Key Insights

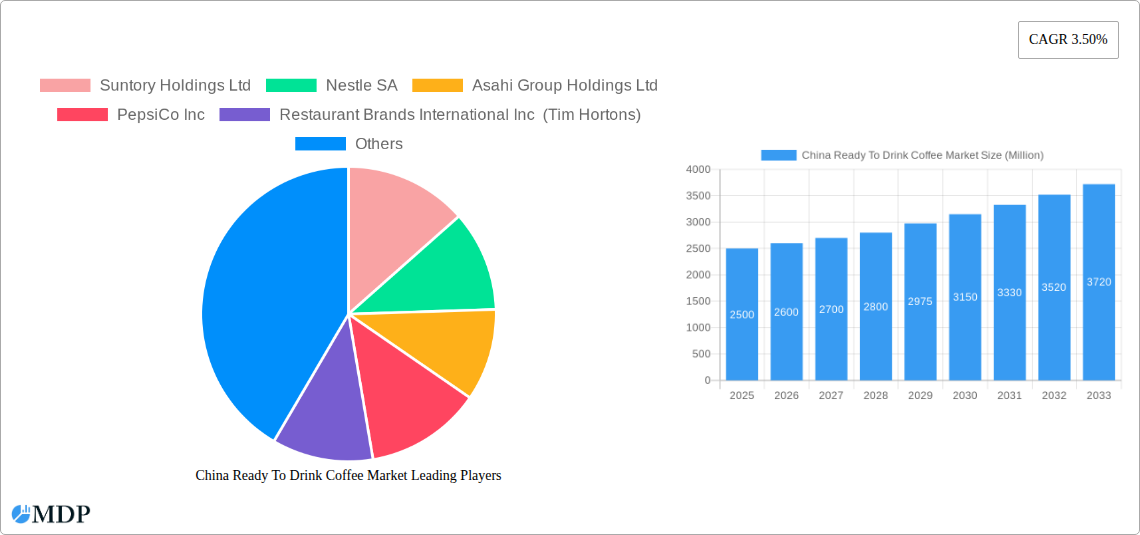

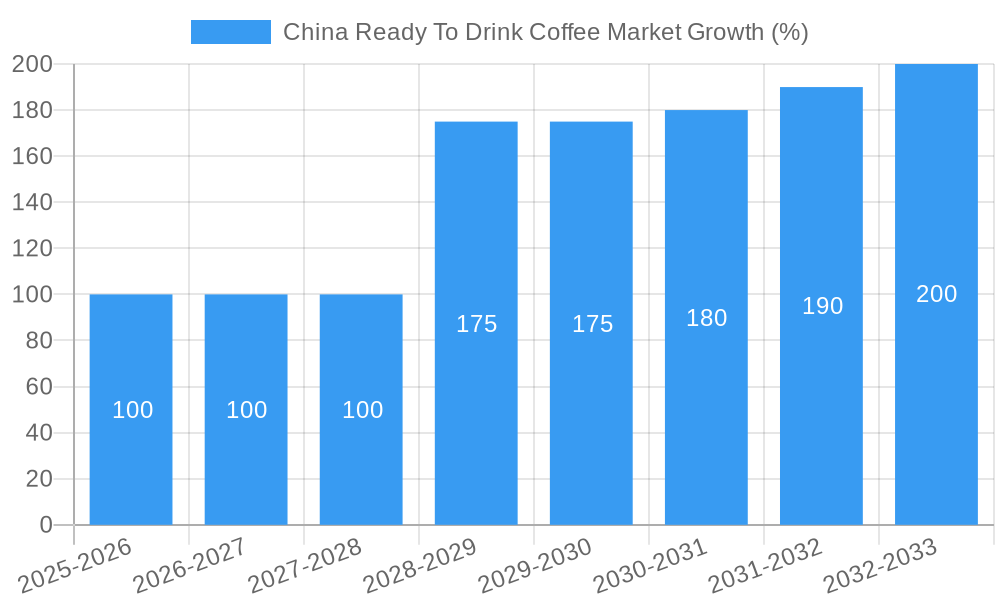

The China Ready-to-Drink (RTD) coffee market is experiencing robust growth, fueled by several key factors. The rising disposable incomes of China's burgeoning middle class, coupled with a growing preference for convenient and on-the-go consumption, are driving significant demand. A younger generation, increasingly exposed to international coffee culture, is actively embracing RTD coffee as a convenient alternative to traditional brewing methods. Furthermore, innovative product offerings, including a wider variety of flavors, functional additions (e.g., added vitamins, collagen), and premium coffee beans, are contributing to market expansion. The strategic partnerships between international coffee brands and local Chinese beverage companies are also facilitating market penetration and distribution reach. While the precise market size for 2025 is unavailable, considering a global RTD coffee market CAGR of 3.50% and the significant growth potential in China, a reasonable estimate for the 2025 market size might be in the range of $2-3 billion USD, with a projection exceeding $4 billion USD by 2033. The dominance of specific packaging types (e.g., bottles, cans) and distribution channels (e.g., supermarkets, convenience stores) will need further investigation based on location-specific market dynamics, but we can assume supermarket/hypermarket channels will maintain a significant share due to their wide availability. Challenges remain, including maintaining quality consistency across a vast geographical area and addressing potential price sensitivity among certain consumer segments.

Growth within the Chinese RTD coffee market is expected to continue at a healthy pace throughout the forecast period (2025-2033). This sustained growth will be fueled by several factors, including product innovation aimed at catering to evolving consumer tastes (e.g., plant-based milks, low-sugar options). The expansion of e-commerce platforms, and efficient delivery services, will provide increased market access. However, intense competition from established players and emerging brands will require continuous innovation and strategic marketing to maintain market share. Potential regulatory changes concerning food and beverage products could also impact market dynamics. Successfully navigating these challenges will hinge on a deep understanding of consumer preferences, effective supply chain management, and the ability to adapt to changing market conditions swiftly. Therefore, we expect a positive and steady increase in the market value over the projected period.

China Ready To Drink Coffee Market: A Comprehensive Report (2019-2033)

This in-depth report provides a comprehensive analysis of the burgeoning China Ready To Drink (RTD) Coffee market, offering invaluable insights for industry stakeholders, investors, and market entrants. With a detailed examination of market dynamics, trends, leading players, and future prospects, this report is your essential guide to navigating this rapidly evolving sector. The study period covers 2019-2033, with 2025 as the base and estimated year. The forecast period is 2025-2033, and the historical period is 2019-2024. Expect detailed analysis across key segments including packaging type (bottles, cans, others), distribution channels (supermarkets, convenience stores, foodservice, online, others), and regional variations. The report projects a market value exceeding xx Million by 2033.

China Ready To Drink Coffee Market Dynamics & Concentration

The China RTD coffee market is characterized by increasing concentration, driven by significant investments from both domestic and international players. Market share data reveals a xx% share held by the top 5 players in 2024, with a projected increase to xx% by 2033. This concentration is fueled by innovation in product offerings, aggressive marketing strategies, and strategic acquisitions. Regulatory frameworks, while generally supportive of market growth, present some hurdles, particularly in labeling and ingredient standards. The presence of substitutes, such as tea and other beverages, influences market dynamics, necessitating constant product differentiation. Consumer preferences are shifting towards healthier options with natural ingredients and unique flavors, creating opportunities for innovative products.

- Market Concentration: Top 5 players hold xx% market share (2024), projected to xx% (2033).

- Innovation Drivers: Healthier options, unique flavors, sustainable packaging.

- Regulatory Frameworks: Labeling, ingredient standards, import/export regulations.

- Product Substitutes: Tea, juices, other non-alcoholic beverages.

- M&A Activities: xx deals recorded between 2019-2024, indicative of increasing consolidation.

China Ready To Drink Coffee Market Industry Trends & Analysis

The China RTD coffee market exhibits robust growth, driven by several factors. The rising disposable incomes of the burgeoning middle class fuel increased spending on premium beverages. Urbanization and changing lifestyles are also contributing factors. The market witnessed a CAGR of xx% during the historical period (2019-2024), and a projected CAGR of xx% is anticipated for the forecast period (2025-2033). Technological advancements in beverage processing and packaging are improving product quality and shelf life. Consumer preferences are evolving towards more convenient, portable, and premium options, influencing product innovation. Competitive dynamics are intense, with both established multinational corporations and emerging local brands vying for market share. Market penetration of RTD coffee in urban areas is currently at approximately xx%, with significant potential for expansion in rural regions.

Leading Markets & Segments in China Ready To Drink Coffee Market

The convenience store channel dominates the RTD coffee distribution network, accounting for xx% of total sales in 2024, followed by supermarkets/hypermarkets at xx%. This dominance is fueled by the widespread reach of convenience stores in urban areas and their convenience for on-the-go consumption. The bottled packaging format holds the largest market share (xx%), primarily due to its perceived convenience and appeal.

- Key Drivers for Convenience Stores: Widespread availability, high foot traffic, convenient location.

- Key Drivers for Bottled Packaging: Perception of convenience and higher perceived quality compared to cans.

- Regional Dominance: Tier 1 and Tier 2 cities account for xx% of market sales due to higher disposable incomes and concentration of young professionals.

China Ready To Drink Coffee Market Product Developments

Recent product innovations focus on functional beverages with added health benefits, such as low sugar options, and the incorporation of premium coffee beans. Companies are also experimenting with unique flavors catering to local palates. These advancements aim to improve product differentiation and meet the evolving preferences of health-conscious consumers. The market is witnessing a rise in sustainable packaging options, aligning with increasing environmental awareness.

Key Drivers of China Ready To Drink Coffee Market Growth

Several key factors are driving the growth of the China RTD coffee market:

- Rising Disposable Incomes: Increasing purchasing power among the middle class fuels higher spending on premium beverages.

- Urbanization: Growing urban populations drive demand for convenient and on-the-go consumption options.

- Changing Lifestyles: Busy lifestyles contribute to the preference for quick and convenient coffee options.

- Technological Advancements: Improvements in beverage processing and packaging enhance product quality and shelf life.

Challenges in the China Ready To Drink Coffee Market Market

Despite the growth potential, the China RTD coffee market faces challenges:

- Intense Competition: The market is characterized by both established multinational corporations and agile local brands, leading to price wars and a highly competitive landscape.

- Supply Chain Issues: Fluctuations in raw material costs and logistical complexities pose ongoing challenges.

- Regulatory Hurdles: Navigating evolving regulations related to food safety and labeling can be complex.

Emerging Opportunities in China Ready To Drink Coffee Market

Significant opportunities exist for long-term growth, particularly with the expansion into less-penetrated markets. Strategic partnerships between international brands and local players facilitate market penetration and distribution. Innovations in functional and healthier RTD coffee, catering to evolving consumer preferences, remain a strong growth catalyst. The incorporation of new technologies, such as smart vending machines and customized product offerings, opens promising avenues.

Leading Players in the China Ready To Drink Coffee Market Sector

- Suntory Holdings Ltd

- Nestle SA

- Asahi Group Holdings Ltd

- PepsiCo Inc

- Restaurant Brands International Inc (Tim Hortons)

- Tsing Hsin International Group

- The Coca-Cola Company

- Uni-President Enterprises Corp

- Starbucks Corporation

- Arla Foods amba

- List Not Exhaustive

Key Milestones in China Ready To Drink Coffee Market Industry

- September 2022: Sinopec's Easy Joy and Tim Hortons launch co-branded RTD coffee products.

- September 2021: Yum China and Lavazza invest USD 200 Million in a joint venture to open 1,000 Lavazza cafes by 2025, including RTD coffee distribution.

- April 2021: Nestlé invests in a new RTD coffee product innovation center in China.

Strategic Outlook for China Ready To Drink Coffee Market Market

The future of the China RTD coffee market appears bright, with continued growth fueled by strong consumer demand, innovation, and strategic partnerships. Companies focusing on product differentiation, sustainable practices, and efficient distribution networks are well-positioned to capture significant market share. The potential for expansion into lower-tier cities and rural areas remains substantial, offering considerable growth opportunities.

China Ready To Drink Coffee Market Segmentation

-

1. Packaging Type

- 1.1. Bottles

- 1.2. Can

- 1.3. Other Packaging Types

-

2. Distribution Channel

- 2.1. Supermarkets/Hypermarkets

- 2.2. Convenience Stores

- 2.3. Foodservice Channels

- 2.4. Online Retail Stores

- 2.5. Other Distribution Channels

China Ready To Drink Coffee Market Segmentation By Geography

- 1. China

China Ready To Drink Coffee Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 3.50% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Government Initiatives and E-commerce Penetration

- 3.3. Market Restrains

- 3.3.1. Detrimental Health Impact of Caffeine Intake

- 3.4. Market Trends

- 3.4.1. Growing Preference for Coffee Over Tea

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. China Ready To Drink Coffee Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Packaging Type

- 5.1.1. Bottles

- 5.1.2. Can

- 5.1.3. Other Packaging Types

- 5.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 5.2.1. Supermarkets/Hypermarkets

- 5.2.2. Convenience Stores

- 5.2.3. Foodservice Channels

- 5.2.4. Online Retail Stores

- 5.2.5. Other Distribution Channels

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. China

- 5.1. Market Analysis, Insights and Forecast - by Packaging Type

- 6. Japan China Ready To Drink Coffee Market Analysis, Insights and Forecast, 2019-2031

- 7. China China Ready To Drink Coffee Market Analysis, Insights and Forecast, 2019-2031

- 8. India China Ready To Drink Coffee Market Analysis, Insights and Forecast, 2019-2031

- 9. Australia China Ready To Drink Coffee Market Analysis, Insights and Forecast, 2019-2031

- 10. South Korea China Ready To Drink Coffee Market Analysis, Insights and Forecast, 2019-2031

- 11. Thailand China Ready To Drink Coffee Market Analysis, Insights and Forecast, 2019-2031

- 12. New Zeland China Ready To Drink Coffee Market Analysis, Insights and Forecast, 2019-2031

- 13. Others China Ready To Drink Coffee Market Analysis, Insights and Forecast, 2019-2031

- 14. Competitive Analysis

- 14.1. Market Share Analysis 2024

- 14.2. Company Profiles

- 14.2.1 Suntory Holdings Ltd

- 14.2.1.1. Overview

- 14.2.1.2. Products

- 14.2.1.3. SWOT Analysis

- 14.2.1.4. Recent Developments

- 14.2.1.5. Financials (Based on Availability)

- 14.2.2 Nestle SA

- 14.2.2.1. Overview

- 14.2.2.2. Products

- 14.2.2.3. SWOT Analysis

- 14.2.2.4. Recent Developments

- 14.2.2.5. Financials (Based on Availability)

- 14.2.3 Asahi Group Holdings Ltd

- 14.2.3.1. Overview

- 14.2.3.2. Products

- 14.2.3.3. SWOT Analysis

- 14.2.3.4. Recent Developments

- 14.2.3.5. Financials (Based on Availability)

- 14.2.4 PepsiCo Inc

- 14.2.4.1. Overview

- 14.2.4.2. Products

- 14.2.4.3. SWOT Analysis

- 14.2.4.4. Recent Developments

- 14.2.4.5. Financials (Based on Availability)

- 14.2.5 Restaurant Brands International Inc (Tim Hortons)

- 14.2.5.1. Overview

- 14.2.5.2. Products

- 14.2.5.3. SWOT Analysis

- 14.2.5.4. Recent Developments

- 14.2.5.5. Financials (Based on Availability)

- 14.2.6 Tsing Hsin International Group

- 14.2.6.1. Overview

- 14.2.6.2. Products

- 14.2.6.3. SWOT Analysis

- 14.2.6.4. Recent Developments

- 14.2.6.5. Financials (Based on Availability)

- 14.2.7 The Coca-Cola Company

- 14.2.7.1. Overview

- 14.2.7.2. Products

- 14.2.7.3. SWOT Analysis

- 14.2.7.4. Recent Developments

- 14.2.7.5. Financials (Based on Availability)

- 14.2.8 Uni-President Enterprises Corp

- 14.2.8.1. Overview

- 14.2.8.2. Products

- 14.2.8.3. SWOT Analysis

- 14.2.8.4. Recent Developments

- 14.2.8.5. Financials (Based on Availability)

- 14.2.9 Starbucks Corporation

- 14.2.9.1. Overview

- 14.2.9.2. Products

- 14.2.9.3. SWOT Analysis

- 14.2.9.4. Recent Developments

- 14.2.9.5. Financials (Based on Availability)

- 14.2.10 Arla Foods amba*List Not Exhaustive

- 14.2.10.1. Overview

- 14.2.10.2. Products

- 14.2.10.3. SWOT Analysis

- 14.2.10.4. Recent Developments

- 14.2.10.5. Financials (Based on Availability)

- 14.2.1 Suntory Holdings Ltd

List of Figures

- Figure 1: China Ready To Drink Coffee Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: China Ready To Drink Coffee Market Share (%) by Company 2024

List of Tables

- Table 1: China Ready To Drink Coffee Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: China Ready To Drink Coffee Market Revenue Million Forecast, by Packaging Type 2019 & 2032

- Table 3: China Ready To Drink Coffee Market Revenue Million Forecast, by Distribution Channel 2019 & 2032

- Table 4: China Ready To Drink Coffee Market Revenue Million Forecast, by Region 2019 & 2032

- Table 5: China Ready To Drink Coffee Market Revenue Million Forecast, by Country 2019 & 2032

- Table 6: Japan China Ready To Drink Coffee Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 7: China China Ready To Drink Coffee Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 8: India China Ready To Drink Coffee Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: Australia China Ready To Drink Coffee Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: South Korea China Ready To Drink Coffee Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 11: Thailand China Ready To Drink Coffee Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 12: New Zeland China Ready To Drink Coffee Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 13: Others China Ready To Drink Coffee Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 14: China Ready To Drink Coffee Market Revenue Million Forecast, by Packaging Type 2019 & 2032

- Table 15: China Ready To Drink Coffee Market Revenue Million Forecast, by Distribution Channel 2019 & 2032

- Table 16: China Ready To Drink Coffee Market Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the China Ready To Drink Coffee Market?

The projected CAGR is approximately 3.50%.

2. Which companies are prominent players in the China Ready To Drink Coffee Market?

Key companies in the market include Suntory Holdings Ltd, Nestle SA, Asahi Group Holdings Ltd, PepsiCo Inc, Restaurant Brands International Inc (Tim Hortons), Tsing Hsin International Group, The Coca-Cola Company, Uni-President Enterprises Corp, Starbucks Corporation, Arla Foods amba*List Not Exhaustive.

3. What are the main segments of the China Ready To Drink Coffee Market?

The market segments include Packaging Type, Distribution Channel.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Government Initiatives and E-commerce Penetration.

6. What are the notable trends driving market growth?

Growing Preference for Coffee Over Tea.

7. Are there any restraints impacting market growth?

Detrimental Health Impact of Caffeine Intake.

8. Can you provide examples of recent developments in the market?

In September 2022, a convenience store in China, Sinopec's Easy Joy, and Tim Horton's International Limited, the exclusive operator of Tim Hortons coffee shops in China, partnered and launched two co-branded ready-to-drink coffee products.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "China Ready To Drink Coffee Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the China Ready To Drink Coffee Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the China Ready To Drink Coffee Market?

To stay informed about further developments, trends, and reports in the China Ready To Drink Coffee Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence