Key Insights

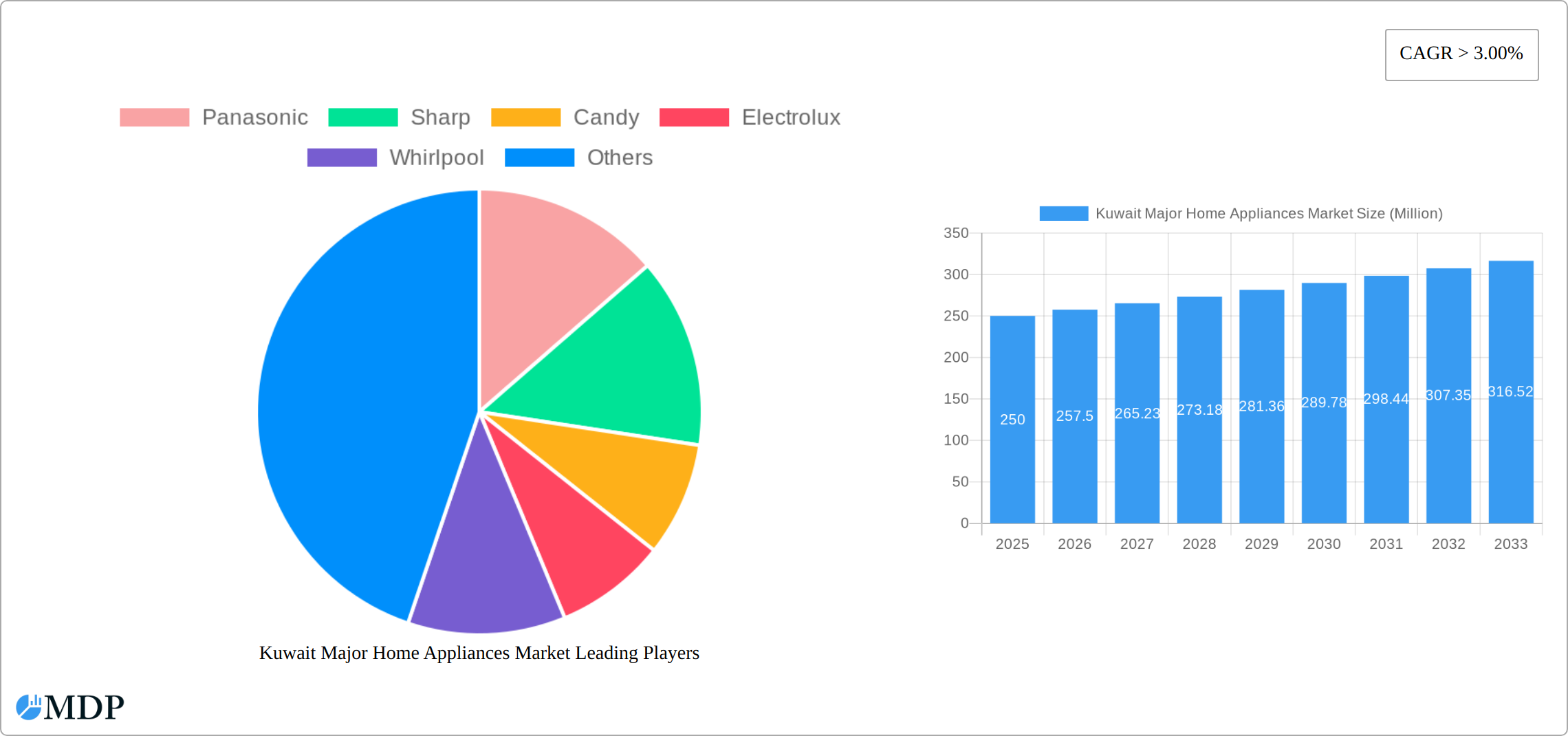

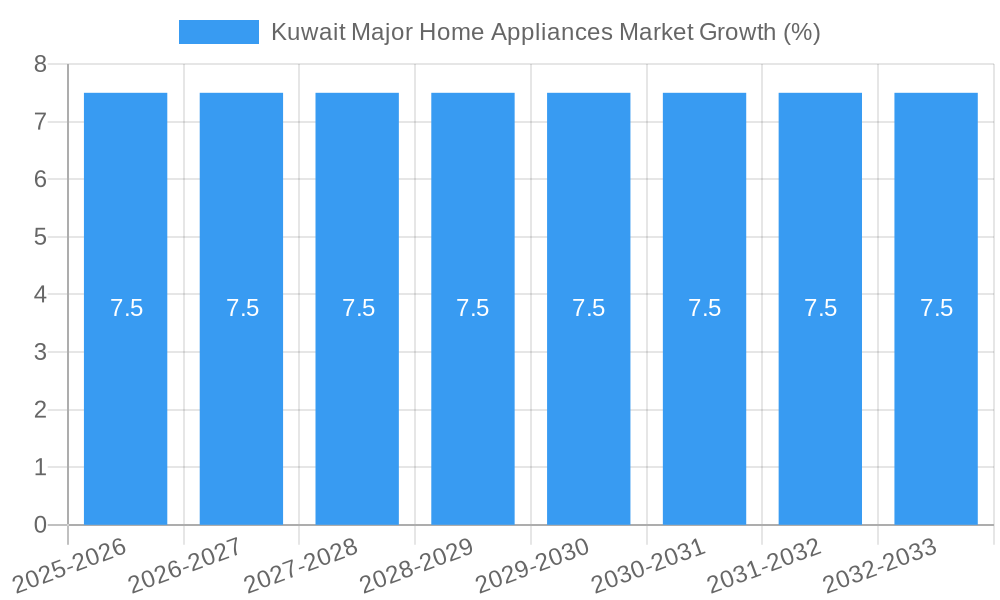

The Kuwait major home appliances market, encompassing refrigerators, freezers, washing machines, dishwashers, microwave ovens, and air conditioners, exhibits robust growth potential. Driven by rising disposable incomes, a growing population, and a preference for modern, convenient lifestyles, the market is projected to maintain a Compound Annual Growth Rate (CAGR) exceeding 3% from 2025 to 2033. The increasing urbanization in Kuwait fuels demand for energy-efficient and technologically advanced appliances, particularly within newly constructed residential units and renovations. The market is segmented by product type and distribution channel, with multi-branded stores and online channels holding significant market share. Strong competition exists among leading brands like Panasonic, Sharp, Candy, Electrolux, Whirlpool, Bosch, Toshiba, Beko, Midea, and Samsung, each vying for market dominance through product innovation, competitive pricing, and effective marketing strategies. While the market faces potential restraints from fluctuating energy prices and global economic uncertainties, the long-term outlook remains positive, driven by consistent consumer demand and ongoing infrastructure development within the country.

Further analysis suggests that the refrigerator and air conditioner segments are likely to be the key growth drivers due to the region's hot climate. Online distribution channels are expected to experience accelerated growth due to increasing internet penetration and the preference for convenient home delivery. The market is also likely to witness the rise of smart home appliances with integrated features, catering to the increasingly tech-savvy consumer base. Government initiatives focused on energy efficiency could also play a significant role in shaping product demand and market dynamics. Manufacturers will need to adapt to these trends by focusing on product differentiation, improved energy efficiency, and customer-centric strategies to succeed in this competitive landscape.

Kuwait Major Home Appliances Market Report: 2019-2033

This comprehensive report provides an in-depth analysis of the Kuwait major home appliances market, offering invaluable insights for industry stakeholders. Covering the period from 2019 to 2033, with a base year of 2025 and a forecast period of 2025-2033, this report meticulously examines market dynamics, trends, leading players, and future opportunities. It analyzes key segments including refrigerators, freezers, washing machines, dishwashers, microwave ovens, and air conditioners across various distribution channels. The report leverages extensive data analysis to predict market growth and identify lucrative investment prospects.

Kuwait Major Home Appliances Market Dynamics & Concentration

The Kuwait major home appliances market is characterized by a moderately concentrated landscape with key players such as Panasonic, Sharp, Candy, Electrolux, Whirlpool, Bosch, Toshiba, Beko, Midea, and Samsung holding significant market share. The combined market share of the top five players is estimated at xx% in 2025. Market concentration is influenced by factors such as brand recognition, product innovation, and distribution network strength. Innovation is a key driver, with companies constantly striving to introduce energy-efficient, smart, and technologically advanced appliances. Regulatory frameworks concerning energy efficiency standards and safety regulations play a crucial role in shaping market dynamics. Product substitutes, such as traditional methods for cooling or cleaning, pose a limited threat, with the majority of households embracing modern appliances. Growing consumer preference for smart home technology and premium features fuels demand. The number of M&A deals within this sector in Kuwait during the historical period (2019-2024) stood at xx. This number is predicted to increase slightly in the coming years, driven by the ambition of larger players to strengthen their market presence and product portfolios.

- Market Share: Top 5 players hold approximately xx% (2025 estimate).

- M&A Activity: xx deals recorded between 2019-2024 (predicted).

- Key Innovation Drivers: Smart home integration, energy efficiency, advanced features.

- Regulatory Influence: Energy efficiency standards and safety regulations.

Kuwait Major Home Appliances Market Industry Trends & Analysis

The Kuwait major home appliances market is experiencing robust growth, with a projected Compound Annual Growth Rate (CAGR) of xx% during the forecast period (2025-2033). This growth is primarily driven by rising disposable incomes, increasing urbanization, and a growing preference for modern conveniences among Kuwaiti consumers. Technological disruptions, such as the rise of smart home appliances and Internet of Things (IoT) integration, are reshaping the competitive landscape. Consumer preferences are shifting towards energy-efficient, space-saving, and technologically advanced appliances. Market penetration of smart home appliances is still relatively low, indicating significant potential for future growth. Competitive dynamics are characterized by intense rivalry among established players and the emergence of new entrants. This trend is likely to create greater market dynamism over the next decade. The market penetration of smart appliances in 2025 is estimated to be approximately xx%, while a CAGR of xx% is projected during the forecast period.

Leading Markets & Segments in Kuwait Major Home Appliances Market

The Kuwait major home appliances market is dominated by the urban areas, reflecting higher disposable income and consumer preference for modern appliances in these regions. Among product types, refrigerators and air conditioners represent the largest market segments, driven by high temperatures and the need for efficient cooling solutions. Multi-branded stores remain the dominant distribution channel, followed by specialty stores, and online sales are gradually gaining traction.

Key Drivers:

- High Disposable Incomes: Fuelling demand for premium appliances.

- Urbanization: Concentrated demand in urban centers.

- Climate: High temperatures drive demand for air conditioners and refrigerators.

- Government Initiatives: Focus on infrastructure development supporting broader growth in consumer spending and appliance usage.

Dominance Analysis:

Refrigerators and air conditioners constitute the largest market segments by product type, driven by high temperatures and high consumer demand. Multi-branded stores maintain the leading position in terms of distribution channels, although online channels are demonstrating significant growth potential.

Kuwait Major Home Appliances Market Product Developments

Recent product innovations focus on energy efficiency, smart features (like Wi-Fi connectivity and voice control), and enhanced convenience. Companies are introducing models with improved cooling technologies, larger capacities, and sleek designs to cater to evolving consumer preferences. This focus on technological advancements enhances product competitiveness and improves market fit.

Key Drivers of Kuwait Major Home Appliances Market Growth

Several factors contribute to the market's growth trajectory. Rising disposable incomes empower consumers to invest in advanced home appliances. Government initiatives focused on infrastructure development fuel higher consumer spending, including investment in home improvement. The increasing adoption of smart home technologies adds further momentum. Furthermore, the shift towards smaller, more energy-efficient appliances plays a significant role in the growth of the market.

Challenges in the Kuwait Major Home Appliances Market

The market faces challenges such as fluctuating energy prices, which can impact consumer spending on high-energy consumption appliances. Supply chain disruptions can hinder product availability and affect pricing. Intense competition puts pressure on profit margins. Moreover, import regulations and customs duties impact market access and pricing, making the market less accessible.

Emerging Opportunities in Kuwait Major Home Appliances Market

The growing adoption of smart home technologies presents significant opportunities. Strategic partnerships between manufacturers and technology providers can enhance product offerings and market penetration. Expansion into emerging consumer segments will also present further growth opportunities. The focus on sustainable and energy-efficient appliances is crucial for long-term success.

Leading Players in the Kuwait Major Home Appliances Market Sector

- Panasonic (https://www.panasonic.com/)

- Sharp (https://www.sharp.com/)

- Candy (https://www.candy-group.com/)

- Electrolux (https://www.electroluxgroup.com/)

- Whirlpool (https://www.whirlpoolcorp.com/)

- Bosch (https://www.bosch-home.com/)

- Toshiba (https://www.toshiba.com/)

- Beko (https://www.beko.com/)

- Midea (https://www.midea.com/global/)

- Samsung (https://www.samsung.com/)

Key Milestones in Kuwait Major Home Appliances Market Industry

- May 2022: Leica and Panasonic signed a strategic collaboration agreement, developing "L2 Technology." This partnership significantly boosted Panasonic's brand image and product innovation capabilities.

- May 2022: TCL Electronics launched its new C Series TV line-up and home appliances in the MEA region, increasing competitive pressure in the Kuwaiti market and broadening consumer choices.

Strategic Outlook for Kuwait Major Home Appliances Market

The Kuwait major home appliances market holds significant long-term growth potential, fueled by rising incomes, technological advancements, and shifting consumer preferences. Strategic partnerships, product diversification, and a focus on sustainable solutions will be crucial for capturing market share and achieving sustainable growth. Companies should actively adapt to emerging trends, such as the rise of smart homes and sustainable technologies, to maintain a competitive edge and cater to the evolving demands of consumers.

Kuwait Major Home Appliances Market Segmentation

-

1. Product Type

- 1.1. Refrigerators

- 1.2. Freezers

- 1.3. Washing Machines

- 1.4. Dish Washers

- 1.5. Microwave Ovens

- 1.6. Air Conditioners

- 1.7. Other Products

-

2. Distribution Channel

- 2.1. Multi-Branded Stores

- 2.2. Specialty Stores

- 2.3. Online

- 2.4. Other Distribution Channels

Kuwait Major Home Appliances Market Segmentation By Geography

- 1. Kuwait

Kuwait Major Home Appliances Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of > 3.00% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Awareness about Indoor Air Quality; Rising Trend of Smart Homes

- 3.3. Market Restrains

- 3.3.1. Lack of Proper Regulations and Standards in Some Regions

- 3.4. Market Trends

- 3.4.1. Refrigerator Segment is Dominating the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Kuwait Major Home Appliances Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 5.1.1. Refrigerators

- 5.1.2. Freezers

- 5.1.3. Washing Machines

- 5.1.4. Dish Washers

- 5.1.5. Microwave Ovens

- 5.1.6. Air Conditioners

- 5.1.7. Other Products

- 5.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 5.2.1. Multi-Branded Stores

- 5.2.2. Specialty Stores

- 5.2.3. Online

- 5.2.4. Other Distribution Channels

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Kuwait

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2024

- 6.2. Company Profiles

- 6.2.1 Panasonic

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Sharp

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Candy

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Electrolux

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Whirlpool

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Bosch

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Toshiba

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Beko**List Not Exhaustive

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Midea

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Samsung

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 Panasonic

List of Figures

- Figure 1: Kuwait Major Home Appliances Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Kuwait Major Home Appliances Market Share (%) by Company 2024

List of Tables

- Table 1: Kuwait Major Home Appliances Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Kuwait Major Home Appliances Market Revenue Million Forecast, by Product Type 2019 & 2032

- Table 3: Kuwait Major Home Appliances Market Revenue Million Forecast, by Distribution Channel 2019 & 2032

- Table 4: Kuwait Major Home Appliances Market Revenue Million Forecast, by Region 2019 & 2032

- Table 5: Kuwait Major Home Appliances Market Revenue Million Forecast, by Country 2019 & 2032

- Table 6: Kuwait Major Home Appliances Market Revenue Million Forecast, by Product Type 2019 & 2032

- Table 7: Kuwait Major Home Appliances Market Revenue Million Forecast, by Distribution Channel 2019 & 2032

- Table 8: Kuwait Major Home Appliances Market Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Kuwait Major Home Appliances Market?

The projected CAGR is approximately > 3.00%.

2. Which companies are prominent players in the Kuwait Major Home Appliances Market?

Key companies in the market include Panasonic, Sharp, Candy, Electrolux, Whirlpool, Bosch, Toshiba, Beko**List Not Exhaustive, Midea, Samsung.

3. What are the main segments of the Kuwait Major Home Appliances Market?

The market segments include Product Type, Distribution Channel.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Increasing Awareness about Indoor Air Quality; Rising Trend of Smart Homes.

6. What are the notable trends driving market growth?

Refrigerator Segment is Dominating the Market.

7. Are there any restraints impacting market growth?

Lack of Proper Regulations and Standards in Some Regions.

8. Can you provide examples of recent developments in the market?

In May 2022, Leica and Panasonic signed a strategic, comprehensive collaboration agreement and developed "L2 Technology" as a symbol of the collaboration.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Kuwait Major Home Appliances Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Kuwait Major Home Appliances Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Kuwait Major Home Appliances Market?

To stay informed about further developments, trends, and reports in the Kuwait Major Home Appliances Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence