Key Insights

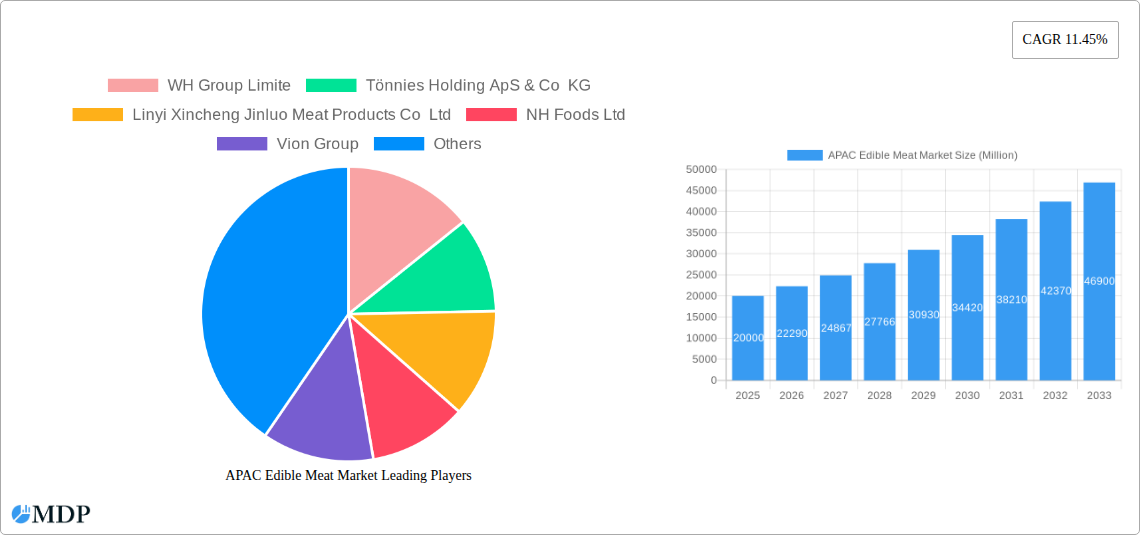

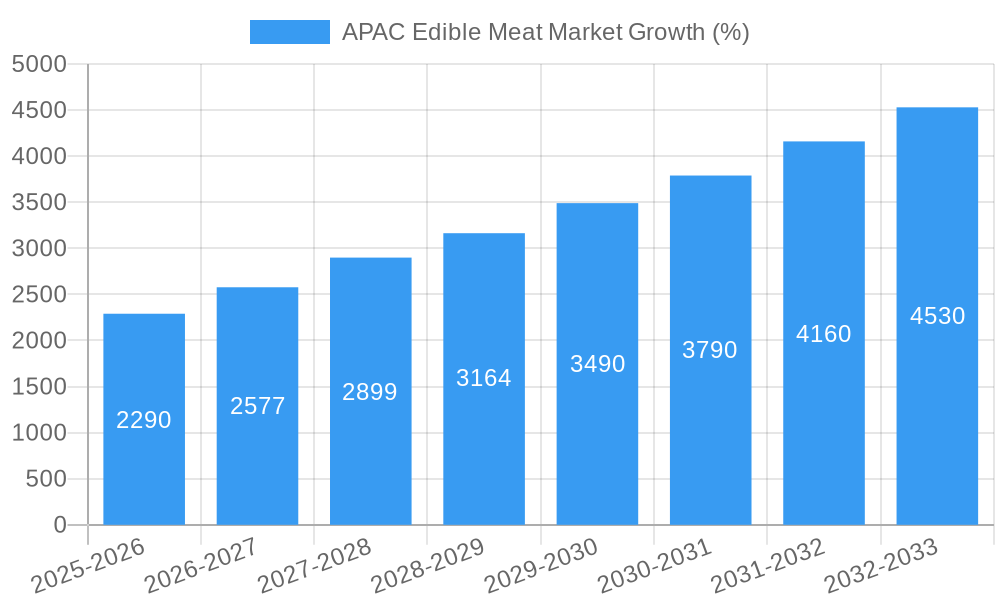

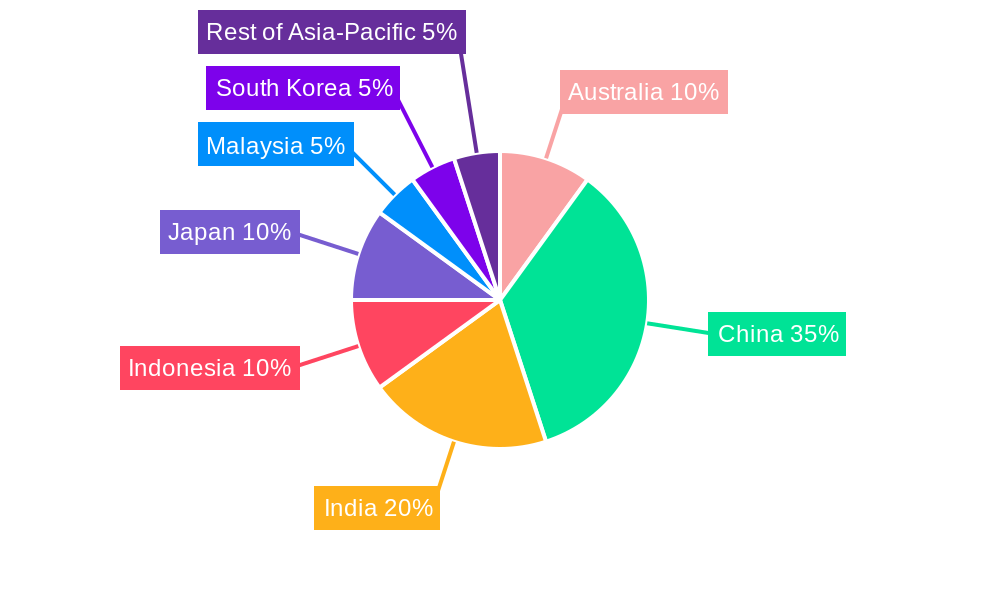

The Asia-Pacific (APAC) edible meat market, valued at approximately $XX million in 2025, is poised for robust growth, exhibiting a Compound Annual Growth Rate (CAGR) of 11.45% from 2025 to 2033. This expansion is fueled by several key drivers. Rising disposable incomes across numerous APAC nations, particularly in rapidly developing economies like India and Indonesia, are increasing consumer spending on protein-rich foods, including meat. Further, changing dietary habits and preferences, with a growing preference for convenience foods and processed meats, significantly contribute to market growth. The burgeoning food service industry and increasing urbanization within the region also fuel demand. While challenges such as fluctuating raw material prices and stringent food safety regulations exist, the overall market outlook remains positive. Significant segmental variations are expected; the processed meat segment is predicted to witness faster growth compared to fresh/chilled, driven by longer shelf life and convenience factors. Within countries, China and India are expected to dominate, reflecting their massive populations and expanding middle classes. However, other nations, like Australia, Japan, and South Korea, with their established meat consumption cultures, will continue to hold substantial market shares. The on-trade segment (restaurants, hotels, etc.) will experience strong growth, paralleling the rise in food service. Poultry and pork are likely to dominate the meat type segment due to affordability and cultural acceptance. This growth is further aided by robust investments from major players like WH Group Limited, Tönnies Holding, and others, aiming to capitalize on this lucrative market.

The competitive landscape is characterized by a mix of large multinational corporations and regional players. These companies are focusing on strategic partnerships, product diversification, and technological advancements to maintain their market positions. A critical aspect of the market's future lies in addressing sustainability concerns and ensuring responsible meat production practices to meet growing consumer demands for ethically and sustainably sourced products. This includes addressing concerns about animal welfare and reducing the environmental impact of meat production. The successful companies will be those who can adapt to these evolving consumer expectations. Given the diverse market dynamics across various countries and segments, targeted strategies are crucial for success within the APAC edible meat market. The market's sustained growth trajectory strongly suggests significant investment opportunities for both existing players and new entrants alike.

APAC Edible Meat Market: A Comprehensive Report (2019-2033)

This comprehensive report provides an in-depth analysis of the Asia-Pacific (APAC) edible meat market, offering invaluable insights for industry stakeholders, investors, and strategists. Covering the period from 2019 to 2033, with a base year of 2025, this report meticulously examines market dynamics, trends, leading players, and future opportunities across various segments. The market is projected to reach xx Million by 2033, exhibiting a CAGR of xx% during the forecast period (2025-2033).

APAC Edible Meat Market Dynamics & Concentration

The APAC edible meat market is characterized by a dynamic interplay of factors influencing its growth and concentration. Market concentration is moderately high, with several large players holding significant market share. However, the presence of numerous smaller regional players creates a competitive landscape. Innovation is driven by consumer demand for convenience, health-conscious products, and sustainable sourcing practices. Stringent regulatory frameworks, varying across countries, significantly impact production and distribution. Substitute proteins, such as plant-based alternatives, pose a growing challenge, although meat remains dominant. End-user trends are shifting towards processed and convenient meat products, fueling demand for value-added offerings. Mergers and acquisitions (M&A) activities are prevalent, reflecting consolidation and expansion strategies among key players.

- Market Share: Top 5 players hold approximately xx% of the market share in 2025.

- M&A Activity: An average of xx M&A deals were recorded annually during the historical period (2019-2024).

- Innovation Drivers: Consumer demand for convenience, health & sustainability.

- Regulatory Impacts: Varying regulations across countries impact production and distribution costs.

- Substitute Products: Plant-based meat alternatives pose a growing competitive threat.

APAC Edible Meat Market Industry Trends & Analysis

The APAC edible meat market is experiencing robust growth, driven by a multitude of factors. Rising disposable incomes, particularly in emerging economies, are boosting meat consumption. Changing lifestyles and increasing urbanization are fueling demand for convenient, ready-to-eat meat products. Technological advancements in processing and preservation techniques are enhancing product quality and shelf life. Consumer preferences are shifting towards healthier meat options, prompting manufacturers to innovate with leaner cuts and value-added products. Competitive dynamics are intense, with established players and new entrants vying for market share through product diversification, branding, and strategic partnerships. The market is witnessing a growing adoption of sustainable farming practices, driven by increasing environmental awareness among consumers.

Leading Markets & Segments in APAC Edible Meat Market

China remains the dominant market in the APAC edible meat sector, accounting for xx% of the total market value in 2025. This is primarily driven by a large population and rising meat consumption. India and Indonesia represent significant growth opportunities, fueled by increasing disposable incomes and a young population.

Key Drivers by Country:

- China: Strong economic growth, large population, and increasing demand for processed meats.

- India: Expanding middle class, rising disposable incomes, and cultural preferences for specific meat types.

- Indonesia: Growing population, increasing urbanization, and rising demand for affordable protein sources.

Dominant Segments:

- Type: Poultry holds the largest market share due to its affordability and widespread consumption. Pork and beef follow closely.

- Form: Fresh/Chilled meat dominates the market, driven by consumer preference for quality and freshness. Frozen meat segments are exhibiting strong growth, driven by improved preservation technologies.

- Distribution Channel: Off-Trade channels, including supermarkets and hypermarkets, are major contributors. The on-trade segment is showing growth, driven by the rise of foodservice industry.

APAC Edible Meat Market Product Developments

Recent product developments focus on value-added products, such as ready-to-cook meals, marinated meats, and convenience products. Technological advancements in meat processing and packaging are enhancing shelf life and product quality. Increased demand for organic and sustainably sourced meat is driving the introduction of new product lines that address these preferences. The market also witnesses the emergence of plant-based alternatives, although their market share remains relatively small.

Key Drivers of APAC Edible Meat Market Growth

The APAC edible meat market's growth is propelled by several key factors: rising disposable incomes across the region, particularly in rapidly developing economies; the growing popularity of convenient, ready-to-eat meal options; continuous improvements in meat processing and preservation technologies; and supportive government policies promoting livestock farming and agricultural development. Furthermore, expanding retail infrastructure and increasing access to modern distribution networks contribute to market expansion.

Challenges in the APAP Edible Meat Market

The APAC edible meat market faces challenges like fluctuating raw material prices, which impact profitability. Stringent food safety and quality regulations require compliance and potentially increase costs. Supply chain disruptions, particularly during outbreaks of animal diseases, can affect availability and price stability. Intense competition among players necessitates continuous innovation and operational efficiency. Moreover, the growing popularity of plant-based meat alternatives represents an emerging challenge to market dominance.

Emerging Opportunities in APAC Edible Meat Market

Significant opportunities exist within value-added meat products, catering to busy lifestyles and evolving preferences. Strategic partnerships between meat producers and foodservice companies can expand distribution channels. Investing in sustainable farming practices and promoting traceability will appeal to environmentally conscious consumers. Expanding into emerging markets within the APAC region offers significant growth potential. Technological advancements in meat processing and alternative protein sources present further opportunities for innovation.

Leading Players in the APAC Edible Meat Market Sector

- WH Group Limited

- Tönnies Holding ApS & Co KG

- Linyi Xincheng Jinluo Meat Products Co Ltd

- NH Foods Ltd

- Vion Group

- Tyson Foods Inc

- Westfleisch SCE mbH

- Bid Corporation Limited

- China Yurun Food Group Ltd

- Danish Crown AmbA

- COFCO Corporation

Key Milestones in APAC Edible Meat Market Industry

- November 2023: Tyson Foods announces plans to build new production facilities in China and Thailand, expanding its Netherlands facility, adding over 100,000 tonnes of poultry capacity and creating over 1700 jobs.

- October 2023: Tonnies Holding signs a Joint Venture Agreement with Dekon Group for slaughterhouse and butchery facilities in Sichuan, China, with a USD 530 million investment.

- February 2021: Tyson Foods acquires a 49% stake in Malaysian Flour Mills Berhad's vertically integrated poultry business in Malaysia.

Strategic Outlook for APAC Edible Meat Market Market

The APAC edible meat market presents a compelling investment landscape for the next decade. Continued economic growth, coupled with evolving consumer preferences and technological advancements, will drive market expansion. Focusing on value-added products, sustainable practices, and strategic partnerships will be crucial for success. Expanding into untapped markets within the region, combined with product diversification, will be key to capturing growth opportunities and establishing a strong market position.

APAC Edible Meat Market Segmentation

-

1. Type

- 1.1. Beef

- 1.2. Mutton

- 1.3. Pork

- 1.4. Poultry

- 1.5. Other Meat

-

2. Form

- 2.1. Canned

- 2.2. Fresh / Chilled

- 2.3. Frozen

- 2.4. Processed

-

3. Distribution Channel

-

3.1. Off-Trade

- 3.1.1. Convenience Stores

- 3.1.2. Online Channel

- 3.1.3. Supermarkets and Hypermarkets

- 3.1.4. Others

- 3.2. On-Trade

-

3.1. Off-Trade

APAC Edible Meat Market Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

APAC Edible Meat Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 11.45% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Rising Trend of Ingestible Beauty Products; Growing demand for Nutrient-Enriched Cosmetic Products

- 3.3. Market Restrains

- 3.3.1. Availability of Counterfeit Beauty Supplements Products

- 3.4. Market Trends

- 3.4.1. OTHER KEY INDUSTRY TRENDS COVERED IN THE REPORT

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global APAC Edible Meat Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Beef

- 5.1.2. Mutton

- 5.1.3. Pork

- 5.1.4. Poultry

- 5.1.5. Other Meat

- 5.2. Market Analysis, Insights and Forecast - by Form

- 5.2.1. Canned

- 5.2.2. Fresh / Chilled

- 5.2.3. Frozen

- 5.2.4. Processed

- 5.3. Market Analysis, Insights and Forecast - by Distribution Channel

- 5.3.1. Off-Trade

- 5.3.1.1. Convenience Stores

- 5.3.1.2. Online Channel

- 5.3.1.3. Supermarkets and Hypermarkets

- 5.3.1.4. Others

- 5.3.2. On-Trade

- 5.3.1. Off-Trade

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. North America

- 5.4.2. South America

- 5.4.3. Europe

- 5.4.4. Middle East & Africa

- 5.4.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. North America APAC Edible Meat Market Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Type

- 6.1.1. Beef

- 6.1.2. Mutton

- 6.1.3. Pork

- 6.1.4. Poultry

- 6.1.5. Other Meat

- 6.2. Market Analysis, Insights and Forecast - by Form

- 6.2.1. Canned

- 6.2.2. Fresh / Chilled

- 6.2.3. Frozen

- 6.2.4. Processed

- 6.3. Market Analysis, Insights and Forecast - by Distribution Channel

- 6.3.1. Off-Trade

- 6.3.1.1. Convenience Stores

- 6.3.1.2. Online Channel

- 6.3.1.3. Supermarkets and Hypermarkets

- 6.3.1.4. Others

- 6.3.2. On-Trade

- 6.3.1. Off-Trade

- 6.1. Market Analysis, Insights and Forecast - by Type

- 7. South America APAC Edible Meat Market Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Type

- 7.1.1. Beef

- 7.1.2. Mutton

- 7.1.3. Pork

- 7.1.4. Poultry

- 7.1.5. Other Meat

- 7.2. Market Analysis, Insights and Forecast - by Form

- 7.2.1. Canned

- 7.2.2. Fresh / Chilled

- 7.2.3. Frozen

- 7.2.4. Processed

- 7.3. Market Analysis, Insights and Forecast - by Distribution Channel

- 7.3.1. Off-Trade

- 7.3.1.1. Convenience Stores

- 7.3.1.2. Online Channel

- 7.3.1.3. Supermarkets and Hypermarkets

- 7.3.1.4. Others

- 7.3.2. On-Trade

- 7.3.1. Off-Trade

- 7.1. Market Analysis, Insights and Forecast - by Type

- 8. Europe APAC Edible Meat Market Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Type

- 8.1.1. Beef

- 8.1.2. Mutton

- 8.1.3. Pork

- 8.1.4. Poultry

- 8.1.5. Other Meat

- 8.2. Market Analysis, Insights and Forecast - by Form

- 8.2.1. Canned

- 8.2.2. Fresh / Chilled

- 8.2.3. Frozen

- 8.2.4. Processed

- 8.3. Market Analysis, Insights and Forecast - by Distribution Channel

- 8.3.1. Off-Trade

- 8.3.1.1. Convenience Stores

- 8.3.1.2. Online Channel

- 8.3.1.3. Supermarkets and Hypermarkets

- 8.3.1.4. Others

- 8.3.2. On-Trade

- 8.3.1. Off-Trade

- 8.1. Market Analysis, Insights and Forecast - by Type

- 9. Middle East & Africa APAC Edible Meat Market Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Type

- 9.1.1. Beef

- 9.1.2. Mutton

- 9.1.3. Pork

- 9.1.4. Poultry

- 9.1.5. Other Meat

- 9.2. Market Analysis, Insights and Forecast - by Form

- 9.2.1. Canned

- 9.2.2. Fresh / Chilled

- 9.2.3. Frozen

- 9.2.4. Processed

- 9.3. Market Analysis, Insights and Forecast - by Distribution Channel

- 9.3.1. Off-Trade

- 9.3.1.1. Convenience Stores

- 9.3.1.2. Online Channel

- 9.3.1.3. Supermarkets and Hypermarkets

- 9.3.1.4. Others

- 9.3.2. On-Trade

- 9.3.1. Off-Trade

- 9.1. Market Analysis, Insights and Forecast - by Type

- 10. Asia Pacific APAC Edible Meat Market Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Type

- 10.1.1. Beef

- 10.1.2. Mutton

- 10.1.3. Pork

- 10.1.4. Poultry

- 10.1.5. Other Meat

- 10.2. Market Analysis, Insights and Forecast - by Form

- 10.2.1. Canned

- 10.2.2. Fresh / Chilled

- 10.2.3. Frozen

- 10.2.4. Processed

- 10.3. Market Analysis, Insights and Forecast - by Distribution Channel

- 10.3.1. Off-Trade

- 10.3.1.1. Convenience Stores

- 10.3.1.2. Online Channel

- 10.3.1.3. Supermarkets and Hypermarkets

- 10.3.1.4. Others

- 10.3.2. On-Trade

- 10.3.1. Off-Trade

- 10.1. Market Analysis, Insights and Forecast - by Type

- 11. Brazil APAC Edible Meat Market Analysis, Insights and Forecast, 2019-2031

- 11.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 11.1.1.

- 12. Argentina APAC Edible Meat Market Analysis, Insights and Forecast, 2019-2031

- 12.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 12.1.1.

- 13. Rest of South America APAC Edible Meat Market Analysis, Insights and Forecast, 2019-2031

- 13.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 13.1.1.

- 14. Competitive Analysis

- 14.1. Global Market Share Analysis 2024

- 14.2. Company Profiles

- 14.2.1 WH Group Limite

- 14.2.1.1. Overview

- 14.2.1.2. Products

- 14.2.1.3. SWOT Analysis

- 14.2.1.4. Recent Developments

- 14.2.1.5. Financials (Based on Availability)

- 14.2.2 Tönnies Holding ApS & Co KG

- 14.2.2.1. Overview

- 14.2.2.2. Products

- 14.2.2.3. SWOT Analysis

- 14.2.2.4. Recent Developments

- 14.2.2.5. Financials (Based on Availability)

- 14.2.3 Linyi Xincheng Jinluo Meat Products Co Ltd

- 14.2.3.1. Overview

- 14.2.3.2. Products

- 14.2.3.3. SWOT Analysis

- 14.2.3.4. Recent Developments

- 14.2.3.5. Financials (Based on Availability)

- 14.2.4 NH Foods Ltd

- 14.2.4.1. Overview

- 14.2.4.2. Products

- 14.2.4.3. SWOT Analysis

- 14.2.4.4. Recent Developments

- 14.2.4.5. Financials (Based on Availability)

- 14.2.5 Vion Group

- 14.2.5.1. Overview

- 14.2.5.2. Products

- 14.2.5.3. SWOT Analysis

- 14.2.5.4. Recent Developments

- 14.2.5.5. Financials (Based on Availability)

- 14.2.6 Tyson Foods Inc

- 14.2.6.1. Overview

- 14.2.6.2. Products

- 14.2.6.3. SWOT Analysis

- 14.2.6.4. Recent Developments

- 14.2.6.5. Financials (Based on Availability)

- 14.2.7 Westfleisch SCE mbH

- 14.2.7.1. Overview

- 14.2.7.2. Products

- 14.2.7.3. SWOT Analysis

- 14.2.7.4. Recent Developments

- 14.2.7.5. Financials (Based on Availability)

- 14.2.8 Bid Corporation Limited

- 14.2.8.1. Overview

- 14.2.8.2. Products

- 14.2.8.3. SWOT Analysis

- 14.2.8.4. Recent Developments

- 14.2.8.5. Financials (Based on Availability)

- 14.2.9 China Yurun Food Group Ltd

- 14.2.9.1. Overview

- 14.2.9.2. Products

- 14.2.9.3. SWOT Analysis

- 14.2.9.4. Recent Developments

- 14.2.9.5. Financials (Based on Availability)

- 14.2.10 Danish Crown AmbA

- 14.2.10.1. Overview

- 14.2.10.2. Products

- 14.2.10.3. SWOT Analysis

- 14.2.10.4. Recent Developments

- 14.2.10.5. Financials (Based on Availability)

- 14.2.11 COFCO Corporation

- 14.2.11.1. Overview

- 14.2.11.2. Products

- 14.2.11.3. SWOT Analysis

- 14.2.11.4. Recent Developments

- 14.2.11.5. Financials (Based on Availability)

- 14.2.1 WH Group Limite

List of Figures

- Figure 1: Global APAC Edible Meat Market Revenue Breakdown (Million, %) by Region 2024 & 2032

- Figure 2: Brazil APAC Edible Meat Market Revenue (Million), by Country 2024 & 2032

- Figure 3: Brazil APAC Edible Meat Market Revenue Share (%), by Country 2024 & 2032

- Figure 4: Argentina APAC Edible Meat Market Revenue (Million), by Country 2024 & 2032

- Figure 5: Argentina APAC Edible Meat Market Revenue Share (%), by Country 2024 & 2032

- Figure 6: Rest of South America APAC Edible Meat Market Revenue (Million), by Country 2024 & 2032

- Figure 7: Rest of South America APAC Edible Meat Market Revenue Share (%), by Country 2024 & 2032

- Figure 8: North America APAC Edible Meat Market Revenue (Million), by Type 2024 & 2032

- Figure 9: North America APAC Edible Meat Market Revenue Share (%), by Type 2024 & 2032

- Figure 10: North America APAC Edible Meat Market Revenue (Million), by Form 2024 & 2032

- Figure 11: North America APAC Edible Meat Market Revenue Share (%), by Form 2024 & 2032

- Figure 12: North America APAC Edible Meat Market Revenue (Million), by Distribution Channel 2024 & 2032

- Figure 13: North America APAC Edible Meat Market Revenue Share (%), by Distribution Channel 2024 & 2032

- Figure 14: North America APAC Edible Meat Market Revenue (Million), by Country 2024 & 2032

- Figure 15: North America APAC Edible Meat Market Revenue Share (%), by Country 2024 & 2032

- Figure 16: South America APAC Edible Meat Market Revenue (Million), by Type 2024 & 2032

- Figure 17: South America APAC Edible Meat Market Revenue Share (%), by Type 2024 & 2032

- Figure 18: South America APAC Edible Meat Market Revenue (Million), by Form 2024 & 2032

- Figure 19: South America APAC Edible Meat Market Revenue Share (%), by Form 2024 & 2032

- Figure 20: South America APAC Edible Meat Market Revenue (Million), by Distribution Channel 2024 & 2032

- Figure 21: South America APAC Edible Meat Market Revenue Share (%), by Distribution Channel 2024 & 2032

- Figure 22: South America APAC Edible Meat Market Revenue (Million), by Country 2024 & 2032

- Figure 23: South America APAC Edible Meat Market Revenue Share (%), by Country 2024 & 2032

- Figure 24: Europe APAC Edible Meat Market Revenue (Million), by Type 2024 & 2032

- Figure 25: Europe APAC Edible Meat Market Revenue Share (%), by Type 2024 & 2032

- Figure 26: Europe APAC Edible Meat Market Revenue (Million), by Form 2024 & 2032

- Figure 27: Europe APAC Edible Meat Market Revenue Share (%), by Form 2024 & 2032

- Figure 28: Europe APAC Edible Meat Market Revenue (Million), by Distribution Channel 2024 & 2032

- Figure 29: Europe APAC Edible Meat Market Revenue Share (%), by Distribution Channel 2024 & 2032

- Figure 30: Europe APAC Edible Meat Market Revenue (Million), by Country 2024 & 2032

- Figure 31: Europe APAC Edible Meat Market Revenue Share (%), by Country 2024 & 2032

- Figure 32: Middle East & Africa APAC Edible Meat Market Revenue (Million), by Type 2024 & 2032

- Figure 33: Middle East & Africa APAC Edible Meat Market Revenue Share (%), by Type 2024 & 2032

- Figure 34: Middle East & Africa APAC Edible Meat Market Revenue (Million), by Form 2024 & 2032

- Figure 35: Middle East & Africa APAC Edible Meat Market Revenue Share (%), by Form 2024 & 2032

- Figure 36: Middle East & Africa APAC Edible Meat Market Revenue (Million), by Distribution Channel 2024 & 2032

- Figure 37: Middle East & Africa APAC Edible Meat Market Revenue Share (%), by Distribution Channel 2024 & 2032

- Figure 38: Middle East & Africa APAC Edible Meat Market Revenue (Million), by Country 2024 & 2032

- Figure 39: Middle East & Africa APAC Edible Meat Market Revenue Share (%), by Country 2024 & 2032

- Figure 40: Asia Pacific APAC Edible Meat Market Revenue (Million), by Type 2024 & 2032

- Figure 41: Asia Pacific APAC Edible Meat Market Revenue Share (%), by Type 2024 & 2032

- Figure 42: Asia Pacific APAC Edible Meat Market Revenue (Million), by Form 2024 & 2032

- Figure 43: Asia Pacific APAC Edible Meat Market Revenue Share (%), by Form 2024 & 2032

- Figure 44: Asia Pacific APAC Edible Meat Market Revenue (Million), by Distribution Channel 2024 & 2032

- Figure 45: Asia Pacific APAC Edible Meat Market Revenue Share (%), by Distribution Channel 2024 & 2032

- Figure 46: Asia Pacific APAC Edible Meat Market Revenue (Million), by Country 2024 & 2032

- Figure 47: Asia Pacific APAC Edible Meat Market Revenue Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global APAC Edible Meat Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Global APAC Edible Meat Market Revenue Million Forecast, by Type 2019 & 2032

- Table 3: Global APAC Edible Meat Market Revenue Million Forecast, by Form 2019 & 2032

- Table 4: Global APAC Edible Meat Market Revenue Million Forecast, by Distribution Channel 2019 & 2032

- Table 5: Global APAC Edible Meat Market Revenue Million Forecast, by Region 2019 & 2032

- Table 6: Global APAC Edible Meat Market Revenue Million Forecast, by Country 2019 & 2032

- Table 7: APAC Edible Meat Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 8: Global APAC Edible Meat Market Revenue Million Forecast, by Country 2019 & 2032

- Table 9: APAC Edible Meat Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: Global APAC Edible Meat Market Revenue Million Forecast, by Country 2019 & 2032

- Table 11: APAC Edible Meat Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 12: Global APAC Edible Meat Market Revenue Million Forecast, by Type 2019 & 2032

- Table 13: Global APAC Edible Meat Market Revenue Million Forecast, by Form 2019 & 2032

- Table 14: Global APAC Edible Meat Market Revenue Million Forecast, by Distribution Channel 2019 & 2032

- Table 15: Global APAC Edible Meat Market Revenue Million Forecast, by Country 2019 & 2032

- Table 16: United States APAC Edible Meat Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 17: Canada APAC Edible Meat Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 18: Mexico APAC Edible Meat Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 19: Global APAC Edible Meat Market Revenue Million Forecast, by Type 2019 & 2032

- Table 20: Global APAC Edible Meat Market Revenue Million Forecast, by Form 2019 & 2032

- Table 21: Global APAC Edible Meat Market Revenue Million Forecast, by Distribution Channel 2019 & 2032

- Table 22: Global APAC Edible Meat Market Revenue Million Forecast, by Country 2019 & 2032

- Table 23: Brazil APAC Edible Meat Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 24: Argentina APAC Edible Meat Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 25: Rest of South America APAC Edible Meat Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 26: Global APAC Edible Meat Market Revenue Million Forecast, by Type 2019 & 2032

- Table 27: Global APAC Edible Meat Market Revenue Million Forecast, by Form 2019 & 2032

- Table 28: Global APAC Edible Meat Market Revenue Million Forecast, by Distribution Channel 2019 & 2032

- Table 29: Global APAC Edible Meat Market Revenue Million Forecast, by Country 2019 & 2032

- Table 30: United Kingdom APAC Edible Meat Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 31: Germany APAC Edible Meat Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 32: France APAC Edible Meat Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 33: Italy APAC Edible Meat Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 34: Spain APAC Edible Meat Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 35: Russia APAC Edible Meat Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 36: Benelux APAC Edible Meat Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 37: Nordics APAC Edible Meat Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 38: Rest of Europe APAC Edible Meat Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 39: Global APAC Edible Meat Market Revenue Million Forecast, by Type 2019 & 2032

- Table 40: Global APAC Edible Meat Market Revenue Million Forecast, by Form 2019 & 2032

- Table 41: Global APAC Edible Meat Market Revenue Million Forecast, by Distribution Channel 2019 & 2032

- Table 42: Global APAC Edible Meat Market Revenue Million Forecast, by Country 2019 & 2032

- Table 43: Turkey APAC Edible Meat Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 44: Israel APAC Edible Meat Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 45: GCC APAC Edible Meat Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 46: North Africa APAC Edible Meat Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 47: South Africa APAC Edible Meat Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 48: Rest of Middle East & Africa APAC Edible Meat Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 49: Global APAC Edible Meat Market Revenue Million Forecast, by Type 2019 & 2032

- Table 50: Global APAC Edible Meat Market Revenue Million Forecast, by Form 2019 & 2032

- Table 51: Global APAC Edible Meat Market Revenue Million Forecast, by Distribution Channel 2019 & 2032

- Table 52: Global APAC Edible Meat Market Revenue Million Forecast, by Country 2019 & 2032

- Table 53: China APAC Edible Meat Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 54: India APAC Edible Meat Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 55: Japan APAC Edible Meat Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 56: South Korea APAC Edible Meat Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 57: ASEAN APAC Edible Meat Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 58: Oceania APAC Edible Meat Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 59: Rest of Asia Pacific APAC Edible Meat Market Revenue (Million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the APAC Edible Meat Market?

The projected CAGR is approximately 11.45%.

2. Which companies are prominent players in the APAC Edible Meat Market?

Key companies in the market include WH Group Limite, Tönnies Holding ApS & Co KG, Linyi Xincheng Jinluo Meat Products Co Ltd, NH Foods Ltd, Vion Group, Tyson Foods Inc, Westfleisch SCE mbH, Bid Corporation Limited, China Yurun Food Group Ltd, Danish Crown AmbA, COFCO Corporation.

3. What are the main segments of the APAC Edible Meat Market?

The market segments include Type, Form, Distribution Channel.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Rising Trend of Ingestible Beauty Products; Growing demand for Nutrient-Enriched Cosmetic Products.

6. What are the notable trends driving market growth?

OTHER KEY INDUSTRY TRENDS COVERED IN THE REPORT.

7. Are there any restraints impacting market growth?

Availability of Counterfeit Beauty Supplements Products.

8. Can you provide examples of recent developments in the market?

November 2023: Tyson Foods announced plans to build new production facilities in China and Thailand, and expand its facility in the Netherlands. The latest expansions, adds over 100,000 tonnes of fully cooked poultry capacity. The new plant in China and Thailand is expected to create more than 700, 1000 jobs respectively and the European expansion will add more than 150 jobs.October 2023: Tonnies Holding announced it had signed a Joint Venture Agreement with the Dekon Group to set up slaughterhouse and butchery facilities in Sichuan, China. The total investment amounts to USD 530 million, of which around USD 158 million is accounted for by the slaughter and cutting centre.February 2021: Tyson Foods has bought a 49% stake in a Malaysia-based company’s vertically integrated poultry business (Malysian Flour Mills Berhad) which operates poultry business that includes feed mills, hatcheries, farms and processing facilities.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "APAC Edible Meat Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the APAC Edible Meat Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the APAC Edible Meat Market?

To stay informed about further developments, trends, and reports in the APAC Edible Meat Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence