Key Insights

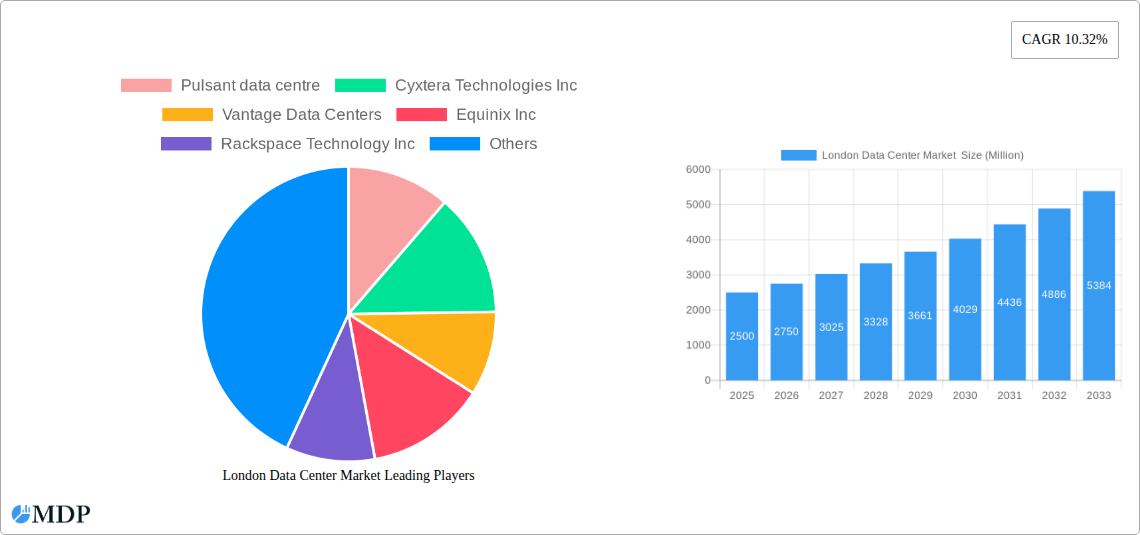

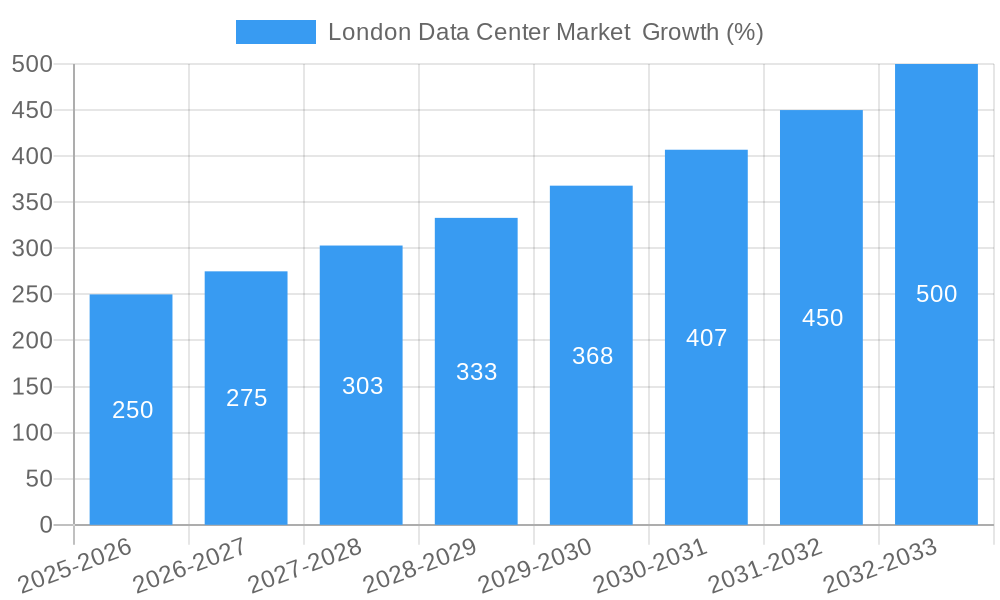

The London data center market is experiencing robust growth, driven by increasing cloud adoption, the expansion of digital services, and a surge in demand for colocation services. The market's sizable size, estimated at [Estimate based on available CAGR and market size; e.g., £X billion in 2025], is projected to expand at a Compound Annual Growth Rate (CAGR) of 10.32% from 2025 to 2033, reaching [Estimate based on CAGR and 2025 estimate; e.g., £Y billion] by 2033. This growth is fueled by several key factors: the flourishing fintech sector in London, the city's status as a major European hub for global businesses, and the escalating need for robust, reliable IT infrastructure to support these operations. The hyperscale segment is a particularly significant contributor to this growth, with major cloud providers establishing and expanding their data center presence in London to meet growing demand. The strong demand is also being driven by a variety of end users, including cloud & IT companies, telecom providers, media and entertainment firms, and financial institutions (BFSI).

However, the market faces certain challenges. Land scarcity and high construction costs in London represent significant restraints to expansion. Furthermore, intense competition among established players and new entrants necessitates strategic planning and innovation to maintain a competitive edge. To mitigate these restraints, data center operators are increasingly focusing on optimizing energy efficiency, leveraging sustainable technologies, and exploring alternative locations within the broader UK market to enhance capacity and reduce operational expenses. The segmentation of the market by DC size (Small, Medium, Large, Massive, Mega), Tier type, absorption rate (Utilized, Non-Utilized), colocation type (Retail, Wholesale, Hyperscale), and end-user type provides a nuanced understanding of the market dynamics and enables targeted strategies for growth. The key players listed – Pulsant, Cyxtera, Vantage, Equinix, and others – are actively shaping this dynamic landscape through strategic acquisitions, capacity expansion, and technological advancements.

London Data Center Market: A Comprehensive Report (2019-2033)

This comprehensive report provides a detailed analysis of the London data center market, offering invaluable insights for industry stakeholders, investors, and businesses seeking to navigate this dynamic landscape. The report covers the period 2019-2033, with a focus on the estimated year 2025 and a forecast period of 2025-2033. It incorporates detailed market sizing, segmentation, competitive analysis, and future growth projections, all backed by robust data and analysis. The market is valued at xx Million in 2025 and is projected to reach xx Million by 2033, exhibiting a CAGR of xx%.

London Data Center Market Market Dynamics & Concentration

The London data center market is characterized by a high level of concentration, with a few major players controlling a significant market share. Equinix Inc, Digital Realty Trust Inc, and NTT Ltd. are among the dominant players, commanding a combined market share of approximately xx%. However, smaller and specialized players, like Pulsant data centre and Kao Data Ltd, are also making significant contributions, particularly within niche segments.

Several factors contribute to this dynamic market environment:

- Innovation Drivers: The constant demand for increased computing power, driven by cloud adoption and big data analytics, fuels innovation in areas like energy efficiency, cooling technologies, and network connectivity.

- Regulatory Frameworks: The UK government's commitment to digital infrastructure development, along with relevant regulations, plays a pivotal role in shaping market growth. However, navigating these regulations can be a challenge for new entrants.

- Product Substitutes: While data centers remain the dominant infrastructure for large-scale data storage and processing, the emergence of edge computing and distributed cloud solutions represents a potential long-term disruption.

- End-User Trends: The growing demand for data center services across various sectors, including Cloud & IT, Telecom, Media & Entertainment, and BFSI, is a key driver of market expansion. Hyperscale operators are increasingly shaping demand patterns.

- M&A Activities: The London market has witnessed several significant mergers and acquisitions in recent years, reflecting the ongoing consolidation among leading players. The number of M&A deals between 2019 and 2024 totaled xx, resulting in the consolidation of xx Million in market value.

London Data Center Market Industry Trends & Analysis

The London data center market is experiencing robust growth, driven by several factors. The increasing adoption of cloud computing services is a major driver, fueling demand for colocation facilities. Furthermore, the rise of big data analytics and the Internet of Things (IoT) necessitates substantial data storage and processing capabilities, further boosting demand. The shift towards hybrid and multi-cloud strategies is also creating opportunities for data center providers.

Technological disruptions, such as the increasing adoption of AI and machine learning, are reshaping the market. These technologies are driving demand for more powerful and efficient data center infrastructure. Consumer preferences for increased security, reliability, and sustainability are shaping the services offered by data center providers. The market's competitive landscape is characterized by intense competition among existing players and the emergence of new entrants, leading to innovative service offerings and price optimization. This intense competition is pushing for more efficient and flexible solutions, enhancing the overall market offering. The market exhibits a strong growth trajectory, with the overall market size projected to increase from xx Million in 2024 to xx Million in 2033, representing a substantial growth opportunity for data center providers.

Leading Markets & Segments in London Data Center Market

London itself dominates the market within the UK, benefiting from its robust digital infrastructure, skilled workforce, and access to major fiber optic networks. The large and mega data center segments are experiencing the fastest growth, driven by hyperscale deployments.

Key Drivers:

- Economic Policies: Government initiatives supporting digital infrastructure development contribute significantly to market growth.

- Infrastructure: London's established fiber optic network and power infrastructure provides a strong foundation for data center deployments.

Dominance Analysis:

The Utilized segment dominates the absorption market, reflecting the high demand for data center capacity. Retail colocation continues to be a substantial segment, but wholesale and hyperscale colocation are experiencing faster growth rates. Within the end-user segment, Cloud & IT, Telecom, and Media & Entertainment collectively account for the largest portion of demand, although growth within BFSI and E-commerce is accelerating. The Tier III segment shows the most rapid growth within the Tier Type segment due to its balance between cost-effectiveness and redundancy requirements. Small and Medium sized data centers dominate overall capacity, while Mega & Massive segments exhibit the highest growth rates due to hyperscale adoption.

London Data Center Market Product Developments

Recent product developments focus on enhancing efficiency, scalability, and sustainability. This includes advancements in cooling technologies, renewable energy integration, and software-defined data center architectures. These innovations aim to optimize operational costs, improve environmental impact, and cater to the evolving needs of hyperscale and cloud providers. The market is also seeing the integration of AI and machine learning into data center management systems, enabling predictive maintenance and improved operational efficiency.

Key Drivers of London Data Center Market Growth

The rapid growth of the London data center market is primarily propelled by:

- Technological Advancements: The relentless advancements in cloud computing, big data, AI, and IoT are driving significant demand for data center capacity.

- Economic Growth: London's thriving economy and its status as a global financial hub contribute significantly to the demand for data center services.

- Government Policies: Supportive regulatory frameworks and government initiatives aimed at fostering digital infrastructure development create a favorable environment for market expansion. For instance, investment in digital infrastructure projects further supports growth.

Challenges in the London Data Center Market Market

The London data center market faces certain challenges:

- High Land and Construction Costs: The scarcity of suitable land in London drives up construction and operational costs, impacting profitability.

- Energy Consumption and Sustainability Concerns: Data centers are significant energy consumers, leading to environmental concerns and regulatory pressure to adopt more sustainable practices.

- Competition: Intense competition among existing players and the emergence of new entrants create pressure on pricing and service differentiation. The increase in competition has put a downward pressure of approx. xx% on average pricing in the last 2 years.

Emerging Opportunities in London Data Center Market

Several factors present exciting opportunities for long-term growth:

- Edge Computing: The increasing adoption of edge computing solutions creates opportunities for deploying smaller, geographically distributed data centers closer to end-users.

- Sustainability Initiatives: Investments in renewable energy sources and energy-efficient technologies present a significant opportunity for data center providers to enhance their sustainability profiles and attract environmentally conscious customers.

- Strategic Partnerships: Collaborations between data center providers and cloud service providers, telecommunications companies, and other technology firms will drive innovation and expand market reach.

Leading Players in the London Data Center Market Sector

- Pulsant data centre

- Cyxtera Technologies Inc

- Vantage Data Centers

- Equinix Inc

- Rackspace Technology Inc

- 4D Data Centres Ltd (Redcentric plc)

- Serverfarm LLC

- Iron Mountain Incorporated

- Kao Data Ltd

- CyrusOne Inc

- Colt Technology Services Group Limited

- Digital Realty Trust Inc

- Virtus Data Centres Properties Ltd (ST Telemedia Global Data Centres)

- Telehouse (KDDI Corporation)

- NTT Ltd

Key Milestones in London Data Center Market Industry

- November 2022: Proposal for a new 30MW data center as part of a larger mixed-use development in East London. This highlights the ongoing investment in data center infrastructure within the city.

- March 2022: CloudHQ announces the development of an 81MW hyperscale data center campus near Didcot, signifying a substantial investment in the UK data center market and the increasing demand for hyperscale capacity.

Strategic Outlook for London Data Center Market Market

The London data center market is poised for continued growth, driven by the increasing demand for digital services, technological advancements, and supportive government policies. Strategic partnerships, investments in sustainable technologies, and the expansion of edge computing will be key drivers of future market potential. The market's strong fundamentals and ongoing innovation suggest a robust growth trajectory in the coming years.

London Data Center Market Segmentation

-

1. DC Size

- 1.1. Small

- 1.2. Medium

- 1.3. Large

- 1.4. Massive

- 1.5. Mega

-

2. Tier Type

- 2.1. Tier 1 & 2

- 2.2. Tier 3

- 2.3. Tier 4

-

3. Absorption

-

3.1. Utilized

-

3.1.1. Colocation Type

- 3.1.1.1. Retail

- 3.1.1.2. Wholesale

- 3.1.1.3. Hyperscale

-

3.1.2. End User

- 3.1.2.1. Cloud & IT

- 3.1.2.2. Telecom

- 3.1.2.3. Media & Entertainment

- 3.1.2.4. Government

- 3.1.2.5. BFSI

- 3.1.2.6. Manufacturing

- 3.1.2.7. E-Commerce

- 3.1.2.8. Other End User

-

3.1.1. Colocation Type

- 3.2. Non-Utilized

-

3.1. Utilized

London Data Center Market Segmentation By Geography

- 1. London

London Data Center Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 10.32% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Rising Regulatory and Compliance Mandates; Growth of Data Volume

- 3.3. Market Restrains

- 3.3.1. Varying Structure of Regulatory Policies and Data Address Validation

- 3.4. Market Trends

- 3.4.1. Mega Size Data Center are Expected to Hold Significant Share

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. London Data Center Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by DC Size

- 5.1.1. Small

- 5.1.2. Medium

- 5.1.3. Large

- 5.1.4. Massive

- 5.1.5. Mega

- 5.2. Market Analysis, Insights and Forecast - by Tier Type

- 5.2.1. Tier 1 & 2

- 5.2.2. Tier 3

- 5.2.3. Tier 4

- 5.3. Market Analysis, Insights and Forecast - by Absorption

- 5.3.1. Utilized

- 5.3.1.1. Colocation Type

- 5.3.1.1.1. Retail

- 5.3.1.1.2. Wholesale

- 5.3.1.1.3. Hyperscale

- 5.3.1.2. End User

- 5.3.1.2.1. Cloud & IT

- 5.3.1.2.2. Telecom

- 5.3.1.2.3. Media & Entertainment

- 5.3.1.2.4. Government

- 5.3.1.2.5. BFSI

- 5.3.1.2.6. Manufacturing

- 5.3.1.2.7. E-Commerce

- 5.3.1.2.8. Other End User

- 5.3.1.1. Colocation Type

- 5.3.2. Non-Utilized

- 5.3.1. Utilized

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. London

- 5.1. Market Analysis, Insights and Forecast - by DC Size

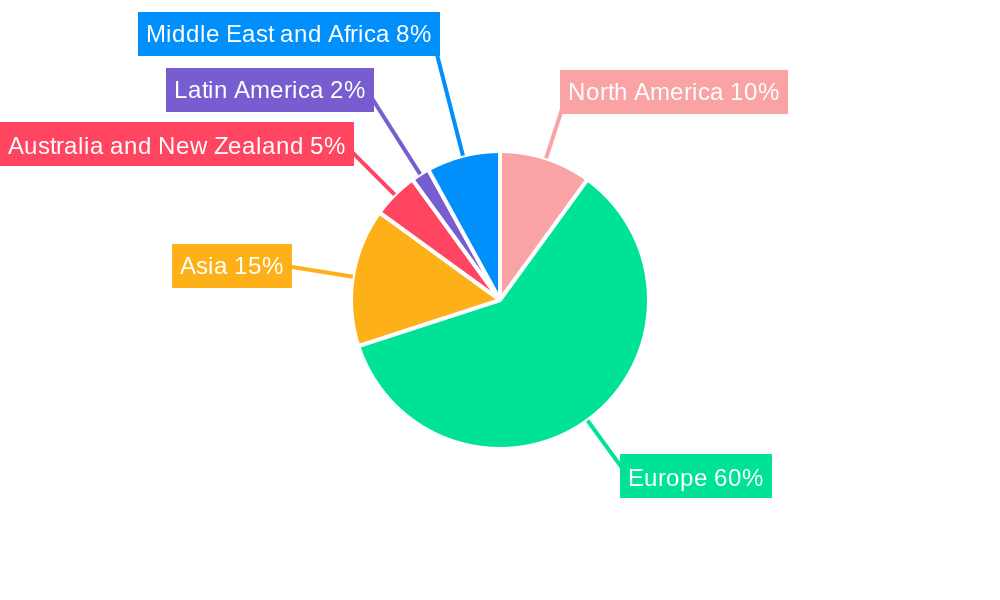

- 6. North America London Data Center Market Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 6.1.1.

- 7. Europe London Data Center Market Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 7.1.1.

- 8. Asia London Data Center Market Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 8.1.1.

- 9. Australia and New Zealand London Data Center Market Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 9.1.1.

- 10. Latin America London Data Center Market Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 10.1.1.

- 11. Middle East and Africa London Data Center Market Analysis, Insights and Forecast, 2019-2031

- 11.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 11.1.1.

- 12. Competitive Analysis

- 12.1. Market Share Analysis 2024

- 12.2. Company Profiles

- 12.2.1 Pulsant data centre

- 12.2.1.1. Overview

- 12.2.1.2. Products

- 12.2.1.3. SWOT Analysis

- 12.2.1.4. Recent Developments

- 12.2.1.5. Financials (Based on Availability)

- 12.2.2 Cyxtera Technologies Inc

- 12.2.2.1. Overview

- 12.2.2.2. Products

- 12.2.2.3. SWOT Analysis

- 12.2.2.4. Recent Developments

- 12.2.2.5. Financials (Based on Availability)

- 12.2.3 Vantage Data Centers

- 12.2.3.1. Overview

- 12.2.3.2. Products

- 12.2.3.3. SWOT Analysis

- 12.2.3.4. Recent Developments

- 12.2.3.5. Financials (Based on Availability)

- 12.2.4 Equinix Inc

- 12.2.4.1. Overview

- 12.2.4.2. Products

- 12.2.4.3. SWOT Analysis

- 12.2.4.4. Recent Developments

- 12.2.4.5. Financials (Based on Availability)

- 12.2.5 Rackspace Technology Inc

- 12.2.5.1. Overview

- 12.2.5.2. Products

- 12.2.5.3. SWOT Analysis

- 12.2.5.4. Recent Developments

- 12.2.5.5. Financials (Based on Availability)

- 12.2.6 4D Data Centres Ltd (Redcentric plc)

- 12.2.6.1. Overview

- 12.2.6.2. Products

- 12.2.6.3. SWOT Analysis

- 12.2.6.4. Recent Developments

- 12.2.6.5. Financials (Based on Availability)

- 12.2.7 Serverfarm LLC

- 12.2.7.1. Overview

- 12.2.7.2. Products

- 12.2.7.3. SWOT Analysis

- 12.2.7.4. Recent Developments

- 12.2.7.5. Financials (Based on Availability)

- 12.2.8 Iron Mountain Incorporated

- 12.2.8.1. Overview

- 12.2.8.2. Products

- 12.2.8.3. SWOT Analysis

- 12.2.8.4. Recent Developments

- 12.2.8.5. Financials (Based on Availability)

- 12.2.9 Kao Data Ltd

- 12.2.9.1. Overview

- 12.2.9.2. Products

- 12.2.9.3. SWOT Analysis

- 12.2.9.4. Recent Developments

- 12.2.9.5. Financials (Based on Availability)

- 12.2.10 CyrusOne Inc

- 12.2.10.1. Overview

- 12.2.10.2. Products

- 12.2.10.3. SWOT Analysis

- 12.2.10.4. Recent Developments

- 12.2.10.5. Financials (Based on Availability)

- 12.2.11 Colt Technology Services Group Limited

- 12.2.11.1. Overview

- 12.2.11.2. Products

- 12.2.11.3. SWOT Analysis

- 12.2.11.4. Recent Developments

- 12.2.11.5. Financials (Based on Availability)

- 12.2.12 Digital Realty Trust Inc

- 12.2.12.1. Overview

- 12.2.12.2. Products

- 12.2.12.3. SWOT Analysis

- 12.2.12.4. Recent Developments

- 12.2.12.5. Financials (Based on Availability)

- 12.2.13 Virtus Data Centres Properties Ltd (ST Telemedia Global Data Centres)

- 12.2.13.1. Overview

- 12.2.13.2. Products

- 12.2.13.3. SWOT Analysis

- 12.2.13.4. Recent Developments

- 12.2.13.5. Financials (Based on Availability)

- 12.2.14 Telehouse (KDDI Corporation)

- 12.2.14.1. Overview

- 12.2.14.2. Products

- 12.2.14.3. SWOT Analysis

- 12.2.14.4. Recent Developments

- 12.2.14.5. Financials (Based on Availability)

- 12.2.15 NTT Ltd

- 12.2.15.1. Overview

- 12.2.15.2. Products

- 12.2.15.3. SWOT Analysis

- 12.2.15.4. Recent Developments

- 12.2.15.5. Financials (Based on Availability)

- 12.2.1 Pulsant data centre

List of Figures

- Figure 1: London Data Center Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: London Data Center Market Share (%) by Company 2024

List of Tables

- Table 1: London Data Center Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: London Data Center Market Revenue Million Forecast, by DC Size 2019 & 2032

- Table 3: London Data Center Market Revenue Million Forecast, by Tier Type 2019 & 2032

- Table 4: London Data Center Market Revenue Million Forecast, by Absorption 2019 & 2032

- Table 5: London Data Center Market Revenue Million Forecast, by Region 2019 & 2032

- Table 6: London Data Center Market Revenue Million Forecast, by Country 2019 & 2032

- Table 7: London Data Center Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 8: London Data Center Market Revenue Million Forecast, by Country 2019 & 2032

- Table 9: London Data Center Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: London Data Center Market Revenue Million Forecast, by Country 2019 & 2032

- Table 11: London Data Center Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 12: London Data Center Market Revenue Million Forecast, by Country 2019 & 2032

- Table 13: London Data Center Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 14: London Data Center Market Revenue Million Forecast, by Country 2019 & 2032

- Table 15: London Data Center Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 16: London Data Center Market Revenue Million Forecast, by Country 2019 & 2032

- Table 17: London Data Center Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 18: London Data Center Market Revenue Million Forecast, by DC Size 2019 & 2032

- Table 19: London Data Center Market Revenue Million Forecast, by Tier Type 2019 & 2032

- Table 20: London Data Center Market Revenue Million Forecast, by Absorption 2019 & 2032

- Table 21: London Data Center Market Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the London Data Center Market ?

The projected CAGR is approximately 10.32%.

2. Which companies are prominent players in the London Data Center Market ?

Key companies in the market include Pulsant data centre, Cyxtera Technologies Inc, Vantage Data Centers, Equinix Inc, Rackspace Technology Inc, 4D Data Centres Ltd (Redcentric plc), Serverfarm LLC, Iron Mountain Incorporated, Kao Data Ltd, CyrusOne Inc, Colt Technology Services Group Limited, Digital Realty Trust Inc, Virtus Data Centres Properties Ltd (ST Telemedia Global Data Centres), Telehouse (KDDI Corporation), NTT Ltd.

3. What are the main segments of the London Data Center Market ?

The market segments include DC Size, Tier Type, Absorption.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Rising Regulatory and Compliance Mandates; Growth of Data Volume.

6. What are the notable trends driving market growth?

Mega Size Data Center are Expected to Hold Significant Share.

7. Are there any restraints impacting market growth?

Varying Structure of Regulatory Policies and Data Address Validation.

8. Can you provide examples of recent developments in the market?

November 2022: A new data center is being proposed in east London, UK. The planning proposal proposes demolishing the existing office buildings and constructing a 30-story residential structure, a 36-story student residential building, a data center, and a facility to provide flexible workspace, community use space, and a swimming pool. EID (General Partner) LLP is the project's applicant, with Simpson Haugh/Nicholas Webb/Savills acting as architects and agents. The eight-story complex might have a potential IT power of 30MW and six 1,200 sqm (12,900 sq ft) halls. According to the petition, the facility would require a backup power source "in the form of 18 diesel-fueled generators of 3.3 MW."

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "London Data Center Market ," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the London Data Center Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the London Data Center Market ?

To stay informed about further developments, trends, and reports in the London Data Center Market , consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence