Key Insights

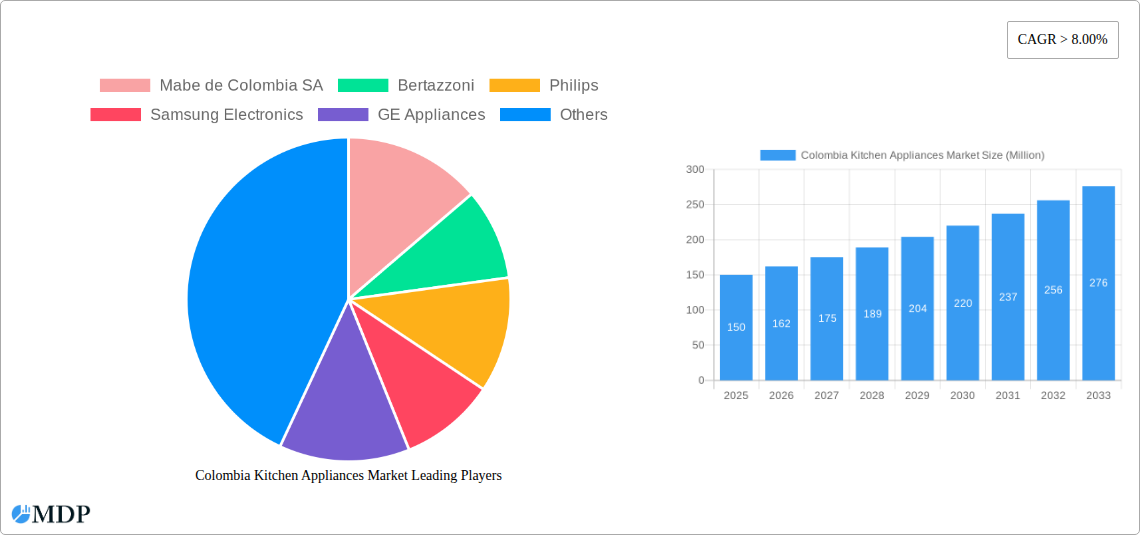

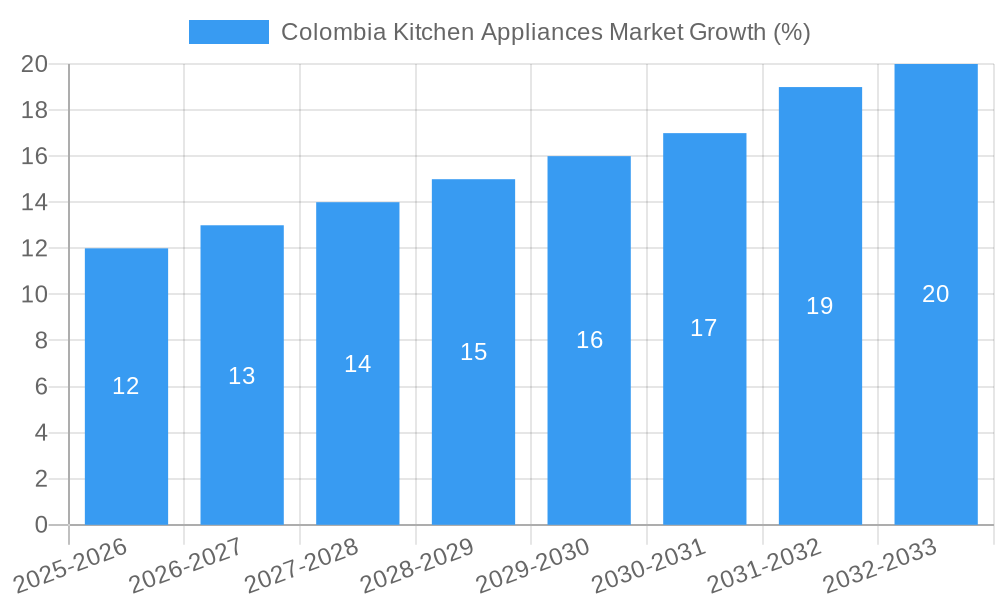

The Colombia kitchen appliances market, valued at approximately $XX million in 2025, is projected to experience robust growth, exceeding an 8% CAGR from 2025 to 2033. This expansion is fueled by several key drivers. Rising disposable incomes among Colombian households are enabling increased spending on home improvement and modern conveniences, including advanced kitchen appliances. A burgeoning middle class is actively adopting a more Westernized lifestyle, which includes a preference for time-saving kitchen technology and aesthetically pleasing designs. Furthermore, government initiatives focused on improving housing infrastructure and promoting urban development contribute positively to market growth. The increasing popularity of online shopping channels is also transforming the market landscape, offering consumers greater convenience and access to a wider range of products, including international brands. However, economic volatility and potential inflation pose challenges, potentially impacting consumer spending on non-essential items. The market is segmented by product type (food processing, small kitchen appliances, large kitchen appliances, and others) and sales channel (offline and online), offering various opportunities for targeted growth strategies. Major players such as Mabe de Colombia SA, Bertazzoni, Philips, Samsung, and Whirlpool are competing to capture market share through product innovation, branding, and effective distribution networks.

The market's segmentation reveals important nuances. The large kitchen appliance segment, including refrigerators and ovens, is expected to maintain a significant share due to its essentiality. However, the small kitchen appliance segment (blenders, toasters, etc.) is likely experiencing accelerated growth driven by consumer demand for convenience and diverse culinary experiences. Online sales channels are projected to exhibit strong growth rates compared to traditional offline retailers, driven by increasing internet penetration and e-commerce adoption in Colombia. Future growth will depend on successful navigation of economic uncertainties, continuous innovation in appliance technology, and the ability of companies to cater to evolving consumer preferences and effectively leverage e-commerce platforms. Brands focusing on energy efficiency and sustainable practices will likely gain a competitive advantage in the environmentally conscious consumer market.

Colombia Kitchen Appliances Market Report: 2019-2033 Forecast

Dive deep into the dynamic Colombian kitchen appliances market with this comprehensive report, providing actionable insights for strategic decision-making. This in-depth analysis covers the period 2019-2033, with a focus on 2025, offering a detailed understanding of market trends, competitive landscape, and future growth potential. The report is designed for industry stakeholders, investors, and market entrants seeking a clear picture of this lucrative market. Millions are used for all values.

Colombia Kitchen Appliances Market Dynamics & Concentration

The Colombian kitchen appliances market, valued at XX Million in 2024, is experiencing moderate concentration, with key players like Mabe de Colombia SA and Industrias HACEB SA holding significant market share. However, the presence of international brands such as Whirlpool, Samsung Electronics, and Electrolux introduces considerable competition. Innovation drivers include the rising demand for smart appliances and energy-efficient models. Regulatory frameworks, particularly those concerning energy consumption and safety standards, play a crucial role in shaping the market. Product substitutes, such as traditional cooking methods, pose a limited threat, given the increasing adoption of modern conveniences. End-user trends highlight a growing preference for multifunctional and aesthetically pleasing appliances. The market has witnessed XX M&A deals between 2019 and 2024, primarily focused on expanding distribution networks and enhancing product portfolios.

- Market Share (2024): Mabe de Colombia SA (xx%), Industrias HACEB SA (xx%), Whirlpool (xx%), Samsung Electronics (xx%), Others (xx%).

- M&A Activity (2019-2024): XX deals focusing on distribution and product expansion.

Colombia Kitchen Appliances Market Industry Trends & Analysis

The Colombian kitchen appliances market is projected to register a CAGR of xx% during the forecast period (2025-2033), driven by rising disposable incomes, urbanization, and a growing preference for modern kitchens. Technological disruptions, such as the integration of smart features and IoT capabilities, are reshaping consumer preferences, leading to increased demand for connected appliances. The market penetration of smart kitchen appliances is currently at xx%, expected to reach xx% by 2033. Competitive dynamics are intensified by the entry of international players and the continuous innovation in product design and functionality. The growing popularity of online retail channels presents a significant opportunity for market expansion.

Leading Markets & Segments in Colombia Kitchen Appliances Market

The Colombian kitchen appliances market is predominantly driven by the Offline channel, accounting for approximately xx% of total sales in 2024. The Large Kitchen Appliances segment (refrigerators, ovens, dishwashers) holds the largest market share, fueled by increasing household sizes and a growing preference for convenience.

- Key Drivers for Offline Channel Dominance: Established distribution networks, consumer preference for physical product inspection, and trust in offline retailers.

- Key Drivers for Large Kitchen Appliances Segment Dominance: Rising disposable incomes, increasing household sizes, and a growing preference for modern kitchen conveniences.

- Key Drivers for Online Channel Growth: Increasing internet and smartphone penetration, convenience of online shopping, and competitive pricing strategies.

- Regional Dominance: Major cities such as Bogotá, Medellín, and Cali contribute significantly to market demand.

Colombia Kitchen Appliances Market Product Developments

Recent product innovations focus on energy efficiency, smart connectivity, and improved aesthetics. Manufacturers are emphasizing multifunctional appliances that integrate cooking, cleaning, and food processing features, meeting the needs of modern consumers who value convenience and time-saving solutions. These developments are enhancing the market appeal of Colombian kitchen appliances, enhancing brand positioning and competitiveness.

Key Drivers of Colombia Kitchen Appliances Market Growth

The market's growth is primarily fueled by rising disposable incomes, particularly within the middle class. Government initiatives promoting energy efficiency are also driving adoption of modern, energy-saving appliances. Furthermore, increasing urbanization and a shift towards nuclear families are boosting the demand for smaller, more efficient kitchen appliances.

Challenges in the Colombia Kitchen Appliances Market Market

Challenges include import tariffs and supply chain disruptions impacting pricing and product availability. Intense competition from both domestic and international players also puts pressure on margins. Furthermore, fluctuating exchange rates and economic uncertainty impact consumer spending patterns.

Emerging Opportunities in Colombia Kitchen Appliances Market

The growing adoption of online retail channels offers vast opportunities for market expansion and access to a broader customer base. Strategic partnerships between manufacturers and retailers can enhance distribution networks and marketing efforts. Focus on sustainable and energy-efficient appliances will also drive market growth.

Leading Players in the Colombia Kitchen Appliances Market Sector

- Mabe de Colombia SA

- Bertazzoni

- Philips

- Samsung Electronics

- GE Appliances

- Electrolux

- Whirlpool

- Industrias HACEB SA

- KitchenAid

- Panasonic Corporation

Key Milestones in Colombia Kitchen Appliances Market Industry

- 2020: Launch of several energy-efficient refrigerator models by major players.

- 2022: Increased investment in e-commerce infrastructure by key retailers.

- 2023: Introduction of smart kitchen appliance features by leading brands.

Strategic Outlook for Colombia Kitchen Appliances Market Market

The Colombian kitchen appliances market exhibits significant long-term growth potential, driven by favorable demographic trends and increasing consumer spending power. Strategic investments in innovation, brand building, and expanding distribution channels are crucial for success in this competitive market. Focusing on sustainability and smart technology will further drive market expansion.

Colombia Kitchen Appliances Market Segmentation

-

1. Product Type

- 1.1. Food Processing

- 1.2. Small Kitchen

- 1.3. Large Kitchen

- 1.4. Other Product Types

-

2. Channel

- 2.1. Offline

- 2.2. Online

Colombia Kitchen Appliances Market Segmentation By Geography

- 1. Colombia

Colombia Kitchen Appliances Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of > 8.00% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Rise in New Offices in South Korea; Wide Range of Design Broadening Consumer Base

- 3.3. Market Restrains

- 3.3.1. Fluctuations in Raw Material Prices and Rise in Shipping Prices; Intense Competition from Both Local and International Players

- 3.4. Market Trends

- 3.4.1. Small Kitchen Appliances Facing Premiumization

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Colombia Kitchen Appliances Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 5.1.1. Food Processing

- 5.1.2. Small Kitchen

- 5.1.3. Large Kitchen

- 5.1.4. Other Product Types

- 5.2. Market Analysis, Insights and Forecast - by Channel

- 5.2.1. Offline

- 5.2.2. Online

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Colombia

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2024

- 6.2. Company Profiles

- 6.2.1 Mabe de Colombia SA

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Bertazzoni

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Philips

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Samsung Electronics

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 GE Appliances

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Electrolux

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Whirlpool

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Industrias HACEB SA

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 KitchenAid

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Panasonic Corporation

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 Mabe de Colombia SA

List of Figures

- Figure 1: Colombia Kitchen Appliances Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Colombia Kitchen Appliances Market Share (%) by Company 2024

List of Tables

- Table 1: Colombia Kitchen Appliances Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Colombia Kitchen Appliances Market Volume K Unit Forecast, by Region 2019 & 2032

- Table 3: Colombia Kitchen Appliances Market Revenue Million Forecast, by Product Type 2019 & 2032

- Table 4: Colombia Kitchen Appliances Market Volume K Unit Forecast, by Product Type 2019 & 2032

- Table 5: Colombia Kitchen Appliances Market Revenue Million Forecast, by Channel 2019 & 2032

- Table 6: Colombia Kitchen Appliances Market Volume K Unit Forecast, by Channel 2019 & 2032

- Table 7: Colombia Kitchen Appliances Market Revenue Million Forecast, by Region 2019 & 2032

- Table 8: Colombia Kitchen Appliances Market Volume K Unit Forecast, by Region 2019 & 2032

- Table 9: Colombia Kitchen Appliances Market Revenue Million Forecast, by Country 2019 & 2032

- Table 10: Colombia Kitchen Appliances Market Volume K Unit Forecast, by Country 2019 & 2032

- Table 11: Colombia Kitchen Appliances Market Revenue Million Forecast, by Product Type 2019 & 2032

- Table 12: Colombia Kitchen Appliances Market Volume K Unit Forecast, by Product Type 2019 & 2032

- Table 13: Colombia Kitchen Appliances Market Revenue Million Forecast, by Channel 2019 & 2032

- Table 14: Colombia Kitchen Appliances Market Volume K Unit Forecast, by Channel 2019 & 2032

- Table 15: Colombia Kitchen Appliances Market Revenue Million Forecast, by Country 2019 & 2032

- Table 16: Colombia Kitchen Appliances Market Volume K Unit Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Colombia Kitchen Appliances Market?

The projected CAGR is approximately > 8.00%.

2. Which companies are prominent players in the Colombia Kitchen Appliances Market?

Key companies in the market include Mabe de Colombia SA, Bertazzoni, Philips, Samsung Electronics, GE Appliances, Electrolux, Whirlpool, Industrias HACEB SA, KitchenAid, Panasonic Corporation.

3. What are the main segments of the Colombia Kitchen Appliances Market?

The market segments include Product Type, Channel.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Rise in New Offices in South Korea; Wide Range of Design Broadening Consumer Base.

6. What are the notable trends driving market growth?

Small Kitchen Appliances Facing Premiumization.

7. Are there any restraints impacting market growth?

Fluctuations in Raw Material Prices and Rise in Shipping Prices; Intense Competition from Both Local and International Players.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in K Unit.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Colombia Kitchen Appliances Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Colombia Kitchen Appliances Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Colombia Kitchen Appliances Market?

To stay informed about further developments, trends, and reports in the Colombia Kitchen Appliances Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence