Key Insights

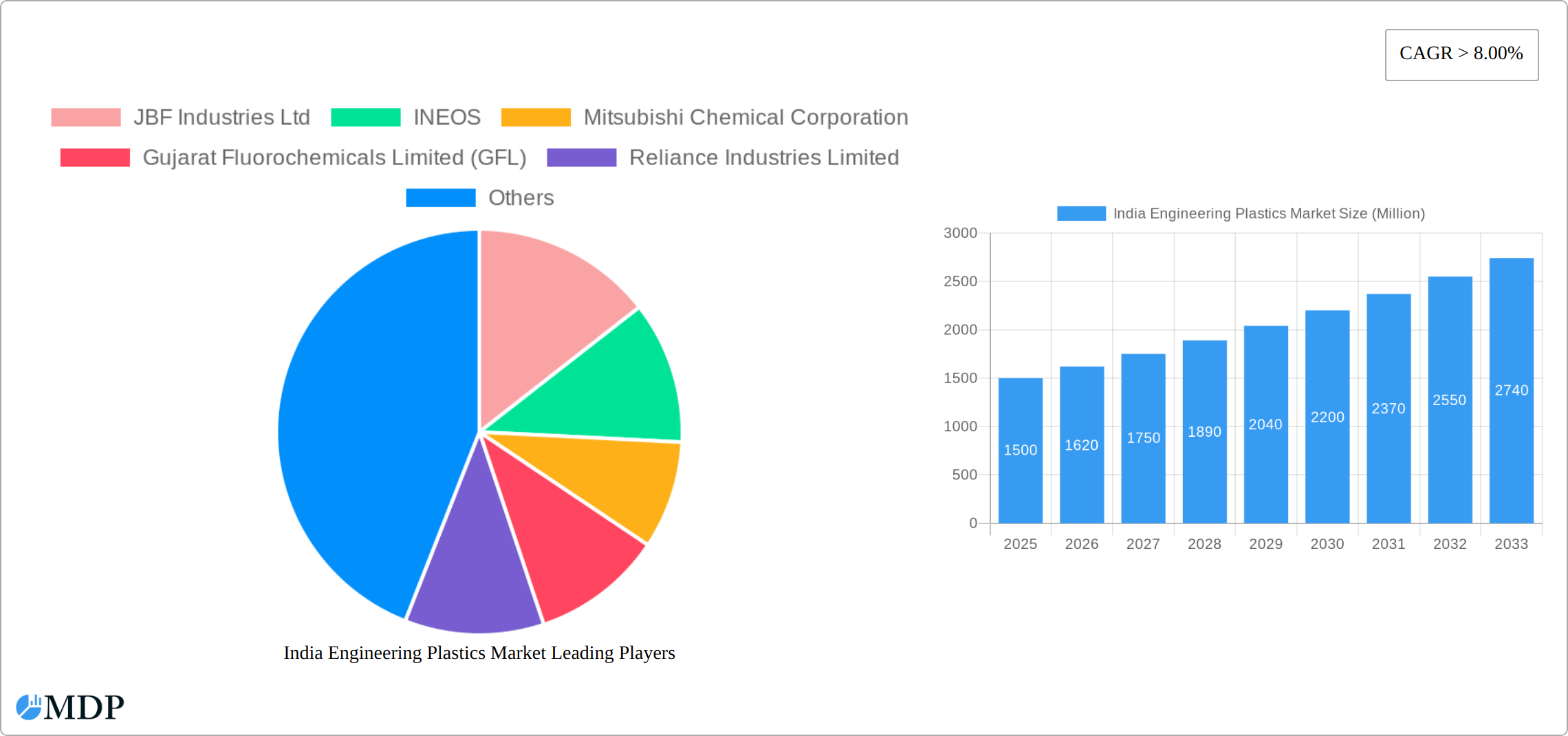

The India engineering plastics market is experiencing robust growth, projected to maintain a CAGR exceeding 8% from 2025 to 2033. This expansion is driven by several key factors. Firstly, the burgeoning automotive and electrical & electronics sectors in India are significantly increasing demand for high-performance engineering plastics. The nation's expanding infrastructure development, particularly in building and construction, further fuels market growth. Secondly, the rising adoption of lightweight materials in various applications, coupled with increasing government initiatives promoting sustainable manufacturing practices, is positively impacting market dynamics. The diverse resin types available, including fluoropolymers, polyamides, and PBT, cater to a wide range of applications, contributing to market breadth. However, price volatility of raw materials and potential supply chain disruptions pose challenges. Furthermore, the market faces competition from traditional materials like metals, limiting immediate market penetration in certain segments. Nevertheless, the long-term outlook remains optimistic, driven by continuous technological advancements, the emergence of novel resin types, and the increasing focus on product innovation.

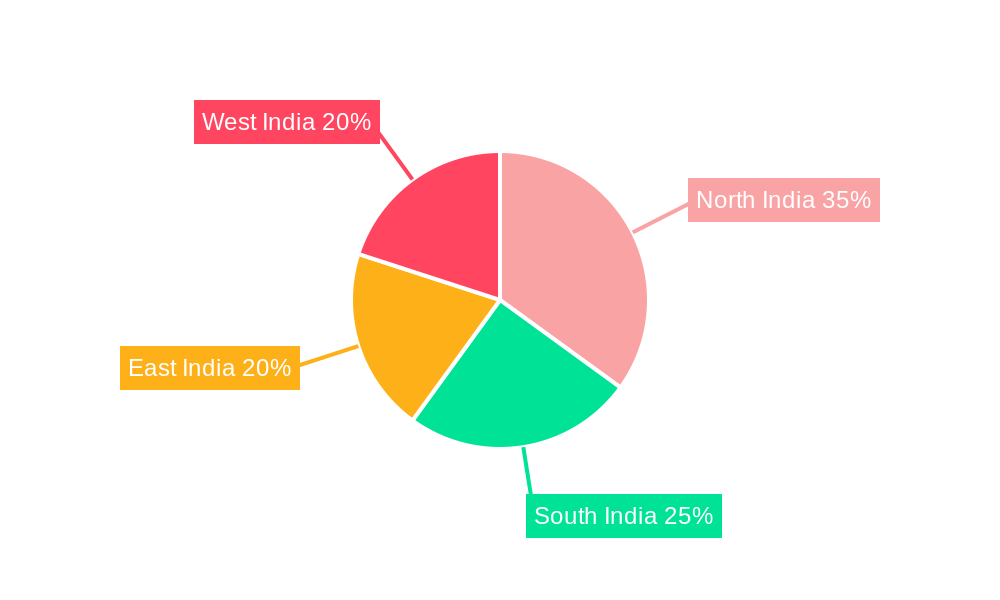

Major players like JBF Industries, Ineos, and Reliance Industries are strategically investing in capacity expansion and R&D to capitalize on the growing demand. The market is segmented by end-user industry (aerospace, automotive, building & construction, etc.) and resin type (fluoropolymer, polyamide, PBT, etc.), offering varied investment opportunities. Regional variations exist, with potentially higher growth rates anticipated in regions experiencing rapid industrialization. While specific regional market shares are not provided, it is reasonable to assume that regions like West and North India, known for their industrial hubs, will dominate market share. Understanding these intricate dynamics is crucial for businesses to navigate the competitive landscape effectively and achieve sustained success in the expanding India engineering plastics market.

India Engineering Plastics Market: A Comprehensive Report (2019-2033)

This comprehensive report provides an in-depth analysis of the India Engineering Plastics Market, offering invaluable insights for stakeholders across the value chain. With a study period spanning 2019-2033, a base year of 2025, and a forecast period of 2025-2033, this report leverages historical data (2019-2024) to project future market trends and opportunities. The report covers key segments, leading players, and emerging trends, enabling informed strategic decision-making. Market values are expressed in Million.

India Engineering Plastics Market Market Dynamics & Concentration

The India engineering plastics market exhibits a moderately concentrated landscape, with a few major players holding significant market share. The market's dynamics are shaped by several key factors, including:

- Innovation Drivers: Continuous research and development leading to the introduction of high-performance, specialized plastics with enhanced properties like durability, heat resistance, and lightweight characteristics fuel market growth.

- Regulatory Frameworks: Government regulations concerning material safety and environmental sustainability influence material choices and production processes. Stringent emission standards are driving the adoption of eco-friendly engineering plastics.

- Product Substitutes: Competition from alternative materials like metals and composites influences market share. However, the superior properties of engineering plastics in several applications maintain a strong market position.

- End-User Trends: Growth across various sectors, including automotive, electronics, and construction, acts as a key driver of market expansion. Increasing demand for lightweight and high-performance components is a significant growth factor.

- Mergers & Acquisitions (M&A) Activities: Consolidation within the industry through strategic acquisitions and mergers is anticipated to increase market concentration and drive innovation. The number of M&A deals in the last five years is estimated at xx. Market share held by the top 5 players is estimated at xx%.

India Engineering Plastics Market Industry Trends & Analysis

The Indian engineering plastics market is experiencing robust growth, fueled by a confluence of factors including the burgeoning automotive and electronics sectors, escalating infrastructural investments, and a rising middle class with increased disposable income. The market's Compound Annual Growth Rate (CAGR) during the forecast period (2025-2033) is projected to be significantly high. This robust growth is further propelled by several key elements:

- Technological Advancements: The integration of cutting-edge manufacturing techniques such as 3D printing, additive manufacturing, and injection molding is expanding the applications of engineering plastics into diverse sectors, from aerospace to medical devices. This enables the creation of complex, lightweight, and highly customized components.

- Evolving Consumer Preferences: A growing preference for lightweight, durable, aesthetically pleasing, and sustainable products is driving demand for high-performance engineering plastics across diverse applications. Consumers are increasingly conscious of environmental impact, pushing manufacturers to adopt eco-friendly materials and processes.

- Competitive Landscape: Intense competition among established players and the emergence of new entrants are stimulating innovation and strategic investments. Price competitiveness remains a factor, but product differentiation based on performance, sustainability, and specialized applications is proving crucial for gaining market share. The market penetration of high-performance engineering plastics is steadily increasing, reaching an estimated [Insert Updated Percentage]% in 2025.

- Government Initiatives: Supportive government policies focused on infrastructure development, "Make in India" initiatives, and promoting domestic manufacturing are further boosting market growth by reducing reliance on imports and encouraging local production.

Leading Markets & Segments in India Engineering Plastics Market

The automotive sector holds a dominant position as the largest end-user industry for engineering plastics in India, closely followed by the electrical and electronics industry. Within resin types, Polybutylene Terephthalate (PBT) and Polycarbonate (PC) enjoy significant market share due to their versatility and performance characteristics.

Key Drivers by Segment:

- Automotive: Stringent fuel efficiency regulations and the rising popularity of electric vehicles are driving demand for lightweight and high-performance engineering plastics.

- Electrical & Electronics: The expanding electronics manufacturing industry, particularly in mobile devices and consumer electronics, is a major driver of growth for engineering plastics.

- Building & Construction: The ongoing infrastructural development in India fuels demand for durable and long-lasting engineering plastics in construction applications.

Dominance Analysis:

The dominance of the automotive and electrical & electronics segments stems from the high volume of applications requiring high-performance materials. PBT and PC's versatility in various applications ensures their sustained market leadership. However, growth is also expected in other segments like aerospace and packaging due to specialized application requirements.

India Engineering Plastics Market Product Developments

Recent years have witnessed remarkable advancements in engineering plastics, characterized by a focus on enhanced material properties, improved sustainability, and optimized processing capabilities. Key developments include the introduction of bio-based engineering plastics derived from renewable resources, increased incorporation of recycled content to minimize environmental impact, and the development of specialized compounds tailored for specific high-performance applications requiring superior strength, heat resistance, or chemical resistance. These innovations are directly responding to the growing demand for sustainable and high-performance materials, thereby enhancing the competitiveness of engineering plastics in diverse sectors.

Key Drivers of India Engineering Plastics Market Growth

Several synergistic factors are contributing to the market's impressive growth trajectory. Rapid technological advancements are continuously leading to the development of new materials with superior properties and enhanced functionalities. The expanding automotive and electronics sectors, along with the construction and packaging industries, represent significant growth drivers. Favorable government policies promoting manufacturing, infrastructure development, and sustainable practices are further catalyzing market expansion. Furthermore, the increasing adoption of engineering plastics in renewable energy technologies is creating new avenues for market growth.

Challenges in the India Engineering Plastics Market Market

The market faces challenges like fluctuating raw material prices, the complexities of managing global supply chains, and competition from alternative materials. These issues can influence production costs and affect market stability.

Emerging Opportunities in India Engineering Plastics Market

The market presents significant opportunities. Technological breakthroughs, such as the development of sustainable and bio-based materials, offer avenues for innovation and growth. Strategic collaborations between manufacturers and end-users can further unlock market potential. Expansion into niche markets, like aerospace and medical devices, could also drive significant growth.

Leading Players in the India Engineering Plastics Market Sector

- JBF Industries Ltd

- INEOS

- Mitsubishi Chemical Corporation

- Gujarat Fluorochemicals Limited (GFL)

- Reliance Industries Limited

- Gujarat State Fertilizers & Chemicals Limited (GSFC)

- LANXESS

- DuPont

- Ester Industries Limited

- IVL Dhunseri Petrochem Industries Private Limited (IDPIPL)

- Polyplex

- Chiripal Poly Film

- Bhansali Engineering Polymers Limited

- Solva

- Hindustan Fluorocarbons Limited

Key Milestones in India Engineering Plastics Market Industry

- September 2022: LANXESS launched Durethan ECO, a sustainable polyamide resin using recycled glass fibers.

- September 2022: LANXESS introduced Pocan E, a PBT compound for e-mobility and electronics.

- August 2022: INEOS expanded its Novodur ABS product line with Novodur E3TZ for extrusion applications.

Strategic Outlook for India Engineering Plastics Market Market

The India engineering plastics market is poised for continued growth, driven by technological advancements and increasing demand from key sectors. Strategic investments in research and development, focus on sustainable materials, and strategic partnerships will be crucial for players seeking to capitalize on the market's potential. Expansion into new applications and markets will also play a significant role in shaping the market's future.

India Engineering Plastics Market Segmentation

-

1. End User Industry

- 1.1. Aerospace

- 1.2. Automotive

- 1.3. Building and Construction

- 1.4. Electrical and Electronics

- 1.5. Industrial and Machinery

- 1.6. Packaging

- 1.7. Other End-user Industries

-

2. Resin Type

-

2.1. Fluoropolymer

-

2.1.1. By Sub Resin Type

- 2.1.1.1. Ethylenetetrafluoroethylene (ETFE)

- 2.1.1.2. Fluorinated Ethylene-propylene (FEP)

- 2.1.1.3. Polytetrafluoroethylene (PTFE)

- 2.1.1.4. Polyvinylfluoride (PVF)

- 2.1.1.5. Polyvinylidene Fluoride (PVDF)

- 2.1.1.6. Other Sub Resin Types

-

2.1.1. By Sub Resin Type

- 2.2. Liquid Crystal Polymer (LCP)

-

2.3. Polyamide (PA)

- 2.3.1. Aramid

- 2.3.2. Polyamide (PA) 6

- 2.3.3. Polyamide (PA) 66

- 2.3.4. Polyphthalamide

- 2.4. Polybutylene Terephthalate (PBT)

- 2.5. Polycarbonate (PC)

- 2.6. Polyether Ether Ketone (PEEK)

- 2.7. Polyethylene Terephthalate (PET)

- 2.8. Polyimide (PI)

- 2.9. Polymethyl Methacrylate (PMMA)

- 2.10. Polyoxymethylene (POM)

- 2.11. Styrene Copolymers (ABS and SAN)

-

2.1. Fluoropolymer

India Engineering Plastics Market Segmentation By Geography

- 1. India

India Engineering Plastics Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of > 8.00% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Growing Demand in Automotive Industry; Rising Use in Electronics and Electrical Applications

- 3.3. Market Restrains

- 3.3.1. Fluctuating Raw Material Prices

- 3.4. Market Trends

- 3.4.1. Increased Focus on High-Performance Materials

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. India Engineering Plastics Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by End User Industry

- 5.1.1. Aerospace

- 5.1.2. Automotive

- 5.1.3. Building and Construction

- 5.1.4. Electrical and Electronics

- 5.1.5. Industrial and Machinery

- 5.1.6. Packaging

- 5.1.7. Other End-user Industries

- 5.2. Market Analysis, Insights and Forecast - by Resin Type

- 5.2.1. Fluoropolymer

- 5.2.1.1. By Sub Resin Type

- 5.2.1.1.1. Ethylenetetrafluoroethylene (ETFE)

- 5.2.1.1.2. Fluorinated Ethylene-propylene (FEP)

- 5.2.1.1.3. Polytetrafluoroethylene (PTFE)

- 5.2.1.1.4. Polyvinylfluoride (PVF)

- 5.2.1.1.5. Polyvinylidene Fluoride (PVDF)

- 5.2.1.1.6. Other Sub Resin Types

- 5.2.1.1. By Sub Resin Type

- 5.2.2. Liquid Crystal Polymer (LCP)

- 5.2.3. Polyamide (PA)

- 5.2.3.1. Aramid

- 5.2.3.2. Polyamide (PA) 6

- 5.2.3.3. Polyamide (PA) 66

- 5.2.3.4. Polyphthalamide

- 5.2.4. Polybutylene Terephthalate (PBT)

- 5.2.5. Polycarbonate (PC)

- 5.2.6. Polyether Ether Ketone (PEEK)

- 5.2.7. Polyethylene Terephthalate (PET)

- 5.2.8. Polyimide (PI)

- 5.2.9. Polymethyl Methacrylate (PMMA)

- 5.2.10. Polyoxymethylene (POM)

- 5.2.11. Styrene Copolymers (ABS and SAN)

- 5.2.1. Fluoropolymer

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. India

- 5.1. Market Analysis, Insights and Forecast - by End User Industry

- 6. North India India Engineering Plastics Market Analysis, Insights and Forecast, 2019-2031

- 7. South India India Engineering Plastics Market Analysis, Insights and Forecast, 2019-2031

- 8. East India India Engineering Plastics Market Analysis, Insights and Forecast, 2019-2031

- 9. West India India Engineering Plastics Market Analysis, Insights and Forecast, 2019-2031

- 10. Competitive Analysis

- 10.1. Market Share Analysis 2024

- 10.2. Company Profiles

- 10.2.1 JBF Industries Ltd

- 10.2.1.1. Overview

- 10.2.1.2. Products

- 10.2.1.3. SWOT Analysis

- 10.2.1.4. Recent Developments

- 10.2.1.5. Financials (Based on Availability)

- 10.2.2 INEOS

- 10.2.2.1. Overview

- 10.2.2.2. Products

- 10.2.2.3. SWOT Analysis

- 10.2.2.4. Recent Developments

- 10.2.2.5. Financials (Based on Availability)

- 10.2.3 Mitsubishi Chemical Corporation

- 10.2.3.1. Overview

- 10.2.3.2. Products

- 10.2.3.3. SWOT Analysis

- 10.2.3.4. Recent Developments

- 10.2.3.5. Financials (Based on Availability)

- 10.2.4 Gujarat Fluorochemicals Limited (GFL)

- 10.2.4.1. Overview

- 10.2.4.2. Products

- 10.2.4.3. SWOT Analysis

- 10.2.4.4. Recent Developments

- 10.2.4.5. Financials (Based on Availability)

- 10.2.5 Reliance Industries Limited

- 10.2.5.1. Overview

- 10.2.5.2. Products

- 10.2.5.3. SWOT Analysis

- 10.2.5.4. Recent Developments

- 10.2.5.5. Financials (Based on Availability)

- 10.2.6 Gujarat State Fertilizers & Chemicals Limited (GSFC)

- 10.2.6.1. Overview

- 10.2.6.2. Products

- 10.2.6.3. SWOT Analysis

- 10.2.6.4. Recent Developments

- 10.2.6.5. Financials (Based on Availability)

- 10.2.7 LANXESS

- 10.2.7.1. Overview

- 10.2.7.2. Products

- 10.2.7.3. SWOT Analysis

- 10.2.7.4. Recent Developments

- 10.2.7.5. Financials (Based on Availability)

- 10.2.8 DuPont

- 10.2.8.1. Overview

- 10.2.8.2. Products

- 10.2.8.3. SWOT Analysis

- 10.2.8.4. Recent Developments

- 10.2.8.5. Financials (Based on Availability)

- 10.2.9 Ester Industries Limited

- 10.2.9.1. Overview

- 10.2.9.2. Products

- 10.2.9.3. SWOT Analysis

- 10.2.9.4. Recent Developments

- 10.2.9.5. Financials (Based on Availability)

- 10.2.10 IVL Dhunseri Petrochem Industries Private Limited (IDPIPL)

- 10.2.10.1. Overview

- 10.2.10.2. Products

- 10.2.10.3. SWOT Analysis

- 10.2.10.4. Recent Developments

- 10.2.10.5. Financials (Based on Availability)

- 10.2.11 Polyplex

- 10.2.11.1. Overview

- 10.2.11.2. Products

- 10.2.11.3. SWOT Analysis

- 10.2.11.4. Recent Developments

- 10.2.11.5. Financials (Based on Availability)

- 10.2.12 Chiripal Poly Film

- 10.2.12.1. Overview

- 10.2.12.2. Products

- 10.2.12.3. SWOT Analysis

- 10.2.12.4. Recent Developments

- 10.2.12.5. Financials (Based on Availability)

- 10.2.13 Bhansali Engineering Polymers Limited

- 10.2.13.1. Overview

- 10.2.13.2. Products

- 10.2.13.3. SWOT Analysis

- 10.2.13.4. Recent Developments

- 10.2.13.5. Financials (Based on Availability)

- 10.2.14 Solva

- 10.2.14.1. Overview

- 10.2.14.2. Products

- 10.2.14.3. SWOT Analysis

- 10.2.14.4. Recent Developments

- 10.2.14.5. Financials (Based on Availability)

- 10.2.15 Hindustan Fluorocarbons Limited

- 10.2.15.1. Overview

- 10.2.15.2. Products

- 10.2.15.3. SWOT Analysis

- 10.2.15.4. Recent Developments

- 10.2.15.5. Financials (Based on Availability)

- 10.2.1 JBF Industries Ltd

List of Figures

- Figure 1: India Engineering Plastics Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: India Engineering Plastics Market Share (%) by Company 2024

List of Tables

- Table 1: India Engineering Plastics Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: India Engineering Plastics Market Volume K Tons Forecast, by Region 2019 & 2032

- Table 3: India Engineering Plastics Market Revenue Million Forecast, by End User Industry 2019 & 2032

- Table 4: India Engineering Plastics Market Volume K Tons Forecast, by End User Industry 2019 & 2032

- Table 5: India Engineering Plastics Market Revenue Million Forecast, by Resin Type 2019 & 2032

- Table 6: India Engineering Plastics Market Volume K Tons Forecast, by Resin Type 2019 & 2032

- Table 7: India Engineering Plastics Market Revenue Million Forecast, by Region 2019 & 2032

- Table 8: India Engineering Plastics Market Volume K Tons Forecast, by Region 2019 & 2032

- Table 9: India Engineering Plastics Market Revenue Million Forecast, by Country 2019 & 2032

- Table 10: India Engineering Plastics Market Volume K Tons Forecast, by Country 2019 & 2032

- Table 11: North India India Engineering Plastics Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 12: North India India Engineering Plastics Market Volume (K Tons) Forecast, by Application 2019 & 2032

- Table 13: South India India Engineering Plastics Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 14: South India India Engineering Plastics Market Volume (K Tons) Forecast, by Application 2019 & 2032

- Table 15: East India India Engineering Plastics Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 16: East India India Engineering Plastics Market Volume (K Tons) Forecast, by Application 2019 & 2032

- Table 17: West India India Engineering Plastics Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 18: West India India Engineering Plastics Market Volume (K Tons) Forecast, by Application 2019 & 2032

- Table 19: India Engineering Plastics Market Revenue Million Forecast, by End User Industry 2019 & 2032

- Table 20: India Engineering Plastics Market Volume K Tons Forecast, by End User Industry 2019 & 2032

- Table 21: India Engineering Plastics Market Revenue Million Forecast, by Resin Type 2019 & 2032

- Table 22: India Engineering Plastics Market Volume K Tons Forecast, by Resin Type 2019 & 2032

- Table 23: India Engineering Plastics Market Revenue Million Forecast, by Country 2019 & 2032

- Table 24: India Engineering Plastics Market Volume K Tons Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the India Engineering Plastics Market?

The projected CAGR is approximately > 8.00%.

2. Which companies are prominent players in the India Engineering Plastics Market?

Key companies in the market include JBF Industries Ltd, INEOS, Mitsubishi Chemical Corporation, Gujarat Fluorochemicals Limited (GFL), Reliance Industries Limited, Gujarat State Fertilizers & Chemicals Limited (GSFC), LANXESS, DuPont, Ester Industries Limited, IVL Dhunseri Petrochem Industries Private Limited (IDPIPL), Polyplex, Chiripal Poly Film, Bhansali Engineering Polymers Limited, Solva, Hindustan Fluorocarbons Limited.

3. What are the main segments of the India Engineering Plastics Market?

The market segments include End User Industry, Resin Type.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Growing Demand in Automotive Industry; Rising Use in Electronics and Electrical Applications.

6. What are the notable trends driving market growth?

Increased Focus on High-Performance Materials.

7. Are there any restraints impacting market growth?

Fluctuating Raw Material Prices.

8. Can you provide examples of recent developments in the market?

September 2022: LANXESS introduced a sustainable polyamide resin, Durethan ECO, which consists of recycled fibers made from waste glass to reduce its carbon footprint.September 2022: LANXESS introduced Pocan E, a new polybutylene terephthalate (PBT) compound with excellent tracking resistance that is particularly suited to applications in e-mobility and the electrical and electronics industry.August 2022: INEOS announced the introduction of an extension to its high-performance Novodur line of specialty ABS products. The new Novodur E3TZ is an extrusion grade that is suitable for a variety of applications, including food trays, sanitary applications, and suitcases.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in K Tons.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "India Engineering Plastics Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the India Engineering Plastics Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the India Engineering Plastics Market?

To stay informed about further developments, trends, and reports in the India Engineering Plastics Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence