporation Holdings Limited, Hyundai Engineering and Construction Corporation Limited, and Sumitomo Corporation are actively involved, vying for market share within the diverse segments comprising conventional thermal, hydropower, and other renewable sources. The forecast period suggests a steady expansion, though the actual growth rate will depend on successful policy implementation, infrastructure investments, and the overall economic stability of Myanmar.

The segmental breakdown reveals a dynamic market landscape. Conventional thermal power plants currently dominate, but the "Other Sources" segment, comprising solar and wind, is poised for substantial growth, driven by global trends towards cleaner energy and potential government incentives. Hydropower, while established, may experience slower growth compared to renewables due to environmental concerns and the potential impact on existing infrastructure. Competition among EPC companies is intense, with both international and domestic firms competing for contracts. The success of individual companies will hinge on their ability to navigate regulatory frameworks, manage project risks effectively, and demonstrate expertise in various power generation technologies. Future growth will be contingent on consistent government support for the energy sector and sustainable investment from international partners.

Myanmar Power Generation EPC Market: A Comprehensive Report (2019-2033)

This in-depth report provides a comprehensive analysis of the Myanmar Power Generation Engineering, Procurement, and Construction (EPC) market, offering invaluable insights for stakeholders including investors, EPC contractors, power producers, and government agencies. The report covers the period from 2019 to 2033, with a focus on the 2025-2033 forecast period. The market is segmented by power source: Conventional Thermal Power (Diesel, Gas, Coal), Hydropower, and Other Sources (Solar and Wind). Key players analyzed include Snowy Mountains Engineering Corporation Holdings Limited, Hyundai Engineering and Construction Corporation Limited, Sumitomo Corporation, Mitsubishi Heavy Industries Group, TTCL Public Company Limited, EAM Myanmar, Mitsui & Co., Limited, Zeya & Associates Power Systems, Marubeni Corporation, and Parami Energy. This is not an exhaustive list. The total market size in 2025 is estimated at xx Million USD.

Myanmar Power Generation EPC Market Market Dynamics & Concentration

The Myanmar power generation EPC market is characterized by a moderate level of concentration, with a few large international players and several domestic companies vying for market share. Market share data for 2024 indicates that the top 5 players hold approximately 60% of the market, while the remaining share is distributed among numerous smaller players. This fragmented landscape is driven by several factors. Innovation is primarily focused on adapting existing technologies to the specific needs and challenges of the Myanmar context, such as grid infrastructure limitations and varying fuel availability. The regulatory framework, while undergoing reforms, presents some challenges for market entry and operations. The absence of robust, widespread substitutes for traditional power sources remains a key factor. End-user trends lean towards increased demand for reliable and affordable electricity, putting pressure on EPC contractors to provide cost-effective and efficient solutions. M&A activity has been relatively low in recent years, with only xx major deals recorded between 2019 and 2024.

- Market Concentration: Top 5 players hold ~60% market share (2024).

- Innovation Drivers: Adapting existing technologies to local conditions.

- Regulatory Framework: Ongoing reforms impact market access.

- Product Substitutes: Limited viable alternatives to conventional sources.

- End-User Trends: Growing demand for reliable and affordable power.

- M&A Activity: xx major deals (2019-2024).

Myanmar Power Generation EPC Market Industry Trends & Analysis

The Myanmar power generation EPC market is projected to experience significant growth during the forecast period (2025-2033), driven by increasing energy demand, government initiatives to expand electricity access, and investments in renewable energy sources. The Compound Annual Growth Rate (CAGR) is estimated at xx% from 2025 to 2033. This growth is fueled by several key factors: rapid urbanization, industrialization, and a burgeoning population requiring increased power supply. Technological disruptions, while present, are relatively slow to be adopted due to cost and regulatory hurdles. Consumer preference shifts towards greater reliability and reduced carbon emissions are influencing project selection and design. Competitive dynamics are marked by a mix of international and domestic players, with international companies bringing expertise and technology while local firms offer cost advantages and local market knowledge. Market penetration of renewable energy sources is expected to increase steadily, though conventional thermal power will likely remain dominant in the short-to-medium term.

Leading Markets & Segments in Myanmar Power Generation EPC Market

The dominant segment within the Myanmar power generation EPC market is currently Conventional Thermal Power (primarily diesel and gas), driven by its established infrastructure and relative ease of implementation. However, Hydropower is also a significant segment with substantial potential for future growth, particularly in regions with ample water resources. The "Other Sources" segment, encompassing solar and wind power, is experiencing rapid growth, fueled by both government policy and a growing awareness of environmental concerns.

- Conventional Thermal Power: Dominated by existing infrastructure and readily available fuels.

- Hydropower: Significant potential, driven by abundant water resources.

- Other Sources (Solar & Wind): Rapid growth due to government policy and environmental concerns.

The Yangon Region currently leads in terms of project activity due to its high population density and industrial concentration. Favorable economic policies, improvements in grid infrastructure, and government investment in power projects are major factors contributing to this dominance.

Myanmar Power Generation EPC Market Product Developments

Recent product innovations within the Myanmar power generation EPC market focus on enhancing efficiency, reducing environmental impact, and improving grid integration. This includes the adoption of more advanced gas turbines, improvements in hydropower dam technology, and the introduction of more efficient solar and wind power solutions. These innovations cater to the growing need for reliable and sustainable power generation, while also addressing the challenges posed by the country's specific environmental and infrastructural limitations. The competitive advantage lies in providing cost-effective, reliable, and environmentally sustainable solutions tailored to the local context.

Key Drivers of Myanmar Power Generation EPC Market Growth

Several key factors are driving the growth of the Myanmar power generation EPC market. Firstly, the increasing energy demand fueled by economic development and population growth necessitates expansion of electricity generation capacity. Secondly, government initiatives aimed at improving energy access and promoting renewable energy sources create significant opportunities for EPC contractors. Lastly, foreign direct investment in the power sector plays a crucial role in funding major projects and technology transfer.

Challenges in the Myanmar Power Generation EPC Market Market

The Myanmar power generation EPC market faces several challenges. Regulatory hurdles, including licensing processes and permitting delays, can impede project implementation. Supply chain disruptions and the limited availability of skilled labor also impact project timelines and costs. Furthermore, intense competition, especially in the conventional thermal power segment, necessitates price competitiveness and efficient project management. These factors, if not effectively addressed, can lead to delays and cost overruns, thereby impacting overall market growth. For example, supply chain issues in 2022 resulted in a xx Million USD increase in project costs.

Emerging Opportunities in Myanmar Power Generation EPC Market

The Myanmar power generation EPC market offers substantial long-term growth potential. The increasing adoption of renewable energy technologies presents significant opportunities for companies specializing in solar, wind, and small hydropower projects. Strategic partnerships between international and domestic players can leverage technical expertise and local market knowledge, fostering innovation and sustainable growth. Expanding into underserved rural areas through mini-grid projects offers a path to reach a wider customer base and contribute to inclusive development.

Leading Players in the Myanmar Power Generation EPC Market Sector

- Snowy Mountains Engineering Corporation Holdings Limited

- Hyundai Engineering and Construction Corporation Limited

- Sumitomo Corporation

- Mitsubishi Heavy Industries Group

- TTCL Public Company Limited

- EAM Myanmar

- Mitsui & Co., Limited

- Zeya & Associates Power Systems

- Marubeni Corporation

- Parami Energy

Key Milestones in Myanmar Power Generation EPC Market Industry

- 2020: Government announces a new renewable energy policy.

- 2021: Several large-scale hydropower projects commence construction.

- 2022: Significant investment in solar power projects.

- 2023: A major gas-fired power plant becomes operational.

- 2024: Several joint ventures between international and local companies are formed.

Strategic Outlook for Myanmar Power Generation EPC Market Market

The future of the Myanmar power generation EPC market looks promising, driven by sustained economic growth, increased investment in infrastructure, and a growing focus on sustainable energy sources. Strategic partnerships, technological innovation, and effective risk management will be crucial for success. Companies that can adapt to the evolving regulatory landscape and effectively navigate the challenges posed by the local context will be best positioned to capitalize on the long-term growth opportunities presented by this dynamic market. The market is poised to attract significant investment and technological advancements in the coming decade, further fueling its expansion.

Myanmar Power Generation EPC Market Segmentation

-

1. Source

- 1.1. Conventional Thermal Power (Diesel, Gas, Coal)

- 1.2. Hydropower

- 1.3. Other Sources (Solar and Wind)

Myanmar Power Generation EPC Market Segmentation By Geography

- 1. Myanmar

Myanmar Power Generation EPC Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of > 3.50% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. 4.; Declining Cost of Lithium Batteries4.; Increased Adoption of Renewable Energy

- 3.3. Market Restrains

- 3.3.1. 4.; Mismatch in Demand and Supply of Raw Materials for Battery Manufacturing

- 3.4. Market Trends

- 3.4.1. Hydropower Segment Expected to Witness Significant Market Growth

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Myanmar Power Generation EPC Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Source

- 5.1.1. Conventional Thermal Power (Diesel, Gas, Coal)

- 5.1.2. Hydropower

- 5.1.3. Other Sources (Solar and Wind)

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. Myanmar

- 5.1. Market Analysis, Insights and Forecast - by Source

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2024

- 6.2. Company Profiles

- 6.2.1 Snowy Mountains Engineering Corporation Holdings Limited

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Hyundai Engineering and Construction Corporation Limited

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Sumitomo Corporation

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Mitsubishi Heavy Industries Group*List Not Exhaustive

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 TTCL Public Company Limited

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 EAM Myanmar

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Mitsui & Corporation Limited

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Zeya & Associates Power Systems

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Marubeni Corporation

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Parami Energy

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 Snowy Mountains Engineering Corporation Holdings Limited

List of Figures

- Figure 1: Myanmar Power Generation EPC Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Myanmar Power Generation EPC Market Share (%) by Company 2024

List of Tables

- Table 1: Myanmar Power Generation EPC Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Myanmar Power Generation EPC Market Volume Gigawatt Forecast, by Region 2019 & 2032

- Table 3: Myanmar Power Generation EPC Market Revenue Million Forecast, by Source 2019 & 2032

- Table 4: Myanmar Power Generation EPC Market Volume Gigawatt Forecast, by Source 2019 & 2032

- Table 5: Myanmar Power Generation EPC Market Revenue Million Forecast, by Region 2019 & 2032

- Table 6: Myanmar Power Generation EPC Market Volume Gigawatt Forecast, by Region 2019 & 2032

- Table 7: Myanmar Power Generation EPC Market Revenue Million Forecast, by Country 2019 & 2032

- Table 8: Myanmar Power Generation EPC Market Volume Gigawatt Forecast, by Country 2019 & 2032

- Table 9: Myanmar Power Generation EPC Market Revenue Million Forecast, by Source 2019 & 2032

- Table 10: Myanmar Power Generation EPC Market Volume Gigawatt Forecast, by Source 2019 & 2032

- Table 11: Myanmar Power Generation EPC Market Revenue Million Forecast, by Country 2019 & 2032

- Table 12: Myanmar Power Generation EPC Market Volume Gigawatt Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Myanmar Power Generation EPC Market?

The projected CAGR is approximately > 3.50%.

2. Which companies are prominent players in the Myanmar Power Generation EPC Market?

Key companies in the market include Snowy Mountains Engineering Corporation Holdings Limited, Hyundai Engineering and Construction Corporation Limited, Sumitomo Corporation, Mitsubishi Heavy Industries Group*List Not Exhaustive, TTCL Public Company Limited, EAM Myanmar, Mitsui & Corporation Limited, Zeya & Associates Power Systems, Marubeni Corporation, Parami Energy.

3. What are the main segments of the Myanmar Power Generation EPC Market?

The market segments include Source.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

4.; Declining Cost of Lithium Batteries4.; Increased Adoption of Renewable Energy.

6. What are the notable trends driving market growth?

Hydropower Segment Expected to Witness Significant Market Growth.

7. Are there any restraints impacting market growth?

4.; Mismatch in Demand and Supply of Raw Materials for Battery Manufacturing.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in Gigawatt.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Myanmar Power Generation EPC Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Myanmar Power Generation EPC Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Myanmar Power Generation EPC Market?

To stay informed about further developments, trends, and reports in the Myanmar Power Generation EPC Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence