Key Insights

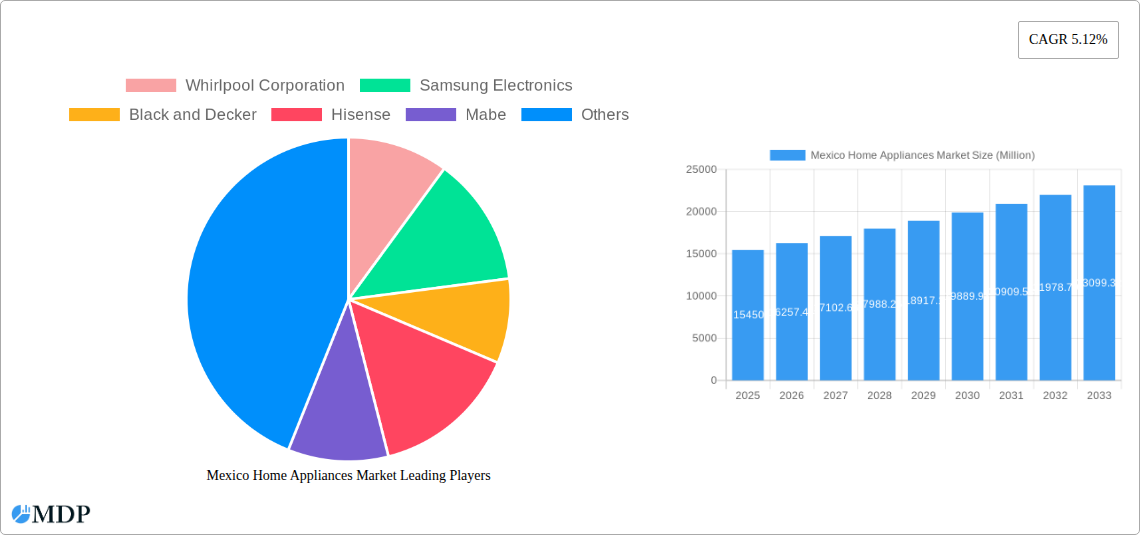

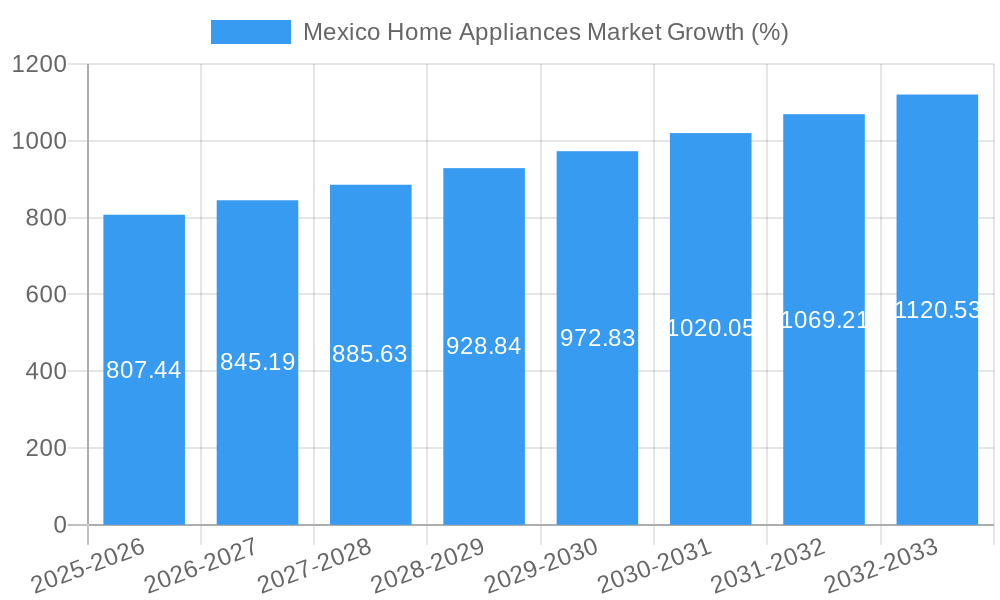

The Mexico home appliances market, valued at $15.45 billion in 2025, is projected to experience robust growth, driven by rising disposable incomes, increasing urbanization, and a preference for modern, convenient appliances. A compound annual growth rate (CAGR) of 5.12% is anticipated from 2025 to 2033, indicating a significant expansion of the market. Key growth drivers include the rising adoption of smart home technologies, increasing demand for energy-efficient appliances, and a shift towards smaller, more space-saving designs. The major appliances segment, encompassing refrigerators, washing machines, and air conditioners, constitutes a substantial portion of the market share, while the small appliances segment, featuring coffee makers, food processors, and vacuum cleaners, is experiencing strong growth fueled by evolving consumer lifestyles and increased focus on convenience and ease of use. The distribution channel landscape is dynamic, with mass merchandisers maintaining a strong presence while online sales are expected to gain significant traction in the coming years. Leading players like Whirlpool, Samsung, and LG are strategically investing in product innovation, brand building, and expanding their distribution networks to capture a larger share of the expanding market. Competitive pressures and fluctuating raw material prices present potential challenges.

The market segmentation provides valuable insights into consumer preferences. Refrigerators and washing machines are expected to remain the dominant categories within major appliances, propelled by their necessity in households. Within small appliances, coffee/tea makers and food processors are predicted to show strong growth, reflecting changing consumer habits and a desire for faster, more efficient meal preparation. The online distribution channel is projected to demonstrate the fastest growth, as consumers increasingly embrace e-commerce platforms for their convenience and wider selection. Understanding the evolving consumer preferences and the competitive dynamics within each segment is crucial for companies looking to establish a robust presence in the thriving Mexican home appliance market. Expansion into rural markets through effective distribution networks will further unlock growth potential for market participants.

Mexico Home Appliances Market: A Comprehensive Report (2019-2033)

This comprehensive report provides an in-depth analysis of the Mexico home appliances market, covering the period from 2019 to 2033. It offers invaluable insights into market dynamics, trends, leading players, and future growth opportunities, making it an essential resource for industry stakeholders, investors, and strategic decision-makers. The report includes detailed segmentation by major and small appliances, distribution channels, and regional analysis, supported by robust data and forecasts. With a base year of 2025 and a forecast period extending to 2033, this report provides a long-term perspective on the evolving Mexican home appliances landscape. The market is valued at xx Million USD in 2025 and is projected to reach xx Million USD by 2033, exhibiting a CAGR of xx% during the forecast period.

Mexico Home Appliances Market Market Dynamics & Concentration

The Mexico home appliances market is characterized by a dynamic interplay of factors influencing its growth and concentration. Market concentration is moderate, with a few major players holding significant market share, while numerous smaller players compete in niche segments. Innovation drives competition, with companies constantly striving to introduce energy-efficient, smart, and technologically advanced appliances. Stringent regulatory frameworks concerning energy consumption and safety standards also shape market dynamics. The presence of substitute products, such as traditional cooking methods, influences market penetration. Evolving consumer preferences, particularly towards smart home technology and premium features, are reshaping the market. Furthermore, M&A activities contribute to market consolidation and technological advancement.

- Market Share: Whirlpool Corporation, Samsung Electronics, and Mabe hold a combined market share of approximately xx%.

- M&A Activity: The past five years have witnessed approximately xx M&A deals in the Mexican home appliances sector.

Mexico Home Appliances Market Industry Trends & Analysis

The Mexican home appliances market is experiencing robust growth driven by several key factors. Rising disposable incomes and urbanization are fuelling demand for modern appliances. Technological disruptions, such as the integration of smart features and IoT capabilities, are transforming consumer preferences. The market is witnessing a shift towards energy-efficient and eco-friendly products, driven by increasing environmental awareness and government regulations. Intense competition among established and emerging players fuels innovation and drives down prices, benefiting consumers. The market exhibits varying growth rates across segments, with premium appliances witnessing faster growth than budget options. The overall market growth is projected at a CAGR of xx% during the forecast period (2025-2033). Market penetration for smart appliances is estimated at xx% in 2025 and is projected to increase to xx% by 2033.

Leading Markets & Segments in Mexico Home Appliances Market

The Mexican home appliances market is geographically diverse, with significant variations in demand across different regions. While precise regional breakdowns aren't provided, leading segments are clearly identifiable.

By Major Appliances:

- Refrigerators: The refrigerator segment dominates the major appliances category, driven by high household penetration and increasing demand for larger capacity and energy-efficient models. Key drivers include rising disposable incomes and changing lifestyles.

- Washing Machines: The washing machine segment experiences consistent growth fueled by increasing urbanization and the preference for convenient laundry solutions. Infrastructure development in underserved areas further fuels expansion.

- Air Conditioners: Demand for air conditioners is rising due to increasing temperatures and rising disposable incomes, particularly in urban areas.

By Small Appliances:

- Coffee/Tea Makers: The coffee/tea maker segment exhibits strong growth, reflecting the growing popularity of coffee consumption in Mexico.

By Distribution Channel:

- Mass Merchandisers: Mass merchandisers represent the largest distribution channel, benefiting from widespread accessibility and competitive pricing.

Mexico Home Appliances Market Product Developments

Recent product innovations focus on energy efficiency, smart features, and improved design aesthetics. Manufacturers are introducing appliances with enhanced connectivity, allowing for remote control and monitoring via smartphones. The integration of AI and IoT is enhancing appliance functionality and user experience. The market emphasizes appliances that cater to evolving consumer lifestyles and preferences, including compact designs for smaller living spaces and specialized features catering to specific needs.

Key Drivers of Mexico Home Appliances Market Growth

Several factors contribute to the sustained growth of the Mexican home appliances market. Rising disposable incomes, particularly among the middle class, fuel demand for modern home appliances. Urbanization and increasing household formation are key drivers. Government initiatives promoting energy efficiency are also contributing. Technological advancements, such as the integration of smart features and energy-efficient technologies, are further propelling market growth.

Challenges in the Mexico Home Appliances Market Market

The Mexican home appliances market faces several challenges. Economic fluctuations can impact consumer spending on durable goods. Supply chain disruptions can affect the availability and cost of appliances. Intense competition from both domestic and international players puts pressure on profit margins. Regulatory changes and compliance requirements add to operational complexity. Fluctuations in the Mexican Peso influence import costs impacting pricing strategies.

Emerging Opportunities in Mexico Home Appliances Market

The market presents significant opportunities for growth. The increasing adoption of smart home technology and the growing demand for energy-efficient appliances create lucrative market segments. Strategic partnerships and collaborations between manufacturers and retailers can enhance distribution efficiency and market reach. Expansion into underserved regions offers potential for significant market penetration.

Leading Players in the Mexico Home Appliances Market Sector

- Whirlpool Corporation

- Samsung Electronics

- Black and Decker

- Hisense

- Mabe

- BSH Hausgerate GmbH

- Electrolux AB

- Daewoo Electronics Mexico

- Midea

- Panasonic Corporation

- LG Electronics

Key Milestones in Mexico Home Appliances Market Industry

- January 2024: LG Electronics inaugurated a state-of-the-art scroll compressor production line in Monterrey, boosting its manufacturing capacity and local presence.

- April 2023: Robert Bosch significantly increased its investment in its Aguascalientes facility to USD 258.2 Million, signaling strong confidence in the Mexican market and its commitment to expansion.

Strategic Outlook for Mexico Home Appliances Market Market

The Mexican home appliances market is poised for sustained growth driven by favorable demographics, economic expansion, and technological advancements. Companies that prioritize energy efficiency, smart features, and strong distribution networks will be well-positioned to capitalize on future growth opportunities. Focusing on consumer preferences and adapting to market trends will be crucial for success in this dynamic and competitive landscape.

Mexico Home Appliances Market Segmentation

- 1. Production Analysis

- 2. Consumption Analysis

- 3. Import Market Analysis (Value & Volume)

- 4. Export Market Analysis (Value & Volume)

- 5. Price Trend Analysis

Mexico Home Appliances Market Segmentation By Geography

- 1. Mexico

Mexico Home Appliances Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 5.12% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Rising Disposable Income; Urbanization and Rising Demand for Residential Housing

- 3.3. Market Restrains

- 3.3.1. High Cost of Maintenance; Lack of Consumer Trust in Online Sales

- 3.4. Market Trends

- 3.4.1. Residential Boom and Changing Lifestyles Fueling the Mexican Home Appliances Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Mexico Home Appliances Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Production Analysis

- 5.2. Market Analysis, Insights and Forecast - by Consumption Analysis

- 5.3. Market Analysis, Insights and Forecast - by Import Market Analysis (Value & Volume)

- 5.4. Market Analysis, Insights and Forecast - by Export Market Analysis (Value & Volume)

- 5.5. Market Analysis, Insights and Forecast - by Price Trend Analysis

- 5.6. Market Analysis, Insights and Forecast - by Region

- 5.6.1. Mexico

- 5.1. Market Analysis, Insights and Forecast - by Production Analysis

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2024

- 6.2. Company Profiles

- 6.2.1 Whirlpool Corporation

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Samsung Electronics

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Black and Decker

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Hisense

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Mabe

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 BSH Hausgerate GmbH**List Not Exhaustive

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Electrolux AB

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Daewoo Electronics Mexico

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Midea

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Panasonic Corporation

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 LG Electronics

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.1 Whirlpool Corporation

List of Figures

- Figure 1: Mexico Home Appliances Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Mexico Home Appliances Market Share (%) by Company 2024

List of Tables

- Table 1: Mexico Home Appliances Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Mexico Home Appliances Market Revenue Million Forecast, by Production Analysis 2019 & 2032

- Table 3: Mexico Home Appliances Market Revenue Million Forecast, by Consumption Analysis 2019 & 2032

- Table 4: Mexico Home Appliances Market Revenue Million Forecast, by Import Market Analysis (Value & Volume) 2019 & 2032

- Table 5: Mexico Home Appliances Market Revenue Million Forecast, by Export Market Analysis (Value & Volume) 2019 & 2032

- Table 6: Mexico Home Appliances Market Revenue Million Forecast, by Price Trend Analysis 2019 & 2032

- Table 7: Mexico Home Appliances Market Revenue Million Forecast, by Region 2019 & 2032

- Table 8: Mexico Home Appliances Market Revenue Million Forecast, by Country 2019 & 2032

- Table 9: Mexico Home Appliances Market Revenue Million Forecast, by Production Analysis 2019 & 2032

- Table 10: Mexico Home Appliances Market Revenue Million Forecast, by Consumption Analysis 2019 & 2032

- Table 11: Mexico Home Appliances Market Revenue Million Forecast, by Import Market Analysis (Value & Volume) 2019 & 2032

- Table 12: Mexico Home Appliances Market Revenue Million Forecast, by Export Market Analysis (Value & Volume) 2019 & 2032

- Table 13: Mexico Home Appliances Market Revenue Million Forecast, by Price Trend Analysis 2019 & 2032

- Table 14: Mexico Home Appliances Market Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Mexico Home Appliances Market?

The projected CAGR is approximately 5.12%.

2. Which companies are prominent players in the Mexico Home Appliances Market?

Key companies in the market include Whirlpool Corporation, Samsung Electronics, Black and Decker, Hisense, Mabe, BSH Hausgerate GmbH**List Not Exhaustive, Electrolux AB, Daewoo Electronics Mexico, Midea, Panasonic Corporation, LG Electronics.

3. What are the main segments of the Mexico Home Appliances Market?

The market segments include Production Analysis, Consumption Analysis, Import Market Analysis (Value & Volume), Export Market Analysis (Value & Volume), Price Trend Analysis.

4. Can you provide details about the market size?

The market size is estimated to be USD 15.45 Million as of 2022.

5. What are some drivers contributing to market growth?

Rising Disposable Income; Urbanization and Rising Demand for Residential Housing.

6. What are the notable trends driving market growth?

Residential Boom and Changing Lifestyles Fueling the Mexican Home Appliances Market.

7. Are there any restraints impacting market growth?

High Cost of Maintenance; Lack of Consumer Trust in Online Sales.

8. Can you provide examples of recent developments in the market?

In January 2024, LG Electronics (LG) bolstered its manufacturing capabilities by inaugurating a state-of-the-art scroll compressor production line at its Monterrey facility in Mexico.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Mexico Home Appliances Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Mexico Home Appliances Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Mexico Home Appliances Market?

To stay informed about further developments, trends, and reports in the Mexico Home Appliances Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence