Key Insights

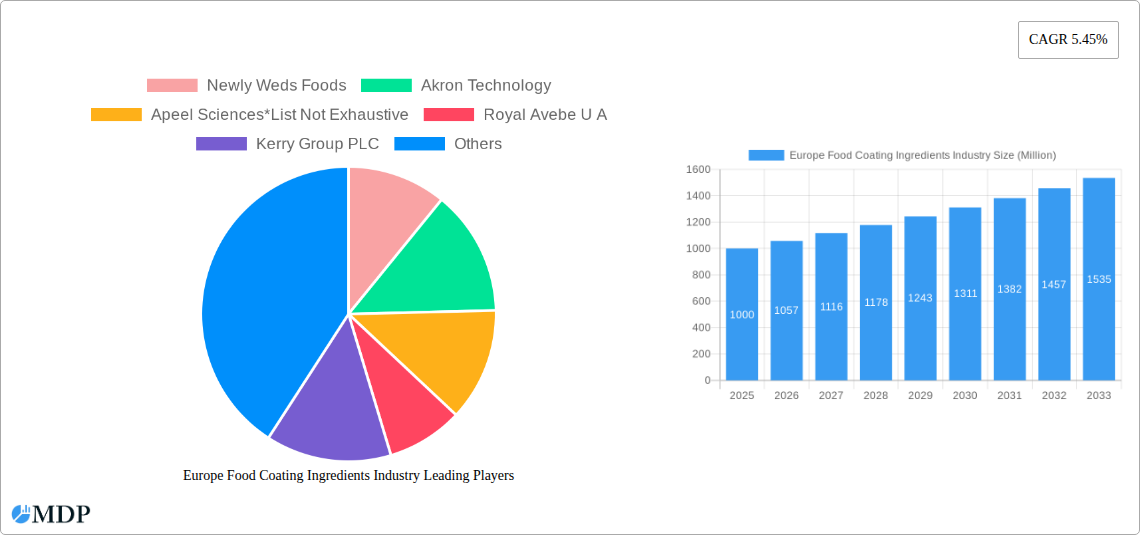

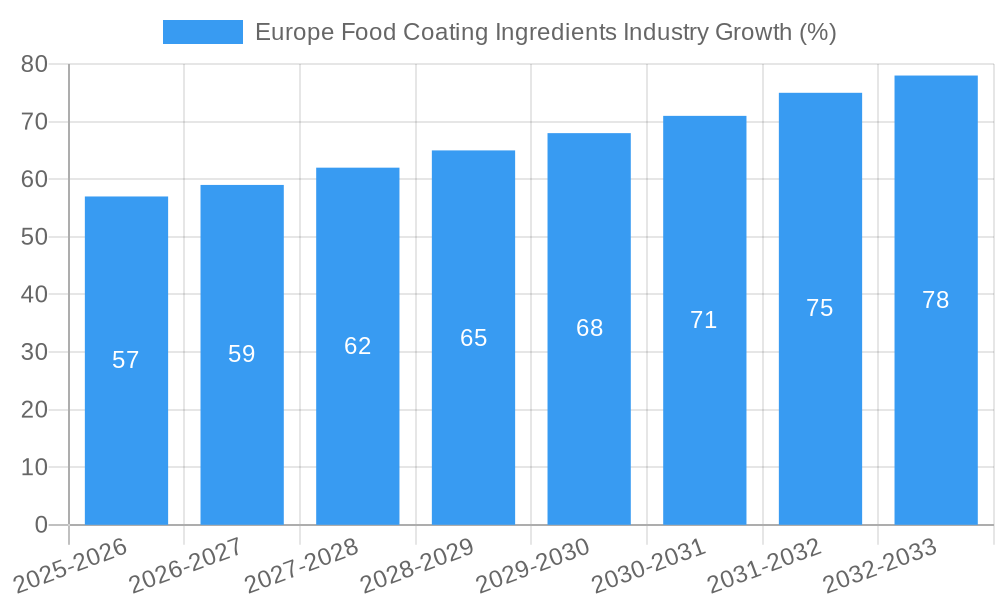

The European food coating ingredients market, valued at approximately €[Estimate based on market size XX and value unit Million – let's assume XX = 1000 for illustration, resulting in €1000 million in 2025] in 2025, is projected to experience robust growth, exhibiting a Compound Annual Growth Rate (CAGR) of 5.45% from 2025 to 2033. This expansion is driven by several key factors. The increasing demand for convenient and ready-to-eat foods fuels the need for food coating ingredients that enhance product shelf life, texture, and appearance. Furthermore, evolving consumer preferences towards healthier and more natural food options are pushing manufacturers to adopt cleaner label ingredients, leading to innovation in coating solutions. The bakery and confectionery sectors are major application areas, while segments like sugars and syrups, cocoa and chocolates, and fats and oils are significant contributors to market value. Growth is further supported by advancements in food processing technologies, enabling the creation of more sophisticated and appealing coated products.

However, market growth may face some challenges. Fluctuations in raw material prices, particularly for ingredients like cocoa and sugar, can impact profitability. Stringent regulatory requirements regarding food additives and labeling in Europe pose another hurdle for manufacturers, necessitating compliance with evolving standards. Despite these restraints, the market's overall positive trajectory is anticipated to persist, driven by ongoing product innovation and a resilient consumer demand for convenient and appealing food products. The presence of established players like Cargill, Archer-Daniels-Midland, and Ingredion, alongside innovative companies like Apeel Sciences, signifies a dynamic and competitive landscape conducive to future expansion. Germany, France, and the UK are expected to remain key markets within Europe.

Europe Food Coating Ingredients Industry: A Comprehensive Market Report (2019-2033)

This comprehensive report provides an in-depth analysis of the Europe Food Coating Ingredients industry, offering valuable insights for stakeholders, investors, and industry professionals. Covering the period 2019-2033, with a base year of 2025 and a forecast period of 2025-2033, this report delivers a holistic view of market dynamics, trends, and opportunities. The report analyzes key segments, including Type (Sugars and Syrups, Cocoa and Chocolates, Fats and Oils, Spices and Seasonings, Flours, Batter and Crumbs, Other Types) and Application (Bakery, Confectionery, Breakfast Cereals, Snacks, Dairy, Meat, Other Applications), revealing market size and growth projections in Millions.

Europe Food Coating Ingredients Industry Market Dynamics & Concentration

The European food coating ingredients market is characterized by a moderately concentrated landscape, with several multinational corporations and regional players vying for market share. The market's value in 2025 is estimated at xx Million, projected to reach xx Million by 2033. Innovation plays a crucial role, driven by the demand for healthier, more convenient, and aesthetically pleasing food products. Stringent regulatory frameworks concerning food safety and labeling influence product development and market entry. Substitutes, such as natural coatings and alternative ingredients, are gaining traction, posing a competitive challenge. End-user trends toward healthier eating and convenience are reshaping the demand for specific coating types. The historical period (2019-2024) witnessed xx M&A deals, indicative of industry consolidation. Market share data for key players will be detailed within the full report.

- Market Concentration: Moderately concentrated, with top 5 players holding approximately xx% market share (2025).

- Innovation Drivers: Consumer demand for enhanced taste, texture, and shelf life; growing health consciousness.

- Regulatory Framework: EU food safety regulations, labeling requirements, and sustainability standards significantly impact the market.

- Product Substitutes: Natural coatings, alternative ingredient-based coatings gaining market share.

- End-User Trends: Demand for convenience foods, functional foods, and sustainable products.

- M&A Activity: xx mergers and acquisitions recorded during 2019-2024.

Europe Food Coating Ingredients Industry Industry Trends & Analysis

The European food coating ingredients market is poised for robust growth, driven by several key factors. The CAGR during the forecast period (2025-2033) is projected at xx%, exceeding the historical CAGR of xx%. Technological advancements, including the development of novel coating materials with improved functionality and sustainability, are reshaping the market. Consumer preferences toward healthier and more natural ingredients are increasing demand for coatings that meet these expectations. The market penetration of functional coatings, such as those enhancing shelf life or nutritional value, is steadily rising. Intense competition among established players and emerging companies fosters innovation and drives market expansion. Market penetration of specific coating types and detailed analysis of consumer preference shifts will be provided within the complete report.

Leading Markets & Segments in Europe Food Coating Ingredients Industry

The report identifies key leading markets and segments within the European food coating ingredients industry. While specific market share data and detailed country-level analysis is contained in the full report, the following provides a preliminary overview.

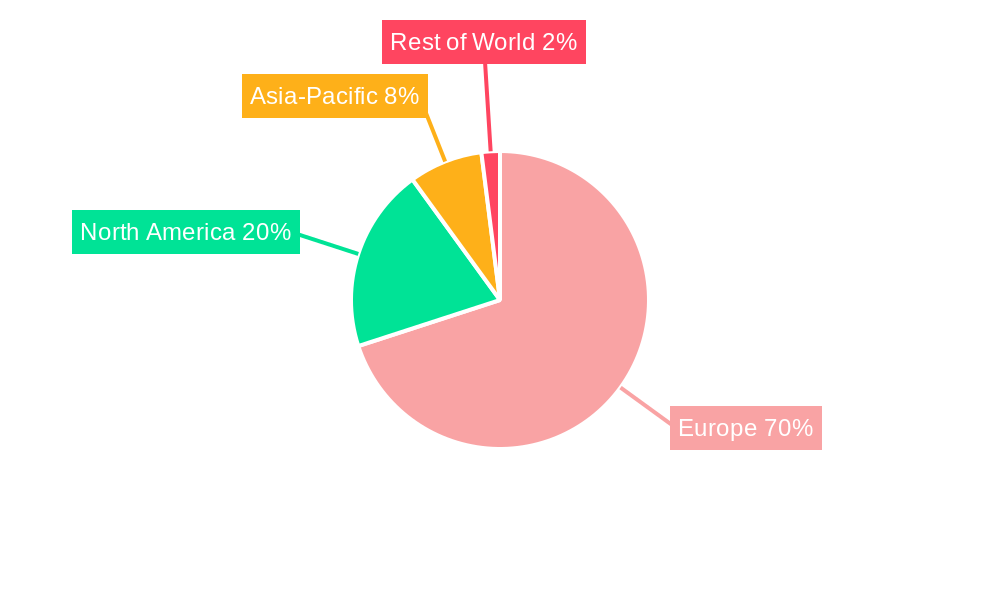

Dominant Regions: Western Europe (specifically Germany, France, and the UK) are expected to lead in consumption, driven by high demand for processed foods and strong food manufacturing sectors.

Dominant Segments (Type): Sugars and syrups and fats and oils are currently the largest segments due to their widespread use across diverse applications.

Dominant Segments (Application): The confectionery and bakery segments are leading in consumption of food coatings, fueled by the high consumption of these food categories.

Key Drivers (Regional): Strong food processing industries, favorable economic conditions, and well-established distribution networks support market growth in leading regions.

Key Drivers (Segment): The large-scale use of these ingredients across numerous food categories leads to their significant market presence.

Europe Food Coating Ingredients Industry Product Developments

Recent product innovations focus on creating healthier, more sustainable, and functional food coatings. Technological advancements include the development of edible films and coatings derived from natural sources, offering improved biodegradability and consumer appeal. This is further enhanced by advances in coating application technologies leading to improved uniformity and efficiency. The market fit of these new products is strong, driven by growing consumer demand for natural and healthier food options.

Key Drivers of Europe Food Coating Ingredients Industry Growth

Several factors contribute to the projected growth of the Europe food coating ingredients market. Technological advancements in coating formulation and application methods improve product performance and efficiency. Economic growth and rising disposable incomes increase spending on convenience and processed foods. Favorable regulatory environments and consumer preference toward functional foods fuel market expansion.

Challenges in the Europe Food Coating Ingredients Industry Market

The market faces challenges like increasing raw material costs, stringent regulatory requirements impacting innovation and time-to-market, and intense competition from both established and new market entrants. Supply chain disruptions, particularly concerning key raw materials, can negatively impact production and profitability. These issues have impacted margins by an estimated xx% in the past year, as detailed in the full report.

Emerging Opportunities in Europe Food Coating Ingredients Industry

Emerging opportunities lie in the development of sustainable and eco-friendly food coatings, catering to the growing consumer demand for environmentally conscious products. Strategic partnerships between ingredient suppliers and food manufacturers can unlock new market segments. Expanding into emerging markets within Europe offers potential for substantial growth.

Leading Players in the Europe Food Coating Ingredients Industry Sector

- Newly Weds Foods

- Akron Technology

- Apeel Sciences

- Royal Avebe U A

- Kerry Group PLC

- Cargill Inc

- Archer-Daniels-Midland Company

- Ingredion Incorporated

- Tate & Lyle

- Bowman Ingredients

Key Milestones in Europe Food Coating Ingredients Industry Industry

- 2021: Kerry Group PLC launched a coating production facility in Rome, Georgia, expanding its capacity and capabilities for customized coating solutions.

- 2021: PPG Industries expanded its food coatings business in Europe, focusing on market expansion and brand building.

- 2022: Akron Technology received EU approval for its edible coatings for fresh produce, expanding its product portfolio and market reach.

Strategic Outlook for Europe Food Coating Ingredients Industry Market

The future of the European food coating ingredients market appears bright, driven by continued innovation in sustainable and functional coatings. Strategic partnerships and investments in research and development will be crucial for companies to maintain competitiveness. Expanding into new applications and focusing on meeting evolving consumer demands will be key factors driving long-term growth and profitability.

Europe Food Coating Ingredients Industry Segmentation

-

1. Type

- 1.1. Sugars and Syrups

- 1.2. Cocoa and Chocolates

- 1.3. Fats and Oils

- 1.4. Spices and Seasonings

- 1.5. Flours

- 1.6. Batter and Crumbs

- 1.7. Other Types

-

2. Application

- 2.1. Bakery

- 2.2. Confectionery

- 2.3. Breakfast Cereals

- 2.4. Snacks

- 2.5. Dairy

- 2.6. Meat

- 2.7. Other Applications

Europe Food Coating Ingredients Industry Segmentation By Geography

- 1. United Kingdom

- 2. Germany

- 3. France

- 4. Spain

- 5. Italy

- 6. Russia

- 7. Rest of Europe

Europe Food Coating Ingredients Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 5.45% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Demand for Low-Fat and Low-Calorie Food; Increasing Product Innovation

- 3.3. Market Restrains

- 3.3.1. ; Threat of New Entrants; Bargaining Power of Buyers/Consumers; Bargaining Power of Suppliers; Threat of Substitute Products; Degree Of Competition

- 3.4. Market Trends

- 3.4.1. Rising Utilization of Flours in Daily Routines

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Europe Food Coating Ingredients Industry Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Sugars and Syrups

- 5.1.2. Cocoa and Chocolates

- 5.1.3. Fats and Oils

- 5.1.4. Spices and Seasonings

- 5.1.5. Flours

- 5.1.6. Batter and Crumbs

- 5.1.7. Other Types

- 5.2. Market Analysis, Insights and Forecast - by Application

- 5.2.1. Bakery

- 5.2.2. Confectionery

- 5.2.3. Breakfast Cereals

- 5.2.4. Snacks

- 5.2.5. Dairy

- 5.2.6. Meat

- 5.2.7. Other Applications

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. United Kingdom

- 5.3.2. Germany

- 5.3.3. France

- 5.3.4. Spain

- 5.3.5. Italy

- 5.3.6. Russia

- 5.3.7. Rest of Europe

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. United Kingdom Europe Food Coating Ingredients Industry Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Type

- 6.1.1. Sugars and Syrups

- 6.1.2. Cocoa and Chocolates

- 6.1.3. Fats and Oils

- 6.1.4. Spices and Seasonings

- 6.1.5. Flours

- 6.1.6. Batter and Crumbs

- 6.1.7. Other Types

- 6.2. Market Analysis, Insights and Forecast - by Application

- 6.2.1. Bakery

- 6.2.2. Confectionery

- 6.2.3. Breakfast Cereals

- 6.2.4. Snacks

- 6.2.5. Dairy

- 6.2.6. Meat

- 6.2.7. Other Applications

- 6.1. Market Analysis, Insights and Forecast - by Type

- 7. Germany Europe Food Coating Ingredients Industry Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Type

- 7.1.1. Sugars and Syrups

- 7.1.2. Cocoa and Chocolates

- 7.1.3. Fats and Oils

- 7.1.4. Spices and Seasonings

- 7.1.5. Flours

- 7.1.6. Batter and Crumbs

- 7.1.7. Other Types

- 7.2. Market Analysis, Insights and Forecast - by Application

- 7.2.1. Bakery

- 7.2.2. Confectionery

- 7.2.3. Breakfast Cereals

- 7.2.4. Snacks

- 7.2.5. Dairy

- 7.2.6. Meat

- 7.2.7. Other Applications

- 7.1. Market Analysis, Insights and Forecast - by Type

- 8. France Europe Food Coating Ingredients Industry Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Type

- 8.1.1. Sugars and Syrups

- 8.1.2. Cocoa and Chocolates

- 8.1.3. Fats and Oils

- 8.1.4. Spices and Seasonings

- 8.1.5. Flours

- 8.1.6. Batter and Crumbs

- 8.1.7. Other Types

- 8.2. Market Analysis, Insights and Forecast - by Application

- 8.2.1. Bakery

- 8.2.2. Confectionery

- 8.2.3. Breakfast Cereals

- 8.2.4. Snacks

- 8.2.5. Dairy

- 8.2.6. Meat

- 8.2.7. Other Applications

- 8.1. Market Analysis, Insights and Forecast - by Type

- 9. Spain Europe Food Coating Ingredients Industry Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Type

- 9.1.1. Sugars and Syrups

- 9.1.2. Cocoa and Chocolates

- 9.1.3. Fats and Oils

- 9.1.4. Spices and Seasonings

- 9.1.5. Flours

- 9.1.6. Batter and Crumbs

- 9.1.7. Other Types

- 9.2. Market Analysis, Insights and Forecast - by Application

- 9.2.1. Bakery

- 9.2.2. Confectionery

- 9.2.3. Breakfast Cereals

- 9.2.4. Snacks

- 9.2.5. Dairy

- 9.2.6. Meat

- 9.2.7. Other Applications

- 9.1. Market Analysis, Insights and Forecast - by Type

- 10. Italy Europe Food Coating Ingredients Industry Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Type

- 10.1.1. Sugars and Syrups

- 10.1.2. Cocoa and Chocolates

- 10.1.3. Fats and Oils

- 10.1.4. Spices and Seasonings

- 10.1.5. Flours

- 10.1.6. Batter and Crumbs

- 10.1.7. Other Types

- 10.2. Market Analysis, Insights and Forecast - by Application

- 10.2.1. Bakery

- 10.2.2. Confectionery

- 10.2.3. Breakfast Cereals

- 10.2.4. Snacks

- 10.2.5. Dairy

- 10.2.6. Meat

- 10.2.7. Other Applications

- 10.1. Market Analysis, Insights and Forecast - by Type

- 11. Russia Europe Food Coating Ingredients Industry Analysis, Insights and Forecast, 2019-2031

- 11.1. Market Analysis, Insights and Forecast - by Type

- 11.1.1. Sugars and Syrups

- 11.1.2. Cocoa and Chocolates

- 11.1.3. Fats and Oils

- 11.1.4. Spices and Seasonings

- 11.1.5. Flours

- 11.1.6. Batter and Crumbs

- 11.1.7. Other Types

- 11.2. Market Analysis, Insights and Forecast - by Application

- 11.2.1. Bakery

- 11.2.2. Confectionery

- 11.2.3. Breakfast Cereals

- 11.2.4. Snacks

- 11.2.5. Dairy

- 11.2.6. Meat

- 11.2.7. Other Applications

- 11.1. Market Analysis, Insights and Forecast - by Type

- 12. Rest of Europe Europe Food Coating Ingredients Industry Analysis, Insights and Forecast, 2019-2031

- 12.1. Market Analysis, Insights and Forecast - by Type

- 12.1.1. Sugars and Syrups

- 12.1.2. Cocoa and Chocolates

- 12.1.3. Fats and Oils

- 12.1.4. Spices and Seasonings

- 12.1.5. Flours

- 12.1.6. Batter and Crumbs

- 12.1.7. Other Types

- 12.2. Market Analysis, Insights and Forecast - by Application

- 12.2.1. Bakery

- 12.2.2. Confectionery

- 12.2.3. Breakfast Cereals

- 12.2.4. Snacks

- 12.2.5. Dairy

- 12.2.6. Meat

- 12.2.7. Other Applications

- 12.1. Market Analysis, Insights and Forecast - by Type

- 13. Germany Europe Food Coating Ingredients Industry Analysis, Insights and Forecast, 2019-2031

- 14. France Europe Food Coating Ingredients Industry Analysis, Insights and Forecast, 2019-2031

- 15. Italy Europe Food Coating Ingredients Industry Analysis, Insights and Forecast, 2019-2031

- 16. United Kingdom Europe Food Coating Ingredients Industry Analysis, Insights and Forecast, 2019-2031

- 17. Netherlands Europe Food Coating Ingredients Industry Analysis, Insights and Forecast, 2019-2031

- 18. Sweden Europe Food Coating Ingredients Industry Analysis, Insights and Forecast, 2019-2031

- 19. Rest of Europe Europe Food Coating Ingredients Industry Analysis, Insights and Forecast, 2019-2031

- 20. Competitive Analysis

- 20.1. Market Share Analysis 2024

- 20.2. Company Profiles

- 20.2.1 Newly Weds Foods

- 20.2.1.1. Overview

- 20.2.1.2. Products

- 20.2.1.3. SWOT Analysis

- 20.2.1.4. Recent Developments

- 20.2.1.5. Financials (Based on Availability)

- 20.2.2 Akron Technology

- 20.2.2.1. Overview

- 20.2.2.2. Products

- 20.2.2.3. SWOT Analysis

- 20.2.2.4. Recent Developments

- 20.2.2.5. Financials (Based on Availability)

- 20.2.3 Apeel Sciences*List Not Exhaustive

- 20.2.3.1. Overview

- 20.2.3.2. Products

- 20.2.3.3. SWOT Analysis

- 20.2.3.4. Recent Developments

- 20.2.3.5. Financials (Based on Availability)

- 20.2.4 Royal Avebe U A

- 20.2.4.1. Overview

- 20.2.4.2. Products

- 20.2.4.3. SWOT Analysis

- 20.2.4.4. Recent Developments

- 20.2.4.5. Financials (Based on Availability)

- 20.2.5 Kerry Group PLC

- 20.2.5.1. Overview

- 20.2.5.2. Products

- 20.2.5.3. SWOT Analysis

- 20.2.5.4. Recent Developments

- 20.2.5.5. Financials (Based on Availability)

- 20.2.6 Cargill Inc

- 20.2.6.1. Overview

- 20.2.6.2. Products

- 20.2.6.3. SWOT Analysis

- 20.2.6.4. Recent Developments

- 20.2.6.5. Financials (Based on Availability)

- 20.2.7 Archer-Daniels-Midland Company

- 20.2.7.1. Overview

- 20.2.7.2. Products

- 20.2.7.3. SWOT Analysis

- 20.2.7.4. Recent Developments

- 20.2.7.5. Financials (Based on Availability)

- 20.2.8 Ingredion Incorporated

- 20.2.8.1. Overview

- 20.2.8.2. Products

- 20.2.8.3. SWOT Analysis

- 20.2.8.4. Recent Developments

- 20.2.8.5. Financials (Based on Availability)

- 20.2.9 Tate & Lyle

- 20.2.9.1. Overview

- 20.2.9.2. Products

- 20.2.9.3. SWOT Analysis

- 20.2.9.4. Recent Developments

- 20.2.9.5. Financials (Based on Availability)

- 20.2.10 Bowman Ingredients

- 20.2.10.1. Overview

- 20.2.10.2. Products

- 20.2.10.3. SWOT Analysis

- 20.2.10.4. Recent Developments

- 20.2.10.5. Financials (Based on Availability)

- 20.2.1 Newly Weds Foods

List of Figures

- Figure 1: Europe Food Coating Ingredients Industry Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Europe Food Coating Ingredients Industry Share (%) by Company 2024

List of Tables

- Table 1: Europe Food Coating Ingredients Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Europe Food Coating Ingredients Industry Revenue Million Forecast, by Type 2019 & 2032

- Table 3: Europe Food Coating Ingredients Industry Revenue Million Forecast, by Application 2019 & 2032

- Table 4: Europe Food Coating Ingredients Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 5: Europe Food Coating Ingredients Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 6: Germany Europe Food Coating Ingredients Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 7: France Europe Food Coating Ingredients Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 8: Italy Europe Food Coating Ingredients Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: United Kingdom Europe Food Coating Ingredients Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: Netherlands Europe Food Coating Ingredients Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 11: Sweden Europe Food Coating Ingredients Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 12: Rest of Europe Europe Food Coating Ingredients Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 13: Europe Food Coating Ingredients Industry Revenue Million Forecast, by Type 2019 & 2032

- Table 14: Europe Food Coating Ingredients Industry Revenue Million Forecast, by Application 2019 & 2032

- Table 15: Europe Food Coating Ingredients Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 16: Europe Food Coating Ingredients Industry Revenue Million Forecast, by Type 2019 & 2032

- Table 17: Europe Food Coating Ingredients Industry Revenue Million Forecast, by Application 2019 & 2032

- Table 18: Europe Food Coating Ingredients Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 19: Europe Food Coating Ingredients Industry Revenue Million Forecast, by Type 2019 & 2032

- Table 20: Europe Food Coating Ingredients Industry Revenue Million Forecast, by Application 2019 & 2032

- Table 21: Europe Food Coating Ingredients Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 22: Europe Food Coating Ingredients Industry Revenue Million Forecast, by Type 2019 & 2032

- Table 23: Europe Food Coating Ingredients Industry Revenue Million Forecast, by Application 2019 & 2032

- Table 24: Europe Food Coating Ingredients Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 25: Europe Food Coating Ingredients Industry Revenue Million Forecast, by Type 2019 & 2032

- Table 26: Europe Food Coating Ingredients Industry Revenue Million Forecast, by Application 2019 & 2032

- Table 27: Europe Food Coating Ingredients Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 28: Europe Food Coating Ingredients Industry Revenue Million Forecast, by Type 2019 & 2032

- Table 29: Europe Food Coating Ingredients Industry Revenue Million Forecast, by Application 2019 & 2032

- Table 30: Europe Food Coating Ingredients Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 31: Europe Food Coating Ingredients Industry Revenue Million Forecast, by Type 2019 & 2032

- Table 32: Europe Food Coating Ingredients Industry Revenue Million Forecast, by Application 2019 & 2032

- Table 33: Europe Food Coating Ingredients Industry Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Europe Food Coating Ingredients Industry?

The projected CAGR is approximately 5.45%.

2. Which companies are prominent players in the Europe Food Coating Ingredients Industry?

Key companies in the market include Newly Weds Foods, Akron Technology, Apeel Sciences*List Not Exhaustive, Royal Avebe U A, Kerry Group PLC, Cargill Inc, Archer-Daniels-Midland Company, Ingredion Incorporated, Tate & Lyle, Bowman Ingredients.

3. What are the main segments of the Europe Food Coating Ingredients Industry?

The market segments include Type, Application.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Increasing Demand for Low-Fat and Low-Calorie Food; Increasing Product Innovation.

6. What are the notable trends driving market growth?

Rising Utilization of Flours in Daily Routines.

7. Are there any restraints impacting market growth?

; Threat of New Entrants; Bargaining Power of Buyers/Consumers; Bargaining Power of Suppliers; Threat of Substitute Products; Degree Of Competition.

8. Can you provide examples of recent developments in the market?

In 2022, Akorn Technology featured edible coatings for fresh produce that recently got approval from the European Union (EU). This innovation can be used on the whole and cut fresh fruits with skins that are either edible or inedible peels. The strategy behind this new launch was to expand the company's product portfolio.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Europe Food Coating Ingredients Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Europe Food Coating Ingredients Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Europe Food Coating Ingredients Industry?

To stay informed about further developments, trends, and reports in the Europe Food Coating Ingredients Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence