Key Insights

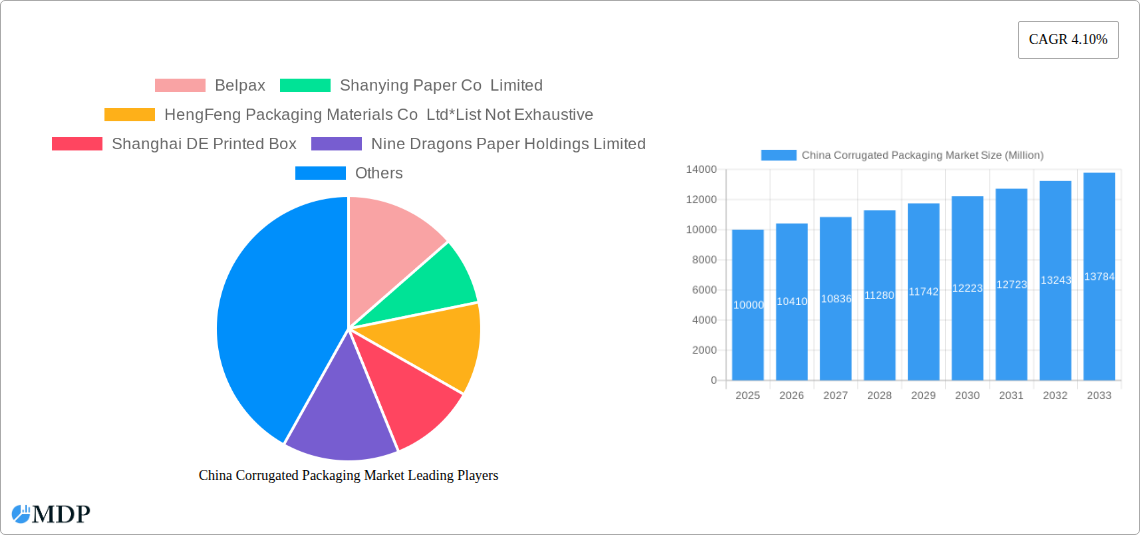

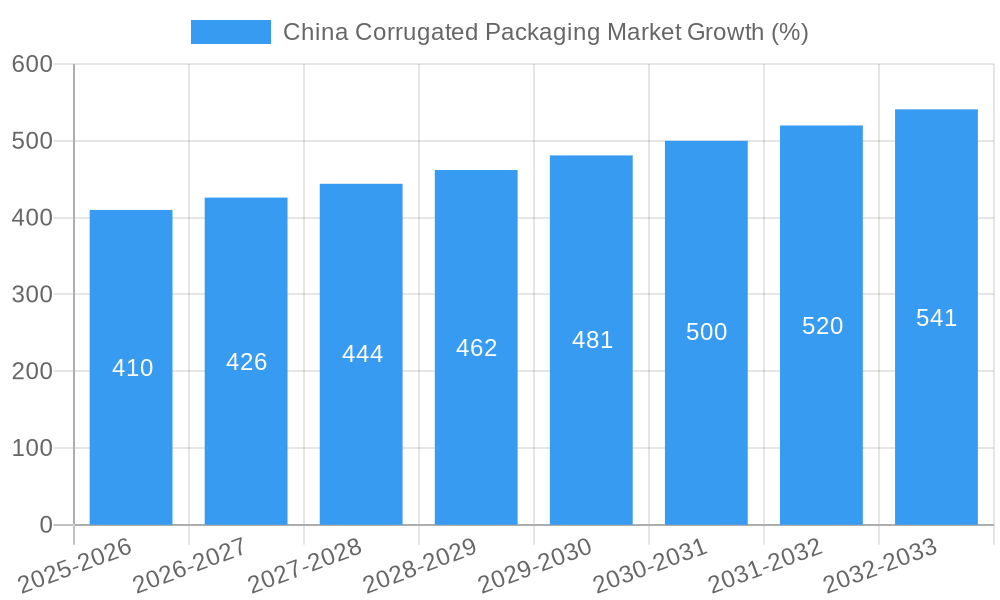

The China corrugated packaging market, valued at approximately $XX million in 2025, exhibits robust growth potential, projected to expand at a compound annual growth rate (CAGR) of 4.10% from 2025 to 2033. This growth is primarily driven by the burgeoning e-commerce sector, fueling demand for efficient and cost-effective packaging solutions. The increasing preference for sustainable packaging materials, coupled with stringent government regulations promoting environmentally friendly practices, further contributes to market expansion. Key segments like food and beverage, and electrical goods, are major contributors to market size, while the industrial and stationary sectors represent emerging opportunities for growth. Leading players like Belpax, Shanying Paper Co Limited, and Nine Dragons Paper Holdings Limited are shaping the market landscape through innovation and expansion strategies. However, fluctuations in raw material prices and intense competition among established and emerging players pose challenges to sustained growth. The market's resilience is underscored by its ability to adapt to evolving consumer preferences and regulatory changes. A shift towards lightweight, recyclable, and customized packaging solutions is expected to dominate future market trends.

The forecast period (2025-2033) anticipates a steady rise in market value, driven by sustained economic growth and increasing consumer demand. Specific growth projections within individual end-user segments will vary based on factors such as consumption patterns, economic development, and government policies. China's robust manufacturing sector and expanding logistics networks create a favorable environment for the corrugated packaging market. The market's dynamic nature necessitates continuous adaptation by companies to maintain competitiveness. Strategic partnerships, technological advancements in packaging design and manufacturing, and emphasis on sustainability will be crucial factors for achieving long-term success within this competitive yet promising market.

China Corrugated Packaging Market: A Comprehensive Report (2019-2033)

This comprehensive report provides an in-depth analysis of the China corrugated packaging market, offering invaluable insights for industry stakeholders, investors, and businesses seeking to navigate this dynamic sector. Covering the period from 2019 to 2033, with a base year of 2025, this report unveils the market's current state, future trajectory, and key players shaping its evolution. The market is projected to reach XX Million by 2033, exhibiting a CAGR of XX% during the forecast period (2025-2033).

China Corrugated Packaging Market Market Dynamics & Concentration

The China corrugated packaging market is characterized by a moderately concentrated landscape, with several large players commanding significant market share. Market concentration is influenced by factors like economies of scale, technological capabilities, and access to raw materials. While precise market share figures for individual companies are proprietary, Nine Dragons Paper Holdings Limited and Shanying Paper Co Limited are known to be major players. The market exhibits strong innovation, driven by advancements in printing technology, automation, and sustainable materials. Regulatory frameworks, including environmental regulations and product safety standards, are continuously evolving, impacting production processes and packaging design. Substitute products like plastic packaging present a competitive challenge, although corrugated packaging maintains a strong position due to its cost-effectiveness and recyclability. End-user trends towards e-commerce and customized packaging are fueling demand. Mergers and acquisitions (M&A) activities, while not frequent, have shaped the market landscape. Over the historical period (2019-2024), an estimated xx M&A deals occurred, primarily driven by consolidation efforts and expansion strategies.

China Corrugated Packaging Market Industry Trends & Analysis

The China corrugated packaging market is experiencing robust growth, fueled by several key factors. The burgeoning e-commerce sector is a significant driver, with increasing demand for efficient and protective packaging solutions. Technological advancements, such as automated production lines and advanced printing techniques, are enhancing efficiency and expanding product offerings. Changing consumer preferences towards sustainable and aesthetically pleasing packaging are also impacting market dynamics. The rise of customized packaging, tailored to specific brand requirements, is gaining traction. The competitive landscape is intense, with established players focusing on innovation, cost optimization, and expansion into new segments. The market penetration of sustainable corrugated packaging solutions is steadily increasing, driven by environmental awareness and governmental regulations. The market is expected to grow at a CAGR of XX% between 2025 and 2033.

Leading Markets & Segments in China Corrugated Packaging Market

The food and beverage segment dominates the China corrugated packaging market, driven by the country's large population and expanding food processing industry. This segment's rapid growth is fueled by increasing consumer demand for packaged food products. The strong growth in e-commerce and online grocery shopping also contributes significantly to the high demand for corrugated packaging in this sector. The electrical goods and household segments are also experiencing substantial growth, reflecting the rising living standards and increasing demand for consumer durables in China.

- Key Drivers for Food & Beverage Segment Dominance:

- Robust growth of the food processing industry.

- Expansion of e-commerce and online grocery platforms.

- Rising consumer preference for packaged food items.

- Stringent regulations for food safety and packaging hygiene.

The dominance of the food and beverage sector is further amplified by favorable economic policies encouraging food production and distribution, and the development of robust cold chain logistics infrastructure. This robust infrastructure facilitates the efficient transportation of packaged food products across the country, supporting the significant demand for corrugated packaging.

China Corrugated Packaging Market Product Developments

Recent product developments focus on sustainable materials, innovative designs, and enhanced functionality. The integration of recycled content and biodegradable materials is gaining prominence, aligning with environmental concerns. Advanced printing technologies, such as high-definition flexography and digital printing, are enabling sophisticated packaging designs, enhancing brand appeal. The development of specialized packaging solutions for specific products, including e-commerce packaging with improved protection and tamper-evident features, is driving market growth.

Key Drivers of China Corrugated Packaging Market Growth

Several factors are driving the growth of the China corrugated packaging market. The continuous expansion of the e-commerce sector necessitates efficient and protective packaging, creating substantial demand. The increasing preference for consumer goods in various sectors fuels demand for attractive and functional packaging. Governmental initiatives promoting sustainable packaging solutions are also driving market growth. Finally, technological advancements in manufacturing and printing technologies enhance efficiency and customization options.

Challenges in the China Corrugated Packaging Market Market

The China corrugated packaging market faces challenges such as fluctuating raw material prices, impacting production costs. Intense competition among numerous players necessitates efficient cost management and innovation. Environmental regulations are increasingly stringent, requiring manufacturers to adopt sustainable practices. Supply chain disruptions can impact production and delivery timelines. The impact of these challenges on market growth is estimated to be XX Million annually.

Emerging Opportunities in China Corrugated Packaging Market

The growing demand for sustainable packaging presents substantial opportunities for manufacturers offering eco-friendly solutions. The integration of smart packaging technologies, enabling features such as track and trace capabilities and product authentication, offers significant growth potential. Strategic partnerships with e-commerce giants and food processors will provide access to larger markets. Expansion into regional markets with growing demand for packaged goods is an important strategic avenue.

Leading Players in the China Corrugated Packaging Market Sector

- Belpax

- Shanying Paper Co Limited

- HengFeng Packaging Materials Co Ltd

- Shanghai DE Printed Box

- Nine Dragons Paper Holdings Limited

- Hung Hing Printing Group Limited

Key Milestones in China Corrugated Packaging Market Industry

- November 2022: Ningbo Unico Packing Co., Ltd. installed a fully automated packaging machine, increasing its rigid gift box production capacity to 300,000 pieces per month. This highlights the industry's adoption of advanced technologies to enhance efficiency and output.

Strategic Outlook for China Corrugated Packaging Market Market

The future of the China corrugated packaging market appears bright, driven by continued e-commerce growth, rising consumer demand, and the adoption of sustainable practices. Strategic focus on innovation, technological advancements, and sustainable solutions will be critical for long-term success. Companies focusing on customized packaging solutions and efficient supply chain management are expected to thrive. The market presents significant opportunities for both established players and new entrants.

China Corrugated Packaging Market Segmentation

-

1. End-user Industry

- 1.1. Food

- 1.2. Beverages

- 1.3. Electrical goods

- 1.4. Household

- 1.5. Other En

China Corrugated Packaging Market Segmentation By Geography

- 1. China

China Corrugated Packaging Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 4.10% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increase in Environmental Awareness by Urban Populations; Growing Demand for Sustainable Packaging; Strong Demand from the E-commerce Sector

- 3.3. Market Restrains

- 3.3.1. High Competition from Substitute Packaging Solutions; Improved Technology Offering Better Solutions

- 3.4. Market Trends

- 3.4.1. Strong Demand from the E-commerce Sector

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. China Corrugated Packaging Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by End-user Industry

- 5.1.1. Food

- 5.1.2. Beverages

- 5.1.3. Electrical goods

- 5.1.4. Household

- 5.1.5. Other En

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. China

- 5.1. Market Analysis, Insights and Forecast - by End-user Industry

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2024

- 6.2. Company Profiles

- 6.2.1 Belpax

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Shanying Paper Co Limited

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 HengFeng Packaging Materials Co Ltd*List Not Exhaustive

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Shanghai DE Printed Box

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Nine Dragons Paper Holdings Limited

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Hung Hing Printing Group Limited

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.1 Belpax

List of Figures

- Figure 1: China Corrugated Packaging Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: China Corrugated Packaging Market Share (%) by Company 2024

List of Tables

- Table 1: China Corrugated Packaging Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: China Corrugated Packaging Market Revenue Million Forecast, by End-user Industry 2019 & 2032

- Table 3: China Corrugated Packaging Market Revenue Million Forecast, by Region 2019 & 2032

- Table 4: China Corrugated Packaging Market Revenue Million Forecast, by Country 2019 & 2032

- Table 5: China Corrugated Packaging Market Revenue Million Forecast, by End-user Industry 2019 & 2032

- Table 6: China Corrugated Packaging Market Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the China Corrugated Packaging Market?

The projected CAGR is approximately 4.10%.

2. Which companies are prominent players in the China Corrugated Packaging Market?

Key companies in the market include Belpax, Shanying Paper Co Limited, HengFeng Packaging Materials Co Ltd*List Not Exhaustive, Shanghai DE Printed Box, Nine Dragons Paper Holdings Limited, Hung Hing Printing Group Limited.

3. What are the main segments of the China Corrugated Packaging Market?

The market segments include End-user Industry.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Increase in Environmental Awareness by Urban Populations; Growing Demand for Sustainable Packaging; Strong Demand from the E-commerce Sector.

6. What are the notable trends driving market growth?

Strong Demand from the E-commerce Sector.

7. Are there any restraints impacting market growth?

High Competition from Substitute Packaging Solutions; Improved Technology Offering Better Solutions.

8. Can you provide examples of recent developments in the market?

November 2022: Ningbo Unico Packing Co., Ltd. purchased a fully-automatic packaging machine and successfully set up the full production line for all kinds of custom cardboard rigid gift boxes. The company's production capacity has now increased to 300,000 pieces of rigid gift boxes per month. The machine takes all work from box printing, mold setting up, lamination, and surface add-ons to final assembling.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "China Corrugated Packaging Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the China Corrugated Packaging Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the China Corrugated Packaging Market?

To stay informed about further developments, trends, and reports in the China Corrugated Packaging Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence