Key Insights

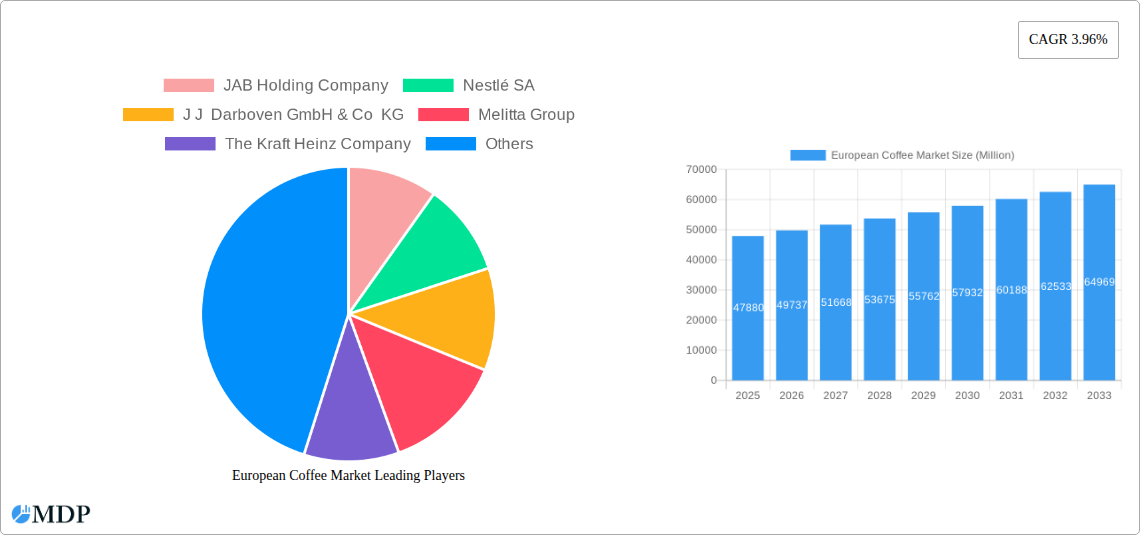

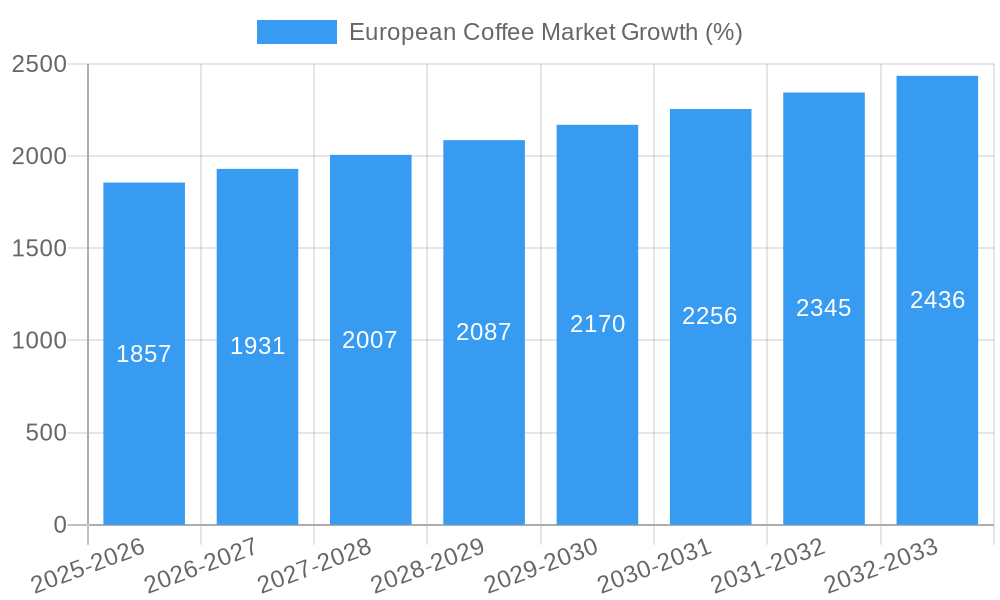

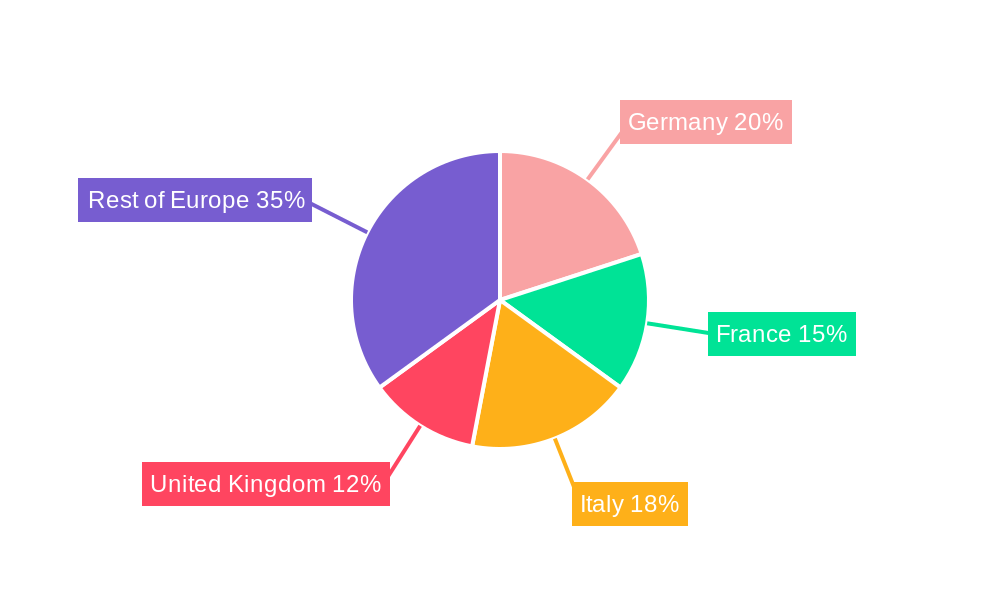

The European coffee market, valued at €47.88 billion in 2025, is projected to experience steady growth, driven by several key factors. Rising disposable incomes across many European countries, coupled with a strong coffee culture, particularly in nations like Germany, Italy, and France, fuels consistent demand. The increasing popularity of specialty coffee, including single-origin beans and artisanal brewing methods, contributes to premiumization and higher average spending per consumer. Furthermore, the convenience of coffee pods and capsules, catering to busy lifestyles, continues to drive segment growth. While the on-trade sector (cafes, restaurants) is recovering from pandemic-related disruptions, the off-trade segment (supermarkets, online retailers) maintains its strong position, boosted by e-commerce expansion and home consumption habits. Competition within the market is fierce, with established players like Nestlé, JAB Holding Company, and Lavazza vying for market share alongside smaller, specialized roasters. Germany, France, Italy, and the UK remain the key markets within Europe, accounting for a significant portion of total consumption, reflecting established coffee traditions and high per capita consumption. However, growth opportunities exist in other European countries as coffee consumption habits evolve and diversify.

Despite the positive outlook, challenges remain. Fluctuations in coffee bean prices due to global climate change and geopolitical factors could impact profitability. Increasing health consciousness may slightly restrain growth of certain coffee products high in sugar or additives. Furthermore, heightened environmental concerns necessitate sustainable sourcing and packaging solutions from coffee producers to maintain consumer trust and mitigate potential negative impacts on brand reputation. The market's future growth hinges on manufacturers’ ability to adapt to consumer preferences, innovate with new products and brewing technologies, and maintain a strong focus on sustainability throughout their supply chain. The projected CAGR of 3.96% suggests a reasonably consistent expansion, assuming these challenges are managed effectively.

European Coffee Market Report: 2019-2033

This comprehensive report provides a detailed analysis of the European coffee market, covering market dynamics, industry trends, leading players, and future opportunities. With a study period spanning 2019-2033 (base year 2025, forecast period 2025-2033), this report is an invaluable resource for industry stakeholders seeking actionable insights and strategic guidance. The report leverages extensive data analysis to project a market valued at xx Million by 2033, showcasing substantial growth potential.

European Coffee Market Market Dynamics & Concentration

This section analyzes the European coffee market's competitive landscape, encompassing market concentration, innovation drivers, regulatory frameworks, product substitutes, end-user trends, and M&A activities. The market exhibits moderate concentration, with a few dominant players commanding significant market share. JAB Holding Company, Nestlé SA, and Luigi Lavazza SpA are key examples of these large players. However, smaller, regional roasters and specialty coffee shops contribute significantly to the overall market diversity.

- Market Concentration: The top 5 players hold an estimated xx% market share in 2025, indicating moderate concentration.

- Innovation Drivers: Sustainability initiatives (e.g., reduced packaging, traceable sourcing), product diversification (e.g., plant-based milk alternatives, new coffee pod formats), and technological advancements (e.g., smart coffee machines) are key drivers of innovation.

- Regulatory Frameworks: EU regulations regarding food safety, labeling, and sustainability are significant factors influencing market operations. These frameworks impact packaging materials, ingredient sourcing, and marketing claims.

- Product Substitutes: Tea, herbal infusions, and energy drinks pose a competitive threat, especially within younger demographics. Health and wellness trends influence consumer choices, impacting coffee consumption patterns.

- End-User Trends: Growing consumer preference for specialty coffee, ethical sourcing, and convenient brewing methods drives market segmentation and product development.

- M&A Activities: The European coffee market witnessed xx M&A deals between 2019 and 2024, primarily driven by expansion strategies and consolidation among players.

European Coffee Market Industry Trends & Analysis

This section delves into the key trends shaping the European coffee market. The market experiences robust growth, fueled by factors such as rising disposable incomes, evolving consumer preferences, and technological advancements in coffee brewing and distribution.

The CAGR from 2019 to 2024 is estimated at xx%, reflecting a healthy expansion trajectory. Market penetration of coffee pods and capsules continues to rise, driven by convenience and ease of use. However, growing environmental concerns regarding single-use plastics are prompting innovative solutions, such as compostable and recyclable alternatives. The increasing popularity of plant-based milk alternatives also significantly influences product development and consumer behavior. Competitive dynamics are characterized by both intense competition among major players and the emergence of niche players focusing on specialty coffee and sustainable practices.

Leading Markets & Segments in European Coffee Market

This section identifies the leading markets and segments within the European coffee market. Germany, Italy, and France consistently rank among the top-consuming countries, driven by strong coffee cultures and high per capita consumption.

- By Product Type: Ground coffee maintains a considerable market share, but coffee pods and capsules demonstrate the highest growth rate, fueled by convenience. Instant coffee remains a significant segment due to its affordability and ease of preparation. Whole bean coffee appeals to a niche market of discerning consumers prioritizing quality and freshness.

- By Distribution Channel: The off-trade channel (supermarkets, hypermarkets, online retailers) dominates the market, reflecting the convenience and widespread accessibility of these channels. The on-trade channel (cafes, restaurants, bars) remains important, particularly for specialty coffee and premium experiences.

Key Drivers:

- Germany: Strong coffee culture, high disposable incomes, robust retail infrastructure.

- Italy: Rich coffee heritage, strong espresso culture, widespread café culture.

- France: Growing demand for specialty coffee, increasing café culture, tourism impact.

European Coffee Market Product Developments

Recent product developments focus on sustainability, convenience, and enhanced consumer experience. Nestlé's Nescafé Dolce Gusto Neo pods, with 70% less packaging, exemplify this trend. Partnerships, such as Melitta and OFI's collaboration using blockchain technology for traceable coffee, are also enhancing product transparency and consumer trust. The introduction of oat milk alternatives by Starbucks highlights the growing demand for plant-based options within the coffee market.

Key Drivers of European Coffee Market Growth

Key drivers include:

- Rising Disposable Incomes: Increased purchasing power fuels demand for premium coffee products and experiences.

- Evolving Consumer Preferences: Growing interest in specialty coffee, sustainable practices, and convenience drives market segmentation and product innovation.

- Technological Advancements: Smart coffee machines and innovative brewing methods enhance consumer experience and market expansion.

Challenges in the European Coffee Market Market

Challenges include:

- Supply Chain Disruptions: Global events and geopolitical instability can impact coffee bean sourcing and pricing, affecting profitability.

- Fluctuating Coffee Bean Prices: Global coffee prices fluctuate according to environmental factors and market dynamics, which in turn impacts profit margins.

- Intense Competition: The market’s competitive nature necessitates continuous innovation and adaptation to remain competitive.

Emerging Opportunities in European Coffee Market

Emerging opportunities lie in sustainable sourcing, innovative brewing technologies, and expanding into new markets within Europe. Strategic partnerships between coffee producers and tech companies can revolutionize the coffee experience and increase the penetration of new technologies within the sector.

Leading Players in the European Coffee Market Sector

- JAB Holding Company

- Nestlé SA

- J J Darboven GmbH & Co KG

- Melitta Group

- The Kraft Heinz Company

- Krüger GmbH & Co KG

- Starbucks Corporation

- Strauss Group Ltd

- Maxingvest AG (Tchibo)

- Luigi Lavazza SpA

Key Milestones in European Coffee Market Industry

- December 2021: Starbucks introduced its new oat dairy alternative coffee.

- May 2022: Melitta and OFI partnered for traceable coffee using blockchain technology.

- November 2022: Nescafé Dolce Gusto launched its Neo coffee pods with 70% less packaging.

Strategic Outlook for European Coffee Market Market

The European coffee market is poised for continued growth, driven by evolving consumer preferences and technological innovation. Strategic partnerships, sustainable practices, and expansion into niche segments offer significant growth opportunities for market players. Companies prioritizing sustainability, convenience, and unique consumer experiences will likely thrive in this dynamic market.

European Coffee Market Segmentation

-

1. Product Type

- 1.1. Whole Bean

- 1.2. Ground Coffee

- 1.3. Instant Coffee

- 1.4. Coffee Pods and Capsules

-

2. Distribution Channel

- 2.1. On-trade

-

2.2. Off-trade

- 2.2.1. Supermarkets/Hypermarkets

- 2.2.2. Convenience Stores

- 2.2.3. Specialist Retailers

- 2.2.4. Other Off-trade Channels

European Coffee Market Segmentation By Geography

- 1. United Kingdom

- 2. Germany

- 3. France

- 4. Russia

- 5. Italy

- 6. Spain

- 7. Rest of Europe

European Coffee Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 3.96% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Incidences of Food Allergies; Favorable Government Initiatives and Regulations for Food Safety

- 3.3. Market Restrains

- 3.3.1. Inconsistencies Involved in Food Allergen Declarations

- 3.4. Market Trends

- 3.4.1. Consumer Preference for Premium Coffee Fuels Growth in Specialty Coffee Shops Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. European Coffee Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 5.1.1. Whole Bean

- 5.1.2. Ground Coffee

- 5.1.3. Instant Coffee

- 5.1.4. Coffee Pods and Capsules

- 5.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 5.2.1. On-trade

- 5.2.2. Off-trade

- 5.2.2.1. Supermarkets/Hypermarkets

- 5.2.2.2. Convenience Stores

- 5.2.2.3. Specialist Retailers

- 5.2.2.4. Other Off-trade Channels

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. United Kingdom

- 5.3.2. Germany

- 5.3.3. France

- 5.3.4. Russia

- 5.3.5. Italy

- 5.3.6. Spain

- 5.3.7. Rest of Europe

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 6. United Kingdom European Coffee Market Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Product Type

- 6.1.1. Whole Bean

- 6.1.2. Ground Coffee

- 6.1.3. Instant Coffee

- 6.1.4. Coffee Pods and Capsules

- 6.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 6.2.1. On-trade

- 6.2.2. Off-trade

- 6.2.2.1. Supermarkets/Hypermarkets

- 6.2.2.2. Convenience Stores

- 6.2.2.3. Specialist Retailers

- 6.2.2.4. Other Off-trade Channels

- 6.1. Market Analysis, Insights and Forecast - by Product Type

- 7. Germany European Coffee Market Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Product Type

- 7.1.1. Whole Bean

- 7.1.2. Ground Coffee

- 7.1.3. Instant Coffee

- 7.1.4. Coffee Pods and Capsules

- 7.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 7.2.1. On-trade

- 7.2.2. Off-trade

- 7.2.2.1. Supermarkets/Hypermarkets

- 7.2.2.2. Convenience Stores

- 7.2.2.3. Specialist Retailers

- 7.2.2.4. Other Off-trade Channels

- 7.1. Market Analysis, Insights and Forecast - by Product Type

- 8. France European Coffee Market Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Product Type

- 8.1.1. Whole Bean

- 8.1.2. Ground Coffee

- 8.1.3. Instant Coffee

- 8.1.4. Coffee Pods and Capsules

- 8.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 8.2.1. On-trade

- 8.2.2. Off-trade

- 8.2.2.1. Supermarkets/Hypermarkets

- 8.2.2.2. Convenience Stores

- 8.2.2.3. Specialist Retailers

- 8.2.2.4. Other Off-trade Channels

- 8.1. Market Analysis, Insights and Forecast - by Product Type

- 9. Russia European Coffee Market Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Product Type

- 9.1.1. Whole Bean

- 9.1.2. Ground Coffee

- 9.1.3. Instant Coffee

- 9.1.4. Coffee Pods and Capsules

- 9.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 9.2.1. On-trade

- 9.2.2. Off-trade

- 9.2.2.1. Supermarkets/Hypermarkets

- 9.2.2.2. Convenience Stores

- 9.2.2.3. Specialist Retailers

- 9.2.2.4. Other Off-trade Channels

- 9.1. Market Analysis, Insights and Forecast - by Product Type

- 10. Italy European Coffee Market Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Product Type

- 10.1.1. Whole Bean

- 10.1.2. Ground Coffee

- 10.1.3. Instant Coffee

- 10.1.4. Coffee Pods and Capsules

- 10.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 10.2.1. On-trade

- 10.2.2. Off-trade

- 10.2.2.1. Supermarkets/Hypermarkets

- 10.2.2.2. Convenience Stores

- 10.2.2.3. Specialist Retailers

- 10.2.2.4. Other Off-trade Channels

- 10.1. Market Analysis, Insights and Forecast - by Product Type

- 11. Spain European Coffee Market Analysis, Insights and Forecast, 2019-2031

- 11.1. Market Analysis, Insights and Forecast - by Product Type

- 11.1.1. Whole Bean

- 11.1.2. Ground Coffee

- 11.1.3. Instant Coffee

- 11.1.4. Coffee Pods and Capsules

- 11.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 11.2.1. On-trade

- 11.2.2. Off-trade

- 11.2.2.1. Supermarkets/Hypermarkets

- 11.2.2.2. Convenience Stores

- 11.2.2.3. Specialist Retailers

- 11.2.2.4. Other Off-trade Channels

- 11.1. Market Analysis, Insights and Forecast - by Product Type

- 12. Rest of Europe European Coffee Market Analysis, Insights and Forecast, 2019-2031

- 12.1. Market Analysis, Insights and Forecast - by Product Type

- 12.1.1. Whole Bean

- 12.1.2. Ground Coffee

- 12.1.3. Instant Coffee

- 12.1.4. Coffee Pods and Capsules

- 12.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 12.2.1. On-trade

- 12.2.2. Off-trade

- 12.2.2.1. Supermarkets/Hypermarkets

- 12.2.2.2. Convenience Stores

- 12.2.2.3. Specialist Retailers

- 12.2.2.4. Other Off-trade Channels

- 12.1. Market Analysis, Insights and Forecast - by Product Type

- 13. Germany European Coffee Market Analysis, Insights and Forecast, 2019-2031

- 14. France European Coffee Market Analysis, Insights and Forecast, 2019-2031

- 15. Italy European Coffee Market Analysis, Insights and Forecast, 2019-2031

- 16. United Kingdom European Coffee Market Analysis, Insights and Forecast, 2019-2031

- 17. Netherlands European Coffee Market Analysis, Insights and Forecast, 2019-2031

- 18. Sweden European Coffee Market Analysis, Insights and Forecast, 2019-2031

- 19. Rest of Europe European Coffee Market Analysis, Insights and Forecast, 2019-2031

- 20. Competitive Analysis

- 20.1. Market Share Analysis 2024

- 20.2. Company Profiles

- 20.2.1 JAB Holding Company

- 20.2.1.1. Overview

- 20.2.1.2. Products

- 20.2.1.3. SWOT Analysis

- 20.2.1.4. Recent Developments

- 20.2.1.5. Financials (Based on Availability)

- 20.2.2 Nestlé SA

- 20.2.2.1. Overview

- 20.2.2.2. Products

- 20.2.2.3. SWOT Analysis

- 20.2.2.4. Recent Developments

- 20.2.2.5. Financials (Based on Availability)

- 20.2.3 J J Darboven GmbH & Co KG

- 20.2.3.1. Overview

- 20.2.3.2. Products

- 20.2.3.3. SWOT Analysis

- 20.2.3.4. Recent Developments

- 20.2.3.5. Financials (Based on Availability)

- 20.2.4 Melitta Group

- 20.2.4.1. Overview

- 20.2.4.2. Products

- 20.2.4.3. SWOT Analysis

- 20.2.4.4. Recent Developments

- 20.2.4.5. Financials (Based on Availability)

- 20.2.5 The Kraft Heinz Company

- 20.2.5.1. Overview

- 20.2.5.2. Products

- 20.2.5.3. SWOT Analysis

- 20.2.5.4. Recent Developments

- 20.2.5.5. Financials (Based on Availability)

- 20.2.6 Krüger GmbH & Co KG

- 20.2.6.1. Overview

- 20.2.6.2. Products

- 20.2.6.3. SWOT Analysis

- 20.2.6.4. Recent Developments

- 20.2.6.5. Financials (Based on Availability)

- 20.2.7 Starbucks Corporation

- 20.2.7.1. Overview

- 20.2.7.2. Products

- 20.2.7.3. SWOT Analysis

- 20.2.7.4. Recent Developments

- 20.2.7.5. Financials (Based on Availability)

- 20.2.8 Strauss Group Ltd

- 20.2.8.1. Overview

- 20.2.8.2. Products

- 20.2.8.3. SWOT Analysis

- 20.2.8.4. Recent Developments

- 20.2.8.5. Financials (Based on Availability)

- 20.2.9 Maxingvest AG (Tchibo)*List Not Exhaustive

- 20.2.9.1. Overview

- 20.2.9.2. Products

- 20.2.9.3. SWOT Analysis

- 20.2.9.4. Recent Developments

- 20.2.9.5. Financials (Based on Availability)

- 20.2.10 Luigi Lavazza SpA

- 20.2.10.1. Overview

- 20.2.10.2. Products

- 20.2.10.3. SWOT Analysis

- 20.2.10.4. Recent Developments

- 20.2.10.5. Financials (Based on Availability)

- 20.2.1 JAB Holding Company

List of Figures

- Figure 1: European Coffee Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: European Coffee Market Share (%) by Company 2024

List of Tables

- Table 1: European Coffee Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: European Coffee Market Revenue Million Forecast, by Product Type 2019 & 2032

- Table 3: European Coffee Market Revenue Million Forecast, by Distribution Channel 2019 & 2032

- Table 4: European Coffee Market Revenue Million Forecast, by Region 2019 & 2032

- Table 5: European Coffee Market Revenue Million Forecast, by Country 2019 & 2032

- Table 6: Germany European Coffee Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 7: France European Coffee Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 8: Italy European Coffee Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: United Kingdom European Coffee Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: Netherlands European Coffee Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 11: Sweden European Coffee Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 12: Rest of Europe European Coffee Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 13: European Coffee Market Revenue Million Forecast, by Product Type 2019 & 2032

- Table 14: European Coffee Market Revenue Million Forecast, by Distribution Channel 2019 & 2032

- Table 15: European Coffee Market Revenue Million Forecast, by Country 2019 & 2032

- Table 16: European Coffee Market Revenue Million Forecast, by Product Type 2019 & 2032

- Table 17: European Coffee Market Revenue Million Forecast, by Distribution Channel 2019 & 2032

- Table 18: European Coffee Market Revenue Million Forecast, by Country 2019 & 2032

- Table 19: European Coffee Market Revenue Million Forecast, by Product Type 2019 & 2032

- Table 20: European Coffee Market Revenue Million Forecast, by Distribution Channel 2019 & 2032

- Table 21: European Coffee Market Revenue Million Forecast, by Country 2019 & 2032

- Table 22: European Coffee Market Revenue Million Forecast, by Product Type 2019 & 2032

- Table 23: European Coffee Market Revenue Million Forecast, by Distribution Channel 2019 & 2032

- Table 24: European Coffee Market Revenue Million Forecast, by Country 2019 & 2032

- Table 25: European Coffee Market Revenue Million Forecast, by Product Type 2019 & 2032

- Table 26: European Coffee Market Revenue Million Forecast, by Distribution Channel 2019 & 2032

- Table 27: European Coffee Market Revenue Million Forecast, by Country 2019 & 2032

- Table 28: European Coffee Market Revenue Million Forecast, by Product Type 2019 & 2032

- Table 29: European Coffee Market Revenue Million Forecast, by Distribution Channel 2019 & 2032

- Table 30: European Coffee Market Revenue Million Forecast, by Country 2019 & 2032

- Table 31: European Coffee Market Revenue Million Forecast, by Product Type 2019 & 2032

- Table 32: European Coffee Market Revenue Million Forecast, by Distribution Channel 2019 & 2032

- Table 33: European Coffee Market Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the European Coffee Market?

The projected CAGR is approximately 3.96%.

2. Which companies are prominent players in the European Coffee Market?

Key companies in the market include JAB Holding Company, Nestlé SA, J J Darboven GmbH & Co KG, Melitta Group, The Kraft Heinz Company, Krüger GmbH & Co KG, Starbucks Corporation, Strauss Group Ltd, Maxingvest AG (Tchibo)*List Not Exhaustive, Luigi Lavazza SpA.

3. What are the main segments of the European Coffee Market?

The market segments include Product Type, Distribution Channel.

4. Can you provide details about the market size?

The market size is estimated to be USD 47.88 Million as of 2022.

5. What are some drivers contributing to market growth?

Increasing Incidences of Food Allergies; Favorable Government Initiatives and Regulations for Food Safety.

6. What are the notable trends driving market growth?

Consumer Preference for Premium Coffee Fuels Growth in Specialty Coffee Shops Market.

7. Are there any restraints impacting market growth?

Inconsistencies Involved in Food Allergen Declarations.

8. Can you provide examples of recent developments in the market?

November 2022: Nescafé Dolce Gusto unveiled its next-generation coffee pods and machines, referred to as Neo. Nestlé's new coffee pods use 70% less packaging than current capsules (by weight) and are paper-based and compostable. Nestlé's Swiss R&D Center for Systems has refined this product over the past five years.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "European Coffee Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the European Coffee Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the European Coffee Market?

To stay informed about further developments, trends, and reports in the European Coffee Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence