Key Insights

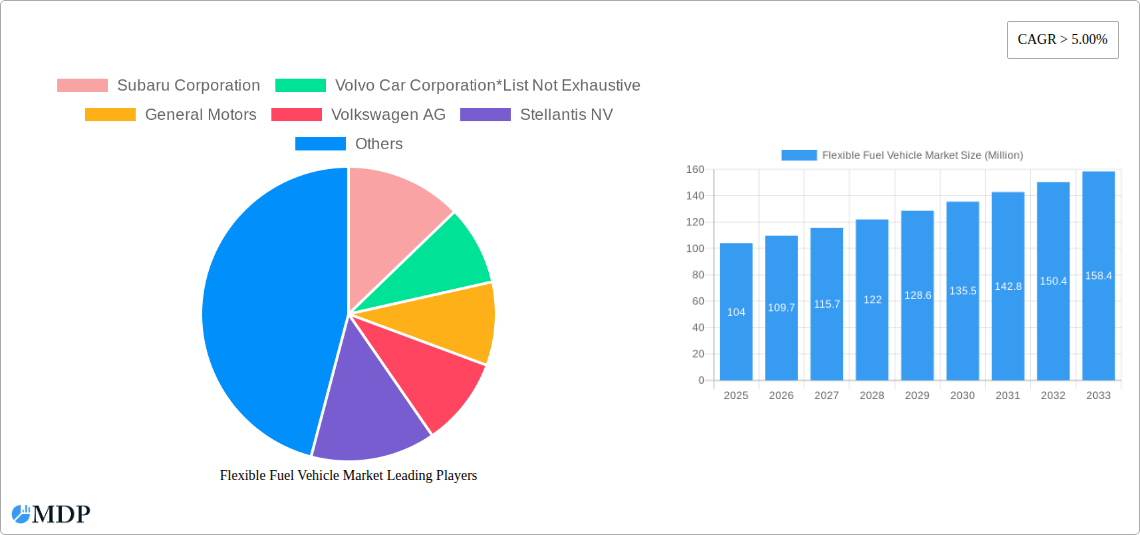

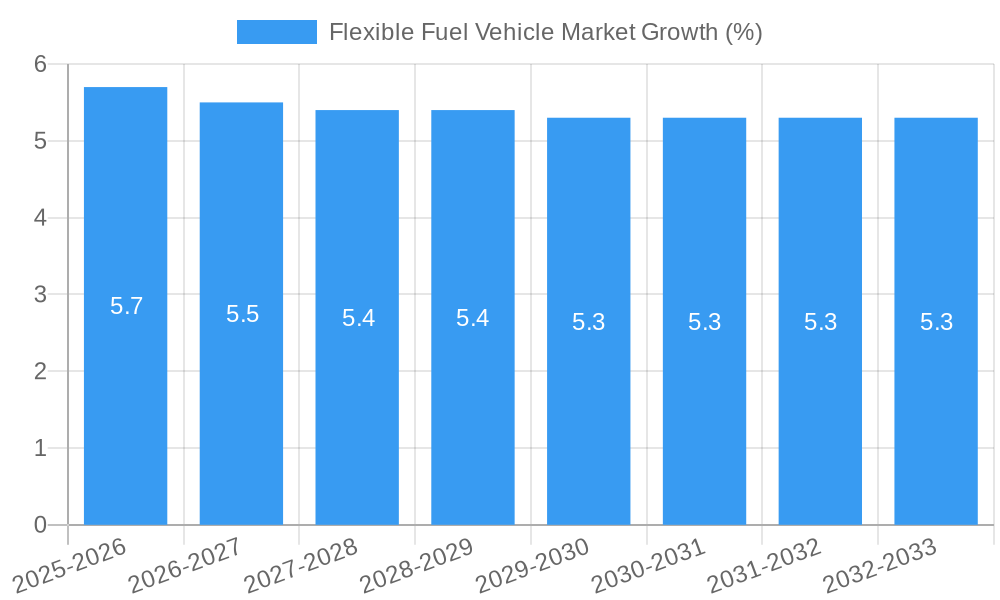

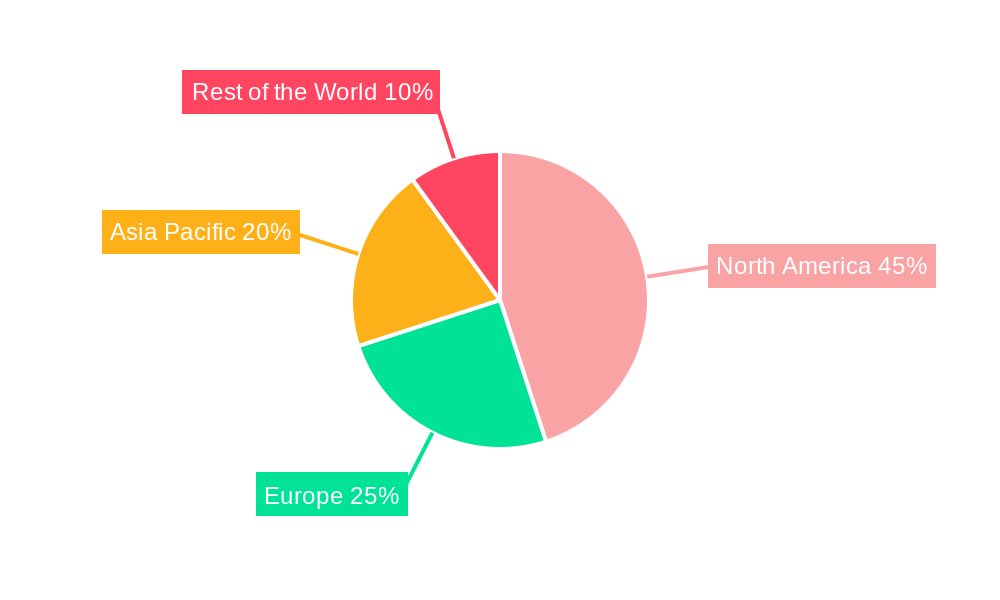

The Flexible Fuel Vehicle (FFV) market is experiencing robust growth, projected to reach a value exceeding $104 million in 2025 and maintain a Compound Annual Growth Rate (CAGR) of over 5% through 2033. This expansion is driven by several key factors. Stringent emission regulations globally are pushing automakers to offer vehicles with greater fuel flexibility, reducing reliance on solely gasoline-powered models. Rising fuel prices and fluctuating oil markets further incentivize consumers to adopt FFVs capable of utilizing ethanol blends, providing cost savings and energy security. Technological advancements leading to improved engine efficiency and performance in FFVs are also contributing to market growth. Segmentation within the market reveals strong demand across passenger cars, with E10-E15 ethanol blends holding the largest market share, reflecting current infrastructure and consumer adoption levels. Commercial vehicles are also exhibiting increasing adoption, driven by fleet operators looking to reduce operational costs and environmental impact. The North American market, particularly the United States and Canada, is expected to remain a significant contributor to overall market growth, owing to established ethanol production and supportive government policies. Asia Pacific, particularly China and India, presents a large growth opportunity due to increasing vehicle ownership and burgeoning biofuel initiatives.

However, challenges remain. The lack of widespread availability of higher ethanol blends (E85 and above) presents a significant restraint in many regions. This is primarily due to limited fueling infrastructure and logistical complexities associated with distribution. Furthermore, the initial cost of FFVs can be slightly higher compared to conventional gasoline vehicles, potentially deterring some consumers. Nevertheless, the long-term economic and environmental benefits associated with FFVs, coupled with continuous technological improvements and supportive government regulations, are expected to mitigate these restraints, ensuring a sustained period of market expansion. The competitive landscape is dominated by major automotive manufacturers including General Motors, Ford, Toyota, and Volkswagen, who are actively investing in research and development to enhance FFV technology and expand their product offerings.

Flexible Fuel Vehicle (FFV) Market Report: 2019-2033

Gain a comprehensive understanding of the dynamic Flexible Fuel Vehicle (FFV) market with this in-depth report, providing actionable insights for strategic decision-making. This report covers the period 2019-2033, with a focus on the 2025-2033 forecast period. It analyzes market dynamics, key players (including Subaru Corporation, Volvo Car Corporation, General Motors, Volkswagen AG, Stellantis NV, Honda Motor Company, Hyundai Motor Company, BMW AG, Nissan Motor Company, Toyota Motor Corporation, and Ford Motor Company), and future growth opportunities. This detailed analysis will equip you with the knowledge needed to navigate this evolving market effectively. The report utilizes data from 2019-2024 as the historical period, with 2025 serving as both the base and estimated year.

Flexible Fuel Vehicle Market Market Dynamics & Concentration

The Flexible Fuel Vehicle (FFV) market is characterized by moderate concentration, with several key players vying for market share. Innovation, driven by stricter emission regulations and fluctuating fuel prices, is a significant growth driver. Government incentives and mandates play a crucial role in shaping market adoption, while the availability of suitable biofuels and the development of robust fueling infrastructure are critical factors. Product substitution, primarily from conventional internal combustion engine (ICE) vehicles and, increasingly, electric vehicles (EVs), presents a significant challenge. However, consumer preference for fuel flexibility and cost savings, alongside advancements in FFV technology, continue to drive market growth. M&A activity within the sector remains relatively low, with xx deals recorded between 2019 and 2024, indicating a focus on organic growth rather than consolidation. Market share is currently dominated by xx% (estimated), largely held by established automotive giants.

- Market Concentration: Moderate, with several major players and emerging entrants.

- Innovation Drivers: Stringent emission regulations, fluctuating fuel prices, technological advancements.

- Regulatory Frameworks: Government incentives, mandates, and emission standards significantly impact market growth.

- Product Substitutes: Conventional ICE vehicles and EVs pose competitive challenges.

- End-User Trends: Increasing preference for fuel flexibility and cost-effective transportation solutions.

- M&A Activities: Relatively low, with xx M&A deals recorded in the historical period.

Flexible Fuel Vehicle Market Industry Trends & Analysis

The FFV market is experiencing significant growth, projected to achieve a Compound Annual Growth Rate (CAGR) of xx% during the forecast period (2025-2033). This growth is propelled by several factors: rising concerns about fuel security and environmental sustainability, favorable government policies promoting biofuel adoption, and technological advancements leading to improved engine efficiency and performance. The market penetration of FFVs is expected to increase from xx% in 2025 to xx% by 2033. Consumer preferences are shifting towards flexible fuel options, particularly in regions with readily available and cost-effective biofuels. The competitive landscape is dynamic, with established automotive manufacturers and new entrants continuously innovating and expanding their FFV offerings. Technological disruptions, such as advancements in engine design and fuel injection systems, are enhancing the efficiency and performance of FFVs, making them increasingly attractive to consumers.

Leading Markets & Segments in Flexible Fuel Vehicle Market

Brazil currently holds the leading position in the FFV market, driven by established ethanol infrastructure and supportive government policies. The E85 and above ethanol blend segment dominates the market due to its high ethanol content and significant cost savings. Within vehicle types, passenger cars constitute the largest segment.

- Dominant Region: Brazil

- Dominant Segment: E85 and Above (Ethanol Blend Type) and Passenger Cars (Vehicle Type)

Key Drivers for Brazil:

- Extensive ethanol production and infrastructure.

- Government incentives and support for biofuel adoption.

- High consumer acceptance and familiarity with FFVs.

Key Drivers for E85 and Above Segment:

- Significant cost savings compared to gasoline.

- Higher ethanol content resulting in reduced carbon emissions.

- Increasing availability of E85 fuel stations.

Key Drivers for Passenger Cars Segment:

- Larger market size compared to commercial vehicles.

- Growing consumer demand for fuel-efficient and cost-effective personal vehicles.

Flexible Fuel Vehicle Market Product Developments

Recent product innovations focus on enhancing engine performance, fuel efficiency, and emission reduction. Manufacturers are optimizing engine designs for broader fuel compatibility and improving fuel injection systems for smoother operation. The integration of advanced sensors and control systems ensures optimal performance across various ethanol blends. These advancements are crucial for expanding the market appeal and accelerating the adoption of FFVs.

Key Drivers of Flexible Fuel Vehicle Market Growth

The FFV market is experiencing robust growth driven by a confluence of factors. Firstly, rising fuel prices and concerns about energy security are prompting consumers and governments to seek alternative fuel sources. Secondly, stringent emission regulations are pushing the automotive industry toward cleaner fuel solutions. Thirdly, technological advancements in FFV technology are improving engine efficiency and performance, enhancing consumer appeal. Finally, government incentives and supportive policies are accelerating market adoption in key regions like Brazil and India.

Challenges in the Flexible Fuel Vehicle Market Market

The FFV market faces challenges including the limited availability of biofuels in many regions, hindering widespread adoption. Supply chain disruptions associated with biofuel production and distribution create further obstacles. Moreover, intense competition from established ICE vehicles and rapidly evolving electric vehicle technologies presents a significant hurdle. These factors, along with the costs associated with upgrading fueling infrastructure, impact the overall market growth.

Emerging Opportunities in Flexible Fuel Vehicle Market

Significant opportunities exist within the FFV market. Continued technological advancements leading to improved engine efficiency, broader fuel compatibility, and reduced emissions will drive long-term growth. Strategic partnerships between automotive manufacturers and biofuel producers can enhance the supply chain and expand market reach. Government support and policies encouraging biofuel adoption will play a pivotal role in stimulating market expansion. Exploration of new biofuel feedstocks and production methods will also fuel market growth.

Leading Players in the Flexible Fuel Vehicle Market Sector

- Subaru Corporation

- Volvo Car Corporation

- General Motors

- Volkswagen AG

- Stellantis NV

- Honda Motor Company

- Hyundai Motor Company

- BMW AG

- Nissan Motor Company

- Toyota Motor Corporation

- Ford Motor Company

Key Milestones in Flexible Fuel Vehicle Market Industry

- February 2022: BMW launched a 3-series sedan in Brazil capable of running on ethanol-blended fuel, demonstrating the growing technological capabilities of FFVs and expanding the market in key regions.

- December 2022: SIAM, along with the Government of India, conducted a demonstration session showcasing FFV features and technologies, highlighting the potential for FFVs in large, developing markets and emphasizing the role of biofuels in waste management.

Strategic Outlook for Flexible Fuel Vehicle Market Market

The FFV market holds substantial growth potential, driven by increasing consumer demand for fuel-efficient and cost-effective vehicles, strengthened by supportive government policies and a rising focus on sustainable transportation. Strategic partnerships, technological advancements, and expansion into new markets will be crucial for capturing this growth. The focus on developing higher ethanol blend compatible vehicles and enhancing the biofuel infrastructure will be key aspects of future market development.

Flexible Fuel Vehicle Market Segmentation

-

1. Ethanol Blend Type

- 1.1. E10 to E25

- 1.2. E25 to E85

- 1.3. E85 and Above

-

2. Vehicle Type

- 2.1. Passenger Cars

- 2.2. Commercial Vehicles

-

3. Fuel Type

- 3.1. Petrol

- 3.2. Diesel

Flexible Fuel Vehicle Market Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Rest of North America

-

2. Europe

- 2.1. Germany

- 2.2. France

- 2.3. Spain

- 2.4. United Kingdom

- 2.5. Rest of Europe

-

3. Asia Pacific

- 3.1. China

- 3.2. India

- 3.3. South Korea

- 3.4. Japan

- 3.5. Rest of Asia Pacific

-

4. Rest of the World

- 4.1. South America

- 4.2. Middle East and Africa

Flexible Fuel Vehicle Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of > 5.00% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Ratification of Stringent Exhaust Emission Regulations

- 3.3. Market Restrains

- 3.3.1. Increase Sales of Electric Vehicle May Restraint the Growth of the Market

- 3.4. Market Trends

- 3.4.1. Ratification of Stringent Exhaust Emission Regulations will Diesel Fuel Type Segment

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Flexible Fuel Vehicle Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Ethanol Blend Type

- 5.1.1. E10 to E25

- 5.1.2. E25 to E85

- 5.1.3. E85 and Above

- 5.2. Market Analysis, Insights and Forecast - by Vehicle Type

- 5.2.1. Passenger Cars

- 5.2.2. Commercial Vehicles

- 5.3. Market Analysis, Insights and Forecast - by Fuel Type

- 5.3.1. Petrol

- 5.3.2. Diesel

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. North America

- 5.4.2. Europe

- 5.4.3. Asia Pacific

- 5.4.4. Rest of the World

- 5.1. Market Analysis, Insights and Forecast - by Ethanol Blend Type

- 6. North America Flexible Fuel Vehicle Market Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Ethanol Blend Type

- 6.1.1. E10 to E25

- 6.1.2. E25 to E85

- 6.1.3. E85 and Above

- 6.2. Market Analysis, Insights and Forecast - by Vehicle Type

- 6.2.1. Passenger Cars

- 6.2.2. Commercial Vehicles

- 6.3. Market Analysis, Insights and Forecast - by Fuel Type

- 6.3.1. Petrol

- 6.3.2. Diesel

- 6.1. Market Analysis, Insights and Forecast - by Ethanol Blend Type

- 7. Europe Flexible Fuel Vehicle Market Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Ethanol Blend Type

- 7.1.1. E10 to E25

- 7.1.2. E25 to E85

- 7.1.3. E85 and Above

- 7.2. Market Analysis, Insights and Forecast - by Vehicle Type

- 7.2.1. Passenger Cars

- 7.2.2. Commercial Vehicles

- 7.3. Market Analysis, Insights and Forecast - by Fuel Type

- 7.3.1. Petrol

- 7.3.2. Diesel

- 7.1. Market Analysis, Insights and Forecast - by Ethanol Blend Type

- 8. Asia Pacific Flexible Fuel Vehicle Market Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Ethanol Blend Type

- 8.1.1. E10 to E25

- 8.1.2. E25 to E85

- 8.1.3. E85 and Above

- 8.2. Market Analysis, Insights and Forecast - by Vehicle Type

- 8.2.1. Passenger Cars

- 8.2.2. Commercial Vehicles

- 8.3. Market Analysis, Insights and Forecast - by Fuel Type

- 8.3.1. Petrol

- 8.3.2. Diesel

- 8.1. Market Analysis, Insights and Forecast - by Ethanol Blend Type

- 9. Rest of the World Flexible Fuel Vehicle Market Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Ethanol Blend Type

- 9.1.1. E10 to E25

- 9.1.2. E25 to E85

- 9.1.3. E85 and Above

- 9.2. Market Analysis, Insights and Forecast - by Vehicle Type

- 9.2.1. Passenger Cars

- 9.2.2. Commercial Vehicles

- 9.3. Market Analysis, Insights and Forecast - by Fuel Type

- 9.3.1. Petrol

- 9.3.2. Diesel

- 9.1. Market Analysis, Insights and Forecast - by Ethanol Blend Type

- 10. North America Flexible Fuel Vehicle Market Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 10.1.1 United States

- 10.1.2 Canada

- 10.1.3 Rest of North America

- 11. Europe Flexible Fuel Vehicle Market Analysis, Insights and Forecast, 2019-2031

- 11.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 11.1.1 Germany

- 11.1.2 France

- 11.1.3 Spain

- 11.1.4 United Kingdom

- 11.1.5 Rest of Europe

- 12. Asia Pacific Flexible Fuel Vehicle Market Analysis, Insights and Forecast, 2019-2031

- 12.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 12.1.1 China

- 12.1.2 India

- 12.1.3 South Korea

- 12.1.4 Japan

- 12.1.5 Rest of Asia Pacific

- 13. Rest of the World Flexible Fuel Vehicle Market Analysis, Insights and Forecast, 2019-2031

- 13.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 13.1.1 South America

- 13.1.2 Middle East and Africa

- 14. Competitive Analysis

- 14.1. Global Market Share Analysis 2024

- 14.2. Company Profiles

- 14.2.1 Subaru Corporation

- 14.2.1.1. Overview

- 14.2.1.2. Products

- 14.2.1.3. SWOT Analysis

- 14.2.1.4. Recent Developments

- 14.2.1.5. Financials (Based on Availability)

- 14.2.2 Volvo Car Corporation*List Not Exhaustive

- 14.2.2.1. Overview

- 14.2.2.2. Products

- 14.2.2.3. SWOT Analysis

- 14.2.2.4. Recent Developments

- 14.2.2.5. Financials (Based on Availability)

- 14.2.3 General Motors

- 14.2.3.1. Overview

- 14.2.3.2. Products

- 14.2.3.3. SWOT Analysis

- 14.2.3.4. Recent Developments

- 14.2.3.5. Financials (Based on Availability)

- 14.2.4 Volkswagen AG

- 14.2.4.1. Overview

- 14.2.4.2. Products

- 14.2.4.3. SWOT Analysis

- 14.2.4.4. Recent Developments

- 14.2.4.5. Financials (Based on Availability)

- 14.2.5 Stellantis NV

- 14.2.5.1. Overview

- 14.2.5.2. Products

- 14.2.5.3. SWOT Analysis

- 14.2.5.4. Recent Developments

- 14.2.5.5. Financials (Based on Availability)

- 14.2.6 Honda Motor Company

- 14.2.6.1. Overview

- 14.2.6.2. Products

- 14.2.6.3. SWOT Analysis

- 14.2.6.4. Recent Developments

- 14.2.6.5. Financials (Based on Availability)

- 14.2.7 Hyundai Motor Company

- 14.2.7.1. Overview

- 14.2.7.2. Products

- 14.2.7.3. SWOT Analysis

- 14.2.7.4. Recent Developments

- 14.2.7.5. Financials (Based on Availability)

- 14.2.8 BMW AG

- 14.2.8.1. Overview

- 14.2.8.2. Products

- 14.2.8.3. SWOT Analysis

- 14.2.8.4. Recent Developments

- 14.2.8.5. Financials (Based on Availability)

- 14.2.9 Nissan Motor Company

- 14.2.9.1. Overview

- 14.2.9.2. Products

- 14.2.9.3. SWOT Analysis

- 14.2.9.4. Recent Developments

- 14.2.9.5. Financials (Based on Availability)

- 14.2.10 Toyota Motor Corporation

- 14.2.10.1. Overview

- 14.2.10.2. Products

- 14.2.10.3. SWOT Analysis

- 14.2.10.4. Recent Developments

- 14.2.10.5. Financials (Based on Availability)

- 14.2.11 Ford Motor Company

- 14.2.11.1. Overview

- 14.2.11.2. Products

- 14.2.11.3. SWOT Analysis

- 14.2.11.4. Recent Developments

- 14.2.11.5. Financials (Based on Availability)

- 14.2.1 Subaru Corporation

List of Figures

- Figure 1: Global Flexible Fuel Vehicle Market Revenue Breakdown (Million, %) by Region 2024 & 2032

- Figure 2: North America Flexible Fuel Vehicle Market Revenue (Million), by Country 2024 & 2032

- Figure 3: North America Flexible Fuel Vehicle Market Revenue Share (%), by Country 2024 & 2032

- Figure 4: Europe Flexible Fuel Vehicle Market Revenue (Million), by Country 2024 & 2032

- Figure 5: Europe Flexible Fuel Vehicle Market Revenue Share (%), by Country 2024 & 2032

- Figure 6: Asia Pacific Flexible Fuel Vehicle Market Revenue (Million), by Country 2024 & 2032

- Figure 7: Asia Pacific Flexible Fuel Vehicle Market Revenue Share (%), by Country 2024 & 2032

- Figure 8: Rest of the World Flexible Fuel Vehicle Market Revenue (Million), by Country 2024 & 2032

- Figure 9: Rest of the World Flexible Fuel Vehicle Market Revenue Share (%), by Country 2024 & 2032

- Figure 10: North America Flexible Fuel Vehicle Market Revenue (Million), by Ethanol Blend Type 2024 & 2032

- Figure 11: North America Flexible Fuel Vehicle Market Revenue Share (%), by Ethanol Blend Type 2024 & 2032

- Figure 12: North America Flexible Fuel Vehicle Market Revenue (Million), by Vehicle Type 2024 & 2032

- Figure 13: North America Flexible Fuel Vehicle Market Revenue Share (%), by Vehicle Type 2024 & 2032

- Figure 14: North America Flexible Fuel Vehicle Market Revenue (Million), by Fuel Type 2024 & 2032

- Figure 15: North America Flexible Fuel Vehicle Market Revenue Share (%), by Fuel Type 2024 & 2032

- Figure 16: North America Flexible Fuel Vehicle Market Revenue (Million), by Country 2024 & 2032

- Figure 17: North America Flexible Fuel Vehicle Market Revenue Share (%), by Country 2024 & 2032

- Figure 18: Europe Flexible Fuel Vehicle Market Revenue (Million), by Ethanol Blend Type 2024 & 2032

- Figure 19: Europe Flexible Fuel Vehicle Market Revenue Share (%), by Ethanol Blend Type 2024 & 2032

- Figure 20: Europe Flexible Fuel Vehicle Market Revenue (Million), by Vehicle Type 2024 & 2032

- Figure 21: Europe Flexible Fuel Vehicle Market Revenue Share (%), by Vehicle Type 2024 & 2032

- Figure 22: Europe Flexible Fuel Vehicle Market Revenue (Million), by Fuel Type 2024 & 2032

- Figure 23: Europe Flexible Fuel Vehicle Market Revenue Share (%), by Fuel Type 2024 & 2032

- Figure 24: Europe Flexible Fuel Vehicle Market Revenue (Million), by Country 2024 & 2032

- Figure 25: Europe Flexible Fuel Vehicle Market Revenue Share (%), by Country 2024 & 2032

- Figure 26: Asia Pacific Flexible Fuel Vehicle Market Revenue (Million), by Ethanol Blend Type 2024 & 2032

- Figure 27: Asia Pacific Flexible Fuel Vehicle Market Revenue Share (%), by Ethanol Blend Type 2024 & 2032

- Figure 28: Asia Pacific Flexible Fuel Vehicle Market Revenue (Million), by Vehicle Type 2024 & 2032

- Figure 29: Asia Pacific Flexible Fuel Vehicle Market Revenue Share (%), by Vehicle Type 2024 & 2032

- Figure 30: Asia Pacific Flexible Fuel Vehicle Market Revenue (Million), by Fuel Type 2024 & 2032

- Figure 31: Asia Pacific Flexible Fuel Vehicle Market Revenue Share (%), by Fuel Type 2024 & 2032

- Figure 32: Asia Pacific Flexible Fuel Vehicle Market Revenue (Million), by Country 2024 & 2032

- Figure 33: Asia Pacific Flexible Fuel Vehicle Market Revenue Share (%), by Country 2024 & 2032

- Figure 34: Rest of the World Flexible Fuel Vehicle Market Revenue (Million), by Ethanol Blend Type 2024 & 2032

- Figure 35: Rest of the World Flexible Fuel Vehicle Market Revenue Share (%), by Ethanol Blend Type 2024 & 2032

- Figure 36: Rest of the World Flexible Fuel Vehicle Market Revenue (Million), by Vehicle Type 2024 & 2032

- Figure 37: Rest of the World Flexible Fuel Vehicle Market Revenue Share (%), by Vehicle Type 2024 & 2032

- Figure 38: Rest of the World Flexible Fuel Vehicle Market Revenue (Million), by Fuel Type 2024 & 2032

- Figure 39: Rest of the World Flexible Fuel Vehicle Market Revenue Share (%), by Fuel Type 2024 & 2032

- Figure 40: Rest of the World Flexible Fuel Vehicle Market Revenue (Million), by Country 2024 & 2032

- Figure 41: Rest of the World Flexible Fuel Vehicle Market Revenue Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global Flexible Fuel Vehicle Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Global Flexible Fuel Vehicle Market Revenue Million Forecast, by Ethanol Blend Type 2019 & 2032

- Table 3: Global Flexible Fuel Vehicle Market Revenue Million Forecast, by Vehicle Type 2019 & 2032

- Table 4: Global Flexible Fuel Vehicle Market Revenue Million Forecast, by Fuel Type 2019 & 2032

- Table 5: Global Flexible Fuel Vehicle Market Revenue Million Forecast, by Region 2019 & 2032

- Table 6: Global Flexible Fuel Vehicle Market Revenue Million Forecast, by Country 2019 & 2032

- Table 7: United States Flexible Fuel Vehicle Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 8: Canada Flexible Fuel Vehicle Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: Rest of North America Flexible Fuel Vehicle Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: Global Flexible Fuel Vehicle Market Revenue Million Forecast, by Country 2019 & 2032

- Table 11: Germany Flexible Fuel Vehicle Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 12: France Flexible Fuel Vehicle Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 13: Spain Flexible Fuel Vehicle Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 14: United Kingdom Flexible Fuel Vehicle Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 15: Rest of Europe Flexible Fuel Vehicle Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 16: Global Flexible Fuel Vehicle Market Revenue Million Forecast, by Country 2019 & 2032

- Table 17: China Flexible Fuel Vehicle Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 18: India Flexible Fuel Vehicle Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 19: South Korea Flexible Fuel Vehicle Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 20: Japan Flexible Fuel Vehicle Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 21: Rest of Asia Pacific Flexible Fuel Vehicle Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 22: Global Flexible Fuel Vehicle Market Revenue Million Forecast, by Country 2019 & 2032

- Table 23: South America Flexible Fuel Vehicle Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 24: Middle East and Africa Flexible Fuel Vehicle Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 25: Global Flexible Fuel Vehicle Market Revenue Million Forecast, by Ethanol Blend Type 2019 & 2032

- Table 26: Global Flexible Fuel Vehicle Market Revenue Million Forecast, by Vehicle Type 2019 & 2032

- Table 27: Global Flexible Fuel Vehicle Market Revenue Million Forecast, by Fuel Type 2019 & 2032

- Table 28: Global Flexible Fuel Vehicle Market Revenue Million Forecast, by Country 2019 & 2032

- Table 29: United States Flexible Fuel Vehicle Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 30: Canada Flexible Fuel Vehicle Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 31: Rest of North America Flexible Fuel Vehicle Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 32: Global Flexible Fuel Vehicle Market Revenue Million Forecast, by Ethanol Blend Type 2019 & 2032

- Table 33: Global Flexible Fuel Vehicle Market Revenue Million Forecast, by Vehicle Type 2019 & 2032

- Table 34: Global Flexible Fuel Vehicle Market Revenue Million Forecast, by Fuel Type 2019 & 2032

- Table 35: Global Flexible Fuel Vehicle Market Revenue Million Forecast, by Country 2019 & 2032

- Table 36: Germany Flexible Fuel Vehicle Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 37: France Flexible Fuel Vehicle Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 38: Spain Flexible Fuel Vehicle Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 39: United Kingdom Flexible Fuel Vehicle Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 40: Rest of Europe Flexible Fuel Vehicle Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 41: Global Flexible Fuel Vehicle Market Revenue Million Forecast, by Ethanol Blend Type 2019 & 2032

- Table 42: Global Flexible Fuel Vehicle Market Revenue Million Forecast, by Vehicle Type 2019 & 2032

- Table 43: Global Flexible Fuel Vehicle Market Revenue Million Forecast, by Fuel Type 2019 & 2032

- Table 44: Global Flexible Fuel Vehicle Market Revenue Million Forecast, by Country 2019 & 2032

- Table 45: China Flexible Fuel Vehicle Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 46: India Flexible Fuel Vehicle Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 47: South Korea Flexible Fuel Vehicle Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 48: Japan Flexible Fuel Vehicle Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 49: Rest of Asia Pacific Flexible Fuel Vehicle Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 50: Global Flexible Fuel Vehicle Market Revenue Million Forecast, by Ethanol Blend Type 2019 & 2032

- Table 51: Global Flexible Fuel Vehicle Market Revenue Million Forecast, by Vehicle Type 2019 & 2032

- Table 52: Global Flexible Fuel Vehicle Market Revenue Million Forecast, by Fuel Type 2019 & 2032

- Table 53: Global Flexible Fuel Vehicle Market Revenue Million Forecast, by Country 2019 & 2032

- Table 54: South America Flexible Fuel Vehicle Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 55: Middle East and Africa Flexible Fuel Vehicle Market Revenue (Million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Flexible Fuel Vehicle Market?

The projected CAGR is approximately > 5.00%.

2. Which companies are prominent players in the Flexible Fuel Vehicle Market?

Key companies in the market include Subaru Corporation, Volvo Car Corporation*List Not Exhaustive, General Motors, Volkswagen AG, Stellantis NV, Honda Motor Company, Hyundai Motor Company, BMW AG, Nissan Motor Company, Toyota Motor Corporation, Ford Motor Company.

3. What are the main segments of the Flexible Fuel Vehicle Market?

The market segments include Ethanol Blend Type, Vehicle Type, Fuel Type.

4. Can you provide details about the market size?

The market size is estimated to be USD 104 Million as of 2022.

5. What are some drivers contributing to market growth?

Ratification of Stringent Exhaust Emission Regulations.

6. What are the notable trends driving market growth?

Ratification of Stringent Exhaust Emission Regulations will Diesel Fuel Type Segment.

7. Are there any restraints impacting market growth?

Increase Sales of Electric Vehicle May Restraint the Growth of the Market.

8. Can you provide examples of recent developments in the market?

February 2022: BMW launched a 3-series sedan in Brazil capable of running on ethanol-blended fuel. The new BMW 3 series can function normally even when running entirely on ethanol. A 2.0-liter four-cylinder B48 turbo powers the 3-series that has been slightly tuned to run on ethanol-based fuel.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Flexible Fuel Vehicle Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Flexible Fuel Vehicle Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Flexible Fuel Vehicle Market?

To stay informed about further developments, trends, and reports in the Flexible Fuel Vehicle Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence