Key Insights

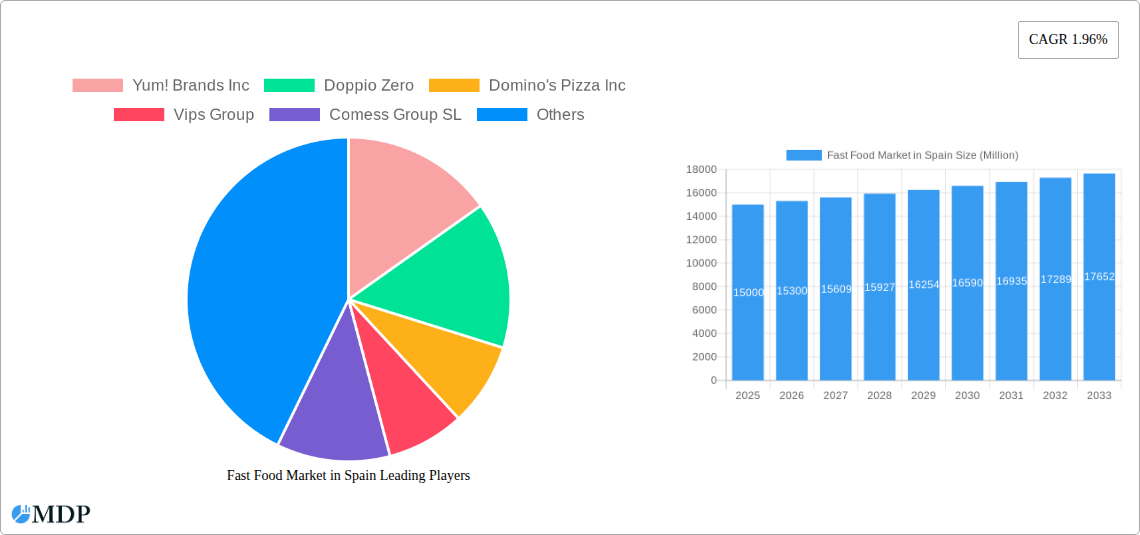

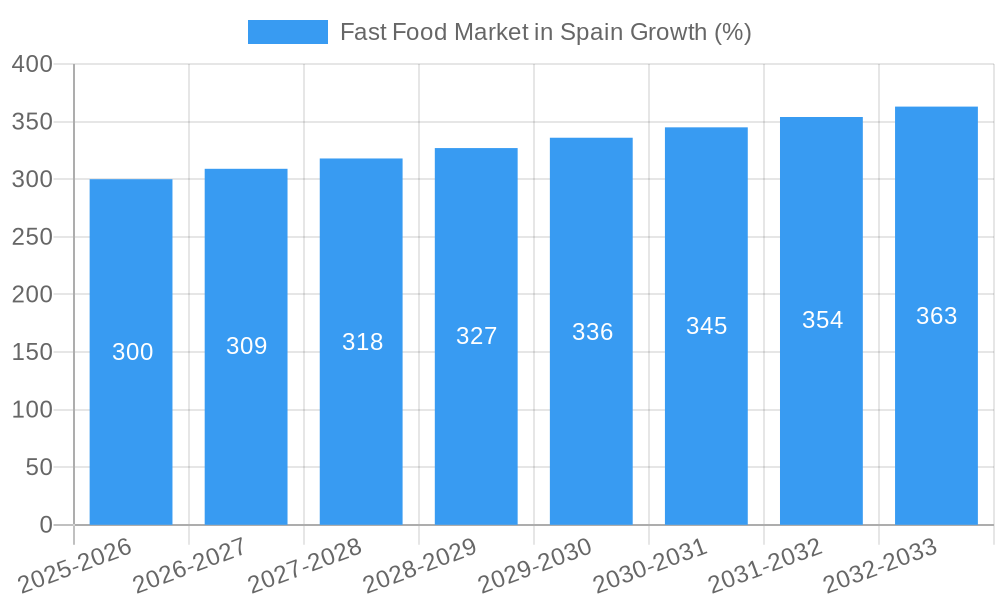

The Spanish fast-food market, valued at approximately €X million in 2025 (assuming a logical estimation based on the provided CAGR and market size), is projected to experience steady growth, with a compound annual growth rate (CAGR) of 1.96% from 2025 to 2033. This growth is fueled by several key drivers. The increasing urbanization in Spain leads to higher demand for convenient and quick meal options, particularly among young professionals and busy families. A growing preference for international fast-food chains, alongside the rising popularity of healthier alternatives within the fast-food sector (e.g., customizable options, vegetarian/vegan choices), are also contributing factors. The market is segmented by type (Consumer Foodservice, Street Stalls/Kiosks, Hotels, Institutional Catering) and structure (Independent Outlet, Chained Outlet). While chained outlets dominate market share due to their brand recognition and established supply chains, independent outlets are seeing growth driven by localized offerings and unique value propositions. However, rising labor costs and increasing food prices represent significant restraints to market expansion, potentially slowing growth in the coming years. The competitive landscape is dominated by international players like McDonald's, Yum! Brands, and Starbucks, alongside strong local chains like Ibersol and Vips. These companies are constantly innovating, incorporating technology like online ordering and delivery apps to enhance customer convenience and remain competitive.

The forecast period of 2025-2033 presents significant opportunities for growth within the Spanish fast-food sector. The continued influx of tourism and the expanding middle class are expected to drive higher consumption. However, companies must strategically navigate the challenges of fluctuating input costs and changing consumer preferences, focusing on sustainability and healthier options to retain market share and appeal to a growing health-conscious consumer base. Successful players will likely focus on targeted marketing campaigns, technological integration, and diversification of their menu offerings to capture different consumer segments and maintain competitiveness in this evolving market. Expansion into underserved regions and strategic partnerships with local suppliers will also play crucial roles in achieving sustainable market growth.

Fast Food Market in Spain: A Comprehensive Report (2019-2033)

This in-depth report provides a comprehensive analysis of the fast-food market in Spain, covering market dynamics, industry trends, leading players, and future growth opportunities. The study period spans from 2019 to 2033, with 2025 as the base and estimated year. The report is crucial for industry stakeholders, investors, and businesses looking to understand and capitalize on the vibrant Spanish fast-food landscape. Download now for actionable insights!

Fast Food Market in Spain Market Dynamics & Concentration

The Spanish fast-food market, valued at xx Million in 2024, is characterized by a dynamic interplay of factors impacting its concentration and growth. Market share is largely concentrated among established international and national chains, with McDonald's Corporation, Yum! Brands Inc, and Restaurant Brands International Inc holding significant positions. However, the market also witnesses considerable activity from independent outlets and smaller chains, particularly in specialized segments like Spanish tapas and artisan pizzas.

Market Concentration Metrics (2024):

- Top 3 players' combined market share: xx%

- Number of M&A deals (2019-2024): xx

Key Dynamics:

- Innovation: Continuous product innovation, including healthier options and customized offerings, is driving market growth. Technological advancements in ordering and delivery systems are also pivotal.

- Regulatory Framework: Spanish regulations concerning food safety, labeling, and marketing significantly impact market operations.

- Product Substitutes: The rise of healthy eating trends and the increasing popularity of home-cooked meals pose a competitive threat to the fast-food sector.

- End-User Trends: Shifting consumer preferences towards convenience, value for money, and diverse culinary experiences shape market demand.

- M&A Activities: Strategic acquisitions and mergers are reshaping the competitive landscape, enabling expansion and consolidation within the market.

Fast Food Market in Spain Industry Trends & Analysis

The Spanish fast-food market exhibits robust growth, driven by several key factors. The CAGR during the historical period (2019-2024) was xx%, and is projected to be xx% during the forecast period (2025-2033). Market penetration, especially in urban areas, is high, reflecting the widespread adoption of fast-food among various demographics.

Technological disruptions, particularly in digital ordering and delivery platforms, are fundamentally altering consumer behavior and operational efficiencies. This trend is further amplified by the increasing use of mobile apps for ordering and payment, as exemplified by Funky Pizza Restaurant's "Funky Pay" app. Consumer preferences are evolving, demanding more customization, healthier options, and diverse culinary experiences. The competitive landscape is intensely competitive, with both international and local players vying for market share through product differentiation, promotional strategies, and expansion initiatives.

Leading Markets & Segments in Fast Food Market in Spain

The Spanish fast-food market demonstrates robust growth across various segments and regions. Urban areas, particularly major cities like Madrid and Barcelona, exhibit the highest market penetration due to higher population density, increased disposable income, and greater accessibility to fast-food outlets.

Dominant Segments:

- Type: Consumer Foodservice remains the dominant segment, driven by high demand from busy professionals and families.

- Structure: Chained outlets hold a significant market share due to their brand recognition, standardized quality, and efficient operations. However, independent outlets cater to niche markets and offer unique culinary experiences.

Key Drivers of Segment Dominance:

- Economic Policies: Government initiatives supporting entrepreneurship and tourism positively impact the market.

- Infrastructure: Well-developed transportation networks facilitate efficient logistics and widespread accessibility of fast-food outlets.

Fast Food Market in Spain Product Developments

Recent product innovations focus on healthier options, customization, and diverse culinary offerings. The introduction of plant-based alternatives, personalized meal options, and fusion cuisine reflects the evolving consumer preferences. Technological advancements, particularly in food preparation and delivery technologies, are driving operational efficiency and enhancing the overall customer experience. These developments enhance market fit by catering to the diverse demands of the modern consumer.

Key Drivers of Fast Food Market in Spain Growth

Several factors propel the growth of the Spanish fast-food market. Firstly, rising disposable incomes and changing lifestyles fuel demand for convenience and affordability. Secondly, technological advancements in online ordering and delivery enhance accessibility and convenience. Thirdly, government policies supporting tourism and entrepreneurship create a conducive business environment.

Challenges in the Fast Food Market in Spain Market

The Spanish fast-food market faces challenges including increasing competition, rising food costs, and stringent regulations. The intense rivalry among established chains and independent outlets puts downward pressure on margins. Supply chain disruptions and rising raw material prices directly impact profitability. Compliance with strict food safety and labeling regulations can incur significant operational costs.

Emerging Opportunities in the Fast Food Market in Spain

The Spanish fast-food market presents several promising opportunities. The expansion of online ordering and delivery platforms, coupled with the adoption of innovative technologies like AI-powered ordering systems and personalized recommendations, will drive significant growth. Strategic partnerships with local suppliers and expansion into underserved regions offer further expansion potential.

Leading Players in the Fast Food Market in Spain Sector

- Yum! Brands Inc

- Doppio Zero

- Domino's Pizza Inc

- Vips Group

- Comess Group SL

- Starbucks Corporation

- Funky Pizza Restaurant

- Restaurant Brands International Inc

- McDonald's Corporation

- Ibersol Restoration Group

Key Milestones in Fast Food Market in Spain Industry

- February 2022: Taco Bell announces plans to open its 100th restaurant in Spain, signifying market expansion.

- August 2022: Funky Pizza Restaurant launches Spain's first virtual waiter app, enhancing customer experience and operational efficiency.

- November 2022: Doppio Zero announces plans for new Spanish tapas eateries, indicating diversification and market expansion.

Strategic Outlook for Fast Food Market in Spain Market

The Spanish fast-food market holds significant growth potential. Continued innovation in product offerings, strategic partnerships, and the adoption of advanced technologies will drive expansion. Further penetration into underserved regions and effective marketing campaigns focused on evolving consumer preferences will be critical for future success.

Fast Food Market in Spain Segmentation

-

1. Type

-

1.1. Consumer Foodservice

- 1.1.1. Cafes and Bars

- 1.1.2. Full-Service Restaurants

- 1.1.3. Fast Food

- 1.1.4. Pizza Consumer Foodservice

- 1.1.5. Self-Service Cafeterias

- 1.1.6. 100% Home Delivery/Takeaway

- 1.1.7. Street Stalls/Kiosks

- 1.2. Hotels

- 1.3. Institutional (Catering)

-

1.1. Consumer Foodservice

-

2. Structure

- 2.1. Independent Outlet

- 2.2. Chained Outlet

Fast Food Market in Spain Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

Fast Food Market in Spain REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 1.96% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1 The younger population in Spain

- 3.2.2 particularly teenagers and young adults

- 3.2.3 is a major consumer base for fast food. This demographic is drawn to the affordability

- 3.2.4 convenience

- 3.2.5 and variety offered by fast food outlets.

- 3.3. Market Restrains

- 3.3.1 There is a growing awareness of the health risks associated with fast food consumption

- 3.3.2 such as obesity and heart disease. This has led some consumers to reduce their fast food intake or seek healthier alternatives.

- 3.4. Market Trends

- 3.4.1 The integration of technology into the fast food experience is becoming more prevalent. Self-service kiosks

- 3.4.2 mobile apps for ordering and payment

- 3.4.3 and digital loyalty programs are increasingly common

- 3.4.4 enhancing customer convenience and engagement.

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Fast Food Market in Spain Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Consumer Foodservice

- 5.1.1.1. Cafes and Bars

- 5.1.1.2. Full-Service Restaurants

- 5.1.1.3. Fast Food

- 5.1.1.4. Pizza Consumer Foodservice

- 5.1.1.5. Self-Service Cafeterias

- 5.1.1.6. 100% Home Delivery/Takeaway

- 5.1.1.7. Street Stalls/Kiosks

- 5.1.2. Hotels

- 5.1.3. Institutional (Catering)

- 5.1.1. Consumer Foodservice

- 5.2. Market Analysis, Insights and Forecast - by Structure

- 5.2.1. Independent Outlet

- 5.2.2. Chained Outlet

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. South America

- 5.3.3. Europe

- 5.3.4. Middle East & Africa

- 5.3.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. North America Fast Food Market in Spain Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Type

- 6.1.1. Consumer Foodservice

- 6.1.1.1. Cafes and Bars

- 6.1.1.2. Full-Service Restaurants

- 6.1.1.3. Fast Food

- 6.1.1.4. Pizza Consumer Foodservice

- 6.1.1.5. Self-Service Cafeterias

- 6.1.1.6. 100% Home Delivery/Takeaway

- 6.1.1.7. Street Stalls/Kiosks

- 6.1.2. Hotels

- 6.1.3. Institutional (Catering)

- 6.1.1. Consumer Foodservice

- 6.2. Market Analysis, Insights and Forecast - by Structure

- 6.2.1. Independent Outlet

- 6.2.2. Chained Outlet

- 6.1. Market Analysis, Insights and Forecast - by Type

- 7. South America Fast Food Market in Spain Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Type

- 7.1.1. Consumer Foodservice

- 7.1.1.1. Cafes and Bars

- 7.1.1.2. Full-Service Restaurants

- 7.1.1.3. Fast Food

- 7.1.1.4. Pizza Consumer Foodservice

- 7.1.1.5. Self-Service Cafeterias

- 7.1.1.6. 100% Home Delivery/Takeaway

- 7.1.1.7. Street Stalls/Kiosks

- 7.1.2. Hotels

- 7.1.3. Institutional (Catering)

- 7.1.1. Consumer Foodservice

- 7.2. Market Analysis, Insights and Forecast - by Structure

- 7.2.1. Independent Outlet

- 7.2.2. Chained Outlet

- 7.1. Market Analysis, Insights and Forecast - by Type

- 8. Europe Fast Food Market in Spain Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Type

- 8.1.1. Consumer Foodservice

- 8.1.1.1. Cafes and Bars

- 8.1.1.2. Full-Service Restaurants

- 8.1.1.3. Fast Food

- 8.1.1.4. Pizza Consumer Foodservice

- 8.1.1.5. Self-Service Cafeterias

- 8.1.1.6. 100% Home Delivery/Takeaway

- 8.1.1.7. Street Stalls/Kiosks

- 8.1.2. Hotels

- 8.1.3. Institutional (Catering)

- 8.1.1. Consumer Foodservice

- 8.2. Market Analysis, Insights and Forecast - by Structure

- 8.2.1. Independent Outlet

- 8.2.2. Chained Outlet

- 8.1. Market Analysis, Insights and Forecast - by Type

- 9. Middle East & Africa Fast Food Market in Spain Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Type

- 9.1.1. Consumer Foodservice

- 9.1.1.1. Cafes and Bars

- 9.1.1.2. Full-Service Restaurants

- 9.1.1.3. Fast Food

- 9.1.1.4. Pizza Consumer Foodservice

- 9.1.1.5. Self-Service Cafeterias

- 9.1.1.6. 100% Home Delivery/Takeaway

- 9.1.1.7. Street Stalls/Kiosks

- 9.1.2. Hotels

- 9.1.3. Institutional (Catering)

- 9.1.1. Consumer Foodservice

- 9.2. Market Analysis, Insights and Forecast - by Structure

- 9.2.1. Independent Outlet

- 9.2.2. Chained Outlet

- 9.1. Market Analysis, Insights and Forecast - by Type

- 10. Asia Pacific Fast Food Market in Spain Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Type

- 10.1.1. Consumer Foodservice

- 10.1.1.1. Cafes and Bars

- 10.1.1.2. Full-Service Restaurants

- 10.1.1.3. Fast Food

- 10.1.1.4. Pizza Consumer Foodservice

- 10.1.1.5. Self-Service Cafeterias

- 10.1.1.6. 100% Home Delivery/Takeaway

- 10.1.1.7. Street Stalls/Kiosks

- 10.1.2. Hotels

- 10.1.3. Institutional (Catering)

- 10.1.1. Consumer Foodservice

- 10.2. Market Analysis, Insights and Forecast - by Structure

- 10.2.1. Independent Outlet

- 10.2.2. Chained Outlet

- 10.1. Market Analysis, Insights and Forecast - by Type

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2024

- 11.2. Company Profiles

- 11.2.1 Yum! Brands Inc

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Doppio Zero

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Domino's Pizza Inc

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Vips Group

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Comess Group SL

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Starbucks Corporation

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Funky Pizza Restaurant

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Restaurant Brands International Inc

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 McDonald's Corporation

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Ibersol Restoration Group

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.1 Yum! Brands Inc

List of Figures

- Figure 1: Global Fast Food Market in Spain Revenue Breakdown (Million, %) by Region 2024 & 2032

- Figure 2: Spain Fast Food Market in Spain Revenue (Million), by Country 2024 & 2032

- Figure 3: Spain Fast Food Market in Spain Revenue Share (%), by Country 2024 & 2032

- Figure 4: North America Fast Food Market in Spain Revenue (Million), by Type 2024 & 2032

- Figure 5: North America Fast Food Market in Spain Revenue Share (%), by Type 2024 & 2032

- Figure 6: North America Fast Food Market in Spain Revenue (Million), by Structure 2024 & 2032

- Figure 7: North America Fast Food Market in Spain Revenue Share (%), by Structure 2024 & 2032

- Figure 8: North America Fast Food Market in Spain Revenue (Million), by Country 2024 & 2032

- Figure 9: North America Fast Food Market in Spain Revenue Share (%), by Country 2024 & 2032

- Figure 10: South America Fast Food Market in Spain Revenue (Million), by Type 2024 & 2032

- Figure 11: South America Fast Food Market in Spain Revenue Share (%), by Type 2024 & 2032

- Figure 12: South America Fast Food Market in Spain Revenue (Million), by Structure 2024 & 2032

- Figure 13: South America Fast Food Market in Spain Revenue Share (%), by Structure 2024 & 2032

- Figure 14: South America Fast Food Market in Spain Revenue (Million), by Country 2024 & 2032

- Figure 15: South America Fast Food Market in Spain Revenue Share (%), by Country 2024 & 2032

- Figure 16: Europe Fast Food Market in Spain Revenue (Million), by Type 2024 & 2032

- Figure 17: Europe Fast Food Market in Spain Revenue Share (%), by Type 2024 & 2032

- Figure 18: Europe Fast Food Market in Spain Revenue (Million), by Structure 2024 & 2032

- Figure 19: Europe Fast Food Market in Spain Revenue Share (%), by Structure 2024 & 2032

- Figure 20: Europe Fast Food Market in Spain Revenue (Million), by Country 2024 & 2032

- Figure 21: Europe Fast Food Market in Spain Revenue Share (%), by Country 2024 & 2032

- Figure 22: Middle East & Africa Fast Food Market in Spain Revenue (Million), by Type 2024 & 2032

- Figure 23: Middle East & Africa Fast Food Market in Spain Revenue Share (%), by Type 2024 & 2032

- Figure 24: Middle East & Africa Fast Food Market in Spain Revenue (Million), by Structure 2024 & 2032

- Figure 25: Middle East & Africa Fast Food Market in Spain Revenue Share (%), by Structure 2024 & 2032

- Figure 26: Middle East & Africa Fast Food Market in Spain Revenue (Million), by Country 2024 & 2032

- Figure 27: Middle East & Africa Fast Food Market in Spain Revenue Share (%), by Country 2024 & 2032

- Figure 28: Asia Pacific Fast Food Market in Spain Revenue (Million), by Type 2024 & 2032

- Figure 29: Asia Pacific Fast Food Market in Spain Revenue Share (%), by Type 2024 & 2032

- Figure 30: Asia Pacific Fast Food Market in Spain Revenue (Million), by Structure 2024 & 2032

- Figure 31: Asia Pacific Fast Food Market in Spain Revenue Share (%), by Structure 2024 & 2032

- Figure 32: Asia Pacific Fast Food Market in Spain Revenue (Million), by Country 2024 & 2032

- Figure 33: Asia Pacific Fast Food Market in Spain Revenue Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global Fast Food Market in Spain Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Global Fast Food Market in Spain Revenue Million Forecast, by Type 2019 & 2032

- Table 3: Global Fast Food Market in Spain Revenue Million Forecast, by Structure 2019 & 2032

- Table 4: Global Fast Food Market in Spain Revenue Million Forecast, by Region 2019 & 2032

- Table 5: Global Fast Food Market in Spain Revenue Million Forecast, by Country 2019 & 2032

- Table 6: Global Fast Food Market in Spain Revenue Million Forecast, by Type 2019 & 2032

- Table 7: Global Fast Food Market in Spain Revenue Million Forecast, by Structure 2019 & 2032

- Table 8: Global Fast Food Market in Spain Revenue Million Forecast, by Country 2019 & 2032

- Table 9: United States Fast Food Market in Spain Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: Canada Fast Food Market in Spain Revenue (Million) Forecast, by Application 2019 & 2032

- Table 11: Mexico Fast Food Market in Spain Revenue (Million) Forecast, by Application 2019 & 2032

- Table 12: Global Fast Food Market in Spain Revenue Million Forecast, by Type 2019 & 2032

- Table 13: Global Fast Food Market in Spain Revenue Million Forecast, by Structure 2019 & 2032

- Table 14: Global Fast Food Market in Spain Revenue Million Forecast, by Country 2019 & 2032

- Table 15: Brazil Fast Food Market in Spain Revenue (Million) Forecast, by Application 2019 & 2032

- Table 16: Argentina Fast Food Market in Spain Revenue (Million) Forecast, by Application 2019 & 2032

- Table 17: Rest of South America Fast Food Market in Spain Revenue (Million) Forecast, by Application 2019 & 2032

- Table 18: Global Fast Food Market in Spain Revenue Million Forecast, by Type 2019 & 2032

- Table 19: Global Fast Food Market in Spain Revenue Million Forecast, by Structure 2019 & 2032

- Table 20: Global Fast Food Market in Spain Revenue Million Forecast, by Country 2019 & 2032

- Table 21: United Kingdom Fast Food Market in Spain Revenue (Million) Forecast, by Application 2019 & 2032

- Table 22: Germany Fast Food Market in Spain Revenue (Million) Forecast, by Application 2019 & 2032

- Table 23: France Fast Food Market in Spain Revenue (Million) Forecast, by Application 2019 & 2032

- Table 24: Italy Fast Food Market in Spain Revenue (Million) Forecast, by Application 2019 & 2032

- Table 25: Spain Fast Food Market in Spain Revenue (Million) Forecast, by Application 2019 & 2032

- Table 26: Russia Fast Food Market in Spain Revenue (Million) Forecast, by Application 2019 & 2032

- Table 27: Benelux Fast Food Market in Spain Revenue (Million) Forecast, by Application 2019 & 2032

- Table 28: Nordics Fast Food Market in Spain Revenue (Million) Forecast, by Application 2019 & 2032

- Table 29: Rest of Europe Fast Food Market in Spain Revenue (Million) Forecast, by Application 2019 & 2032

- Table 30: Global Fast Food Market in Spain Revenue Million Forecast, by Type 2019 & 2032

- Table 31: Global Fast Food Market in Spain Revenue Million Forecast, by Structure 2019 & 2032

- Table 32: Global Fast Food Market in Spain Revenue Million Forecast, by Country 2019 & 2032

- Table 33: Turkey Fast Food Market in Spain Revenue (Million) Forecast, by Application 2019 & 2032

- Table 34: Israel Fast Food Market in Spain Revenue (Million) Forecast, by Application 2019 & 2032

- Table 35: GCC Fast Food Market in Spain Revenue (Million) Forecast, by Application 2019 & 2032

- Table 36: North Africa Fast Food Market in Spain Revenue (Million) Forecast, by Application 2019 & 2032

- Table 37: South Africa Fast Food Market in Spain Revenue (Million) Forecast, by Application 2019 & 2032

- Table 38: Rest of Middle East & Africa Fast Food Market in Spain Revenue (Million) Forecast, by Application 2019 & 2032

- Table 39: Global Fast Food Market in Spain Revenue Million Forecast, by Type 2019 & 2032

- Table 40: Global Fast Food Market in Spain Revenue Million Forecast, by Structure 2019 & 2032

- Table 41: Global Fast Food Market in Spain Revenue Million Forecast, by Country 2019 & 2032

- Table 42: China Fast Food Market in Spain Revenue (Million) Forecast, by Application 2019 & 2032

- Table 43: India Fast Food Market in Spain Revenue (Million) Forecast, by Application 2019 & 2032

- Table 44: Japan Fast Food Market in Spain Revenue (Million) Forecast, by Application 2019 & 2032

- Table 45: South Korea Fast Food Market in Spain Revenue (Million) Forecast, by Application 2019 & 2032

- Table 46: ASEAN Fast Food Market in Spain Revenue (Million) Forecast, by Application 2019 & 2032

- Table 47: Oceania Fast Food Market in Spain Revenue (Million) Forecast, by Application 2019 & 2032

- Table 48: Rest of Asia Pacific Fast Food Market in Spain Revenue (Million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Fast Food Market in Spain?

The projected CAGR is approximately 1.96%.

2. Which companies are prominent players in the Fast Food Market in Spain?

Key companies in the market include Yum! Brands Inc, Doppio Zero, Domino's Pizza Inc, Vips Group, Comess Group SL, Starbucks Corporation, Funky Pizza Restaurant, Restaurant Brands International Inc, McDonald's Corporation, Ibersol Restoration Group.

3. What are the main segments of the Fast Food Market in Spain?

The market segments include Type, Structure.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

The younger population in Spain. particularly teenagers and young adults. is a major consumer base for fast food. This demographic is drawn to the affordability. convenience. and variety offered by fast food outlets..

6. What are the notable trends driving market growth?

The integration of technology into the fast food experience is becoming more prevalent. Self-service kiosks. mobile apps for ordering and payment. and digital loyalty programs are increasingly common. enhancing customer convenience and engagement..

7. Are there any restraints impacting market growth?

There is a growing awareness of the health risks associated with fast food consumption. such as obesity and heart disease. This has led some consumers to reduce their fast food intake or seek healthier alternatives..

8. Can you provide examples of recent developments in the market?

In November 2022, the Owners of Doppio Zero announced plans to launch their new outlet Spanish tapas eateries at 110 Castro St. in Mountain View. Courtesy Vida.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Fast Food Market in Spain," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Fast Food Market in Spain report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Fast Food Market in Spain?

To stay informed about further developments, trends, and reports in the Fast Food Market in Spain, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence