Key Insights

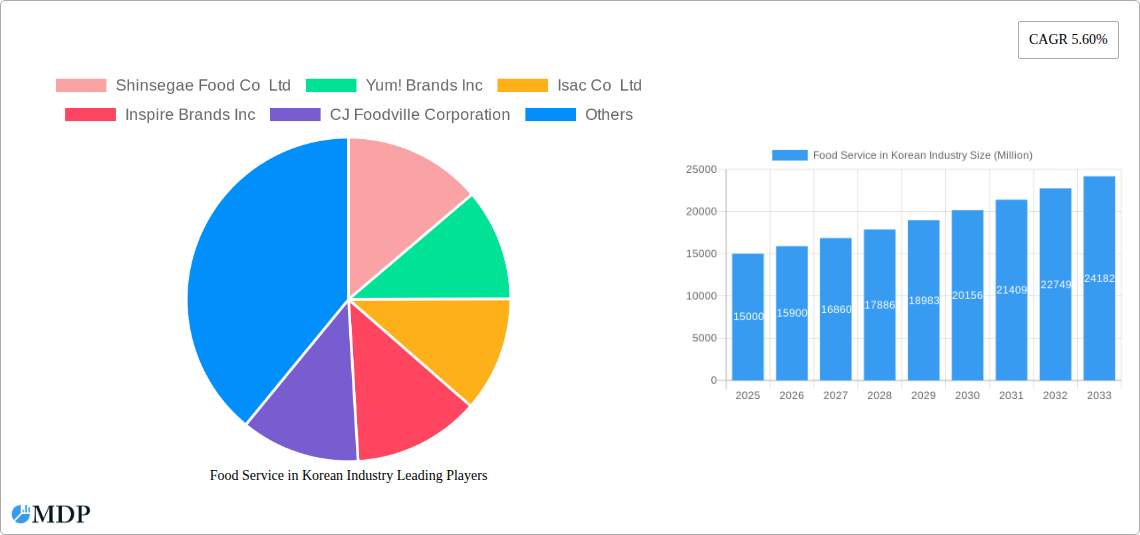

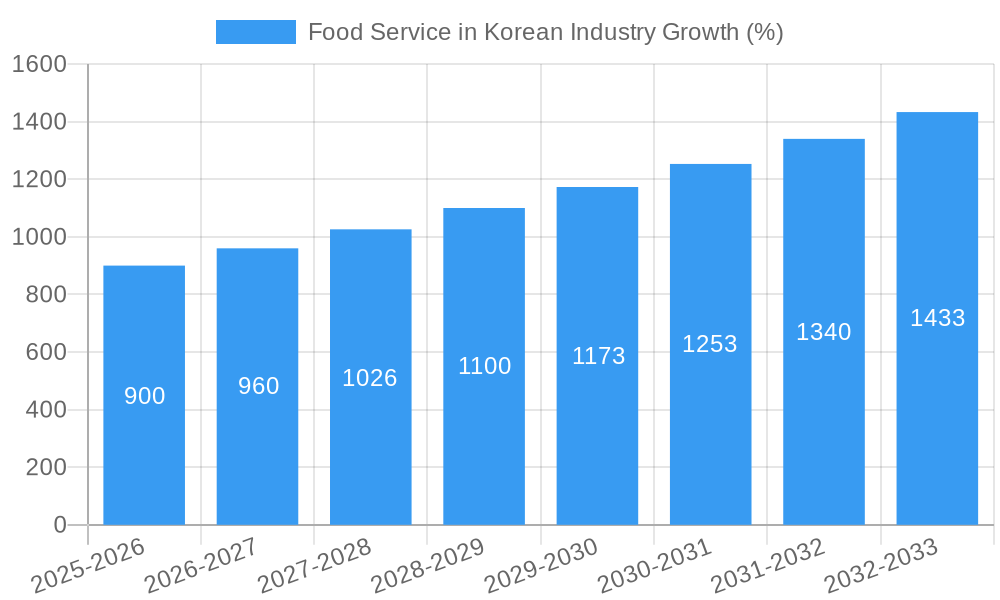

The South Korean food service industry, exhibiting a Compound Annual Growth Rate (CAGR) of 5.60% from 2019 to 2024, presents a dynamic and lucrative market. Driven by rising disposable incomes, changing lifestyles favoring convenience and diverse culinary experiences, and a burgeoning tourism sector, the industry shows strong potential for continued expansion. The market segmentation reveals a diverse landscape, with chained outlets holding a significant share, but independent outlets also contributing substantially. Popular locations include retail spaces, standalone restaurants, and those integrated within leisure and lodging establishments. Cafes and bars form a notable segment within the broader food service type classification. Key players such as Shinsegae Food Co Ltd, Yum! Brands Inc, and CJ Foodville Corporation compete fiercely, showcasing innovation in menu offerings and operational strategies to cater to evolving consumer preferences. The robust growth is further fueled by the increasing popularity of international cuisines alongside traditional Korean fare, leading to a highly competitive yet expanding market.

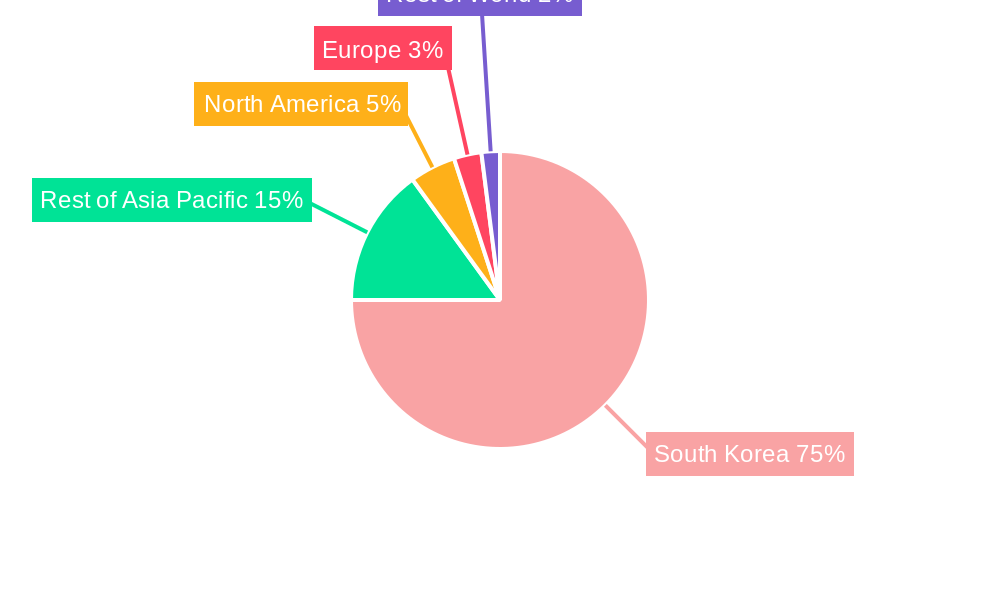

Growth projections for the forecast period (2025-2033) are optimistic, considering the sustained economic growth and the continuing trend towards eating out. While challenges like rising labor costs and ingredient prices represent potential restraints, the industry's adaptability and innovation suggest that these can be effectively navigated. The regional breakdown indicates a strong domestic market within South Korea, with potential for further growth in adjacent Asian markets due to cultural proximity and shared consumer preferences. International expansion by Korean food service brands is also a likely trajectory, leveraging the increasing global appeal of Korean cuisine. Specific market share details for each segment and region would require further investigation but the available data paints a clear picture of a thriving and complex market primed for sustained growth.

Food Service in Korean Industry: A Comprehensive Market Report (2019-2033)

This in-depth report provides a comprehensive analysis of the dynamic Korean food service industry, covering market size, trends, competitive landscape, and future outlook. Valued at $XX Million in 2025, the industry is projected to experience significant growth, reaching $XX Million by 2033, exhibiting a CAGR of XX%. This report is essential for industry stakeholders, investors, and businesses seeking to understand and capitalize on opportunities within this thriving market. The study period spans 2019-2033, with 2025 serving as the base and estimated year.

Food Service in Korean Industry Market Dynamics & Concentration

The Korean food service market is characterized by a dynamic interplay of established players and emerging entrants. Market concentration is moderate, with a few large chains holding significant market share, while numerous independent outlets and smaller chains contribute to the overall market vibrancy. The market share of the top 5 players is estimated to be around XX%, indicating a relatively fragmented landscape. Innovation is driven by consumer demand for diverse cuisines, healthier options, and convenient experiences. Stringent food safety regulations and evolving consumer preferences are significant factors shaping market dynamics. The industry witnesses consistent M&A activity, with approximately XX deals recorded in the historical period (2019-2024). These mergers and acquisitions often involve strategic partnerships to expand market reach and enhance brand portfolios. Product substitutes, like home-cooked meals and meal delivery services, pose a moderate competitive threat, but the convenience and social aspect of dining out largely sustains the industry's growth. End-user trends indicate a growing preference for premium experiences, personalized offerings, and tech-enabled services.

Food Service in Korean Industry Industry Trends & Analysis

The Korean food service industry is experiencing robust growth, fueled by several key trends. Rising disposable incomes, a young and increasingly affluent population, and a burgeoning preference for diverse culinary experiences are driving market expansion. Technological disruptions, including online ordering platforms, mobile payment systems, and AI-powered restaurant management tools, are streamlining operations and enhancing customer experiences. Consumer preferences are shifting towards healthier and more sustainable food options, with increased demand for organic ingredients, plant-based alternatives, and customizable meals. Intense competition drives innovation, pushing companies to invest in branding, loyalty programs, and unique offerings to attract and retain customers. The market is witnessing the emergence of new cuisines, fusion concepts, and personalized dining experiences, contributing to overall market dynamism. The rapid expansion of chained outlets is a significant trend, alongside the continued presence of independent players catering to niche markets. The market penetration of online food delivery services continues to increase, exceeding XX% in 2024 and forecast to reach XX% by 2033.

Leading Markets & Segments in Food Service in Korean Industry

The Chained Outlets segment dominates the Korean food service market, accounting for approximately XX% of the total revenue in 2025. This dominance is fueled by the economies of scale, consistent brand recognition, and efficient operations characteristic of larger chains.

- Key Drivers for Chained Outlets:

- Brand recognition and customer loyalty

- Efficient supply chain management

- Standardized quality and service

- Targeted marketing and promotional campaigns

- Strategic locations in high-traffic areas

The Retail location segment also exhibits strong growth, benefiting from high foot traffic and diverse consumer demographics. Standalone and Travel locations hold substantial importance, catering to specific consumer segments and exhibiting unique market dynamics.

- Other significant segments: Cafes & Bars demonstrate steady growth, and the Other QSR Cuisines segment thrives on consumer demand for diverse flavors and culinary experiences. The independent outlets sector, while smaller than chained outlets, retains relevance due to their capacity to cater to niche tastes and local preferences.

Food Service in Korean Industry Product Developments

Recent product developments showcase a clear emphasis on innovation and consumer preferences. The introduction of plant-based options, like Shinsegae Food's Better Burger, reflects growing consumer interest in healthier and more sustainable choices. The industry is also witnessing an increased focus on customized meal options, personalized experiences, and technology-driven enhancements to food quality and presentation. These innovations are designed to enhance the customer experience, differentiate brands, and maintain a competitive edge in a dynamic market.

Key Drivers of Food Service in Korean Industry Growth

Several key factors contribute to the sustained growth of the Korean food service industry. Firstly, increasing disposable incomes among Koreans fuel higher spending on dining experiences. Secondly, the government's support for the culinary tourism sector through infrastructure development and promotional campaigns has a positive impact. Thirdly, technological advancements such as online ordering and mobile payment systems improve efficiency and customer convenience.

Challenges in the Food Service in Korean Industry Market

The Korean food service industry faces several challenges, including intense competition, rising food costs, and stringent food safety regulations. The labor shortage in the hospitality sector adds operational complexity, and fluctuations in raw material prices impact profitability. Maintaining consistent food quality and customer satisfaction amidst these pressures remains a core challenge for businesses. The impact of these challenges on profit margins is estimated at approximately XX% annually.

Emerging Opportunities in Food Service in Korean Industry

The long-term growth of the Korean food service industry is driven by several emerging opportunities. The expansion of food delivery services offers significant potential for market growth. Strategic partnerships and mergers and acquisitions offer avenues for market consolidation and enhanced brand portfolios. Technological innovations, such as AI-powered ordering and kitchen automation, promise efficiency gains and cost savings. The increasing popularity of diverse cuisines and fusion concepts also presents attractive avenues for market expansion and differentiation.

Leading Players in the Food Service in Korean Industry Sector

- Shinsegae Food Co Ltd

- Yum! Brands Inc

- Isac Co Ltd

- Inspire Brands Inc

- CJ Foodville Corporation

- Seven & I Holdings Co Ltd

- Kyochon Food&Beverage Co Ltd

- Doctor's Associate Inc

- MP DAESAN Inc

- Genesis Co Ltd

- Domino's Pizza Inc

- Starbucks Corporation

- Restaurant Brands International Inc

- Royal T Group Pte Ltd

- McDonald's Corporation

- Mom's Touch & Co

Key Milestones in Food Service in Korean Industry Industry

- February 2023: McDonald's Korea collaborated with NewJeans and introduced a special crispy chicken sandwich meal, boosting brand visibility and attracting a younger demographic.

- March 2023: Yum! Brands Inc. acquired KFC Korea Co., strengthening its market position in the Korean quick-service restaurant sector.

- April 2023: Shinsegae Food introduced the Better Burger, a 100% plant-based burger, expanding its menu to cater to the growing demand for vegetarian and vegan options.

Strategic Outlook for Food Service in Korean Industry Market

The future of the Korean food service industry is promising, with significant potential for growth driven by evolving consumer preferences, technological advancements, and strategic partnerships. Companies that prioritize innovation, customer experience, and sustainable practices are poised to succeed in this competitive landscape. The industry's continued expansion hinges on adapting to shifting demographics, exploring new culinary trends, and leveraging technology to enhance efficiency and customer engagement. The focus on health-conscious options and personalized dining experiences will remain key to maintaining a strong market position.

Food Service in Korean Industry Segmentation

-

1. Foodservice Type

-

1.1. Cafes & Bars

-

1.1.1. By Cuisine

- 1.1.1.1. Bars & Pubs

- 1.1.1.2. Juice/Smoothie/Desserts Bars

- 1.1.1.3. Specialist Coffee & Tea Shops

-

1.1.1. By Cuisine

- 1.2. Cloud Kitchen

-

1.3. Full Service Restaurants

- 1.3.1. Asian

- 1.3.2. European

- 1.3.3. Latin American

- 1.3.4. Middle Eastern

- 1.3.5. North American

- 1.3.6. Other FSR Cuisines

-

1.4. Quick Service Restaurants

- 1.4.1. Bakeries

- 1.4.2. Burger

- 1.4.3. Ice Cream

- 1.4.4. Meat-based Cuisines

- 1.4.5. Pizza

- 1.4.6. Other QSR Cuisines

-

1.1. Cafes & Bars

-

2. Outlet

- 2.1. Chained Outlets

- 2.2. Independent Outlets

-

3. Location

- 3.1. Leisure

- 3.2. Lodging

- 3.3. Retail

- 3.4. Standalone

- 3.5. Travel

Food Service in Korean Industry Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

Food Service in Korean Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 5.60% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Growing Demand for Cocoa Butter Equivalents Among Food Manufacturers; Rising Application in Food Industry

- 3.3. Market Restrains

- 3.3.1. Health Concerns Pertaining to the Excessive Consumption of Fats and Oils

- 3.4. Market Trends

- 3.4.1. High demand for traditional cuisines and increased spending on dining increase the sales

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Food Service in Korean Industry Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Foodservice Type

- 5.1.1. Cafes & Bars

- 5.1.1.1. By Cuisine

- 5.1.1.1.1. Bars & Pubs

- 5.1.1.1.2. Juice/Smoothie/Desserts Bars

- 5.1.1.1.3. Specialist Coffee & Tea Shops

- 5.1.1.1. By Cuisine

- 5.1.2. Cloud Kitchen

- 5.1.3. Full Service Restaurants

- 5.1.3.1. Asian

- 5.1.3.2. European

- 5.1.3.3. Latin American

- 5.1.3.4. Middle Eastern

- 5.1.3.5. North American

- 5.1.3.6. Other FSR Cuisines

- 5.1.4. Quick Service Restaurants

- 5.1.4.1. Bakeries

- 5.1.4.2. Burger

- 5.1.4.3. Ice Cream

- 5.1.4.4. Meat-based Cuisines

- 5.1.4.5. Pizza

- 5.1.4.6. Other QSR Cuisines

- 5.1.1. Cafes & Bars

- 5.2. Market Analysis, Insights and Forecast - by Outlet

- 5.2.1. Chained Outlets

- 5.2.2. Independent Outlets

- 5.3. Market Analysis, Insights and Forecast - by Location

- 5.3.1. Leisure

- 5.3.2. Lodging

- 5.3.3. Retail

- 5.3.4. Standalone

- 5.3.5. Travel

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. North America

- 5.4.2. South America

- 5.4.3. Europe

- 5.4.4. Middle East & Africa

- 5.4.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Foodservice Type

- 6. North America Food Service in Korean Industry Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Foodservice Type

- 6.1.1. Cafes & Bars

- 6.1.1.1. By Cuisine

- 6.1.1.1.1. Bars & Pubs

- 6.1.1.1.2. Juice/Smoothie/Desserts Bars

- 6.1.1.1.3. Specialist Coffee & Tea Shops

- 6.1.1.1. By Cuisine

- 6.1.2. Cloud Kitchen

- 6.1.3. Full Service Restaurants

- 6.1.3.1. Asian

- 6.1.3.2. European

- 6.1.3.3. Latin American

- 6.1.3.4. Middle Eastern

- 6.1.3.5. North American

- 6.1.3.6. Other FSR Cuisines

- 6.1.4. Quick Service Restaurants

- 6.1.4.1. Bakeries

- 6.1.4.2. Burger

- 6.1.4.3. Ice Cream

- 6.1.4.4. Meat-based Cuisines

- 6.1.4.5. Pizza

- 6.1.4.6. Other QSR Cuisines

- 6.1.1. Cafes & Bars

- 6.2. Market Analysis, Insights and Forecast - by Outlet

- 6.2.1. Chained Outlets

- 6.2.2. Independent Outlets

- 6.3. Market Analysis, Insights and Forecast - by Location

- 6.3.1. Leisure

- 6.3.2. Lodging

- 6.3.3. Retail

- 6.3.4. Standalone

- 6.3.5. Travel

- 6.1. Market Analysis, Insights and Forecast - by Foodservice Type

- 7. South America Food Service in Korean Industry Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Foodservice Type

- 7.1.1. Cafes & Bars

- 7.1.1.1. By Cuisine

- 7.1.1.1.1. Bars & Pubs

- 7.1.1.1.2. Juice/Smoothie/Desserts Bars

- 7.1.1.1.3. Specialist Coffee & Tea Shops

- 7.1.1.1. By Cuisine

- 7.1.2. Cloud Kitchen

- 7.1.3. Full Service Restaurants

- 7.1.3.1. Asian

- 7.1.3.2. European

- 7.1.3.3. Latin American

- 7.1.3.4. Middle Eastern

- 7.1.3.5. North American

- 7.1.3.6. Other FSR Cuisines

- 7.1.4. Quick Service Restaurants

- 7.1.4.1. Bakeries

- 7.1.4.2. Burger

- 7.1.4.3. Ice Cream

- 7.1.4.4. Meat-based Cuisines

- 7.1.4.5. Pizza

- 7.1.4.6. Other QSR Cuisines

- 7.1.1. Cafes & Bars

- 7.2. Market Analysis, Insights and Forecast - by Outlet

- 7.2.1. Chained Outlets

- 7.2.2. Independent Outlets

- 7.3. Market Analysis, Insights and Forecast - by Location

- 7.3.1. Leisure

- 7.3.2. Lodging

- 7.3.3. Retail

- 7.3.4. Standalone

- 7.3.5. Travel

- 7.1. Market Analysis, Insights and Forecast - by Foodservice Type

- 8. Europe Food Service in Korean Industry Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Foodservice Type

- 8.1.1. Cafes & Bars

- 8.1.1.1. By Cuisine

- 8.1.1.1.1. Bars & Pubs

- 8.1.1.1.2. Juice/Smoothie/Desserts Bars

- 8.1.1.1.3. Specialist Coffee & Tea Shops

- 8.1.1.1. By Cuisine

- 8.1.2. Cloud Kitchen

- 8.1.3. Full Service Restaurants

- 8.1.3.1. Asian

- 8.1.3.2. European

- 8.1.3.3. Latin American

- 8.1.3.4. Middle Eastern

- 8.1.3.5. North American

- 8.1.3.6. Other FSR Cuisines

- 8.1.4. Quick Service Restaurants

- 8.1.4.1. Bakeries

- 8.1.4.2. Burger

- 8.1.4.3. Ice Cream

- 8.1.4.4. Meat-based Cuisines

- 8.1.4.5. Pizza

- 8.1.4.6. Other QSR Cuisines

- 8.1.1. Cafes & Bars

- 8.2. Market Analysis, Insights and Forecast - by Outlet

- 8.2.1. Chained Outlets

- 8.2.2. Independent Outlets

- 8.3. Market Analysis, Insights and Forecast - by Location

- 8.3.1. Leisure

- 8.3.2. Lodging

- 8.3.3. Retail

- 8.3.4. Standalone

- 8.3.5. Travel

- 8.1. Market Analysis, Insights and Forecast - by Foodservice Type

- 9. Middle East & Africa Food Service in Korean Industry Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Foodservice Type

- 9.1.1. Cafes & Bars

- 9.1.1.1. By Cuisine

- 9.1.1.1.1. Bars & Pubs

- 9.1.1.1.2. Juice/Smoothie/Desserts Bars

- 9.1.1.1.3. Specialist Coffee & Tea Shops

- 9.1.1.1. By Cuisine

- 9.1.2. Cloud Kitchen

- 9.1.3. Full Service Restaurants

- 9.1.3.1. Asian

- 9.1.3.2. European

- 9.1.3.3. Latin American

- 9.1.3.4. Middle Eastern

- 9.1.3.5. North American

- 9.1.3.6. Other FSR Cuisines

- 9.1.4. Quick Service Restaurants

- 9.1.4.1. Bakeries

- 9.1.4.2. Burger

- 9.1.4.3. Ice Cream

- 9.1.4.4. Meat-based Cuisines

- 9.1.4.5. Pizza

- 9.1.4.6. Other QSR Cuisines

- 9.1.1. Cafes & Bars

- 9.2. Market Analysis, Insights and Forecast - by Outlet

- 9.2.1. Chained Outlets

- 9.2.2. Independent Outlets

- 9.3. Market Analysis, Insights and Forecast - by Location

- 9.3.1. Leisure

- 9.3.2. Lodging

- 9.3.3. Retail

- 9.3.4. Standalone

- 9.3.5. Travel

- 9.1. Market Analysis, Insights and Forecast - by Foodservice Type

- 10. Asia Pacific Food Service in Korean Industry Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Foodservice Type

- 10.1.1. Cafes & Bars

- 10.1.1.1. By Cuisine

- 10.1.1.1.1. Bars & Pubs

- 10.1.1.1.2. Juice/Smoothie/Desserts Bars

- 10.1.1.1.3. Specialist Coffee & Tea Shops

- 10.1.1.1. By Cuisine

- 10.1.2. Cloud Kitchen

- 10.1.3. Full Service Restaurants

- 10.1.3.1. Asian

- 10.1.3.2. European

- 10.1.3.3. Latin American

- 10.1.3.4. Middle Eastern

- 10.1.3.5. North American

- 10.1.3.6. Other FSR Cuisines

- 10.1.4. Quick Service Restaurants

- 10.1.4.1. Bakeries

- 10.1.4.2. Burger

- 10.1.4.3. Ice Cream

- 10.1.4.4. Meat-based Cuisines

- 10.1.4.5. Pizza

- 10.1.4.6. Other QSR Cuisines

- 10.1.1. Cafes & Bars

- 10.2. Market Analysis, Insights and Forecast - by Outlet

- 10.2.1. Chained Outlets

- 10.2.2. Independent Outlets

- 10.3. Market Analysis, Insights and Forecast - by Location

- 10.3.1. Leisure

- 10.3.2. Lodging

- 10.3.3. Retail

- 10.3.4. Standalone

- 10.3.5. Travel

- 10.1. Market Analysis, Insights and Forecast - by Foodservice Type

- 11. North America Food Service in Korean Industry Analysis, Insights and Forecast, 2019-2031

- 11.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 11.1.1 United States

- 11.1.2 Canada

- 11.1.3 Mexico

- 11.1.4 Rest of North America

- 12. Europe Food Service in Korean Industry Analysis, Insights and Forecast, 2019-2031

- 12.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 12.1.1 Germany

- 12.1.2 United Kingdom

- 12.1.3 Italy

- 12.1.4 Spain

- 12.1.5 France

- 12.1.6 Russia

- 12.1.7 Rest of Europe

- 13. Asia Pacific Food Service in Korean Industry Analysis, Insights and Forecast, 2019-2031

- 13.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 13.1.1 China

- 13.1.2 Japan

- 13.1.3 India

- 13.1.4 Australia

- 13.1.5 Rest of Asia Pacific

- 14. South America Food Service in Korean Industry Analysis, Insights and Forecast, 2019-2031

- 14.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 14.1.1 Brazil

- 14.1.2 Argentina

- 14.1.3 Rest of South America

- 15. Middle East and Africa Food Service in Korean Industry Analysis, Insights and Forecast, 2019-2031

- 15.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 15.1.1 Saudi Arabia

- 15.1.2 South Africa

- 15.1.3 Rest of Middle East and Africa

- 16. Competitive Analysis

- 16.1. Global Market Share Analysis 2024

- 16.2. Company Profiles

- 16.2.1 Shinsegae Food Co Ltd

- 16.2.1.1. Overview

- 16.2.1.2. Products

- 16.2.1.3. SWOT Analysis

- 16.2.1.4. Recent Developments

- 16.2.1.5. Financials (Based on Availability)

- 16.2.2 Yum! Brands Inc

- 16.2.2.1. Overview

- 16.2.2.2. Products

- 16.2.2.3. SWOT Analysis

- 16.2.2.4. Recent Developments

- 16.2.2.5. Financials (Based on Availability)

- 16.2.3 Isac Co Ltd

- 16.2.3.1. Overview

- 16.2.3.2. Products

- 16.2.3.3. SWOT Analysis

- 16.2.3.4. Recent Developments

- 16.2.3.5. Financials (Based on Availability)

- 16.2.4 Inspire Brands Inc

- 16.2.4.1. Overview

- 16.2.4.2. Products

- 16.2.4.3. SWOT Analysis

- 16.2.4.4. Recent Developments

- 16.2.4.5. Financials (Based on Availability)

- 16.2.5 CJ Foodville Corporation

- 16.2.5.1. Overview

- 16.2.5.2. Products

- 16.2.5.3. SWOT Analysis

- 16.2.5.4. Recent Developments

- 16.2.5.5. Financials (Based on Availability)

- 16.2.6 Seven & I Holdings Co Ltd

- 16.2.6.1. Overview

- 16.2.6.2. Products

- 16.2.6.3. SWOT Analysis

- 16.2.6.4. Recent Developments

- 16.2.6.5. Financials (Based on Availability)

- 16.2.7 Kyochon Food&Beverage Co Ltd

- 16.2.7.1. Overview

- 16.2.7.2. Products

- 16.2.7.3. SWOT Analysis

- 16.2.7.4. Recent Developments

- 16.2.7.5. Financials (Based on Availability)

- 16.2.8 Doctor's Associate Inc

- 16.2.8.1. Overview

- 16.2.8.2. Products

- 16.2.8.3. SWOT Analysis

- 16.2.8.4. Recent Developments

- 16.2.8.5. Financials (Based on Availability)

- 16.2.9 MP DAESAN Inc

- 16.2.9.1. Overview

- 16.2.9.2. Products

- 16.2.9.3. SWOT Analysis

- 16.2.9.4. Recent Developments

- 16.2.9.5. Financials (Based on Availability)

- 16.2.10 Genesis Co Ltd

- 16.2.10.1. Overview

- 16.2.10.2. Products

- 16.2.10.3. SWOT Analysis

- 16.2.10.4. Recent Developments

- 16.2.10.5. Financials (Based on Availability)

- 16.2.11 Domino's Pizza Inc

- 16.2.11.1. Overview

- 16.2.11.2. Products

- 16.2.11.3. SWOT Analysis

- 16.2.11.4. Recent Developments

- 16.2.11.5. Financials (Based on Availability)

- 16.2.12 Starbucks Corporation

- 16.2.12.1. Overview

- 16.2.12.2. Products

- 16.2.12.3. SWOT Analysis

- 16.2.12.4. Recent Developments

- 16.2.12.5. Financials (Based on Availability)

- 16.2.13 Restaurant Brands International Inc

- 16.2.13.1. Overview

- 16.2.13.2. Products

- 16.2.13.3. SWOT Analysis

- 16.2.13.4. Recent Developments

- 16.2.13.5. Financials (Based on Availability)

- 16.2.14 Royal T Group Pte Ltd

- 16.2.14.1. Overview

- 16.2.14.2. Products

- 16.2.14.3. SWOT Analysis

- 16.2.14.4. Recent Developments

- 16.2.14.5. Financials (Based on Availability)

- 16.2.15 McDonald's Corporation

- 16.2.15.1. Overview

- 16.2.15.2. Products

- 16.2.15.3. SWOT Analysis

- 16.2.15.4. Recent Developments

- 16.2.15.5. Financials (Based on Availability)

- 16.2.16 Mom's Touch & Co

- 16.2.16.1. Overview

- 16.2.16.2. Products

- 16.2.16.3. SWOT Analysis

- 16.2.16.4. Recent Developments

- 16.2.16.5. Financials (Based on Availability)

- 16.2.1 Shinsegae Food Co Ltd

List of Figures

- Figure 1: Global Food Service in Korean Industry Revenue Breakdown (Million, %) by Region 2024 & 2032

- Figure 2: North America Food Service in Korean Industry Revenue (Million), by Country 2024 & 2032

- Figure 3: North America Food Service in Korean Industry Revenue Share (%), by Country 2024 & 2032

- Figure 4: Europe Food Service in Korean Industry Revenue (Million), by Country 2024 & 2032

- Figure 5: Europe Food Service in Korean Industry Revenue Share (%), by Country 2024 & 2032

- Figure 6: Asia Pacific Food Service in Korean Industry Revenue (Million), by Country 2024 & 2032

- Figure 7: Asia Pacific Food Service in Korean Industry Revenue Share (%), by Country 2024 & 2032

- Figure 8: South America Food Service in Korean Industry Revenue (Million), by Country 2024 & 2032

- Figure 9: South America Food Service in Korean Industry Revenue Share (%), by Country 2024 & 2032

- Figure 10: Middle East and Africa Food Service in Korean Industry Revenue (Million), by Country 2024 & 2032

- Figure 11: Middle East and Africa Food Service in Korean Industry Revenue Share (%), by Country 2024 & 2032

- Figure 12: North America Food Service in Korean Industry Revenue (Million), by Foodservice Type 2024 & 2032

- Figure 13: North America Food Service in Korean Industry Revenue Share (%), by Foodservice Type 2024 & 2032

- Figure 14: North America Food Service in Korean Industry Revenue (Million), by Outlet 2024 & 2032

- Figure 15: North America Food Service in Korean Industry Revenue Share (%), by Outlet 2024 & 2032

- Figure 16: North America Food Service in Korean Industry Revenue (Million), by Location 2024 & 2032

- Figure 17: North America Food Service in Korean Industry Revenue Share (%), by Location 2024 & 2032

- Figure 18: North America Food Service in Korean Industry Revenue (Million), by Country 2024 & 2032

- Figure 19: North America Food Service in Korean Industry Revenue Share (%), by Country 2024 & 2032

- Figure 20: South America Food Service in Korean Industry Revenue (Million), by Foodservice Type 2024 & 2032

- Figure 21: South America Food Service in Korean Industry Revenue Share (%), by Foodservice Type 2024 & 2032

- Figure 22: South America Food Service in Korean Industry Revenue (Million), by Outlet 2024 & 2032

- Figure 23: South America Food Service in Korean Industry Revenue Share (%), by Outlet 2024 & 2032

- Figure 24: South America Food Service in Korean Industry Revenue (Million), by Location 2024 & 2032

- Figure 25: South America Food Service in Korean Industry Revenue Share (%), by Location 2024 & 2032

- Figure 26: South America Food Service in Korean Industry Revenue (Million), by Country 2024 & 2032

- Figure 27: South America Food Service in Korean Industry Revenue Share (%), by Country 2024 & 2032

- Figure 28: Europe Food Service in Korean Industry Revenue (Million), by Foodservice Type 2024 & 2032

- Figure 29: Europe Food Service in Korean Industry Revenue Share (%), by Foodservice Type 2024 & 2032

- Figure 30: Europe Food Service in Korean Industry Revenue (Million), by Outlet 2024 & 2032

- Figure 31: Europe Food Service in Korean Industry Revenue Share (%), by Outlet 2024 & 2032

- Figure 32: Europe Food Service in Korean Industry Revenue (Million), by Location 2024 & 2032

- Figure 33: Europe Food Service in Korean Industry Revenue Share (%), by Location 2024 & 2032

- Figure 34: Europe Food Service in Korean Industry Revenue (Million), by Country 2024 & 2032

- Figure 35: Europe Food Service in Korean Industry Revenue Share (%), by Country 2024 & 2032

- Figure 36: Middle East & Africa Food Service in Korean Industry Revenue (Million), by Foodservice Type 2024 & 2032

- Figure 37: Middle East & Africa Food Service in Korean Industry Revenue Share (%), by Foodservice Type 2024 & 2032

- Figure 38: Middle East & Africa Food Service in Korean Industry Revenue (Million), by Outlet 2024 & 2032

- Figure 39: Middle East & Africa Food Service in Korean Industry Revenue Share (%), by Outlet 2024 & 2032

- Figure 40: Middle East & Africa Food Service in Korean Industry Revenue (Million), by Location 2024 & 2032

- Figure 41: Middle East & Africa Food Service in Korean Industry Revenue Share (%), by Location 2024 & 2032

- Figure 42: Middle East & Africa Food Service in Korean Industry Revenue (Million), by Country 2024 & 2032

- Figure 43: Middle East & Africa Food Service in Korean Industry Revenue Share (%), by Country 2024 & 2032

- Figure 44: Asia Pacific Food Service in Korean Industry Revenue (Million), by Foodservice Type 2024 & 2032

- Figure 45: Asia Pacific Food Service in Korean Industry Revenue Share (%), by Foodservice Type 2024 & 2032

- Figure 46: Asia Pacific Food Service in Korean Industry Revenue (Million), by Outlet 2024 & 2032

- Figure 47: Asia Pacific Food Service in Korean Industry Revenue Share (%), by Outlet 2024 & 2032

- Figure 48: Asia Pacific Food Service in Korean Industry Revenue (Million), by Location 2024 & 2032

- Figure 49: Asia Pacific Food Service in Korean Industry Revenue Share (%), by Location 2024 & 2032

- Figure 50: Asia Pacific Food Service in Korean Industry Revenue (Million), by Country 2024 & 2032

- Figure 51: Asia Pacific Food Service in Korean Industry Revenue Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global Food Service in Korean Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Global Food Service in Korean Industry Revenue Million Forecast, by Foodservice Type 2019 & 2032

- Table 3: Global Food Service in Korean Industry Revenue Million Forecast, by Outlet 2019 & 2032

- Table 4: Global Food Service in Korean Industry Revenue Million Forecast, by Location 2019 & 2032

- Table 5: Global Food Service in Korean Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 6: Global Food Service in Korean Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 7: United States Food Service in Korean Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 8: Canada Food Service in Korean Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: Mexico Food Service in Korean Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: Rest of North America Food Service in Korean Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 11: Global Food Service in Korean Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 12: Germany Food Service in Korean Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 13: United Kingdom Food Service in Korean Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 14: Italy Food Service in Korean Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 15: Spain Food Service in Korean Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 16: France Food Service in Korean Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 17: Russia Food Service in Korean Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 18: Rest of Europe Food Service in Korean Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 19: Global Food Service in Korean Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 20: China Food Service in Korean Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 21: Japan Food Service in Korean Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 22: India Food Service in Korean Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 23: Australia Food Service in Korean Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 24: Rest of Asia Pacific Food Service in Korean Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 25: Global Food Service in Korean Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 26: Brazil Food Service in Korean Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 27: Argentina Food Service in Korean Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 28: Rest of South America Food Service in Korean Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 29: Global Food Service in Korean Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 30: Saudi Arabia Food Service in Korean Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 31: South Africa Food Service in Korean Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 32: Rest of Middle East and Africa Food Service in Korean Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 33: Global Food Service in Korean Industry Revenue Million Forecast, by Foodservice Type 2019 & 2032

- Table 34: Global Food Service in Korean Industry Revenue Million Forecast, by Outlet 2019 & 2032

- Table 35: Global Food Service in Korean Industry Revenue Million Forecast, by Location 2019 & 2032

- Table 36: Global Food Service in Korean Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 37: United States Food Service in Korean Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 38: Canada Food Service in Korean Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 39: Mexico Food Service in Korean Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 40: Global Food Service in Korean Industry Revenue Million Forecast, by Foodservice Type 2019 & 2032

- Table 41: Global Food Service in Korean Industry Revenue Million Forecast, by Outlet 2019 & 2032

- Table 42: Global Food Service in Korean Industry Revenue Million Forecast, by Location 2019 & 2032

- Table 43: Global Food Service in Korean Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 44: Brazil Food Service in Korean Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 45: Argentina Food Service in Korean Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 46: Rest of South America Food Service in Korean Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 47: Global Food Service in Korean Industry Revenue Million Forecast, by Foodservice Type 2019 & 2032

- Table 48: Global Food Service in Korean Industry Revenue Million Forecast, by Outlet 2019 & 2032

- Table 49: Global Food Service in Korean Industry Revenue Million Forecast, by Location 2019 & 2032

- Table 50: Global Food Service in Korean Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 51: United Kingdom Food Service in Korean Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 52: Germany Food Service in Korean Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 53: France Food Service in Korean Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 54: Italy Food Service in Korean Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 55: Spain Food Service in Korean Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 56: Russia Food Service in Korean Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 57: Benelux Food Service in Korean Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 58: Nordics Food Service in Korean Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 59: Rest of Europe Food Service in Korean Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 60: Global Food Service in Korean Industry Revenue Million Forecast, by Foodservice Type 2019 & 2032

- Table 61: Global Food Service in Korean Industry Revenue Million Forecast, by Outlet 2019 & 2032

- Table 62: Global Food Service in Korean Industry Revenue Million Forecast, by Location 2019 & 2032

- Table 63: Global Food Service in Korean Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 64: Turkey Food Service in Korean Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 65: Israel Food Service in Korean Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 66: GCC Food Service in Korean Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 67: North Africa Food Service in Korean Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 68: South Africa Food Service in Korean Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 69: Rest of Middle East & Africa Food Service in Korean Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 70: Global Food Service in Korean Industry Revenue Million Forecast, by Foodservice Type 2019 & 2032

- Table 71: Global Food Service in Korean Industry Revenue Million Forecast, by Outlet 2019 & 2032

- Table 72: Global Food Service in Korean Industry Revenue Million Forecast, by Location 2019 & 2032

- Table 73: Global Food Service in Korean Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 74: China Food Service in Korean Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 75: India Food Service in Korean Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 76: Japan Food Service in Korean Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 77: South Korea Food Service in Korean Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 78: ASEAN Food Service in Korean Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 79: Oceania Food Service in Korean Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 80: Rest of Asia Pacific Food Service in Korean Industry Revenue (Million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Food Service in Korean Industry?

The projected CAGR is approximately 5.60%.

2. Which companies are prominent players in the Food Service in Korean Industry?

Key companies in the market include Shinsegae Food Co Ltd, Yum! Brands Inc, Isac Co Ltd, Inspire Brands Inc, CJ Foodville Corporation, Seven & I Holdings Co Ltd, Kyochon Food&Beverage Co Ltd, Doctor's Associate Inc, MP DAESAN Inc, Genesis Co Ltd, Domino's Pizza Inc, Starbucks Corporation, Restaurant Brands International Inc, Royal T Group Pte Ltd, McDonald's Corporation, Mom's Touch & Co.

3. What are the main segments of the Food Service in Korean Industry?

The market segments include Foodservice Type, Outlet, Location.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Growing Demand for Cocoa Butter Equivalents Among Food Manufacturers; Rising Application in Food Industry.

6. What are the notable trends driving market growth?

High demand for traditional cuisines and increased spending on dining increase the sales.

7. Are there any restraints impacting market growth?

Health Concerns Pertaining to the Excessive Consumption of Fats and Oils.

8. Can you provide examples of recent developments in the market?

April 2023: Shinsegae Food introduced a 100% plant-based burger called Better Burger. Instead of using animal products like milk and eggs, the burger uses substitute meat, cheese, and buns created from plant-based proteins like soybeans and cashew nuts.March 2023: Yum! Brands Inc. teamed up with a Korean private equity fund to acquire KFC Korea Co.February 2023: McDonald's Korea collaborated with NewJeans and introduced a special crispy chicken sandwich meal.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Food Service in Korean Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Food Service in Korean Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Food Service in Korean Industry?

To stay informed about further developments, trends, and reports in the Food Service in Korean Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence