Key Insights

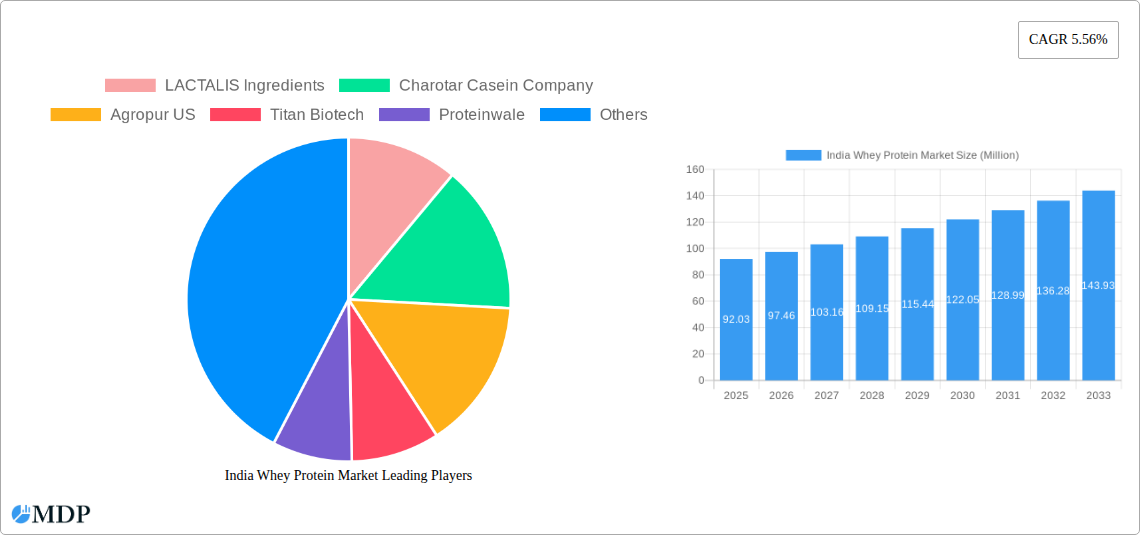

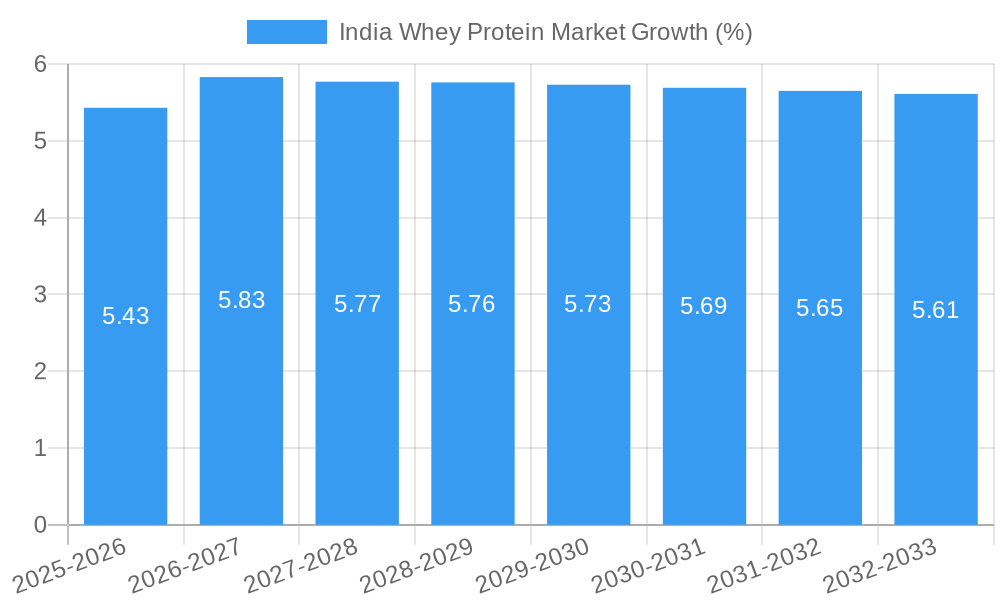

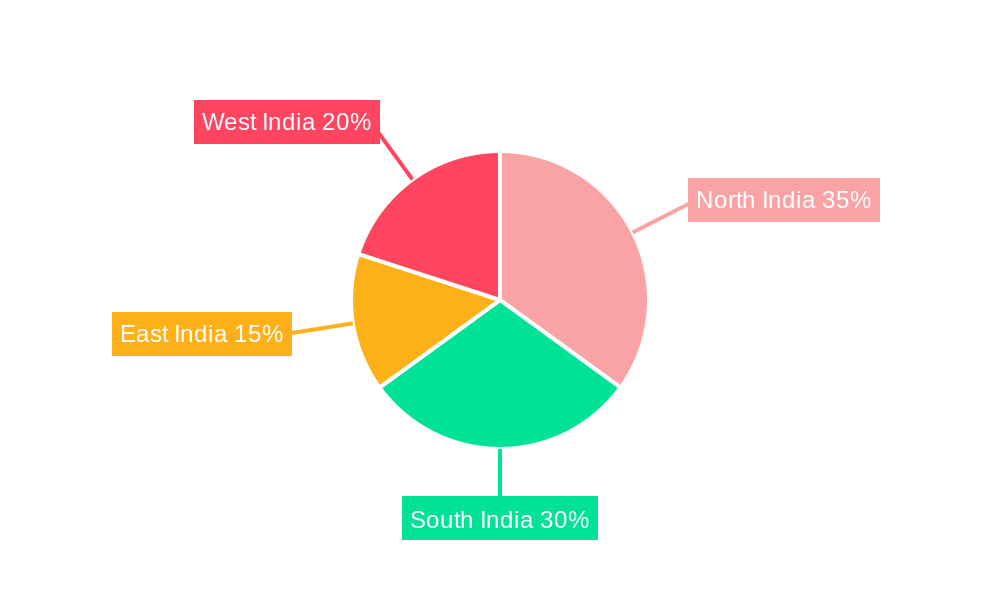

The India whey protein market, valued at $92.03 million in 2025, is projected to experience robust growth, driven by increasing health consciousness, rising disposable incomes, and a growing fitness-focused population. The market's Compound Annual Growth Rate (CAGR) of 5.56% from 2019 to 2024 indicates a steady upward trajectory, expected to continue through 2033. Key growth drivers include the surging popularity of sports and performance nutrition, the expanding infant formula market, and the increasing demand for functional and fortified foods. The whey protein concentrate segment currently holds a significant market share, followed by whey protein isolate and hydrolyzed whey protein. Regional variations exist, with North and South India likely leading the market due to higher levels of health awareness and urbanization. However, the market's expansion into East and West India is expected to accelerate as consumer preferences evolve and distribution networks improve. The competitive landscape features both domestic and international players, showcasing opportunities for both established brands and emerging companies. Challenges include price volatility of raw materials, stringent regulatory requirements, and the need to educate consumers on the benefits of whey protein.

The continued growth of the Indian whey protein market hinges on several factors. Sustained marketing efforts highlighting the health benefits of whey protein, particularly among young adults, will be crucial. Furthermore, innovation in product formulation, such as the development of novel flavors and delivery systems (e.g., ready-to-drink products), will attract new consumers. Addressing consumer concerns regarding product purity and sourcing through transparent supply chains will also bolster market trust. Companies that effectively leverage these opportunities while navigating the regulatory environment will be well-positioned to capitalize on the market’s growth potential.

India Whey Protein Market: A Comprehensive Report (2019-2033)

This comprehensive report provides an in-depth analysis of the India whey protein market, encompassing market dynamics, industry trends, leading segments, key players, and future growth opportunities. With a study period spanning 2019-2033, a base year of 2025, and a forecast period of 2025-2033, this report is an invaluable resource for industry stakeholders, investors, and anyone seeking to understand this rapidly evolving market. The market size is predicted to reach xx Million by 2033, showcasing significant growth potential.

India Whey Protein Market Market Dynamics & Concentration

The India whey protein market is characterized by a dynamic interplay of factors influencing its growth and concentration. Market concentration is currently [Insert Market Concentration Metric, e.g., moderately fragmented], with several key players holding significant market share. However, the market is witnessing increased competition due to both domestic and international players. Innovation is a key driver, with companies continually developing new product formulations, such as hydrolyzed whey protein, to cater to evolving consumer preferences and health consciousness. The regulatory framework, while evolving, plays a crucial role in ensuring product safety and quality. The market also faces competition from substitute proteins, such as soy protein and plant-based alternatives. Consumer trends, particularly the growing awareness of fitness and health, are driving demand. Finally, mergers and acquisitions (M&A) activity is shaping the competitive landscape. While precise M&A deal counts for the period are unavailable, we estimate approximately xx deals occurred between 2019-2024. Key players' market share is estimated as follows:

- LACTALIS Ingredients: xx%

- Charotar Casein Company: xx%

- Agropur US: xx%

- Other Players: xx%

India Whey Protein Market Industry Trends & Analysis

The India whey protein market is experiencing robust growth, driven by several key factors. The increasing health consciousness among Indian consumers, fueled by rising disposable incomes and greater awareness of the benefits of protein supplementation, is a major driver. The burgeoning fitness and sports nutrition industry further enhances market demand. Technological advancements in whey protein production, leading to improved product quality and functionality, contribute significantly to growth. The market is also witnessing a shift in consumer preferences, with a preference for more convenient and readily available forms of whey protein, such as ready-to-drink shakes. The competitive dynamics are intense, with both domestic and international players vying for market share. This competitive environment is fostering innovation and driving down prices, making whey protein more accessible to a wider consumer base. The CAGR for the India whey protein market during the forecast period (2025-2033) is estimated to be xx%, indicating substantial growth potential. Market penetration of whey protein in India remains relatively low, suggesting significant room for expansion.

Leading Markets & Segments in India Whey Protein Market

Within the India whey protein market, certain segments dominate. The Sports and Performance Nutrition application segment holds a significant market share due to the growing popularity of fitness activities and sports. Similarly, the Whey Protein Concentrate segment accounts for the largest share in terms of product type, driven by its cost-effectiveness.

Key Drivers for Dominant Segments:

- Sports & Performance Nutrition: Rising disposable incomes, increased health awareness, and a growing fitness culture in urban areas.

- Whey Protein Concentrate: Lower cost compared to isolates and hydrolysates, making it accessible to a wider consumer base.

Regional Dominance: While nationwide data is not yet fully available, we anticipate that urban centers in states like Maharashtra, Gujarat, and Tamil Nadu will represent the most significant regional markets, primarily due to higher disposable incomes, greater health awareness, and established fitness infrastructure.

India Whey Protein Market Product Developments

The India whey protein market witnesses constant product innovation. Companies are focusing on developing products with enhanced functionalities, such as improved solubility, taste, and digestibility. There's a growing trend towards incorporating natural flavors and sweeteners to cater to consumer preferences for cleaner label products. Furthermore, the emergence of innovative delivery systems, like ready-to-mix pouches and convenient on-the-go formats, contributes to product diversification and market expansion. This innovation is largely driven by the competitive landscape and the need to differentiate offerings in a rapidly evolving market.

Key Drivers of India Whey Protein Market Growth

Several factors drive the growth of the India whey protein market. The rising health and fitness consciousness among consumers, coupled with increasing disposable incomes, leads to greater demand for protein supplements. Technological advancements in whey protein production, resulting in enhanced product quality and affordability, also contribute significantly. Finally, favorable government policies supporting the growth of the food processing industry create a positive environment for market expansion.

Challenges in the India Whey Protein Market Market

Despite its growth potential, the India whey protein market faces challenges. Regulatory hurdles and inconsistencies in food safety standards across different states can pose difficulties for manufacturers. The fluctuating prices of raw materials and potential supply chain disruptions impact profitability. The intense competition from both established players and new entrants necessitates strategic pricing and marketing to maintain market share. These factors can collectively constrain market growth and profitability.

Emerging Opportunities in India Whey Protein Market

The India whey protein market presents significant long-term opportunities. The increasing adoption of precision fermentation for sustainable whey protein production offers a promising avenue for growth, providing potentially more cost-effective and environmentally-friendly solutions. Strategic partnerships between domestic and international companies can enhance market penetration and product diversification. Expansion into new consumer segments, such as the elderly and those with specific dietary needs, further holds great potential.

Leading Players in the India Whey Protein Market Sector

- LACTALIS Ingredients

- Charotar Casein Company

- Agropur US

- Titan Biotech

- Proteinwale

- Glanbia PLC

- Arla Foods Amba

- Medisysbiotech Private Limited

- Euroserum

- Fonterra Group

Key Milestones in India Whey Protein Market Industry

- June 2022: NZMP launched Pro-OptimaTM, a Grade A functional Whey Protein Concentrate, showcasing innovation in product development and potentially impacting market share.

- August 2022: Fonterra and DSM's precision fermentation startup signals a move towards sustainable whey protein production, impacting the long-term supply chain and potentially driving market growth.

- May 2022: Perfect Day Foods' expansion into India, including the acquisition of Sterling Biotech's plants, represents significant foreign investment and expansion of production capacity, impacting market competition and supply.

Strategic Outlook for India Whey Protein Market Market

The future of the India whey protein market looks promising. Continued growth is anticipated, driven by evolving consumer preferences, technological innovations, and increased investment. Companies that focus on product innovation, sustainable production practices, and strategic partnerships will be best positioned to capitalize on emerging opportunities and achieve long-term success within this dynamic market.

India Whey Protein Market Segmentation

-

1. Product Type

- 1.1. Whey Protein Concentrate

- 1.2. Whey Protein Isolate

- 1.3. Hydrolyzed Whey Protein

-

2. Application

- 2.1. Sports and Performance Nutrition

- 2.2. Infant Formula

- 2.3. Functional/Fortified Food

India Whey Protein Market Segmentation By Geography

- 1. India

India Whey Protein Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 5.56% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Surge in Participation of Sports Activities; Functional and Processing Bnefits of Whey Protein

- 3.3. Market Restrains

- 3.3.1. High Manufacturing Costs and Fluctuations in Raw Material Prices

- 3.4. Market Trends

- 3.4.1. Surge in Participation of Sports and Physical Activities

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. India Whey Protein Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 5.1.1. Whey Protein Concentrate

- 5.1.2. Whey Protein Isolate

- 5.1.3. Hydrolyzed Whey Protein

- 5.2. Market Analysis, Insights and Forecast - by Application

- 5.2.1. Sports and Performance Nutrition

- 5.2.2. Infant Formula

- 5.2.3. Functional/Fortified Food

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. India

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 6. North India India Whey Protein Market Analysis, Insights and Forecast, 2019-2031

- 7. South India India Whey Protein Market Analysis, Insights and Forecast, 2019-2031

- 8. East India India Whey Protein Market Analysis, Insights and Forecast, 2019-2031

- 9. West India India Whey Protein Market Analysis, Insights and Forecast, 2019-2031

- 10. Competitive Analysis

- 10.1. Market Share Analysis 2024

- 10.2. Company Profiles

- 10.2.1 LACTALIS Ingredients

- 10.2.1.1. Overview

- 10.2.1.2. Products

- 10.2.1.3. SWOT Analysis

- 10.2.1.4. Recent Developments

- 10.2.1.5. Financials (Based on Availability)

- 10.2.2 Charotar Casein Company

- 10.2.2.1. Overview

- 10.2.2.2. Products

- 10.2.2.3. SWOT Analysis

- 10.2.2.4. Recent Developments

- 10.2.2.5. Financials (Based on Availability)

- 10.2.3 Agropur US

- 10.2.3.1. Overview

- 10.2.3.2. Products

- 10.2.3.3. SWOT Analysis

- 10.2.3.4. Recent Developments

- 10.2.3.5. Financials (Based on Availability)

- 10.2.4 Titan Biotech

- 10.2.4.1. Overview

- 10.2.4.2. Products

- 10.2.4.3. SWOT Analysis

- 10.2.4.4. Recent Developments

- 10.2.4.5. Financials (Based on Availability)

- 10.2.5 Proteinwale

- 10.2.5.1. Overview

- 10.2.5.2. Products

- 10.2.5.3. SWOT Analysis

- 10.2.5.4. Recent Developments

- 10.2.5.5. Financials (Based on Availability)

- 10.2.6 Glanbia PLC

- 10.2.6.1. Overview

- 10.2.6.2. Products

- 10.2.6.3. SWOT Analysis

- 10.2.6.4. Recent Developments

- 10.2.6.5. Financials (Based on Availability)

- 10.2.7 Arla Foods Amba

- 10.2.7.1. Overview

- 10.2.7.2. Products

- 10.2.7.3. SWOT Analysis

- 10.2.7.4. Recent Developments

- 10.2.7.5. Financials (Based on Availability)

- 10.2.8 Medisysbiotech Private Limited*List Not Exhaustive

- 10.2.8.1. Overview

- 10.2.8.2. Products

- 10.2.8.3. SWOT Analysis

- 10.2.8.4. Recent Developments

- 10.2.8.5. Financials (Based on Availability)

- 10.2.9 Euroserum

- 10.2.9.1. Overview

- 10.2.9.2. Products

- 10.2.9.3. SWOT Analysis

- 10.2.9.4. Recent Developments

- 10.2.9.5. Financials (Based on Availability)

- 10.2.10 Fonterra Group

- 10.2.10.1. Overview

- 10.2.10.2. Products

- 10.2.10.3. SWOT Analysis

- 10.2.10.4. Recent Developments

- 10.2.10.5. Financials (Based on Availability)

- 10.2.1 LACTALIS Ingredients

List of Figures

- Figure 1: India Whey Protein Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: India Whey Protein Market Share (%) by Company 2024

List of Tables

- Table 1: India Whey Protein Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: India Whey Protein Market Volume K Tons Forecast, by Region 2019 & 2032

- Table 3: India Whey Protein Market Revenue Million Forecast, by Product Type 2019 & 2032

- Table 4: India Whey Protein Market Volume K Tons Forecast, by Product Type 2019 & 2032

- Table 5: India Whey Protein Market Revenue Million Forecast, by Application 2019 & 2032

- Table 6: India Whey Protein Market Volume K Tons Forecast, by Application 2019 & 2032

- Table 7: India Whey Protein Market Revenue Million Forecast, by Region 2019 & 2032

- Table 8: India Whey Protein Market Volume K Tons Forecast, by Region 2019 & 2032

- Table 9: India Whey Protein Market Revenue Million Forecast, by Country 2019 & 2032

- Table 10: India Whey Protein Market Volume K Tons Forecast, by Country 2019 & 2032

- Table 11: North India India Whey Protein Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 12: North India India Whey Protein Market Volume (K Tons) Forecast, by Application 2019 & 2032

- Table 13: South India India Whey Protein Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 14: South India India Whey Protein Market Volume (K Tons) Forecast, by Application 2019 & 2032

- Table 15: East India India Whey Protein Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 16: East India India Whey Protein Market Volume (K Tons) Forecast, by Application 2019 & 2032

- Table 17: West India India Whey Protein Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 18: West India India Whey Protein Market Volume (K Tons) Forecast, by Application 2019 & 2032

- Table 19: India Whey Protein Market Revenue Million Forecast, by Product Type 2019 & 2032

- Table 20: India Whey Protein Market Volume K Tons Forecast, by Product Type 2019 & 2032

- Table 21: India Whey Protein Market Revenue Million Forecast, by Application 2019 & 2032

- Table 22: India Whey Protein Market Volume K Tons Forecast, by Application 2019 & 2032

- Table 23: India Whey Protein Market Revenue Million Forecast, by Country 2019 & 2032

- Table 24: India Whey Protein Market Volume K Tons Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the India Whey Protein Market?

The projected CAGR is approximately 5.56%.

2. Which companies are prominent players in the India Whey Protein Market?

Key companies in the market include LACTALIS Ingredients, Charotar Casein Company, Agropur US, Titan Biotech, Proteinwale, Glanbia PLC, Arla Foods Amba, Medisysbiotech Private Limited*List Not Exhaustive, Euroserum, Fonterra Group.

3. What are the main segments of the India Whey Protein Market?

The market segments include Product Type, Application.

4. Can you provide details about the market size?

The market size is estimated to be USD 92.03 Million as of 2022.

5. What are some drivers contributing to market growth?

Surge in Participation of Sports Activities; Functional and Processing Bnefits of Whey Protein.

6. What are the notable trends driving market growth?

Surge in Participation of Sports and Physical Activities.

7. Are there any restraints impacting market growth?

High Manufacturing Costs and Fluctuations in Raw Material Prices.

8. Can you provide examples of recent developments in the market?

May 2022: Perfect Day Foods, a California-based food technology startup making whey and casein proteins using precision fermentation, expanded its footprint in animal-free products by investing both in India. The company launched a new Enterprise Biology Hub in Salt Lake City and also announced its plans to expand in India with a liquidation buy-off of Mumbai-based Sterling Biotech, acquiring two manufacturing plants in Gujarat and another in Tamil Nadu.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in K Tons.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "India Whey Protein Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the India Whey Protein Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the India Whey Protein Market?

To stay informed about further developments, trends, and reports in the India Whey Protein Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence