Key Insights

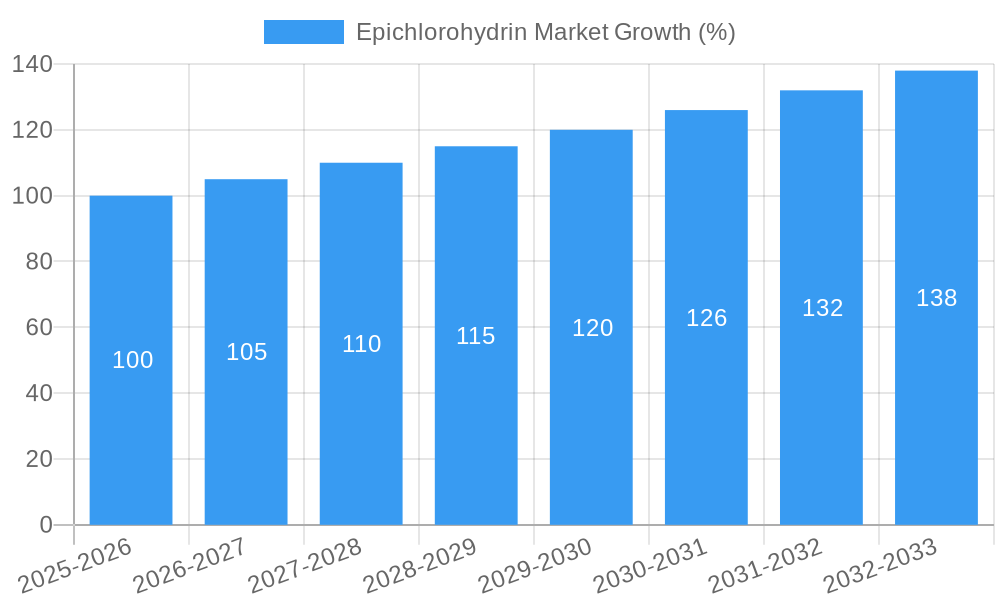

The Epichlorohydrin market, currently valued at approximately $2 billion in 2025 (estimated based on the provided CAGR of >5% and a stated value unit of millions), is poised for robust growth throughout the forecast period (2025-2033). This expansion is driven primarily by the increasing demand from key downstream applications, notably epoxy resins. The epoxy resin market benefits from its use in various sectors such as construction (adhesives, coatings), automotive (lightweight components), wind energy (blades), and electronics (circuit boards). Furthermore, advancements in manufacturing technologies leading to enhanced efficiency and reduced production costs contribute to market growth. However, stringent environmental regulations surrounding the production and handling of epichlorohydrin, along with fluctuations in raw material prices (e.g., propylene), pose potential restraints. The market's segmentation reflects this diversity, with significant contributions from various geographic regions and applications, leading to strategic opportunities for major players such as Grasim Industries, Aditya Birla Chemicals, Hexion, and others listed. Competition is intense, driven by ongoing innovation in production processes and the development of more sustainable alternatives to meet evolving market demands.

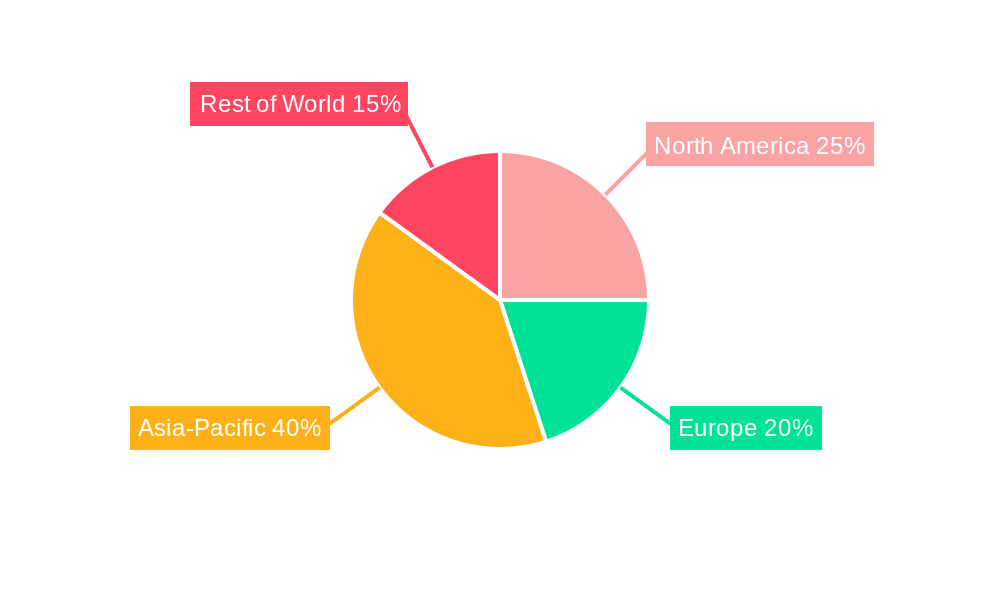

The market's projected CAGR of over 5% indicates a significant expansion over the forecast period. This growth is anticipated to be fueled by the expanding global infrastructure development, particularly in emerging economies. The increasing adoption of sustainable practices across various industries, while presenting regulatory challenges, also opens avenues for the development of eco-friendly epichlorohydrin production methods. This further drives competition and innovation within the market. The regional breakdown likely shows strong contributions from regions with substantial industrial activity, particularly in Asia-Pacific given the presence of major players like Grasim Industries and Aditya Birla Chemicals. A thorough understanding of these market dynamics – drivers, restraints, and regional variations – is crucial for stakeholders to capitalize on emerging opportunities. Further research into specific segment performance and technological advancements will provide a more refined market outlook.

Epichlorohydrin Market: A Comprehensive Market Report (2019-2033)

This comprehensive report provides an in-depth analysis of the Epichlorohydrin (ECH) market, offering crucial insights for stakeholders seeking to navigate this dynamic sector. With a study period spanning 2019-2033, a base year of 2025, and a forecast period from 2025-2033, this report delivers actionable intelligence based on historical data (2019-2024) and projected market trends. The report features key players such as Grasim Industries Limited (India), Aditya Birla Chemicals (Thailand) Pvt Ltd, Hexion, and more, offering a detailed competitive landscape analysis. Discover the key drivers, challenges, and opportunities shaping the future of the ECH market, empowering your strategic decision-making.

Epichlorohydrin Market Market Dynamics & Concentration

This section analyzes the competitive landscape of the Epichlorohydrin market, exploring factors that influence market concentration, innovation, and growth. The report delves into regulatory frameworks, the presence of product substitutes, evolving end-user trends, and the impact of mergers and acquisitions (M&A) activities. The market concentration is currently assessed as moderately consolidated, with the top five players holding an estimated xx% market share in 2025.

- Market Concentration: The report details the market share held by key players like Grasim Industries Limited and Aditya Birla Chemicals, providing a thorough understanding of the competitive intensity.

- Innovation Drivers: Analysis of R&D investments, technological advancements, and the development of bio-based ECH production methods are included.

- Regulatory Frameworks: The report explores the influence of environmental regulations and safety standards on market dynamics.

- Product Substitutes: The presence and potential impact of alternative materials are evaluated.

- End-User Trends: Analysis of shifting demand patterns across key applications, such as epoxy resins, glycerol, and others, is provided.

- M&A Activities: The report quantifies M&A activity within the ECH market, providing details on deal counts and their impact on market consolidation. For example, the partnership between OCIM Sdn. Bhd. and KUMHO P&B CHEMICALS., INC. significantly increases production capacity.

Epichlorohydrin Market Industry Trends & Analysis

This section provides a comprehensive analysis of the Epichlorohydrin market's trajectory, examining key growth drivers, technological advancements, consumer preferences, and the competitive dynamics shaping its evolution. The report projects a Compound Annual Growth Rate (CAGR) of xx% during the forecast period (2025-2033), driven by increasing demand from the epoxy resin sector and expanding applications in other industries. Market penetration is analyzed across various segments and geographies. The report details the impact of factors such as rising global demand for epoxy resins, the increasing adoption of bio-based raw materials, and technological advancements influencing production efficiency and product quality.

Leading Markets & Segments in Epichlorohydrin Market

This section identifies the leading regions, countries, and segments within the Epichlorohydrin market. Detailed analysis illuminates the dominance of specific regions, focusing on factors contributing to their leadership position.

- Key Drivers (Examples):

- Favorable economic policies supporting industrial growth.

- Robust infrastructure facilitating efficient production and distribution.

- High concentration of key players and downstream industries.

- Government initiatives promoting sustainable manufacturing practices.

Epichlorohydrin Market Product Developments

This section summarizes recent product innovations, applications, and their competitive advantages within the Epichlorohydrin market. The focus is on technological advancements and their market relevance, including the shift toward bio-based ECH and the development of higher-performance epoxy resins.

Key Drivers of Epichlorohydrin Market Growth

Several factors contribute to the growth of the Epichlorohydrin market. These include the increasing demand for epoxy resins in various industries (construction, automotive, wind energy), the development of more sustainable production methods using bio-based raw materials, and government support for renewable materials. Technological advancements in production processes also contribute to cost efficiency and enhanced product quality.

Challenges in the Epichlorohydrin Market Market

The Epichlorohydrin market faces challenges including stringent environmental regulations, volatile raw material prices, and intense competition among existing players. Supply chain disruptions and the need for continuous innovation to maintain a competitive edge also pose significant challenges. These challenges may impact production costs and profitability.

Emerging Opportunities in Epichlorohydrin Market

The Epichlorohydrin market presents significant long-term growth opportunities. The increasing focus on sustainable manufacturing, the exploration of new applications for ECH-derived products, and strategic partnerships to expand market reach are key factors driving growth. Technological advancements continue to unlock further efficiencies and new possibilities.

Leading Players in the Epichlorohydrin Market Sector

- Grasim Industries Limited (India)

- Aditya Birla Chemicals (Thailand) Pvt Ltd

- Hexion

- Kashima Chemical Co LTD

- KUMHO P&B CHEMICALS INC

- LOTTE FINE CHEMICAL

- Momentive

- NAMA Chemicals

- Parchem fine & specialty chemicals

- Shandong Haili Chemical Industry Co Ltd

- Sumitomo Chemical Co Ltd

- Solvay

- SPOLCHEMIE

- *List Not Exhaustive

Key Milestones in Epichlorohydrin Market Industry

- August 2022: OCIM Sdn. Bhd. and KUMHO P&B CHEMICALS., INC. partnered to establish a 100 KTPA epichlorohydrin production facility in Malaysia, focusing on bio-based raw materials for epoxy resin production.

- March 2022: Grasim Industries Limited (India) and Aditya Birla Chemicals (Thailand) Pvt. Ltd announced plans to increase their epichlorohydrin production capacity in Q1 2025.

Strategic Outlook for Epichlorohydrin Market Market

The Epichlorohydrin market exhibits strong potential for future growth, fueled by technological advancements, strategic partnerships, and the expanding applications of ECH-derived products. Companies that invest in sustainable production methods, R&D, and strategic collaborations are poised to capture significant market share in the coming years. The market is expected to witness continued consolidation and innovation, leading to increased efficiency and a wider range of high-performance products.

Epichlorohydrin Market Segmentation

-

1. Product

- 1.1. Epichlorohydrin

-

2. Type

- 2.1. Oil-based Epichlorohydrin

- 2.2. Bio-based Epichlorohydrin

-

3. Application

- 3.1. Epoxy Resins

- 3.2. Synthetic Glycerin

- 3.3. Epichlorohydrin Elastomers

- 3.4. Specialty Water Treatment Chemicals

- 3.5. Other Applications

Epichlorohydrin Market Segmentation By Geography

-

1. Asia Pacific

- 1.1. China

- 1.2. India

- 1.3. Japan

- 1.4. South Korea

- 1.5. Rest of Asia Pacific

-

2. North America

- 2.1. United States

- 2.2. Canada

- 2.3. Mexico

-

3. Europe

- 3.1. Germany

- 3.2. United Kingdom

- 3.3. France

- 3.4. Italy

- 3.5. Rest of Europe

-

4. South America

- 4.1. Brazil

- 4.2. Argentina

- 4.3. Rest of South America

- 5. Rest of the World

Epichlorohydrin Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of > 5.00% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Growing Demand of Epoxy resin in Global Market; Increasing Availability of Bio-Based Glycerin For the Production of Bio Based Epichlorohydrin; Other Drivers

- 3.3. Market Restrains

- 3.3.1. Growing Demand of Epoxy resin in Global Market; Increasing Availability of Bio-Based Glycerin For the Production of Bio Based Epichlorohydrin; Other Drivers

- 3.4. Market Trends

- 3.4.1. Growing Demand of Epoxy Resin in Global Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Epichlorohydrin Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Product

- 5.1.1. Epichlorohydrin

- 5.2. Market Analysis, Insights and Forecast - by Type

- 5.2.1. Oil-based Epichlorohydrin

- 5.2.2. Bio-based Epichlorohydrin

- 5.3. Market Analysis, Insights and Forecast - by Application

- 5.3.1. Epoxy Resins

- 5.3.2. Synthetic Glycerin

- 5.3.3. Epichlorohydrin Elastomers

- 5.3.4. Specialty Water Treatment Chemicals

- 5.3.5. Other Applications

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. Asia Pacific

- 5.4.2. North America

- 5.4.3. Europe

- 5.4.4. South America

- 5.4.5. Rest of the World

- 5.1. Market Analysis, Insights and Forecast - by Product

- 6. Asia Pacific Epichlorohydrin Market Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Product

- 6.1.1. Epichlorohydrin

- 6.2. Market Analysis, Insights and Forecast - by Type

- 6.2.1. Oil-based Epichlorohydrin

- 6.2.2. Bio-based Epichlorohydrin

- 6.3. Market Analysis, Insights and Forecast - by Application

- 6.3.1. Epoxy Resins

- 6.3.2. Synthetic Glycerin

- 6.3.3. Epichlorohydrin Elastomers

- 6.3.4. Specialty Water Treatment Chemicals

- 6.3.5. Other Applications

- 6.1. Market Analysis, Insights and Forecast - by Product

- 7. North America Epichlorohydrin Market Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Product

- 7.1.1. Epichlorohydrin

- 7.2. Market Analysis, Insights and Forecast - by Type

- 7.2.1. Oil-based Epichlorohydrin

- 7.2.2. Bio-based Epichlorohydrin

- 7.3. Market Analysis, Insights and Forecast - by Application

- 7.3.1. Epoxy Resins

- 7.3.2. Synthetic Glycerin

- 7.3.3. Epichlorohydrin Elastomers

- 7.3.4. Specialty Water Treatment Chemicals

- 7.3.5. Other Applications

- 7.1. Market Analysis, Insights and Forecast - by Product

- 8. Europe Epichlorohydrin Market Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Product

- 8.1.1. Epichlorohydrin

- 8.2. Market Analysis, Insights and Forecast - by Type

- 8.2.1. Oil-based Epichlorohydrin

- 8.2.2. Bio-based Epichlorohydrin

- 8.3. Market Analysis, Insights and Forecast - by Application

- 8.3.1. Epoxy Resins

- 8.3.2. Synthetic Glycerin

- 8.3.3. Epichlorohydrin Elastomers

- 8.3.4. Specialty Water Treatment Chemicals

- 8.3.5. Other Applications

- 8.1. Market Analysis, Insights and Forecast - by Product

- 9. South America Epichlorohydrin Market Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Product

- 9.1.1. Epichlorohydrin

- 9.2. Market Analysis, Insights and Forecast - by Type

- 9.2.1. Oil-based Epichlorohydrin

- 9.2.2. Bio-based Epichlorohydrin

- 9.3. Market Analysis, Insights and Forecast - by Application

- 9.3.1. Epoxy Resins

- 9.3.2. Synthetic Glycerin

- 9.3.3. Epichlorohydrin Elastomers

- 9.3.4. Specialty Water Treatment Chemicals

- 9.3.5. Other Applications

- 9.1. Market Analysis, Insights and Forecast - by Product

- 10. Rest of the World Epichlorohydrin Market Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Product

- 10.1.1. Epichlorohydrin

- 10.2. Market Analysis, Insights and Forecast - by Type

- 10.2.1. Oil-based Epichlorohydrin

- 10.2.2. Bio-based Epichlorohydrin

- 10.3. Market Analysis, Insights and Forecast - by Application

- 10.3.1. Epoxy Resins

- 10.3.2. Synthetic Glycerin

- 10.3.3. Epichlorohydrin Elastomers

- 10.3.4. Specialty Water Treatment Chemicals

- 10.3.5. Other Applications

- 10.1. Market Analysis, Insights and Forecast - by Product

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2024

- 11.2. Company Profiles

- 11.2.1 Grasim Industries Limited (India) and Aditya Birla Chemicals (Thailand) Pvt Ltd

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Hexion

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Kashima Chemical Co LTD

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 KUMHO P&B CHEMICALS INC

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 LOTTE FINE CHEMICAL

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Momentive

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 NAMA Chemicals

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Parchem fine & specialty chemicals

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Shandong Haili Chemical Industry Co Ltd

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Sumitomo Chemical Co Ltd

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 Solvay

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.12 SPOLCHEMIE

- 11.2.12.1. Overview

- 11.2.12.2. Products

- 11.2.12.3. SWOT Analysis

- 11.2.12.4. Recent Developments

- 11.2.12.5. Financials (Based on Availability)

- 11.2.13 *List Not Exhaustive

- 11.2.13.1. Overview

- 11.2.13.2. Products

- 11.2.13.3. SWOT Analysis

- 11.2.13.4. Recent Developments

- 11.2.13.5. Financials (Based on Availability)

- 11.2.1 Grasim Industries Limited (India) and Aditya Birla Chemicals (Thailand) Pvt Ltd

List of Figures

- Figure 1: Global Epichlorohydrin Market Revenue Breakdown (Million, %) by Region 2024 & 2032

- Figure 2: Asia Pacific Epichlorohydrin Market Revenue (Million), by Product 2024 & 2032

- Figure 3: Asia Pacific Epichlorohydrin Market Revenue Share (%), by Product 2024 & 2032

- Figure 4: Asia Pacific Epichlorohydrin Market Revenue (Million), by Type 2024 & 2032

- Figure 5: Asia Pacific Epichlorohydrin Market Revenue Share (%), by Type 2024 & 2032

- Figure 6: Asia Pacific Epichlorohydrin Market Revenue (Million), by Application 2024 & 2032

- Figure 7: Asia Pacific Epichlorohydrin Market Revenue Share (%), by Application 2024 & 2032

- Figure 8: Asia Pacific Epichlorohydrin Market Revenue (Million), by Country 2024 & 2032

- Figure 9: Asia Pacific Epichlorohydrin Market Revenue Share (%), by Country 2024 & 2032

- Figure 10: North America Epichlorohydrin Market Revenue (Million), by Product 2024 & 2032

- Figure 11: North America Epichlorohydrin Market Revenue Share (%), by Product 2024 & 2032

- Figure 12: North America Epichlorohydrin Market Revenue (Million), by Type 2024 & 2032

- Figure 13: North America Epichlorohydrin Market Revenue Share (%), by Type 2024 & 2032

- Figure 14: North America Epichlorohydrin Market Revenue (Million), by Application 2024 & 2032

- Figure 15: North America Epichlorohydrin Market Revenue Share (%), by Application 2024 & 2032

- Figure 16: North America Epichlorohydrin Market Revenue (Million), by Country 2024 & 2032

- Figure 17: North America Epichlorohydrin Market Revenue Share (%), by Country 2024 & 2032

- Figure 18: Europe Epichlorohydrin Market Revenue (Million), by Product 2024 & 2032

- Figure 19: Europe Epichlorohydrin Market Revenue Share (%), by Product 2024 & 2032

- Figure 20: Europe Epichlorohydrin Market Revenue (Million), by Type 2024 & 2032

- Figure 21: Europe Epichlorohydrin Market Revenue Share (%), by Type 2024 & 2032

- Figure 22: Europe Epichlorohydrin Market Revenue (Million), by Application 2024 & 2032

- Figure 23: Europe Epichlorohydrin Market Revenue Share (%), by Application 2024 & 2032

- Figure 24: Europe Epichlorohydrin Market Revenue (Million), by Country 2024 & 2032

- Figure 25: Europe Epichlorohydrin Market Revenue Share (%), by Country 2024 & 2032

- Figure 26: South America Epichlorohydrin Market Revenue (Million), by Product 2024 & 2032

- Figure 27: South America Epichlorohydrin Market Revenue Share (%), by Product 2024 & 2032

- Figure 28: South America Epichlorohydrin Market Revenue (Million), by Type 2024 & 2032

- Figure 29: South America Epichlorohydrin Market Revenue Share (%), by Type 2024 & 2032

- Figure 30: South America Epichlorohydrin Market Revenue (Million), by Application 2024 & 2032

- Figure 31: South America Epichlorohydrin Market Revenue Share (%), by Application 2024 & 2032

- Figure 32: South America Epichlorohydrin Market Revenue (Million), by Country 2024 & 2032

- Figure 33: South America Epichlorohydrin Market Revenue Share (%), by Country 2024 & 2032

- Figure 34: Rest of the World Epichlorohydrin Market Revenue (Million), by Product 2024 & 2032

- Figure 35: Rest of the World Epichlorohydrin Market Revenue Share (%), by Product 2024 & 2032

- Figure 36: Rest of the World Epichlorohydrin Market Revenue (Million), by Type 2024 & 2032

- Figure 37: Rest of the World Epichlorohydrin Market Revenue Share (%), by Type 2024 & 2032

- Figure 38: Rest of the World Epichlorohydrin Market Revenue (Million), by Application 2024 & 2032

- Figure 39: Rest of the World Epichlorohydrin Market Revenue Share (%), by Application 2024 & 2032

- Figure 40: Rest of the World Epichlorohydrin Market Revenue (Million), by Country 2024 & 2032

- Figure 41: Rest of the World Epichlorohydrin Market Revenue Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global Epichlorohydrin Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Global Epichlorohydrin Market Revenue Million Forecast, by Product 2019 & 2032

- Table 3: Global Epichlorohydrin Market Revenue Million Forecast, by Type 2019 & 2032

- Table 4: Global Epichlorohydrin Market Revenue Million Forecast, by Application 2019 & 2032

- Table 5: Global Epichlorohydrin Market Revenue Million Forecast, by Region 2019 & 2032

- Table 6: Global Epichlorohydrin Market Revenue Million Forecast, by Product 2019 & 2032

- Table 7: Global Epichlorohydrin Market Revenue Million Forecast, by Type 2019 & 2032

- Table 8: Global Epichlorohydrin Market Revenue Million Forecast, by Application 2019 & 2032

- Table 9: Global Epichlorohydrin Market Revenue Million Forecast, by Country 2019 & 2032

- Table 10: China Epichlorohydrin Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 11: India Epichlorohydrin Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 12: Japan Epichlorohydrin Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 13: South Korea Epichlorohydrin Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 14: Rest of Asia Pacific Epichlorohydrin Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 15: Global Epichlorohydrin Market Revenue Million Forecast, by Product 2019 & 2032

- Table 16: Global Epichlorohydrin Market Revenue Million Forecast, by Type 2019 & 2032

- Table 17: Global Epichlorohydrin Market Revenue Million Forecast, by Application 2019 & 2032

- Table 18: Global Epichlorohydrin Market Revenue Million Forecast, by Country 2019 & 2032

- Table 19: United States Epichlorohydrin Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 20: Canada Epichlorohydrin Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 21: Mexico Epichlorohydrin Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 22: Global Epichlorohydrin Market Revenue Million Forecast, by Product 2019 & 2032

- Table 23: Global Epichlorohydrin Market Revenue Million Forecast, by Type 2019 & 2032

- Table 24: Global Epichlorohydrin Market Revenue Million Forecast, by Application 2019 & 2032

- Table 25: Global Epichlorohydrin Market Revenue Million Forecast, by Country 2019 & 2032

- Table 26: Germany Epichlorohydrin Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 27: United Kingdom Epichlorohydrin Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 28: France Epichlorohydrin Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 29: Italy Epichlorohydrin Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 30: Rest of Europe Epichlorohydrin Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 31: Global Epichlorohydrin Market Revenue Million Forecast, by Product 2019 & 2032

- Table 32: Global Epichlorohydrin Market Revenue Million Forecast, by Type 2019 & 2032

- Table 33: Global Epichlorohydrin Market Revenue Million Forecast, by Application 2019 & 2032

- Table 34: Global Epichlorohydrin Market Revenue Million Forecast, by Country 2019 & 2032

- Table 35: Brazil Epichlorohydrin Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 36: Argentina Epichlorohydrin Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 37: Rest of South America Epichlorohydrin Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 38: Global Epichlorohydrin Market Revenue Million Forecast, by Product 2019 & 2032

- Table 39: Global Epichlorohydrin Market Revenue Million Forecast, by Type 2019 & 2032

- Table 40: Global Epichlorohydrin Market Revenue Million Forecast, by Application 2019 & 2032

- Table 41: Global Epichlorohydrin Market Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Epichlorohydrin Market?

The projected CAGR is approximately > 5.00%.

2. Which companies are prominent players in the Epichlorohydrin Market?

Key companies in the market include Grasim Industries Limited (India) and Aditya Birla Chemicals (Thailand) Pvt Ltd, Hexion, Kashima Chemical Co LTD, KUMHO P&B CHEMICALS INC, LOTTE FINE CHEMICAL, Momentive, NAMA Chemicals, Parchem fine & specialty chemicals, Shandong Haili Chemical Industry Co Ltd, Sumitomo Chemical Co Ltd, Solvay, SPOLCHEMIE, *List Not Exhaustive.

3. What are the main segments of the Epichlorohydrin Market?

The market segments include Product, Type, Application.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Growing Demand of Epoxy resin in Global Market; Increasing Availability of Bio-Based Glycerin For the Production of Bio Based Epichlorohydrin; Other Drivers.

6. What are the notable trends driving market growth?

Growing Demand of Epoxy Resin in Global Market.

7. Are there any restraints impacting market growth?

Growing Demand of Epoxy resin in Global Market; Increasing Availability of Bio-Based Glycerin For the Production of Bio Based Epichlorohydrin; Other Drivers.

8. Can you provide examples of recent developments in the market?

In August 2022, OCIM Sdn. Bhd. and KUMHO P&B CHEMICALS., INC. partnered to manufacture epichlorohydrin in Malaysia. The annual production capacity of the plant is 100 KTPA. The ECH will be mainly used to produce epoxy resins using bio-based raw materials.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Epichlorohydrin Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Epichlorohydrin Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Epichlorohydrin Market?

To stay informed about further developments, trends, and reports in the Epichlorohydrin Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence