Key Insights

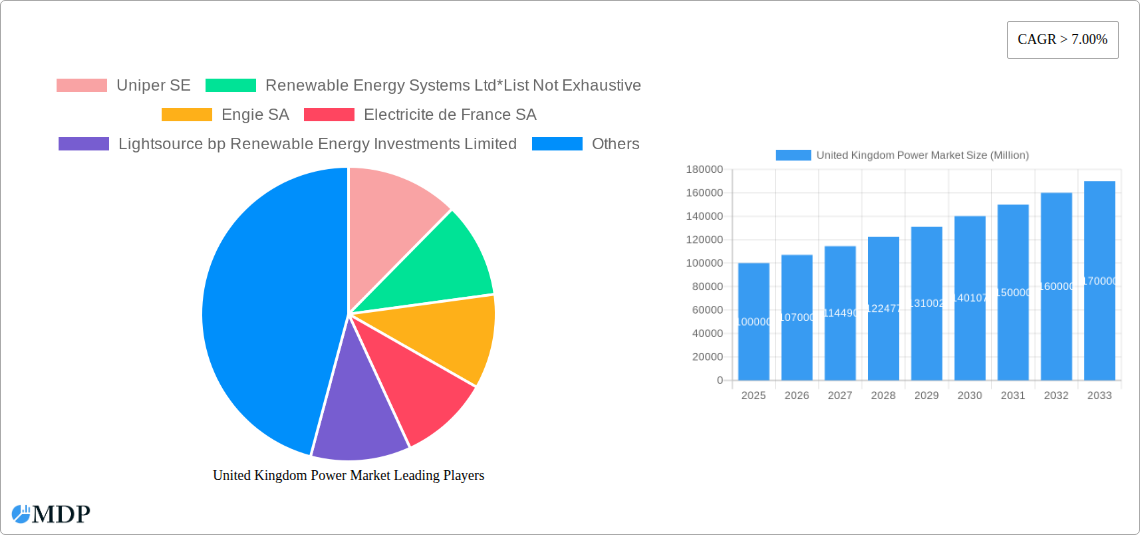

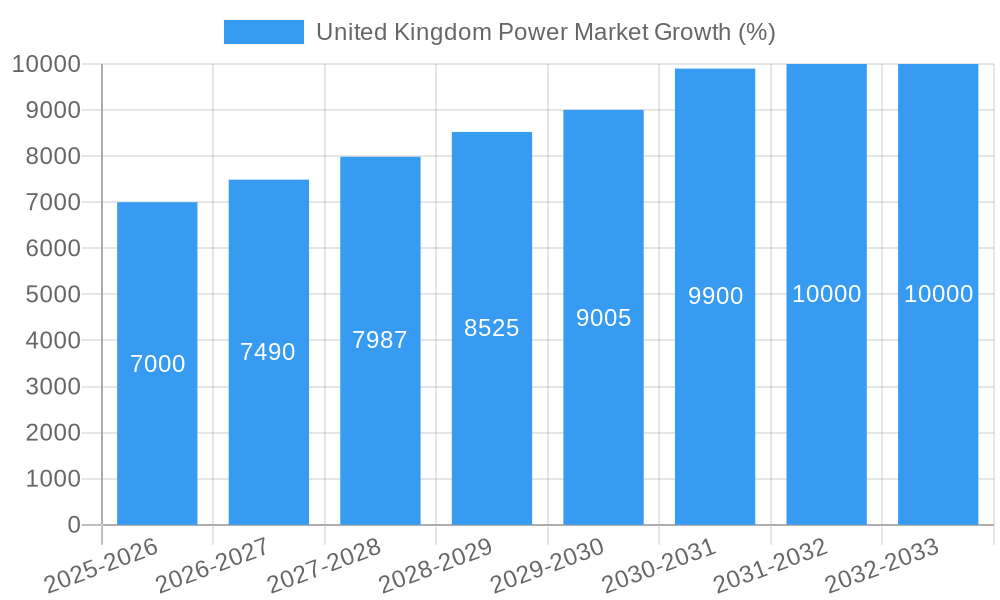

The United Kingdom power market, valued at approximately £X million in 2025 (estimated based on provided CAGR and market size data), is experiencing robust growth, projected to expand at a compound annual growth rate (CAGR) exceeding 7% through 2033. This growth is primarily driven by increasing energy demand fueled by economic expansion and population growth, coupled with a strong government push towards renewable energy sources to meet climate change targets. Significant investments in renewable energy infrastructure, particularly offshore wind and solar, are key catalysts. The transition away from traditional thermal power sources, while facing challenges related to grid infrastructure upgrades and intermittency concerns associated with renewable energy, is undeniably reshaping the market landscape. This shift is creating opportunities for companies specializing in renewable energy technologies, energy storage solutions, and grid modernization. The UK's commitment to net-zero emissions by 2050 is further accelerating this transformation, demanding significant capital expenditure and innovative solutions.

The market is segmented by power generation source, with thermal power, renewable energy (including hydroelectric, non-hydro renewable like wind and solar), and nuclear power being the major contributors. The non-hydro renewable segment is poised for the most significant growth, driven by substantial government support, falling technology costs, and increasing public awareness of environmental sustainability. However, challenges remain in managing the intermittent nature of renewable energy sources and ensuring grid stability. Furthermore, regulatory hurdles and permitting processes could potentially impede the rate of expansion in certain segments. Despite these challenges, the long-term outlook for the UK power market remains positive, fueled by ongoing policy support, technological advancements, and growing environmental awareness, presenting lucrative opportunities for both established players and new entrants. Key players like Uniper SE, Engie SA, and Vestas Wind Systems AS are actively shaping this dynamic market.

United Kingdom Power Market: 2019-2033 Forecast Report - Unlocking Growth Opportunities in a Transforming Energy Landscape

This comprehensive report provides an in-depth analysis of the United Kingdom power market, offering crucial insights for stakeholders navigating the dynamic energy transition. Covering the period from 2019 to 2033, with a focus on 2025, this report unveils market dynamics, leading players, emerging trends, and lucrative opportunities within the UK's evolving power sector. We delve into market segmentation (Thermal Power, Non-hydro Renewable Power, Hydroelectric, Nuclear Power), key players (including Uniper SE, Renewable Energy Systems Ltd, Engie SA, and more), and the regulatory landscape, providing actionable intelligence for strategic decision-making. Expect detailed financial projections, identifying high-growth segments and emerging technologies poised to reshape the UK power market. Download now to gain a competitive edge.

United Kingdom Power Market Market Dynamics & Concentration

The UK power market is characterized by moderate concentration, with several large players holding significant market share. Innovation is driven by the government's ambitious renewable energy targets and the need to decarbonize the power sector. Stringent regulatory frameworks, including emissions standards and renewable energy obligations, heavily influence market behavior. The increasing adoption of renewable energy sources represents a significant product substitute for traditional thermal power. End-user trends showcase a growing preference for sustainable and affordable energy solutions. The market has witnessed a notable number of M&A activities in recent years, particularly involving renewable energy companies.

- Market Share: The top 5 players account for approximately XX% of the market in 2025 (estimated).

- M&A Activity: An estimated XX M&A deals were recorded between 2019 and 2024, with a projected increase to XX deals by 2033.

- Innovation Drivers: Government incentives for renewable energy, technological advancements in renewable energy generation and storage, and rising consumer demand for sustainable energy.

- Regulatory Landscape: The UK's commitment to net-zero emissions drives regulatory changes affecting the entire energy value chain, influencing investment decisions and market structure.

United Kingdom Power Market Industry Trends & Analysis

The UK power market is experiencing a rapid transformation, driven by several key trends. The increasing penetration of renewable energy sources, particularly offshore wind and solar, is a major growth driver, resulting in a significant shift away from fossil fuels. Technological disruptions, including advancements in battery storage and smart grid technologies, are enhancing grid stability and integration of renewable sources. Consumer preferences are shifting towards cleaner and more sustainable energy options, prompting increased demand for green energy tariffs and services. Competitive dynamics are intensifying, with new entrants and established players vying for market share in the rapidly evolving landscape. The market is projected to experience a CAGR of XX% during the forecast period (2025-2033), with renewable energy sources achieving a market penetration of XX% by 2033.

Leading Markets & Segments in United Kingdom Power Market

While the UK power market is relatively unified, certain segments and regions demonstrate stronger growth.

- Non-hydro Renewable Power: This segment is experiencing the most rapid growth, fueled by government support and decreasing technology costs. Offshore wind projects are particularly prominent, driving significant investment and capacity additions.

- Thermal Power: Although declining, thermal power remains a significant contributor, primarily due to its role in providing baseload power and supporting grid stability during periods of low renewable energy generation.

- Hydroelectric Power: This segment contributes a relatively smaller but stable portion of the UK's energy mix.

- Nuclear Power: Nuclear power plants continue to operate, providing a consistent baseload power supply while new nuclear projects are being evaluated and planned.

Key Drivers:

- Economic Policies: Government subsidies and tax incentives for renewable energy projects.

- Infrastructure Development: Investments in grid infrastructure to accommodate increased renewable energy integration.

- Technological Advancements: Decreasing costs and improved efficiency of renewable energy technologies.

United Kingdom Power Market Product Developments

The UK power market is witnessing significant product innovations, particularly in renewable energy technologies. Advancements in offshore wind turbine technology are leading to larger, more efficient turbines, while solar panel efficiency is steadily increasing. Smart grid technologies are improving grid management and integration of distributed energy resources. Energy storage solutions, such as battery storage systems, are becoming increasingly important for grid stability and managing intermittency of renewable energy sources. These developments are improving the competitiveness of renewable energy sources and enhancing their market fit.

Key Drivers of United Kingdom Power Market Growth

Several key factors contribute to the projected growth of the UK power market. These include ambitious government targets for renewable energy deployment, which stimulate significant investments in renewable energy projects. Technological advancements leading to reduced costs and improved efficiency of renewable energy technologies are also accelerating the transition. Furthermore, growing consumer awareness of climate change and a preference for sustainable energy sources further drives market expansion.

Challenges in the United Kingdom Power Market Market

The UK power market faces several challenges, including the intermittent nature of renewable energy sources, requiring effective grid management and energy storage solutions. Supply chain disruptions and material price volatility can impact the timely completion of renewable energy projects. Finally, intense competition among players within the rapidly expanding renewable energy sector can create price pressure.

Emerging Opportunities in United Kingdom Power Market

Significant opportunities exist in the UK power market, particularly in offshore wind energy, smart grid technologies, and energy storage solutions. Strategic partnerships and collaborations among energy companies and technology providers are crucial for driving innovation and accelerating the energy transition. Market expansion into new technologies and services, such as green hydrogen production and carbon capture utilization and storage (CCUS), presents long-term growth potential.

Leading Players in the United Kingdom Power Market Sector

- Uniper SE

- Renewable Energy Systems Ltd

- Engie SA

- Electricite de France SA

- Lightsource bp Renewable Energy Investments Limited

- E ON UK PLC

- Siemens Gamesa Renewable Energy SA

- Good Energy Group PLC

- Vestas Wind Systems AS

- Ecotricity Group Ltd

Key Milestones in United Kingdom Power Market Industry

- 2020: Significant increase in offshore wind capacity additions.

- 2021: Launch of several large-scale renewable energy projects.

- 2022: Government announcement of further incentives for renewable energy deployment.

- 2023: Several mergers and acquisitions in the renewable energy sector.

- 2024: Continued growth in renewable energy installations.

Strategic Outlook for United Kingdom Power Market Market

The UK power market exhibits robust growth potential, driven by government policy, technological advancements, and evolving consumer preferences. Strategic opportunities include investment in renewable energy projects, development of smart grid infrastructure, and exploration of emerging technologies. Companies that embrace innovation, strategic partnerships, and sustainable practices will be best positioned to capitalize on the long-term growth opportunities within this dynamic market.

United Kingdom Power Market Segmentation

-

1. Power Generation from Sources

- 1.1. Thermal Power

- 1.2. Non-hydro Renewable Power

- 1.3. Hydroelectric

- 1.4. Nuclear Power

- 2. Transmission and Distribution (T&D)

United Kingdom Power Market Segmentation By Geography

- 1. United Kingdom

United Kingdom Power Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of > 7.00% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. 4.; Increase in Demand for Clean Energy4.; Plant Lifetime Extensions With Favorable Policies

- 3.3. Market Restrains

- 3.3.1. 4.; Intense Competition From Renewable Energy Sources4.; Accidents and Uncertainty over the Cost Effectiveness

- 3.4. Market Trends

- 3.4.1. Non-hydro Renewable Power Segment to Witness Significant Market Growth

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. United Kingdom Power Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Power Generation from Sources

- 5.1.1. Thermal Power

- 5.1.2. Non-hydro Renewable Power

- 5.1.3. Hydroelectric

- 5.1.4. Nuclear Power

- 5.2. Market Analysis, Insights and Forecast - by Transmission and Distribution (T&D)

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. United Kingdom

- 5.1. Market Analysis, Insights and Forecast - by Power Generation from Sources

- 6. United Kingdom United Kingdom Power Market Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 6.1.1.

- 7. France United Kingdom Power Market Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 7.1.1.

- 8. Germany United Kingdom Power Market Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 8.1.1.

- 9. Rest of Europe United Kingdom Power Market Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 9.1.1.

- 10. Competitive Analysis

- 10.1. Market Share Analysis 2024

- 10.2. Company Profiles

- 10.2.1 Uniper SE

- 10.2.1.1. Overview

- 10.2.1.2. Products

- 10.2.1.3. SWOT Analysis

- 10.2.1.4. Recent Developments

- 10.2.1.5. Financials (Based on Availability)

- 10.2.2 Renewable Energy Systems Ltd*List Not Exhaustive

- 10.2.2.1. Overview

- 10.2.2.2. Products

- 10.2.2.3. SWOT Analysis

- 10.2.2.4. Recent Developments

- 10.2.2.5. Financials (Based on Availability)

- 10.2.3 Engie SA

- 10.2.3.1. Overview

- 10.2.3.2. Products

- 10.2.3.3. SWOT Analysis

- 10.2.3.4. Recent Developments

- 10.2.3.5. Financials (Based on Availability)

- 10.2.4 Electricite de France SA

- 10.2.4.1. Overview

- 10.2.4.2. Products

- 10.2.4.3. SWOT Analysis

- 10.2.4.4. Recent Developments

- 10.2.4.5. Financials (Based on Availability)

- 10.2.5 Lightsource bp Renewable Energy Investments Limited

- 10.2.5.1. Overview

- 10.2.5.2. Products

- 10.2.5.3. SWOT Analysis

- 10.2.5.4. Recent Developments

- 10.2.5.5. Financials (Based on Availability)

- 10.2.6 E ON UK PLC

- 10.2.6.1. Overview

- 10.2.6.2. Products

- 10.2.6.3. SWOT Analysis

- 10.2.6.4. Recent Developments

- 10.2.6.5. Financials (Based on Availability)

- 10.2.7 Siemens Gamesa Renewable Energy SA

- 10.2.7.1. Overview

- 10.2.7.2. Products

- 10.2.7.3. SWOT Analysis

- 10.2.7.4. Recent Developments

- 10.2.7.5. Financials (Based on Availability)

- 10.2.8 Good Energy Group PLC

- 10.2.8.1. Overview

- 10.2.8.2. Products

- 10.2.8.3. SWOT Analysis

- 10.2.8.4. Recent Developments

- 10.2.8.5. Financials (Based on Availability)

- 10.2.9 Vestas Wind Systems AS

- 10.2.9.1. Overview

- 10.2.9.2. Products

- 10.2.9.3. SWOT Analysis

- 10.2.9.4. Recent Developments

- 10.2.9.5. Financials (Based on Availability)

- 10.2.10 Ecotricity Group Ltd

- 10.2.10.1. Overview

- 10.2.10.2. Products

- 10.2.10.3. SWOT Analysis

- 10.2.10.4. Recent Developments

- 10.2.10.5. Financials (Based on Availability)

- 10.2.1 Uniper SE

List of Figures

- Figure 1: United Kingdom Power Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: United Kingdom Power Market Share (%) by Company 2024

List of Tables

- Table 1: United Kingdom Power Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: United Kingdom Power Market Revenue Million Forecast, by Power Generation from Sources 2019 & 2032

- Table 3: United Kingdom Power Market Revenue Million Forecast, by Transmission and Distribution (T&D) 2019 & 2032

- Table 4: United Kingdom Power Market Revenue Million Forecast, by Region 2019 & 2032

- Table 5: United Kingdom Power Market Revenue Million Forecast, by Country 2019 & 2032

- Table 6: United Kingdom Power Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 7: United Kingdom Power Market Revenue Million Forecast, by Country 2019 & 2032

- Table 8: United Kingdom Power Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: United Kingdom Power Market Revenue Million Forecast, by Country 2019 & 2032

- Table 10: United Kingdom Power Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 11: United Kingdom Power Market Revenue Million Forecast, by Country 2019 & 2032

- Table 12: United Kingdom Power Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 13: United Kingdom Power Market Revenue Million Forecast, by Power Generation from Sources 2019 & 2032

- Table 14: United Kingdom Power Market Revenue Million Forecast, by Transmission and Distribution (T&D) 2019 & 2032

- Table 15: United Kingdom Power Market Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the United Kingdom Power Market?

The projected CAGR is approximately > 7.00%.

2. Which companies are prominent players in the United Kingdom Power Market?

Key companies in the market include Uniper SE, Renewable Energy Systems Ltd*List Not Exhaustive, Engie SA, Electricite de France SA, Lightsource bp Renewable Energy Investments Limited, E ON UK PLC, Siemens Gamesa Renewable Energy SA, Good Energy Group PLC, Vestas Wind Systems AS, Ecotricity Group Ltd.

3. What are the main segments of the United Kingdom Power Market?

The market segments include Power Generation from Sources, Transmission and Distribution (T&D).

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

4.; Increase in Demand for Clean Energy4.; Plant Lifetime Extensions With Favorable Policies.

6. What are the notable trends driving market growth?

Non-hydro Renewable Power Segment to Witness Significant Market Growth.

7. Are there any restraints impacting market growth?

4.; Intense Competition From Renewable Energy Sources4.; Accidents and Uncertainty over the Cost Effectiveness.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "United Kingdom Power Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the United Kingdom Power Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the United Kingdom Power Market?

To stay informed about further developments, trends, and reports in the United Kingdom Power Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence