Key Insights

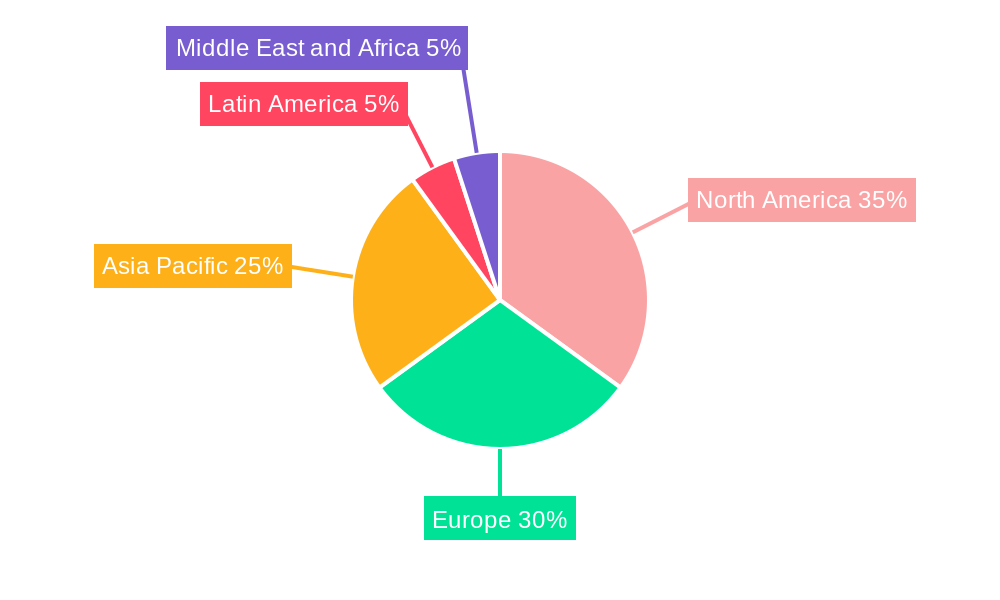

The luxury packaging market, valued at $17.77 billion in 2025, is projected to experience robust growth, driven by increasing consumer demand for premium products and sophisticated packaging solutions. The Compound Annual Growth Rate (CAGR) of 4.20% from 2025 to 2033 indicates a steady expansion, fueled by several key factors. The rising popularity of e-commerce and the need for enhanced brand presentation online are significant drivers. Consumers are increasingly willing to pay a premium for products with aesthetically pleasing and sustainable packaging, boosting demand for eco-friendly materials like recycled paperboard and sustainable glass. Growth is further propelled by the burgeoning cosmetics and fragrances, confectionery, and premium beverages sectors, which are key end-users of luxury packaging. The geographic distribution is expected to remain diverse, with North America and Europe maintaining significant market shares, while the Asia-Pacific region shows substantial growth potential due to rising disposable incomes and a growing middle class. However, challenges remain, including fluctuating raw material prices and the need for innovative solutions to address sustainability concerns. The competitive landscape is characterized by a mix of large multinational corporations and specialized luxury packaging providers, leading to ongoing innovation and consolidation within the industry. The market is segmented by end-user industry (cosmetics & fragrances, confectionery, watches & jewelry, premium beverages, others) and material type (paperboard, glass, metal, others), offering diverse opportunities for specialized players.

The forecast period of 2025-2033 promises continued market expansion, with growth potentially accelerating in certain segments driven by technological advancements in packaging design and manufacturing. The increasing adoption of personalized packaging and augmented reality experiences enhances brand engagement and further contributes to market growth. Competition will intensify as companies strive to differentiate themselves through innovative sustainable solutions and unique packaging designs. This necessitates continuous investment in research and development to meet evolving consumer preferences and regulatory requirements. The market's success hinges on the industry's ability to balance luxury aesthetics with sustainable practices and to adapt to evolving consumer demands for eco-consciousness and personalized brand experiences.

Luxury Packaging Industry Market Report: 2019-2033

Uncover the lucrative opportunities and challenges shaping the multi-billion dollar luxury packaging market. This comprehensive report provides a detailed analysis of the luxury packaging industry, offering invaluable insights for stakeholders, investors, and industry professionals. With a forecast period spanning 2025-2033, and encompassing historical data from 2019-2024, this report is your definitive guide to navigating this dynamic sector. The market is projected to reach $xx Million by 2033, exhibiting a CAGR of xx% during the forecast period.

Luxury Packaging Industry Market Dynamics & Concentration

The luxury packaging market, valued at $xx Million in 2025, displays a moderately concentrated landscape with several key players commanding significant market share. Luxpac Ltd, WestRock Company, and Ardagh Group are among the leading players, exhibiting a combined market share of approximately xx%. The market is driven by innovation in materials, design, and sustainability, while regulatory frameworks concerning environmental impact and product safety play a significant role. Product substitutes, primarily focusing on cost-effective alternatives, pose a competitive challenge. End-user trends towards personalized and sustainable packaging influence demand.

Key Dynamics:

- Market Concentration: Moderately concentrated, with top players holding xx% market share.

- Innovation Drivers: Sustainable materials, personalization technologies, and augmented reality integration.

- Regulatory Frameworks: Increasing focus on eco-friendly materials and sustainable sourcing.

- Product Substitutes: Pressure from cost-effective, less luxurious packaging options.

- End-User Trends: Growing demand for personalized, sustainable, and aesthetically appealing packaging.

- M&A Activity: A moderate number of mergers and acquisitions (xx deals in the last 5 years) reflect industry consolidation.

Luxury Packaging Industry Industry Trends & Analysis

The luxury packaging market exhibits robust growth, driven by increasing consumer disposable incomes, a rise in demand for premium products across various sectors (cosmetics, beverages, confectionery), and the increasing importance of brand building and product differentiation through exquisite packaging. Technological disruptions, including advancements in printing techniques, material science, and digitalization, fuel further growth. Consumer preference for sustainable and ethically sourced packaging is a prominent trend, influencing material choices and manufacturing processes. Competitive dynamics are marked by innovation, brand building, and strategic partnerships.

- Market Growth Drivers: Rising disposable incomes, premiumization of consumer goods, and brand differentiation strategies.

- Technological Disruptions: Advancements in printing, material science, and digital packaging solutions.

- Consumer Preferences: Growing demand for sustainable, personalized, and aesthetically pleasing packaging.

- Competitive Dynamics: Intense competition driven by innovation, brand building, and strategic alliances.

Leading Markets & Segments in Luxury Packaging Industry

Dominant Regions/Segments:

The cosmetics and fragrances segment currently holds the largest market share, driven by the high value of products and the significant emphasis on packaging aesthetics. Within materials, paperboard remains dominant, though glass and metal maintain significant shares in specific end-user segments like premium beverages and watches & jewelry. Western Europe and North America are leading markets due to high per capita consumption of luxury goods.

Key Drivers:

- Cosmetics & Fragrances: High product value, emphasis on luxury aesthetics, and brand differentiation.

- Watches & Jewelry: Exclusive branding, high-value protection, and aesthetic appeal.

- Premium Beverages: Prestige association, brand identity, and product protection.

- Paperboard: Versatility, cost-effectiveness, and suitability for print embellishment.

- Glass: Premium perception, sustainability concerns (recyclability), and luxury aesthetic.

- Metal: Durability, luxury perception, and suitability for high-end products.

- Economic Policies: Government support for luxury industries in certain regions.

- Infrastructure: Availability of skilled labor and advanced manufacturing facilities.

Luxury Packaging Industry Product Developments

Recent product innovations include advancements in sustainable packaging materials, such as biodegradable and recyclable alternatives to traditional plastics, and the integration of smart packaging technologies like RFID tags and augmented reality experiences. These innovations aim to enhance brand engagement, product security, and sustainability appeal. The market focus is on creating high-impact, differentiated packaging that meets consumer demands for both luxury and environmental responsibility.

Key Drivers of Luxury Packaging Industry Growth

The luxury packaging market's growth is propelled by several factors: the escalating demand for premium goods, consumers' growing willingness to pay a premium for aesthetically pleasing and sustainable packaging, technological advancements allowing for customized and innovative packaging solutions, and favorable economic conditions in key markets.

Challenges in the Luxury Packaging Industry Market

Significant challenges include increasing raw material costs, supply chain disruptions impacting timely delivery, and intense competition from both established and emerging players. Stringent regulatory requirements regarding material composition and environmental impact also add complexity and expense. These factors can impact profitability and timely product launches.

Emerging Opportunities in Luxury Packaging Industry

Significant opportunities lie in leveraging sustainable and eco-friendly materials, incorporating innovative technologies like augmented reality and personalized packaging, and tapping into emerging markets with increasing purchasing power. Strategic partnerships and collaborations can facilitate market expansion and innovation.

Leading Players in the Luxury Packaging Industry Sector

- Luxpac Ltd

- WestRock Company

- Ardagh Group

- B Smith Packaging Lt

- GPA Global

- Lucas Luxury Packaging

- Stolzle Glass Group

- Elegant Packaging

- Amcor Plc

- HH Deluxe Packaging

- Crown Holdings Inc

- McLaren Packaging Ltd

- Prestige Packaging Industries

- International Paper Company

- DS Smith Plc

- Keenpac

- Pendragon Presentation Packaging

- Delta Global

- Owens-Illinois Inc

Key Milestones in Luxury Packaging Industry Industry

- October 2022: Fedrigoni acquires Guarro Casas, expanding its specialty paper offerings for luxury packaging. This significantly strengthens Fedrigoni's position in the high-value paper segment for luxury packaging.

- August 2022: Delta Global receives a Gold Award from EcoVadis, underscoring its commitment to sustainability. This boosts its reputation and appeal to environmentally conscious clients.

- January 2022: Groupe Caisserie Bordelaise acquires Wildcat Packaging, entering the luxury packaging market. This acquisition expands Groupe Caisserie Bordelaise's product portfolio and market reach within the luxury sector.

Strategic Outlook for Luxury Packaging Industry Market

The luxury packaging market presents substantial long-term growth potential, driven by ongoing demand for premium goods, escalating consumer spending, and the continued integration of innovative technologies. Strategic partnerships, expansion into emerging markets, and a focus on sustainability will be pivotal for companies seeking to capitalize on future opportunities within this dynamic sector.

Luxury Packaging Industry Segmentation

-

1. Material

- 1.1. Paperboard

- 1.2. Glass

- 1.3. Metal

- 1.4. Other Material Types

-

2. End User

- 2.1. Cosmetics and Fragrances

- 2.2. Confectionery

- 2.3. Watches and Jewelry

- 2.4. Premium Beverages

- 2.5. Other End Users

Luxury Packaging Industry Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

-

2. Europe

- 2.1. United Kingdom

- 2.2. Germany

- 2.3. France

- 2.4. Russia

- 2.5. Rest of Europe

-

3. Asia Pacific

- 3.1. China

- 3.2. Japan

- 3.3. India

- 3.4. Rest of Asia Pacific

- 4. Latin America

- 5. Middle East and Africa

Luxury Packaging Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 4.20% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increased Usage of Sustainable and Bio-Degradable Materials such as Paperboard; Demand for Travel and Retail Chains Due to Increase in Tourism

- 3.3. Market Restrains

- 3.3.1. Reluctance in Packaging Heavy and Bulk Products; High Initial and Operating Costs of Machineries

- 3.4. Market Trends

- 3.4.1. Increased Usage of Sustainable and Bio-Degradable Materials such as Paperboard may Drive the Market Growth

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Luxury Packaging Industry Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Material

- 5.1.1. Paperboard

- 5.1.2. Glass

- 5.1.3. Metal

- 5.1.4. Other Material Types

- 5.2. Market Analysis, Insights and Forecast - by End User

- 5.2.1. Cosmetics and Fragrances

- 5.2.2. Confectionery

- 5.2.3. Watches and Jewelry

- 5.2.4. Premium Beverages

- 5.2.5. Other End Users

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. Europe

- 5.3.3. Asia Pacific

- 5.3.4. Latin America

- 5.3.5. Middle East and Africa

- 5.1. Market Analysis, Insights and Forecast - by Material

- 6. North America Luxury Packaging Industry Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Material

- 6.1.1. Paperboard

- 6.1.2. Glass

- 6.1.3. Metal

- 6.1.4. Other Material Types

- 6.2. Market Analysis, Insights and Forecast - by End User

- 6.2.1. Cosmetics and Fragrances

- 6.2.2. Confectionery

- 6.2.3. Watches and Jewelry

- 6.2.4. Premium Beverages

- 6.2.5. Other End Users

- 6.1. Market Analysis, Insights and Forecast - by Material

- 7. Europe Luxury Packaging Industry Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Material

- 7.1.1. Paperboard

- 7.1.2. Glass

- 7.1.3. Metal

- 7.1.4. Other Material Types

- 7.2. Market Analysis, Insights and Forecast - by End User

- 7.2.1. Cosmetics and Fragrances

- 7.2.2. Confectionery

- 7.2.3. Watches and Jewelry

- 7.2.4. Premium Beverages

- 7.2.5. Other End Users

- 7.1. Market Analysis, Insights and Forecast - by Material

- 8. Asia Pacific Luxury Packaging Industry Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Material

- 8.1.1. Paperboard

- 8.1.2. Glass

- 8.1.3. Metal

- 8.1.4. Other Material Types

- 8.2. Market Analysis, Insights and Forecast - by End User

- 8.2.1. Cosmetics and Fragrances

- 8.2.2. Confectionery

- 8.2.3. Watches and Jewelry

- 8.2.4. Premium Beverages

- 8.2.5. Other End Users

- 8.1. Market Analysis, Insights and Forecast - by Material

- 9. Latin America Luxury Packaging Industry Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Material

- 9.1.1. Paperboard

- 9.1.2. Glass

- 9.1.3. Metal

- 9.1.4. Other Material Types

- 9.2. Market Analysis, Insights and Forecast - by End User

- 9.2.1. Cosmetics and Fragrances

- 9.2.2. Confectionery

- 9.2.3. Watches and Jewelry

- 9.2.4. Premium Beverages

- 9.2.5. Other End Users

- 9.1. Market Analysis, Insights and Forecast - by Material

- 10. Middle East and Africa Luxury Packaging Industry Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Material

- 10.1.1. Paperboard

- 10.1.2. Glass

- 10.1.3. Metal

- 10.1.4. Other Material Types

- 10.2. Market Analysis, Insights and Forecast - by End User

- 10.2.1. Cosmetics and Fragrances

- 10.2.2. Confectionery

- 10.2.3. Watches and Jewelry

- 10.2.4. Premium Beverages

- 10.2.5. Other End Users

- 10.1. Market Analysis, Insights and Forecast - by Material

- 11. North America Luxury Packaging Industry Analysis, Insights and Forecast, 2019-2031

- 11.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 11.1.1 United States

- 11.1.2 Canada

- 12. Europe Luxury Packaging Industry Analysis, Insights and Forecast, 2019-2031

- 12.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 12.1.1 United Kingdom

- 12.1.2 Germany

- 12.1.3 France

- 12.1.4 Russia

- 12.1.5 Rest of Europe

- 13. Asia Pacific Luxury Packaging Industry Analysis, Insights and Forecast, 2019-2031

- 13.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 13.1.1 China

- 13.1.2 Japan

- 13.1.3 India

- 13.1.4 Rest of Asia Pacific

- 14. Latin America Luxury Packaging Industry Analysis, Insights and Forecast, 2019-2031

- 14.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 14.1.1.

- 15. Middle East and Africa Luxury Packaging Industry Analysis, Insights and Forecast, 2019-2031

- 15.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 15.1.1.

- 16. Competitive Analysis

- 16.1. Global Market Share Analysis 2024

- 16.2. Company Profiles

- 16.2.1 Luxpac Ltd

- 16.2.1.1. Overview

- 16.2.1.2. Products

- 16.2.1.3. SWOT Analysis

- 16.2.1.4. Recent Developments

- 16.2.1.5. Financials (Based on Availability)

- 16.2.2 WestRock Company

- 16.2.2.1. Overview

- 16.2.2.2. Products

- 16.2.2.3. SWOT Analysis

- 16.2.2.4. Recent Developments

- 16.2.2.5. Financials (Based on Availability)

- 16.2.3 Ardagh Group

- 16.2.3.1. Overview

- 16.2.3.2. Products

- 16.2.3.3. SWOT Analysis

- 16.2.3.4. Recent Developments

- 16.2.3.5. Financials (Based on Availability)

- 16.2.4 B Smith Packaging Lt

- 16.2.4.1. Overview

- 16.2.4.2. Products

- 16.2.4.3. SWOT Analysis

- 16.2.4.4. Recent Developments

- 16.2.4.5. Financials (Based on Availability)

- 16.2.5 GPA Global

- 16.2.5.1. Overview

- 16.2.5.2. Products

- 16.2.5.3. SWOT Analysis

- 16.2.5.4. Recent Developments

- 16.2.5.5. Financials (Based on Availability)

- 16.2.6 Lucas Luxury Packaging

- 16.2.6.1. Overview

- 16.2.6.2. Products

- 16.2.6.3. SWOT Analysis

- 16.2.6.4. Recent Developments

- 16.2.6.5. Financials (Based on Availability)

- 16.2.7 Stolzle Glass Group

- 16.2.7.1. Overview

- 16.2.7.2. Products

- 16.2.7.3. SWOT Analysis

- 16.2.7.4. Recent Developments

- 16.2.7.5. Financials (Based on Availability)

- 16.2.8 Elegant Packaging

- 16.2.8.1. Overview

- 16.2.8.2. Products

- 16.2.8.3. SWOT Analysis

- 16.2.8.4. Recent Developments

- 16.2.8.5. Financials (Based on Availability)

- 16.2.9 Amcor Plc

- 16.2.9.1. Overview

- 16.2.9.2. Products

- 16.2.9.3. SWOT Analysis

- 16.2.9.4. Recent Developments

- 16.2.9.5. Financials (Based on Availability)

- 16.2.10 HH Deluxe Packaging

- 16.2.10.1. Overview

- 16.2.10.2. Products

- 16.2.10.3. SWOT Analysis

- 16.2.10.4. Recent Developments

- 16.2.10.5. Financials (Based on Availability)

- 16.2.11 Crown Holdings Inc

- 16.2.11.1. Overview

- 16.2.11.2. Products

- 16.2.11.3. SWOT Analysis

- 16.2.11.4. Recent Developments

- 16.2.11.5. Financials (Based on Availability)

- 16.2.12 McLaren Packaging Ltd

- 16.2.12.1. Overview

- 16.2.12.2. Products

- 16.2.12.3. SWOT Analysis

- 16.2.12.4. Recent Developments

- 16.2.12.5. Financials (Based on Availability)

- 16.2.13 Prestige Packaging Industries

- 16.2.13.1. Overview

- 16.2.13.2. Products

- 16.2.13.3. SWOT Analysis

- 16.2.13.4. Recent Developments

- 16.2.13.5. Financials (Based on Availability)

- 16.2.14 International Paper Company

- 16.2.14.1. Overview

- 16.2.14.2. Products

- 16.2.14.3. SWOT Analysis

- 16.2.14.4. Recent Developments

- 16.2.14.5. Financials (Based on Availability)

- 16.2.15 DS Smith Plc

- 16.2.15.1. Overview

- 16.2.15.2. Products

- 16.2.15.3. SWOT Analysis

- 16.2.15.4. Recent Developments

- 16.2.15.5. Financials (Based on Availability)

- 16.2.16 Keenpac

- 16.2.16.1. Overview

- 16.2.16.2. Products

- 16.2.16.3. SWOT Analysis

- 16.2.16.4. Recent Developments

- 16.2.16.5. Financials (Based on Availability)

- 16.2.17 Pendragon Presentation Packaging

- 16.2.17.1. Overview

- 16.2.17.2. Products

- 16.2.17.3. SWOT Analysis

- 16.2.17.4. Recent Developments

- 16.2.17.5. Financials (Based on Availability)

- 16.2.18 Delta Global

- 16.2.18.1. Overview

- 16.2.18.2. Products

- 16.2.18.3. SWOT Analysis

- 16.2.18.4. Recent Developments

- 16.2.18.5. Financials (Based on Availability)

- 16.2.19 Owens-Illinois Inc

- 16.2.19.1. Overview

- 16.2.19.2. Products

- 16.2.19.3. SWOT Analysis

- 16.2.19.4. Recent Developments

- 16.2.19.5. Financials (Based on Availability)

- 16.2.1 Luxpac Ltd

List of Figures

- Figure 1: Global Luxury Packaging Industry Revenue Breakdown (Million, %) by Region 2024 & 2032

- Figure 2: North America Luxury Packaging Industry Revenue (Million), by Country 2024 & 2032

- Figure 3: North America Luxury Packaging Industry Revenue Share (%), by Country 2024 & 2032

- Figure 4: Europe Luxury Packaging Industry Revenue (Million), by Country 2024 & 2032

- Figure 5: Europe Luxury Packaging Industry Revenue Share (%), by Country 2024 & 2032

- Figure 6: Asia Pacific Luxury Packaging Industry Revenue (Million), by Country 2024 & 2032

- Figure 7: Asia Pacific Luxury Packaging Industry Revenue Share (%), by Country 2024 & 2032

- Figure 8: Latin America Luxury Packaging Industry Revenue (Million), by Country 2024 & 2032

- Figure 9: Latin America Luxury Packaging Industry Revenue Share (%), by Country 2024 & 2032

- Figure 10: Middle East and Africa Luxury Packaging Industry Revenue (Million), by Country 2024 & 2032

- Figure 11: Middle East and Africa Luxury Packaging Industry Revenue Share (%), by Country 2024 & 2032

- Figure 12: North America Luxury Packaging Industry Revenue (Million), by Material 2024 & 2032

- Figure 13: North America Luxury Packaging Industry Revenue Share (%), by Material 2024 & 2032

- Figure 14: North America Luxury Packaging Industry Revenue (Million), by End User 2024 & 2032

- Figure 15: North America Luxury Packaging Industry Revenue Share (%), by End User 2024 & 2032

- Figure 16: North America Luxury Packaging Industry Revenue (Million), by Country 2024 & 2032

- Figure 17: North America Luxury Packaging Industry Revenue Share (%), by Country 2024 & 2032

- Figure 18: Europe Luxury Packaging Industry Revenue (Million), by Material 2024 & 2032

- Figure 19: Europe Luxury Packaging Industry Revenue Share (%), by Material 2024 & 2032

- Figure 20: Europe Luxury Packaging Industry Revenue (Million), by End User 2024 & 2032

- Figure 21: Europe Luxury Packaging Industry Revenue Share (%), by End User 2024 & 2032

- Figure 22: Europe Luxury Packaging Industry Revenue (Million), by Country 2024 & 2032

- Figure 23: Europe Luxury Packaging Industry Revenue Share (%), by Country 2024 & 2032

- Figure 24: Asia Pacific Luxury Packaging Industry Revenue (Million), by Material 2024 & 2032

- Figure 25: Asia Pacific Luxury Packaging Industry Revenue Share (%), by Material 2024 & 2032

- Figure 26: Asia Pacific Luxury Packaging Industry Revenue (Million), by End User 2024 & 2032

- Figure 27: Asia Pacific Luxury Packaging Industry Revenue Share (%), by End User 2024 & 2032

- Figure 28: Asia Pacific Luxury Packaging Industry Revenue (Million), by Country 2024 & 2032

- Figure 29: Asia Pacific Luxury Packaging Industry Revenue Share (%), by Country 2024 & 2032

- Figure 30: Latin America Luxury Packaging Industry Revenue (Million), by Material 2024 & 2032

- Figure 31: Latin America Luxury Packaging Industry Revenue Share (%), by Material 2024 & 2032

- Figure 32: Latin America Luxury Packaging Industry Revenue (Million), by End User 2024 & 2032

- Figure 33: Latin America Luxury Packaging Industry Revenue Share (%), by End User 2024 & 2032

- Figure 34: Latin America Luxury Packaging Industry Revenue (Million), by Country 2024 & 2032

- Figure 35: Latin America Luxury Packaging Industry Revenue Share (%), by Country 2024 & 2032

- Figure 36: Middle East and Africa Luxury Packaging Industry Revenue (Million), by Material 2024 & 2032

- Figure 37: Middle East and Africa Luxury Packaging Industry Revenue Share (%), by Material 2024 & 2032

- Figure 38: Middle East and Africa Luxury Packaging Industry Revenue (Million), by End User 2024 & 2032

- Figure 39: Middle East and Africa Luxury Packaging Industry Revenue Share (%), by End User 2024 & 2032

- Figure 40: Middle East and Africa Luxury Packaging Industry Revenue (Million), by Country 2024 & 2032

- Figure 41: Middle East and Africa Luxury Packaging Industry Revenue Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global Luxury Packaging Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Global Luxury Packaging Industry Revenue Million Forecast, by Material 2019 & 2032

- Table 3: Global Luxury Packaging Industry Revenue Million Forecast, by End User 2019 & 2032

- Table 4: Global Luxury Packaging Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 5: Global Luxury Packaging Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 6: United States Luxury Packaging Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 7: Canada Luxury Packaging Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 8: Global Luxury Packaging Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 9: United Kingdom Luxury Packaging Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: Germany Luxury Packaging Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 11: France Luxury Packaging Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 12: Russia Luxury Packaging Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 13: Rest of Europe Luxury Packaging Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 14: Global Luxury Packaging Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 15: China Luxury Packaging Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 16: Japan Luxury Packaging Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 17: India Luxury Packaging Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 18: Rest of Asia Pacific Luxury Packaging Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 19: Global Luxury Packaging Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 20: Luxury Packaging Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 21: Global Luxury Packaging Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 22: Luxury Packaging Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 23: Global Luxury Packaging Industry Revenue Million Forecast, by Material 2019 & 2032

- Table 24: Global Luxury Packaging Industry Revenue Million Forecast, by End User 2019 & 2032

- Table 25: Global Luxury Packaging Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 26: United States Luxury Packaging Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 27: Canada Luxury Packaging Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 28: Global Luxury Packaging Industry Revenue Million Forecast, by Material 2019 & 2032

- Table 29: Global Luxury Packaging Industry Revenue Million Forecast, by End User 2019 & 2032

- Table 30: Global Luxury Packaging Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 31: United Kingdom Luxury Packaging Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 32: Germany Luxury Packaging Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 33: France Luxury Packaging Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 34: Russia Luxury Packaging Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 35: Rest of Europe Luxury Packaging Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 36: Global Luxury Packaging Industry Revenue Million Forecast, by Material 2019 & 2032

- Table 37: Global Luxury Packaging Industry Revenue Million Forecast, by End User 2019 & 2032

- Table 38: Global Luxury Packaging Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 39: China Luxury Packaging Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 40: Japan Luxury Packaging Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 41: India Luxury Packaging Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 42: Rest of Asia Pacific Luxury Packaging Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 43: Global Luxury Packaging Industry Revenue Million Forecast, by Material 2019 & 2032

- Table 44: Global Luxury Packaging Industry Revenue Million Forecast, by End User 2019 & 2032

- Table 45: Global Luxury Packaging Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 46: Global Luxury Packaging Industry Revenue Million Forecast, by Material 2019 & 2032

- Table 47: Global Luxury Packaging Industry Revenue Million Forecast, by End User 2019 & 2032

- Table 48: Global Luxury Packaging Industry Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Luxury Packaging Industry?

The projected CAGR is approximately 4.20%.

2. Which companies are prominent players in the Luxury Packaging Industry?

Key companies in the market include Luxpac Ltd, WestRock Company, Ardagh Group, B Smith Packaging Lt, GPA Global, Lucas Luxury Packaging, Stolzle Glass Group, Elegant Packaging, Amcor Plc, HH Deluxe Packaging, Crown Holdings Inc, McLaren Packaging Ltd, Prestige Packaging Industries, International Paper Company, DS Smith Plc, Keenpac, Pendragon Presentation Packaging, Delta Global, Owens-Illinois Inc.

3. What are the main segments of the Luxury Packaging Industry?

The market segments include Material, End User.

4. Can you provide details about the market size?

The market size is estimated to be USD 17.77 Million as of 2022.

5. What are some drivers contributing to market growth?

Increased Usage of Sustainable and Bio-Degradable Materials such as Paperboard; Demand for Travel and Retail Chains Due to Increase in Tourism.

6. What are the notable trends driving market growth?

Increased Usage of Sustainable and Bio-Degradable Materials such as Paperboard may Drive the Market Growth.

7. Are there any restraints impacting market growth?

Reluctance in Packaging Heavy and Bulk Products; High Initial and Operating Costs of Machineries.

8. Can you provide examples of recent developments in the market?

October 2022: Fedrigoni, a prominent paper manufacturer, acquires Guarro Casas, enhancing its selection of specialty papers for high-end printing, packaging, and other creative uses. Guarro Casas specializes in producing fine papers for innovative and binding applications. It is a market player in high-added-value finishing for luxury packaging, fine book covering, and security applications. This acquisition strengthens Fedrigoni's proposal in the specialty papers business.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Luxury Packaging Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Luxury Packaging Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Luxury Packaging Industry?

To stay informed about further developments, trends, and reports in the Luxury Packaging Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence