Key Insights

The Mexico caustic soda market, valued at approximately $500 million in 2025, exhibits robust growth potential, driven by a compound annual growth rate (CAGR) exceeding 2.00% from 2025 to 2033. This expansion is fueled by several key factors. The burgeoning chemical and related industries within Mexico, particularly in sectors like pulp and paper, textiles, and water treatment, represent significant demand drivers. Increasing industrialization and infrastructure development further contribute to heightened consumption. Growth in the food processing industry, requiring caustic soda for cleaning and sanitation, also boosts market demand. While potential constraints like fluctuating raw material prices and environmental regulations exist, the overall outlook remains positive. The market's segmentation, encompassing various grades and applications, reflects the diverse needs of its customer base. Key players like Covestro AG, Dow, and others are vying for market share through strategic investments, capacity expansions, and innovative product offerings, contributing to a competitive yet dynamic landscape.

The forecast period from 2025 to 2033 suggests a continued upward trajectory for the Mexican caustic soda market. This projected growth signifies opportunities for existing players to consolidate their positions and for new entrants to gain a foothold. However, success will depend on factors such as effective cost management, the ability to adapt to evolving regulatory requirements, and the introduction of innovative, sustainable caustic soda production methods. Given the ongoing industrial development in Mexico and the increasing demand for chemicals across various sectors, the market is well-positioned for sustained growth and significant returns on investment in the coming years.

Mexico Caustic Soda Industry: A Comprehensive Market Report (2019-2033)

This comprehensive report provides an in-depth analysis of the Mexico Caustic Soda industry, offering invaluable insights for stakeholders seeking to navigate this dynamic market. Covering the period 2019-2033, with a base year of 2025 and a forecast period of 2025-2033, this report unveils crucial market trends, competitive landscapes, and future growth opportunities. The report leverages rigorous research methodologies and incorporates data from leading industry players like Covestro AG, Dow, FMC Corporation, Hanwha Group, INEOS, Kemira, Manuchar Mexico, Nouryon, Occidental Petroleum Corporation, Olin Corporation, QUÍMICA TREZA, SABIC, Solvay, and Westlake Chemical Corporation (list not exhaustive) to deliver actionable intelligence.

Mexico Caustic Soda Industry Market Dynamics & Concentration

The Mexican caustic soda market presents a moderately concentrated landscape, with the top five players commanding a significant market share—estimated at [Insert Updated Percentage]% in 2025. This concentration is influenced by ongoing consolidation efforts and the substantial capital investment required for efficient production. A key driver of market dynamics is the relentless pursuit of innovation in production processes, with a sharp focus on enhancing energy efficiency and minimizing environmental impact. This is largely in response to increasingly stringent environmental regulations implemented by the Mexican government, pushing producers towards more sustainable manufacturing practices. While alternative cleaning agents and chemicals represent a moderate competitive threat, caustic soda's established indispensability across diverse industrial applications ensures its continued dominance. Demand fluctuations are significantly influenced by end-user trends, particularly within the burgeoning paper, pulp, and water treatment sectors. The period between 2019 and 2024 witnessed approximately [Insert Updated Number] mergers and acquisitions (M&A) deals, predominantly aimed at consolidating market share and expanding geographical reach. This M&A activity is projected to persist, driven by the pursuit of economies of scale and access to cutting-edge technologies. Furthermore, the evolving regulatory landscape is pushing companies to invest in cleaner production technologies and adopt more sustainable business practices.

- Market Concentration: Top 5 players hold [Insert Updated Percentage]% market share (2025 est.)

- M&A Activity (2019-2024): Approx. [Insert Updated Number] deals

- Key Innovation Drivers: Energy efficiency, reduced environmental footprint, and advanced process control.

- Regulatory Framework: Stringent environmental regulations, driving investment in sustainable technologies.

- Competitive Landscape: Moderate threat from substitute chemicals, but strong demand sustains market dominance.

Mexico Caustic Soda Industry Industry Trends & Analysis

The Mexico caustic soda market is projected to witness a CAGR of xx% during the forecast period (2025-2033). This robust growth is propelled by increasing demand from key sectors like chemical manufacturing, pulp and paper production, and water treatment, coupled with Mexico's expanding industrial base. Technological disruptions, including advancements in electrolysis techniques for caustic soda production, are driving efficiency gains and cost reductions. Consumer preferences toward environmentally friendly products are pushing companies to adopt sustainable practices. Competitive dynamics remain intense, with companies competing on price, quality, and delivery. Market penetration in niche segments, such as specialized cleaning solutions, presents considerable opportunities for growth. The rise of e-commerce is also having a small but growing impact.

Leading Markets & Segments in Mexico Caustic Soda Industry

The dominant segment within the Mexican caustic soda market is the chemical manufacturing sector, accounting for approximately xx% of total consumption in 2025. This dominance is primarily attributed to the robust growth of the Mexican chemical industry, driving high demand for caustic soda as a key raw material. Specific geographic regions, particularly those with concentrated industrial activity and robust infrastructure, exhibit disproportionately high consumption.

- Key Drivers in the Chemical Manufacturing Segment:

- Strong growth of the Mexican chemical industry.

- Abundant availability of raw materials.

- Favorable government policies supporting industrial development.

- Well-developed infrastructure supporting logistics.

The report provides detailed analysis of regional variations in consumption patterns, influencing factors, and future projections.

Mexico Caustic Soda Industry Product Developments

Recent product innovations are characterized by a focus on enhancing the purity and performance of caustic soda to meet the specialized demands of various industries. This includes the development of customized formulations for specific applications and the introduction of innovative packaging solutions to improve product handling and safety. Concurrent with product improvements, significant strides are being made in developing more efficient and sustainable production methods, minimizing waste and reducing the industry's carbon footprint. The applications of caustic soda are continuously expanding into new niche markets fueled by ongoing research and development efforts. Companies are strategically leveraging technological advancements to solidify their competitive advantage in terms of cost optimization, superior quality, and minimized environmental impact. The emphasis is on providing high-quality, reliable products to meet the growing demands of various sectors.

Key Drivers of Mexico Caustic Soda Industry Growth

The growth trajectory of the Mexican caustic soda industry is propelled by a confluence of factors. The robust expansion of the chemical and manufacturing sectors creates a strong and consistent demand for caustic soda. Government initiatives aimed at bolstering industrialization and infrastructure development further contribute to market expansion. Simultaneously, technological advancements leading to more efficient and sustainable production processes are fueling industry growth. The sustained demand from key sectors such as water treatment, detergents, and textiles plays a pivotal role in shaping market dynamics. Furthermore, the increasing adoption of caustic soda in emerging applications, such as the production of biofuels and renewable energy materials, presents significant growth potential.

Challenges in the Mexico Caustic Soda Industry Market

The industry faces challenges, including fluctuations in raw material prices, potential supply chain disruptions, and intensifying competition among manufacturers. Regulatory hurdles related to environmental compliance and worker safety impose additional costs. The high energy demands for caustic soda production might also pose a challenge, especially with pricing volatility.

Emerging Opportunities in Mexico Caustic Soda Industry

Long-term growth opportunities are abundant, driven by technological advancements in production processes and the creation of specialized, high-value caustic soda products tailored for niche applications. Strategic partnerships are proving critical for securing a stable supply of raw materials and optimizing distribution networks. Expanding into new geographic regions and tapping into underserved sectors will be instrumental in driving future growth. Investment in research and development to identify and develop new applications for caustic soda will be crucial for long-term success. Moreover, the adoption of circular economy principles and the integration of digital technologies to enhance process optimization and supply chain management present significant opportunities for industry players.

Leading Players in the Mexico Caustic Soda Industry Sector

- Covestro AG

- Dow

- FMC Corporation

- Hanwha Group

- INEOS

- Kemira

- Manuchar Mexico

- Nouryon

- Occidental Petroleum Corporation

- Olin Corporation

- QUÍMICA TREZA

- SABIC

- Solvay

- Westlake Chemical Corporation (List Not Exhaustive)

Key Milestones in Mexico Caustic Soda Industry Industry

- 2020: Implementation of stricter environmental regulations impacting production methods.

- 2022: Successful launch of a new, energy-efficient caustic soda production plant by a major player.

- 2023: A significant merger between two mid-sized caustic soda producers. (Specific details may vary based on actual data)

Strategic Outlook for Mexico Caustic Soda Industry Market

The Mexican caustic soda market presents a compelling long-term growth outlook, underpinned by sustained industrial expansion and rising demand across various sectors. Companies prioritizing technological innovation, sustainable practices, and efficient supply chain management are best positioned to capture and retain significant market share. Strategic partnerships and acquisitions will continue to shape the competitive landscape, driving consolidation and fostering innovation. The ability to effectively navigate the evolving regulatory environment, comply with increasingly stringent environmental standards, and explore novel applications will prove crucial for driving future growth and ensuring the industry’s sustained success. A proactive approach to sustainability and embracing digital transformation will be key to achieving a competitive edge and realizing long-term profitability.

Mexico Caustic Soda Industry Segmentation

-

1. Production Process

- 1.1. Membrane Cell

- 1.2. Diaphragm Cell

- 1.3. Other Production Processes

-

2. Application

- 2.1. Pulp & Paper

- 2.2. Organic Chemical

- 2.3. Inorganic Chemical

- 2.4. Soap & Detergent

- 2.5. Alumina

- 2.6. Water Treatment

- 2.7. Textile

- 2.8. Other Application Sectors

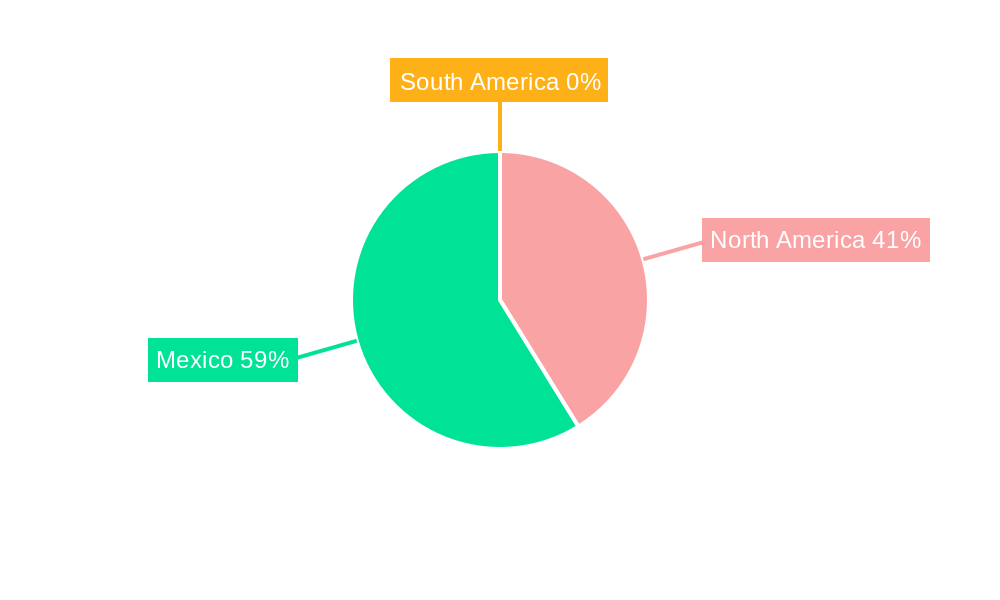

Mexico Caustic Soda Industry Segmentation By Geography

- 1. Mexico

Mexico Caustic Soda Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of > 2.00% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. ; Increasing Demand for Paper and Paperboards; Other Drivers

- 3.3. Market Restrains

- 3.3.1. ; Increasing Demand for Paper and Paperboards; Other Drivers

- 3.4. Market Trends

- 3.4.1. High Demand from Pulp & Paper Application to Boost Caustic Soda Market in Mexico

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Mexico Caustic Soda Industry Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Production Process

- 5.1.1. Membrane Cell

- 5.1.2. Diaphragm Cell

- 5.1.3. Other Production Processes

- 5.2. Market Analysis, Insights and Forecast - by Application

- 5.2.1. Pulp & Paper

- 5.2.2. Organic Chemical

- 5.2.3. Inorganic Chemical

- 5.2.4. Soap & Detergent

- 5.2.5. Alumina

- 5.2.6. Water Treatment

- 5.2.7. Textile

- 5.2.8. Other Application Sectors

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Mexico

- 5.1. Market Analysis, Insights and Forecast - by Production Process

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2024

- 6.2. Company Profiles

- 6.2.1 Covestro AG

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Dow

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 FMC Corporation

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Hanwha Group

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 INEOS

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Kemira

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Manuchar Mexico

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Nouryon

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Occidental Petroleum Corporation

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Olin Corporation

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 QUÍMICA TREZA

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.12 SABIC

- 6.2.12.1. Overview

- 6.2.12.2. Products

- 6.2.12.3. SWOT Analysis

- 6.2.12.4. Recent Developments

- 6.2.12.5. Financials (Based on Availability)

- 6.2.13 Solvay

- 6.2.13.1. Overview

- 6.2.13.2. Products

- 6.2.13.3. SWOT Analysis

- 6.2.13.4. Recent Developments

- 6.2.13.5. Financials (Based on Availability)

- 6.2.14 Westlake Chemical Corporation*List Not Exhaustive

- 6.2.14.1. Overview

- 6.2.14.2. Products

- 6.2.14.3. SWOT Analysis

- 6.2.14.4. Recent Developments

- 6.2.14.5. Financials (Based on Availability)

- 6.2.1 Covestro AG

List of Figures

- Figure 1: Mexico Caustic Soda Industry Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Mexico Caustic Soda Industry Share (%) by Company 2024

List of Tables

- Table 1: Mexico Caustic Soda Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Mexico Caustic Soda Industry Revenue Million Forecast, by Production Process 2019 & 2032

- Table 3: Mexico Caustic Soda Industry Revenue Million Forecast, by Application 2019 & 2032

- Table 4: Mexico Caustic Soda Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 5: Mexico Caustic Soda Industry Revenue Million Forecast, by Production Process 2019 & 2032

- Table 6: Mexico Caustic Soda Industry Revenue Million Forecast, by Application 2019 & 2032

- Table 7: Mexico Caustic Soda Industry Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Mexico Caustic Soda Industry?

The projected CAGR is approximately > 2.00%.

2. Which companies are prominent players in the Mexico Caustic Soda Industry?

Key companies in the market include Covestro AG, Dow, FMC Corporation, Hanwha Group, INEOS, Kemira, Manuchar Mexico, Nouryon, Occidental Petroleum Corporation, Olin Corporation, QUÍMICA TREZA, SABIC, Solvay, Westlake Chemical Corporation*List Not Exhaustive.

3. What are the main segments of the Mexico Caustic Soda Industry?

The market segments include Production Process, Application.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

; Increasing Demand for Paper and Paperboards; Other Drivers.

6. What are the notable trends driving market growth?

High Demand from Pulp & Paper Application to Boost Caustic Soda Market in Mexico.

7. Are there any restraints impacting market growth?

; Increasing Demand for Paper and Paperboards; Other Drivers.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Mexico Caustic Soda Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Mexico Caustic Soda Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Mexico Caustic Soda Industry?

To stay informed about further developments, trends, and reports in the Mexico Caustic Soda Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence