Key Insights

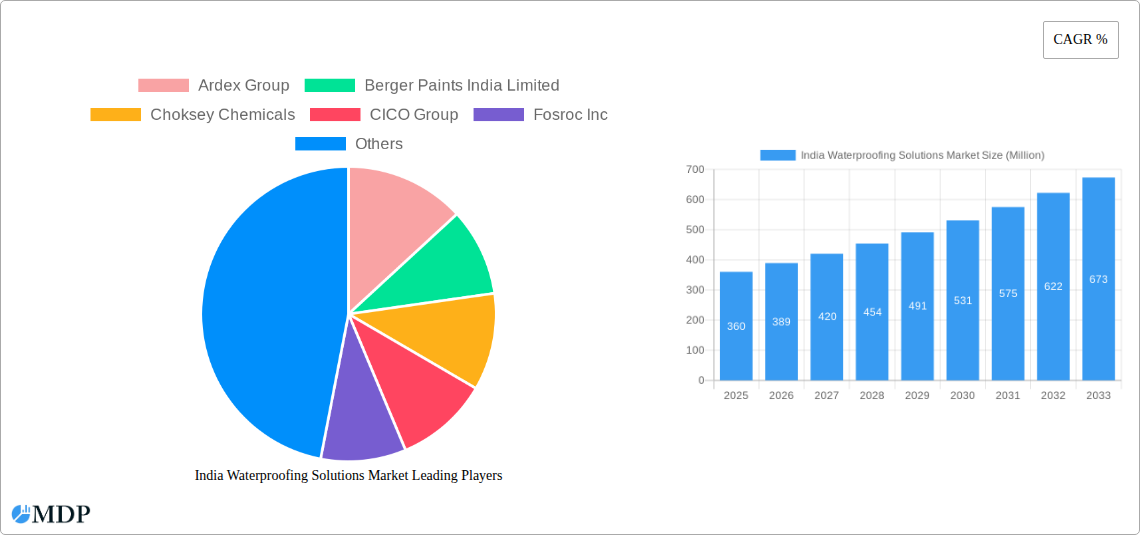

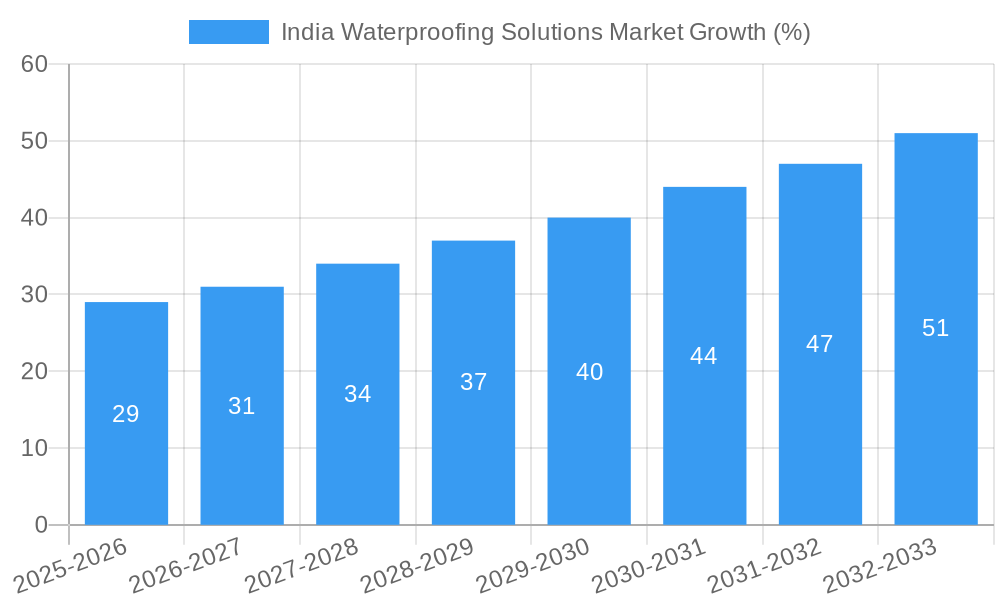

The India waterproofing solutions market is experiencing robust growth, driven by factors such as rapid urbanization, increasing construction activity, and a rising awareness of the importance of building durability. The market is segmented by product type (e.g., cement-based, polymer-based, bitumen-based), application (e.g., residential, commercial, industrial), and region. While precise figures are unavailable without specific data, assuming a conservative CAGR of 8% based on typical growth in developing economies experiencing similar construction booms, and a current market size in 2025 of approximately ₹3000 crore (approximately $360 million USD), the market is projected to reach ₹5000 crore (approximately $600 million USD) by 2033. Key growth drivers include government initiatives promoting affordable housing and infrastructure development, coupled with a rising middle class increasing demand for higher-quality homes and buildings. Furthermore, the market is seeing increased adoption of advanced waterproofing technologies, such as polyurethane and crystalline waterproofing, that offer superior performance and longevity.

However, challenges remain. High initial investment costs associated with advanced waterproofing solutions can act as a restraint for some customers, particularly in the residential segment. Additionally, lack of skilled labor and inconsistencies in quality control can sometimes hinder project success. To overcome these challenges, manufacturers are increasingly focusing on developing cost-effective and user-friendly products. The presence of established players like Pidilite Industries, Berger Paints, and international companies such as Sika and Mapei signifies the market's maturity and potential for further expansion. The competitive landscape features both domestic and multinational companies, leading to innovation and diversified product offerings catering to varied customer needs.

India Waterproofing Solutions Market: A Comprehensive Report (2019-2033)

This comprehensive report provides an in-depth analysis of the India Waterproofing Solutions Market, offering invaluable insights for industry stakeholders, investors, and businesses seeking to navigate this dynamic sector. The report covers the period 2019-2033, with a focus on the 2025-2033 forecast period. The market size is valued in Millions.

Keywords: India Waterproofing Solutions Market, Waterproofing Products, Construction Chemicals, Market Size, Market Share, CAGR, Market Growth, Industry Trends, Competitive Landscape, Berger Paints India, Sika, Saint-Gobain, Pidilite Industries, Ardex Group, M&A, Market Analysis, Forecast, India Infrastructure Development, Building Materials

India Waterproofing Solutions Market Dynamics & Concentration

The Indian waterproofing solutions market is experiencing robust growth, driven by factors such as increasing urbanization, infrastructure development, and rising construction activities. The market exhibits a moderately concentrated structure, with a few dominant players holding significant market share. However, the presence of numerous smaller players and regional manufacturers adds to the competitive intensity. Innovation is a key driver, with companies constantly developing new products and technologies to meet evolving customer demands and address challenges like sustainability and durability. The regulatory landscape plays a crucial role, with building codes and environmental regulations influencing product development and market access. The availability of substitute materials, such as traditional methods like bitumen, presents competition, while increasing awareness of the long-term benefits of waterproofing solutions contributes positively to market growth. M&A activity is significant, reflecting consolidation trends and expansion strategies. The past few years have seen xx M&A deals, consolidating market share among major players. Companies are focusing on strategic partnerships to leverage their expertise and gain a competitive edge. Market share for the top 5 players is estimated at xx% in 2025.

- Market Concentration: Moderately concentrated, with top 5 players holding xx% market share in 2025.

- Innovation Drivers: Development of advanced materials, eco-friendly solutions, and specialized products for different applications.

- Regulatory Framework: Compliance with building codes and environmental regulations influences market dynamics.

- Product Substitutes: Traditional waterproofing methods pose competition.

- End-User Trends: Growing preference for high-performance, durable, and sustainable solutions.

- M&A Activities: xx deals in the last five years indicate consolidation trends.

India Waterproofing Solutions Market Industry Trends & Analysis

The India Waterproofing Solutions Market is projected to experience significant growth, with a CAGR of xx% during the forecast period (2025-2033). This growth is primarily fuelled by the booming construction sector, expanding infrastructure projects (including Smart Cities initiatives), and increasing disposable incomes leading to higher investments in residential and commercial properties. Technological advancements, such as the introduction of nanotechnology-based waterproofing materials and smart coatings, are further driving market expansion. Consumer preferences are shifting towards eco-friendly and sustainable products, creating opportunities for manufacturers offering solutions with reduced environmental impact. The competitive landscape is dynamic, with both domestic and international players vying for market share. This competition fosters innovation and drives price competitiveness, benefiting consumers. Market penetration of advanced waterproofing solutions remains relatively low, indicating significant untapped potential.

Leading Markets & Segments in India Waterproofing Solutions Market

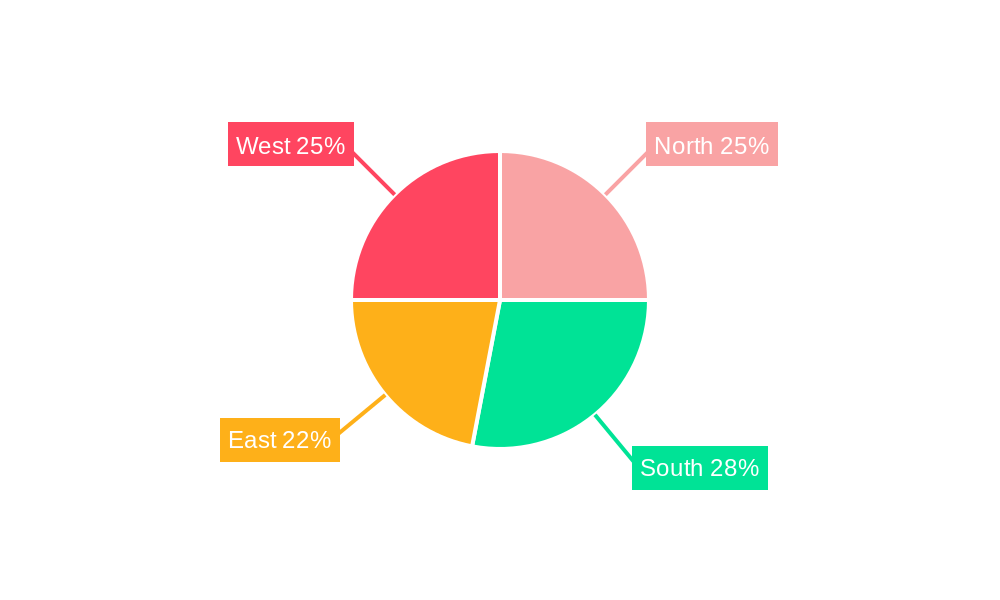

The Indian waterproofing solutions market shows robust growth across various regions, but the fastest-growing segments are concentrated in urban areas and rapidly developing states. The residential segment currently holds the largest market share, followed by commercial and industrial construction.

Key Drivers in Dominant Regions:

- Urbanization: Rapid urbanization is driving the demand for new constructions and renovations, fueling the need for waterproofing solutions.

- Infrastructure Development: Government initiatives such as the Smart Cities Mission are boosting infrastructure projects, leading to higher demand.

- Economic Growth: Increasing disposable incomes and rising construction activity are propelling market growth.

Dominance Analysis: The South and West regions are anticipated to maintain dominance due to higher construction activity and favourable economic conditions. However, other regions are experiencing rapid growth, making the market highly competitive.

India Waterproofing Solutions Market Product Developments

Recent innovations focus on enhanced durability, eco-friendliness, and ease of application. Companies are developing specialized products for different substrates and applications, including cementitious, polymeric, and hybrid waterproofing systems. The emphasis is on providing holistic solutions addressing various waterproofing needs, including dampness, leakage, and corrosion protection. These developments are driven by technological advancements and the changing needs of the construction industry. Market fit is optimized through partnerships with contractors, architects, and construction material suppliers.

Key Drivers of India Waterproofing Solutions Market Growth

Several factors contribute to the market’s robust growth trajectory. Rapid urbanization and infrastructure development are primary drivers, creating massive demand for new constructions and renovations. Government initiatives supporting infrastructure projects significantly fuel the market. Moreover, increasing awareness among consumers about the importance of waterproofing solutions for property protection is steadily driving demand. Technological advancements contribute significantly, offering innovative, durable, and efficient solutions.

Challenges in the India Waterproofing Solutions Market Market

Despite the positive outlook, the market faces certain challenges. Fluctuations in raw material prices can impact profitability. The presence of unorganized players offering low-cost solutions creates competitive pressure. Ensuring consistent quality and meeting stringent regulatory standards pose ongoing challenges. These factors collectively influence market dynamics. Supply chain disruptions, particularly in the case of specialized imported materials, pose significant hurdles for manufacturers.

Emerging Opportunities in India Waterproofing Solutions Market

The market offers promising opportunities for growth. The expanding infrastructure sector, coupled with government initiatives, presents a vast potential market. Technological advancements, such as nanotechnology and smart coatings, create opportunities for innovation. Strategic partnerships and mergers & acquisitions are likely to shape the market landscape in the coming years, creating new opportunities for players looking to expand their reach and product portfolio. Expansion into niche markets with specialized waterproofing solutions is another key opportunity.

Leading Players in the India Waterproofing Solutions Market Sector

- Ardex Group

- Berger Paints India Limited

- Choksey Chemicals

- CICO Group

- Fosroc Inc

- MAPEI S p A

- Pidilite Industries Ltd

- Saint-Gobain

- Sika AG

- Soprem

Key Milestones in India Waterproofing Solutions Market Industry

- October 2023: Berger Paints India Limited launched Berger DAMPSTOP, a range of waterproofing products offering diverse solutions.

- May 2023: Sika acquired MBCC Group, significantly expanding its waterproofing solutions portfolio.

- September 2022: Saint-Gobain acquired GCP Applied Technologies Inc., strengthening its market position.

Strategic Outlook for India Waterproofing Solutions Market Market

The India Waterproofing Solutions Market is poised for sustained growth, driven by consistent infrastructure development and increasing consumer awareness. Strategic partnerships, technological innovations, and expansion into specialized segments offer significant opportunities for growth. Companies focusing on sustainable and high-performance solutions are well-positioned to capitalize on the market’s potential. The long-term outlook remains positive, with continued expansion in both the residential and commercial sectors.

India Waterproofing Solutions Market Segmentation

-

1. End Use Sector

- 1.1. Commercial

- 1.2. Industrial and Institutional

- 1.3. Infrastructure

- 1.4. Residential

-

2. Sub Product

-

2.1. Chemicals

-

2.1.1. By Technology

- 2.1.1.1. Epoxy-based

- 2.1.1.2. Polyurethane-based

- 2.1.1.3. Water-based

- 2.1.1.4. Other Technologies

-

2.1.1. By Technology

-

2.2. Membranes

- 2.2.1. Cold Liquid Applied

- 2.2.2. Fully Adhered Sheet

- 2.2.3. Hot Liquid Applied

- 2.2.4. Loose Laid Sheet

-

2.1. Chemicals

India Waterproofing Solutions Market Segmentation By Geography

- 1. India

India Waterproofing Solutions Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of % from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 3.4.1. OTHER KEY INDUSTRY TRENDS COVERED IN THE REPORT

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. India Waterproofing Solutions Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by End Use Sector

- 5.1.1. Commercial

- 5.1.2. Industrial and Institutional

- 5.1.3. Infrastructure

- 5.1.4. Residential

- 5.2. Market Analysis, Insights and Forecast - by Sub Product

- 5.2.1. Chemicals

- 5.2.1.1. By Technology

- 5.2.1.1.1. Epoxy-based

- 5.2.1.1.2. Polyurethane-based

- 5.2.1.1.3. Water-based

- 5.2.1.1.4. Other Technologies

- 5.2.1.1. By Technology

- 5.2.2. Membranes

- 5.2.2.1. Cold Liquid Applied

- 5.2.2.2. Fully Adhered Sheet

- 5.2.2.3. Hot Liquid Applied

- 5.2.2.4. Loose Laid Sheet

- 5.2.1. Chemicals

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. India

- 5.1. Market Analysis, Insights and Forecast - by End Use Sector

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2024

- 6.2. Company Profiles

- 6.2.1 Ardex Group

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Berger Paints India Limited

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Choksey Chemicals

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 CICO Group

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Fosroc Inc

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 MAPEI S p A

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Pidilite Industries Ltd

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Saint-Gobain

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Sika AG

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Soprem

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 Ardex Group

List of Figures

- Figure 1: India Waterproofing Solutions Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: India Waterproofing Solutions Market Share (%) by Company 2024

List of Tables

- Table 1: India Waterproofing Solutions Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: India Waterproofing Solutions Market Revenue Million Forecast, by End Use Sector 2019 & 2032

- Table 3: India Waterproofing Solutions Market Revenue Million Forecast, by Sub Product 2019 & 2032

- Table 4: India Waterproofing Solutions Market Revenue Million Forecast, by Region 2019 & 2032

- Table 5: India Waterproofing Solutions Market Revenue Million Forecast, by End Use Sector 2019 & 2032

- Table 6: India Waterproofing Solutions Market Revenue Million Forecast, by Sub Product 2019 & 2032

- Table 7: India Waterproofing Solutions Market Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the India Waterproofing Solutions Market?

The projected CAGR is approximately N/A%.

2. Which companies are prominent players in the India Waterproofing Solutions Market?

Key companies in the market include Ardex Group, Berger Paints India Limited, Choksey Chemicals, CICO Group, Fosroc Inc, MAPEI S p A, Pidilite Industries Ltd, Saint-Gobain, Sika AG, Soprem.

3. What are the main segments of the India Waterproofing Solutions Market?

The market segments include End Use Sector, Sub Product.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

OTHER KEY INDUSTRY TRENDS COVERED IN THE REPORT.

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

October 2023: Berger Paints India Limited developed a range of waterproofing products named Berger DAMPSTOP that provide diverse solutions for various waterproofing demands, such as dampness, silane treatment, and salt leaching treatment, and ensure a simplified process for consumers.May 2023: Sika, a global leader in construction chemicals, acquired the MBCC Group, including its waterproofing solutions, anchors & grouts, flooring resins, repair & rehabilitation chemicals, and other businesses, with the exception of its concrete admixture operations in Europe, North America, Australia, and New Zealand.September 2022: Saint-Gobain acquired GCP Applied Technologies Inc. to strengthen its market presence through a global platform with extensive expertise in cement additives, concrete admixtures, infrastructure, and commercial and residential building materials.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "India Waterproofing Solutions Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the India Waterproofing Solutions Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the India Waterproofing Solutions Market?

To stay informed about further developments, trends, and reports in the India Waterproofing Solutions Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence