Key Insights

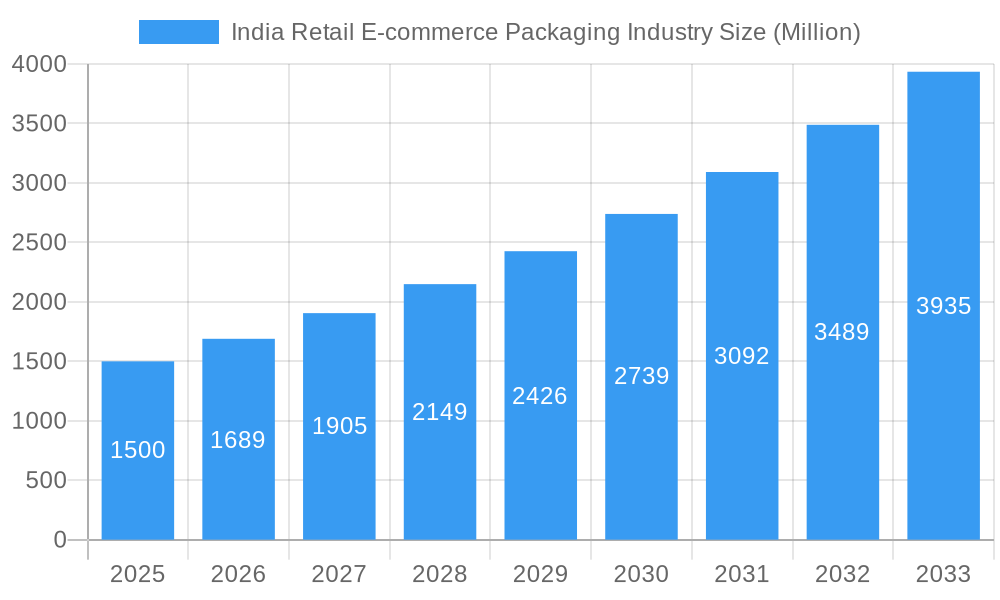

The India retail e-commerce packaging market is experiencing robust growth, fueled by the booming e-commerce sector and a rising preference for online shopping. With a CAGR of 12.97% from 2019 to 2024, the market demonstrates significant potential. The market's segmentation reflects diverse needs across various product categories. Boxes and protective packaging dominate the "type" segment, indicating a strong emphasis on product safety during transit. Among end-user industries, Fashion and Apparel, Consumer Electronics, and Food and Beverage are major contributors, reflecting the popularity of online purchases in these sectors. Growth drivers include increasing internet penetration, smartphone adoption, and a growing middle class with increased disposable income. However, challenges such as sustainability concerns related to packaging waste and the need for cost-effective solutions remain. Considering the substantial growth in e-commerce, we can project a continued upward trend in the market size. While precise figures for the past and present years aren't provided, a logical estimation based on the CAGR suggests a substantial increase in the market value. Furthermore, regional variations likely exist, with metropolitan areas potentially showing higher growth rates compared to rural regions due to greater e-commerce penetration. The competitive landscape includes both domestic and international players, indicating opportunities for both established companies and new entrants. Strategic investments in sustainable packaging solutions and efficient supply chains will be key to success in this dynamic market.

India Retail E-commerce Packaging Industry Market Size (In Billion)

This rapidly expanding market presents lucrative opportunities for packaging companies. Companies should focus on innovation to meet evolving consumer demands for eco-friendly and customized packaging solutions. The significant growth in the market requires a strategic approach to cater to the diverse needs of e-commerce businesses. This includes catering to various product categories, ensuring efficient logistics, and adhering to environmental regulations. The market's regional diversity necessitates targeted strategies to effectively reach different customer segments and address specific logistical challenges in various parts of India. Future growth hinges on the industry's ability to adapt to changing consumer preferences, prioritize sustainability, and embrace technological advancements in packaging design and logistics.

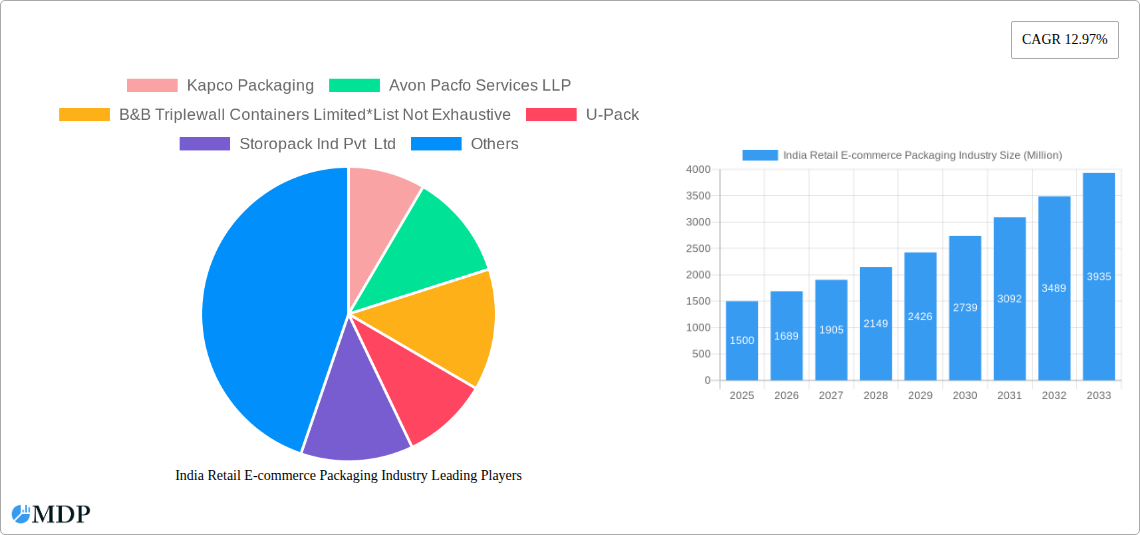

India Retail E-commerce Packaging Industry Company Market Share

India Retail E-commerce Packaging Industry: A Comprehensive Market Report (2019-2033)

This comprehensive report provides an in-depth analysis of the dynamic India retail e-commerce packaging industry, offering crucial insights for stakeholders, investors, and industry professionals. With a study period spanning 2019-2033, a base year of 2025, and a forecast period of 2025-2033, this report unveils the market's historical performance (2019-2024) and projects its future trajectory. Discover key trends, challenges, and opportunities shaping this rapidly expanding sector, valued at xx Million in 2025 and projected to reach xx Million by 2033.

India Retail E-commerce Packaging Industry Market Dynamics & Concentration

The Indian retail e-commerce packaging market exhibits a moderately consolidated structure, with key players vying for market share. The market's dynamics are driven by several factors, including:

- Innovation: A constant influx of innovative packaging materials and solutions, emphasizing sustainability and enhanced product protection.

- Regulatory Framework: Government regulations regarding packaging waste management and sustainable practices significantly influence industry operations.

- Product Substitutes: The emergence of biodegradable and eco-friendly packaging materials presents both opportunities and challenges for traditional players.

- End-User Trends: Growing consumer preference for convenient, safe, and aesthetically pleasing packaging fuels demand for specialized solutions.

- M&A Activities: Strategic mergers and acquisitions are reshaping the competitive landscape, leading to increased market concentration. The number of M&A deals in the sector from 2019 to 2024 totaled approximately xx, resulting in a market share shift among leading players. For instance, the market share of the top 5 players in 2024 is estimated at xx%.

India Retail E-commerce Packaging Industry Industry Trends & Analysis

The Indian retail e-commerce packaging industry is experiencing robust growth, fueled by several key factors. The market's Compound Annual Growth Rate (CAGR) during the forecast period (2025-2033) is projected to be xx%. This growth is driven by:

- E-commerce Boom: The exponential rise of e-commerce in India is the primary driver, significantly increasing the demand for packaging materials.

- Technological Disruptions: Advancements in packaging technologies, including automated packaging systems and smart packaging solutions, are enhancing efficiency and improving product safety.

- Consumer Preferences: Evolving consumer expectations regarding convenience, aesthetics, and sustainability are shaping packaging design and material choices.

- Competitive Dynamics: Intense competition among packaging manufacturers is pushing innovation and driving down prices, benefiting consumers. Market penetration of sustainable packaging solutions is estimated to reach xx% by 2033.

Leading Markets & Segments in India Retail E-commerce Packaging Industry

While detailed regional data requires further analysis, the key segments driving growth are:

- By Type: Boxes account for the largest segment, followed by protective packaging and other types of packaging. The key drivers for the boxes segment include its versatility and cost-effectiveness. Protective packaging is driven by the need for product safety and reduced damage during transit.

- By End-user Industry: Fashion and apparel, consumer electronics, and food and beverage are leading end-user segments.

- Key Drivers: Rapid growth in online sales, increasing disposable incomes, and improved logistics infrastructure.

India Retail E-commerce Packaging Industry Product Developments

The industry witnesses continuous product innovation, with a focus on sustainable, eco-friendly materials like biodegradable plastics and recycled paperboard. Technological advancements include improved barrier properties for extended shelf life and the integration of smart packaging features for enhanced traceability and consumer engagement. This trend aligns with growing consumer demand for sustainable and innovative packaging solutions, giving manufacturers with strong R&D capabilities a significant competitive edge.

Key Drivers of India Retail E-commerce Packaging Industry Growth

Several factors fuel the industry's growth:

- Technological advancements: Automation, smart packaging, and sustainable materials are driving efficiency and consumer appeal.

- Economic growth: Rising disposable incomes and increased online shopping contribute to higher demand.

- Government initiatives: Favorable policies promoting e-commerce and sustainable packaging practices support market expansion. For example, the push for waste reduction creates opportunities for eco-friendly packaging solutions.

Challenges in the India Retail E-commerce Packaging Industry Market

The industry faces significant challenges:

- Regulatory hurdles: Compliance with evolving environmental regulations can be complex and costly.

- Supply chain issues: Disruptions in raw material supply and logistics can impact production and delivery timelines. The impact of raw material price fluctuations on profitability is estimated to be approximately xx%.

- Competitive pressures: Intense competition necessitates continuous innovation and cost optimization.

Emerging Opportunities in India Retail E-commerce Packaging Industry

Long-term growth is fueled by:

- Technological breakthroughs: Advancements in materials science and packaging automation offer significant cost and efficiency improvements.

- Strategic partnerships: Collaboration between packaging companies and e-commerce platforms can optimize supply chains and offer tailored packaging solutions.

- Market expansion: Penetration into rural areas and untapped markets offers considerable growth potential.

Leading Players in the India Retail E-commerce Packaging Industry Sector

- Kapco Packaging

- Avon Pacfo Services LLP

- B&B Triplewall Containers Limited

- U-Pack

- Storopack Ind Pvt Ltd

- Oji India Packaging Pvt Ltd

- TGI Packaging Pvt Ltd

- Packman Packaging

- Ecom Packaging

- Astron Packaging Ltd

- Total Pack

Key Milestones in India Retail E-commerce Packaging Industry Industry

- April 2022: SIG's investment in a new Indian facility signals the growing importance of the aseptic carton packaging market.

- March 2022: AdwayPrint Concept's plant relocation reflects the industry's expansion and increased production capacity.

Strategic Outlook for India Retail E-commerce Packaging Industry Market

The Indian retail e-commerce packaging market presents significant long-term growth opportunities. Strategic investments in sustainable packaging solutions, automation, and supply chain optimization will be crucial for success. Companies that prioritize innovation, sustainability, and customer-centric approaches are well-positioned to capitalize on the market's potential. The focus on enhancing logistics and supply chain efficiency is expected to drive further market growth in the coming years.

India Retail E-commerce Packaging Industry Segmentation

-

1. Type

- 1.1. Boxes

- 1.2. Protective Packaging

- 1.3. Other Types of Packaging

-

2. End-user Industry

- 2.1. Fashion and Apparel

- 2.2. Consumer Electronics

- 2.3. Food and Beverage

- 2.4. Personal Care Products

- 2.5. Other End-user Industries

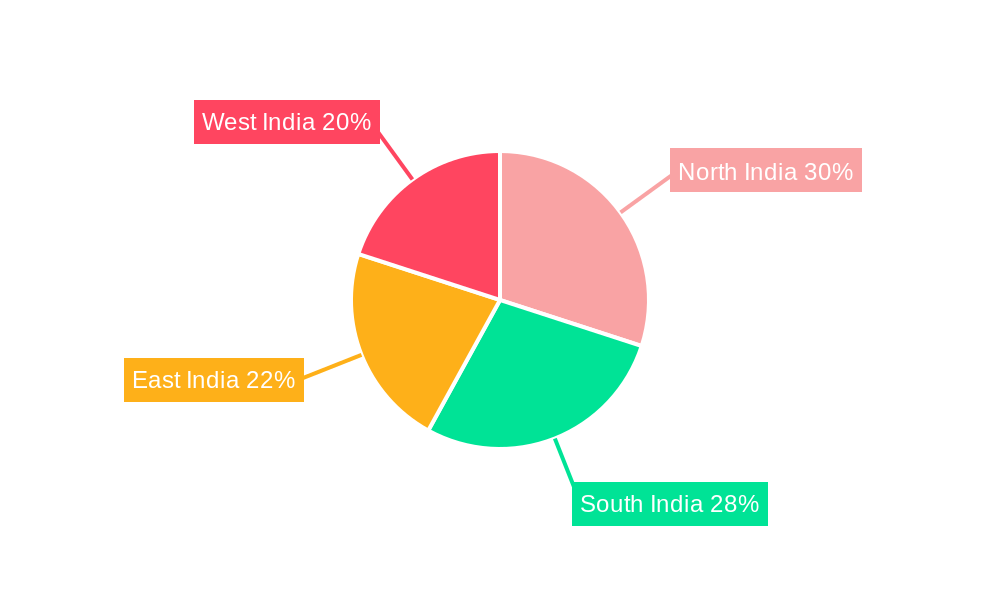

India Retail E-commerce Packaging Industry Segmentation By Geography

- 1. India

India Retail E-commerce Packaging Industry Regional Market Share

Geographic Coverage of India Retail E-commerce Packaging Industry

India Retail E-commerce Packaging Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 12.66% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Growing Proliferation of Online Retailing and Emergence of Omnichannel Presence

- 3.3. Market Restrains

- 3.3.1. Regulation Pertaining to the Use of Plastic and Lack of Exposure to Good Manufacturing Practices

- 3.4. Market Trends

- 3.4.1. Protective Packaging to Witness Significant Market Growth

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. India Retail E-commerce Packaging Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Boxes

- 5.1.2. Protective Packaging

- 5.1.3. Other Types of Packaging

- 5.2. Market Analysis, Insights and Forecast - by End-user Industry

- 5.2.1. Fashion and Apparel

- 5.2.2. Consumer Electronics

- 5.2.3. Food and Beverage

- 5.2.4. Personal Care Products

- 5.2.5. Other End-user Industries

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. India

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Kapco Packaging

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Avon Pacfo Services LLP

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 B&B Triplewall Containers Limited*List Not Exhaustive

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 U-Pack

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Storopack Ind Pvt Ltd

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Oji India Packaging Pvt Ltd

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 TGI Packaging Pvt Ltd

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Packman Packaging

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Ecom Packaging

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Astron Packaging Ltd

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 Total Pack

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.1 Kapco Packaging

List of Figures

- Figure 1: India Retail E-commerce Packaging Industry Revenue Breakdown (undefined, %) by Product 2025 & 2033

- Figure 2: India Retail E-commerce Packaging Industry Share (%) by Company 2025

List of Tables

- Table 1: India Retail E-commerce Packaging Industry Revenue undefined Forecast, by Type 2020 & 2033

- Table 2: India Retail E-commerce Packaging Industry Revenue undefined Forecast, by End-user Industry 2020 & 2033

- Table 3: India Retail E-commerce Packaging Industry Revenue undefined Forecast, by Region 2020 & 2033

- Table 4: India Retail E-commerce Packaging Industry Revenue undefined Forecast, by Type 2020 & 2033

- Table 5: India Retail E-commerce Packaging Industry Revenue undefined Forecast, by End-user Industry 2020 & 2033

- Table 6: India Retail E-commerce Packaging Industry Revenue undefined Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the India Retail E-commerce Packaging Industry?

The projected CAGR is approximately 12.66%.

2. Which companies are prominent players in the India Retail E-commerce Packaging Industry?

Key companies in the market include Kapco Packaging, Avon Pacfo Services LLP, B&B Triplewall Containers Limited*List Not Exhaustive, U-Pack, Storopack Ind Pvt Ltd, Oji India Packaging Pvt Ltd, TGI Packaging Pvt Ltd, Packman Packaging, Ecom Packaging, Astron Packaging Ltd, Total Pack.

3. What are the main segments of the India Retail E-commerce Packaging Industry?

The market segments include Type, End-user Industry.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX N/A as of 2022.

5. What are some drivers contributing to market growth?

Growing Proliferation of Online Retailing and Emergence of Omnichannel Presence.

6. What are the notable trends driving market growth?

Protective Packaging to Witness Significant Market Growth.

7. Are there any restraints impacting market growth?

Regulation Pertaining to the Use of Plastic and Lack of Exposure to Good Manufacturing Practices.

8. Can you provide examples of recent developments in the market?

April 2022 - SIG, a Swiss provider of aseptic carton packaging systems, plans to invest in a new facility in India. The move will be advantageous for SIG's operations in the country, which is one of its fastest-growing markets. An aseptic carton is a multilayered packaging solution created by combining layers of paperboard and plastic for the packing of liquid meals and drinks. Other firms in this industry include Tetra and UFlex.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in N/A.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "India Retail E-commerce Packaging Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the India Retail E-commerce Packaging Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the India Retail E-commerce Packaging Industry?

To stay informed about further developments, trends, and reports in the India Retail E-commerce Packaging Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence