Key Insights

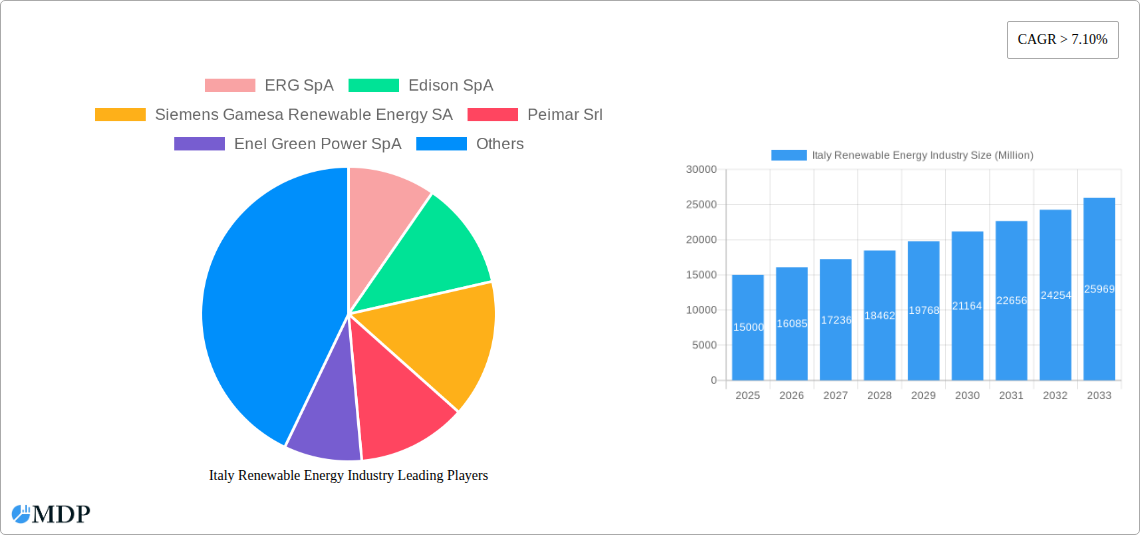

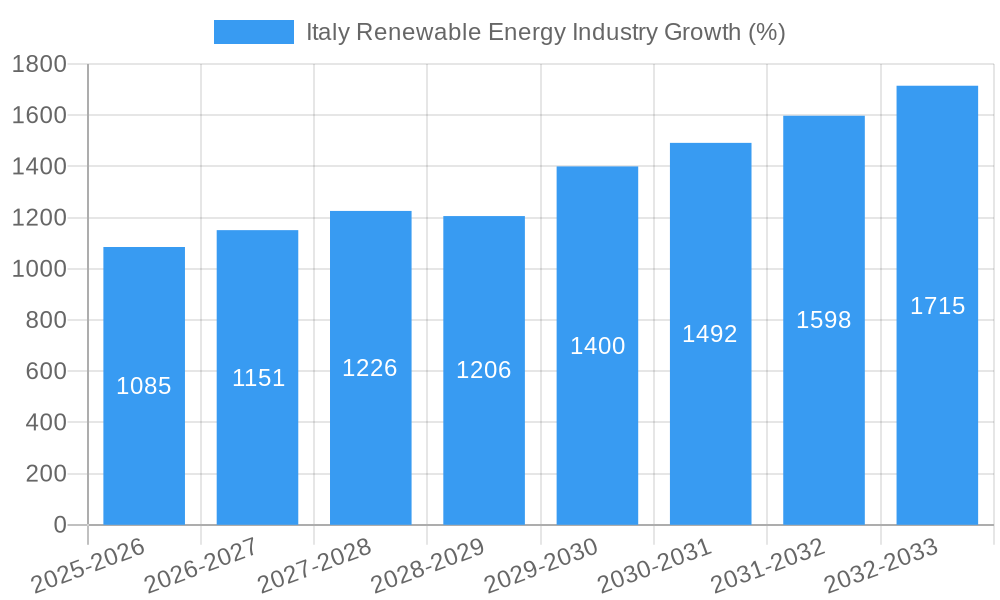

The Italian renewable energy market is experiencing robust growth, driven by the country's ambitious climate targets and increasing energy independence needs. The market size in 2025 is estimated at €15 billion (assuming a logical extrapolation based on a 7.10% CAGR from a prior year's value and considering the industry growth trends). Key drivers include supportive government policies such as feed-in tariffs and tax incentives, along with decreasing technology costs, making solar, wind, and hydro power increasingly competitive. The solar segment holds a significant share due to Italy's abundant sunshine and favorable geographical conditions. While wind energy also plays a substantial role, particularly in northern regions, hydropower maintains a steady contribution owing to existing infrastructure. Emerging geothermal and tidal technologies are nascent but demonstrate growth potential within the "Other Types" segment. However, challenges persist, including land-use constraints, grid integration difficulties, and permitting processes, potentially limiting the sector's overall expansion. Despite these restraints, the forecast period (2025-2033) anticipates continued expansion, fueled by ongoing policy support and technological advancements. The involvement of major players like Enel Green Power SpA, ERG SpA, and Siemens Gamesa Renewable Energy SA indicates a high level of private investment and confidence in the sector's long-term prospects. The market's ongoing expansion underscores Italy's commitment to transitioning towards a cleaner energy future and reinforces its position as a key player within the European renewable energy landscape.

The projected CAGR of >7.10% translates to significant growth over the forecast period. This growth is expected to be primarily driven by increased investments in large-scale renewable energy projects, particularly in solar and wind power. While the hydro segment will maintain a stable contribution, the 'Other Types' segment's growth will depend on further technological advancements and policy support for less established renewable energy sources. The competitive landscape showcases a mix of established international players and domestic companies, leading to innovation and a diversified market structure. The regional distribution will likely reflect the existing infrastructure and resource availability, with higher concentration in regions with suitable geographic conditions for different renewable energy sources. Further analysis suggests that the market size will exceed €25 billion by 2033, reflecting sustained investment and robust market expansion.

Italy Renewable Energy Industry: Market Analysis & Forecast (2019-2033)

Unlocking the Potential of Italy's Green Energy Transition: A Comprehensive Market Report

This comprehensive report provides an in-depth analysis of the Italian renewable energy industry, covering the period from 2019 to 2033. With a focus on market dynamics, key players, and future growth opportunities, this report is an essential resource for investors, industry professionals, and policymakers seeking to navigate this rapidly evolving sector. The report leverages robust data and analysis to provide actionable insights, forecasting a market valued at xx Million by 2033. The base year for the study is 2025, and forecasts cover the period 2025-2033. Key segments analyzed include solar, wind, hydro, and other renewable energy sources (geothermal and tidal).

Italy Renewable Energy Industry Market Dynamics & Concentration

The Italian renewable energy market is characterized by a dynamic interplay of factors influencing its growth and concentration. Market concentration is moderately high, with several large players holding significant market share. However, smaller independent power producers (IPPs) also contribute significantly. The market's innovation is fueled by government incentives, technological advancements, and the increasing demand for cleaner energy. Stringent regulatory frameworks, including emission reduction targets and renewable energy mandates, drive the adoption of renewable energy technologies. While traditional fossil fuels remain competitors, the economic viability and environmental benefits of renewables are leading to their increased penetration. Mergers and acquisitions (M&A) activity has been significant, with xx M&A deals recorded between 2019 and 2024, consolidating market power and accelerating technological integration.

- Market Share: Enel Green Power SpA and ERG SpA hold a combined market share of approximately xx%, reflecting their significant investments and project portfolios.

- M&A Activity: The increasing number of M&A deals signals industry consolidation and the entry of international players seeking opportunities in the growing Italian renewable energy market.

- Innovation Drivers: Technological advancements in solar PV, wind turbine technology, and energy storage solutions are crucial drivers.

- Regulatory Landscape: Government policies and incentives significantly impact market growth and investment decisions.

Italy Renewable Energy Industry Industry Trends & Analysis

The Italian renewable energy market has experienced significant growth over the past few years, driven by a combination of factors. The Compound Annual Growth Rate (CAGR) for the period 2019-2024 was estimated at xx%, and is projected to reach xx% between 2025-2033. This growth is underpinned by rising energy demand, ambitious government renewable energy targets, and decreasing costs of renewable energy technologies. Technological advancements, particularly in solar PV and wind energy, have increased efficiency and reduced costs, making these technologies increasingly competitive. Consumer preferences are shifting towards sustainable energy sources, further boosting demand. Competitive dynamics remain intense, with both domestic and international players vying for market share through strategic investments, technological innovation, and operational efficiencies. Market penetration of renewable energy in Italy’s electricity generation mix continues to increase, reaching xx% in 2024.

Leading Markets & Segments in Italy Renewable Energy Industry

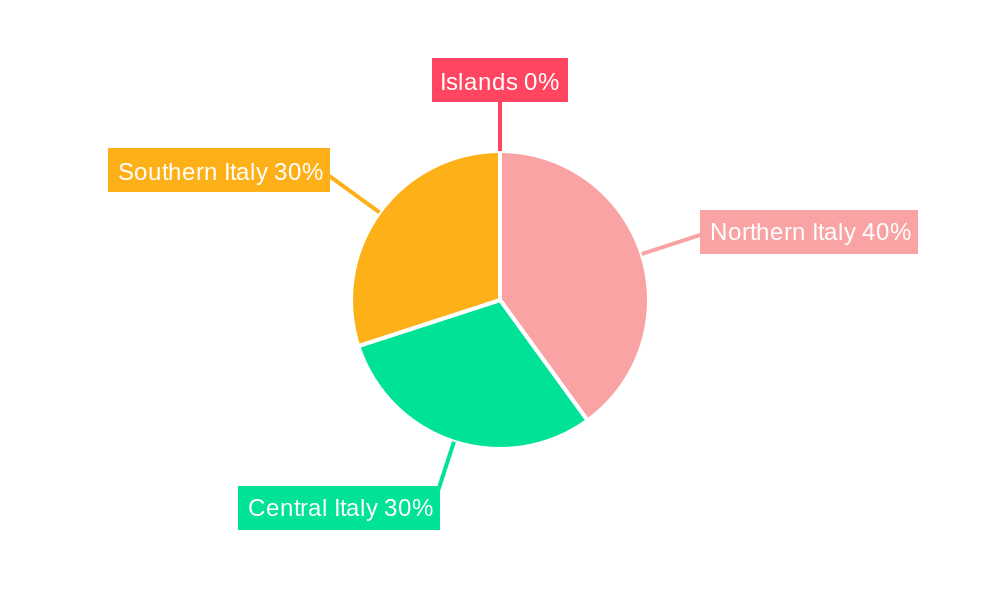

The Italian renewable energy market is geographically diverse, with various regions experiencing strong growth depending on their specific resource availability and policy frameworks. However, Southern Italy and Sicily have emerged as leading regions for solar and wind power, benefiting from higher solar irradiance and favourable wind conditions. While all segments are experiencing growth, the solar energy segment currently holds the largest market share, followed by wind energy, hydropower, and other renewable energy types such as geothermal and tidal power.

- Key Drivers for Solar Energy Dominance:

- Abundant solar irradiance, particularly in Southern Italy.

- Favorable government policies and incentives.

- Decreasing costs of solar PV technology.

- Key Drivers for Wind Energy Growth:

- High wind speeds in certain regions, notably Sicily.

- Technological advancements in wind turbine design.

- Government support for onshore and offshore wind projects.

The dominance of solar and wind is attributed to their relatively lower capital costs compared to hydropower and other less-established technologies, and to rapid technological advancements that continuously improve efficiency and reduce costs.

Italy Renewable Energy Industry Product Developments

Significant advancements in renewable energy technology are driving market expansion. Innovations include higher-efficiency solar PV panels, larger and more efficient wind turbines, and improved energy storage solutions, such as batteries. These advancements translate into lower costs, increased power output, and greater grid stability. The market is also witnessing the integration of smart grids and digital technologies to optimize energy distribution and enhance the reliability of renewable energy systems. This technological push is improving the competitiveness of renewables compared to traditional sources and making them attractive to a wider range of consumers and businesses.

Key Drivers of Italy Renewable Energy Industry Growth

The growth of Italy's renewable energy industry is driven by a potent combination of factors. Firstly, there’s a clear governmental push, with ambitious renewable energy targets and supportive policies designed to attract investments and accelerate the energy transition. Secondly, decreasing costs of renewable energy technologies (especially solar and wind) are making them increasingly competitive compared to traditional fossil fuels. Thirdly, rising energy demand and increasing environmental concerns amongst consumers and businesses are fueling the demand for cleaner energy sources. Finally, technological advancements continually improve the efficiency and performance of renewable energy systems.

Challenges in the Italy Renewable Energy Industry Market

Despite the significant growth potential, the Italian renewable energy market faces several challenges. Grid infrastructure limitations in some regions pose a constraint on integrating higher amounts of intermittent renewable energy sources. Permitting processes and bureaucratic hurdles can delay project development and increase costs. Furthermore, fluctuations in the price of raw materials for manufacturing renewable energy equipment and occasional dependence on foreign suppliers can affect the stability of the supply chain. This underscores the need for strategic investments in grid infrastructure, streamlined regulatory procedures, and diversified sourcing strategies to overcome these obstacles.

Emerging Opportunities in Italy Renewable Energy Industry

The Italian renewable energy sector presents significant long-term growth opportunities. Strategic partnerships between energy companies, technology providers, and research institutions can facilitate technological breakthroughs and accelerate innovation. The integration of energy storage solutions can address the intermittency of renewable energy sources, enhancing grid stability and reliability. Moreover, expanding into offshore wind energy and exploring niche technologies like geothermal and tidal energy holds significant potential for diversification and further growth.

Leading Players in the Italy Renewable Energy Industry Sector

- ERG SpA

- Edison SpA

- Siemens Gamesa Renewable Energy SA

- Peimar Srl

- Enel Green Power SpA

- Gruppo STG Srl

- Vestas Wind Systems AS

- EF Solare Italia SpA

Key Milestones in Italy Renewable Energy Industry Industry

- December 2021: BNZ secures authorization to build a 45MW solar PV plant in Lazio, expected to be operational by 2023. This project signifies the growing investment in large-scale solar projects in Italy.

- April 2021: RWE commissions its Alcamo II onshore wind farm in Sicily, a collaborative project with Goldwind, highlighting international partnerships and advancements in wind energy technology. This project demonstrates the successful integration of global technology and expertise into the Italian renewable energy market.

Strategic Outlook for Italy Renewable Energy Industry Market

The Italian renewable energy market is poised for continued expansion driven by ambitious government targets, technological advancements, and a growing demand for sustainable energy. Strategic investments in grid infrastructure, R&D, and human capital will be vital to unlocking the full potential of the sector. A focus on innovation, efficient regulatory frameworks, and fostering public-private partnerships will be key to ensuring a smooth energy transition and maximizing the economic and environmental benefits of renewable energy. The future of the Italian renewable energy market appears bright, with significant opportunities for growth and investment.

Italy Renewable Energy Industry Segmentation

-

1. Type

- 1.1. Solar

- 1.2. Wind

- 1.3. Hydro

- 1.4. Other Types (Geothermal and Tidal))

Italy Renewable Energy Industry Segmentation By Geography

- 1. Italy

Italy Renewable Energy Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of > 7.10% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. 4.; Declining Cost of Solar PV Installations4.; Supportive Government Policies For Renewable Energy

- 3.3. Market Restrains

- 3.3.1. 4.; Penetration of Other Energy Sources

- 3.4. Market Trends

- 3.4.1. Solar Type Sub-segment to be the Fastest Growing Segment

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Italy Renewable Energy Industry Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Solar

- 5.1.2. Wind

- 5.1.3. Hydro

- 5.1.4. Other Types (Geothermal and Tidal))

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. Italy

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2024

- 6.2. Company Profiles

- 6.2.1 ERG SpA

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Edison SpA

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Siemens Gamesa Renewable Energy SA

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Peimar Srl

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Enel Green Power SpA

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Gruppo STG Srl

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Vestas Wind Systems AS

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 EF Solare Italia SpA

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.1 ERG SpA

List of Figures

- Figure 1: Italy Renewable Energy Industry Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Italy Renewable Energy Industry Share (%) by Company 2024

List of Tables

- Table 1: Italy Renewable Energy Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Italy Renewable Energy Industry Volume Gigawatt Forecast, by Region 2019 & 2032

- Table 3: Italy Renewable Energy Industry Revenue Million Forecast, by Type 2019 & 2032

- Table 4: Italy Renewable Energy Industry Volume Gigawatt Forecast, by Type 2019 & 2032

- Table 5: Italy Renewable Energy Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 6: Italy Renewable Energy Industry Volume Gigawatt Forecast, by Region 2019 & 2032

- Table 7: Italy Renewable Energy Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 8: Italy Renewable Energy Industry Volume Gigawatt Forecast, by Country 2019 & 2032

- Table 9: Italy Renewable Energy Industry Revenue Million Forecast, by Type 2019 & 2032

- Table 10: Italy Renewable Energy Industry Volume Gigawatt Forecast, by Type 2019 & 2032

- Table 11: Italy Renewable Energy Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 12: Italy Renewable Energy Industry Volume Gigawatt Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Italy Renewable Energy Industry?

The projected CAGR is approximately > 7.10%.

2. Which companies are prominent players in the Italy Renewable Energy Industry?

Key companies in the market include ERG SpA, Edison SpA, Siemens Gamesa Renewable Energy SA, Peimar Srl, Enel Green Power SpA, Gruppo STG Srl, Vestas Wind Systems AS, EF Solare Italia SpA.

3. What are the main segments of the Italy Renewable Energy Industry?

The market segments include Type.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

4.; Declining Cost of Solar PV Installations4.; Supportive Government Policies For Renewable Energy.

6. What are the notable trends driving market growth?

Solar Type Sub-segment to be the Fastest Growing Segment.

7. Are there any restraints impacting market growth?

4.; Penetration of Other Energy Sources.

8. Can you provide examples of recent developments in the market?

In December 2021, BNZ (an independent power producer company (IPP)) announced that it had obtained authorization to construct a 45MW solar PV plant in the Lazio region of Italy. The developer expects the project to be operational by 2023.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in Gigawatt.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Italy Renewable Energy Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Italy Renewable Energy Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Italy Renewable Energy Industry?

To stay informed about further developments, trends, and reports in the Italy Renewable Energy Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence