Key Insights

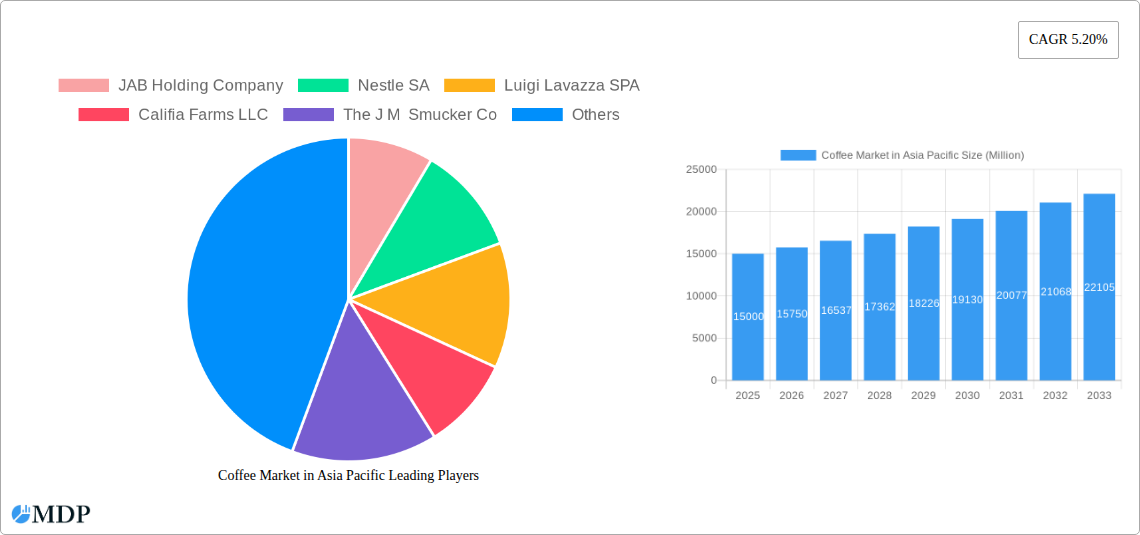

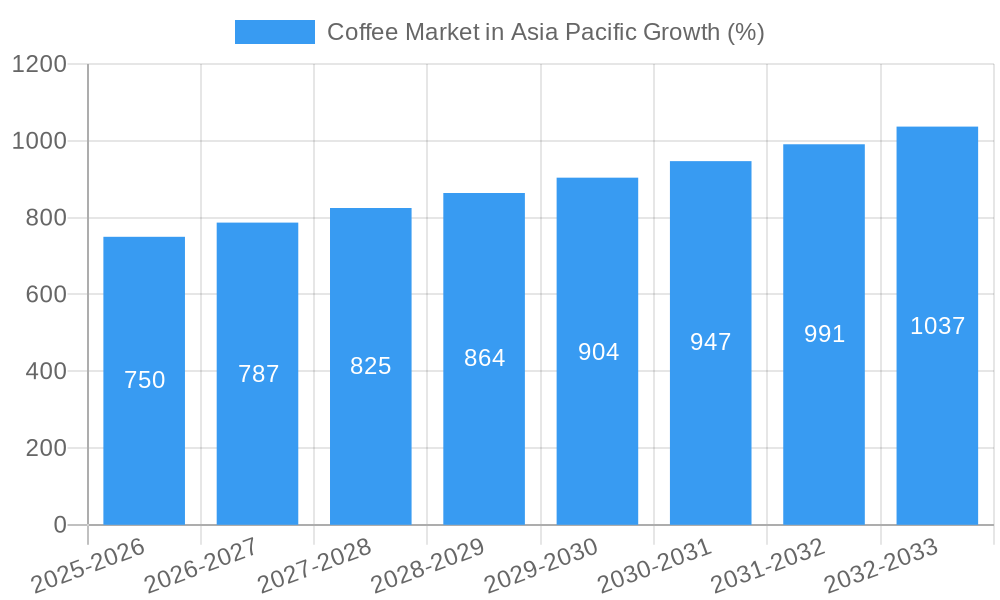

The Asia-Pacific coffee market, valued at approximately $XX million in 2025, is projected to experience robust growth, driven by a rising young population with increasing disposable incomes and a burgeoning preference for Westernized lifestyles. This translates to a significant rise in coffee consumption, particularly in rapidly developing economies like China and India. The market is segmented by type (whole bean, ground, instant, pods/capsules), with instant coffee and convenient coffee pods gaining traction due to their ease of preparation and appeal to busy consumers. Distribution channels are diverse, encompassing supermarkets, convenience stores, and rapidly expanding online retail platforms. Key players like Nestle, JAB Holding Company, and Lavazza are strategically investing in the region, focusing on brand building and expanding distribution networks to capture growing market share. The increasing popularity of specialty coffee, including organic and ethically sourced beans, is creating further opportunities for premium segment growth. While factors like fluctuating coffee bean prices and intense competition could pose challenges, the overall market outlook remains optimistic, with a projected CAGR of 5.20% from 2025 to 2033.

The growth trajectory is influenced by several factors. The increasing urbanization within the region leads to higher coffee consumption due to changing lifestyles and the rise of coffee shops. Furthermore, the growing adoption of coffee culture, fueled by social media trends and western influence, is significantly boosting demand. The market also witnesses the emergence of innovative coffee products and flavors tailored to local tastes, further driving market expansion. While challenges such as economic fluctuations and the potential impact of health concerns related to excessive caffeine consumption exist, these are likely to be offset by the strong underlying growth drivers. Therefore, strategic investments in product innovation, marketing, and efficient distribution channels are key for market participants to succeed in this dynamic and promising market.

Coffee Market in Asia Pacific: A Comprehensive Market Report (2019-2033)

This in-depth report provides a comprehensive analysis of the Coffee Market in Asia Pacific, offering invaluable insights for industry stakeholders, investors, and strategic planners. Covering the period from 2019 to 2033, with a focus on 2025, this report meticulously examines market dynamics, trends, leading players, and future opportunities within this rapidly evolving sector. The study period (2019–2024) and the forecast period (2025–2033) provide a complete picture for informed decision-making.

Coffee Market in Asia Pacific Market Dynamics & Concentration

The Asia Pacific coffee market is characterized by a dynamic interplay of factors influencing its concentration and growth. Market concentration is currently moderate, with several key players holding significant shares, but a fragmented landscape also exists, particularly within smaller, regional brands. Innovation, particularly in product formats (e.g., single-serve pods, functional coffees), plays a crucial role in driving market expansion. Regulatory frameworks concerning food safety, labeling, and taxation vary across countries, creating both opportunities and challenges. The presence of readily available tea and other beverages acts as a substitute, though coffee's increasing popularity is mitigating this factor. End-user trends reflect a rising preference for premium and specialty coffee, fueling premiumization and specialty coffee shop proliferation. M&A activity has been notable, with several larger companies strategically acquiring smaller players to expand their market reach and product portfolios. Market share data indicates that the top five players command approximately xx% of the total market, with the remaining share spread across numerous smaller businesses. The number of M&A deals within the last five years is estimated at xx.

Coffee Market in Asia Pacific Industry Trends & Analysis

The Asia Pacific coffee market exhibits a robust growth trajectory, driven by several key factors. Rising disposable incomes, particularly in emerging economies, are fueling increased coffee consumption. The changing lifestyle and increasing urbanization within many parts of the region are fostering a rise in the demand for ready-to-drink and convenient coffee options. Technological advancements, such as improved processing and brewing technologies, are enhancing product quality and accessibility. Consumer preferences are shifting towards more premium, ethically sourced, and sustainably produced coffee. Competitive dynamics are fierce, with both established international brands and local players vying for market share through innovations in product offerings, marketing strategies, and distribution channels. The market shows a Compound Annual Growth Rate (CAGR) of xx% during the forecast period. Market penetration is increasing across diverse demographics, with younger consumers demonstrating particularly high adoption rates.

Leading Markets & Segments in Coffee Market in Asia Pacific

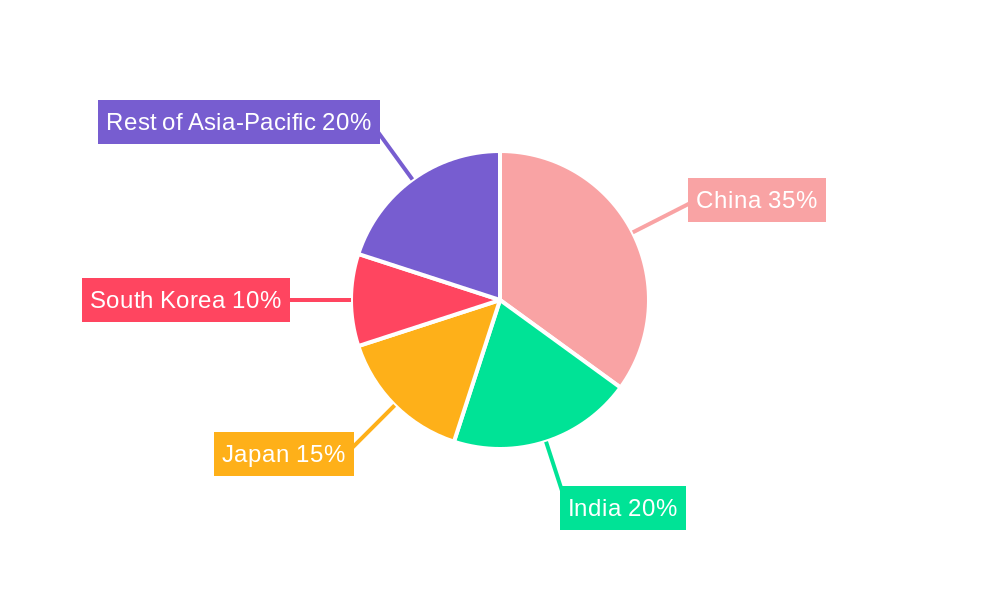

Dominant Region/Country: China and India currently lead the Asia Pacific coffee market, fueled by their large populations and rapidly expanding middle classes. Other significant markets include Japan, Australia, and South Korea.

Dominant Segments:

- By Type: Instant coffee remains the most popular segment due to its affordability and convenience, followed by ground coffee and whole bean coffee, which are gaining traction among discerning consumers. Coffee pods and capsules are demonstrating high growth potential, driven by increasing consumer demand for ease of use and consistent quality.

- By Distribution: Supermarkets/hypermarkets retain a significant market share due to their widespread reach, though convenience stores are rapidly increasing their share owing to their convenience and strategic locations. The online retail sector is exhibiting significant growth, driven by e-commerce adoption. Other channels, such as cafes and restaurants, also contribute substantially.

Key Drivers:

- Economic Policies: Favorable economic policies in many Asia Pacific countries have supported market growth.

- Infrastructure: Improvements in infrastructure, particularly logistics, has facilitated greater distribution efficiency.

- Cultural Shifts: Changes in lifestyle and consumer preferences have led to higher coffee consumption.

The dominance of specific regions and segments is mainly determined by factors such as disposable income, consumer preferences, distribution infrastructure and marketing strategies.

Coffee Market in Asia Pacific Product Developments

Recent product innovations in the Asia Pacific coffee market are primarily focused on enhancing convenience, quality, and health benefits. Single-serve coffee pods and capsules are becoming increasingly popular due to their ease of use and consistent quality. Functional coffees, infused with health-promoting ingredients like collagen or adaptogens, are gaining traction among health-conscious consumers. Technological advancements in brewing technologies are improving the extraction and taste profile of coffee. Manufacturers are also emphasizing sustainability and ethical sourcing practices to appeal to environmentally and socially responsible consumers. This focus on innovation ensures a continued appeal to the diverse preferences of the region.

Key Drivers of Coffee Market in Asia Pacific Growth

Several key factors are driving the growth of the Asia Pacific coffee market. Technological advancements in coffee processing and brewing technologies are improving efficiency and enhancing product quality. The rising disposable incomes in several key markets are leading to increased consumer spending on premium coffee products. Favorable government policies, such as reduced import tariffs in certain countries, have also positively influenced market growth. The increasing popularity of specialty coffee shops contributes to overall market growth.

Challenges in the Coffee Market in Asia Pacific Market

The Asia Pacific coffee market faces several challenges, including fluctuating coffee bean prices which impact profitability and create volatility. Supply chain disruptions, especially during times of global uncertainty, can affect product availability and pricing. Intense competition among both domestic and international brands necessitates significant investment in marketing and product differentiation. Further, varying regulatory landscapes and inconsistencies in food safety standards across different countries pose operational challenges. These factors, combined, can affect the overall growth trajectory of the market. The impact of supply chain disruptions on coffee prices alone resulted in a xx Million loss in revenue for the region in 2022.

Emerging Opportunities in Coffee Market in Asia Pacific

Several opportunities are driving long-term growth in the Asia Pacific coffee market. The expanding middle class in many emerging economies is creating a large pool of new coffee consumers. Technological innovations in brewing and processing technologies are constantly improving product quality and consumer experience. The rising trend of health and wellness is opening up new avenues for functional coffees. Strategic partnerships between international and local brands are fostering market expansion and increased product diversity. Furthermore, focusing on sustainable and ethical sourcing practices is gaining increasing importance for many consumers.

Leading Players in the Coffee Market in Asia Pacific Sector

- JAB Holding Company

- Nestle SA

- Luigi Lavazza SPA

- Califia Farms LLC

- The J M Smucker Co

- F Gaviña & Sons Inc

- The Kraft Heinz Company

- Massimo Zanetti Beverage Group

- Four Sigmatic

- Cedar Lake

- List Not Exhaustive

Key Milestones in Coffee Market in Asia Pacific Industry

- September 2022: Nestlé announced a $613 Million investment in India by 2025, driven by strong coffee demand.

- September 2022: The Coffee Board of India launched new coffee brands on Amazon, expanding its market reach.

- July 2022: Bestar Coffee, a Chinese coffee chain, secured funding for expansion plans, opening 500 locations in three years.

These developments highlight the significant investment and expansion occurring within the Asia Pacific coffee market, signifying its considerable potential for future growth.

Strategic Outlook for Coffee Market in Asia Pacific Market

The Asia Pacific coffee market shows immense long-term growth potential, driven by a confluence of factors. Continued economic development and a rising middle class will significantly increase coffee consumption. Strategic partnerships and mergers and acquisitions will reshape the market landscape, leading to greater innovation and wider distribution. A focus on sustainability, ethical sourcing, and functional coffee will also create new market niches. These factors, combined with ongoing technological advancements, suggest a bright future for the Asia Pacific coffee market.

Coffee Market in Asia Pacific Segmentation

-

1. Type

- 1.1. Whole-bean

- 1.2. Ground Coffee

- 1.3. Instant Coffe

- 1.4. Coffee Pods, and Capsules

-

2. Distribution

- 2.1. Supermarkets/Hypermarkets

- 2.2. Convenience stores

- 2.3. Online Retail Stores

- 2.4. Other distribution channels

-

3. Geography

- 3.1. India

- 3.2. China

- 3.3. Japan

- 3.4. Australia

- 3.5. Rest of Asia Pacific

Coffee Market in Asia Pacific Segmentation By Geography

- 1. India

- 2. China

- 3. Japan

- 4. Australia

- 5. Rest of Asia Pacific

Coffee Market in Asia Pacific REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 5.20% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Popularization of Adventure Sports and Expedition; Suitability of the Freeze-Dried Technique for Heat Sensitive Food Products

- 3.3. Market Restrains

- 3.3.1. High Cost Associated with the Freeze-Drying Technology

- 3.4. Market Trends

- 3.4.1. An increasing trend for organic certified coffee

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Coffee Market in Asia Pacific Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Whole-bean

- 5.1.2. Ground Coffee

- 5.1.3. Instant Coffe

- 5.1.4. Coffee Pods, and Capsules

- 5.2. Market Analysis, Insights and Forecast - by Distribution

- 5.2.1. Supermarkets/Hypermarkets

- 5.2.2. Convenience stores

- 5.2.3. Online Retail Stores

- 5.2.4. Other distribution channels

- 5.3. Market Analysis, Insights and Forecast - by Geography

- 5.3.1. India

- 5.3.2. China

- 5.3.3. Japan

- 5.3.4. Australia

- 5.3.5. Rest of Asia Pacific

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. India

- 5.4.2. China

- 5.4.3. Japan

- 5.4.4. Australia

- 5.4.5. Rest of Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. India Coffee Market in Asia Pacific Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Type

- 6.1.1. Whole-bean

- 6.1.2. Ground Coffee

- 6.1.3. Instant Coffe

- 6.1.4. Coffee Pods, and Capsules

- 6.2. Market Analysis, Insights and Forecast - by Distribution

- 6.2.1. Supermarkets/Hypermarkets

- 6.2.2. Convenience stores

- 6.2.3. Online Retail Stores

- 6.2.4. Other distribution channels

- 6.3. Market Analysis, Insights and Forecast - by Geography

- 6.3.1. India

- 6.3.2. China

- 6.3.3. Japan

- 6.3.4. Australia

- 6.3.5. Rest of Asia Pacific

- 6.1. Market Analysis, Insights and Forecast - by Type

- 7. China Coffee Market in Asia Pacific Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Type

- 7.1.1. Whole-bean

- 7.1.2. Ground Coffee

- 7.1.3. Instant Coffe

- 7.1.4. Coffee Pods, and Capsules

- 7.2. Market Analysis, Insights and Forecast - by Distribution

- 7.2.1. Supermarkets/Hypermarkets

- 7.2.2. Convenience stores

- 7.2.3. Online Retail Stores

- 7.2.4. Other distribution channels

- 7.3. Market Analysis, Insights and Forecast - by Geography

- 7.3.1. India

- 7.3.2. China

- 7.3.3. Japan

- 7.3.4. Australia

- 7.3.5. Rest of Asia Pacific

- 7.1. Market Analysis, Insights and Forecast - by Type

- 8. Japan Coffee Market in Asia Pacific Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Type

- 8.1.1. Whole-bean

- 8.1.2. Ground Coffee

- 8.1.3. Instant Coffe

- 8.1.4. Coffee Pods, and Capsules

- 8.2. Market Analysis, Insights and Forecast - by Distribution

- 8.2.1. Supermarkets/Hypermarkets

- 8.2.2. Convenience stores

- 8.2.3. Online Retail Stores

- 8.2.4. Other distribution channels

- 8.3. Market Analysis, Insights and Forecast - by Geography

- 8.3.1. India

- 8.3.2. China

- 8.3.3. Japan

- 8.3.4. Australia

- 8.3.5. Rest of Asia Pacific

- 8.1. Market Analysis, Insights and Forecast - by Type

- 9. Australia Coffee Market in Asia Pacific Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Type

- 9.1.1. Whole-bean

- 9.1.2. Ground Coffee

- 9.1.3. Instant Coffe

- 9.1.4. Coffee Pods, and Capsules

- 9.2. Market Analysis, Insights and Forecast - by Distribution

- 9.2.1. Supermarkets/Hypermarkets

- 9.2.2. Convenience stores

- 9.2.3. Online Retail Stores

- 9.2.4. Other distribution channels

- 9.3. Market Analysis, Insights and Forecast - by Geography

- 9.3.1. India

- 9.3.2. China

- 9.3.3. Japan

- 9.3.4. Australia

- 9.3.5. Rest of Asia Pacific

- 9.1. Market Analysis, Insights and Forecast - by Type

- 10. Rest of Asia Pacific Coffee Market in Asia Pacific Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Type

- 10.1.1. Whole-bean

- 10.1.2. Ground Coffee

- 10.1.3. Instant Coffe

- 10.1.4. Coffee Pods, and Capsules

- 10.2. Market Analysis, Insights and Forecast - by Distribution

- 10.2.1. Supermarkets/Hypermarkets

- 10.2.2. Convenience stores

- 10.2.3. Online Retail Stores

- 10.2.4. Other distribution channels

- 10.3. Market Analysis, Insights and Forecast - by Geography

- 10.3.1. India

- 10.3.2. China

- 10.3.3. Japan

- 10.3.4. Australia

- 10.3.5. Rest of Asia Pacific

- 10.1. Market Analysis, Insights and Forecast - by Type

- 11. China Coffee Market in Asia Pacific Analysis, Insights and Forecast, 2019-2031

- 12. Japan Coffee Market in Asia Pacific Analysis, Insights and Forecast, 2019-2031

- 13. India Coffee Market in Asia Pacific Analysis, Insights and Forecast, 2019-2031

- 14. South Korea Coffee Market in Asia Pacific Analysis, Insights and Forecast, 2019-2031

- 15. Taiwan Coffee Market in Asia Pacific Analysis, Insights and Forecast, 2019-2031

- 16. Australia Coffee Market in Asia Pacific Analysis, Insights and Forecast, 2019-2031

- 17. Rest of Asia-Pacific Coffee Market in Asia Pacific Analysis, Insights and Forecast, 2019-2031

- 18. Competitive Analysis

- 18.1. Market Share Analysis 2024

- 18.2. Company Profiles

- 18.2.1 JAB Holding Company

- 18.2.1.1. Overview

- 18.2.1.2. Products

- 18.2.1.3. SWOT Analysis

- 18.2.1.4. Recent Developments

- 18.2.1.5. Financials (Based on Availability)

- 18.2.2 Nestle SA

- 18.2.2.1. Overview

- 18.2.2.2. Products

- 18.2.2.3. SWOT Analysis

- 18.2.2.4. Recent Developments

- 18.2.2.5. Financials (Based on Availability)

- 18.2.3 Luigi Lavazza SPA

- 18.2.3.1. Overview

- 18.2.3.2. Products

- 18.2.3.3. SWOT Analysis

- 18.2.3.4. Recent Developments

- 18.2.3.5. Financials (Based on Availability)

- 18.2.4 Califia Farms LLC

- 18.2.4.1. Overview

- 18.2.4.2. Products

- 18.2.4.3. SWOT Analysis

- 18.2.4.4. Recent Developments

- 18.2.4.5. Financials (Based on Availability)

- 18.2.5 The J M Smucker Co

- 18.2.5.1. Overview

- 18.2.5.2. Products

- 18.2.5.3. SWOT Analysis

- 18.2.5.4. Recent Developments

- 18.2.5.5. Financials (Based on Availability)

- 18.2.6 F Gaviña & Sons Inc

- 18.2.6.1. Overview

- 18.2.6.2. Products

- 18.2.6.3. SWOT Analysis

- 18.2.6.4. Recent Developments

- 18.2.6.5. Financials (Based on Availability)

- 18.2.7 The Kraft Heinz Company

- 18.2.7.1. Overview

- 18.2.7.2. Products

- 18.2.7.3. SWOT Analysis

- 18.2.7.4. Recent Developments

- 18.2.7.5. Financials (Based on Availability)

- 18.2.8 Massimo Zanetti Beverage Group

- 18.2.8.1. Overview

- 18.2.8.2. Products

- 18.2.8.3. SWOT Analysis

- 18.2.8.4. Recent Developments

- 18.2.8.5. Financials (Based on Availability)

- 18.2.9 Four Sigmatic

- 18.2.9.1. Overview

- 18.2.9.2. Products

- 18.2.9.3. SWOT Analysis

- 18.2.9.4. Recent Developments

- 18.2.9.5. Financials (Based on Availability)

- 18.2.10 Cedar Lake*List Not Exhaustive

- 18.2.10.1. Overview

- 18.2.10.2. Products

- 18.2.10.3. SWOT Analysis

- 18.2.10.4. Recent Developments

- 18.2.10.5. Financials (Based on Availability)

- 18.2.1 JAB Holding Company

List of Figures

- Figure 1: Coffee Market in Asia Pacific Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Coffee Market in Asia Pacific Share (%) by Company 2024

List of Tables

- Table 1: Coffee Market in Asia Pacific Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Coffee Market in Asia Pacific Revenue Million Forecast, by Type 2019 & 2032

- Table 3: Coffee Market in Asia Pacific Revenue Million Forecast, by Distribution 2019 & 2032

- Table 4: Coffee Market in Asia Pacific Revenue Million Forecast, by Geography 2019 & 2032

- Table 5: Coffee Market in Asia Pacific Revenue Million Forecast, by Region 2019 & 2032

- Table 6: Coffee Market in Asia Pacific Revenue Million Forecast, by Country 2019 & 2032

- Table 7: China Coffee Market in Asia Pacific Revenue (Million) Forecast, by Application 2019 & 2032

- Table 8: Japan Coffee Market in Asia Pacific Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: India Coffee Market in Asia Pacific Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: South Korea Coffee Market in Asia Pacific Revenue (Million) Forecast, by Application 2019 & 2032

- Table 11: Taiwan Coffee Market in Asia Pacific Revenue (Million) Forecast, by Application 2019 & 2032

- Table 12: Australia Coffee Market in Asia Pacific Revenue (Million) Forecast, by Application 2019 & 2032

- Table 13: Rest of Asia-Pacific Coffee Market in Asia Pacific Revenue (Million) Forecast, by Application 2019 & 2032

- Table 14: Coffee Market in Asia Pacific Revenue Million Forecast, by Type 2019 & 2032

- Table 15: Coffee Market in Asia Pacific Revenue Million Forecast, by Distribution 2019 & 2032

- Table 16: Coffee Market in Asia Pacific Revenue Million Forecast, by Geography 2019 & 2032

- Table 17: Coffee Market in Asia Pacific Revenue Million Forecast, by Country 2019 & 2032

- Table 18: Coffee Market in Asia Pacific Revenue Million Forecast, by Type 2019 & 2032

- Table 19: Coffee Market in Asia Pacific Revenue Million Forecast, by Distribution 2019 & 2032

- Table 20: Coffee Market in Asia Pacific Revenue Million Forecast, by Geography 2019 & 2032

- Table 21: Coffee Market in Asia Pacific Revenue Million Forecast, by Country 2019 & 2032

- Table 22: Coffee Market in Asia Pacific Revenue Million Forecast, by Type 2019 & 2032

- Table 23: Coffee Market in Asia Pacific Revenue Million Forecast, by Distribution 2019 & 2032

- Table 24: Coffee Market in Asia Pacific Revenue Million Forecast, by Geography 2019 & 2032

- Table 25: Coffee Market in Asia Pacific Revenue Million Forecast, by Country 2019 & 2032

- Table 26: Coffee Market in Asia Pacific Revenue Million Forecast, by Type 2019 & 2032

- Table 27: Coffee Market in Asia Pacific Revenue Million Forecast, by Distribution 2019 & 2032

- Table 28: Coffee Market in Asia Pacific Revenue Million Forecast, by Geography 2019 & 2032

- Table 29: Coffee Market in Asia Pacific Revenue Million Forecast, by Country 2019 & 2032

- Table 30: Coffee Market in Asia Pacific Revenue Million Forecast, by Type 2019 & 2032

- Table 31: Coffee Market in Asia Pacific Revenue Million Forecast, by Distribution 2019 & 2032

- Table 32: Coffee Market in Asia Pacific Revenue Million Forecast, by Geography 2019 & 2032

- Table 33: Coffee Market in Asia Pacific Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Coffee Market in Asia Pacific?

The projected CAGR is approximately 5.20%.

2. Which companies are prominent players in the Coffee Market in Asia Pacific?

Key companies in the market include JAB Holding Company, Nestle SA, Luigi Lavazza SPA, Califia Farms LLC, The J M Smucker Co, F Gaviña & Sons Inc, The Kraft Heinz Company, Massimo Zanetti Beverage Group, Four Sigmatic, Cedar Lake*List Not Exhaustive.

3. What are the main segments of the Coffee Market in Asia Pacific?

The market segments include Type, Distribution, Geography.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Popularization of Adventure Sports and Expedition; Suitability of the Freeze-Dried Technique for Heat Sensitive Food Products.

6. What are the notable trends driving market growth?

An increasing trend for organic certified coffee.

7. Are there any restraints impacting market growth?

High Cost Associated with the Freeze-Drying Technology.

8. Can you provide examples of recent developments in the market?

In September 2022, Nestle announced its plan of investing Rs 5,000 Cr ($613m) in India by 2025 following strong demand for key products, including its portfolio of coffee brands in the market. Nestlé sells a range of retailed Nescafé products in India, including the Nescafé Classic, Gold, and Sunrise blends.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Coffee Market in Asia Pacific," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Coffee Market in Asia Pacific report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Coffee Market in Asia Pacific?

To stay informed about further developments, trends, and reports in the Coffee Market in Asia Pacific, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence