Key Insights

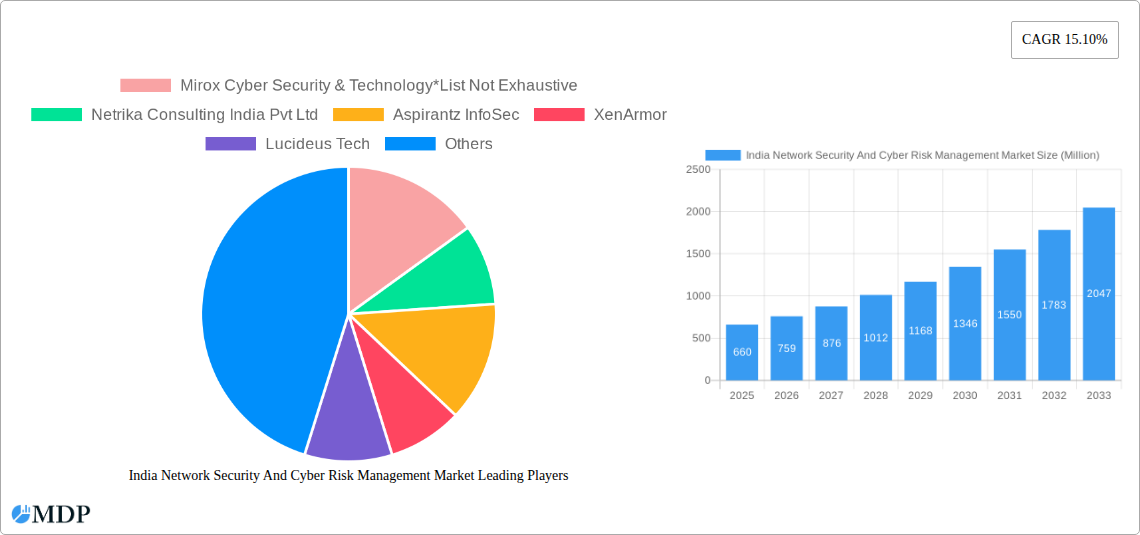

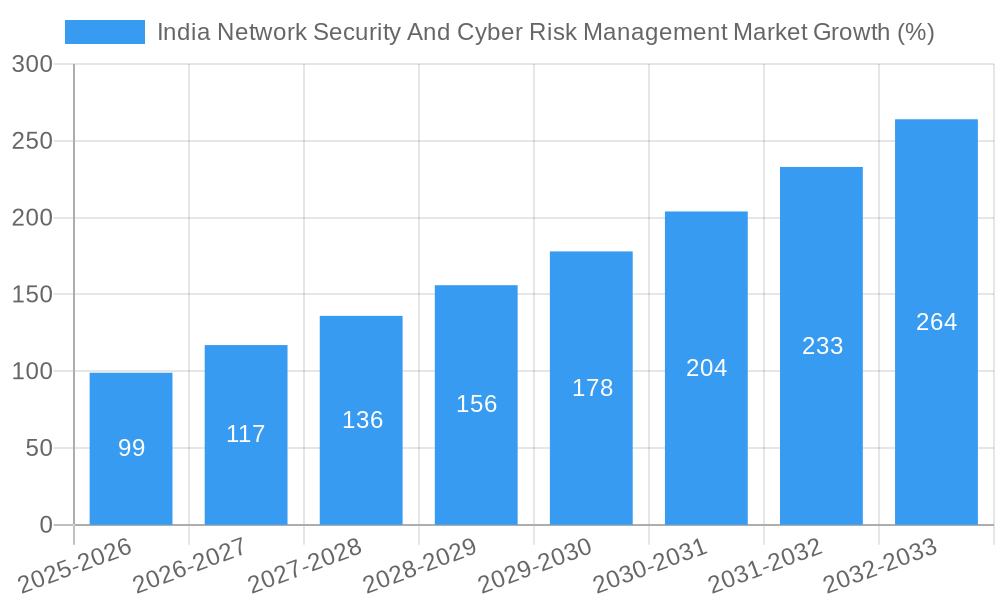

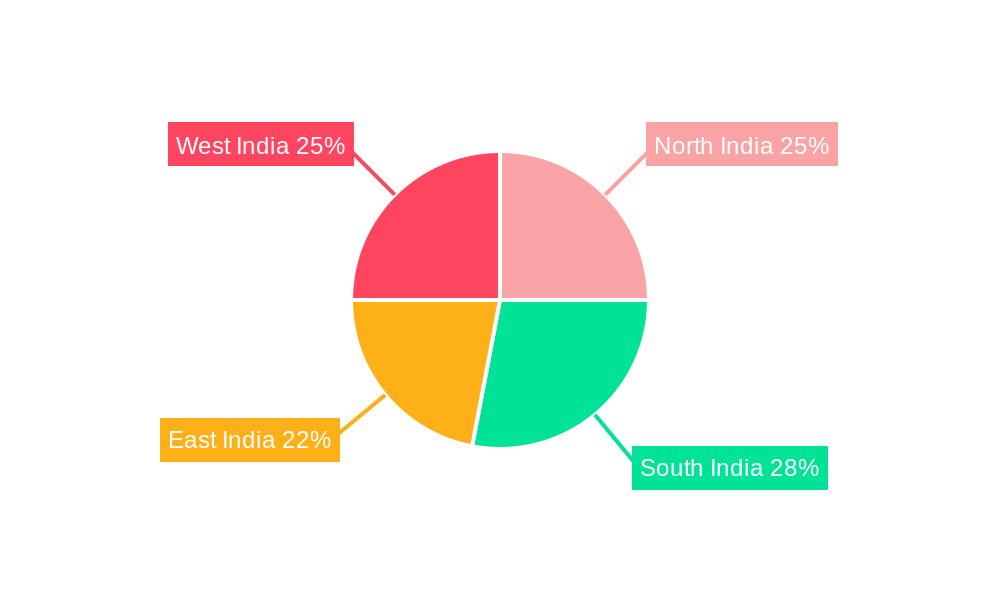

The India Network Security and Cyber Risk Management market is experiencing robust growth, projected to reach \$0.66 billion in 2025 and maintain a Compound Annual Growth Rate (CAGR) of 15.10% from 2025 to 2033. This expansion is driven by several factors. The increasing adoption of cloud computing and digital transformation initiatives across various sectors, including BFSI, healthcare, and government, necessitates robust network security solutions. Furthermore, the rising frequency and sophistication of cyberattacks, coupled with stringent data privacy regulations like the Personal Data Protection Bill, are compelling organizations to invest heavily in comprehensive cyber risk management strategies. This includes a diverse range of solutions such as SIEM, SWG, IAM, DLP, and various security services spanning network, endpoint, cloud, and wireless environments. The market's segmentation reflects this breadth, with significant demand across all identified verticals and service types. The geographical spread demonstrates a strong market presence across North, South, East, and West India, suggesting substantial opportunities for growth throughout the country.

The market's future trajectory is heavily influenced by the ongoing evolution of cyber threats. The emergence of new attack vectors, such as AI-powered malware and sophisticated phishing campaigns, necessitates continuous innovation and adaptation within the network security landscape. Consequently, we can anticipate increased adoption of advanced threat detection technologies, proactive security measures, and enhanced security awareness training programs. This will drive demand for solutions like advanced endpoint detection and response (EDR), extended detection and response (XDR), and security information and event management (SIEM) with advanced analytics capabilities. The government's continued emphasis on digital infrastructure development and cybersecurity initiatives further solidifies the long-term growth prospects of the India Network Security and Cyber Risk Management market.

India Network Security and Cyber Risk Management Market Report: 2019-2033

This comprehensive report provides an in-depth analysis of the India Network Security and Cyber Risk Management market, offering invaluable insights for stakeholders across the industry. With a study period spanning 2019-2033, a base year of 2025, and a forecast period of 2025-2033, this report is your essential guide to navigating this rapidly evolving landscape. The market is segmented by solution, service, end-user vertical, and security type, providing a granular view of current trends and future projections. Key players like Mirox Cyber Security & Technology, Netrika Consulting India Pvt Ltd, Aspirantz InfoSec, XenArmor, Lucideus Tech, Instasafe, ArraySheild Technologies, Data Resolve Technologies, and Cyberoam are analyzed for their market positioning and strategic moves. The report incorporates data from the historical period (2019-2024) and provides crucial forecasts for the future. Expect detailed analysis, data-driven insights, and actionable recommendations to help your organization thrive in the Indian network security market.

India Network Security And Cyber Risk Management Market Market Dynamics & Concentration

The Indian network security and cyber risk management market exhibits a dynamic interplay of factors influencing its concentration and growth. Market concentration is currently moderate, with a few large players holding significant shares, but a substantial number of smaller, specialized firms also competing. The market share of the top 5 players is estimated at xx%, indicating a competitive landscape. Innovation drives market growth, particularly in areas like AI-powered threat detection, cloud security, and zero-trust architectures. India's evolving regulatory framework, including the Digital Personal Data Protection Bill, is a key factor shaping market dynamics, impacting data protection and compliance needs. Product substitutes, such as open-source security tools, exert some competitive pressure. However, the increasing sophistication of cyber threats and the growing demand for robust security solutions limit the impact of these substitutes. End-user trends, like the rise of remote work and cloud adoption, significantly fuel market expansion. M&A activity remains relatively active, with xx mergers and acquisitions recorded between 2020 and 2023, primarily driven by companies seeking to expand their product portfolios and geographic reach.

- Market Concentration: Moderate, top 5 players holding xx% market share (estimated).

- Innovation Drivers: AI-powered threat detection, cloud security, zero-trust architectures.

- Regulatory Framework: Evolving regulations impacting data protection and compliance (e.g., Digital Personal Data Protection Bill).

- Product Substitutes: Open-source tools exert limited pressure due to increasing threat sophistication.

- End-User Trends: Remote work, cloud adoption, and digital transformation drive demand.

- M&A Activity: xx M&A deals between 2020 and 2023, driven by portfolio expansion and geographic reach.

India Network Security And Cyber Risk Management Market Industry Trends & Analysis

The Indian network security and cyber risk management market is experiencing robust growth, driven by a confluence of factors. The increasing adoption of cloud computing, IoT devices, and digital transformation initiatives across various sectors is a primary growth driver. This trend is projected to yield a CAGR of xx% from 2025 to 2033, significantly expanding the market size from xx Million in 2025 to xx Million by 2033. Technological disruptions, especially the proliferation of AI and ML in cybersecurity, are revolutionizing threat detection and response capabilities. Consumer preferences are shifting towards comprehensive, integrated security solutions that offer seamless protection across multiple platforms. Competitive dynamics are characterized by both intense competition and collaborative partnerships. Larger vendors are investing heavily in R&D to maintain their market leadership, while smaller firms are focusing on niche solutions and specialized services. Market penetration of advanced security solutions, such as SIEM and DLP, is gradually increasing, driven by growing awareness of cyber threats and the rising cost of data breaches.

Leading Markets & Segments in India Network Security And Cyber Risk Management Market

The Indian network security market shows robust growth across segments and verticals. While specific market share data is unavailable for each segment in this description, the following provides insights into the leading areas:

By Segment: The Security Information and Event Management (SIEM) segment is expected to be a leading market segment, followed closely by Identity and Access Management (IAM) solutions. The demand for robust security analytics and comprehensive identity management is bolstering these segments. Enterprise Content-Aware Data Loss Prevention (DLP) is also experiencing significant growth due to increasing regulatory compliance requirements.

By Solution: Identity and Access Management (IAM) solutions are expected to lead due to their role in secure access control and compliance. Data Loss Protection (DLP) is another prominent solution area, reflecting the need to safeguard sensitive data. Encryption solutions are also experiencing increasing demand.

By Service: Network security services currently hold a significant market share, but cloud security services are experiencing rapid growth, closely followed by endpoint security, reflecting the shift towards cloud-based infrastructure and the increasing number of remote workers.

By End-user Vertical: The BFSI (Banking, Financial Services, and Insurance), Government, and IT & Telecom sectors are expected to be the most significant end-users due to their sensitive data and critical infrastructure. The government’s emphasis on cybersecurity and stringent regulations for these sectors fuel this demand. The healthcare sector also presents a growing segment, with increasing concerns about data privacy and security in medical records.

Key Drivers: Economic growth, increasing digitalization, and government initiatives promoting cybersecurity are significant drivers across all segments. The availability of skilled cybersecurity professionals also influences market growth in specific regions.

India Network Security And Cyber Risk Management Market Product Developments

Recent product innovations include AI-powered threat detection systems, cloud-native security solutions, and integrated security platforms offering comprehensive protection across networks, endpoints, and cloud environments. These solutions leverage advanced analytics and machine learning to identify and respond to threats more effectively. The key competitive advantage lies in providing solutions that effectively address the evolving cyber threat landscape, offering a blend of security, usability, and scalability. The focus is shifting towards automation, simplification, and proactive threat mitigation.

Key Drivers of India Network Security And Cyber Risk Management Market Growth

Several factors contribute to the market's rapid expansion:

- Technological advancements: AI-powered threat detection, advanced encryption techniques, and cloud-based security solutions are key drivers.

- Economic growth: India's expanding digital economy fuels demand for robust cybersecurity infrastructure.

- Government initiatives: Regulatory changes and cybersecurity awareness campaigns are promoting market growth. The 'Bharat NCX 2023' exercise exemplifies this.

Challenges in the India Network Security And Cyber Risk Management Market Market

Several challenges impede market growth:

- Skill gap: A shortage of skilled cybersecurity professionals hinders the effective implementation of security solutions.

- Cost of implementation: The high cost of advanced security solutions can limit adoption, particularly for smaller businesses.

- Complex regulatory landscape: Navigating evolving data privacy regulations requires significant effort and expertise.

Emerging Opportunities in India Network Security And Cyber Risk Management Market

The Indian market presents significant opportunities for growth. The increasing adoption of cloud computing and IoT devices creates a demand for robust cloud security and IoT security solutions. Strategic partnerships between security vendors and cloud providers are also expanding the market. Government initiatives focused on cybersecurity education and training are expected to increase the availability of skilled professionals.

Leading Players in the India Network Security And Cyber Risk Management Market Sector

- Mirox Cyber Security & Technology

- Netrika Consulting India Pvt Ltd

- Aspirantz InfoSec

- XenArmor

- Lucideus Tech

- Instasafe

- ArraySheild Technologies

- Data Resolve Technologies

- Cyberoam

Key Milestones in India Network Security And Cyber Risk Management Market Industry

- December 2023: WSO2 partners with Microsoft to streamline cloud application development for Indian startups on Microsoft Azure, boosting cloud security adoption.

- October 2023: Launch of 'Bharat NCX 2023', enhancing India's cybersecurity preparedness and capabilities.

- June 2023: Government of India provides structured cybersecurity guidance to critical sectors, driving compliance and market demand.

Strategic Outlook for India Network Security And Cyber Risk Management Market Market

The future of the Indian network security market is bright. Continued digital transformation, expanding cloud adoption, and rising awareness of cybersecurity threats will drive significant growth. Strategic partnerships, investments in R&D, and the development of innovative security solutions are crucial for success in this dynamic market. The focus on proactive threat mitigation and AI-driven solutions presents significant opportunities for players who can effectively address the evolving needs of businesses and government agencies.

India Network Security And Cyber Risk Management Market Segmentation

-

1. Segment

- 1.1. Security Information and Event Management (SIEM)

- 1.2. Security Web Gateway (SWG)

- 1.3. Identity Governance and Administration (IGA)

- 1.4. Enterpri

-

2. Solution

- 2.1. Encryption

- 2.2. Identity and Access Management (IAM)

- 2.3. Data Loss Protection (DLP)

- 2.4. Intrusio

- 2.5. Other Solutions

-

3. Service

- 3.1. Network Security

- 3.2. Endpoint Security

- 3.3. Wireless Security

- 3.4. Cloud Security

- 3.5. Other Services

-

4. End-user Vertical

- 4.1. Aerospace and Defense

- 4.2. Retail

- 4.3. Government

- 4.4. Healthcare

- 4.5. IT & Telecom

- 4.6. BFSI

India Network Security And Cyber Risk Management Market Segmentation By Geography

- 1. India

India Network Security And Cyber Risk Management Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 15.10% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Government Initiatives Towards Digitizing Industries is Driving the Market Growth

- 3.3. Market Restrains

- 3.3.1. Absence of National Security Infrastructure is Discouraging the Market Growth

- 3.4. Market Trends

- 3.4.1. Intrusion Detection and Prevention System to Dominate the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. India Network Security And Cyber Risk Management Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Segment

- 5.1.1. Security Information and Event Management (SIEM)

- 5.1.2. Security Web Gateway (SWG)

- 5.1.3. Identity Governance and Administration (IGA)

- 5.1.4. Enterpri

- 5.2. Market Analysis, Insights and Forecast - by Solution

- 5.2.1. Encryption

- 5.2.2. Identity and Access Management (IAM)

- 5.2.3. Data Loss Protection (DLP)

- 5.2.4. Intrusio

- 5.2.5. Other Solutions

- 5.3. Market Analysis, Insights and Forecast - by Service

- 5.3.1. Network Security

- 5.3.2. Endpoint Security

- 5.3.3. Wireless Security

- 5.3.4. Cloud Security

- 5.3.5. Other Services

- 5.4. Market Analysis, Insights and Forecast - by End-user Vertical

- 5.4.1. Aerospace and Defense

- 5.4.2. Retail

- 5.4.3. Government

- 5.4.4. Healthcare

- 5.4.5. IT & Telecom

- 5.4.6. BFSI

- 5.5. Market Analysis, Insights and Forecast - by Region

- 5.5.1. India

- 5.1. Market Analysis, Insights and Forecast - by Segment

- 6. North India India Network Security And Cyber Risk Management Market Analysis, Insights and Forecast, 2019-2031

- 7. South India India Network Security And Cyber Risk Management Market Analysis, Insights and Forecast, 2019-2031

- 8. East India India Network Security And Cyber Risk Management Market Analysis, Insights and Forecast, 2019-2031

- 9. West India India Network Security And Cyber Risk Management Market Analysis, Insights and Forecast, 2019-2031

- 10. Competitive Analysis

- 10.1. Market Share Analysis 2024

- 10.2. Company Profiles

- 10.2.1 Mirox Cyber Security & Technology*List Not Exhaustive

- 10.2.1.1. Overview

- 10.2.1.2. Products

- 10.2.1.3. SWOT Analysis

- 10.2.1.4. Recent Developments

- 10.2.1.5. Financials (Based on Availability)

- 10.2.2 Netrika Consulting India Pvt Ltd

- 10.2.2.1. Overview

- 10.2.2.2. Products

- 10.2.2.3. SWOT Analysis

- 10.2.2.4. Recent Developments

- 10.2.2.5. Financials (Based on Availability)

- 10.2.3 Aspirantz InfoSec

- 10.2.3.1. Overview

- 10.2.3.2. Products

- 10.2.3.3. SWOT Analysis

- 10.2.3.4. Recent Developments

- 10.2.3.5. Financials (Based on Availability)

- 10.2.4 XenArmor

- 10.2.4.1. Overview

- 10.2.4.2. Products

- 10.2.4.3. SWOT Analysis

- 10.2.4.4. Recent Developments

- 10.2.4.5. Financials (Based on Availability)

- 10.2.5 Lucideus Tech

- 10.2.5.1. Overview

- 10.2.5.2. Products

- 10.2.5.3. SWOT Analysis

- 10.2.5.4. Recent Developments

- 10.2.5.5. Financials (Based on Availability)

- 10.2.6 Instasafe

- 10.2.6.1. Overview

- 10.2.6.2. Products

- 10.2.6.3. SWOT Analysis

- 10.2.6.4. Recent Developments

- 10.2.6.5. Financials (Based on Availability)

- 10.2.7 ArraySheild Technologies

- 10.2.7.1. Overview

- 10.2.7.2. Products

- 10.2.7.3. SWOT Analysis

- 10.2.7.4. Recent Developments

- 10.2.7.5. Financials (Based on Availability)

- 10.2.8 Data Resolve Technologies

- 10.2.8.1. Overview

- 10.2.8.2. Products

- 10.2.8.3. SWOT Analysis

- 10.2.8.4. Recent Developments

- 10.2.8.5. Financials (Based on Availability)

- 10.2.9 Cyberoam

- 10.2.9.1. Overview

- 10.2.9.2. Products

- 10.2.9.3. SWOT Analysis

- 10.2.9.4. Recent Developments

- 10.2.9.5. Financials (Based on Availability)

- 10.2.1 Mirox Cyber Security & Technology*List Not Exhaustive

List of Figures

- Figure 1: India Network Security And Cyber Risk Management Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: India Network Security And Cyber Risk Management Market Share (%) by Company 2024

List of Tables

- Table 1: India Network Security And Cyber Risk Management Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: India Network Security And Cyber Risk Management Market Revenue Million Forecast, by Segment 2019 & 2032

- Table 3: India Network Security And Cyber Risk Management Market Revenue Million Forecast, by Solution 2019 & 2032

- Table 4: India Network Security And Cyber Risk Management Market Revenue Million Forecast, by Service 2019 & 2032

- Table 5: India Network Security And Cyber Risk Management Market Revenue Million Forecast, by End-user Vertical 2019 & 2032

- Table 6: India Network Security And Cyber Risk Management Market Revenue Million Forecast, by Region 2019 & 2032

- Table 7: India Network Security And Cyber Risk Management Market Revenue Million Forecast, by Country 2019 & 2032

- Table 8: North India India Network Security And Cyber Risk Management Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: South India India Network Security And Cyber Risk Management Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: East India India Network Security And Cyber Risk Management Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 11: West India India Network Security And Cyber Risk Management Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 12: India Network Security And Cyber Risk Management Market Revenue Million Forecast, by Segment 2019 & 2032

- Table 13: India Network Security And Cyber Risk Management Market Revenue Million Forecast, by Solution 2019 & 2032

- Table 14: India Network Security And Cyber Risk Management Market Revenue Million Forecast, by Service 2019 & 2032

- Table 15: India Network Security And Cyber Risk Management Market Revenue Million Forecast, by End-user Vertical 2019 & 2032

- Table 16: India Network Security And Cyber Risk Management Market Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the India Network Security And Cyber Risk Management Market?

The projected CAGR is approximately 15.10%.

2. Which companies are prominent players in the India Network Security And Cyber Risk Management Market?

Key companies in the market include Mirox Cyber Security & Technology*List Not Exhaustive, Netrika Consulting India Pvt Ltd, Aspirantz InfoSec, XenArmor, Lucideus Tech, Instasafe, ArraySheild Technologies, Data Resolve Technologies, Cyberoam.

3. What are the main segments of the India Network Security And Cyber Risk Management Market?

The market segments include Segment, Solution, Service, End-user Vertical.

4. Can you provide details about the market size?

The market size is estimated to be USD 0.66 Million as of 2022.

5. What are some drivers contributing to market growth?

Government Initiatives Towards Digitizing Industries is Driving the Market Growth.

6. What are the notable trends driving market growth?

Intrusion Detection and Prevention System to Dominate the Market.

7. Are there any restraints impacting market growth?

Absence of National Security Infrastructure is Discouraging the Market Growth.

8. Can you provide examples of recent developments in the market?

December 2023 - WSO2, a customer identity and access management (CIAM) services provider, partnered with Microsoft to streamline cloud application development for Indian startups on Microsoft Azure using WSO2's cloud-native internal developer platform on Azure, Choreo. Choreo provides startups access to essential tools, reducing time and costs. The collaboration aims to provide startups with tools and support to accelerate their journey from concept to product.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "India Network Security And Cyber Risk Management Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the India Network Security And Cyber Risk Management Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the India Network Security And Cyber Risk Management Market?

To stay informed about further developments, trends, and reports in the India Network Security And Cyber Risk Management Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence