Key Insights

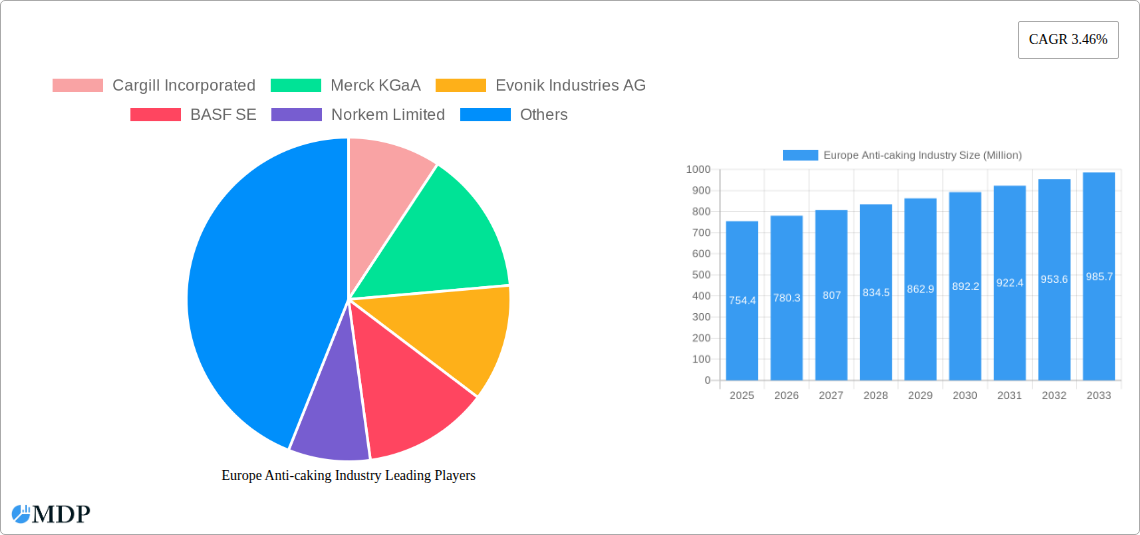

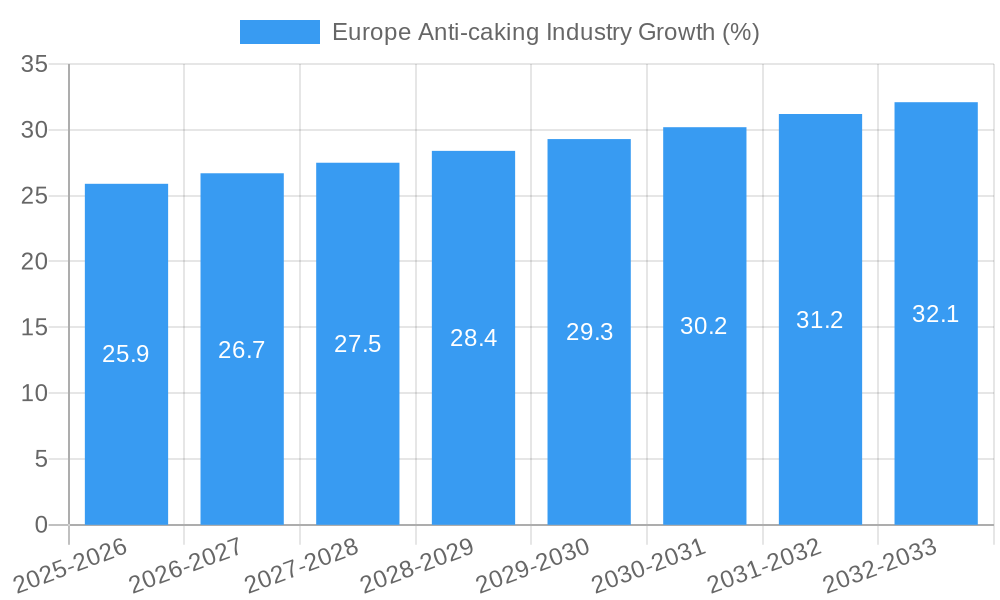

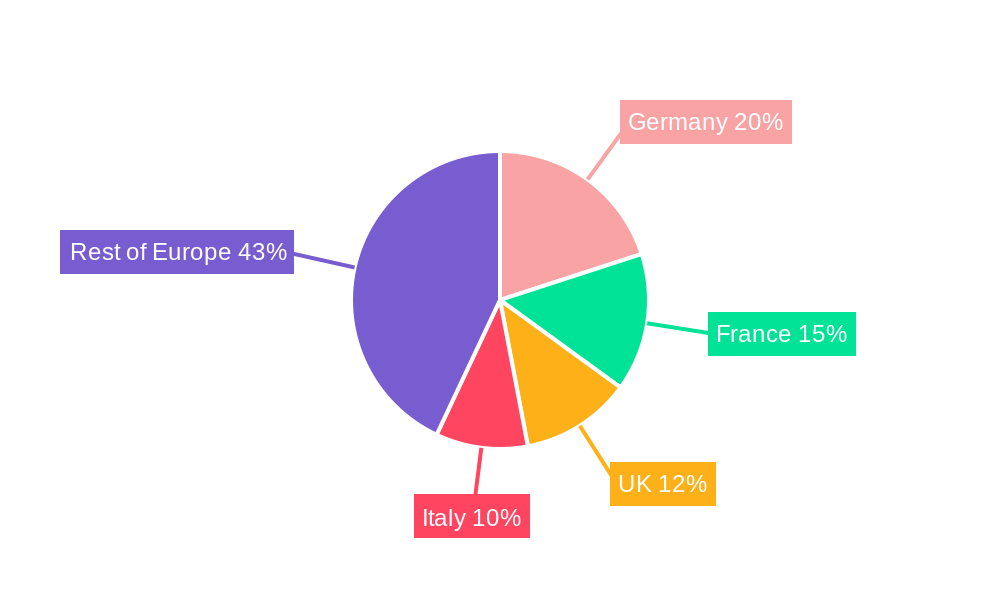

The European anti-caking agents market, valued at €754.4 million in 2025, is projected to experience steady growth, driven by increasing demand across diverse sectors. The food and beverage industry remains a significant driver, with anti-caking agents crucial for maintaining product flowability and preventing clumping in powders and granules. The cosmetics and personal care sector also contributes substantially, utilizing these agents to improve the texture and handling of various products. Growth is further fueled by the expanding feed industry, where anti-caking agents enhance the efficiency of animal feed distribution. While the market exhibits a Compound Annual Growth Rate (CAGR) of 3.46%, factors such as stringent regulatory compliance regarding food additives and the rising cost of raw materials could pose moderate restraints on growth. The market segmentation reveals calcium, sodium, and magnesium compounds as dominant types, with calcium compounds likely holding the largest market share due to their widespread use and cost-effectiveness. Key players such as Cargill, Merck KGaA, and BASF SE are strategically positioning themselves to capitalize on market growth through product innovation and expansion into new applications. The projected growth indicates a promising future for the European anti-caking agents market, particularly within specific segments such as food and beverage, where increasing consumer demand for convenient and easy-to-use products will drive market expansion. The regional analysis, focusing on major European markets like Germany, France, and the UK, highlights the robust demand for these essential additives within the established food production and processing landscape.

The forecast period of 2025-2033 anticipates continued growth, with a likely acceleration in specific segments driven by evolving consumer preferences and technological advancements. For instance, innovations in food processing technologies and the development of novel anti-caking agents with enhanced performance characteristics could positively impact market growth. However, potential challenges such as fluctuating raw material prices and the evolving regulatory landscape need to be considered when forecasting long-term market trends. The competitive landscape will likely see increased mergers and acquisitions, as larger players seek to consolidate their market position and expand their product portfolios. Focus on sustainable and environmentally friendly anti-caking agents is also anticipated to gain traction, aligning with the growing consumer demand for more sustainable products.

Europe Anti-caking Industry Market Report: 2019-2033

Unlock the potential of the €XX Billion European anti-caking industry with this comprehensive market analysis. This in-depth report provides a detailed overview of market dynamics, trends, leading players, and future growth opportunities across various segments. From 2019 to 2033, we analyze the historical, current, and projected future of this vital sector. Our research covers crucial aspects, empowering stakeholders to make informed decisions and capitalize on emerging trends.

Europe Anti-caking Industry Market Dynamics & Concentration

The European anti-caking industry, valued at €XX Billion in 2025, displays a moderately concentrated market structure. Key players like Cargill Incorporated, Merck KGaA, Evonik Industries AG, BASF SE, Norkem Limited, Kao Corporation, Roquette Freres, and J M Huber Corporation (CP Kelco) hold significant market share, though the exact figures remain proprietary to this report. However, we observe that these companies collectively account for approximately 60% of the total market in 2025.

Innovation is a crucial driver, with companies focusing on developing sustainable and high-performance anti-caking agents. Stringent regulatory frameworks, particularly concerning food safety and environmental impact, shape product development and market access. Furthermore, the increasing availability of product substitutes exerts competitive pressure, while evolving end-user preferences—especially towards natural and organic options—influence demand. The past five years have witnessed a modest number of M&A activities (approximately xx deals), primarily focused on consolidating market share and expanding product portfolios. Further analysis of these transactions highlights a strong preference towards inorganic growth strategies within this sector.

Europe Anti-caking Industry Industry Trends & Analysis

The European anti-caking industry exhibits a CAGR of xx% during the forecast period (2025-2033). This growth is propelled by several factors. The increasing demand for processed foods and beverages, coupled with the rising consumer preference for convenient and shelf-stable products, significantly boosts the demand for anti-caking agents. Technological advancements, specifically in formulation and application techniques, are continuously improving the efficiency and effectiveness of these agents. Consumer preferences are also shifting towards natural and clean-label ingredients, prompting manufacturers to develop anti-caking agents that meet these evolving demands, leading to a market penetration rate of xx% for these eco-conscious solutions in 2025. However, fluctuating raw material prices and intense competition among established and emerging players present notable challenges.

Leading Markets & Segments in Europe Anti-caking Industry

The Food & Beverage segment dominates the European anti-caking industry in 2025, accounting for approximately 65% of the market. This is driven by the high consumption of processed foods and beverages in Western European countries. The Calcium Compounds segment leads by type, followed by Sodium Compounds, reflecting their wide applicability and cost-effectiveness.

- Key Drivers for Food & Beverage Dominance:

- High demand for processed foods and convenience products.

- Stringent food safety regulations driving the adoption of high-quality anti-caking agents.

- Rising disposable incomes in several European regions.

- Key Drivers for Calcium Compound Dominance:

- Cost-effectiveness compared to other types of anti-caking agents.

- High efficacy in preventing caking and clumping.

- Wide applicability across various food and beverage applications.

Germany, France, and the UK represent the leading national markets, benefiting from strong food processing industries and substantial consumer spending.

Europe Anti-caking Industry Product Developments

Recent product innovations focus on developing eco-friendly, bio-based anti-caking agents to cater to the growing demand for natural and sustainable products. Nanotechnology-enabled solutions offer enhanced functionality and improved performance. The market is also witnessing the introduction of specialized anti-caking agents tailored for specific applications, such as those designed to enhance the flowability of powdered ingredients in the food industry or the stability of formulations in cosmetics. These developments contribute to improved product quality, extended shelf life, and enhanced consumer satisfaction.

Key Drivers of Europe Anti-caking Industry Growth

The growth of the European anti-caking industry is fueled by several factors: the expanding processed food and beverage sector, increasing demand for convenient and shelf-stable products, advancements in anti-caking agent technology, and the rising focus on food safety and quality. Government regulations promoting food safety and encouraging the use of effective anti-caking agents are also key contributors. Finally, the shift towards natural and sustainable ingredients creates new opportunities for manufacturers to develop and market innovative products.

Challenges in the Europe Anti-caking Industry Market

Fluctuating raw material prices, particularly for minerals used in anti-caking agent production, represent a significant challenge. Intense competition among established and emerging players puts pressure on profit margins. Strict regulatory compliance costs can also hinder the profitability of smaller players. Lastly, supply chain disruptions caused by geopolitical instability or unforeseen events can significantly impact production and distribution networks, potentially leading to a xx% reduction in supply in extreme cases.

Emerging Opportunities in Europe Anti-caking Industry

Growing consumer demand for natural and sustainable ingredients presents a significant opportunity. This drives innovation in bio-based anti-caking agents. Strategic partnerships and collaborations between manufacturers and ingredient suppliers are fostering the development of next-generation products. Expansion into new markets and applications, such as pharmaceuticals and construction materials, offers further growth potential. The exploration of new technologies and formulation approaches continues to unlock new opportunities for industry advancement.

Leading Players in the Europe Anti-caking Industry Sector

- Cargill Incorporated

- Merck KGaA

- Evonik Industries AG

- BASF SE

- Norkem Limited

- Kao Corporation

- Roquette Freres

- J M Huber Corporation (CP Kelco)

- List Not Exhaustive

Key Milestones in Europe Anti-caking Industry Industry

- 2020: Introduction of a new bio-based anti-caking agent by a major player.

- 2022: Implementation of stricter EU regulations on food additives.

- 2023: Successful launch of a novel anti-caking agent utilizing nanotechnology.

- 2024: Merger between two mid-sized anti-caking agent manufacturers.

- Further milestones detailed within the full report.

Strategic Outlook for Europe Anti-caking Industry Market

The European anti-caking industry is poised for continued growth, driven by the factors mentioned earlier. Strategic investments in research and development, focusing on sustainable and innovative products, will be crucial for maintaining a competitive edge. Companies that successfully adapt to evolving consumer preferences and proactively address regulatory changes will be best positioned to capture significant market share and achieve long-term success. The market presents substantial potential for expansion into niche applications and emerging regions, paving the way for innovative business models and market leadership.

Europe Anti-caking Industry Segmentation

-

1. Type

- 1.1. Calcium Compounds

- 1.2. Sodium Compounds

- 1.3. Magnesium Compounds

- 1.4. Other Types

Europe Anti-caking Industry Segmentation By Geography

- 1. Germany

- 2. United Kingdom

- 3. Italy

- 4. France

- 5. Russia

- 6. Spain

- 7. Rest of Europe

Europe Anti-caking Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 3.46% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Demand for Functional and Fortified Food; Multi-functionality and Wide Application of Riboflavin

- 3.3. Market Restrains

- 3.3.1. Low Stability of Riboflavin on Exposure to Light and Heat

- 3.4. Market Trends

- 3.4.1. Approval of Application of Silicon Dioxide as an Anti-Caking Agent

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Europe Anti-caking Industry Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Calcium Compounds

- 5.1.2. Sodium Compounds

- 5.1.3. Magnesium Compounds

- 5.1.4. Other Types

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. Germany

- 5.2.2. United Kingdom

- 5.2.3. Italy

- 5.2.4. France

- 5.2.5. Russia

- 5.2.6. Spain

- 5.2.7. Rest of Europe

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. Germany Europe Anti-caking Industry Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Type

- 6.1.1. Calcium Compounds

- 6.1.2. Sodium Compounds

- 6.1.3. Magnesium Compounds

- 6.1.4. Other Types

- 6.1. Market Analysis, Insights and Forecast - by Type

- 7. United Kingdom Europe Anti-caking Industry Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Type

- 7.1.1. Calcium Compounds

- 7.1.2. Sodium Compounds

- 7.1.3. Magnesium Compounds

- 7.1.4. Other Types

- 7.1. Market Analysis, Insights and Forecast - by Type

- 8. Italy Europe Anti-caking Industry Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Type

- 8.1.1. Calcium Compounds

- 8.1.2. Sodium Compounds

- 8.1.3. Magnesium Compounds

- 8.1.4. Other Types

- 8.1. Market Analysis, Insights and Forecast - by Type

- 9. France Europe Anti-caking Industry Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Type

- 9.1.1. Calcium Compounds

- 9.1.2. Sodium Compounds

- 9.1.3. Magnesium Compounds

- 9.1.4. Other Types

- 9.1. Market Analysis, Insights and Forecast - by Type

- 10. Russia Europe Anti-caking Industry Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Type

- 10.1.1. Calcium Compounds

- 10.1.2. Sodium Compounds

- 10.1.3. Magnesium Compounds

- 10.1.4. Other Types

- 10.1. Market Analysis, Insights and Forecast - by Type

- 11. Spain Europe Anti-caking Industry Analysis, Insights and Forecast, 2019-2031

- 11.1. Market Analysis, Insights and Forecast - by Type

- 11.1.1. Calcium Compounds

- 11.1.2. Sodium Compounds

- 11.1.3. Magnesium Compounds

- 11.1.4. Other Types

- 11.1. Market Analysis, Insights and Forecast - by Type

- 12. Rest of Europe Europe Anti-caking Industry Analysis, Insights and Forecast, 2019-2031

- 12.1. Market Analysis, Insights and Forecast - by Type

- 12.1.1. Calcium Compounds

- 12.1.2. Sodium Compounds

- 12.1.3. Magnesium Compounds

- 12.1.4. Other Types

- 12.1. Market Analysis, Insights and Forecast - by Type

- 13. Germany Europe Anti-caking Industry Analysis, Insights and Forecast, 2019-2031

- 14. France Europe Anti-caking Industry Analysis, Insights and Forecast, 2019-2031

- 15. Italy Europe Anti-caking Industry Analysis, Insights and Forecast, 2019-2031

- 16. United Kingdom Europe Anti-caking Industry Analysis, Insights and Forecast, 2019-2031

- 17. Netherlands Europe Anti-caking Industry Analysis, Insights and Forecast, 2019-2031

- 18. Sweden Europe Anti-caking Industry Analysis, Insights and Forecast, 2019-2031

- 19. Rest of Europe Europe Anti-caking Industry Analysis, Insights and Forecast, 2019-2031

- 20. Competitive Analysis

- 20.1. Market Share Analysis 2024

- 20.2. Company Profiles

- 20.2.1 Cargill Incorporated

- 20.2.1.1. Overview

- 20.2.1.2. Products

- 20.2.1.3. SWOT Analysis

- 20.2.1.4. Recent Developments

- 20.2.1.5. Financials (Based on Availability)

- 20.2.2 Merck KGaA

- 20.2.2.1. Overview

- 20.2.2.2. Products

- 20.2.2.3. SWOT Analysis

- 20.2.2.4. Recent Developments

- 20.2.2.5. Financials (Based on Availability)

- 20.2.3 Evonik Industries AG

- 20.2.3.1. Overview

- 20.2.3.2. Products

- 20.2.3.3. SWOT Analysis

- 20.2.3.4. Recent Developments

- 20.2.3.5. Financials (Based on Availability)

- 20.2.4 BASF SE

- 20.2.4.1. Overview

- 20.2.4.2. Products

- 20.2.4.3. SWOT Analysis

- 20.2.4.4. Recent Developments

- 20.2.4.5. Financials (Based on Availability)

- 20.2.5 Norkem Limited

- 20.2.5.1. Overview

- 20.2.5.2. Products

- 20.2.5.3. SWOT Analysis

- 20.2.5.4. Recent Developments

- 20.2.5.5. Financials (Based on Availability)

- 20.2.6 Kao Corporation

- 20.2.6.1. Overview

- 20.2.6.2. Products

- 20.2.6.3. SWOT Analysis

- 20.2.6.4. Recent Developments

- 20.2.6.5. Financials (Based on Availability)

- 20.2.7 Roquette Freres

- 20.2.7.1. Overview

- 20.2.7.2. Products

- 20.2.7.3. SWOT Analysis

- 20.2.7.4. Recent Developments

- 20.2.7.5. Financials (Based on Availability)

- 20.2.8 J M Huber Corporation (CP Kelco)*List Not Exhaustive

- 20.2.8.1. Overview

- 20.2.8.2. Products

- 20.2.8.3. SWOT Analysis

- 20.2.8.4. Recent Developments

- 20.2.8.5. Financials (Based on Availability)

- 20.2.1 Cargill Incorporated

List of Figures

- Figure 1: Europe Anti-caking Industry Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Europe Anti-caking Industry Share (%) by Company 2024

List of Tables

- Table 1: Europe Anti-caking Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Europe Anti-caking Industry Revenue Million Forecast, by Type 2019 & 2032

- Table 3: Europe Anti-caking Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 4: Europe Anti-caking Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 5: Germany Europe Anti-caking Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 6: France Europe Anti-caking Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 7: Italy Europe Anti-caking Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 8: United Kingdom Europe Anti-caking Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: Netherlands Europe Anti-caking Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: Sweden Europe Anti-caking Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 11: Rest of Europe Europe Anti-caking Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 12: Europe Anti-caking Industry Revenue Million Forecast, by Type 2019 & 2032

- Table 13: Europe Anti-caking Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 14: Europe Anti-caking Industry Revenue Million Forecast, by Type 2019 & 2032

- Table 15: Europe Anti-caking Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 16: Europe Anti-caking Industry Revenue Million Forecast, by Type 2019 & 2032

- Table 17: Europe Anti-caking Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 18: Europe Anti-caking Industry Revenue Million Forecast, by Type 2019 & 2032

- Table 19: Europe Anti-caking Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 20: Europe Anti-caking Industry Revenue Million Forecast, by Type 2019 & 2032

- Table 21: Europe Anti-caking Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 22: Europe Anti-caking Industry Revenue Million Forecast, by Type 2019 & 2032

- Table 23: Europe Anti-caking Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 24: Europe Anti-caking Industry Revenue Million Forecast, by Type 2019 & 2032

- Table 25: Europe Anti-caking Industry Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Europe Anti-caking Industry?

The projected CAGR is approximately 3.46%.

2. Which companies are prominent players in the Europe Anti-caking Industry?

Key companies in the market include Cargill Incorporated, Merck KGaA, Evonik Industries AG, BASF SE, Norkem Limited, Kao Corporation, Roquette Freres, J M Huber Corporation (CP Kelco)*List Not Exhaustive.

3. What are the main segments of the Europe Anti-caking Industry?

The market segments include Type.

4. Can you provide details about the market size?

The market size is estimated to be USD 754.4 Million as of 2022.

5. What are some drivers contributing to market growth?

Increasing Demand for Functional and Fortified Food; Multi-functionality and Wide Application of Riboflavin.

6. What are the notable trends driving market growth?

Approval of Application of Silicon Dioxide as an Anti-Caking Agent.

7. Are there any restraints impacting market growth?

Low Stability of Riboflavin on Exposure to Light and Heat.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Europe Anti-caking Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Europe Anti-caking Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Europe Anti-caking Industry?

To stay informed about further developments, trends, and reports in the Europe Anti-caking Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence