Key Insights

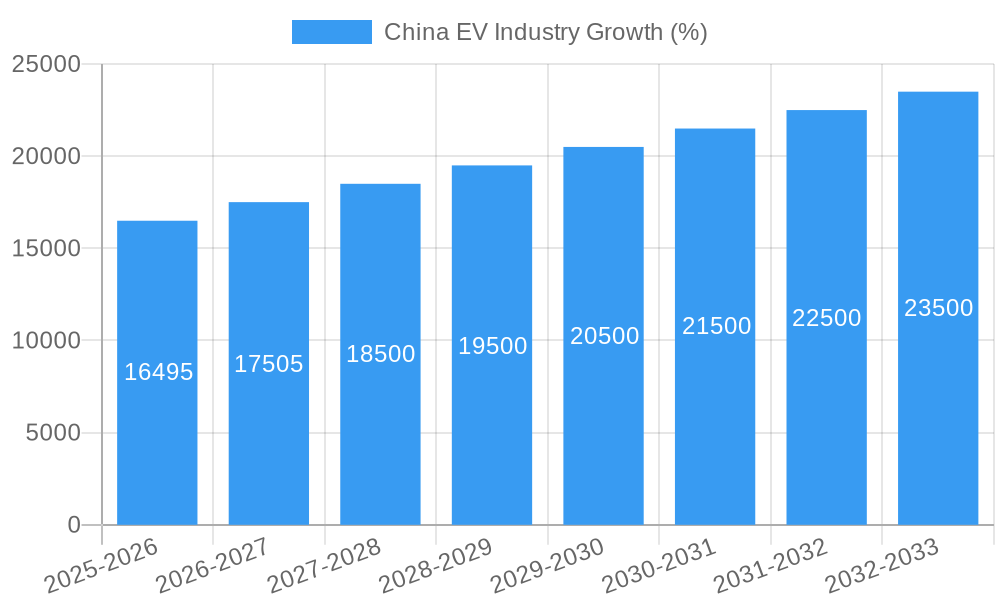

The China electric vehicle (EV) industry is experiencing robust growth, driven by strong government support, increasing environmental awareness, and advancements in battery technology. With a Compound Annual Growth Rate (CAGR) exceeding 6.59% from 2019 to 2024, the market demonstrates significant potential. The market size in 2025 is estimated to be substantial, considering the consistent high growth rate. Key segments driving this expansion include Battery Electric Vehicles (BEVs), Plug-in Hybrid Electric Vehicles (PHEVs), and passenger cars. Leading players like BYD Auto, Tesla, Nio, and GAC Aion are shaping the market landscape through innovation in vehicle design, battery technology, and charging infrastructure. The government's commitment to reducing carbon emissions and promoting domestic EV manufacturing further fuels market expansion. However, challenges remain, including the need for continued investment in charging infrastructure to address range anxiety, the development of more affordable EV models to reach a wider consumer base, and ensuring the sustainable sourcing of raw materials for battery production.

Despite these challenges, the long-term outlook for the China EV market remains positive. The forecast period (2025-2033) is projected to witness continued expansion, propelled by ongoing technological advancements, improvements in battery performance and lifespan, and the increasing availability of diverse EV models. The government's continued support, combined with escalating consumer demand and the increasing competitiveness of domestic manufacturers, positions China as a global leader in the EV sector. Growth will likely be influenced by factors such as evolving consumer preferences, government policies concerning subsidies and emission standards, and advancements in autonomous driving technology. The market segmentation by fuel category (BEV, FCEV, HEV, PHEV) and vehicle configuration (passenger cars) provides valuable insights into specific growth areas and potential investment opportunities within the wider EV ecosystem.

China EV Industry: 2019-2033 Market Analysis & Forecast Report

This comprehensive report provides an in-depth analysis of the dynamic China Electric Vehicle (EV) industry, offering invaluable insights for stakeholders, investors, and industry professionals. Covering the period from 2019 to 2033, with a focus on 2025, this report unveils the market's current state, future trajectory, and key players shaping its evolution. We project a market size of xx Million by 2033, driven by strong government support and burgeoning consumer demand. Download now to gain a competitive edge!

China EV Industry Market Dynamics & Concentration

The China EV market, valued at xx Million in 2024, exhibits a complex interplay of factors driving its growth and consolidation. Market concentration is moderate, with a few dominant players like BYD Auto Co Ltd and Tesla Inc commanding significant shares alongside several rapidly growing domestic brands. Innovation is fueled by substantial R&D investment and government incentives focused on battery technology, autonomous driving, and charging infrastructure. The regulatory landscape, characterized by stringent emission standards and supportive policies, plays a crucial role in shaping market dynamics. Product substitutes, primarily internal combustion engine (ICE) vehicles, face increasing pressure due to cost parity and environmental concerns. End-user trends reveal a strong preference for BEVs (Battery Electric Vehicles) in urban areas and PHEVs (Plug-in Hybrid Electric Vehicles) in rural areas. The market has seen significant M&A activity.

- Market Share (2024): BYD Auto Co Ltd (xx%), Tesla Inc (xx%), others (xx%)

- M&A Deal Count (2019-2024): xx deals, indicating industry consolidation.

- Innovation Drivers: Battery technology advancements, autonomous driving features, improved charging infrastructure.

- Regulatory Framework: Stringent emission standards, subsidies for EV adoption, charging infrastructure development plans.

China EV Industry Industry Trends & Analysis

The China EV market is experiencing explosive growth, driven by a confluence of factors. Government initiatives promoting electric mobility have been pivotal, coupled with increasing consumer awareness of environmental concerns and the falling cost of battery technology. Technological advancements are rapidly improving battery range, charging speed, and vehicle performance, fueling wider adoption. Consumer preferences are shifting towards larger, more feature-rich EVs, with a growing emphasis on smart connectivity and autonomous capabilities. Competitive dynamics are intense, with both established automakers and new entrants vying for market share, resulting in rapid innovation and price competition. The Compound Annual Growth Rate (CAGR) from 2025 to 2033 is projected at xx%, indicating substantial market expansion. Market penetration is expected to reach xx% by 2033.

Leading Markets & Segments in China EV Industry

The dominant segment in the China EV market is currently BEVs, driven by decreasing battery costs and enhanced performance. Passenger cars constitute the largest vehicle configuration segment. The leading regions are concentrated in major urban centers and coastal provinces due to higher consumer purchasing power and well-developed charging infrastructure.

- Key Drivers for BEV Dominance: Falling battery prices, improved range and performance, government subsidies.

- Key Drivers for Passenger Car Dominance: Strong consumer demand, extensive model variety, supportive government policies.

- Regional Dominance: Major metropolitan areas and economically developed coastal provinces.

- Dominant Fuel Category: BEV

- Dominant Vehicle Configuration: Passenger Cars

China EV Industry Product Developments

Recent product innovations focus on enhancing battery technology, autonomous driving capabilities, and connectivity features. Improved battery density extends driving range, while advanced driver-assistance systems (ADAS) and autonomous features enhance safety and user experience. Companies are prioritizing competitive advantages through superior technology, cost-effectiveness, and brand recognition. These developments cater to the increasing consumer demand for sophisticated and environmentally friendly vehicles.

Key Drivers of China EV Industry Growth

The phenomenal growth of the China EV industry stems from a combination of factors. Government policies, including subsidies and stringent emission regulations, have strongly incentivized EV adoption. Technological advancements, particularly in battery technology, have made EVs more affordable and practical. Rising consumer awareness of environmental concerns and a growing preference for sustainable transportation have further boosted demand. Furthermore, the development of charging infrastructure is crucial to support the expanding EV fleet.

Challenges in the China EV Industry Market

Despite significant progress, the China EV market faces several challenges. Supply chain disruptions, particularly concerning battery materials, can affect production and pricing. Intense competition from both domestic and international players necessitates continuous innovation and cost optimization. Ensuring adequate charging infrastructure development to support the growing EV population remains an important task. Regulatory changes and evolving standards pose ongoing challenges for manufacturers. These factors, if not adequately addressed, could impede the industry's sustained growth.

Emerging Opportunities in China EV Industry

Significant opportunities exist for further growth. Technological breakthroughs in solid-state batteries and advancements in autonomous driving technology promise to revolutionize the EV landscape. Strategic partnerships between automakers, battery manufacturers, and technology companies can unlock synergies and drive innovation. Expanding into new markets, both within China and internationally, presents significant growth potential. Investment in charging infrastructure and battery recycling will support sustainable development and minimize environmental impact.

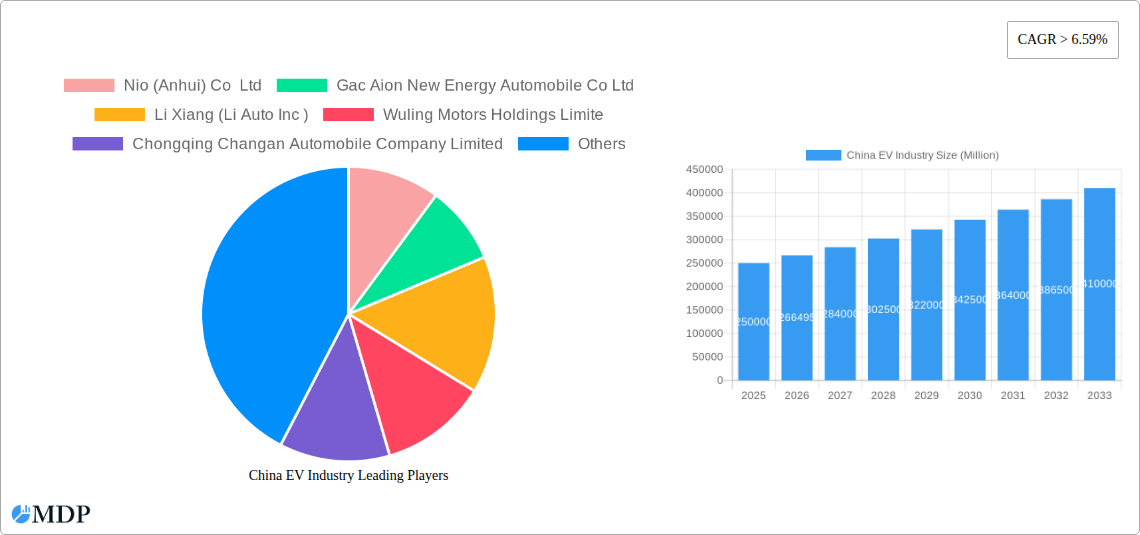

Leading Players in the China EV Industry Sector

- Nio (Anhui) Co Ltd

- Gac Aion New Energy Automobile Co Ltd

- Li Xiang (Li Auto Inc)

- Wuling Motors Holdings Limite

- Chongqing Changan Automobile Company Limited

- Volkswagen AG

- Hozon New Energy Automobile Co Ltd

- Tesla Inc

- BYD Auto Co Ltd

- Chery Automobile Co Ltd

Key Milestones in China EV Industry Industry

- November 2023: Tesla acquired US-based start-up SiILion battery (Battery manufacturer), enhancing its battery production capabilities in the US.

- November 2023: Volkswagen launched the new Nivus in Argentina, expanding its market reach in South America.

- November 2023: Tesla opened a new super-charging station between the Bay Area and Los Angeles, improving charging infrastructure in the US.

Strategic Outlook for China EV Industry Market

The China EV market is poised for continued strong growth, driven by technological innovation, supportive government policies, and increasing consumer demand. Strategic opportunities abound for companies that can leverage technological advancements, build robust supply chains, and adapt to evolving consumer preferences. Focus on battery technology, autonomous driving, and smart connectivity will be key to success. The market presents significant potential for both established players and new entrants, promising a dynamic and exciting future.

China EV Industry Segmentation

-

1. Vehicle Configuration

-

1.1. Passenger Cars

- 1.1.1. Hatchback

- 1.1.2. Multi-purpose Vehicle

- 1.1.3. Sedan

- 1.1.4. Sports Utility Vehicle

-

1.1. Passenger Cars

-

2. Fuel Category

- 2.1. BEV

- 2.2. FCEV

- 2.3. HEV

- 2.4. PHEV

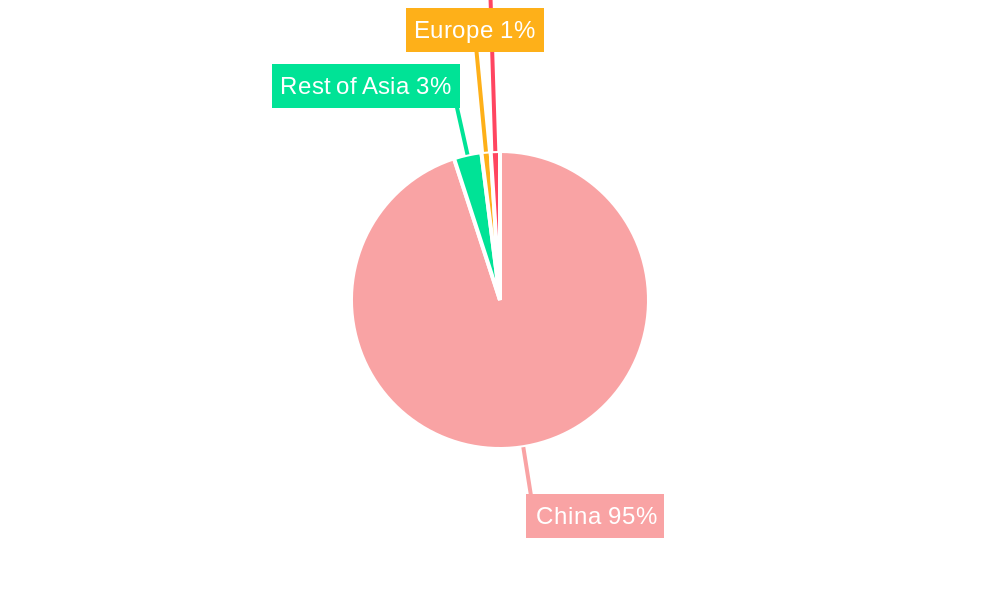

China EV Industry Segmentation By Geography

- 1. China

China EV Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of > 6.59% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Air Pollution Awareness and Health Concern is Driving the Demand

- 3.3. Market Restrains

- 3.3.1. High Cost of Installation Related to Industrial Robots

- 3.4. Market Trends

- 3.4.1. OTHER KEY INDUSTRY TRENDS COVERED IN THE REPORT

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. China EV Industry Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Vehicle Configuration

- 5.1.1. Passenger Cars

- 5.1.1.1. Hatchback

- 5.1.1.2. Multi-purpose Vehicle

- 5.1.1.3. Sedan

- 5.1.1.4. Sports Utility Vehicle

- 5.1.1. Passenger Cars

- 5.2. Market Analysis, Insights and Forecast - by Fuel Category

- 5.2.1. BEV

- 5.2.2. FCEV

- 5.2.3. HEV

- 5.2.4. PHEV

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. China

- 5.1. Market Analysis, Insights and Forecast - by Vehicle Configuration

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2024

- 6.2. Company Profiles

- 6.2.1 Nio (Anhui) Co Ltd

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Gac Aion New Energy Automobile Co Ltd

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Li Xiang (Li Auto Inc )

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Wuling Motors Holdings Limite

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Chongqing Changan Automobile Company Limited

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Volkswagen AG

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Hozon New Energy Automobile Co Ltd

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Tesla Inc

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 BYD Auto Co Ltd

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Chery Automobile Co Ltd

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 Nio (Anhui) Co Ltd

List of Figures

- Figure 1: China EV Industry Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: China EV Industry Share (%) by Company 2024

List of Tables

- Table 1: China EV Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 2: China EV Industry Revenue Million Forecast, by Vehicle Configuration 2019 & 2032

- Table 3: China EV Industry Revenue Million Forecast, by Fuel Category 2019 & 2032

- Table 4: China EV Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 5: China EV Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 6: China EV Industry Revenue Million Forecast, by Vehicle Configuration 2019 & 2032

- Table 7: China EV Industry Revenue Million Forecast, by Fuel Category 2019 & 2032

- Table 8: China EV Industry Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the China EV Industry?

The projected CAGR is approximately > 6.59%.

2. Which companies are prominent players in the China EV Industry?

Key companies in the market include Nio (Anhui) Co Ltd, Gac Aion New Energy Automobile Co Ltd, Li Xiang (Li Auto Inc ), Wuling Motors Holdings Limite, Chongqing Changan Automobile Company Limited, Volkswagen AG, Hozon New Energy Automobile Co Ltd, Tesla Inc, BYD Auto Co Ltd, Chery Automobile Co Ltd.

3. What are the main segments of the China EV Industry?

The market segments include Vehicle Configuration, Fuel Category.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Increasing Air Pollution Awareness and Health Concern is Driving the Demand.

6. What are the notable trends driving market growth?

OTHER KEY INDUSTRY TRENDS COVERED IN THE REPORT.

7. Are there any restraints impacting market growth?

High Cost of Installation Related to Industrial Robots.

8. Can you provide examples of recent developments in the market?

November 2023: Tesla has acquired US-based start-up SiILion battery (Battery manufacturer) to excel the battery production in US.November 2023: In Argentina, Volkswagen debuted the brand-new Nivus. Both the Comfortline and Highline models of the VW Nivus will be offered in Argentina. They both come equipped with a 1.0-liter TSi three-cylinder engine that generates 116 horsepower and 200 Nm of torque and is coupled to a six-speed automated transmission.November 2023: Tesla opened its single-point electric vehicle super-charging station between the Bay Area and Los Angeles areas in the US.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "China EV Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the China EV Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the China EV Industry?

To stay informed about further developments, trends, and reports in the China EV Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence