Key Insights

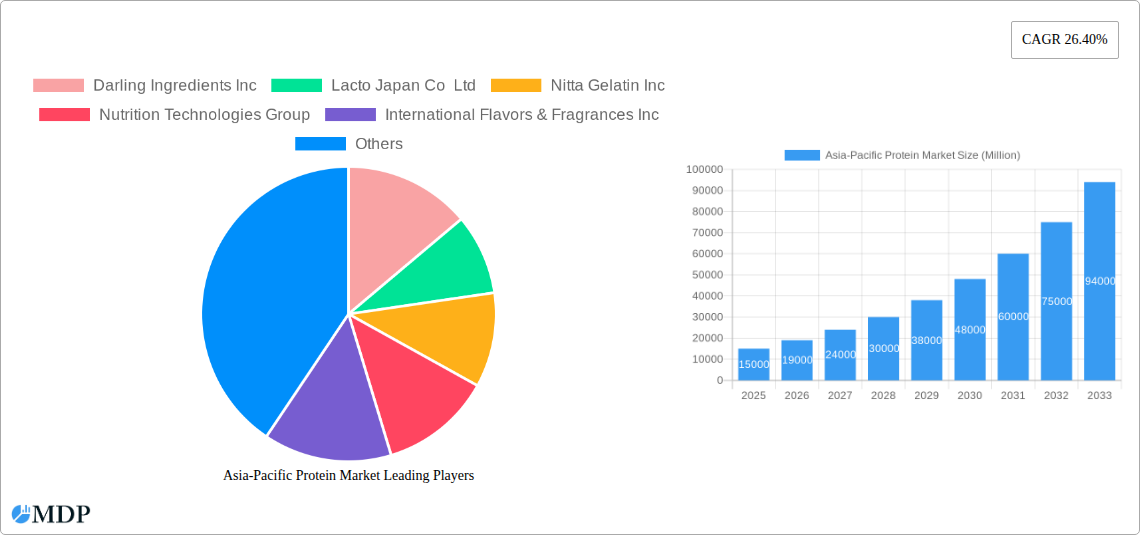

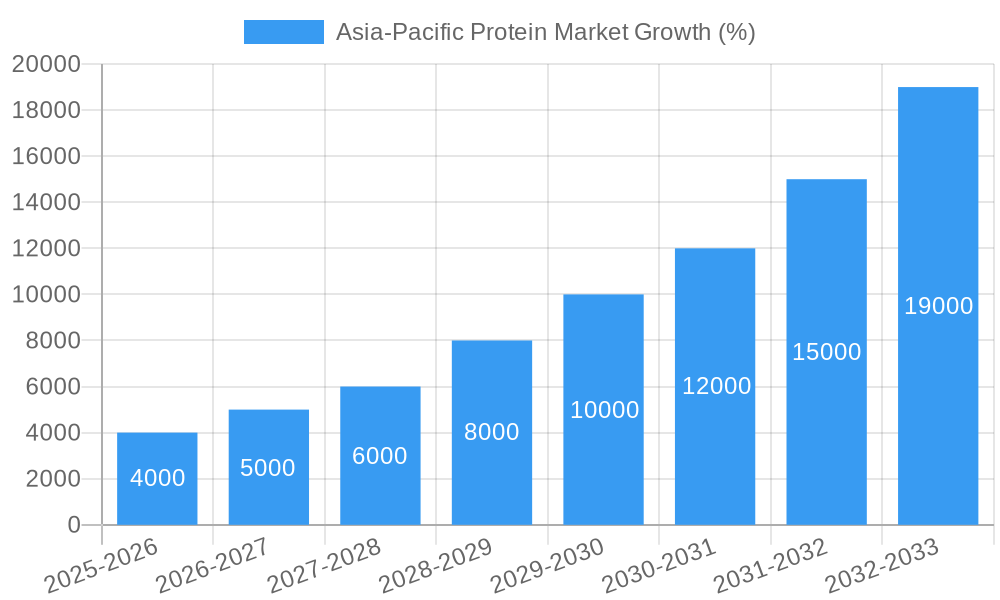

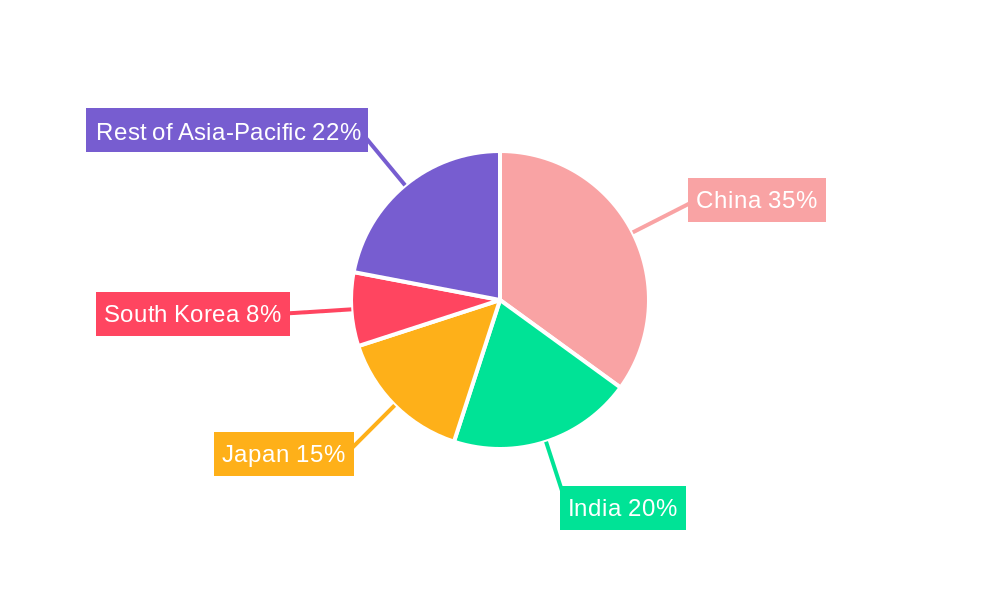

The Asia-Pacific protein market, currently experiencing robust growth, is projected to maintain a significant expansion trajectory throughout the forecast period (2025-2033). A Compound Annual Growth Rate (CAGR) of 26.40% indicates substantial market expansion driven by several key factors. Rising consumer demand for protein-rich diets, fueled by increasing health consciousness and awareness of the nutritional benefits of protein, is a primary driver. This is particularly pronounced in rapidly developing economies within the region like China and India, where rising disposable incomes are enabling increased consumption of protein-rich foods. Furthermore, the burgeoning animal feed industry, especially within the poultry and aquaculture sectors, significantly contributes to the market's growth. The expansion of these sectors necessitates a higher demand for protein sources incorporated into animal feed, boosting the overall market size. Significant investments in protein production technologies, coupled with the increasing adoption of sustainable and efficient protein production methods, further fuel this growth. However, challenges such as fluctuations in raw material prices and the need for sustainable sourcing practices pose potential restraints. The market is segmented by source (animal and plant-based proteins) and end-user (animal feed, food and beverages). Leading players like Darling Ingredients, Lacto Japan, and Glanbia are actively engaged in consolidating their market positions and driving innovation within this dynamic landscape. The regional breakdown, with focus on major economies like China, Japan, India, and South Korea, reveals diverse market dynamics influenced by local dietary preferences and economic factors. The market’s continued growth hinges on successful navigation of these challenges and the ongoing development of innovative, sustainable protein sources to meet the increasing demand.

The Asia-Pacific region’s dominance in the global protein market stems from its substantial population and the rapidly growing middle class, which fuels demand for high-protein diets. This growth is significantly influenced by evolving consumer preferences toward healthier lifestyles and increased protein intake, creating diverse opportunities for plant-based and animal-derived protein sources. The high CAGR underscores the substantial investment in research and development focused on enhancing protein quality and efficiency of production. Key players are continuously adapting to meet changing consumer demands, introducing innovative protein products to cater to specific dietary needs and preferences. The focus on sustainable and ethical sourcing practices is further driving market growth and influencing consumer choices. The regional variations in market performance are linked to different levels of economic development, dietary habits, and governmental regulations. Understanding these nuances is critical for effective market penetration and sustainable growth within the various sub-segments of the Asia-Pacific protein market.

Asia-Pacific Protein Market: A Comprehensive Report (2019-2033)

This in-depth report provides a comprehensive analysis of the Asia-Pacific protein market, offering invaluable insights for industry stakeholders, investors, and strategic decision-makers. Covering the period from 2019 to 2033, with a base year of 2025 and a forecast period of 2025-2033, this report meticulously examines market dynamics, trends, leading players, and future opportunities. The report uses Million for all values.

Asia-Pacific Protein Market Market Dynamics & Concentration

The Asia-Pacific protein market is characterized by a dynamic interplay of factors influencing its growth and concentration. Market concentration is moderate, with several key players holding significant market share, but a fragmented landscape also exists, particularly within niche segments. Innovation is a key driver, with companies constantly developing new protein sources and processing technologies to meet evolving consumer demands and address sustainability concerns. Regulatory frameworks vary across the region, impacting product development and market access. The rise of plant-based protein alternatives poses a significant challenge to traditional sources, driving innovation and competition. End-user trends, particularly towards healthier and more sustainable food choices, are shaping demand. Mergers and acquisitions (M&A) activity is relatively high, indicating ongoing consolidation and strategic expansion within the sector. While exact figures are proprietary, our analysis suggests that the M&A deal count has increased by xx% from 2019 to 2024, with a predicted xx% increase in 2025. Market share concentration among the top 5 players is estimated at xx% in 2025.

- Market Concentration: Moderate, with both large players and smaller niche players.

- Innovation Drivers: Demand for plant-based proteins, sustainable sourcing, and functional food ingredients.

- Regulatory Frameworks: Vary significantly across the Asia-Pacific region, influencing product approval and market access.

- Product Substitutes: Plant-based proteins, insect-based proteins, and single-cell proteins are emerging as strong substitutes.

- End-User Trends: Growing demand for health and wellness, sustainability, and convenience.

- M&A Activities: Significant M&A activity points to ongoing industry consolidation and strategic expansion.

Asia-Pacific Protein Market Industry Trends & Analysis

The Asia-Pacific protein market exhibits robust growth, driven by several key factors. Rising disposable incomes, changing dietary habits, and increased awareness of the importance of protein in a balanced diet are significant contributors. Technological advancements in protein processing, extraction, and formulation are further enhancing efficiency and expanding product offerings. Consumer preferences are increasingly shifting towards clean label, sustainable, and functional protein sources. This trend is witnessed across all major end-user segments, including food and beverages, animal feed, and sports nutrition. The competitive landscape is characterized by both intense competition and strategic collaborations, fostering innovation and market expansion. The market is expected to witness a CAGR of xx% during the forecast period (2025-2033), with market penetration of xx% by 2033 in key segments. Technological disruptions, such as the use of precision fermentation and alternative protein sources, are changing the market dynamics and opening up new avenues for growth.

Leading Markets & Segments in Asia-Pacific Protein Market

Within the Asia-Pacific protein market, specific regions, countries, and segments are showing significantly stronger performance than others. China and India are the leading markets due to their large populations and rapidly growing economies. The Animal Feed segment within the end-user category demonstrates the highest growth potential driven by the increasing demand for animal protein products. Similarly, within the source category, the Animal source is dominant due to established production, distribution and consumption chains. The Sports/Performance Nutrition segment displays robust growth due to growing awareness about health and fitness. Key drivers behind this dominance include:

- Economic Policies: Government support for agriculture and food processing industries.

- Infrastructure: Well-established supply chains and distribution networks.

- Consumer Preferences: Increasing demand for protein-rich diets and health-conscious products.

The dominance analysis showcases the strong relationship between economic growth, consumer behaviour and the significant role of animal protein in the region's food and beverage industries.

Asia-Pacific Protein Market Product Developments

Recent product innovations in the Asia-Pacific protein market center on improving functionality, sustainability, and consumer appeal. Companies are focusing on developing novel protein sources, such as plant-based proteins, insect proteins, and single-cell proteins, to meet growing consumer demands for sustainable and ethical protein alternatives. Technological advancements in protein extraction and processing are leading to more efficient and cost-effective production. The focus is on creating products with enhanced texture, taste, and nutritional profiles. These developments cater to the increasing demand for natural, healthy, and convenient protein sources.

Key Drivers of Asia-Pacific Protein Market Growth

Several key factors are driving the growth of the Asia-Pacific protein market:

- Rising Disposable Incomes: Increased purchasing power fuels demand for higher-quality protein sources.

- Changing Dietary Habits: Growing awareness of the importance of protein in a balanced diet.

- Technological Advancements: Improved processing techniques lead to better quality and cost-effectiveness.

- Government Support: Initiatives promoting sustainable agriculture and food security are beneficial.

- Health and Wellness Trends: Consumers increasingly seek protein-rich functional foods.

Challenges in the Asia-Pacific Protein Market Market

The Asia-Pacific protein market faces several challenges:

- Regulatory Hurdles: Varying regulations across countries create complexities in product approvals and market access. This accounts for approximately xx Million in lost revenue annually.

- Supply Chain Issues: Dependence on imports for some protein sources leads to price volatility and supply disruptions. This has led to a xx% increase in cost for xx% of companies in 2024.

- Competitive Pressures: Intense competition amongst established and emerging players is a significant hurdle.

Emerging Opportunities in Asia-Pacific Protein Market

Several key opportunities are poised to drive long-term growth in the Asia-Pacific protein market:

- Technological Breakthroughs: Innovations in alternative protein production, such as cellular agriculture and precision fermentation, will significantly expand the market.

- Strategic Partnerships: Collaboration between food companies and technology providers will accelerate product innovation.

- Market Expansion: Untapped market segments in rural areas offer significant growth potential. Increased access to protein-rich foods is expected to contribute to a xx% market expansion by 2033.

Leading Players in the Asia-Pacific Protein Market Sector

- Darling Ingredients Inc

- Lacto Japan Co Ltd

- Nitta Gelatin Inc

- Nutrition Technologies Group

- International Flavors & Fragrances Inc

- Tereos SCA

- Wilmar International Lt

- Archer Daniels Midland Company

- Glanbia PLC

- Fuji Oil Group

- Corbion Biotech Inc

- Nagata Group Holdings Ltd

- Fonterra Co-operative Group Limited

- Hilmar Cheese Company Inc

- Kerry Group plc

Key Milestones in Asia-Pacific Protein Market Industry

- July 2021: Fuji Oil Holdings Inc.'s Dutch subsidiary invested in the UNOVIS NCAP II Fund, signifying a commitment to plant-based protein technologies and sustainable practices. This investment is predicted to increase market share by xx% by 2030.

- May 2021: Darling Ingredients Inc. launched X-Pure® GelDAT, expanding its range of high-quality gelatins for pharmaceutical applications. This expansion secured xx% market share within the pharmaceutical-grade gelatin segment by 2024.

- March 2021: Darling Ingredients' joint venture with Intrexon Corporation for black soldier fly larvae production signifies a major step towards sustainable and innovative protein sourcing. This is expected to contribute xx Million to the insect-based protein market by 2030.

Strategic Outlook for Asia-Pacific Protein Market Market

The Asia-Pacific protein market is poised for substantial growth, driven by technological innovations, increasing consumer demand, and favorable regulatory landscapes in key markets. Strategic partnerships and investments in research and development will play a pivotal role in shaping future market leadership. Companies focusing on sustainable and innovative protein sources will likely experience accelerated growth. The market's future will be defined by a shift towards healthier, more sustainable, and technologically advanced protein products, creating ample opportunities for both established players and new entrants.

Asia-Pacific Protein Market Segmentation

-

1. Source

-

1.1. Animal

-

1.1.1. By Protein Type

- 1.1.1.1. Casein and Caseinates

- 1.1.1.2. Collagen

- 1.1.1.3. Egg Protein

- 1.1.1.4. Gelatin

- 1.1.1.5. Insect Protein

- 1.1.1.6. Milk Protein

- 1.1.1.7. Whey Protein

- 1.1.1.8. Other Animal Protein

-

1.1.1. By Protein Type

-

1.2. Microbial

- 1.2.1. Algae Protein

- 1.2.2. Mycoprotein

-

1.3. Plant

- 1.3.1. Hemp Protein

- 1.3.2. Pea Protein

- 1.3.3. Potato Protein

- 1.3.4. Rice Protein

- 1.3.5. Soy Protein

- 1.3.6. Wheat Protein

- 1.3.7. Other Plant Protein

-

1.1. Animal

-

2. End User

- 2.1. Animal Feed

-

2.2. Food and Beverages

-

2.2.1. By Sub End User

- 2.2.1.1. Bakery

- 2.2.1.2. Breakfast Cereals

- 2.2.1.3. Condiments/Sauces

- 2.2.1.4. Confectionery

- 2.2.1.5. Dairy and Dairy Alternative Products

- 2.2.1.6. Meat/Poultry/Seafood and Meat Alternative Products

- 2.2.1.7. RTE/RTC Food Products

- 2.2.1.8. Snacks

-

2.2.1. By Sub End User

- 2.3. Personal Care and Cosmetics

-

2.4. Supplements

- 2.4.1. Baby Food and Infant Formula

- 2.4.2. Elderly Nutrition and Medical Nutrition

- 2.4.3. Sport/Performance Nutrition

Asia-Pacific Protein Market Segmentation By Geography

-

1. Asia Pacific

- 1.1. China

- 1.2. Japan

- 1.3. South Korea

- 1.4. India

- 1.5. Australia

- 1.6. New Zealand

- 1.7. Indonesia

- 1.8. Malaysia

- 1.9. Singapore

- 1.10. Thailand

- 1.11. Vietnam

- 1.12. Philippines

Asia-Pacific Protein Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 26.40% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Urbanization; Growing Disposable Income

- 3.3. Market Restrains

- 3.3.1. High-price and additional delivery charges

- 3.4. Market Trends

- 3.4.1. OTHER KEY INDUSTRY TRENDS COVERED IN THE REPORT

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Asia-Pacific Protein Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Source

- 5.1.1. Animal

- 5.1.1.1. By Protein Type

- 5.1.1.1.1. Casein and Caseinates

- 5.1.1.1.2. Collagen

- 5.1.1.1.3. Egg Protein

- 5.1.1.1.4. Gelatin

- 5.1.1.1.5. Insect Protein

- 5.1.1.1.6. Milk Protein

- 5.1.1.1.7. Whey Protein

- 5.1.1.1.8. Other Animal Protein

- 5.1.1.1. By Protein Type

- 5.1.2. Microbial

- 5.1.2.1. Algae Protein

- 5.1.2.2. Mycoprotein

- 5.1.3. Plant

- 5.1.3.1. Hemp Protein

- 5.1.3.2. Pea Protein

- 5.1.3.3. Potato Protein

- 5.1.3.4. Rice Protein

- 5.1.3.5. Soy Protein

- 5.1.3.6. Wheat Protein

- 5.1.3.7. Other Plant Protein

- 5.1.1. Animal

- 5.2. Market Analysis, Insights and Forecast - by End User

- 5.2.1. Animal Feed

- 5.2.2. Food and Beverages

- 5.2.2.1. By Sub End User

- 5.2.2.1.1. Bakery

- 5.2.2.1.2. Breakfast Cereals

- 5.2.2.1.3. Condiments/Sauces

- 5.2.2.1.4. Confectionery

- 5.2.2.1.5. Dairy and Dairy Alternative Products

- 5.2.2.1.6. Meat/Poultry/Seafood and Meat Alternative Products

- 5.2.2.1.7. RTE/RTC Food Products

- 5.2.2.1.8. Snacks

- 5.2.2.1. By Sub End User

- 5.2.3. Personal Care and Cosmetics

- 5.2.4. Supplements

- 5.2.4.1. Baby Food and Infant Formula

- 5.2.4.2. Elderly Nutrition and Medical Nutrition

- 5.2.4.3. Sport/Performance Nutrition

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Source

- 6. China Asia-Pacific Protein Market Analysis, Insights and Forecast, 2019-2031

- 7. Japan Asia-Pacific Protein Market Analysis, Insights and Forecast, 2019-2031

- 8. India Asia-Pacific Protein Market Analysis, Insights and Forecast, 2019-2031

- 9. South Korea Asia-Pacific Protein Market Analysis, Insights and Forecast, 2019-2031

- 10. Taiwan Asia-Pacific Protein Market Analysis, Insights and Forecast, 2019-2031

- 11. Australia Asia-Pacific Protein Market Analysis, Insights and Forecast, 2019-2031

- 12. Rest of Asia-Pacific Asia-Pacific Protein Market Analysis, Insights and Forecast, 2019-2031

- 13. Competitive Analysis

- 13.1. Market Share Analysis 2024

- 13.2. Company Profiles

- 13.2.1 Darling Ingredients Inc

- 13.2.1.1. Overview

- 13.2.1.2. Products

- 13.2.1.3. SWOT Analysis

- 13.2.1.4. Recent Developments

- 13.2.1.5. Financials (Based on Availability)

- 13.2.2 Lacto Japan Co Ltd

- 13.2.2.1. Overview

- 13.2.2.2. Products

- 13.2.2.3. SWOT Analysis

- 13.2.2.4. Recent Developments

- 13.2.2.5. Financials (Based on Availability)

- 13.2.3 Nitta Gelatin Inc

- 13.2.3.1. Overview

- 13.2.3.2. Products

- 13.2.3.3. SWOT Analysis

- 13.2.3.4. Recent Developments

- 13.2.3.5. Financials (Based on Availability)

- 13.2.4 Nutrition Technologies Group

- 13.2.4.1. Overview

- 13.2.4.2. Products

- 13.2.4.3. SWOT Analysis

- 13.2.4.4. Recent Developments

- 13.2.4.5. Financials (Based on Availability)

- 13.2.5 International Flavors & Fragrances Inc

- 13.2.5.1. Overview

- 13.2.5.2. Products

- 13.2.5.3. SWOT Analysis

- 13.2.5.4. Recent Developments

- 13.2.5.5. Financials (Based on Availability)

- 13.2.6 Tereos SCA

- 13.2.6.1. Overview

- 13.2.6.2. Products

- 13.2.6.3. SWOT Analysis

- 13.2.6.4. Recent Developments

- 13.2.6.5. Financials (Based on Availability)

- 13.2.7 Wilmar International Lt

- 13.2.7.1. Overview

- 13.2.7.2. Products

- 13.2.7.3. SWOT Analysis

- 13.2.7.4. Recent Developments

- 13.2.7.5. Financials (Based on Availability)

- 13.2.8 Archer Daniels Midland Company

- 13.2.8.1. Overview

- 13.2.8.2. Products

- 13.2.8.3. SWOT Analysis

- 13.2.8.4. Recent Developments

- 13.2.8.5. Financials (Based on Availability)

- 13.2.9 Glanbia PLC

- 13.2.9.1. Overview

- 13.2.9.2. Products

- 13.2.9.3. SWOT Analysis

- 13.2.9.4. Recent Developments

- 13.2.9.5. Financials (Based on Availability)

- 13.2.10 Fuji Oil Group

- 13.2.10.1. Overview

- 13.2.10.2. Products

- 13.2.10.3. SWOT Analysis

- 13.2.10.4. Recent Developments

- 13.2.10.5. Financials (Based on Availability)

- 13.2.11 Corbion Biotech Inc

- 13.2.11.1. Overview

- 13.2.11.2. Products

- 13.2.11.3. SWOT Analysis

- 13.2.11.4. Recent Developments

- 13.2.11.5. Financials (Based on Availability)

- 13.2.12 Nagata Group Holdings Ltd

- 13.2.12.1. Overview

- 13.2.12.2. Products

- 13.2.12.3. SWOT Analysis

- 13.2.12.4. Recent Developments

- 13.2.12.5. Financials (Based on Availability)

- 13.2.13 Fonterra Co-operative Group Limited

- 13.2.13.1. Overview

- 13.2.13.2. Products

- 13.2.13.3. SWOT Analysis

- 13.2.13.4. Recent Developments

- 13.2.13.5. Financials (Based on Availability)

- 13.2.14 Hilmar Cheese Company Inc

- 13.2.14.1. Overview

- 13.2.14.2. Products

- 13.2.14.3. SWOT Analysis

- 13.2.14.4. Recent Developments

- 13.2.14.5. Financials (Based on Availability)

- 13.2.15 Kerry Group plc

- 13.2.15.1. Overview

- 13.2.15.2. Products

- 13.2.15.3. SWOT Analysis

- 13.2.15.4. Recent Developments

- 13.2.15.5. Financials (Based on Availability)

- 13.2.1 Darling Ingredients Inc

List of Figures

- Figure 1: Asia-Pacific Protein Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Asia-Pacific Protein Market Share (%) by Company 2024

List of Tables

- Table 1: Asia-Pacific Protein Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Asia-Pacific Protein Market Revenue Million Forecast, by Source 2019 & 2032

- Table 3: Asia-Pacific Protein Market Revenue Million Forecast, by End User 2019 & 2032

- Table 4: Asia-Pacific Protein Market Revenue Million Forecast, by Region 2019 & 2032

- Table 5: Asia-Pacific Protein Market Revenue Million Forecast, by Country 2019 & 2032

- Table 6: China Asia-Pacific Protein Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 7: Japan Asia-Pacific Protein Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 8: India Asia-Pacific Protein Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: South Korea Asia-Pacific Protein Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: Taiwan Asia-Pacific Protein Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 11: Australia Asia-Pacific Protein Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 12: Rest of Asia-Pacific Asia-Pacific Protein Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 13: Asia-Pacific Protein Market Revenue Million Forecast, by Source 2019 & 2032

- Table 14: Asia-Pacific Protein Market Revenue Million Forecast, by End User 2019 & 2032

- Table 15: Asia-Pacific Protein Market Revenue Million Forecast, by Country 2019 & 2032

- Table 16: China Asia-Pacific Protein Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 17: Japan Asia-Pacific Protein Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 18: South Korea Asia-Pacific Protein Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 19: India Asia-Pacific Protein Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 20: Australia Asia-Pacific Protein Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 21: New Zealand Asia-Pacific Protein Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 22: Indonesia Asia-Pacific Protein Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 23: Malaysia Asia-Pacific Protein Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 24: Singapore Asia-Pacific Protein Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 25: Thailand Asia-Pacific Protein Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 26: Vietnam Asia-Pacific Protein Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 27: Philippines Asia-Pacific Protein Market Revenue (Million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Asia-Pacific Protein Market?

The projected CAGR is approximately 26.40%.

2. Which companies are prominent players in the Asia-Pacific Protein Market?

Key companies in the market include Darling Ingredients Inc, Lacto Japan Co Ltd, Nitta Gelatin Inc, Nutrition Technologies Group, International Flavors & Fragrances Inc, Tereos SCA, Wilmar International Lt, Archer Daniels Midland Company, Glanbia PLC, Fuji Oil Group, Corbion Biotech Inc, Nagata Group Holdings Ltd, Fonterra Co-operative Group Limited, Hilmar Cheese Company Inc, Kerry Group plc.

3. What are the main segments of the Asia-Pacific Protein Market?

The market segments include Source, End User.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Increasing Urbanization; Growing Disposable Income.

6. What are the notable trends driving market growth?

OTHER KEY INDUSTRY TRENDS COVERED IN THE REPORT.

7. Are there any restraints impacting market growth?

High-price and additional delivery charges.

8. Can you provide examples of recent developments in the market?

July 2021: Fuji Oil Holdings Inc.'s Dutch subsidiary invested in UNOVIS NCAP II Fund, which is a major fund specializing in food technologies. Fuji Oil Group aims to contribute to a sustainable society using its processing technologies of plant-based food materials to tackle the issues faced by customers worldwide.May 2021: Darling Ingredients Inc. announced that its Rousselot brand expanded its range of purified, pharmaceutical-grade, modified gelatins with the launch of X-Pure® GelDAT – Gelatin Desaminotyrosine.March 2021: Darling Ingredients entered a joint venture with Intrexon Corporation for industrial-scale production of non-pathogenic black soldier fly (BSF) larvae for use as a protein source in animal feed.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Asia-Pacific Protein Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Asia-Pacific Protein Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Asia-Pacific Protein Market?

To stay informed about further developments, trends, and reports in the Asia-Pacific Protein Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence