Key Insights

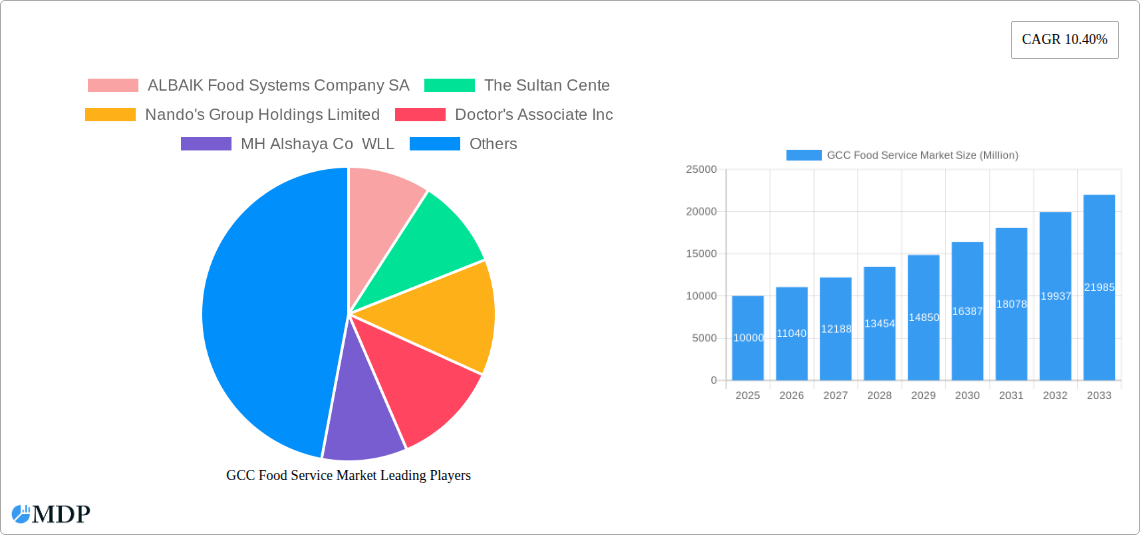

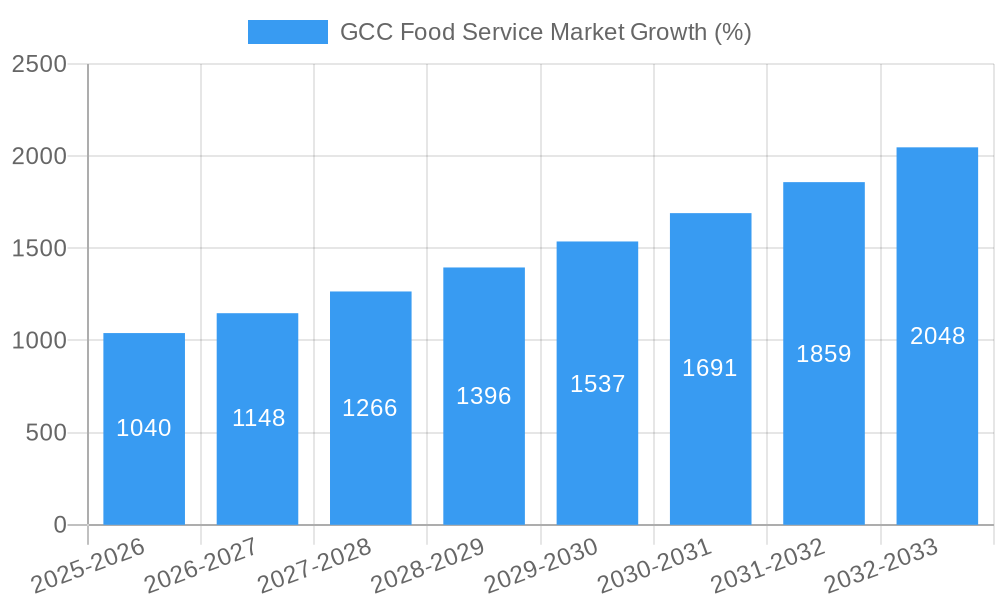

The GCC food service market, exhibiting a robust CAGR of 10.40%, presents a compelling investment opportunity. Driven by factors such as rising disposable incomes, a burgeoning young population with evolving culinary preferences, and a surge in tourism, the market is poised for significant growth. The increasing prevalence of quick-service restaurants (QSRs), particularly chained outlets catering to busy lifestyles, fuels this expansion. Furthermore, the diversification of culinary offerings beyond traditional cuisines, encompassing international flavors and specialized diets, is attracting a wider customer base. While challenges exist, such as fluctuating food prices and potential economic slowdowns, the overall market outlook remains positive. Segmentation analysis reveals that cafes and bars, alongside other QSR cuisines, are major contributors, with chained outlets holding a significant market share compared to independent establishments. Location-wise, leisure, lodging, and retail spaces drive significant demand. Key players like ALBAIK, Nando's, and McDonald's are strategically expanding their presence, highlighting the market's competitive landscape and potential for further consolidation. The forecast period (2025-2033) is expected to witness accelerated growth, driven by continuous innovation and adaptation to changing consumer demands.

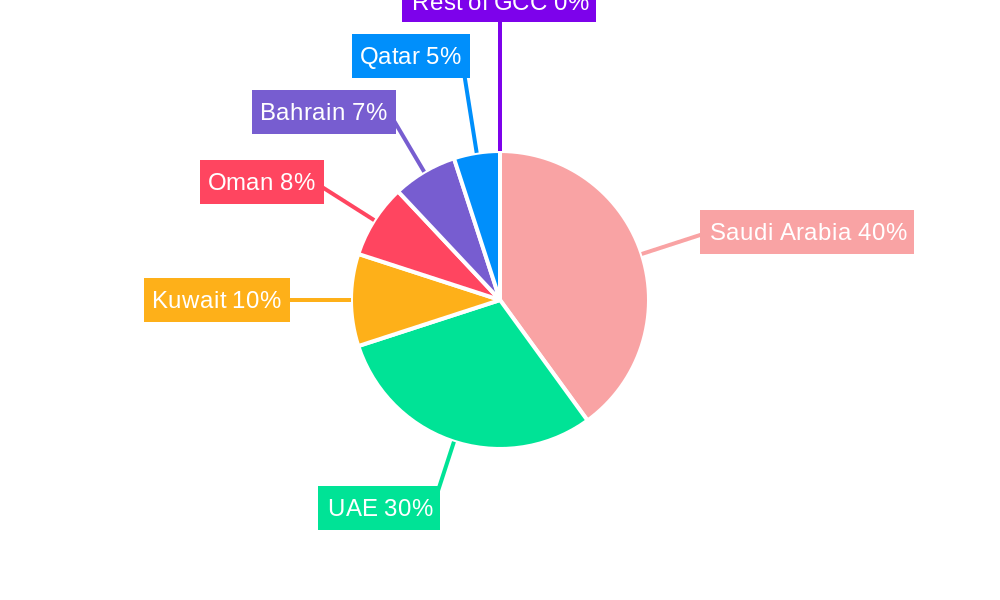

The regional breakdown, while not fully specified, suggests Saudi Arabia and the UAE as dominant markets within the GCC, accounting for a substantial share of the overall revenue. South Africa and the "Rest of Middle East and Africa" regions, while included in the study, likely contribute less significantly to the overall GCC food service market size. The market's resilience stems from its adaptability to both local tastes and global trends, demonstrated by the co-existence of traditional eateries and internationally recognized brands. The focus on enhancing customer experience through technological integrations, loyalty programs, and delivery services further contributes to the market's dynamism and growth potential. The presence of established players alongside emerging local brands indicates a robust competitive landscape that fosters innovation and caters to diverse consumer segments. This dynamic environment will continue shaping the GCC food service market's trajectory in the coming years.

GCC Food Service Market: A Comprehensive Report (2019-2033)

This comprehensive report provides an in-depth analysis of the GCC Food Service Market, offering invaluable insights for industry stakeholders. Covering the period 2019-2033, with a base year of 2025, this report unveils the market's dynamics, trends, and future potential. It features detailed analysis of key segments, leading players, and significant industry developments, presenting actionable data for strategic decision-making. The market is projected to reach xx Million by 2033, exhibiting a robust CAGR of xx% during the forecast period (2025-2033).

GCC Food Service Market Market Dynamics & Concentration

The GCC food service market is characterized by a dynamic interplay of factors influencing its growth and concentration. Market concentration is relatively high, with a few large players holding significant market share. However, the presence of numerous smaller, independent outlets adds complexity to the competitive landscape. Innovation, particularly in technology and food offerings, is a key driver, with companies constantly seeking to improve efficiency, enhance customer experience, and diversify their menus. Stringent regulatory frameworks related to food safety and hygiene significantly impact operations. The presence of product substitutes, such as home-cooked meals and meal delivery services, presents a challenge. End-user trends, such as increasing health consciousness and demand for diverse culinary experiences, shape market demand. M&A activity has played a crucial role in shaping the market landscape. The number of M&A deals in the GCC food service sector reached approximately xx during the historical period (2019-2024), indicating a consolidated market structure. Market share data reveals that the top five players account for approximately xx% of the total market value in 2025.

- Market Concentration: High, with a few dominant players.

- Innovation Drivers: Technological advancements, evolving consumer preferences, and the need for operational efficiency.

- Regulatory Frameworks: Strict food safety and hygiene regulations.

- Product Substitutes: Home-cooked meals, meal delivery services.

- End-User Trends: Health consciousness, demand for diverse cuisines.

- M&A Activities: Significant M&A activity, with xx deals recorded in the historical period.

GCC Food Service Market Industry Trends & Analysis

The GCC food service market exhibits significant growth, driven by several factors. Rising disposable incomes and a burgeoning young population fuel demand for convenient and diverse food options. Rapid urbanization and a shift towards a fast-paced lifestyle have increased reliance on ready-to-eat and quick-service restaurants. Technological disruptions, such as online ordering platforms and delivery apps, have revolutionized consumer access to food services. Consumer preferences are increasingly influenced by health concerns, sustainability, and personalized experiences, which has sparked innovation in menu development and service models. Competitive dynamics are intense, with established players and new entrants vying for market share through brand building, strategic partnerships, and innovative offerings. The market penetration of online food ordering platforms is estimated at xx% in 2025, highlighting a significant shift in consumer behaviour. The CAGR for the overall market during the historical period (2019-2024) was approximately xx%, reflecting strong and consistent growth.

Leading Markets & Segments in GCC Food Service Market

The GCC food service market demonstrates significant diversity across regions, countries, and segments. While specific market share data requires further detailed analysis for precise allocation, this section highlights the key factors contributing to segment dominance.

Dominant Segments:

- Foodservice Type: Quick-Service Restaurants (QSRs) including cafes and bars, and other QSR cuisines dominate, driven by affordability and convenience. The chained outlet segment outperforms the independent outlet segment due to brand recognition and consistent quality.

- Outlet Type: Chained outlets hold a larger market share than independent outlets due to brand recognition, consistent quality, and economies of scale.

- Location: Retail locations (malls, supermarkets) and standalone locations exhibit high growth owing to high foot traffic and convenient accessibility.

Key Drivers of Segment Dominance:

- Economic Policies: Government initiatives supporting the food service sector and tourism.

- Infrastructure Development: Well-developed infrastructure supporting efficient logistics and accessibility.

- Tourism: High tourist influx boosts demand for diverse food options.

- Changing Lifestyle: Busy lifestyle and rising disposable incomes increase the preference for outside dining.

GCC Food Service Market Product Developments

The GCC food service market showcases continuous product innovation. Companies are focusing on healthier options, ethnic cuisines, and personalized meal customization to cater to evolving consumer tastes. Technological advancements, including automated kitchen systems and personalized ordering apps, are improving operational efficiency and the customer experience. The integration of digital platforms for marketing and loyalty programs is enhancing customer engagement and brand loyalty. This ongoing innovation directly contributes to the competitiveness of the market and the growth of the sector.

Key Drivers of GCC Food Service Market Growth

Several factors fuel the GCC food service market's growth. The region's increasing population and rising disposable incomes are leading to higher spending on food and beverage services. Technological advancements in food preparation and delivery enhance convenience and efficiency. Government initiatives promoting tourism and investment in the hospitality sector further stimulate market expansion. Finally, changing lifestyles and cultural influences drive demand for diverse culinary experiences.

Challenges in the GCC Food Service Market Market

The GCC food service market faces several hurdles. Strict regulatory compliance regarding food safety and hygiene demands substantial investment and expertise. Supply chain disruptions, particularly with ingredient sourcing and logistics, can impact operational efficiency and profitability. Intense competition, characterized by both established players and new entrants, necessitates continuous innovation and differentiation. These combined factors pose considerable challenges to consistent and sustainable growth for businesses in the sector.

Emerging Opportunities in GCC Food Service Market

The GCC food service market presents significant growth opportunities. Technological advancements, such as AI-powered solutions for order management and kitchen automation, offer enhanced operational efficiency and cost savings. Strategic partnerships with technology providers and delivery platforms can expand market reach and customer base. Exploring niche markets, such as healthy food options and specialized cuisines, can attract a broader consumer segment. Expansion into underserved areas and the diversification of service offerings through franchising and brand extension present additional avenues for growth.

Leading Players in the GCC Food Service Market Sector

- ALBAIK Food Systems Company SA

- The Sultan Center

- Nando's Group Holdings Limited

- Doctor's Associate Inc

- MH Alshaya Co WLL

- Americana Restaurants International PLC

- Kudu Company For Food And Catering

- LuLu Group International

- Herfy Food Service Company

- Alamar Foods Company

- Restaurant Brands International Inc

- Galadari Ice Cream Co Ltd LLC

- McDonald's Corporation

- Al Tazaj Fakeih

Key Milestones in GCC Food Service Market Industry

- December 2022: Americana Restaurants re-launched Wimpy, a burger brand, in the UAE market, introducing a robotic solution (Flippy 2) for enhanced efficiency and consistency. This signals a significant technological advancement in the sector.

- January 2023: Popeyes introduced a new shrimp roll, reflecting menu innovation to meet evolving consumer preferences.

- February 2023: Alshaya Group inaugurated a new production facility in Saudi Arabia for Starbucks, significantly enhancing distribution and supply chain efficiency. This demonstrates investment in infrastructure to support growth.

Strategic Outlook for GCC Food Service Market Market

The GCC food service market is poised for robust growth, driven by continuous technological innovation, evolving consumer preferences, and supportive government policies. Strategic opportunities lie in adopting sustainable practices, personalized service offerings, and leveraging technology to optimize operations and enhance the customer experience. Further expansion into underserved markets and strategic partnerships hold immense potential for market leaders to solidify their positions and drive future growth.

GCC Food Service Market Segmentation

-

1. Foodservice Type

-

1.1. Cafes & Bars

-

1.1.1. By Cuisine

- 1.1.1.1. Bars & Pubs

- 1.1.1.2. Juice/Smoothie/Desserts Bars

- 1.1.1.3. Specialist Coffee & Tea Shops

-

1.1.1. By Cuisine

- 1.2. Cloud Kitchen

-

1.3. Full Service Restaurants

- 1.3.1. Asian

- 1.3.2. European

- 1.3.3. Latin American

- 1.3.4. Middle Eastern

- 1.3.5. North American

- 1.3.6. Other FSR Cuisines

-

1.4. Quick Service Restaurants

- 1.4.1. Bakeries

- 1.4.2. Burger

- 1.4.3. Ice Cream

- 1.4.4. Meat-based Cuisines

- 1.4.5. Pizza

- 1.4.6. Other QSR Cuisines

-

1.1. Cafes & Bars

-

2. Outlet

- 2.1. Chained Outlets

- 2.2. Independent Outlets

-

3. Location

- 3.1. Leisure

- 3.2. Lodging

- 3.3. Retail

- 3.4. Standalone

- 3.5. Travel

GCC Food Service Market Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

GCC Food Service Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 10.40% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Consumer inclination toward functional food and beverages; Increasing Number of Applications and Growing Industrial Use

- 3.3. Market Restrains

- 3.3.1. Increasing Shift Toward Plant-Based Protein

- 3.4. Market Trends

- 3.4.1. OTHER KEY INDUSTRY TRENDS COVERED IN THE REPORT

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global GCC Food Service Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Foodservice Type

- 5.1.1. Cafes & Bars

- 5.1.1.1. By Cuisine

- 5.1.1.1.1. Bars & Pubs

- 5.1.1.1.2. Juice/Smoothie/Desserts Bars

- 5.1.1.1.3. Specialist Coffee & Tea Shops

- 5.1.1.1. By Cuisine

- 5.1.2. Cloud Kitchen

- 5.1.3. Full Service Restaurants

- 5.1.3.1. Asian

- 5.1.3.2. European

- 5.1.3.3. Latin American

- 5.1.3.4. Middle Eastern

- 5.1.3.5. North American

- 5.1.3.6. Other FSR Cuisines

- 5.1.4. Quick Service Restaurants

- 5.1.4.1. Bakeries

- 5.1.4.2. Burger

- 5.1.4.3. Ice Cream

- 5.1.4.4. Meat-based Cuisines

- 5.1.4.5. Pizza

- 5.1.4.6. Other QSR Cuisines

- 5.1.1. Cafes & Bars

- 5.2. Market Analysis, Insights and Forecast - by Outlet

- 5.2.1. Chained Outlets

- 5.2.2. Independent Outlets

- 5.3. Market Analysis, Insights and Forecast - by Location

- 5.3.1. Leisure

- 5.3.2. Lodging

- 5.3.3. Retail

- 5.3.4. Standalone

- 5.3.5. Travel

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. North America

- 5.4.2. South America

- 5.4.3. Europe

- 5.4.4. Middle East & Africa

- 5.4.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Foodservice Type

- 6. North America GCC Food Service Market Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Foodservice Type

- 6.1.1. Cafes & Bars

- 6.1.1.1. By Cuisine

- 6.1.1.1.1. Bars & Pubs

- 6.1.1.1.2. Juice/Smoothie/Desserts Bars

- 6.1.1.1.3. Specialist Coffee & Tea Shops

- 6.1.1.1. By Cuisine

- 6.1.2. Cloud Kitchen

- 6.1.3. Full Service Restaurants

- 6.1.3.1. Asian

- 6.1.3.2. European

- 6.1.3.3. Latin American

- 6.1.3.4. Middle Eastern

- 6.1.3.5. North American

- 6.1.3.6. Other FSR Cuisines

- 6.1.4. Quick Service Restaurants

- 6.1.4.1. Bakeries

- 6.1.4.2. Burger

- 6.1.4.3. Ice Cream

- 6.1.4.4. Meat-based Cuisines

- 6.1.4.5. Pizza

- 6.1.4.6. Other QSR Cuisines

- 6.1.1. Cafes & Bars

- 6.2. Market Analysis, Insights and Forecast - by Outlet

- 6.2.1. Chained Outlets

- 6.2.2. Independent Outlets

- 6.3. Market Analysis, Insights and Forecast - by Location

- 6.3.1. Leisure

- 6.3.2. Lodging

- 6.3.3. Retail

- 6.3.4. Standalone

- 6.3.5. Travel

- 6.1. Market Analysis, Insights and Forecast - by Foodservice Type

- 7. South America GCC Food Service Market Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Foodservice Type

- 7.1.1. Cafes & Bars

- 7.1.1.1. By Cuisine

- 7.1.1.1.1. Bars & Pubs

- 7.1.1.1.2. Juice/Smoothie/Desserts Bars

- 7.1.1.1.3. Specialist Coffee & Tea Shops

- 7.1.1.1. By Cuisine

- 7.1.2. Cloud Kitchen

- 7.1.3. Full Service Restaurants

- 7.1.3.1. Asian

- 7.1.3.2. European

- 7.1.3.3. Latin American

- 7.1.3.4. Middle Eastern

- 7.1.3.5. North American

- 7.1.3.6. Other FSR Cuisines

- 7.1.4. Quick Service Restaurants

- 7.1.4.1. Bakeries

- 7.1.4.2. Burger

- 7.1.4.3. Ice Cream

- 7.1.4.4. Meat-based Cuisines

- 7.1.4.5. Pizza

- 7.1.4.6. Other QSR Cuisines

- 7.1.1. Cafes & Bars

- 7.2. Market Analysis, Insights and Forecast - by Outlet

- 7.2.1. Chained Outlets

- 7.2.2. Independent Outlets

- 7.3. Market Analysis, Insights and Forecast - by Location

- 7.3.1. Leisure

- 7.3.2. Lodging

- 7.3.3. Retail

- 7.3.4. Standalone

- 7.3.5. Travel

- 7.1. Market Analysis, Insights and Forecast - by Foodservice Type

- 8. Europe GCC Food Service Market Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Foodservice Type

- 8.1.1. Cafes & Bars

- 8.1.1.1. By Cuisine

- 8.1.1.1.1. Bars & Pubs

- 8.1.1.1.2. Juice/Smoothie/Desserts Bars

- 8.1.1.1.3. Specialist Coffee & Tea Shops

- 8.1.1.1. By Cuisine

- 8.1.2. Cloud Kitchen

- 8.1.3. Full Service Restaurants

- 8.1.3.1. Asian

- 8.1.3.2. European

- 8.1.3.3. Latin American

- 8.1.3.4. Middle Eastern

- 8.1.3.5. North American

- 8.1.3.6. Other FSR Cuisines

- 8.1.4. Quick Service Restaurants

- 8.1.4.1. Bakeries

- 8.1.4.2. Burger

- 8.1.4.3. Ice Cream

- 8.1.4.4. Meat-based Cuisines

- 8.1.4.5. Pizza

- 8.1.4.6. Other QSR Cuisines

- 8.1.1. Cafes & Bars

- 8.2. Market Analysis, Insights and Forecast - by Outlet

- 8.2.1. Chained Outlets

- 8.2.2. Independent Outlets

- 8.3. Market Analysis, Insights and Forecast - by Location

- 8.3.1. Leisure

- 8.3.2. Lodging

- 8.3.3. Retail

- 8.3.4. Standalone

- 8.3.5. Travel

- 8.1. Market Analysis, Insights and Forecast - by Foodservice Type

- 9. Middle East & Africa GCC Food Service Market Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Foodservice Type

- 9.1.1. Cafes & Bars

- 9.1.1.1. By Cuisine

- 9.1.1.1.1. Bars & Pubs

- 9.1.1.1.2. Juice/Smoothie/Desserts Bars

- 9.1.1.1.3. Specialist Coffee & Tea Shops

- 9.1.1.1. By Cuisine

- 9.1.2. Cloud Kitchen

- 9.1.3. Full Service Restaurants

- 9.1.3.1. Asian

- 9.1.3.2. European

- 9.1.3.3. Latin American

- 9.1.3.4. Middle Eastern

- 9.1.3.5. North American

- 9.1.3.6. Other FSR Cuisines

- 9.1.4. Quick Service Restaurants

- 9.1.4.1. Bakeries

- 9.1.4.2. Burger

- 9.1.4.3. Ice Cream

- 9.1.4.4. Meat-based Cuisines

- 9.1.4.5. Pizza

- 9.1.4.6. Other QSR Cuisines

- 9.1.1. Cafes & Bars

- 9.2. Market Analysis, Insights and Forecast - by Outlet

- 9.2.1. Chained Outlets

- 9.2.2. Independent Outlets

- 9.3. Market Analysis, Insights and Forecast - by Location

- 9.3.1. Leisure

- 9.3.2. Lodging

- 9.3.3. Retail

- 9.3.4. Standalone

- 9.3.5. Travel

- 9.1. Market Analysis, Insights and Forecast - by Foodservice Type

- 10. Asia Pacific GCC Food Service Market Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Foodservice Type

- 10.1.1. Cafes & Bars

- 10.1.1.1. By Cuisine

- 10.1.1.1.1. Bars & Pubs

- 10.1.1.1.2. Juice/Smoothie/Desserts Bars

- 10.1.1.1.3. Specialist Coffee & Tea Shops

- 10.1.1.1. By Cuisine

- 10.1.2. Cloud Kitchen

- 10.1.3. Full Service Restaurants

- 10.1.3.1. Asian

- 10.1.3.2. European

- 10.1.3.3. Latin American

- 10.1.3.4. Middle Eastern

- 10.1.3.5. North American

- 10.1.3.6. Other FSR Cuisines

- 10.1.4. Quick Service Restaurants

- 10.1.4.1. Bakeries

- 10.1.4.2. Burger

- 10.1.4.3. Ice Cream

- 10.1.4.4. Meat-based Cuisines

- 10.1.4.5. Pizza

- 10.1.4.6. Other QSR Cuisines

- 10.1.1. Cafes & Bars

- 10.2. Market Analysis, Insights and Forecast - by Outlet

- 10.2.1. Chained Outlets

- 10.2.2. Independent Outlets

- 10.3. Market Analysis, Insights and Forecast - by Location

- 10.3.1. Leisure

- 10.3.2. Lodging

- 10.3.3. Retail

- 10.3.4. Standalone

- 10.3.5. Travel

- 10.1. Market Analysis, Insights and Forecast - by Foodservice Type

- 11. South Africa GCC Food Service Market Analysis, Insights and Forecast, 2019-2031

- 11.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 11.1.1.

- 12. Saudi Arabia GCC Food Service Market Analysis, Insights and Forecast, 2019-2031

- 12.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 12.1.1.

- 13. United Arab Emirates GCC Food Service Market Analysis, Insights and Forecast, 2019-2031

- 13.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 13.1.1.

- 14. Rest of Middle East and Africa GCC Food Service Market Analysis, Insights and Forecast, 2019-2031

- 14.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 14.1.1.

- 15. Competitive Analysis

- 15.1. Global Market Share Analysis 2024

- 15.2. Company Profiles

- 15.2.1 ALBAIK Food Systems Company SA

- 15.2.1.1. Overview

- 15.2.1.2. Products

- 15.2.1.3. SWOT Analysis

- 15.2.1.4. Recent Developments

- 15.2.1.5. Financials (Based on Availability)

- 15.2.2 The Sultan Cente

- 15.2.2.1. Overview

- 15.2.2.2. Products

- 15.2.2.3. SWOT Analysis

- 15.2.2.4. Recent Developments

- 15.2.2.5. Financials (Based on Availability)

- 15.2.3 Nando's Group Holdings Limited

- 15.2.3.1. Overview

- 15.2.3.2. Products

- 15.2.3.3. SWOT Analysis

- 15.2.3.4. Recent Developments

- 15.2.3.5. Financials (Based on Availability)

- 15.2.4 Doctor's Associate Inc

- 15.2.4.1. Overview

- 15.2.4.2. Products

- 15.2.4.3. SWOT Analysis

- 15.2.4.4. Recent Developments

- 15.2.4.5. Financials (Based on Availability)

- 15.2.5 MH Alshaya Co WLL

- 15.2.5.1. Overview

- 15.2.5.2. Products

- 15.2.5.3. SWOT Analysis

- 15.2.5.4. Recent Developments

- 15.2.5.5. Financials (Based on Availability)

- 15.2.6 Americana Restaurants International PLC

- 15.2.6.1. Overview

- 15.2.6.2. Products

- 15.2.6.3. SWOT Analysis

- 15.2.6.4. Recent Developments

- 15.2.6.5. Financials (Based on Availability)

- 15.2.7 Kudu Company For Food And Catering

- 15.2.7.1. Overview

- 15.2.7.2. Products

- 15.2.7.3. SWOT Analysis

- 15.2.7.4. Recent Developments

- 15.2.7.5. Financials (Based on Availability)

- 15.2.8 LuLu Group International

- 15.2.8.1. Overview

- 15.2.8.2. Products

- 15.2.8.3. SWOT Analysis

- 15.2.8.4. Recent Developments

- 15.2.8.5. Financials (Based on Availability)

- 15.2.9 Herfy Food Service Company

- 15.2.9.1. Overview

- 15.2.9.2. Products

- 15.2.9.3. SWOT Analysis

- 15.2.9.4. Recent Developments

- 15.2.9.5. Financials (Based on Availability)

- 15.2.10 Alamar Foods Company

- 15.2.10.1. Overview

- 15.2.10.2. Products

- 15.2.10.3. SWOT Analysis

- 15.2.10.4. Recent Developments

- 15.2.10.5. Financials (Based on Availability)

- 15.2.11 Restaurant Brands International Inc

- 15.2.11.1. Overview

- 15.2.11.2. Products

- 15.2.11.3. SWOT Analysis

- 15.2.11.4. Recent Developments

- 15.2.11.5. Financials (Based on Availability)

- 15.2.12 Galadari Ice Cream Co Ltd LLC

- 15.2.12.1. Overview

- 15.2.12.2. Products

- 15.2.12.3. SWOT Analysis

- 15.2.12.4. Recent Developments

- 15.2.12.5. Financials (Based on Availability)

- 15.2.13 McDonald's Corporation

- 15.2.13.1. Overview

- 15.2.13.2. Products

- 15.2.13.3. SWOT Analysis

- 15.2.13.4. Recent Developments

- 15.2.13.5. Financials (Based on Availability)

- 15.2.14 Al Tazaj Fakeih

- 15.2.14.1. Overview

- 15.2.14.2. Products

- 15.2.14.3. SWOT Analysis

- 15.2.14.4. Recent Developments

- 15.2.14.5. Financials (Based on Availability)

- 15.2.1 ALBAIK Food Systems Company SA

List of Figures

- Figure 1: Global GCC Food Service Market Revenue Breakdown (Million, %) by Region 2024 & 2032

- Figure 2: South Africa GCC Food Service Market Revenue (Million), by Country 2024 & 2032

- Figure 3: South Africa GCC Food Service Market Revenue Share (%), by Country 2024 & 2032

- Figure 4: Saudi Arabia GCC Food Service Market Revenue (Million), by Country 2024 & 2032

- Figure 5: Saudi Arabia GCC Food Service Market Revenue Share (%), by Country 2024 & 2032

- Figure 6: United Arab Emirates GCC Food Service Market Revenue (Million), by Country 2024 & 2032

- Figure 7: United Arab Emirates GCC Food Service Market Revenue Share (%), by Country 2024 & 2032

- Figure 8: Rest of Middle East and Africa GCC Food Service Market Revenue (Million), by Country 2024 & 2032

- Figure 9: Rest of Middle East and Africa GCC Food Service Market Revenue Share (%), by Country 2024 & 2032

- Figure 10: North America GCC Food Service Market Revenue (Million), by Foodservice Type 2024 & 2032

- Figure 11: North America GCC Food Service Market Revenue Share (%), by Foodservice Type 2024 & 2032

- Figure 12: North America GCC Food Service Market Revenue (Million), by Outlet 2024 & 2032

- Figure 13: North America GCC Food Service Market Revenue Share (%), by Outlet 2024 & 2032

- Figure 14: North America GCC Food Service Market Revenue (Million), by Location 2024 & 2032

- Figure 15: North America GCC Food Service Market Revenue Share (%), by Location 2024 & 2032

- Figure 16: North America GCC Food Service Market Revenue (Million), by Country 2024 & 2032

- Figure 17: North America GCC Food Service Market Revenue Share (%), by Country 2024 & 2032

- Figure 18: South America GCC Food Service Market Revenue (Million), by Foodservice Type 2024 & 2032

- Figure 19: South America GCC Food Service Market Revenue Share (%), by Foodservice Type 2024 & 2032

- Figure 20: South America GCC Food Service Market Revenue (Million), by Outlet 2024 & 2032

- Figure 21: South America GCC Food Service Market Revenue Share (%), by Outlet 2024 & 2032

- Figure 22: South America GCC Food Service Market Revenue (Million), by Location 2024 & 2032

- Figure 23: South America GCC Food Service Market Revenue Share (%), by Location 2024 & 2032

- Figure 24: South America GCC Food Service Market Revenue (Million), by Country 2024 & 2032

- Figure 25: South America GCC Food Service Market Revenue Share (%), by Country 2024 & 2032

- Figure 26: Europe GCC Food Service Market Revenue (Million), by Foodservice Type 2024 & 2032

- Figure 27: Europe GCC Food Service Market Revenue Share (%), by Foodservice Type 2024 & 2032

- Figure 28: Europe GCC Food Service Market Revenue (Million), by Outlet 2024 & 2032

- Figure 29: Europe GCC Food Service Market Revenue Share (%), by Outlet 2024 & 2032

- Figure 30: Europe GCC Food Service Market Revenue (Million), by Location 2024 & 2032

- Figure 31: Europe GCC Food Service Market Revenue Share (%), by Location 2024 & 2032

- Figure 32: Europe GCC Food Service Market Revenue (Million), by Country 2024 & 2032

- Figure 33: Europe GCC Food Service Market Revenue Share (%), by Country 2024 & 2032

- Figure 34: Middle East & Africa GCC Food Service Market Revenue (Million), by Foodservice Type 2024 & 2032

- Figure 35: Middle East & Africa GCC Food Service Market Revenue Share (%), by Foodservice Type 2024 & 2032

- Figure 36: Middle East & Africa GCC Food Service Market Revenue (Million), by Outlet 2024 & 2032

- Figure 37: Middle East & Africa GCC Food Service Market Revenue Share (%), by Outlet 2024 & 2032

- Figure 38: Middle East & Africa GCC Food Service Market Revenue (Million), by Location 2024 & 2032

- Figure 39: Middle East & Africa GCC Food Service Market Revenue Share (%), by Location 2024 & 2032

- Figure 40: Middle East & Africa GCC Food Service Market Revenue (Million), by Country 2024 & 2032

- Figure 41: Middle East & Africa GCC Food Service Market Revenue Share (%), by Country 2024 & 2032

- Figure 42: Asia Pacific GCC Food Service Market Revenue (Million), by Foodservice Type 2024 & 2032

- Figure 43: Asia Pacific GCC Food Service Market Revenue Share (%), by Foodservice Type 2024 & 2032

- Figure 44: Asia Pacific GCC Food Service Market Revenue (Million), by Outlet 2024 & 2032

- Figure 45: Asia Pacific GCC Food Service Market Revenue Share (%), by Outlet 2024 & 2032

- Figure 46: Asia Pacific GCC Food Service Market Revenue (Million), by Location 2024 & 2032

- Figure 47: Asia Pacific GCC Food Service Market Revenue Share (%), by Location 2024 & 2032

- Figure 48: Asia Pacific GCC Food Service Market Revenue (Million), by Country 2024 & 2032

- Figure 49: Asia Pacific GCC Food Service Market Revenue Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global GCC Food Service Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Global GCC Food Service Market Revenue Million Forecast, by Foodservice Type 2019 & 2032

- Table 3: Global GCC Food Service Market Revenue Million Forecast, by Outlet 2019 & 2032

- Table 4: Global GCC Food Service Market Revenue Million Forecast, by Location 2019 & 2032

- Table 5: Global GCC Food Service Market Revenue Million Forecast, by Region 2019 & 2032

- Table 6: Global GCC Food Service Market Revenue Million Forecast, by Country 2019 & 2032

- Table 7: GCC Food Service Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 8: Global GCC Food Service Market Revenue Million Forecast, by Country 2019 & 2032

- Table 9: GCC Food Service Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: Global GCC Food Service Market Revenue Million Forecast, by Country 2019 & 2032

- Table 11: GCC Food Service Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 12: Global GCC Food Service Market Revenue Million Forecast, by Country 2019 & 2032

- Table 13: GCC Food Service Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 14: Global GCC Food Service Market Revenue Million Forecast, by Foodservice Type 2019 & 2032

- Table 15: Global GCC Food Service Market Revenue Million Forecast, by Outlet 2019 & 2032

- Table 16: Global GCC Food Service Market Revenue Million Forecast, by Location 2019 & 2032

- Table 17: Global GCC Food Service Market Revenue Million Forecast, by Country 2019 & 2032

- Table 18: United States GCC Food Service Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 19: Canada GCC Food Service Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 20: Mexico GCC Food Service Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 21: Global GCC Food Service Market Revenue Million Forecast, by Foodservice Type 2019 & 2032

- Table 22: Global GCC Food Service Market Revenue Million Forecast, by Outlet 2019 & 2032

- Table 23: Global GCC Food Service Market Revenue Million Forecast, by Location 2019 & 2032

- Table 24: Global GCC Food Service Market Revenue Million Forecast, by Country 2019 & 2032

- Table 25: Brazil GCC Food Service Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 26: Argentina GCC Food Service Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 27: Rest of South America GCC Food Service Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 28: Global GCC Food Service Market Revenue Million Forecast, by Foodservice Type 2019 & 2032

- Table 29: Global GCC Food Service Market Revenue Million Forecast, by Outlet 2019 & 2032

- Table 30: Global GCC Food Service Market Revenue Million Forecast, by Location 2019 & 2032

- Table 31: Global GCC Food Service Market Revenue Million Forecast, by Country 2019 & 2032

- Table 32: United Kingdom GCC Food Service Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 33: Germany GCC Food Service Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 34: France GCC Food Service Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 35: Italy GCC Food Service Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 36: Spain GCC Food Service Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 37: Russia GCC Food Service Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 38: Benelux GCC Food Service Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 39: Nordics GCC Food Service Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 40: Rest of Europe GCC Food Service Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 41: Global GCC Food Service Market Revenue Million Forecast, by Foodservice Type 2019 & 2032

- Table 42: Global GCC Food Service Market Revenue Million Forecast, by Outlet 2019 & 2032

- Table 43: Global GCC Food Service Market Revenue Million Forecast, by Location 2019 & 2032

- Table 44: Global GCC Food Service Market Revenue Million Forecast, by Country 2019 & 2032

- Table 45: Turkey GCC Food Service Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 46: Israel GCC Food Service Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 47: GCC GCC Food Service Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 48: North Africa GCC Food Service Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 49: South Africa GCC Food Service Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 50: Rest of Middle East & Africa GCC Food Service Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 51: Global GCC Food Service Market Revenue Million Forecast, by Foodservice Type 2019 & 2032

- Table 52: Global GCC Food Service Market Revenue Million Forecast, by Outlet 2019 & 2032

- Table 53: Global GCC Food Service Market Revenue Million Forecast, by Location 2019 & 2032

- Table 54: Global GCC Food Service Market Revenue Million Forecast, by Country 2019 & 2032

- Table 55: China GCC Food Service Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 56: India GCC Food Service Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 57: Japan GCC Food Service Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 58: South Korea GCC Food Service Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 59: ASEAN GCC Food Service Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 60: Oceania GCC Food Service Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 61: Rest of Asia Pacific GCC Food Service Market Revenue (Million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the GCC Food Service Market?

The projected CAGR is approximately 10.40%.

2. Which companies are prominent players in the GCC Food Service Market?

Key companies in the market include ALBAIK Food Systems Company SA, The Sultan Cente, Nando's Group Holdings Limited, Doctor's Associate Inc, MH Alshaya Co WLL, Americana Restaurants International PLC, Kudu Company For Food And Catering, LuLu Group International, Herfy Food Service Company, Alamar Foods Company, Restaurant Brands International Inc, Galadari Ice Cream Co Ltd LLC, McDonald's Corporation, Al Tazaj Fakeih.

3. What are the main segments of the GCC Food Service Market?

The market segments include Foodservice Type, Outlet, Location.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Consumer inclination toward functional food and beverages; Increasing Number of Applications and Growing Industrial Use.

6. What are the notable trends driving market growth?

OTHER KEY INDUSTRY TRENDS COVERED IN THE REPORT.

7. Are there any restraints impacting market growth?

Increasing Shift Toward Plant-Based Protein.

8. Can you provide examples of recent developments in the market?

February 2023: Alshaya Group inaugurated a new production facility in Saudi Arabia to produce freshly baked and packaged food for 400 Starbucks stores in the country. Alshaya Group, which operates more than 1,000 Starbucks stores across the Middle East, has been planning to enhance the distribution reach of the site to over 500 Starbucks outlets by the end of 2023.January 2023: Popeyes introduced a new shrimp roll to its seafood menu.December 2022: Americana Restaurants re-launched Wimpy, a burger brand, in the UAE market. Wimpy's new location is expected to use the innovative robotic solution as part of the restaurant's vision to become the Middle East's first tech burger brand. Flippy 2 is a robotics solution that can automate a variety of restaurant cooking tasks while assisting with consistency and accuracy at the fry station.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "GCC Food Service Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the GCC Food Service Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the GCC Food Service Market?

To stay informed about further developments, trends, and reports in the GCC Food Service Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence