Key Insights

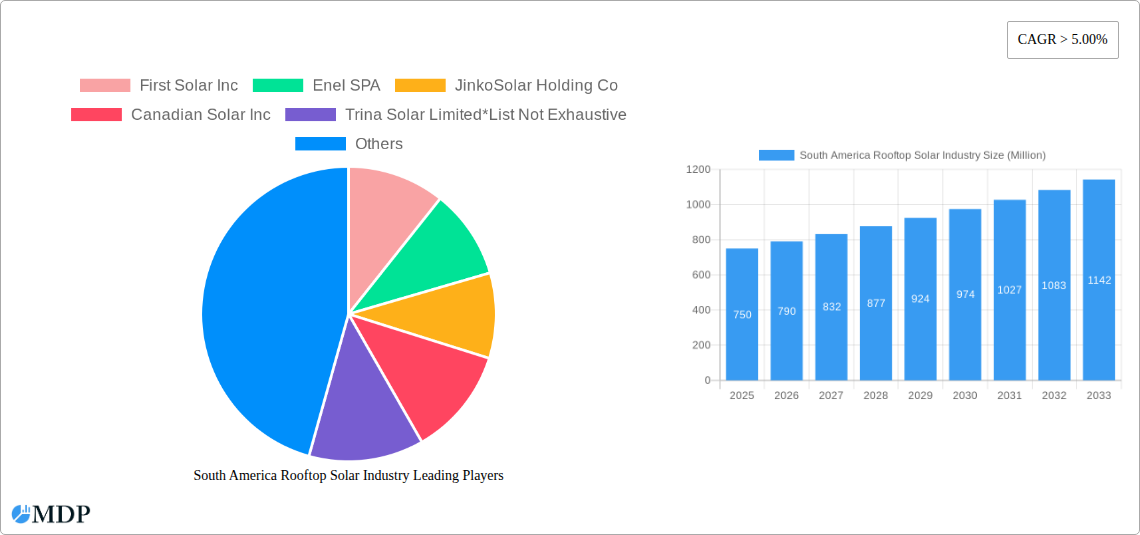

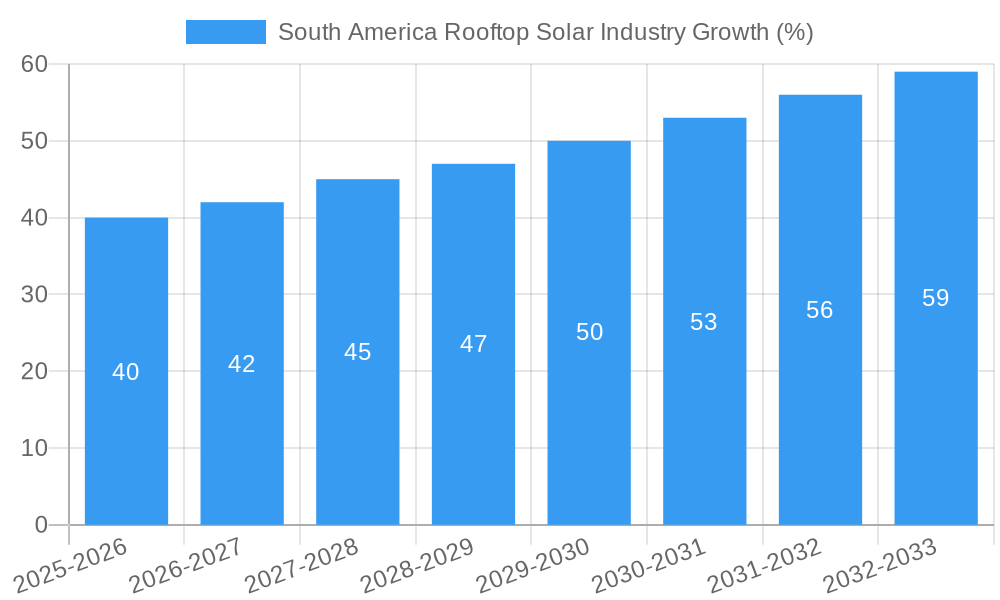

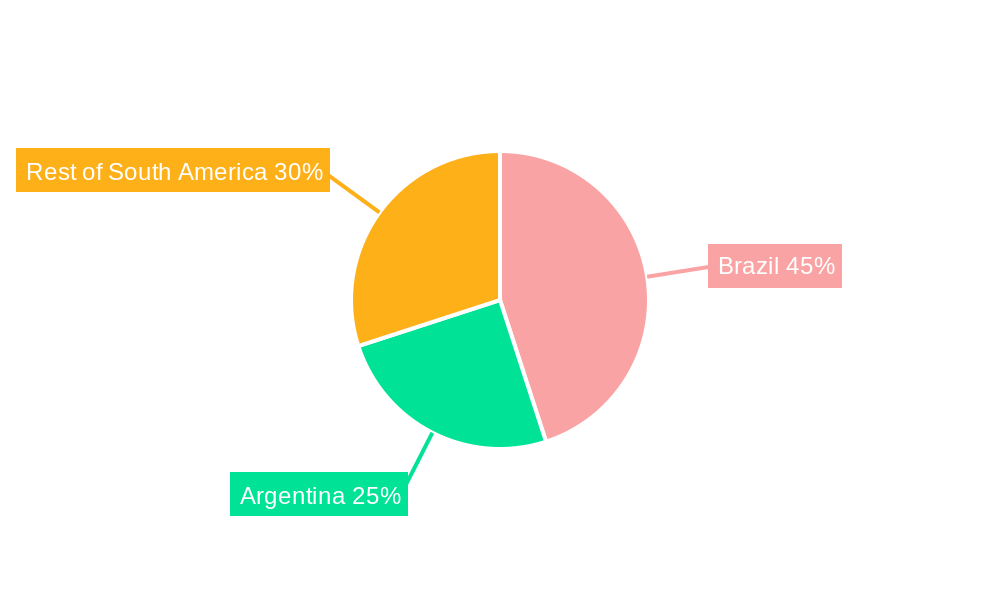

The South American rooftop solar industry is experiencing robust growth, driven by increasing electricity costs, supportive government policies promoting renewable energy adoption, and rising environmental awareness among consumers and businesses. A Compound Annual Growth Rate (CAGR) exceeding 5% signifies a significant expansion of this market from 2019 to 2033. While precise market sizing data is unavailable, considering a typical market size for similar regions and the stated CAGR, we can reasonably estimate the 2025 market size to be in the range of $500 million to $1 billion USD, depending on the precise definition of "rooftop solar" (which may include residential, commercial, and industrial segments). This range reflects the potential for substantial market growth, particularly in countries like Brazil and Argentina, which are leading the adoption curve. The residential sector is likely to dominate in the initial stages due to increasing energy affordability, followed by a gradual increase in commercial and industrial segment participation as larger-scale projects become more economically viable. However, challenges remain, including the relatively high initial investment costs, inconsistent electricity grid infrastructure in some areas, and potential regulatory hurdles. Overcoming these obstacles will be critical for achieving the full market potential of South America’s rooftop solar sector.

Further growth will be fueled by technological advancements, leading to lower system costs and improved efficiency. Government incentives, such as tax credits and subsidies, will continue to stimulate demand. As the industry matures, we anticipate increased competition among established players like First Solar, Enel, JinkoSolar, Canadian Solar, and Trina Solar, alongside the emergence of local South American companies. This competition will drive innovation and price reductions, thereby benefiting consumers and contributing to further market expansion. This expansion is further enhanced by the integration of smart technologies in rooftop solar systems, enabling better energy monitoring and management and improving efficiency. The future of the South American rooftop solar market is bright, with significant opportunities for growth and investment in the coming years.

This comprehensive report provides an in-depth analysis of the South America rooftop solar industry, covering market dynamics, leading players, technological advancements, and future growth prospects. The study period spans from 2019 to 2033, with 2025 serving as both the base and estimated year. This report is essential for investors, industry stakeholders, and businesses seeking to navigate this rapidly expanding market.

South America Rooftop Solar Industry Market Dynamics & Concentration

This section analyzes the competitive landscape, innovation drivers, regulatory environment, and market trends within the South American rooftop solar industry from 2019-2024 and forecasts to 2033. Market concentration is assessed through analysis of market share held by key players such as First Solar Inc, Enel SPA, JinkoSolar Holding Co, Canadian Solar Inc, Trina Solar Limited, Aes Gener SA, and other significant participants. The report examines the impact of mergers and acquisitions (M&A) activities, quantifying the number of deals over the study period (xx). Innovation drivers are explored, including technological advancements in solar panel efficiency and energy storage solutions. Regulatory frameworks and their influence on market growth are evaluated, considering variations across different South American nations. The report also examines the impact of substitute products, such as other renewable energy sources, and analyzes evolving end-user trends influencing adoption rates within residential, commercial, and industrial segments.

- Market Share: Analysis of market share distribution amongst key players (detailed breakdown provided within the full report).

- M&A Activity: Quantifiable data on the number of M&A deals (xx) during the historical and forecast periods, and their impact on market consolidation.

- Regulatory Landscape: Assessment of regulatory frameworks across key South American countries and their influence on industry growth.

- Innovation Drivers: Detailed exploration of technological advancements and their impact on market dynamics.

South America Rooftop Solar Industry Industry Trends & Analysis

This section delves into the key trends shaping the South American rooftop solar market, analyzing market growth drivers, technological advancements, consumer preferences, and competitive dynamics from 2019 to 2033. The compound annual growth rate (CAGR) for the forecast period (2025-2033) is projected to be xx%, driven by factors such as increasing electricity prices, government incentives, and growing environmental awareness. The analysis also assesses market penetration rates within different segments and geographic regions, highlighting shifts in consumer preferences and the influence of technological disruptions on market structure. The competitive dynamics are explored, examining the strategies employed by key players to maintain and expand their market share.

- CAGR (2025-2033): Projected at xx%

- Market Penetration: Detailed analysis of market penetration across residential, commercial, and industrial segments.

Leading Markets & Segments in South America Rooftop Solar Industry

This section identifies the leading markets and segments within the South American rooftop solar industry. Dominant regions, countries, and deployment locations (residential, commercial, industrial) are analyzed, revealing the key factors driving their growth. This includes an examination of economic policies, infrastructure development, and consumer behavior.

- Dominant Region: [Insert dominant region, e.g., Brazil] – Detailed explanation of reasons for dominance provided within the full report.

- Key Drivers (Brazil Example):

- Government incentives and subsidies.

- Expanding grid infrastructure in key urban areas.

- Rising electricity costs making solar more cost-competitive.

- Dominant Segment: [Insert dominant segment, e.g., Residential] – Reasoning for segment dominance provided in the full report.

- Key Drivers (Residential Example):

- Falling solar panel costs

- Increased consumer awareness of environmental benefits

- Government incentives for residential installations

South America Rooftop Solar Industry Product Developments

This section summarizes recent product innovations, applications, and competitive advantages in the South American rooftop solar industry. The focus will be on technological trends such as advancements in panel efficiency, energy storage solutions, and smart grid integration capabilities, along with their market relevance and impact on industry competition.

Key Drivers of South America Rooftop Solar Industry Growth

The growth of the South American rooftop solar industry is propelled by a confluence of factors. Falling solar panel prices make it increasingly cost-competitive with traditional energy sources. Government incentives, including tax credits and subsidies, further stimulate market adoption. Moreover, growing environmental concerns and the push towards renewable energy sources enhance the appeal of rooftop solar among consumers and businesses. Technological advancements constantly improve panel efficiency and energy storage capabilities, boosting the overall attractiveness of this technology.

Challenges in the South America Rooftop Solar Industry Market

Despite considerable growth potential, the South American rooftop solar market faces several challenges. Regulatory hurdles, including bureaucratic processes and permitting issues, can hinder project development and deployment. Supply chain constraints, particularly concerning the availability of key components, may impact the cost and timeline of projects. Furthermore, intense competition among industry players could lead to price pressures and reduced profit margins. The inconsistent availability of financing options for solar projects presents another obstacle to market expansion. These challenges, if not properly addressed, may curb the sector’s full potential.

Emerging Opportunities in South America Rooftop Solar Industry

Despite the existing challenges, the South American rooftop solar industry presents significant long-term opportunities. Technological breakthroughs, especially in energy storage and smart grid integration, will likely enhance the reliability and cost-effectiveness of rooftop solar systems. Strategic partnerships between energy companies, technology providers, and financial institutions can help overcome financing limitations and streamline project development. Expansion into new geographic markets and segments, such as rural communities and industrial complexes, holds immense growth potential.

Leading Players in the South America Rooftop Solar Industry Sector

Key Milestones in South America Rooftop Solar Industry Industry

- [Year/Month]: [Milestone description and impact on market dynamics – e.g., "July 2022: Brazil announces new solar energy incentives, leading to a surge in project approvals."]

- [Year/Month]: [Milestone description and impact on market dynamics]

- [Year/Month]: [Milestone description and impact on market dynamics]

- [Year/Month]: [Milestone description and impact on market dynamics]

Strategic Outlook for South America Rooftop Solar Industry Market

The South American rooftop solar industry is poised for continued growth driven by declining technology costs, supportive government policies, and rising energy demand. Strategic opportunities exist for companies focusing on innovative financing models, technological advancements, and expanding into underserved markets. The focus on integrating rooftop solar with energy storage solutions and smart grid technologies will significantly enhance market appeal and accelerate adoption rates. The potential for significant market expansion, particularly in countries with limited grid access, highlights the significant long-term investment opportunities within the sector.

South America Rooftop Solar Industry Segmentation

-

1. Location of Deployment

- 1.1. Residential

- 1.2. Commericial

- 1.3. Industrial

-

2. Geography

- 2.1. Brazil

- 2.2. Chile

- 2.3. Argentina

- 2.4. Rest of South America

South America Rooftop Solar Industry Segmentation By Geography

- 1. Brazil

- 2. Chile

- 3. Argentina

- 4. Rest of South America

South America Rooftop Solar Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of > 5.00% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. 4.; The Growing Demand for Clean Energy Sources 4.; Efforts to Reduce Over-Reliance on Coal-Based Power Plants

- 3.3. Market Restrains

- 3.3.1. 4.; Rising Adoption of Alternate Clean Power Sources

- 3.4. Market Trends

- 3.4.1. Commercial Segment to be the Largest Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. South America Rooftop Solar Industry Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Location of Deployment

- 5.1.1. Residential

- 5.1.2. Commericial

- 5.1.3. Industrial

- 5.2. Market Analysis, Insights and Forecast - by Geography

- 5.2.1. Brazil

- 5.2.2. Chile

- 5.2.3. Argentina

- 5.2.4. Rest of South America

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Brazil

- 5.3.2. Chile

- 5.3.3. Argentina

- 5.3.4. Rest of South America

- 5.1. Market Analysis, Insights and Forecast - by Location of Deployment

- 6. Brazil South America Rooftop Solar Industry Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Location of Deployment

- 6.1.1. Residential

- 6.1.2. Commericial

- 6.1.3. Industrial

- 6.2. Market Analysis, Insights and Forecast - by Geography

- 6.2.1. Brazil

- 6.2.2. Chile

- 6.2.3. Argentina

- 6.2.4. Rest of South America

- 6.1. Market Analysis, Insights and Forecast - by Location of Deployment

- 7. Chile South America Rooftop Solar Industry Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Location of Deployment

- 7.1.1. Residential

- 7.1.2. Commericial

- 7.1.3. Industrial

- 7.2. Market Analysis, Insights and Forecast - by Geography

- 7.2.1. Brazil

- 7.2.2. Chile

- 7.2.3. Argentina

- 7.2.4. Rest of South America

- 7.1. Market Analysis, Insights and Forecast - by Location of Deployment

- 8. Argentina South America Rooftop Solar Industry Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Location of Deployment

- 8.1.1. Residential

- 8.1.2. Commericial

- 8.1.3. Industrial

- 8.2. Market Analysis, Insights and Forecast - by Geography

- 8.2.1. Brazil

- 8.2.2. Chile

- 8.2.3. Argentina

- 8.2.4. Rest of South America

- 8.1. Market Analysis, Insights and Forecast - by Location of Deployment

- 9. Rest of South America South America Rooftop Solar Industry Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Location of Deployment

- 9.1.1. Residential

- 9.1.2. Commericial

- 9.1.3. Industrial

- 9.2. Market Analysis, Insights and Forecast - by Geography

- 9.2.1. Brazil

- 9.2.2. Chile

- 9.2.3. Argentina

- 9.2.4. Rest of South America

- 9.1. Market Analysis, Insights and Forecast - by Location of Deployment

- 10. Brazil South America Rooftop Solar Industry Analysis, Insights and Forecast, 2019-2031

- 11. Argentina South America Rooftop Solar Industry Analysis, Insights and Forecast, 2019-2031

- 12. Rest of South America South America Rooftop Solar Industry Analysis, Insights and Forecast, 2019-2031

- 13. Competitive Analysis

- 13.1. Market Share Analysis 2024

- 13.2. Company Profiles

- 13.2.1 First Solar Inc

- 13.2.1.1. Overview

- 13.2.1.2. Products

- 13.2.1.3. SWOT Analysis

- 13.2.1.4. Recent Developments

- 13.2.1.5. Financials (Based on Availability)

- 13.2.2 Enel SPA

- 13.2.2.1. Overview

- 13.2.2.2. Products

- 13.2.2.3. SWOT Analysis

- 13.2.2.4. Recent Developments

- 13.2.2.5. Financials (Based on Availability)

- 13.2.3 JinkoSolar Holding Co

- 13.2.3.1. Overview

- 13.2.3.2. Products

- 13.2.3.3. SWOT Analysis

- 13.2.3.4. Recent Developments

- 13.2.3.5. Financials (Based on Availability)

- 13.2.4 Canadian Solar Inc

- 13.2.4.1. Overview

- 13.2.4.2. Products

- 13.2.4.3. SWOT Analysis

- 13.2.4.4. Recent Developments

- 13.2.4.5. Financials (Based on Availability)

- 13.2.5 Trina Solar Limited*List Not Exhaustive

- 13.2.5.1. Overview

- 13.2.5.2. Products

- 13.2.5.3. SWOT Analysis

- 13.2.5.4. Recent Developments

- 13.2.5.5. Financials (Based on Availability)

- 13.2.6 Aes Gener SA

- 13.2.6.1. Overview

- 13.2.6.2. Products

- 13.2.6.3. SWOT Analysis

- 13.2.6.4. Recent Developments

- 13.2.6.5. Financials (Based on Availability)

- 13.2.1 First Solar Inc

List of Figures

- Figure 1: South America Rooftop Solar Industry Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: South America Rooftop Solar Industry Share (%) by Company 2024

List of Tables

- Table 1: South America Rooftop Solar Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 2: South America Rooftop Solar Industry Revenue Million Forecast, by Location of Deployment 2019 & 2032

- Table 3: South America Rooftop Solar Industry Revenue Million Forecast, by Geography 2019 & 2032

- Table 4: South America Rooftop Solar Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 5: South America Rooftop Solar Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 6: Brazil South America Rooftop Solar Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 7: Argentina South America Rooftop Solar Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 8: Rest of South America South America Rooftop Solar Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: South America Rooftop Solar Industry Revenue Million Forecast, by Location of Deployment 2019 & 2032

- Table 10: South America Rooftop Solar Industry Revenue Million Forecast, by Geography 2019 & 2032

- Table 11: South America Rooftop Solar Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 12: South America Rooftop Solar Industry Revenue Million Forecast, by Location of Deployment 2019 & 2032

- Table 13: South America Rooftop Solar Industry Revenue Million Forecast, by Geography 2019 & 2032

- Table 14: South America Rooftop Solar Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 15: South America Rooftop Solar Industry Revenue Million Forecast, by Location of Deployment 2019 & 2032

- Table 16: South America Rooftop Solar Industry Revenue Million Forecast, by Geography 2019 & 2032

- Table 17: South America Rooftop Solar Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 18: South America Rooftop Solar Industry Revenue Million Forecast, by Location of Deployment 2019 & 2032

- Table 19: South America Rooftop Solar Industry Revenue Million Forecast, by Geography 2019 & 2032

- Table 20: South America Rooftop Solar Industry Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the South America Rooftop Solar Industry?

The projected CAGR is approximately > 5.00%.

2. Which companies are prominent players in the South America Rooftop Solar Industry?

Key companies in the market include First Solar Inc, Enel SPA, JinkoSolar Holding Co, Canadian Solar Inc, Trina Solar Limited*List Not Exhaustive, Aes Gener SA.

3. What are the main segments of the South America Rooftop Solar Industry?

The market segments include Location of Deployment, Geography.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

4.; The Growing Demand for Clean Energy Sources 4.; Efforts to Reduce Over-Reliance on Coal-Based Power Plants.

6. What are the notable trends driving market growth?

Commercial Segment to be the Largest Market.

7. Are there any restraints impacting market growth?

4.; Rising Adoption of Alternate Clean Power Sources.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "South America Rooftop Solar Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the South America Rooftop Solar Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the South America Rooftop Solar Industry?

To stay informed about further developments, trends, and reports in the South America Rooftop Solar Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence