Key Insights

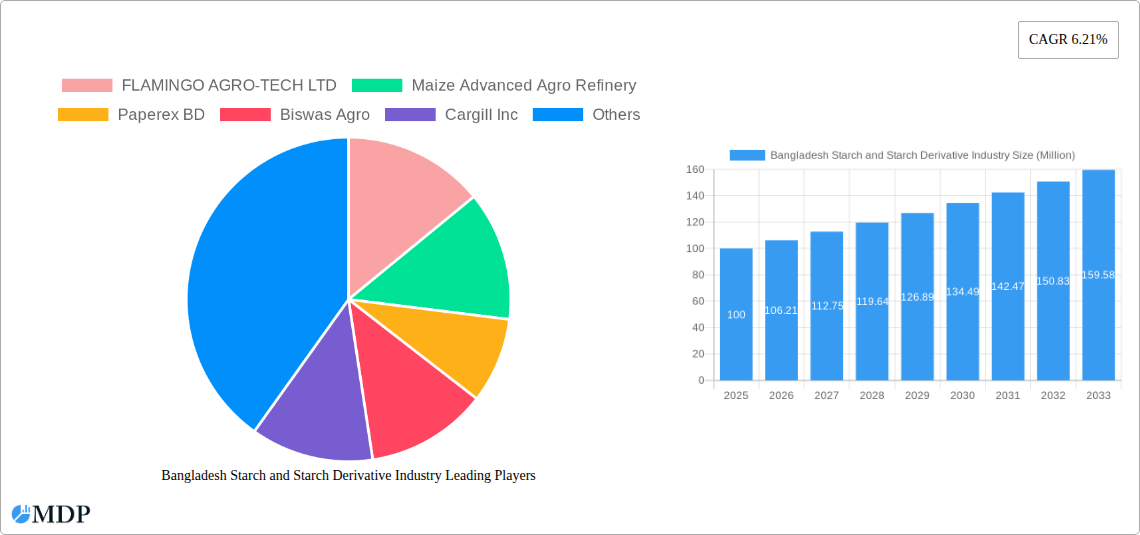

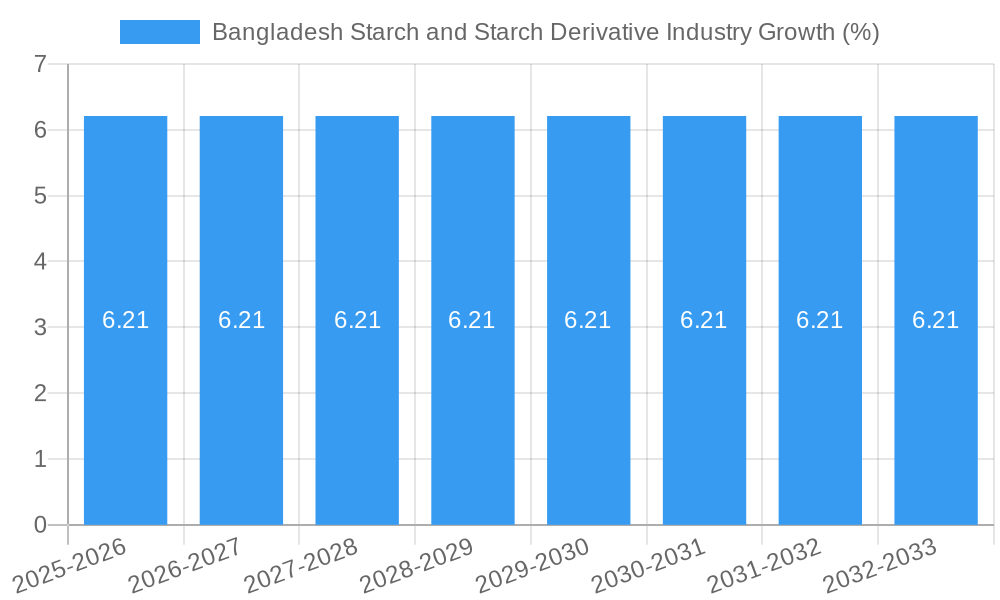

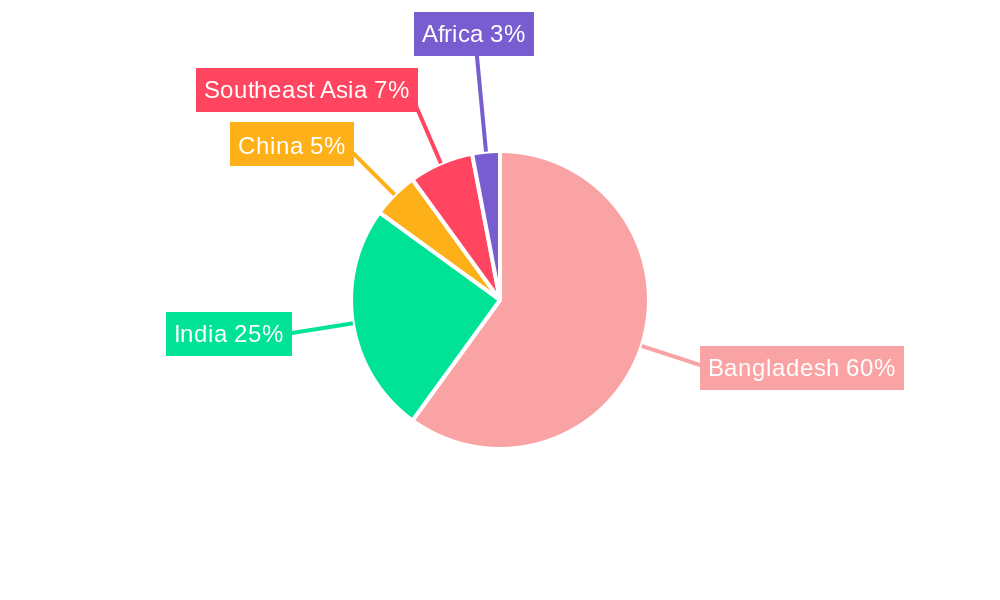

The Bangladesh starch and starch derivative industry, valued at approximately $XX million in 2025, is projected to experience robust growth, exhibiting a Compound Annual Growth Rate (CAGR) of 6.21% from 2025 to 2033. This expansion is fueled by several key drivers. The burgeoning textile industry in Bangladesh, a significant consumer of starch as a sizing agent, is a primary catalyst. The growing food and beverage sector, demanding starch for thickening and stabilizing agents, further contributes to market growth. Increasing demand from the paper and corrugation industries, alongside a rising pharmaceutical sector utilizing starch derivatives, also propels market expansion. Furthermore, the diversification of applications for modified starches, particularly in the food industry, is creating new opportunities. However, challenges remain. Price fluctuations in raw materials, like maize and cassava, pose a significant constraint. Competition from imported starch products, along with technological limitations in some local production facilities, also present hurdles to the industry's growth. Despite these restraints, the favorable demographics of Bangladesh and government initiatives aimed at supporting the agricultural and manufacturing sectors are expected to provide a positive outlook for the industry. The regional segmentation shows significant contribution from Bangladesh itself, followed by India and then other South East Asian Countries. The study period from 2019-2024 already shows growth within the Bangladesh market, and projection till 2033 is very encouraging. The prevalent product types are starch and modified starch, alongside glucose and fructose, each catering to specific industry requirements. Companies like Flamingo Agro-Tech Ltd., Maize Advanced Agro Refinery, and Cargill Inc. are key players, contributing to the industry's dynamic landscape.

The forecast for the Bangladesh starch and starch derivative market is promising. While challenges exist, the inherent growth potential within the country's expanding industries, coupled with a rising population and increased disposable incomes, will support consistent growth. Further investment in technology and research & development within the starch processing sector is crucial to optimize production, reduce costs and enhance competitiveness. This will also ensure Bangladesh can meet the increasing domestic demand and potentially explore export opportunities in the regional market. Focusing on value-added products such as modified starches and specialized derivatives will be vital in attracting higher margins and greater market share.

Bangladesh Starch and Starch Derivative Industry: A Comprehensive Market Report (2019-2033)

This in-depth report provides a comprehensive analysis of the Bangladesh starch and starch derivative industry, offering invaluable insights for stakeholders seeking to navigate this dynamic market. The report covers the period from 2019 to 2033, with a focus on the year 2025, and includes detailed analysis of market dynamics, leading players, emerging opportunities, and challenges. This meticulously researched report leverages extensive data analysis to provide actionable intelligence for strategic decision-making.

High-Traffic Keywords: Bangladesh starch market, starch derivatives industry Bangladesh, starch industry growth, Bangladesh food industry, modified starch market, glucose market Bangladesh, fructose market, Bangladesh textile industry, paper and corrugation industry Bangladesh, starch market analysis, Bangladesh agricultural industry, starch market size Bangladesh.

Bangladesh Starch and Starch Derivative Industry Market Dynamics & Concentration

The Bangladesh starch and starch derivative market is characterized by moderate concentration, with several key players holding significant market share. The market size in 2025 is estimated at xx Million USD. While precise market share figures for individual companies are proprietary, Cargill Inc., KMC, and FLAMINGO AGRO-TECH LTD are considered major players, though exact percentages remain confidential. Innovation is driven by the increasing demand for modified starches in diverse applications, alongside government initiatives supporting agricultural development. The regulatory framework is generally supportive, but further streamlining could enhance industry competitiveness. Substitutes, such as synthetic polymers, exist but haven’t significantly impacted the market due to starch's cost-effectiveness and biodegradability. End-user trends reflect a growing demand for high-quality, functional starches. M&A activity remains relatively low, with less than 5 deals recorded in the last five years.

- Market Concentration: Moderately concentrated.

- Innovation Drivers: Demand for modified starches, government support.

- Regulatory Framework: Supportive, with potential for improvement.

- Product Substitutes: Synthetic polymers, limited market impact.

- End-User Trends: Increasing demand for high-quality, functional starches.

- M&A Activity: Low; fewer than 5 deals in the last five years.

Bangladesh Starch and Starch Derivative Industry Industry Trends & Analysis

The Bangladesh starch and starch derivative market is experiencing robust growth, projected to reach xx Million USD by 2033, with a Compound Annual Growth Rate (CAGR) of xx% during the forecast period (2025-2033). This growth is fueled by several key factors: expansion of the food and beverage, textile, and paper industries; increasing consumer demand for processed foods; and the rising adoption of modified starches in various applications. Technological advancements, especially in starch modification processes, are improving product functionality and expanding applications. Competitive dynamics are primarily driven by price competition, product differentiation, and capacity expansion. Market penetration of modified starches remains relatively high in the food and beverage sector, with significant growth potential in the pharmaceutical and other applications.

Leading Markets & Segments in Bangladesh Starch and Starch Derivative Industry

The Bangladesh domestic market is currently the largest segment for starch and starch derivatives, driven by strong local demand across various sectors. However, significant export opportunities exist in neighboring countries like India, China, and Southeast Asia, as well as African nations. The food and beverage industry dominates the application segment, followed by the textile and paper industries.

Key Drivers by Segment:

- Bangladesh (Domestic Market): Strong local demand, robust food processing sector, growing textile industry, rising paper and packaging consumption.

- India: Proximity, established trade relations, large consumer base.

- China: Potential for large-scale exports, but faces competition from domestic producers.

- Southeast Asia: Growing demand for processed foods, expanding industrial sector.

- Africa: Emerging market with substantial growth potential, though infrastructural challenges exist.

- Food and Beverage: High demand for sweeteners, thickeners, and stabilizers.

- Textile: Use of starch as a sizing agent in textile processing.

- Paper and Corrugation: Starch as a binder and adhesive.

- Pharmaceuticals: Use of starch as an excipient in pharmaceutical formulations.

- Other Applications: Construction materials, adhesives, etc.

Product Type Dominance: Starch and modified starch segments hold the largest market share. Glucose and fructose markets are relatively smaller, but experiencing growth.

Bangladesh Starch and Starch Derivative Industry Product Developments

Recent innovations include the development of high-amylose starches for enhanced film-forming properties and resistant starches for improved digestive health benefits. These advancements address specific market needs, creating competitive advantages for producers. The focus remains on enhancing functional properties, improving cost-effectiveness, and meeting evolving regulatory requirements. Technological trends point toward the increased use of bio-based processes and environmentally friendly modification techniques.

Key Drivers of Bangladesh Starch and Starch Derivative Industry Growth

Several factors contribute to the industry's growth: the expanding food and beverage industry, the increasing demand for high-quality food products, and advancements in starch modification technologies. Government initiatives promoting agricultural development, and the growing textile and paper industries provide additional support. The rising disposable incomes are also fueling demand.

Challenges in the Bangladesh Starch and Starch Derivative Industry Market

The industry faces challenges including fluctuations in raw material prices, limited access to advanced technologies, and competition from imported products. Supply chain inefficiencies and a lack of skilled labor also pose significant hurdles. These issues can lead to cost increases and reduced competitiveness.

Emerging Opportunities in Bangladesh Starch and Starch Derivative Industry

Expanding into new export markets, particularly in Southeast Asia and Africa, presents significant opportunities for growth. Strategic partnerships with international players can enhance technological capabilities and market access. Developing new, specialized starch derivatives for niche applications, such as biodegradable plastics, also offers substantial potential.

Leading Players in the Bangladesh Starch and Starch Derivative Industry Sector

- FLAMINGO AGRO-TECH LTD

- Maize Advanced Agro Refinery

- Paperex BD

- Biswas Agro

- Cargill Inc.

- KMC

- Bangladesh Maize Products Limited

- Gulshan Polyols Limited

- JTA Group

Key Milestones in Bangladesh Starch and Starch Derivative Industry Industry

- 2021: Flamingo Agro-Tech Ltd. expands production capacity by xx Million USD.

- 2022: A joint venture is formed between Maize Advanced Agro Refinery and a foreign company.

- 2023: Paperex BD invests xx Million USD in R&D for new starch derivative product development.

Strategic Outlook for Bangladesh Starch and Starch Derivative Industry Market

The Bangladesh starch and starch derivative industry is poised for sustained growth, driven by rising demand, technological advancements, and increasing export opportunities. Companies adopting strategic partnerships, focusing on R&D, and improving supply chain efficiency are well-positioned to capture market share and drive future growth. The market shows considerable potential for innovation and expansion within the next decade.

Bangladesh Starch and Starch Derivative Industry Segmentation

-

1. Application

- 1.1. Textile

- 1.2. Food and Beverage

- 1.3. Paper and Corrugation

- 1.4. Pharmaceuticals

- 1.5. Other Applications

Bangladesh Starch and Starch Derivative Industry Segmentation By Geography

- 1. Bangladesh

Bangladesh Starch and Starch Derivative Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 6.21% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Wide Applications and Functionality; Demand For Gluten-Free Products

- 3.3. Market Restrains

- 3.3.1. Easy Availability of Economically Feasible Alternatives

- 3.4. Market Trends

- 3.4.1. Food and Beverage is the Fastest Growing Segment

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Bangladesh Starch and Starch Derivative Industry Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Application

- 5.1.1. Textile

- 5.1.2. Food and Beverage

- 5.1.3. Paper and Corrugation

- 5.1.4. Pharmaceuticals

- 5.1.5. Other Applications

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. Bangladesh

- 5.1. Market Analysis, Insights and Forecast - by Application

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2024

- 6.2. Company Profiles

- 6.2.1 FLAMINGO AGRO-TECH LTD

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Maize Advanced Agro Refinery

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Paperex BD

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Biswas Agro

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Cargill Inc

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 KMC

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Bangladesh Maize Products Limited*List Not Exhaustive

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Gulshan Polyols Limited

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 JTA Group

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.1 FLAMINGO AGRO-TECH LTD

List of Figures

- Figure 1: Bangladesh Starch and Starch Derivative Industry Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Bangladesh Starch and Starch Derivative Industry Share (%) by Company 2024

List of Tables

- Table 1: Bangladesh Starch and Starch Derivative Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Bangladesh Starch and Starch Derivative Industry Revenue Million Forecast, by Application 2019 & 2032

- Table 3: Bangladesh Starch and Starch Derivative Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 4: Bangladesh Starch and Starch Derivative Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 5: Bangladesh Starch and Starch Derivative Industry Revenue Million Forecast, by Application 2019 & 2032

- Table 6: Bangladesh Starch and Starch Derivative Industry Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Bangladesh Starch and Starch Derivative Industry?

The projected CAGR is approximately 6.21%.

2. Which companies are prominent players in the Bangladesh Starch and Starch Derivative Industry?

Key companies in the market include FLAMINGO AGRO-TECH LTD, Maize Advanced Agro Refinery, Paperex BD, Biswas Agro, Cargill Inc, KMC, Bangladesh Maize Products Limited*List Not Exhaustive, Gulshan Polyols Limited, JTA Group.

3. What are the main segments of the Bangladesh Starch and Starch Derivative Industry?

The market segments include Application.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Wide Applications and Functionality; Demand For Gluten-Free Products.

6. What are the notable trends driving market growth?

Food and Beverage is the Fastest Growing Segment.

7. Are there any restraints impacting market growth?

Easy Availability of Economically Feasible Alternatives.

8. Can you provide examples of recent developments in the market?

1. Expansion of production capacities by leading players 2. Joint ventures and partnerships for market expansion 3. Investment in research and development for product innovation

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Bangladesh Starch and Starch Derivative Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Bangladesh Starch and Starch Derivative Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Bangladesh Starch and Starch Derivative Industry?

To stay informed about further developments, trends, and reports in the Bangladesh Starch and Starch Derivative Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence