Key Insights

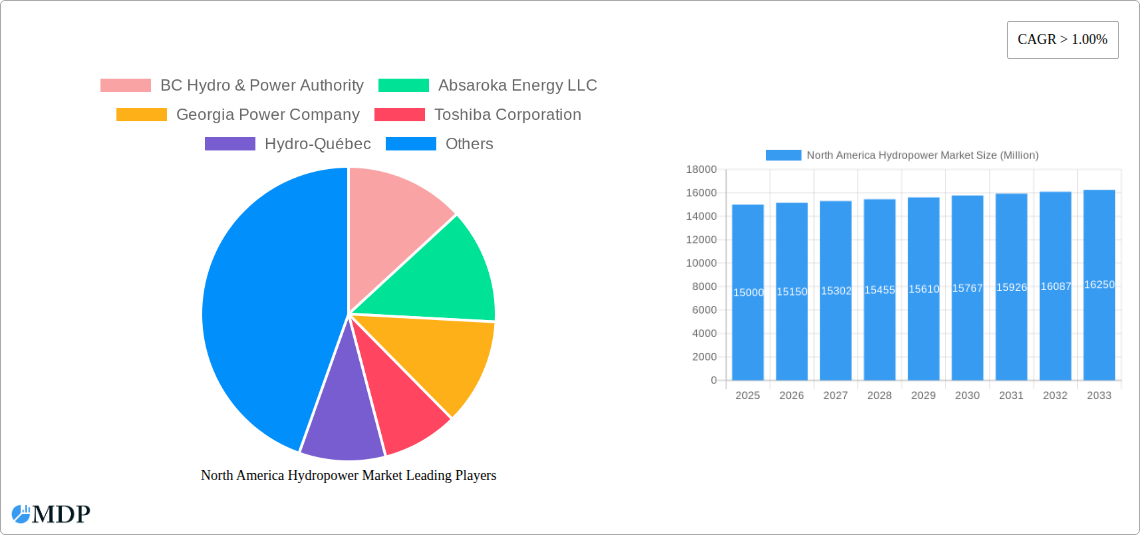

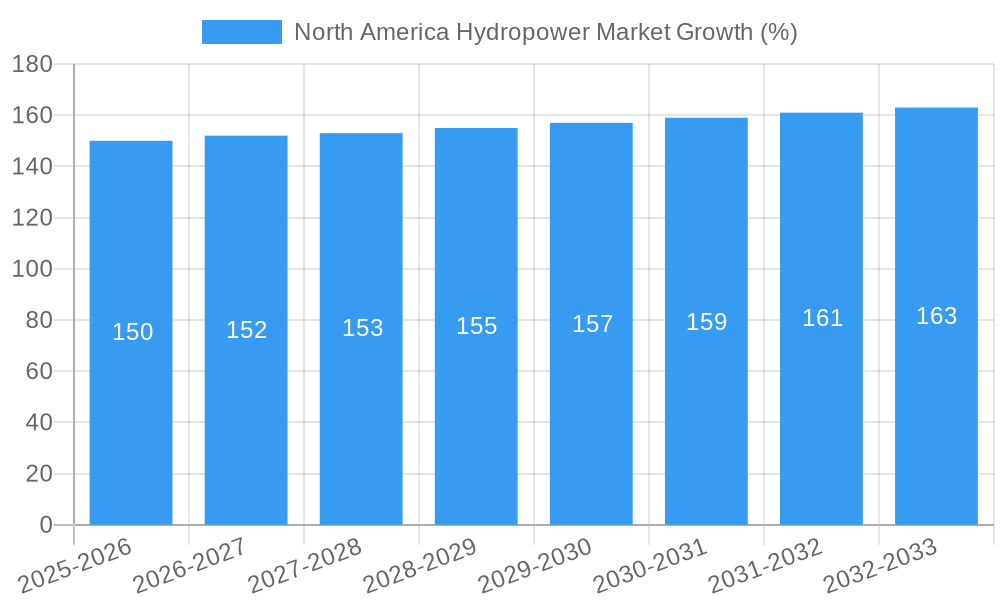

The North American hydropower market, encompassing large and small hydropower plants, pumped storage facilities, and other technologies, is experiencing steady growth, driven by increasing demand for renewable energy and a focus on decarbonizing the electricity sector. The market size in 2025 is estimated at $15 billion (USD), based on a logical extrapolation considering typical growth rates for established renewable energy markets and the substantial existing hydropower infrastructure in North America. A CAGR exceeding 1% indicates a consistent expansion, fueled by government incentives for renewable energy projects, improved energy storage technologies (particularly pumped storage), and a growing awareness of the environmental benefits of hydropower compared to fossil fuels. Major players like BC Hydro, Duke Energy, and General Electric are actively involved in developing and upgrading existing hydropower facilities, contributing to the market's sustained growth. While regulatory hurdles and environmental concerns related to dam construction and ecological impact can act as restraints, technological advancements and optimized project planning are mitigating these challenges. The segment breakdown shows a significant contribution from large hydropower projects, followed by smaller-scale installations that offer greater geographic flexibility and reduced environmental impact in certain locations. The forecast period of 2025-2033 anticipates further growth, driven by ongoing investments in modernization, expansion, and the integration of smart grid technologies for optimized energy distribution.

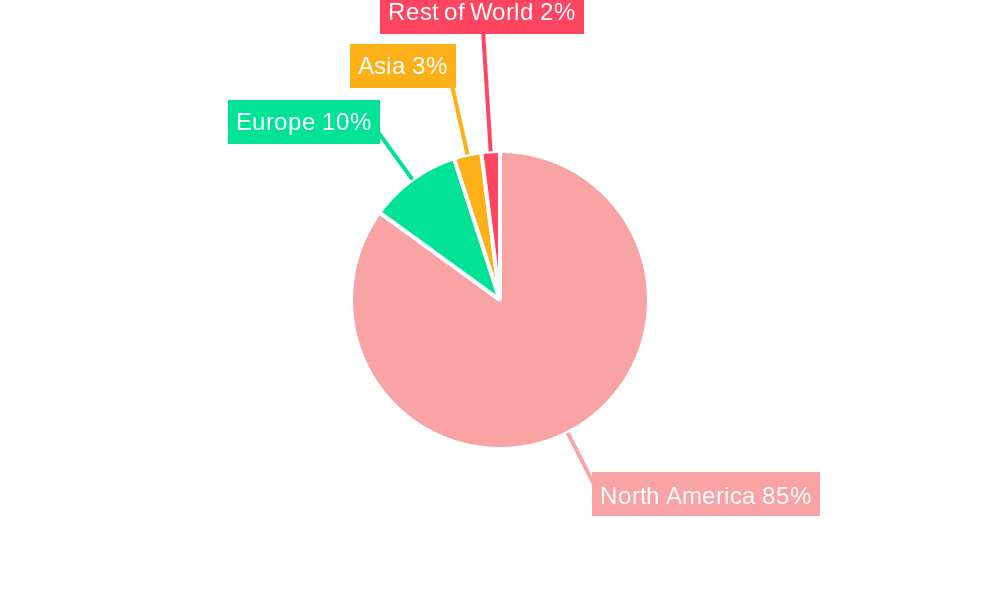

The United States, Canada, and Mexico form the core of the North American market, with the US likely holding the largest share due to its extensive network of existing hydropower plants and ongoing investments in renewable energy. The "Rest of North America" segment comprises smaller contributions from other countries in the region. Future growth will depend on factors such as government policies, technological innovations (e.g., advancements in turbine efficiency), and the successful navigation of environmental regulations. The market's overall trajectory reflects a positive outlook, suggesting continued expansion and a significant role for hydropower in achieving North America's renewable energy targets. Competition among established players and the emergence of new technological solutions will shape the market's evolution in the coming years. Consistent investment in research and development will be crucial for enhancing efficiency, reducing environmental impact, and strengthening the overall sustainability of the North American hydropower sector.

North America Hydropower Market: A Comprehensive Report (2019-2033)

This in-depth report provides a comprehensive analysis of the North America hydropower market, offering invaluable insights for stakeholders across the industry. Covering the period from 2019 to 2033, with a focus on 2025, this study unveils key market dynamics, emerging trends, and lucrative opportunities within this dynamic sector. The report forecasts a market valued at xx Million by 2033, showcasing significant growth potential. Download now to gain a competitive edge!

North America Hydropower Market Market Dynamics & Concentration

The North American hydropower market is characterized by a moderately concentrated landscape with a handful of major players holding significant market share. BC Hydro & Power Authority, Hydro-Québec, and Duke Energy Corporation are among the dominant players, collectively accounting for an estimated xx% of the market in 2025. However, the presence of several regional and smaller independent power producers contributes to a competitive environment.

Market concentration is influenced by factors such as access to resources, regulatory frameworks, and capital investment capacity. Innovation drivers include the ongoing development of more efficient turbines, improved grid integration technologies, and the increasing adoption of pumped storage hydropower (PSH). Regulatory frameworks, while generally supportive of hydropower development, vary across different jurisdictions, impacting investment decisions and project timelines. The market also faces competition from alternative renewable energy sources, such as solar and wind power, although hydropower’s reliability and baseload capacity remain key advantages.

Mergers and acquisitions (M&A) activity has been relatively moderate in recent years, with approximately xx deals recorded between 2019 and 2024. These activities primarily involve smaller players consolidating their positions or larger companies acquiring smaller projects to expand their portfolios. End-user trends show a growing demand for clean and reliable energy sources, fueling the growth of the hydropower sector.

North America Hydropower Market Industry Trends & Analysis

The North American hydropower market is experiencing steady growth, driven by increasing demand for renewable energy, government incentives, and technological advancements. The Compound Annual Growth Rate (CAGR) is projected to be xx% from 2025 to 2033. Market penetration of hydropower in the overall electricity generation mix remains significant, particularly in regions with abundant water resources.

Technological disruptions, such as the development of advanced turbine designs and improved energy storage solutions, are enhancing the efficiency and flexibility of hydropower plants. This is leading to increased competitiveness against other renewable energy sources. Consumer preferences are shifting towards environmentally sustainable energy options, creating a strong demand for hydropower. Competitive dynamics are shaped by the interplay between established players and new entrants, with innovation and cost-effectiveness being key differentiators.

Leading Markets & Segments in North America Hydropower Market

The leading segment within the North American hydropower market is Large Hydropower, representing an estimated xx% of the total market in 2025. Key drivers for this segment's dominance include the existing infrastructure, economies of scale, and established grid connections. The Pumped Storage segment is also experiencing significant growth, driven by the increasing need for grid stability and energy storage.

Large Hydropower:

- Existing Infrastructure

- Economies of scale

- Established grid connections

- Government support for large-scale projects

Pumped Storage:

- Grid stability requirements

- Energy storage needs

- Increasing renewable energy integration

- Technological advancements

Canada and the United States are the dominant markets in North America, with vast hydropower resources and established regulatory frameworks supporting the industry. Specific regional variations exist, with certain provinces and states exhibiting higher hydropower penetration due to factors such as hydrological conditions, government policies, and existing infrastructure.

North America Hydropower Market Product Developments

Recent product innovations have focused on improving turbine efficiency, enhancing grid integration capabilities, and optimizing plant operation and maintenance. New technologies are being developed to improve the reliability and lifespan of hydropower plants, while also reducing environmental impacts. These advancements are enhancing the overall competitiveness of hydropower in the energy mix. The market is witnessing a growing focus on smart grid technologies and digitalization, further strengthening the sector's efficiency and sustainability profile.

Key Drivers of North America Hydropower Market Growth

Several factors are driving the growth of the North American hydropower market. These include:

- Government regulations and incentives: Policies promoting renewable energy and carbon reduction targets are stimulating investments in hydropower.

- Technological advancements: Improvements in turbine technology, grid integration, and energy storage enhance efficiency and competitiveness.

- Environmental concerns: The increasing focus on reducing carbon emissions and transitioning to sustainable energy sources fuels demand for hydropower.

- Economic viability: In many regions, hydropower remains a cost-effective and reliable source of electricity.

Challenges in the North America Hydropower Market Market

The North American hydropower market faces several challenges:

- Environmental concerns: Hydropower projects can have environmental impacts, including habitat disruption and changes in water flow. Mitigation efforts are crucial.

- Regulatory hurdles: Permitting and licensing processes can be complex and time-consuming, delaying project development.

- Competition from other renewable sources: Solar and wind power pose competition, demanding optimized strategies to ensure hydropower remains cost-competitive.

- Infrastructure limitations: Upgrading existing infrastructure and building new transmission lines can be expensive and challenging.

Emerging Opportunities in North America Hydropower Market

The long-term growth of the North American hydropower market is supported by several opportunities. Technological breakthroughs in areas such as pumped storage and small-scale hydro are opening up new possibilities. Strategic partnerships between energy companies and technology providers are fostering innovation and accelerating project development. Market expansion strategies, including the development of new projects and the modernization of existing facilities, are key to sustaining long-term growth.

Leading Players in the North America Hydropower Market Sector

- BC Hydro & Power Authority

- Absaroka Energy LLC

- Georgia Power Company

- Toshiba Corporation

- Hydro-Québec

- Duke Energy Corporation

- Ontario Power Generation Inc

- General Electric Company

- Andritz AG

Key Milestones in North America Hydropower Market Industry

- June 2022: Stantec commissioned to assess the potential for pumped storage hydropower across Canada, highlighting growing interest in energy storage solutions.

- May 2022: USD 8 Million in funding from the U.S. Department of Energy to enhance the flexibility of the U.S. hydropower fleet, signifying government support for grid modernization.

Strategic Outlook for North America Hydropower Market Market

The North American hydropower market holds significant potential for long-term growth. Continued investment in renewable energy, technological advancements, and supportive government policies will drive market expansion. Strategic partnerships, focused on innovation and efficient project development, will be key to unlocking the full potential of this sector. The focus on improving grid integration, enhancing energy storage, and minimizing environmental impacts will further shape the industry’s trajectory.

North America Hydropower Market Segmentation

-

1. Type

- 1.1. Large Hydropower

- 1.2. Small Hydropower

- 1.3. Pumped Storage

- 1.4. Other Types

-

2. Geography

- 2.1. United States

- 2.2. Canada

- 2.3. Mexico

North America Hydropower Market Segmentation By Geography

- 1. United States

- 2. Canada

- 3. Mexico

North America Hydropower Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of > 1.00% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. 4.; Increasing Investment in the Upstream Sector4.; Supportive Government Policies

- 3.3. Market Restrains

- 3.3.1. 4.; Increasing Demand to Diversify the Power Generation Mix by Introducing Renewable Energy Sources

- 3.4. Market Trends

- 3.4.1. Pumped Storage to Witness Growth

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. North America Hydropower Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Large Hydropower

- 5.1.2. Small Hydropower

- 5.1.3. Pumped Storage

- 5.1.4. Other Types

- 5.2. Market Analysis, Insights and Forecast - by Geography

- 5.2.1. United States

- 5.2.2. Canada

- 5.2.3. Mexico

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. United States

- 5.3.2. Canada

- 5.3.3. Mexico

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. United States North America Hydropower Market Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Type

- 6.1.1. Large Hydropower

- 6.1.2. Small Hydropower

- 6.1.3. Pumped Storage

- 6.1.4. Other Types

- 6.2. Market Analysis, Insights and Forecast - by Geography

- 6.2.1. United States

- 6.2.2. Canada

- 6.2.3. Mexico

- 6.1. Market Analysis, Insights and Forecast - by Type

- 7. Canada North America Hydropower Market Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Type

- 7.1.1. Large Hydropower

- 7.1.2. Small Hydropower

- 7.1.3. Pumped Storage

- 7.1.4. Other Types

- 7.2. Market Analysis, Insights and Forecast - by Geography

- 7.2.1. United States

- 7.2.2. Canada

- 7.2.3. Mexico

- 7.1. Market Analysis, Insights and Forecast - by Type

- 8. Mexico North America Hydropower Market Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Type

- 8.1.1. Large Hydropower

- 8.1.2. Small Hydropower

- 8.1.3. Pumped Storage

- 8.1.4. Other Types

- 8.2. Market Analysis, Insights and Forecast - by Geography

- 8.2.1. United States

- 8.2.2. Canada

- 8.2.3. Mexico

- 8.1. Market Analysis, Insights and Forecast - by Type

- 9. United States North America Hydropower Market Analysis, Insights and Forecast, 2019-2031

- 10. Canada North America Hydropower Market Analysis, Insights and Forecast, 2019-2031

- 11. Mexico North America Hydropower Market Analysis, Insights and Forecast, 2019-2031

- 12. Rest of North America North America Hydropower Market Analysis, Insights and Forecast, 2019-2031

- 13. Competitive Analysis

- 13.1. Market Share Analysis 2024

- 13.2. Company Profiles

- 13.2.1 BC Hydro & Power Authority

- 13.2.1.1. Overview

- 13.2.1.2. Products

- 13.2.1.3. SWOT Analysis

- 13.2.1.4. Recent Developments

- 13.2.1.5. Financials (Based on Availability)

- 13.2.2 Absaroka Energy LLC

- 13.2.2.1. Overview

- 13.2.2.2. Products

- 13.2.2.3. SWOT Analysis

- 13.2.2.4. Recent Developments

- 13.2.2.5. Financials (Based on Availability)

- 13.2.3 Georgia Power Company

- 13.2.3.1. Overview

- 13.2.3.2. Products

- 13.2.3.3. SWOT Analysis

- 13.2.3.4. Recent Developments

- 13.2.3.5. Financials (Based on Availability)

- 13.2.4 Toshiba Corporation

- 13.2.4.1. Overview

- 13.2.4.2. Products

- 13.2.4.3. SWOT Analysis

- 13.2.4.4. Recent Developments

- 13.2.4.5. Financials (Based on Availability)

- 13.2.5 Hydro-Québec

- 13.2.5.1. Overview

- 13.2.5.2. Products

- 13.2.5.3. SWOT Analysis

- 13.2.5.4. Recent Developments

- 13.2.5.5. Financials (Based on Availability)

- 13.2.6 Duke Energy Corporation

- 13.2.6.1. Overview

- 13.2.6.2. Products

- 13.2.6.3. SWOT Analysis

- 13.2.6.4. Recent Developments

- 13.2.6.5. Financials (Based on Availability)

- 13.2.7 Ontario Power Generation Inc

- 13.2.7.1. Overview

- 13.2.7.2. Products

- 13.2.7.3. SWOT Analysis

- 13.2.7.4. Recent Developments

- 13.2.7.5. Financials (Based on Availability)

- 13.2.8 General Electric Company

- 13.2.8.1. Overview

- 13.2.8.2. Products

- 13.2.8.3. SWOT Analysis

- 13.2.8.4. Recent Developments

- 13.2.8.5. Financials (Based on Availability)

- 13.2.9 Andritz AG

- 13.2.9.1. Overview

- 13.2.9.2. Products

- 13.2.9.3. SWOT Analysis

- 13.2.9.4. Recent Developments

- 13.2.9.5. Financials (Based on Availability)

- 13.2.1 BC Hydro & Power Authority

List of Figures

- Figure 1: North America Hydropower Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: North America Hydropower Market Share (%) by Company 2024

List of Tables

- Table 1: North America Hydropower Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: North America Hydropower Market Volume Gigawatt Forecast, by Region 2019 & 2032

- Table 3: North America Hydropower Market Revenue Million Forecast, by Type 2019 & 2032

- Table 4: North America Hydropower Market Volume Gigawatt Forecast, by Type 2019 & 2032

- Table 5: North America Hydropower Market Revenue Million Forecast, by Geography 2019 & 2032

- Table 6: North America Hydropower Market Volume Gigawatt Forecast, by Geography 2019 & 2032

- Table 7: North America Hydropower Market Revenue Million Forecast, by Region 2019 & 2032

- Table 8: North America Hydropower Market Volume Gigawatt Forecast, by Region 2019 & 2032

- Table 9: North America Hydropower Market Revenue Million Forecast, by Country 2019 & 2032

- Table 10: North America Hydropower Market Volume Gigawatt Forecast, by Country 2019 & 2032

- Table 11: United States North America Hydropower Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 12: United States North America Hydropower Market Volume (Gigawatt) Forecast, by Application 2019 & 2032

- Table 13: Canada North America Hydropower Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 14: Canada North America Hydropower Market Volume (Gigawatt) Forecast, by Application 2019 & 2032

- Table 15: Mexico North America Hydropower Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 16: Mexico North America Hydropower Market Volume (Gigawatt) Forecast, by Application 2019 & 2032

- Table 17: Rest of North America North America Hydropower Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 18: Rest of North America North America Hydropower Market Volume (Gigawatt) Forecast, by Application 2019 & 2032

- Table 19: North America Hydropower Market Revenue Million Forecast, by Type 2019 & 2032

- Table 20: North America Hydropower Market Volume Gigawatt Forecast, by Type 2019 & 2032

- Table 21: North America Hydropower Market Revenue Million Forecast, by Geography 2019 & 2032

- Table 22: North America Hydropower Market Volume Gigawatt Forecast, by Geography 2019 & 2032

- Table 23: North America Hydropower Market Revenue Million Forecast, by Country 2019 & 2032

- Table 24: North America Hydropower Market Volume Gigawatt Forecast, by Country 2019 & 2032

- Table 25: North America Hydropower Market Revenue Million Forecast, by Type 2019 & 2032

- Table 26: North America Hydropower Market Volume Gigawatt Forecast, by Type 2019 & 2032

- Table 27: North America Hydropower Market Revenue Million Forecast, by Geography 2019 & 2032

- Table 28: North America Hydropower Market Volume Gigawatt Forecast, by Geography 2019 & 2032

- Table 29: North America Hydropower Market Revenue Million Forecast, by Country 2019 & 2032

- Table 30: North America Hydropower Market Volume Gigawatt Forecast, by Country 2019 & 2032

- Table 31: North America Hydropower Market Revenue Million Forecast, by Type 2019 & 2032

- Table 32: North America Hydropower Market Volume Gigawatt Forecast, by Type 2019 & 2032

- Table 33: North America Hydropower Market Revenue Million Forecast, by Geography 2019 & 2032

- Table 34: North America Hydropower Market Volume Gigawatt Forecast, by Geography 2019 & 2032

- Table 35: North America Hydropower Market Revenue Million Forecast, by Country 2019 & 2032

- Table 36: North America Hydropower Market Volume Gigawatt Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the North America Hydropower Market?

The projected CAGR is approximately > 1.00%.

2. Which companies are prominent players in the North America Hydropower Market?

Key companies in the market include BC Hydro & Power Authority, Absaroka Energy LLC, Georgia Power Company, Toshiba Corporation, Hydro-Québec, Duke Energy Corporation, Ontario Power Generation Inc, General Electric Company, Andritz AG.

3. What are the main segments of the North America Hydropower Market?

The market segments include Type, Geography.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

4.; Increasing Investment in the Upstream Sector4.; Supportive Government Policies.

6. What are the notable trends driving market growth?

Pumped Storage to Witness Growth.

7. Are there any restraints impacting market growth?

4.; Increasing Demand to Diversify the Power Generation Mix by Introducing Renewable Energy Sources.

8. Can you provide examples of recent developments in the market?

June 2022: Stantec announced that WaterPower Canada had commissioned it to assess the potential for pumped storage hydropower across Canada. Stantec and its partners, the Australian National University, CEATI, and Power Advisory, will study the strategic value of pumped storage hydropower (PSH) facilities to help WaterPower Canada and the hydropower industry as a whole.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in Gigawatt.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "North America Hydropower Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the North America Hydropower Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the North America Hydropower Market?

To stay informed about further developments, trends, and reports in the North America Hydropower Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence