Key Insights

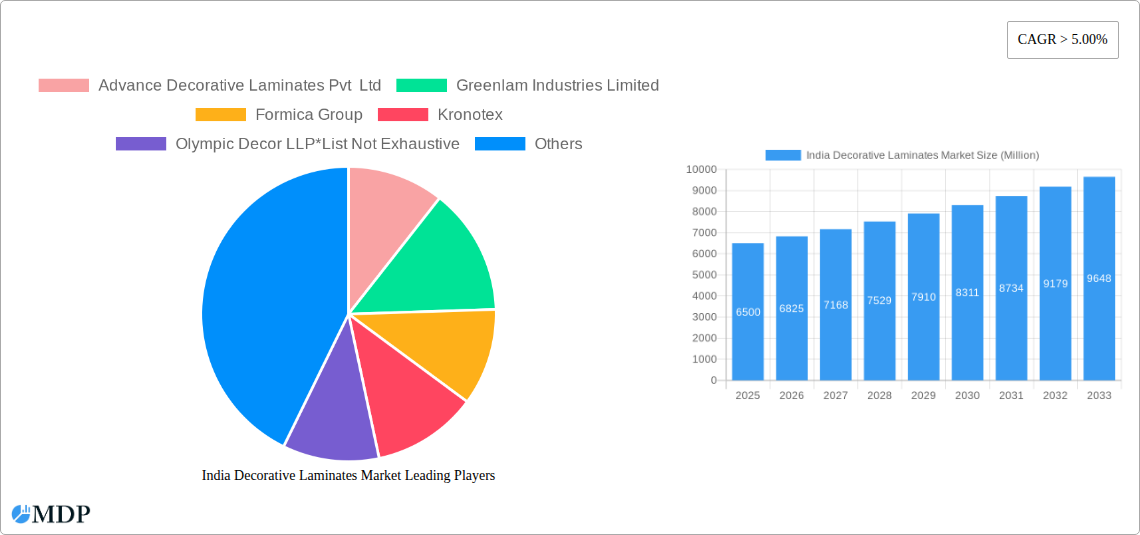

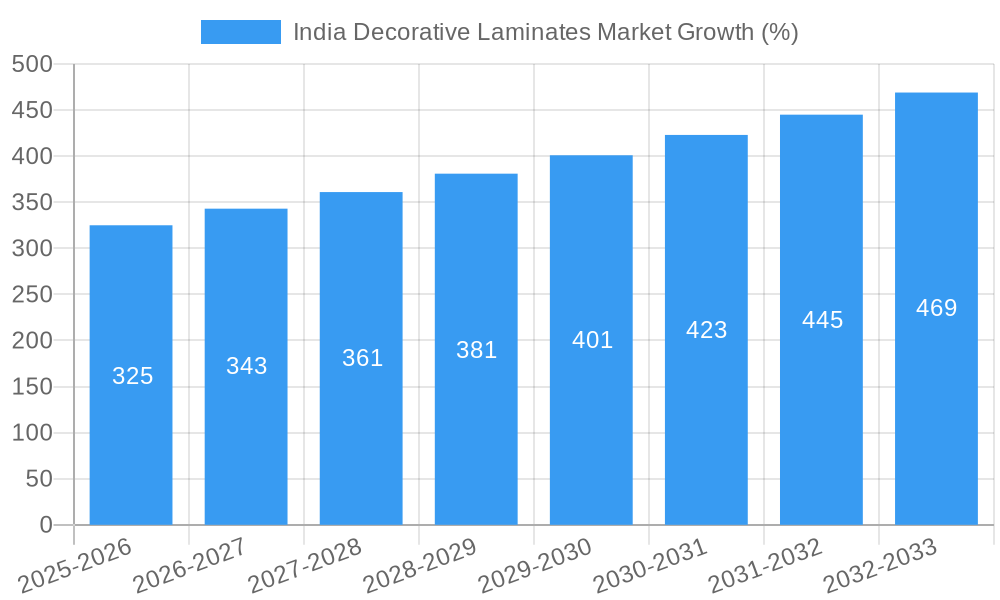

The India decorative laminates market is experiencing robust growth, driven by a surge in construction activity, particularly in the residential and commercial sectors. The rising disposable incomes and urbanization are fueling demand for aesthetically pleasing and durable interior solutions, making decorative laminates a preferred choice for furniture, cabinets, flooring, and wall panels. A CAGR exceeding 5% indicates a consistent expansion, projected to continue through 2033. The market is segmented by raw materials (plastic resins, overlays, adhesives, wood substrates), applications (furniture, cabinets, flooring, wall panels, tabletops, countertops), and end-user industries (residential, non-residential, transportation). While the residential segment currently holds a larger market share, the non-residential sector shows significant growth potential, driven by commercial construction projects and infrastructure development. Key players like Greenlam Industries, Formica Group, and Advance Decorative Laminates are actively shaping the market landscape through product innovation and expansion strategies. The increasing adoption of eco-friendly laminates is also a prominent trend, reflecting a growing consumer preference for sustainable products. However, challenges such as fluctuating raw material prices and potential supply chain disruptions could influence market growth. Considering the current market size and projected CAGR, a reasonable estimation suggests a market value exceeding ₹10,000 million (approximately $1.2 billion USD) by 2033, assuming a consistent growth trajectory.

The diverse applications of decorative laminates across various sectors contribute significantly to the market's overall growth. The increasing preference for customized and aesthetically appealing interiors in both residential and commercial spaces fuels the demand for innovative designs and textures. Furthermore, the durability and cost-effectiveness of decorative laminates compared to other materials make them an attractive option for consumers and businesses. The competitive landscape is characterized by both domestic and international players, leading to increased product innovation and market penetration. Government initiatives promoting sustainable building practices and infrastructure development are likely to positively impact the market in the coming years. However, challenges related to maintaining consistent quality and addressing potential environmental concerns associated with certain raw materials necessitate a focus on sustainable manufacturing practices. Continued expansion into untapped markets such as transportation and specialized applications will further contribute to the growth of the India decorative laminates market.

India Decorative Laminates Market: A Comprehensive Report (2019-2033)

This comprehensive report provides an in-depth analysis of the India Decorative Laminates Market, offering invaluable insights for stakeholders across the value chain. Covering the period 2019-2033, with a focus on 2025, this study meticulously examines market dynamics, industry trends, leading segments, and key players, equipping businesses with the knowledge to navigate the evolving landscape and capitalize on emerging opportunities. The report utilizes data from the historical period (2019-2024), the base year (2025), and forecasts up to 2033.

India Decorative Laminates Market Dynamics & Concentration

The India decorative laminates market exhibits a moderately concentrated structure, with a few major players commanding significant market share. Advance Decorative Laminates Pvt Ltd, Greenlam Industries Limited, Formica Group, and Kronotex are some of the key players, collectively holding an estimated xx% market share in 2025. However, the market also accommodates numerous smaller regional players and emerging brands. Innovation in surface textures, finishes (like matte, high-gloss, and woodgrains), and sustainable materials are key drivers. Stringent environmental regulations regarding volatile organic compounds (VOCs) and sustainable sourcing are shaping the market, while increasing urbanization and a growing construction sector fuel demand. Product substitutes, such as engineered stone and tiles, pose competitive pressure, though decorative laminates retain an advantage in cost-effectiveness and design versatility. M&A activity has been moderate in recent years, with approximately xx deals recorded between 2019 and 2024. End-user trends favour aesthetically appealing and durable laminates for diverse applications, driving innovation and expansion in the market.

- Market Concentration: Moderately concentrated, with top players holding xx% market share in 2025.

- Innovation Drivers: Sustainable materials, diverse surface textures and finishes.

- Regulatory Framework: Environmental regulations concerning VOC emissions and sustainable sourcing.

- Product Substitutes: Engineered stone, tiles.

- End-User Trends: Preference for aesthetically pleasing and durable laminates.

- M&A Activity: Approximately xx deals between 2019 and 2024.

India Decorative Laminates Market Industry Trends & Analysis

The India decorative laminates market is experiencing robust growth, driven by factors such as rising disposable incomes, rapid urbanization, and increased construction activity. The market is projected to register a CAGR of xx% during the forecast period (2025-2033). Technological advancements, including the introduction of antimicrobial laminates and digitally printed designs, are further propelling growth. Consumer preferences are shifting towards high-quality, durable, and aesthetically pleasing laminates, reflecting a trend towards enhanced interior design. Competitive dynamics are characterized by both price competition and innovation-driven differentiation, with leading players investing heavily in R&D and expanding their product portfolios. Market penetration of decorative laminates in various applications is increasing steadily, particularly within the residential sector. The increasing adoption of sustainable and eco-friendly laminates is also contributing to the market's growth. The residential segment is expected to contribute the highest share of revenue in the coming years.

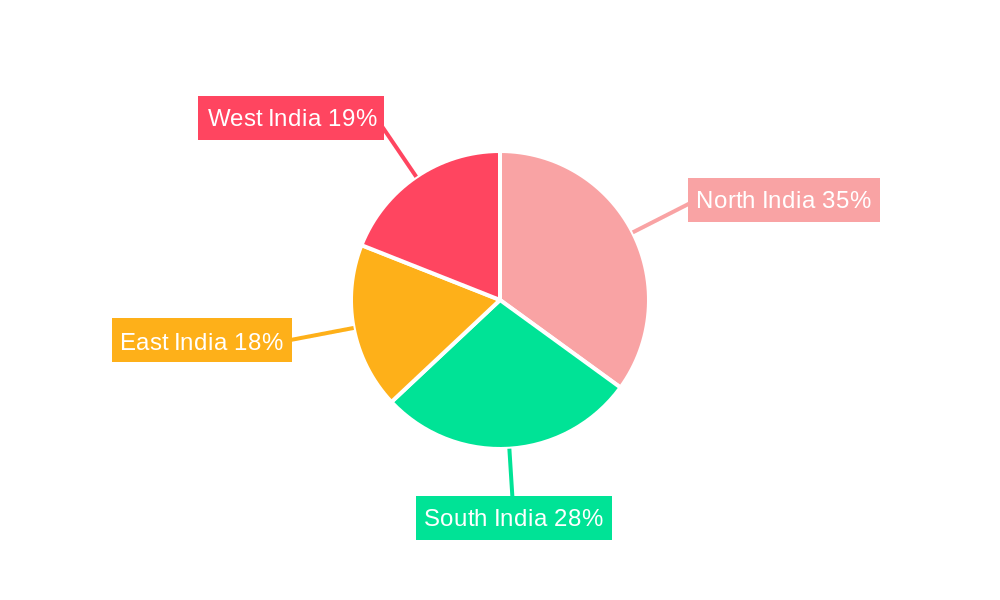

Leading Markets & Segments in India Decorative Laminates Market

The residential sector dominates the India decorative laminates market, accounting for an estimated xx% of total consumption in 2025. This dominance is fueled by rising disposable incomes, increasing urbanization, and a preference for modern and aesthetically pleasing interiors. Within raw materials, plastic resin is the most significant component, followed by overlays and adhesives. The furniture application segment leads the way in terms of consumption, followed by cabinets and flooring. Regionally, major metropolitan areas and rapidly developing cities are major contributors to market growth.

- Key Drivers for Residential Segment: Rising disposable incomes, urbanization, preference for modern interiors.

- Key Drivers for Furniture Application: Growing furniture industry, increasing demand for customized furniture.

- Dominant Raw Material: Plastic Resin

- Dominant Application: Furniture

India Decorative Laminates Market Product Developments

Recent product innovations have focused on enhanced durability, aesthetic appeal, and sustainability. Manufacturers are introducing laminates with improved scratch resistance, stain resistance, and antimicrobial properties. Digitally printed laminates offer unparalleled design flexibility, allowing for customized patterns and textures. The market is witnessing a growing demand for eco-friendly laminates made from recycled materials and with reduced VOC emissions. These developments are aligned with evolving consumer preferences and environmental concerns, enhancing the market fit and competitive advantage of these products.

Key Drivers of India Decorative Laminates Market Growth

The growth of the India decorative laminates market is fuelled by several factors:

- Economic Growth: Rising disposable incomes and increasing urbanization are driving demand for improved home interiors and commercial spaces.

- Construction Boom: The robust construction sector is a major driver, with a significant increase in residential and commercial building projects.

- Technological Advancements: Innovations in laminate technology, such as digitally printed designs and sustainable materials, cater to evolving consumer preferences.

- Government Initiatives: Government policies promoting affordable housing and infrastructure development support market expansion.

Challenges in the India Decorative Laminates Market

The India decorative laminates market faces several challenges:

- Fluctuating Raw Material Prices: The price volatility of raw materials, particularly plastic resins, can impact profitability and pricing strategies.

- Intense Competition: A large number of players, both domestic and international, create intense competition, putting pressure on pricing and margins.

- Supply Chain Disruptions: Occasional disruptions in the supply chain can lead to delays and production bottlenecks.

Emerging Opportunities in India Decorative Laminates Market

Significant opportunities exist for growth in the Indian decorative laminates market:

- Expansion into Tier 2 and Tier 3 Cities: Untapped potential in smaller cities and towns presents substantial growth opportunities.

- Strategic Partnerships: Collaborations with interior designers, architects, and builders can enhance brand reach and market penetration.

- Focus on Sustainable Products: Growing environmental consciousness presents an opportunity to cater to the demand for eco-friendly laminates.

Leading Players in the India Decorative Laminates Market Sector

- Advance Decorative Laminates Pvt Ltd

- Greenlam Industries Limited

- Formica Group

- Kronotex

- Olympic Decor LLP

- Faus Group Inc

- Bloom Dekor Limited

- FunderMax GmbH

- OMNOVA Solutions Inc

- AICA Laminates India Pvt Limited

Key Milestones in India Decorative Laminates Market Industry

- June 2023: Greenlam Industries opened exclusive display centers in Patna, Chandigarh, and Hisar, expanding its retail presence and market reach.

- March 2023: Formica inaugurated a premier showroom in SouthEx, New Delhi, showcasing its flagship products FENIX and DecoMetal, aiming to strengthen its position in the Indian market.

Strategic Outlook for India Decorative Laminates Market

The future of the India decorative laminates market appears promising, driven by continued economic growth, urbanization, and infrastructure development. Strategic focus on product innovation, sustainable practices, and expanding distribution networks will be crucial for success. Capitalizing on the growing demand for customized and high-quality laminates, while navigating challenges related to raw material costs and competition, will be key for players looking to achieve long-term growth and profitability.

India Decorative Laminates Market Segmentation

-

1. Raw Material

- 1.1. Plastic Resin

- 1.2. Overlays

- 1.3. Adhesives

- 1.4. Wood Substrate

-

2. Application

- 2.1. Furniture

- 2.2. Cabinets

- 2.3. Flooring

- 2.4. Wall Panels

- 2.5. Other Applications (Table Tops and Counter Tops)

-

3. End-user Industry

- 3.1. Residential

- 3.2. Non-residential

- 3.3. Transportation

India Decorative Laminates Market Segmentation By Geography

- 1. India

India Decorative Laminates Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of > 5.00% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Growing Demand from the Construction Sector; Increased Consumption of Furniture; Low Cost of Installation and Maintenance

- 3.3. Market Restrains

- 3.3.1. Availability of Substitutes; Other Restraints

- 3.4. Market Trends

- 3.4.1. Furniture Industry to Dominate the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. India Decorative Laminates Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Raw Material

- 5.1.1. Plastic Resin

- 5.1.2. Overlays

- 5.1.3. Adhesives

- 5.1.4. Wood Substrate

- 5.2. Market Analysis, Insights and Forecast - by Application

- 5.2.1. Furniture

- 5.2.2. Cabinets

- 5.2.3. Flooring

- 5.2.4. Wall Panels

- 5.2.5. Other Applications (Table Tops and Counter Tops)

- 5.3. Market Analysis, Insights and Forecast - by End-user Industry

- 5.3.1. Residential

- 5.3.2. Non-residential

- 5.3.3. Transportation

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. India

- 5.1. Market Analysis, Insights and Forecast - by Raw Material

- 6. North India India Decorative Laminates Market Analysis, Insights and Forecast, 2019-2031

- 7. South India India Decorative Laminates Market Analysis, Insights and Forecast, 2019-2031

- 8. East India India Decorative Laminates Market Analysis, Insights and Forecast, 2019-2031

- 9. West India India Decorative Laminates Market Analysis, Insights and Forecast, 2019-2031

- 10. Competitive Analysis

- 10.1. Market Share Analysis 2024

- 10.2. Company Profiles

- 10.2.1 Advance Decorative Laminates Pvt Ltd

- 10.2.1.1. Overview

- 10.2.1.2. Products

- 10.2.1.3. SWOT Analysis

- 10.2.1.4. Recent Developments

- 10.2.1.5. Financials (Based on Availability)

- 10.2.2 Greenlam Industries Limited

- 10.2.2.1. Overview

- 10.2.2.2. Products

- 10.2.2.3. SWOT Analysis

- 10.2.2.4. Recent Developments

- 10.2.2.5. Financials (Based on Availability)

- 10.2.3 Formica Group

- 10.2.3.1. Overview

- 10.2.3.2. Products

- 10.2.3.3. SWOT Analysis

- 10.2.3.4. Recent Developments

- 10.2.3.5. Financials (Based on Availability)

- 10.2.4 Kronotex

- 10.2.4.1. Overview

- 10.2.4.2. Products

- 10.2.4.3. SWOT Analysis

- 10.2.4.4. Recent Developments

- 10.2.4.5. Financials (Based on Availability)

- 10.2.5 Olympic Decor LLP*List Not Exhaustive

- 10.2.5.1. Overview

- 10.2.5.2. Products

- 10.2.5.3. SWOT Analysis

- 10.2.5.4. Recent Developments

- 10.2.5.5. Financials (Based on Availability)

- 10.2.6 Faus Group Inc

- 10.2.6.1. Overview

- 10.2.6.2. Products

- 10.2.6.3. SWOT Analysis

- 10.2.6.4. Recent Developments

- 10.2.6.5. Financials (Based on Availability)

- 10.2.7 Bloom Dekor Limited

- 10.2.7.1. Overview

- 10.2.7.2. Products

- 10.2.7.3. SWOT Analysis

- 10.2.7.4. Recent Developments

- 10.2.7.5. Financials (Based on Availability)

- 10.2.8 FunderMax GmbH

- 10.2.8.1. Overview

- 10.2.8.2. Products

- 10.2.8.3. SWOT Analysis

- 10.2.8.4. Recent Developments

- 10.2.8.5. Financials (Based on Availability)

- 10.2.9 OMNOVA Solutions Inc

- 10.2.9.1. Overview

- 10.2.9.2. Products

- 10.2.9.3. SWOT Analysis

- 10.2.9.4. Recent Developments

- 10.2.9.5. Financials (Based on Availability)

- 10.2.10 AICA Laminates India Pvt Limited

- 10.2.10.1. Overview

- 10.2.10.2. Products

- 10.2.10.3. SWOT Analysis

- 10.2.10.4. Recent Developments

- 10.2.10.5. Financials (Based on Availability)

- 10.2.1 Advance Decorative Laminates Pvt Ltd

List of Figures

- Figure 1: India Decorative Laminates Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: India Decorative Laminates Market Share (%) by Company 2024

List of Tables

- Table 1: India Decorative Laminates Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: India Decorative Laminates Market Revenue Million Forecast, by Raw Material 2019 & 2032

- Table 3: India Decorative Laminates Market Revenue Million Forecast, by Application 2019 & 2032

- Table 4: India Decorative Laminates Market Revenue Million Forecast, by End-user Industry 2019 & 2032

- Table 5: India Decorative Laminates Market Revenue Million Forecast, by Region 2019 & 2032

- Table 6: India Decorative Laminates Market Revenue Million Forecast, by Country 2019 & 2032

- Table 7: North India India Decorative Laminates Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 8: South India India Decorative Laminates Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: East India India Decorative Laminates Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: West India India Decorative Laminates Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 11: India Decorative Laminates Market Revenue Million Forecast, by Raw Material 2019 & 2032

- Table 12: India Decorative Laminates Market Revenue Million Forecast, by Application 2019 & 2032

- Table 13: India Decorative Laminates Market Revenue Million Forecast, by End-user Industry 2019 & 2032

- Table 14: India Decorative Laminates Market Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the India Decorative Laminates Market?

The projected CAGR is approximately > 5.00%.

2. Which companies are prominent players in the India Decorative Laminates Market?

Key companies in the market include Advance Decorative Laminates Pvt Ltd, Greenlam Industries Limited, Formica Group, Kronotex, Olympic Decor LLP*List Not Exhaustive, Faus Group Inc, Bloom Dekor Limited, FunderMax GmbH, OMNOVA Solutions Inc, AICA Laminates India Pvt Limited.

3. What are the main segments of the India Decorative Laminates Market?

The market segments include Raw Material, Application, End-user Industry.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Growing Demand from the Construction Sector; Increased Consumption of Furniture; Low Cost of Installation and Maintenance.

6. What are the notable trends driving market growth?

Furniture Industry to Dominate the Market.

7. Are there any restraints impacting market growth?

Availability of Substitutes; Other Restraints.

8. Can you provide examples of recent developments in the market?

June 2023: Greenlam Industries opened its exclusive display centers for Greenlam Laminates in Patna, Chandigarh, and Hisar.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "India Decorative Laminates Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the India Decorative Laminates Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the India Decorative Laminates Market?

To stay informed about further developments, trends, and reports in the India Decorative Laminates Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence