Key Insights

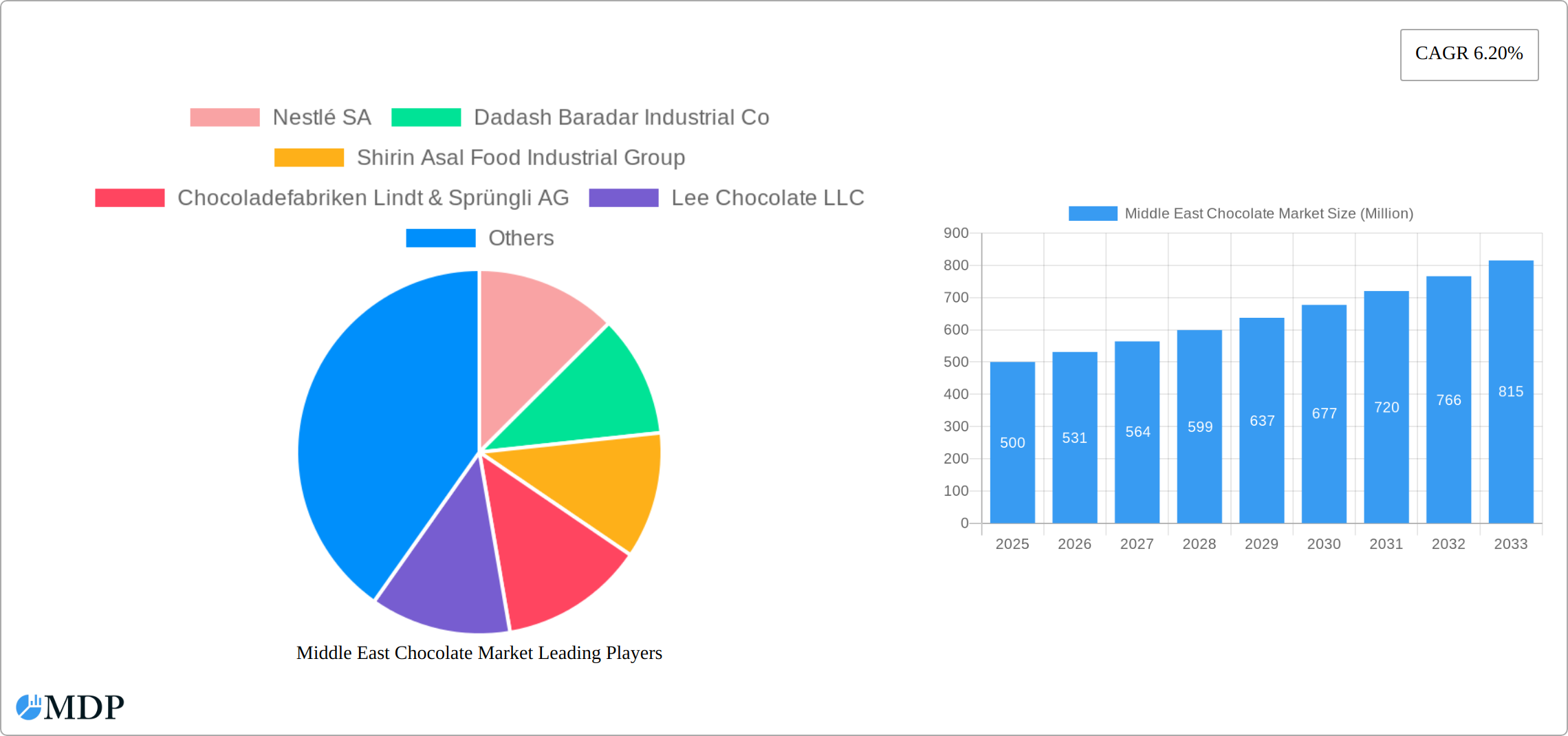

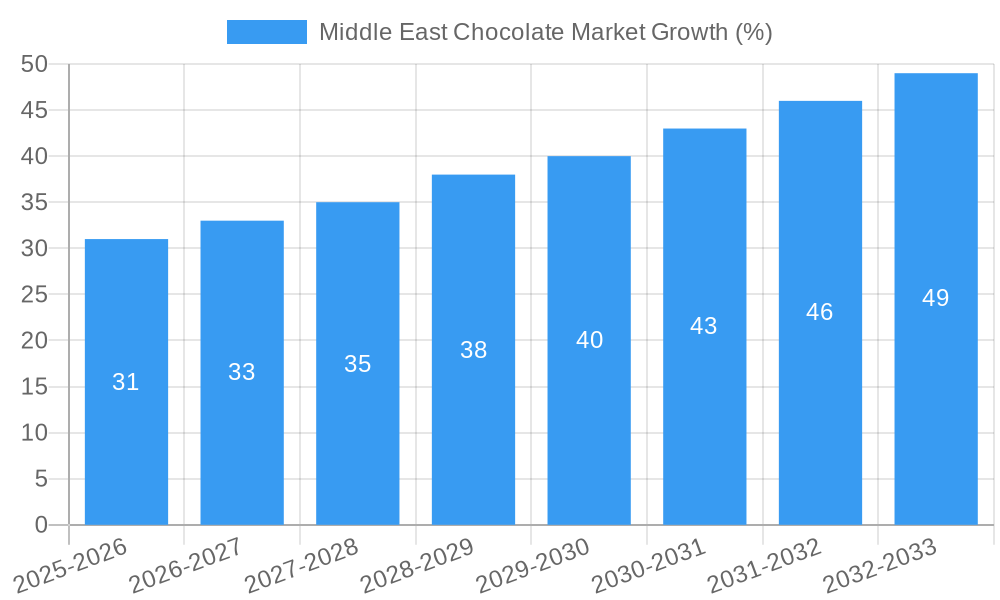

The Middle East chocolate market, valued at approximately $X million in 2025, is projected to experience robust growth, exhibiting a Compound Annual Growth Rate (CAGR) of 6.20% from 2025 to 2033. This expansion is fueled by several key drivers. Rising disposable incomes across the region, particularly in countries like the UAE and Saudi Arabia, are empowering consumers to indulge in premium chocolate products. A burgeoning young population with a penchant for Westernized lifestyles and a growing preference for gifting chocolates during festivals like Eid and Ramadan further propel market growth. The increasing availability of diverse chocolate variants, from dark and milk chocolate to innovative flavors catering to local preferences, also contribute significantly. Furthermore, the expansion of organized retail channels, including supermarkets, hypermarkets, and online retail stores, is facilitating wider product accessibility and market penetration. However, the market faces certain restraints, such as fluctuating raw material prices (cocoa beans, sugar) and potential health concerns associated with high sugar and fat content. The competitive landscape is dynamic, with both international giants like Nestlé and Mars, and regional players like Patchi vying for market share. Strategic partnerships, new product launches, and effective marketing campaigns are pivotal to success in this expanding market.

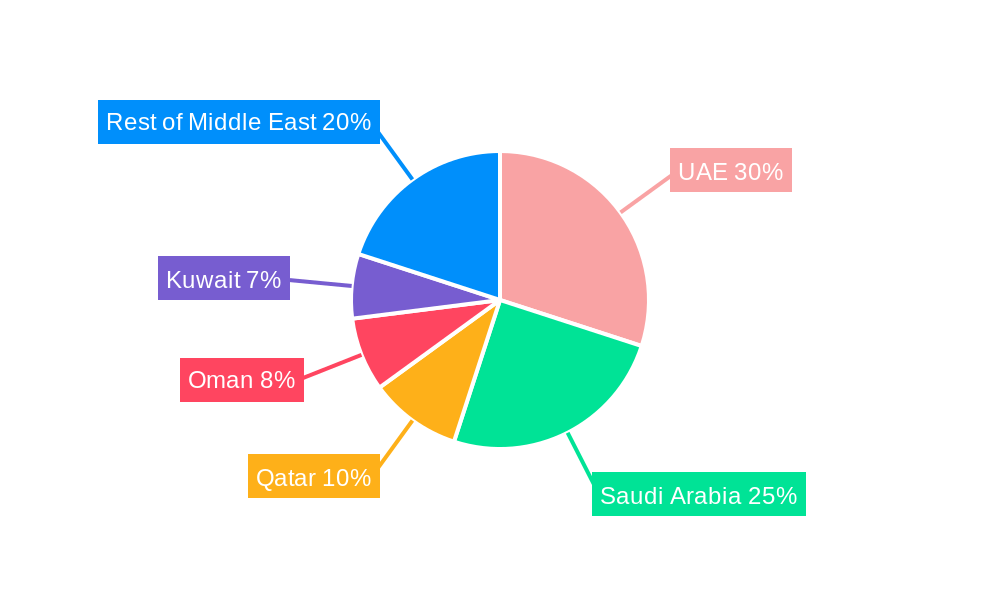

Segmentation within the Middle East chocolate market reveals strong preferences. The milk chocolate segment currently holds a dominant position, driven by its broad appeal to diverse age groups. However, the dark chocolate segment demonstrates impressive growth potential, fueled by increasing health consciousness and the perception of dark chocolate as a healthier alternative. Distribution channels reveal a mix, with supermarkets and hypermarkets holding the largest share, reflecting the established retail infrastructure. Online retail is rapidly emerging as a significant channel, benefiting from increasing internet penetration and e-commerce adoption in the region. Geographically, the UAE and Saudi Arabia represent the largest markets, driven by higher per capita incomes and robust consumer spending. However, other markets like Oman, Qatar, and Kuwait also show promising growth trajectories. This makes the Middle East chocolate market a lucrative and dynamic sector, presenting considerable opportunities for established players and new entrants alike. Further market research focusing on specific consumer preferences and emerging trends will be crucial to achieving sustainable growth.

Middle East Chocolate Market: A Comprehensive Report (2019-2033)

This in-depth report provides a comprehensive analysis of the Middle East chocolate market, offering invaluable insights for industry stakeholders, investors, and strategic decision-makers. The report covers the period from 2019 to 2033, with a focus on the forecast period of 2025-2033 and a base year of 2025. Expect detailed market sizing in Millions, granular segment breakdowns, and key player analysis. Uncover the growth trajectory of this lucrative market, identify emerging opportunities, and understand the competitive landscape.

Middle East Chocolate Market Dynamics & Concentration

The Middle East chocolate market exhibits a moderately concentrated landscape, with key players like Nestlé SA, Ferrero International SA, and Mondelēz International Inc. holding significant market share. However, the presence of numerous regional and local players fosters competitive dynamics. Market concentration is further influenced by factors such as:

- Innovation Drivers: The rising demand for premium chocolate, novel flavors, and health-conscious options drives continuous product innovation.

- Regulatory Frameworks: Varying regulations across different Middle Eastern countries impact import/export dynamics and labeling requirements.

- Product Substitutes: The market faces competition from confectionery alternatives and healthier snack options.

- End-User Trends: Growing disposable incomes and changing lifestyles fuel increased chocolate consumption. A strong preference for premium and specialized chocolate varieties is also observed.

- M&A Activities: Consolidation activities and strategic partnerships play a role in shaping the market structure. The estimated M&A deal count for 2024 is xx, while the estimated market share of the top 3 players is xx%.

Middle East Chocolate Market Industry Trends & Analysis

The Middle East chocolate market is experiencing robust growth, driven by factors such as rising disposable incomes, increasing urbanization, and a growing preference for premium chocolate products. The market's CAGR during the historical period (2019-2024) is estimated at xx%, while the projected CAGR for the forecast period (2025-2033) is xx%. Market penetration has also increased from xx% in 2019 to xx% in 2024. Several factors contribute to this growth:

- Technological Disruptions: Automated manufacturing processes and advanced packaging technologies are enhancing production efficiency and product quality.

- Consumer Preferences: There is a clear preference shift towards healthier options like dark chocolate and plant-based alternatives, influencing product development strategies.

- Competitive Dynamics: Intense competition among established players and emerging brands necessitates continuous innovation and strategic marketing.

- Market Growth Drivers: Increased tourism, expanding retail infrastructure, and evolving consumer tastes, particularly towards premium chocolates, are driving significant growth in this market.

Leading Markets & Segments in Middle East Chocolate Market

The United Arab Emirates and Saudi Arabia are the dominant markets, accounting for the largest share of the overall chocolate consumption, followed by other countries like Kuwait, Qatar, and Oman. Market dominance is influenced by several factors:

United Arab Emirates (UAE): Strong economic growth, a large expatriate population, and a well-developed retail infrastructure are key drivers.

Saudi Arabia: A sizable population, rising disposable incomes, and government initiatives supporting the food processing sector contribute significantly to the market's growth.

Confectionery Variant: Milk chocolate holds the largest market share, followed by dark chocolate and white chocolate. This preference is attributed to its familiar taste and broad consumer appeal.

Distribution Channel: Supermarket/Hypermarkets remain the dominant distribution channel due to their wide reach and accessibility, followed by convenience stores, and online retail stores are gradually gaining traction.

Key Drivers (UAE & Saudi Arabia):

- High disposable incomes

- Strong tourism sectors

- Well-developed retail infrastructure

- Pro-business government policies

Middle East Chocolate Market Product Developments

Recent product innovations focus on healthier options, such as dairy-free and plant-based chocolates (like Barry Callebaut's NXT), and whole-fruit chocolates with reduced sugar content (Cacao Barry). These innovations cater to evolving consumer preferences and health concerns. Technological advancements in production processes lead to improved quality, consistency, and efficiency. The growing market for premium and specialty chocolates further drives product diversification.

Key Drivers of Middle East Chocolate Market Growth

Several factors contribute to the growth of the Middle East chocolate market:

- Economic Growth: Rising disposable incomes and urbanization are driving increased chocolate consumption.

- Changing Consumer Preferences: A growing preference for premium and specialized chocolates, along with healthier options, is pushing innovation.

- Technological Advancements: Improvements in production and packaging technologies enhance efficiency and product quality.

Challenges in the Middle East Chocolate Market

The Middle East chocolate market, while experiencing significant growth, faces several key challenges that impact profitability and market penetration. These include:

- Complex Regulatory Landscape: Navigating the diverse and sometimes conflicting food regulations across different Middle Eastern countries presents a significant operational hurdle. Compliance requirements vary widely, impacting product formulation, labeling, and import/export processes.

- Supply Chain Volatility: The chocolate industry is susceptible to fluctuations in raw material prices (cocoa beans, sugar, dairy), impacting production costs. Furthermore, logistical challenges, including transportation disruptions and infrastructure limitations in certain regions, can lead to delays and increased expenses.

- Fierce Competition and Market Saturation: The Middle East chocolate market is characterized by intense competition, with a mix of established international brands and thriving local players. This necessitates substantial investments in marketing, branding, and product innovation to gain and maintain market share. Differentiation through unique product offerings and targeted marketing strategies is crucial for success.

- Economic Fluctuations and Consumer Spending: Economic instability in some parts of the Middle East can impact consumer spending on discretionary items like chocolate. Market players must be adept at adapting to these economic shifts and adjusting their pricing and product strategies accordingly.

Emerging Opportunities in Middle East Chocolate Market

Despite the challenges, the Middle East chocolate market presents compelling opportunities for growth and expansion:

- Untapped Market Potential: Significant growth potential exists in less saturated markets within the Middle East. Expanding into these underserved regions, through targeted distribution strategies and culturally relevant product offerings, can unlock significant market share.

- Strategic Alliances and Joint Ventures: Collaborations between international chocolate manufacturers and local businesses can offer a powerful pathway to market entry and expansion. These partnerships leverage the expertise and resources of both parties, facilitating efficient distribution networks and culturally sensitive marketing campaigns.

- Premiumization and Health-Conscious Trends: The increasing demand for premium, high-quality chocolates, and a growing awareness of health and wellness, presents a key opportunity. Offering organic, fair-trade, or other health-focused products caters to this evolving consumer preference, commanding premium pricing and enhancing brand image.

- E-commerce and Digital Marketing: The growing adoption of e-commerce in the Middle East provides new avenues for reaching consumers. Effective digital marketing strategies, including targeted online advertising and social media engagement, can be instrumental in driving brand awareness and sales.

Leading Players in the Middle East Chocolate Market Sector

- Nestlé SA

- Dadash Baradar Industrial Co

- Shirin Asal Food Industrial Group

- Chocoladefabriken Lindt & Sprüngli AG

- Lee Chocolate LLC

- Barry Callebaut

- Makaw Chocolate LLC

- Ferrero International SA

- Mars Incorporated

- Yıldız Holding A.Ş.

- IFFCO

- Patchi LLC

- Parand Chocolate Co

- Strauss Group Ltd

- Mondelēz International Inc

- Bostani Chocolatier Inc

- The Hershey Company

Key Milestones in Middle East Chocolate Market Industry

- September 2022: Barry Callebaut launched its line of whole-fruit chocolates under the Cacao Barry brand in the UAE, highlighting a focus on healthier options.

- November 2022: Barry Callebaut launched 100% dairy-free and plant-based chocolate NXT in Saudi Arabia, reflecting the growing demand for vegan products.

- November 2022: Nestlé announced a SAR 7 billion investment in Saudi Arabia, including USD 99.6 Million for a new manufacturing plant (opening 2025), signaling substantial commitment to the market.

Strategic Outlook for Middle East Chocolate Market

The Middle East chocolate market presents a dynamic and evolving landscape. Sustained growth is projected, driven by a rising middle class with increased disposable income, a preference for premium and specialized chocolate products, and the ongoing development of sophisticated retail channels. Success will hinge on strategic agility, a deep understanding of local consumer preferences, and the ability to navigate the complexities of the regional regulatory environment. Companies that embrace innovation, prioritize sustainability, and build strong brand loyalty are best positioned to thrive in this competitive and rewarding market.

Middle East Chocolate Market Segmentation

-

1. Confectionery Variant

- 1.1. Dark Chocolate

- 1.2. Milk and White Chocolate

-

2. Distribution Channel

- 2.1. Convenience Store

- 2.2. Online Retail Store

- 2.3. Supermarket/Hypermarket

- 2.4. Others

Middle East Chocolate Market Segmentation By Geography

-

1. Middle East

- 1.1. Saudi Arabia

- 1.2. United Arab Emirates

- 1.3. Israel

- 1.4. Qatar

- 1.5. Kuwait

- 1.6. Oman

- 1.7. Bahrain

- 1.8. Jordan

- 1.9. Lebanon

Middle East Chocolate Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 6.20% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Demand for Functional and Fortified Food; Multi-functionality and Wide Application of Riboflavin

- 3.3. Market Restrains

- 3.3.1. Low Stability of Riboflavin on Exposure to Light and Heat

- 3.4. Market Trends

- 3.4.1. OTHER KEY INDUSTRY TRENDS COVERED IN THE REPORT

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Middle East Chocolate Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Confectionery Variant

- 5.1.1. Dark Chocolate

- 5.1.2. Milk and White Chocolate

- 5.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 5.2.1. Convenience Store

- 5.2.2. Online Retail Store

- 5.2.3. Supermarket/Hypermarket

- 5.2.4. Others

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Middle East

- 5.1. Market Analysis, Insights and Forecast - by Confectionery Variant

- 6. United Arab Emirates Middle East Chocolate Market Analysis, Insights and Forecast, 2019-2031

- 7. Saudi Arabia Middle East Chocolate Market Analysis, Insights and Forecast, 2019-2031

- 8. Qatar Middle East Chocolate Market Analysis, Insights and Forecast, 2019-2031

- 9. Israel Middle East Chocolate Market Analysis, Insights and Forecast, 2019-2031

- 10. Egypt Middle East Chocolate Market Analysis, Insights and Forecast, 2019-2031

- 11. Oman Middle East Chocolate Market Analysis, Insights and Forecast, 2019-2031

- 12. Rest of Middle East Middle East Chocolate Market Analysis, Insights and Forecast, 2019-2031

- 13. Competitive Analysis

- 13.1. Market Share Analysis 2024

- 13.2. Company Profiles

- 13.2.1 Nestlé SA

- 13.2.1.1. Overview

- 13.2.1.2. Products

- 13.2.1.3. SWOT Analysis

- 13.2.1.4. Recent Developments

- 13.2.1.5. Financials (Based on Availability)

- 13.2.2 Dadash Baradar Industrial Co

- 13.2.2.1. Overview

- 13.2.2.2. Products

- 13.2.2.3. SWOT Analysis

- 13.2.2.4. Recent Developments

- 13.2.2.5. Financials (Based on Availability)

- 13.2.3 Shirin Asal Food Industrial Group

- 13.2.3.1. Overview

- 13.2.3.2. Products

- 13.2.3.3. SWOT Analysis

- 13.2.3.4. Recent Developments

- 13.2.3.5. Financials (Based on Availability)

- 13.2.4 Chocoladefabriken Lindt & Sprüngli AG

- 13.2.4.1. Overview

- 13.2.4.2. Products

- 13.2.4.3. SWOT Analysis

- 13.2.4.4. Recent Developments

- 13.2.4.5. Financials (Based on Availability)

- 13.2.5 Lee Chocolate LLC

- 13.2.5.1. Overview

- 13.2.5.2. Products

- 13.2.5.3. SWOT Analysis

- 13.2.5.4. Recent Developments

- 13.2.5.5. Financials (Based on Availability)

- 13.2.6 Berry Callebaut

- 13.2.6.1. Overview

- 13.2.6.2. Products

- 13.2.6.3. SWOT Analysis

- 13.2.6.4. Recent Developments

- 13.2.6.5. Financials (Based on Availability)

- 13.2.7 Makaw Chocolate LLC

- 13.2.7.1. Overview

- 13.2.7.2. Products

- 13.2.7.3. SWOT Analysis

- 13.2.7.4. Recent Developments

- 13.2.7.5. Financials (Based on Availability)

- 13.2.8 Ferrero International SA

- 13.2.8.1. Overview

- 13.2.8.2. Products

- 13.2.8.3. SWOT Analysis

- 13.2.8.4. Recent Developments

- 13.2.8.5. Financials (Based on Availability)

- 13.2.9 Mars Incorporated

- 13.2.9.1. Overview

- 13.2.9.2. Products

- 13.2.9.3. SWOT Analysis

- 13.2.9.4. Recent Developments

- 13.2.9.5. Financials (Based on Availability)

- 13.2.10 Yıldız Holding A

- 13.2.10.1. Overview

- 13.2.10.2. Products

- 13.2.10.3. SWOT Analysis

- 13.2.10.4. Recent Developments

- 13.2.10.5. Financials (Based on Availability)

- 13.2.11 IFFCO

- 13.2.11.1. Overview

- 13.2.11.2. Products

- 13.2.11.3. SWOT Analysis

- 13.2.11.4. Recent Developments

- 13.2.11.5. Financials (Based on Availability)

- 13.2.12 Patchi LLC

- 13.2.12.1. Overview

- 13.2.12.2. Products

- 13.2.12.3. SWOT Analysis

- 13.2.12.4. Recent Developments

- 13.2.12.5. Financials (Based on Availability)

- 13.2.13 Parand Chocolate Co

- 13.2.13.1. Overview

- 13.2.13.2. Products

- 13.2.13.3. SWOT Analysis

- 13.2.13.4. Recent Developments

- 13.2.13.5. Financials (Based on Availability)

- 13.2.14 Strauss Group Ltd

- 13.2.14.1. Overview

- 13.2.14.2. Products

- 13.2.14.3. SWOT Analysis

- 13.2.14.4. Recent Developments

- 13.2.14.5. Financials (Based on Availability)

- 13.2.15 Mondelēz International Inc

- 13.2.15.1. Overview

- 13.2.15.2. Products

- 13.2.15.3. SWOT Analysis

- 13.2.15.4. Recent Developments

- 13.2.15.5. Financials (Based on Availability)

- 13.2.16 Bostani Chocolatier Inc

- 13.2.16.1. Overview

- 13.2.16.2. Products

- 13.2.16.3. SWOT Analysis

- 13.2.16.4. Recent Developments

- 13.2.16.5. Financials (Based on Availability)

- 13.2.17 The Hershey Company

- 13.2.17.1. Overview

- 13.2.17.2. Products

- 13.2.17.3. SWOT Analysis

- 13.2.17.4. Recent Developments

- 13.2.17.5. Financials (Based on Availability)

- 13.2.1 Nestlé SA

List of Figures

- Figure 1: Middle East Chocolate Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Middle East Chocolate Market Share (%) by Company 2024

List of Tables

- Table 1: Middle East Chocolate Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Middle East Chocolate Market Revenue Million Forecast, by Confectionery Variant 2019 & 2032

- Table 3: Middle East Chocolate Market Revenue Million Forecast, by Distribution Channel 2019 & 2032

- Table 4: Middle East Chocolate Market Revenue Million Forecast, by Region 2019 & 2032

- Table 5: Middle East Chocolate Market Revenue Million Forecast, by Country 2019 & 2032

- Table 6: United Arab Emirates Middle East Chocolate Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 7: Saudi Arabia Middle East Chocolate Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 8: Qatar Middle East Chocolate Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: Israel Middle East Chocolate Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: Egypt Middle East Chocolate Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 11: Oman Middle East Chocolate Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 12: Rest of Middle East Middle East Chocolate Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 13: Middle East Chocolate Market Revenue Million Forecast, by Confectionery Variant 2019 & 2032

- Table 14: Middle East Chocolate Market Revenue Million Forecast, by Distribution Channel 2019 & 2032

- Table 15: Middle East Chocolate Market Revenue Million Forecast, by Country 2019 & 2032

- Table 16: Saudi Arabia Middle East Chocolate Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 17: United Arab Emirates Middle East Chocolate Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 18: Israel Middle East Chocolate Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 19: Qatar Middle East Chocolate Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 20: Kuwait Middle East Chocolate Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 21: Oman Middle East Chocolate Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 22: Bahrain Middle East Chocolate Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 23: Jordan Middle East Chocolate Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 24: Lebanon Middle East Chocolate Market Revenue (Million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Middle East Chocolate Market?

The projected CAGR is approximately 6.20%.

2. Which companies are prominent players in the Middle East Chocolate Market?

Key companies in the market include Nestlé SA, Dadash Baradar Industrial Co, Shirin Asal Food Industrial Group, Chocoladefabriken Lindt & Sprüngli AG, Lee Chocolate LLC, Berry Callebaut, Makaw Chocolate LLC, Ferrero International SA, Mars Incorporated, Yıldız Holding A, IFFCO, Patchi LLC, Parand Chocolate Co, Strauss Group Ltd, Mondelēz International Inc, Bostani Chocolatier Inc, The Hershey Company.

3. What are the main segments of the Middle East Chocolate Market?

The market segments include Confectionery Variant, Distribution Channel.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Increasing Demand for Functional and Fortified Food; Multi-functionality and Wide Application of Riboflavin.

6. What are the notable trends driving market growth?

OTHER KEY INDUSTRY TRENDS COVERED IN THE REPORT.

7. Are there any restraints impacting market growth?

Low Stability of Riboflavin on Exposure to Light and Heat.

8. Can you provide examples of recent developments in the market?

November 2022: Nestlé announced plans to invest SAR 7 billion in the Kingdom of Saudi Arabia in the coming ten years in a strategic move to grow its longstanding business in the country, beginning with up to USD 99.6 million to establish a cutting-edge manufacturing plant – which is set to open in 2025.November 2022: Barry Callebaut launched 100% dairy-free and plant-based chocolate NXT in Saudi Arabia. NXT is the first-of-its-kind dairy-free, lactose-free, nut-free, allergen-free, 100% plant-based, and vegan dark and milk chocolate to respond to the growing demand for plant-based foods across the country.September 2022: Barry Callebaut launched its line of whole-fruit chocolates under the Cacao Barry brand in the United Arab Emirates. The product has less sugar than conventional dark chocolate and is made from pure cacao fruit.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Middle East Chocolate Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Middle East Chocolate Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Middle East Chocolate Market?

To stay informed about further developments, trends, and reports in the Middle East Chocolate Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence