Key Insights

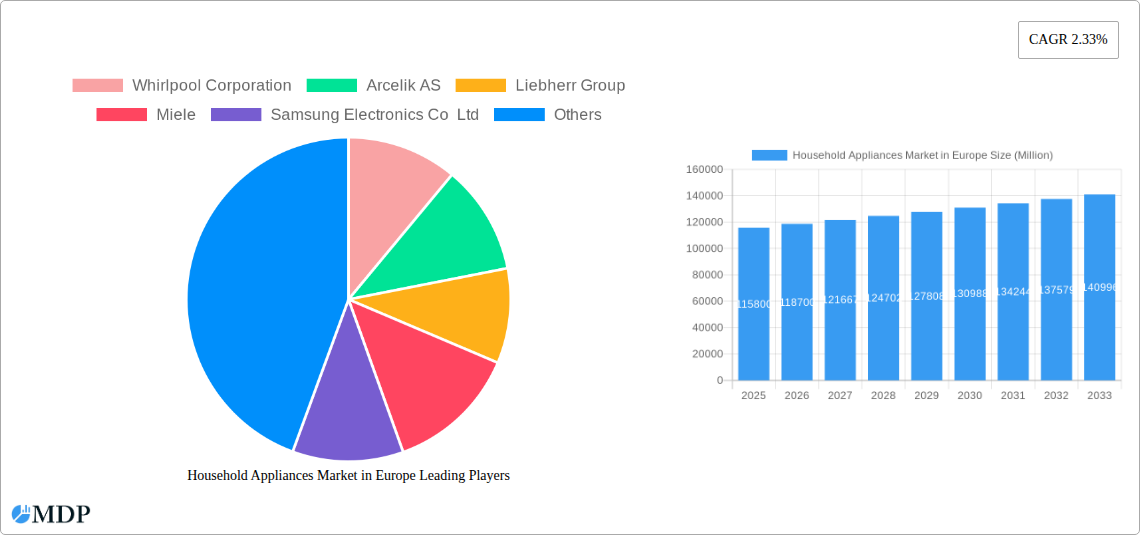

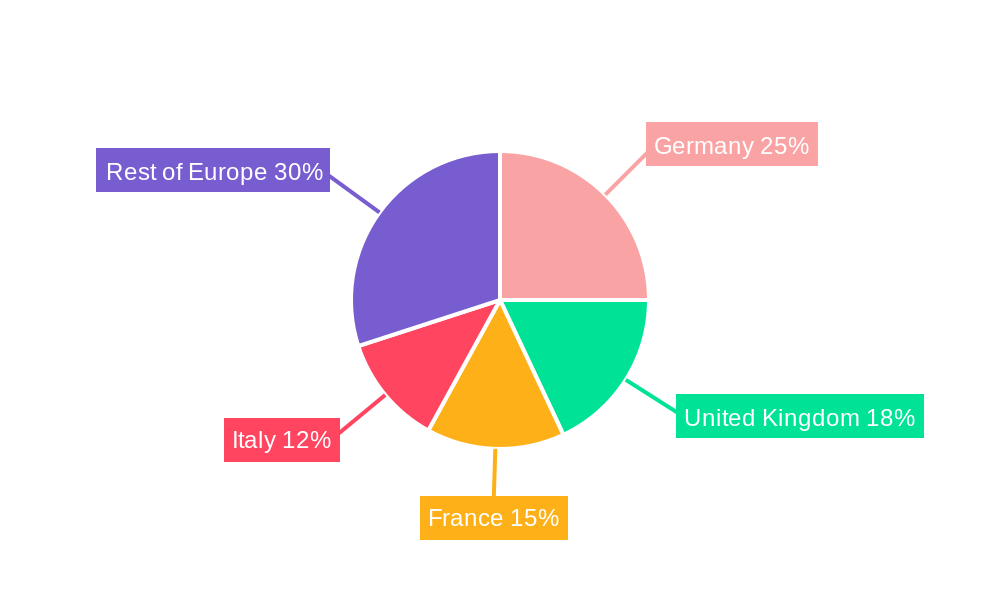

The European household appliance market, valued at €115.80 billion in 2025, is projected to experience steady growth, driven by several key factors. Rising disposable incomes across many European nations, coupled with increasing urbanization and the preference for convenient, time-saving appliances, are fueling demand. Furthermore, technological advancements, such as smart home integration and energy-efficient models, are attracting consumers seeking enhanced functionality and sustainability. The market is segmented across major and small appliances, with significant distribution through exclusive stores, multi-brand retailers, and increasingly, online channels. Germany, the United Kingdom, France, and Italy represent the largest national markets, reflecting their higher consumer spending power and established retail infrastructure. Competition is intense, with established players like Whirlpool, Electrolux, Bosch, and Miele facing pressure from emerging brands offering innovative products at competitive price points. However, economic downturns or supply chain disruptions could act as potential restraints, impacting sales growth in the coming years. The market's continued expansion will likely be driven by a blend of premium offerings catering to discerning consumers and value-oriented products targeting price-sensitive buyers. This will necessitate strategic adaptation by manufacturers to maintain competitiveness and profitability.

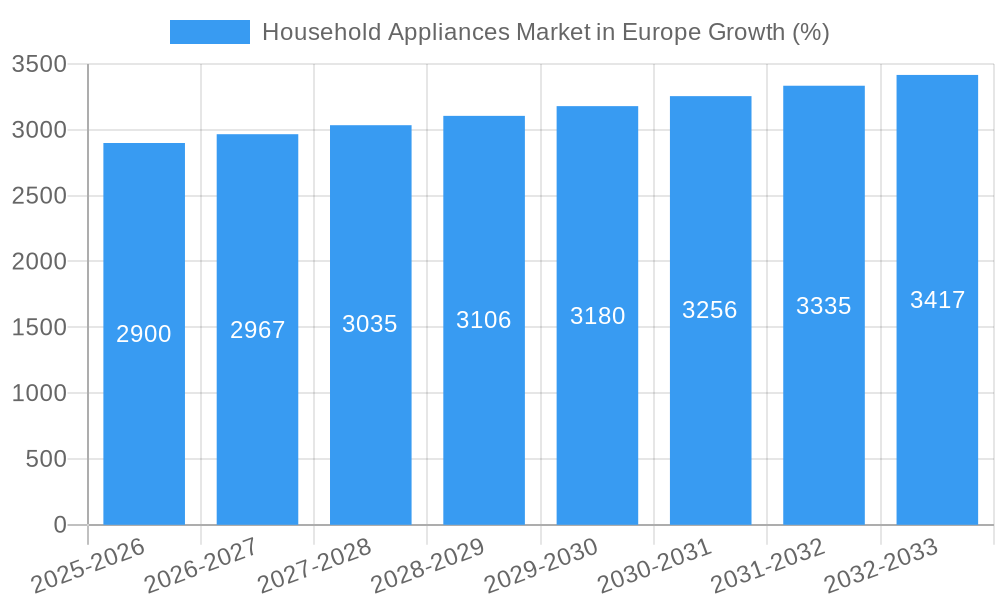

The forecast period (2025-2033) anticipates a consistent CAGR of 2.33%, indicating a gradual yet persistent market expansion. This growth trajectory is expected to be influenced by changing consumer preferences towards sustainability, smart appliances, and customized solutions. The increasing adoption of online sales channels will also significantly impact market dynamics, demanding a robust online presence and efficient e-commerce strategies from manufacturers and retailers. The shift towards premiumization, with consumers willing to pay more for high-quality, feature-rich appliances, presents opportunities for brands to differentiate themselves through innovation and brand building. The competitive landscape is likely to see consolidation and strategic partnerships as companies seek to enhance their market share and expand their product portfolios. Analyzing the individual performance of segments (major vs. small appliances and distribution channels) will be critical to understanding specific market trends and developing targeted growth strategies.

Europe Household Appliances Market: A Comprehensive Report (2019-2033)

This in-depth report provides a comprehensive analysis of the European household appliances market, covering the period 2019-2033. It delves into market dynamics, leading players, key trends, and future growth opportunities, offering invaluable insights for industry stakeholders, investors, and strategic planners. The report utilizes robust data and forecasts to deliver actionable intelligence for informed decision-making within this dynamic sector. The market is expected to reach xx Million by 2033, growing at a CAGR of xx% during the forecast period (2025-2033).

Household Appliances Market in Europe Market Dynamics & Concentration

The European household appliances market is characterized by a moderately concentrated landscape, with key players such as Whirlpool Corporation, Electrolux AB, and Robert Bosch GmbH holding significant market share. However, the market also exhibits considerable fragmentation due to the presence of numerous regional and niche players. Market concentration is further influenced by factors such as mergers and acquisitions (M&A) activity. During the historical period (2019-2024), the European region witnessed approximately xx M&A deals in the household appliances sector, contributing to increased market consolidation. Innovation is a key driver, with companies continuously investing in R&D to develop energy-efficient, smart, and connected appliances. Stringent environmental regulations, particularly concerning energy consumption and waste management, shape product development and market dynamics. The market also faces pressure from product substitutes, such as rental services and sharing economies for appliances. Consumer trends, such as increasing demand for convenience and smart home integration, are reshaping product preferences and creating opportunities for new entrants.

- Market Share: Whirlpool Corporation holds an estimated xx% market share in 2025. Electrolux AB holds approximately xx% and Robert Bosch GmbH holds approximately xx%.

- M&A Activity: xx M&A deals were recorded between 2019 and 2024.

- Innovation Drivers: Energy efficiency standards, smart home integration, and connected appliances.

- Regulatory Frameworks: EU regulations on energy labeling and waste electrical and electronic equipment (WEEE).

Household Appliances Market in Europe Industry Trends & Analysis

The European household appliances market demonstrates robust growth, driven by several key factors. Rising disposable incomes, particularly in emerging European economies, fuel demand for higher-end appliances. The increasing adoption of smart home technologies is a significant trend, with consumers increasingly seeking connected appliances that offer convenience and enhanced functionalities. Technological advancements, such as the integration of AI and IoT capabilities, are revolutionizing the appliances sector, leading to the development of sophisticated products with enhanced features. The market also observes intensified competition amongst established players and emerging brands vying for market share through innovative product offerings and aggressive marketing strategies. The overall market experienced a CAGR of xx% during the historical period (2019-2024), reflecting considerable market expansion. Market penetration of smart appliances is steadily increasing, reaching approximately xx% in 2025.

Leading Markets & Segments in Household Appliances Market in Europe

Germany, the United Kingdom, and France represent the leading markets within Europe, characterized by strong consumer demand, established retail infrastructure, and high levels of disposable income. The online distribution channel is experiencing rapid growth, driven by the convenience it offers to consumers. Within the product segments, major appliances exhibit the highest market share, followed by small appliances.

- Key Drivers for Leading Markets:

- Germany: Strong economic growth, high consumer spending, and advanced retail infrastructure.

- United Kingdom: Large market size, diverse consumer preferences, and established e-commerce sector.

- France: Growing disposable incomes, increasing adoption of smart home technology, and robust retail sector.

- Dominant Segments:

- Major Appliances: High market share driven by essential household needs and high purchase values.

- Online Distribution: Rapid growth fueled by convenience and wide product selection.

- Other Leading Countries: Poland and Italy demonstrate significant growth potential.

Household Appliances Market in Europe Product Developments

Recent product developments highlight the integration of smart features, energy efficiency, and improved design aesthetics. Key trends include the introduction of smart refrigerators with integrated displays and voice control, energy-efficient washing machines with advanced water management systems, and ovens with enhanced cooking functionalities. These innovations aim to cater to evolving consumer preferences for convenience, sustainability, and enhanced user experience. The market also witnesses increasing integration of AI and IoT capabilities for predictive maintenance and personalized settings.

Key Drivers of Household Appliances Market in Europe Growth

Several factors contribute to the growth of the European household appliances market:

- Technological Advancements: Development of smart, energy-efficient, and connected appliances.

- Rising Disposable Incomes: Increased purchasing power in several European countries fuels demand.

- Favorable Government Policies: Incentives and regulations promoting energy efficiency.

Challenges in the Household Appliances Market in Europe Market

The European household appliances market faces several challenges:

- Supply Chain Disruptions: Global events and geopolitical factors impact component availability and manufacturing.

- Intense Competition: Established players and emerging brands compete for market share.

- Economic Fluctuations: Economic downturns can reduce consumer spending and impact demand.

Emerging Opportunities in Household Appliances Market in Europe

The market presents opportunities in areas such as the expansion of smart home technology integration, growth in emerging European markets, and the development of sustainable and energy-efficient products. Strategic partnerships and collaborations between manufacturers and technology providers are creating innovative solutions that cater to the evolving needs of consumers.

Leading Players in the Household Appliances Market in Europe Sector

- Whirlpool Corporation

- Arcelik AS

- Liebherr Group

- Miele

- Samsung Electronics Co Ltd

- De'Longhi S p A

- Gorenje Group

- Koninklijke Philips

- Haier

- Robert Bosch GmbH

- Smeg

- Electrolux AB

- Panasonic Corporation

- LG Electronics

Key Milestones in Household Appliances Market in Europe Industry

- August 2020: Samsung Electronics Co. Ltd. launched the RB7300 refrigerator, showcasing advancements in cooling technology and flexible storage capacity. This launch reinforced Samsung's position in the premium refrigerator segment.

Strategic Outlook for Household Appliances Market in Europe Market

The European household appliances market is poised for continued growth driven by technological advancements, increasing consumer demand for smart and energy-efficient products, and expansion into emerging markets. Strategic partnerships, investments in R&D, and effective marketing strategies will be crucial for players seeking to maintain a competitive edge in this evolving landscape. The market’s future hinges on addressing sustainability concerns and adapting to evolving consumer preferences.

Household Appliances Market in Europe Segmentation

-

1. Appliances Types

-

1.1. Refrigeration Appliances

- 1.1.1. Freezers

- 1.1.2. Refrigerators

- 1.1.3. Water Coolers

- 1.1.4. Ice Makers

-

1.2. Cooking Appliances

- 1.2.1. Kitchen

- 1.2.2. Stoves

- 1.2.3. Rice Cookers

- 1.2.4. Steamer

- 1.2.5. Ovens

- 1.2.6. Microwaves

- 1.2.7. Others

-

1.3. Washing & Drying Appliances

- 1.3.1. Washing Machines

- 1.3.2. Clothes Dryer

- 1.3.3. Drying Cabinets

- 1.3.4. Dishwashers

-

1.4. Heating & Cooling Appliances

- 1.4.1. Air Conditioners

- 1.4.2. Radiators

- 1.4.3. Water Heaters

-

1.5. Kitchen Appliances

- 1.5.1. Coffee Makers

- 1.5.2. Blenders Mixers

- 1.5.3. Toasters

- 1.5.4. Water Purifiers

- 1.5.5. Kitchen

- 1.5.6. Hoods Food Processors

- 1.5.7. Deep Fryers

- 1.5.8. Air fryers

- 1.5.9. Food Dehydrators

- 1.5.10. Others

-

1.6. Other Appliances

- 1.6.1. Televisions

- 1.6.2. Iron

- 1.6.3. Electric Drills

- 1.6.4. Kettles

- 1.6.5. Vacuum Cleaners

- 1.6.6. Electric Fans

- 1.6.7. Others

-

1.1. Refrigeration Appliances

-

2. Category

- 2.1. Smart

- 2.2. Traditional

Household Appliances Market in Europe Segmentation By Geography

-

1. Europe

- 1.1. United Kingdom

- 1.2. Germany

- 1.3. France

- 1.4. Italy

- 1.5. Spain

- 1.6. Russia

- 1.7. Benelux

- 1.8. Nordics

- 1.9. Rest of Europe

Household Appliances Market in Europe REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 2.33% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increase in Residential Construction; Increased Penetration of Smart Appliances

- 3.3. Market Restrains

- 3.3.1. Saturation in Adoption of Major Appliances

- 3.4. Market Trends

- 3.4.1. Growing Number of Smart Homes is Driving the Demand for Smart Appliances in the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Household Appliances Market in Europe Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Appliances Types

- 5.1.1. Refrigeration Appliances

- 5.1.1.1. Freezers

- 5.1.1.2. Refrigerators

- 5.1.1.3. Water Coolers

- 5.1.1.4. Ice Makers

- 5.1.2. Cooking Appliances

- 5.1.2.1. Kitchen

- 5.1.2.2. Stoves

- 5.1.2.3. Rice Cookers

- 5.1.2.4. Steamer

- 5.1.2.5. Ovens

- 5.1.2.6. Microwaves

- 5.1.2.7. Others

- 5.1.3. Washing & Drying Appliances

- 5.1.3.1. Washing Machines

- 5.1.3.2. Clothes Dryer

- 5.1.3.3. Drying Cabinets

- 5.1.3.4. Dishwashers

- 5.1.4. Heating & Cooling Appliances

- 5.1.4.1. Air Conditioners

- 5.1.4.2. Radiators

- 5.1.4.3. Water Heaters

- 5.1.5. Kitchen Appliances

- 5.1.5.1. Coffee Makers

- 5.1.5.2. Blenders Mixers

- 5.1.5.3. Toasters

- 5.1.5.4. Water Purifiers

- 5.1.5.5. Kitchen

- 5.1.5.6. Hoods Food Processors

- 5.1.5.7. Deep Fryers

- 5.1.5.8. Air fryers

- 5.1.5.9. Food Dehydrators

- 5.1.5.10. Others

- 5.1.6. Other Appliances

- 5.1.6.1. Televisions

- 5.1.6.2. Iron

- 5.1.6.3. Electric Drills

- 5.1.6.4. Kettles

- 5.1.6.5. Vacuum Cleaners

- 5.1.6.6. Electric Fans

- 5.1.6.7. Others

- 5.1.1. Refrigeration Appliances

- 5.2. Market Analysis, Insights and Forecast - by Category

- 5.2.1. Smart

- 5.2.2. Traditional

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Europe

- 5.1. Market Analysis, Insights and Forecast - by Appliances Types

- 6. Germany Household Appliances Market in Europe Analysis, Insights and Forecast, 2019-2031

- 7. France Household Appliances Market in Europe Analysis, Insights and Forecast, 2019-2031

- 8. Italy Household Appliances Market in Europe Analysis, Insights and Forecast, 2019-2031

- 9. United Kingdom Household Appliances Market in Europe Analysis, Insights and Forecast, 2019-2031

- 10. Netherlands Household Appliances Market in Europe Analysis, Insights and Forecast, 2019-2031

- 11. Sweden Household Appliances Market in Europe Analysis, Insights and Forecast, 2019-2031

- 12. Rest of Europe Household Appliances Market in Europe Analysis, Insights and Forecast, 2019-2031

- 13. Competitive Analysis

- 13.1. Global Market Share Analysis 2024

- 13.2. Company Profiles

- 13.2.1 Whirlpool Corporation

- 13.2.1.1. Overview

- 13.2.1.2. Products

- 13.2.1.3. SWOT Analysis

- 13.2.1.4. Recent Developments

- 13.2.1.5. Financials (Based on Availability)

- 13.2.2 Arcelik AS

- 13.2.2.1. Overview

- 13.2.2.2. Products

- 13.2.2.3. SWOT Analysis

- 13.2.2.4. Recent Developments

- 13.2.2.5. Financials (Based on Availability)

- 13.2.3 Liebherr Group

- 13.2.3.1. Overview

- 13.2.3.2. Products

- 13.2.3.3. SWOT Analysis

- 13.2.3.4. Recent Developments

- 13.2.3.5. Financials (Based on Availability)

- 13.2.4 Miele

- 13.2.4.1. Overview

- 13.2.4.2. Products

- 13.2.4.3. SWOT Analysis

- 13.2.4.4. Recent Developments

- 13.2.4.5. Financials (Based on Availability)

- 13.2.5 Samsung Electronics Co Ltd

- 13.2.5.1. Overview

- 13.2.5.2. Products

- 13.2.5.3. SWOT Analysis

- 13.2.5.4. Recent Developments

- 13.2.5.5. Financials (Based on Availability)

- 13.2.6 De'Longhi S p A

- 13.2.6.1. Overview

- 13.2.6.2. Products

- 13.2.6.3. SWOT Analysis

- 13.2.6.4. Recent Developments

- 13.2.6.5. Financials (Based on Availability)

- 13.2.7 Gorenje Group

- 13.2.7.1. Overview

- 13.2.7.2. Products

- 13.2.7.3. SWOT Analysis

- 13.2.7.4. Recent Developments

- 13.2.7.5. Financials (Based on Availability)

- 13.2.8 Koninklijke Philips

- 13.2.8.1. Overview

- 13.2.8.2. Products

- 13.2.8.3. SWOT Analysis

- 13.2.8.4. Recent Developments

- 13.2.8.5. Financials (Based on Availability)

- 13.2.9 Haier

- 13.2.9.1. Overview

- 13.2.9.2. Products

- 13.2.9.3. SWOT Analysis

- 13.2.9.4. Recent Developments

- 13.2.9.5. Financials (Based on Availability)

- 13.2.10 Robert Bosch GmbH

- 13.2.10.1. Overview

- 13.2.10.2. Products

- 13.2.10.3. SWOT Analysis

- 13.2.10.4. Recent Developments

- 13.2.10.5. Financials (Based on Availability)

- 13.2.11 Smeg

- 13.2.11.1. Overview

- 13.2.11.2. Products

- 13.2.11.3. SWOT Analysis

- 13.2.11.4. Recent Developments

- 13.2.11.5. Financials (Based on Availability)

- 13.2.12 Electrolux AB

- 13.2.12.1. Overview

- 13.2.12.2. Products

- 13.2.12.3. SWOT Analysis

- 13.2.12.4. Recent Developments

- 13.2.12.5. Financials (Based on Availability)

- 13.2.13 Panasonic Corporation

- 13.2.13.1. Overview

- 13.2.13.2. Products

- 13.2.13.3. SWOT Analysis

- 13.2.13.4. Recent Developments

- 13.2.13.5. Financials (Based on Availability)

- 13.2.14 LG Electronics

- 13.2.14.1. Overview

- 13.2.14.2. Products

- 13.2.14.3. SWOT Analysis

- 13.2.14.4. Recent Developments

- 13.2.14.5. Financials (Based on Availability)

- 13.2.1 Whirlpool Corporation

List of Figures

- Figure 1: Global Household Appliances Market in Europe Revenue Breakdown (Million, %) by Region 2024 & 2032

- Figure 2: Europe Household Appliances Market in Europe Revenue (Million), by Country 2024 & 2032

- Figure 3: Europe Household Appliances Market in Europe Revenue Share (%), by Country 2024 & 2032

- Figure 4: Europe Household Appliances Market in Europe Revenue (Million), by Appliances Types 2024 & 2032

- Figure 5: Europe Household Appliances Market in Europe Revenue Share (%), by Appliances Types 2024 & 2032

- Figure 6: Europe Household Appliances Market in Europe Revenue (Million), by Category 2024 & 2032

- Figure 7: Europe Household Appliances Market in Europe Revenue Share (%), by Category 2024 & 2032

- Figure 8: Europe Household Appliances Market in Europe Revenue (Million), by Country 2024 & 2032

- Figure 9: Europe Household Appliances Market in Europe Revenue Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global Household Appliances Market in Europe Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Global Household Appliances Market in Europe Revenue Million Forecast, by Appliances Types 2019 & 2032

- Table 3: Global Household Appliances Market in Europe Revenue Million Forecast, by Category 2019 & 2032

- Table 4: Global Household Appliances Market in Europe Revenue Million Forecast, by Region 2019 & 2032

- Table 5: Global Household Appliances Market in Europe Revenue Million Forecast, by Country 2019 & 2032

- Table 6: Germany Household Appliances Market in Europe Revenue (Million) Forecast, by Application 2019 & 2032

- Table 7: France Household Appliances Market in Europe Revenue (Million) Forecast, by Application 2019 & 2032

- Table 8: Italy Household Appliances Market in Europe Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: United Kingdom Household Appliances Market in Europe Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: Netherlands Household Appliances Market in Europe Revenue (Million) Forecast, by Application 2019 & 2032

- Table 11: Sweden Household Appliances Market in Europe Revenue (Million) Forecast, by Application 2019 & 2032

- Table 12: Rest of Europe Household Appliances Market in Europe Revenue (Million) Forecast, by Application 2019 & 2032

- Table 13: Global Household Appliances Market in Europe Revenue Million Forecast, by Appliances Types 2019 & 2032

- Table 14: Global Household Appliances Market in Europe Revenue Million Forecast, by Category 2019 & 2032

- Table 15: Global Household Appliances Market in Europe Revenue Million Forecast, by Country 2019 & 2032

- Table 16: United Kingdom Household Appliances Market in Europe Revenue (Million) Forecast, by Application 2019 & 2032

- Table 17: Germany Household Appliances Market in Europe Revenue (Million) Forecast, by Application 2019 & 2032

- Table 18: France Household Appliances Market in Europe Revenue (Million) Forecast, by Application 2019 & 2032

- Table 19: Italy Household Appliances Market in Europe Revenue (Million) Forecast, by Application 2019 & 2032

- Table 20: Spain Household Appliances Market in Europe Revenue (Million) Forecast, by Application 2019 & 2032

- Table 21: Russia Household Appliances Market in Europe Revenue (Million) Forecast, by Application 2019 & 2032

- Table 22: Benelux Household Appliances Market in Europe Revenue (Million) Forecast, by Application 2019 & 2032

- Table 23: Nordics Household Appliances Market in Europe Revenue (Million) Forecast, by Application 2019 & 2032

- Table 24: Rest of Europe Household Appliances Market in Europe Revenue (Million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Household Appliances Market in Europe?

The projected CAGR is approximately 2.33%.

2. Which companies are prominent players in the Household Appliances Market in Europe?

Key companies in the market include Whirlpool Corporation, Arcelik AS, Liebherr Group, Miele, Samsung Electronics Co Ltd, De'Longhi S p A, Gorenje Group, Koninklijke Philips, Haier, Robert Bosch GmbH, Smeg, Electrolux AB, Panasonic Corporation, LG Electronics.

3. What are the main segments of the Household Appliances Market in Europe?

The market segments include Appliances Types, Category.

4. Can you provide details about the market size?

The market size is estimated to be USD 115.80 Million as of 2022.

5. What are some drivers contributing to market growth?

Increase in Residential Construction; Increased Penetration of Smart Appliances.

6. What are the notable trends driving market growth?

Growing Number of Smart Homes is Driving the Demand for Smart Appliances in the Market.

7. Are there any restraints impacting market growth?

Saturation in Adoption of Major Appliances.

8. Can you provide examples of recent developments in the market?

In August 2020, Samsung Electronics Co. Ltd announced the launch of a new RB7300 refrigerator that delivers core cooling performance while offering a large, flexible capacity to meet all types of food storage needs.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 4950, and USD 6800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Household Appliances Market in Europe," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Household Appliances Market in Europe report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Household Appliances Market in Europe?

To stay informed about further developments, trends, and reports in the Household Appliances Market in Europe, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence