Key Insights

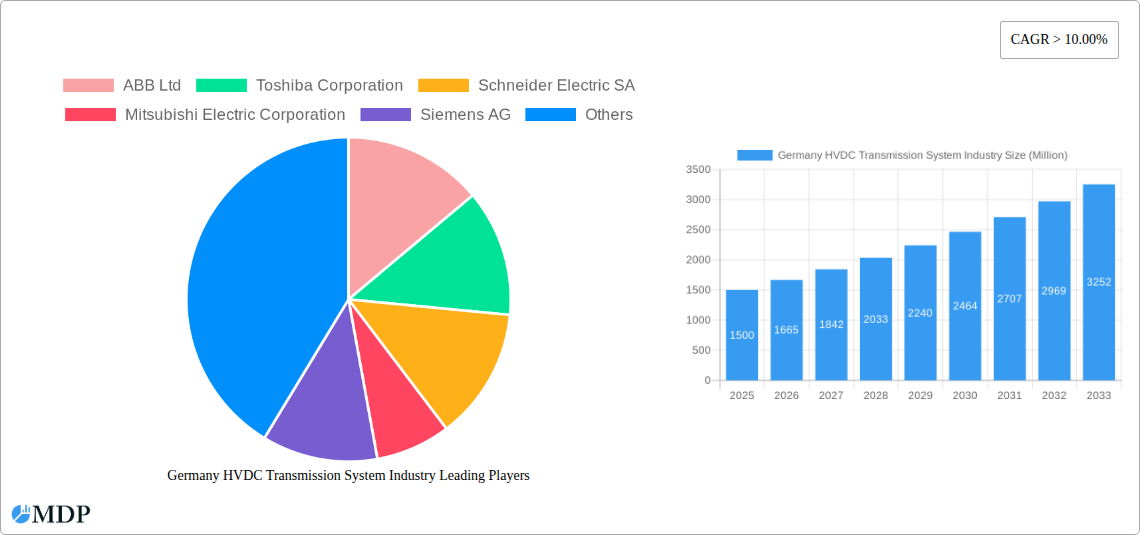

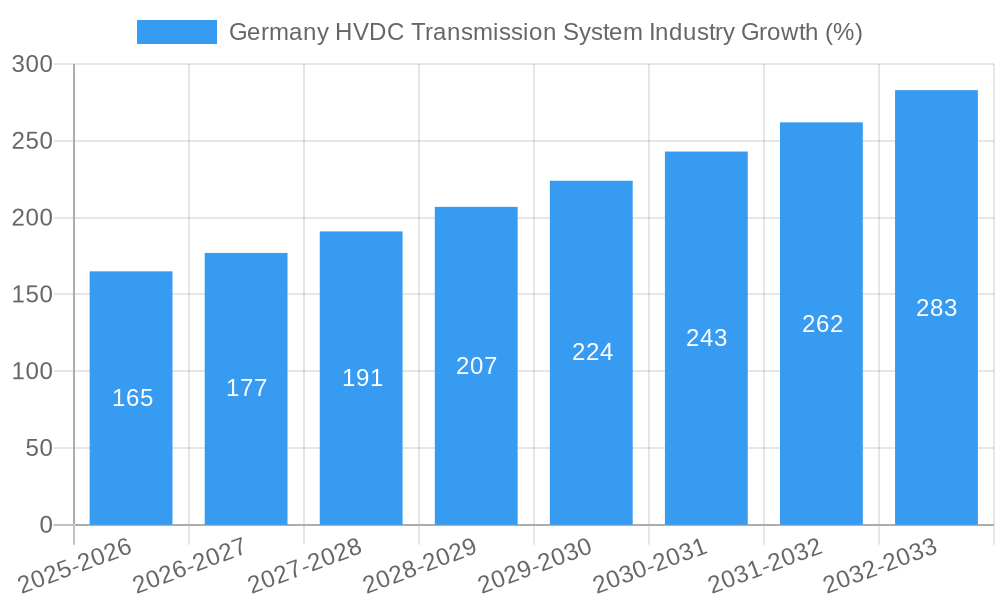

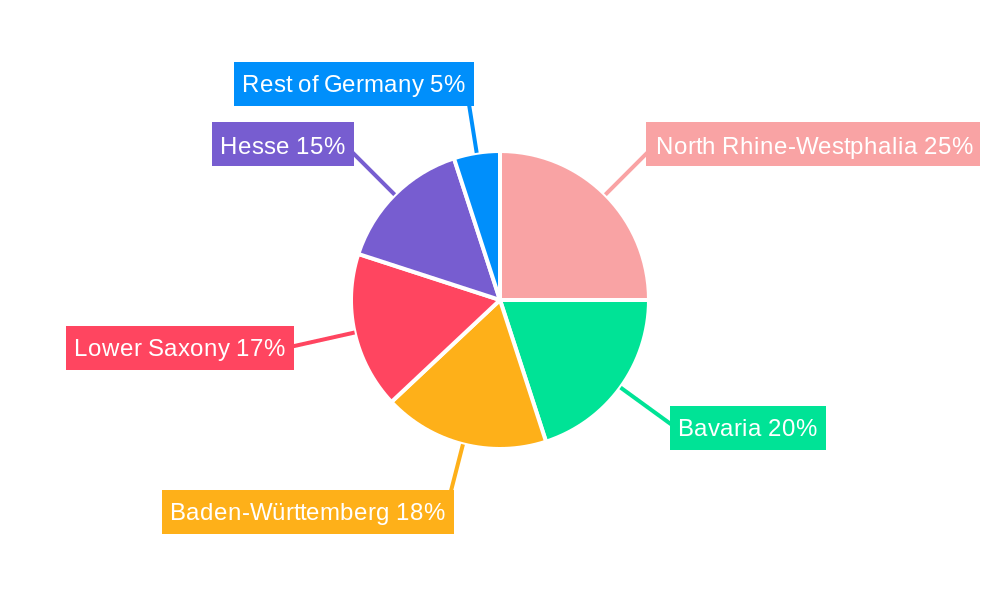

The German HVDC Transmission System market, currently experiencing robust growth, presents significant opportunities for investors and industry players. Driven by the nation's ambitious renewable energy targets and the increasing need for efficient long-distance power transmission, the market is projected to maintain a Compound Annual Growth Rate (CAGR) exceeding 10% from 2025 to 2033. This expansion is fueled by several key factors. The German government's commitment to phasing out fossil fuels and integrating substantial renewable energy sources, primarily wind and solar, necessitates a robust and efficient transmission infrastructure capable of handling the intermittent nature of these sources. Further accelerating market growth is the expanding network of offshore wind farms, requiring sophisticated HVDC technology for optimal power delivery to onshore grids. Key segments, such as submarine HVDC transmission systems and converter stations, are anticipated to witness the strongest growth, propelled by ongoing infrastructure investments and technological advancements. Germany's strong industrial base and skilled workforce also contribute to a favorable market environment. The states of North Rhine-Westphalia, Bavaria, Baden-Württemberg, Lower Saxony, and Hesse are expected to be key contributors to this market expansion.

While the market shows great potential, challenges remain. High initial investment costs associated with HVDC systems can act as a restraint, particularly for smaller projects. Furthermore, regulatory hurdles and permitting processes can occasionally impede project timelines. However, ongoing technological innovations, such as advancements in converter technology and cable design, are addressing these challenges and driving down costs. Moreover, supportive government policies and financial incentives aimed at promoting renewable energy integration are mitigating these restraints. The intense competition among established players like ABB, Toshiba, Schneider Electric, Mitsubishi Electric, Siemens, Hitachi, and General Electric will likely drive innovation and price optimization, further benefiting the market's overall development. The long-term outlook for the German HVDC Transmission System market remains positive, underpinned by strong government support, renewable energy targets, and the continuous improvement of HVDC technology.

This comprehensive report provides an in-depth analysis of the Germany HVDC Transmission System industry, offering invaluable insights for stakeholders, investors, and industry professionals. Leveraging extensive market research conducted over the study period (2019-2024), and incorporating forecasts until 2033 (forecast period: 2025-2033, base year: 2025, estimated year: 2025), this report presents a detailed overview of market dynamics, industry trends, leading players, and future growth prospects. Keywords: Germany, HVDC, Transmission System, Submarine HVDC, Overhead HVDC, Underground HVDC, Converter Stations, Cables, ABB, Siemens, Toshiba, Schneider Electric, Mitsubishi Electric, Hitachi, General Electric.

Germany HVDC Transmission System Industry Market Dynamics & Concentration

The German HVDC transmission system market exhibits a moderately concentrated landscape, with key players like Siemens AG, ABB Ltd, and Toshiba Corporation holding significant market share. The combined market share of these three companies in 2025 is estimated at xx%. Innovation is driven by the increasing demand for renewable energy integration, necessitating efficient long-distance power transmission. Stringent environmental regulations and the shift towards sustainable energy sources further fuel market growth. Product substitutes, primarily AC transmission lines, are facing increasing limitations due to power loss and distance constraints, thus bolstering the demand for HVDC systems. The end-user landscape comprises primarily electricity transmission system operators (TSOs) and renewable energy developers. M&A activity within the sector has been moderate in recent years, with approximately xx deals recorded between 2019 and 2024. This activity is projected to increase as companies seek strategic partnerships to expand their market reach and technological capabilities. The regulatory framework in Germany is supportive of HVDC technology adoption, providing incentives for renewable energy integration and grid modernization.

Germany HVDC Transmission System Industry Industry Trends & Analysis

The German HVDC transmission system market is experiencing robust growth, driven primarily by the country's ambitious renewable energy targets and the need to upgrade its aging electricity grid infrastructure. The market is projected to witness a Compound Annual Growth Rate (CAGR) of xx% during the forecast period (2025-2033). Technological advancements, such as the development of more efficient and cost-effective HVDC converter stations and cables, are further accelerating market expansion. Consumer preference for reliable and sustainable electricity supplies is pushing TSOs and energy companies to prioritize investments in modernizing their transmission infrastructure. The competitive dynamics are characterized by intense competition among established players, who are constantly striving to innovate and offer improved solutions. Market penetration of HVDC technology in Germany is currently at xx%, with significant growth potential in upcoming years.

Leading Markets & Segments in Germany HVDC Transmission System Industry

By Transmission Type: The HVDC Underground Transmission System segment is currently dominant, driven by the need to minimize land acquisition challenges and environmental impact. This segment accounts for approximately xx% of the total market value in 2025. The Submarine HVDC Transmission System segment is expected to witness significant growth, driven by offshore wind energy projects. Key drivers for this segment include government incentives for offshore wind development and increasing focus on renewable energy integration. The HVDC Overhead Transmission System segment holds a smaller share, due to its limited applicability in densely populated areas.

By Component: The Converter Stations segment holds the largest market share, accounting for approximately xx% in 2025. The high capital expenditure and technological complexity associated with Converter Stations necessitate robust investments, thus driving this segment's dominance. The Transmission Medium (Cables) segment is also experiencing substantial growth, driven by the increasing demand for HVDC transmission lines. Key drivers include advancements in cable technology, offering improved efficiency and capacity. Robust infrastructure development and ongoing grid modernization initiatives in Germany support the significant market value of both segments.

Germany HVDC Transmission System Industry Product Developments

Recent years have witnessed significant advancements in HVDC technology, focusing on enhancing efficiency, reducing costs, and improving reliability. Innovations include the development of more compact and efficient converter stations, utilizing advanced semiconductor technologies. New cable designs are focused on increasing transmission capacity and enhancing durability. These innovations are directly enhancing the competitiveness of HVDC systems compared to traditional AC transmission, leading to wider adoption and greater market fit within the renewable energy sector.

Key Drivers of Germany HVDC Transmission System Industry Growth

The growth of the German HVDC transmission system market is propelled by several key factors:

Renewable Energy Integration: Germany's ambitious targets for renewable energy integration necessitate efficient long-distance power transmission, fostering demand for HVDC systems.

Grid Modernization: The need to upgrade aging grid infrastructure and enhance its capacity is driving investments in modern HVDC technology.

Government Support: Government policies and incentives aimed at promoting renewable energy and grid modernization are supporting HVDC adoption.

Technological Advancements: Developments in converter technology and cable design are enhancing the efficiency and cost-effectiveness of HVDC systems.

Challenges in the Germany HVDC Transmission System Industry Market

The industry faces several challenges:

High Initial Investment Costs: The significant upfront investment required for HVDC projects can pose a barrier for some developers.

Complex Project Implementation: The technical complexity of HVDC projects can lead to delays and cost overruns.

Supply Chain Disruptions: Global supply chain disruptions can impact the availability of key components, potentially affecting project timelines.

Competition from AC Transmission: AC transmission systems continue to be a viable alternative, creating competitive pressure.

Emerging Opportunities in Germany HVDC Transmission System Industry

Long-term growth opportunities arise from:

Offshore Wind Energy Expansion: The rapid expansion of offshore wind farms will fuel demand for HVDC transmission systems to connect them to the mainland grid.

Strategic Partnerships: Collaborations between technology providers and energy companies can accelerate innovation and market penetration.

Technological Breakthroughs: Further technological advancements, including the development of more efficient and cost-effective solutions, will continue to expand market potential.

Leading Players in the Germany HVDC Transmission System Industry Sector

- ABB Ltd

- Toshiba Corporation

- Schneider Electric SA

- Mitsubishi Electric Corporation

- Siemens AG

- Hitachi Ltd

- General Electric Company

Key Milestones in Germany HVDC Transmission System Industry Industry

- 2020: Successful commissioning of the xx HVDC project, showcasing technological advancements in converter technology.

- 2022: Announcement of a strategic partnership between xx and xx to develop next-generation HVDC systems for offshore wind integration.

- 2023: Launch of a new HVDC cable with improved capacity and efficiency by xx company.

- 2024: Completion of major grid modernization project incorporating HVDC technology, enhancing transmission capacity.

Strategic Outlook for Germany HVDC Transmission System Industry Market

The future of the German HVDC transmission system market appears bright, driven by strong growth drivers and emerging opportunities. Continued expansion of renewable energy, particularly offshore wind, will fuel sustained demand for HVDC infrastructure. Strategic partnerships and technological innovation will further propel market growth, creating significant opportunities for industry players. The market is poised for substantial expansion over the forecast period, presenting attractive prospects for investors and industry participants alike.

Germany HVDC Transmission System Industry Segmentation

-

1. Transmission Type

- 1.1. Submarine HVDC Transmission System

- 1.2. HVDC Overhead Transmission System

- 1.3. HVDC Underground Transmission System

-

2. Component

- 2.1. Converter Stations

- 2.2. Transmission Medium (Cables)

Germany HVDC Transmission System Industry Segmentation By Geography

- 1. Germany

Germany HVDC Transmission System Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of > 10.00% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. 4.; Domestic Oil and Gas Production4.; Investments in Oil and Gas Infrastructure Development

- 3.3. Market Restrains

- 3.3.1. 4.; Growth of Renewable Energy

- 3.4. Market Trends

- 3.4.1. Submarine HVDC Transmission System to Dominate the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Germany HVDC Transmission System Industry Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Transmission Type

- 5.1.1. Submarine HVDC Transmission System

- 5.1.2. HVDC Overhead Transmission System

- 5.1.3. HVDC Underground Transmission System

- 5.2. Market Analysis, Insights and Forecast - by Component

- 5.2.1. Converter Stations

- 5.2.2. Transmission Medium (Cables)

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Germany

- 5.1. Market Analysis, Insights and Forecast - by Transmission Type

- 6. North Rhine-Westphalia Germany HVDC Transmission System Industry Analysis, Insights and Forecast, 2019-2031

- 7. Bavaria Germany HVDC Transmission System Industry Analysis, Insights and Forecast, 2019-2031

- 8. Baden-Württemberg Germany HVDC Transmission System Industry Analysis, Insights and Forecast, 2019-2031

- 9. Lower Saxony Germany HVDC Transmission System Industry Analysis, Insights and Forecast, 2019-2031

- 10. Hesse Germany HVDC Transmission System Industry Analysis, Insights and Forecast, 2019-2031

- 11. Competitive Analysis

- 11.1. Market Share Analysis 2024

- 11.2. Company Profiles

- 11.2.1 ABB Ltd

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Toshiba Corporation

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Schneider Electric SA

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Mitsubishi Electric Corporation

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Siemens AG

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Hitachi Lt

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 General Electric Company

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.1 ABB Ltd

List of Figures

- Figure 1: Germany HVDC Transmission System Industry Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Germany HVDC Transmission System Industry Share (%) by Company 2024

List of Tables

- Table 1: Germany HVDC Transmission System Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Germany HVDC Transmission System Industry Volume kilovolts Forecast, by Region 2019 & 2032

- Table 3: Germany HVDC Transmission System Industry Revenue Million Forecast, by Transmission Type 2019 & 2032

- Table 4: Germany HVDC Transmission System Industry Volume kilovolts Forecast, by Transmission Type 2019 & 2032

- Table 5: Germany HVDC Transmission System Industry Revenue Million Forecast, by Component 2019 & 2032

- Table 6: Germany HVDC Transmission System Industry Volume kilovolts Forecast, by Component 2019 & 2032

- Table 7: Germany HVDC Transmission System Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 8: Germany HVDC Transmission System Industry Volume kilovolts Forecast, by Region 2019 & 2032

- Table 9: Germany HVDC Transmission System Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 10: Germany HVDC Transmission System Industry Volume kilovolts Forecast, by Country 2019 & 2032

- Table 11: North Rhine-Westphalia Germany HVDC Transmission System Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 12: North Rhine-Westphalia Germany HVDC Transmission System Industry Volume (kilovolts) Forecast, by Application 2019 & 2032

- Table 13: Bavaria Germany HVDC Transmission System Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 14: Bavaria Germany HVDC Transmission System Industry Volume (kilovolts) Forecast, by Application 2019 & 2032

- Table 15: Baden-Württemberg Germany HVDC Transmission System Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 16: Baden-Württemberg Germany HVDC Transmission System Industry Volume (kilovolts) Forecast, by Application 2019 & 2032

- Table 17: Lower Saxony Germany HVDC Transmission System Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 18: Lower Saxony Germany HVDC Transmission System Industry Volume (kilovolts) Forecast, by Application 2019 & 2032

- Table 19: Hesse Germany HVDC Transmission System Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 20: Hesse Germany HVDC Transmission System Industry Volume (kilovolts) Forecast, by Application 2019 & 2032

- Table 21: Germany HVDC Transmission System Industry Revenue Million Forecast, by Transmission Type 2019 & 2032

- Table 22: Germany HVDC Transmission System Industry Volume kilovolts Forecast, by Transmission Type 2019 & 2032

- Table 23: Germany HVDC Transmission System Industry Revenue Million Forecast, by Component 2019 & 2032

- Table 24: Germany HVDC Transmission System Industry Volume kilovolts Forecast, by Component 2019 & 2032

- Table 25: Germany HVDC Transmission System Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 26: Germany HVDC Transmission System Industry Volume kilovolts Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Germany HVDC Transmission System Industry?

The projected CAGR is approximately > 10.00%.

2. Which companies are prominent players in the Germany HVDC Transmission System Industry?

Key companies in the market include ABB Ltd, Toshiba Corporation, Schneider Electric SA, Mitsubishi Electric Corporation, Siemens AG, Hitachi Lt, General Electric Company.

3. What are the main segments of the Germany HVDC Transmission System Industry?

The market segments include Transmission Type, Component.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

4.; Domestic Oil and Gas Production4.; Investments in Oil and Gas Infrastructure Development.

6. What are the notable trends driving market growth?

Submarine HVDC Transmission System to Dominate the Market.

7. Are there any restraints impacting market growth?

4.; Growth of Renewable Energy.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in kilovolts.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Germany HVDC Transmission System Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Germany HVDC Transmission System Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Germany HVDC Transmission System Industry?

To stay informed about further developments, trends, and reports in the Germany HVDC Transmission System Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence